UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 29, 2015

|

|

Carter’s, Inc. |

(Exact name of Registrant as specified in its charter) |

|

| | | | |

Delaware | | 001-31829 | | 13-3912933 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

Phipps Tower 3438 Peachtree Road NE, Suite 1800 Atlanta, Georgia 30326 |

(Address of principal executive offices, including zip code) |

|

(678) 791-1000 |

(Registrant’s telephone number, including area code) |

|

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On July 29, 2015, Carter’s, Inc. issued a press release announcing its financial results for the fiscal quarter ended July 4, 2015. A copy of that press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

|

| |

Exhibits – The following exhibit is furnished as part of this Current Report on Form 8-K. |

| |

Exhibit Number | Description |

| |

99.1 | Press Release of Carter’s, Inc., dated July 29, 2015 |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, Carter’s, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

July 29, 2015 | CARTER’S, INC. |

| | |

| By: | /s/ Michael C. Wu |

| Name: | Michael C. Wu |

| Title: | Senior Vice President, General Counsel and Secretary |

| | |

|

| |

| Contact: |

| Sean McHugh |

| Vice President & Treasurer |

| (678) 791-7615 |

Carter’s, Inc. Reports Second Quarter Fiscal 2015 Results

| |

• | Net Sales $613 Million, Up 7% |

| |

• | Operating Margin 10.1%, Up 190 Basis Points; Adjusted Operating Margin 10.7%, Up 50 Basis Points |

| |

• | Diluted EPS $0.68, Up 42%; Adjusted Diluted EPS $0.73, Up 19% |

| |

• | Company Raises Fiscal 2015 Adjusted Diluted EPS Guidance Range To Growth Of 12% - 15%; Previously 10% - 14% |

ATLANTA, July 29, 2015 - Carter’s, Inc. (NYSE:CRI), the largest branded marketer in the United States and Canada of apparel exclusively for babies and young children, today reported its second quarter fiscal 2015 results.

“We continued to see strong demand for our brands in the second quarter with sales growth in all of our business segments,” said Michael D. Casey, Chairman and Chief Executive Officer. “We’re encouraged by our consumers’ response to our new fall marketing and product offerings. Given our progress in the first half, and outlook for the balance of the year, we are raising our earnings forecast for fiscal 2015.”

Consolidated Results

Second Quarter of Fiscal 2015 compared to Second Quarter of Fiscal 2014

Consolidated net sales increased $38.7 million, or 6.7%, to $612.8 million, reflecting growth in all business segments. Changes in foreign currency exchange rates in the second quarter of fiscal 2015 as compared to the second quarter of fiscal 2014 negatively impacted consolidated net sales in the second quarter of fiscal 2015 by $5.6 million, or 1.0%. On a constant currency basis, consolidated net sales increased 7.7% in the second quarter of fiscal 2015.

Operating income in the second quarter of fiscal 2015 increased $14.6 million, or 30.8%, to $62.0 million, compared to $47.3 million in the second quarter of fiscal 2014. Operating margin in the second quarter of

fiscal 2015 increased 190 basis points to 10.1%, compared to 8.2% in the second quarter of fiscal 2014. Adjusted operating income (a non-GAAP measure) in the second quarter of fiscal 2015 increased $6.6 million, or 11.2%, to $65.4 million, compared to $58.8 million in the second quarter of fiscal 2014. Adjusted operating margin (a non-GAAP measure) in the second quarter of fiscal 2015 increased 50 basis points to 10.7%, compared to 10.2% in the second quarter of fiscal 2014, principally driven by expense leverage.

Net income in the second quarter of fiscal 2015 increased $10.2 million, or 39.4%, to $36.1 million, or $0.68 per diluted share, compared to $25.9 million, or $0.48 per diluted share, in the second quarter of fiscal 2014. Adjusted net income (a non-GAAP measure) in the second quarter of fiscal 2015 increased $5.7 million, or 17.2%, to $38.8 million, compared to $33.1 million in the second quarter of fiscal 2014. Adjusted earnings per diluted share (a non-GAAP measure) in the second quarter of fiscal 2015 increased 19.4% to $0.73, compared to $0.61 in the second quarter of fiscal 2014. The Company estimates that changes in foreign currency exchange rates in the second quarter of fiscal 2015 as compared to the second quarter of fiscal 2014 had an immaterial effect on adjusted earnings per diluted share in the second quarter of fiscal 2015.

First Half of Fiscal 2015 compared to First Half of Fiscal 2014

Consolidated net sales increased $71.8 million, or 5.9%, to $1,297.5 million, principally driven by growth in the Company’s U.S. Carter’s and OshKosh direct-to-consumer businesses. Changes in foreign currency exchange rates in the first half of fiscal 2015 as compared to the first half of fiscal 2014 negatively impacted consolidated net sales in the first half of fiscal 2015 by $11.1 million, or 0.9%. On a constant currency basis, consolidated net sales increased 6.8% in the first half of fiscal 2015.

Operating income in the first half of fiscal 2015 increased $37.6 million, or 34.5%, to $146.5 million, compared to $108.9 million in the first half of fiscal 2014. Operating margin in the first half of fiscal 2015 increased 240 basis points to 11.3%, compared to 8.9% in the first half of fiscal 2014. Adjusted operating income in the first half of fiscal 2015 increased $23.8 million, or 18.4%, to $152.7 million, compared to $128.9 million in the first half of fiscal 2014. Adjusted operating margin in the first half of fiscal 2015 increased 130 basis points to 11.8%, compared to 10.5% in the first half of fiscal 2014, reflecting improved gross margin and expense leverage.

Net income in the first half of fiscal 2015 increased $25.7 million, or 42.7%, to $85.9 million, or $1.62 per diluted share, compared to $60.2 million, or $1.11 per diluted share, in the first half of fiscal

2014. Adjusted net income in the first half of fiscal 2015 increased $17.5 million, or 24.0%, to $90.5 million, compared to $73.0 million in the first half of fiscal 2014. Adjusted earnings per diluted share in the first half of fiscal 2015 increased 26.6% to $1.70, compared to $1.35 in the first half of fiscal 2014. The Company estimates that changes in foreign currency exchange rates in the first half of fiscal 2015 as compared to the first half of fiscal 2014 negatively affected adjusted earnings per diluted share in the first half of fiscal 2015 by approximately $0.05.

Cash flow from operations in the first half of fiscal 2015 was $27.1 million compared to $33.1 million in the first half of fiscal 2014. The decrease reflects higher earnings that were more than offset by changes in net working capital.

See the “Reconciliation of GAAP to Adjusted Results” section of this release for additional disclosures and reconciliations regarding non-GAAP measures.

Note on Net Sales vs. Comparable Sales (52 vs. 53 Week Calendars)

The Company's fiscal 2015 results will include 52 weeks compared to 53 weeks in fiscal 2014. This change in weeks will impact the comparability of results in 2015. In the following segment discussions the net sales amounts and related comparisons are based on the Company's reported fiscal 2015 and 2014 calendars. However, direct-to-consumer (“DTC”), retail store, and eCommerce comparable sales are based on adjusted 2014 periods that have been aligned to the corresponding 13 and 26 week periods in fiscal 2015.

Carter’s Retail Segment Results

Second Quarter of Fiscal 2015 compared to Second Quarter of Fiscal 2014

Carter’s retail segment sales increased $13.3 million, or 5.7%, to $247.0 million. Carter’s DTC comparable sales increased 1.1%, comprised of eCommerce comparable sales growth of 26.5%, partially offset by a retail stores comparable sales decline of 4.0%.

In the second quarter of fiscal 2015, the Company opened 13 Carter’s retail stores in the United States. The Company operated 562 Carter’s retail stores in the United States as of July 4, 2015.

First Half of Fiscal 2015 compared to First Half of Fiscal 2014

Carter’s retail segment sales increased $40.7 million, or 8.8%, to $504.7 million. Carter’s DTC comparable sales increased 0.9%, comprised of eCommerce comparable sales growth of 16.0%, partially offset by a retail stores comparable sales decline of 2.6%.

In the first half of fiscal 2015, the Company opened 33 Carter’s retail stores in the United States and closed two stores.

Carter’s Wholesale Segment Results

Second Quarter of Fiscal 2015 compared to Second Quarter of Fiscal 2014

Carter’s wholesale segment sales increased $11.7 million, or 5.8%, to $211.7 million, reflecting strong product demand, a new playwear initiative, and fall product launches.

First Half of Fiscal 2015 compared to First Half of Fiscal 2014

Carter’s wholesale segment sales increased $9.4 million, or 2.0%, to $481.0 million, reflecting greater product demand, a new playwear initiative, and fall product launches.

OshKosh Retail Segment Results

Second Quarter of Fiscal 2015 compared to Second Quarter of Fiscal 2014

OshKosh retail segment sales increased $5.9 million, or 8.8%, to $73.5 million. OshKosh DTC comparable sales increased 3.3%, comprised of eCommerce comparable sales growth of 36.2%, partially offset by a retail stores comparable sales decline of 2.6%.

In the second quarter of fiscal 2015, the Company opened 15 OshKosh retail stores in the United States and closed two stores. The Company operated 221 OshKosh retail stores in the United States as of July 4, 2015.

First Half of Fiscal 2015 compared to First Half of Fiscal 2014

OshKosh retail segment sales increased $15.4 million, or 11.8%, to $146.5 million. OshKosh DTC comparable sales increased 4.2%, comprised of eCommerce comparable sales growth of 27.2%, partially offset by a decline in retail stores comparable sales of 0.6%.

In the first half of fiscal 2015, the Company opened 24 OshKosh retail stores in the United States and closed three stores.

OshKosh Wholesale Segment Results

Second Quarter of Fiscal 2015 compared to Second Quarter of Fiscal 2014

OshKosh wholesale segment sales increased $2.7 million, or 22.8%, to $14.3 million, reflecting favorable timing of demand.

First Half of Fiscal 2015 compared to First Half of Fiscal 2014

OshKosh wholesale segment sales increased $3.1 million, or 11.5%, to $30.4 million, reflecting favorable timing of demand.

International Segment Results

Second Quarter of Fiscal 2015 compared to Second Quarter of Fiscal 2014

International segment sales increased $5.1 million, or 8.4%, to $66.3 million. This increase reflects growth in the Company’s direct-to-consumer businesses in Canada and increased wholesale demand in other international markets. This growth was partially offset by the impact of the Target Canada bankruptcy in January 2015 and unfavorable foreign currency exchange rates.

Changes in foreign currency exchange rates in the second quarter of fiscal 2015 as compared to the second quarter of fiscal 2014 negatively impacted international segment net sales in the second quarter of fiscal 2015 by $5.6 million, or 9.1%. On a constant currency basis, international segment net sales increased 17.5%.

Canadian comparable retail stores sales increased 0.2%. In the second quarter of fiscal 2015, the Company opened six retail stores in Canada. The Company operated 133 retail stores in Canada as of July 4, 2015.

First Half of Fiscal 2015 compared to First Half of Fiscal 2014

International segment sales increased $3.2 million, or 2.5%, to $134.9 million. This increase reflects growth in the Company’s direct-to-consumer businesses in Canada and increased wholesale demand in other international markets. This growth was partially offset by the impact of the Target Canada bankruptcy in January 2015, the Company’s exit of retail operations in Japan in fiscal 2014, and unfavorable foreign currency exchange rates. The Company’s former retail operations in Japan contributed $4.4 million to segment sales in the first half of fiscal 2014.

Changes in foreign currency exchange rates in the first half of fiscal 2015 as compared to the first half of fiscal 2014 negatively impacted international segment net sales in the first half of fiscal 2015 by $11.1 million, or 8.5%. On a constant currency basis, international segment net sales increased 10.9%.

Canadian comparable retail stores sales increased 3.3% in the first half of fiscal 2015. In the first half of fiscal 2015, the Company opened nine retail stores in Canada.

Dividends

During the second quarter of fiscal 2015, the Company paid a cash dividend of $0.22 per share totaling $11.5 million. The Company paid cash dividends totaling $23.1 million in the first half of fiscal 2015. Future declarations of quarterly dividends and the establishment of related record and payment dates will be at the discretion of the Company’s Board of Directors based on a number of factors, including the Company’s future financial performance and other considerations.

Stock Repurchase Activity

During the second quarter of fiscal 2015, the Company repurchased and retired 346,325 shares of its common stock for $34.8 million at an average price of $100.40 per share. In the first half of fiscal 2015, the Company repurchased and retired 504,225 shares for $48.9 million at an average price of $96.97 per share. Year-to-date through July 28, 2015, the Company repurchased and retired a total of 602,425 shares for $59.4 million at an average price of $98.60 per share. All shares were repurchased in open market transactions pursuant to applicable regulations for such transactions.

As of July 28, 2015, the total remaining capacity under the Company’s previously-announced repurchase authorizations was $126 million.

2015 Business Outlook

For the third quarter of fiscal 2015, the Company projects net sales to increase approximately 7% over the third quarter of fiscal 2014 and adjusted diluted earnings per share to increase approximately 10% to 15% compared to adjusted diluted earnings per share of $1.27 in the third quarter of fiscal 2014. The adjusted diluted earnings per share forecast excludes anticipated expenses of approximately $1 million related to the amortization of acquired tradenames and other items the Company believes to be non-representative of underlying business performance.

For fiscal 2015, the Company projects net sales to increase approximately 5% over fiscal 2014 and adjusted diluted earnings per share to increase approximately 12% to 15% compared to adjusted diluted earnings per share of $3.93 in fiscal 2014. This forecast for fiscal 2015 adjusted diluted earnings per share excludes anticipated expenses of approximately $6 million related to the amortization of acquired tradenames, approximately $2 million related to the revaluation of the Bonnie Togs contingent consideration, and other items the Company believes to be non-representative of underlying business performance.

Conference Call

The Company will hold a conference call with investors to discuss second quarter fiscal 2015 results and its business outlook on July 29, 2015 at 8:30 a.m. Eastern Daylight Time. To participate in the call, please dial 913-312-1456. To listen via the internet, please visit www.carters.com and select links for “Investor Relations” followed by “Second Quarter 2015 Earnings Conference Call”. Presentation materials for the call can be accessed under the same “Investor Relations” section by selecting links for “News & Events” followed by “Webcasts & Presentations”. A replay of the call will be available shortly after the broadcast through August 6, 2015, at 888-203-1112 (U.S. / Canada) or 719-457-0820 (international), passcode 2253968. The replay will also be archived on the Company’s website under the “Investor Relations” tab.

About Carter’s, Inc.

Carter’s, Inc. is the largest branded marketer in the United States and Canada of apparel and related products exclusively for babies and young children. The Company owns the Carter’s and OshKosh B’gosh brands, two of the most recognized brands in the marketplace. These brands are sold in leading department stores, national chains, and specialty retailers domestically and internationally. They are also sold through more than 900 Company-operated stores in the United States and Canada and on-line at www.carters.com, www.oshkoshbgosh.com, and www.cartersoshkosh.ca. The Company’s Just One You, Precious Firsts, and Genuine Kids brands are available at Target, and its Child of Mine brand is available at Walmart. Carter’s is headquartered in Atlanta, Georgia. Additional information may be found at www.carters.com.

Cautionary Language

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 relating to the Company’s future performance, including, without limitation, statements with respect to the Company’s anticipated financial results for the third quarter of fiscal 2015 and fiscal year 2015, or any other future period, assessment of the

Company’s performance and financial position, and drivers of the Company’s sales and earnings growth. Such statements are based on current expectations only, and are subject to certain risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, or projected. Factors that could cause actual results to materially differ include the risks of: losing one or more major customers, vendors, or licensees or financial difficulties for one or more of our major customers, vendors, or licensees; the Company’s products not being accepted in the marketplace; changes in consumer preference and fashion trends; negative publicity; the Company failing to protect its intellectual property; incurring costs in connection with cooperating with regulatory investigations and proceedings; the breach of the Company’s consumer databases, systems or processes; deflationary pricing pressures; decreases in the overall level of consumer spending; disruptions resulting from the Company’s dependence on foreign supply sources; foreign currency risks due to the Company’s operations outside of the United States; the Company’s use of a small number of vendors over whom it has little control; the Company’s foreign supply sources not meeting the Company’s quality standards or regulatory requirements; disruptions in the Company’s supply chain, including distribution centers or in-sourcing capabilities or otherwise, and the risk of slow-downs, disruptions or strikes along our supply chain; product recalls; the loss of the Company’s principal product sourcing agent; increased competition in the baby and young children’s apparel market; the Company being unable to identify new retail store locations or negotiate appropriate lease terms for the retail stores; the Company’s failure to successfully manage its eCommerce business; the Company not adequately forecasting demand, which could, among other things, create significant levels of excess inventory; failure to achieve sales growth plans, cost savings, and other assumptions that support the carrying value of the Company’s intangible assets; increased leverage, not being able to repay its indebtedness and being subject to restrictions on operations by the Company’s debt agreements; not attracting and retaining key individuals within the organization; failure to properly manage strategic projects; failure to implement needed upgrades to the Company’s information technology systems; disruptions of distribution functions in its Braselton, Georgia facility; being unsuccessful in expanding into international markets and failing to successfully manage legal, regulatory, political and economic risks of international operations, including maintaining compliance with worldwide anti-bribery laws; fluctuations in the Company’s tax obligations and effective tax rate; incurring substantial costs as a result of various claims or pending or threatened lawsuits; and the failure to declare future quarterly dividends. Many of these risks are further described in the most recently filed Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission under the headings “Risk Factors” and “Forward-Looking Statements.” The Company undertakes no obligation

to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

CARTER’S, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in thousands, except for share data)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Fiscal quarter ended | | Two fiscal quarters ended |

| July 4, 2015 | | June 28, 2014 | | July 4, 2015 | | June 28, 2014 |

Net sales | $ | 612,765 |

| | $ | 574,065 |

| | $ | 1,297,529 |

| | $ | 1,225,709 |

|

Cost of goods sold | 349,870 |

| | 328,588 |

| | 750,582 |

| | 718,507 |

|

Gross profit | 262,895 |

| | 245,477 |

| | 546,947 |

| | 507,202 |

|

Selling, general, and administrative expenses | 209,296 |

| | 206,315 |

| | 420,479 |

| | 416,410 |

|

Royalty income | (8,353 | ) | | (8,185 | ) | | (19,989 | ) | | (18,086 | ) |

Operating income | 61,952 |

| | 47,347 |

| | 146,457 |

| | 108,878 |

|

Interest expense | 6,935 |

| | 6,882 |

| | 13,627 |

| | 13,780 |

|

Interest income | (157 | ) | | (140 | ) | | (294 | ) | | (272 | ) |

Other (income) expense, net | (1,900 | ) | | (189 | ) | | 62 |

| | 407 |

|

Income before income taxes | 57,074 |

| | 40,794 |

| | 133,062 |

| | 94,963 |

|

Provision for income taxes | 20,969 |

| | 14,897 |

| | 47,165 |

| | 34,770 |

|

Net income | $ | 36,105 |

| | $ | 25,897 |

| | $ | 85,897 |

| | $ | 60,193 |

|

| | | | | | | |

Basic net income per common share | $ | 0.69 |

| | $ | 0.48 |

| | $ | 1.63 |

| | $ | 1.12 |

|

Diluted net income per common share | $ | 0.68 |

| | $ | 0.48 |

| | $ | 1.62 |

| | $ | 1.11 |

|

Dividend declared and paid per common share | $ | 0.22 |

| | $ | 0.19 |

| | $ | 0.44 |

| | $ | 0.38 |

|

CARTER’S, INC.

BUSINESS SEGMENT RESULTS

(dollars in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal quarter ended | | | Two fiscal quarters ended |

| July 4,

2015 | | % of

Total Net Sales | | June 28,

2014 | | % of

Total Net Sales | | | July 4,

2015 | | % of

Total Net Sales | | June 28,

2014 | | % of

Total Net Sales |

Net sales: | | | | | | | | | | | | | | | | |

Carter’s Wholesale | $ | 211,730 |

| | 34.6 | % | | $ | 200,059 |

| | 34.8 | % | | | $ | 481,045 |

| | 37.1 | % | | $ | 471,688 |

| | 38.5 | % |

Carter’s Retail (a) | 246,980 |

| | 40.4 | % | | 233,690 |

| | 40.7 | % | | | 504,707 |

| | 39.0 | % | | 464,018 |

| | 37.9 | % |

Total Carter’s | 458,710 |

| | 75.0 | % | | 433,749 |

| | 75.5 | % | | | 985,752 |

| | 76.1 | % | | 935,706 |

| | 76.4 | % |

OshKosh Retail (a) | 73,453 |

| | 12.0 | % | | 67,515 |

| | 11.8 | % | | | 146,495 |

| | 11.3 | % | | 131,073 |

| | 10.7 | % |

OshKosh Wholesale | 14,306 |

| | 2.3 | % | | 11,649 |

| | 2.0 | % | | | 30,357 |

| | 2.3 | % | | 27,235 |

| | 2.2 | % |

Total OshKosh | 87,759 |

| | 14.3 | % | | 79,164 |

| | 13.8 | % | | | 176,852 |

| | 13.6 | % | | 158,308 |

| | 12.9 | % |

International (b) | 66,296 |

| | 10.7 | % | | 61,152 |

| | 10.7 | % | | | 134,925 |

| | 10.3 | % | | 131,695 |

| | 10.7 | % |

Total net sales | $ | 612,765 |

| | 100.0 | % | | $ | 574,065 |

| | 100.0 | % | | | $ | 1,297,529 |

| | 100.0 | % | | $ | 1,225,709 |

| | 100.0 | % |

| | | | | | | | | | | | | | | | |

Operating income: | | | % of

Segment

Net Sales | | | | % of

Segment

Net Sales | | | | | % of

Segment

Net Sales | | | | % of

Segment

Net Sales |

Carter’s Wholesale | $ | 40,207 |

| | 19.0 | % | | $ | 30,860 |

| | 15.4 | % | | | $ | 98,138 |

| | 20.4 | % | | $ | 77,727 |

| | 16.5 | % |

Carter’s Retail (a) | 38,331 |

| | 15.5 | % | | 40,179 |

| | 17.2 | % | | | 82,824 |

| | 16.4 | % | | 83,158 |

| | 17.9 | % |

Total Carter’s | 78,538 |

| | 17.1 | % | | 71,039 |

| | 16.4 | % | | | 180,962 |

| | 18.4 | % | | 160,885 |

| | 17.2 | % |

OshKosh Retail (a) | (1,815 | ) | | (2.5 | )% | | (1,694 | ) | | (2.5 | )% | | | (2,775 | ) | | (1.9 | )% | | (6,183 | ) | | (4.7 | )% |

OshKosh Wholesale | 2,249 |

| | 15.7 | % | | 859 |

| | 7.4 | % | | | 5,228 |

| | 17.2 | % | | 2,885 |

| | 10.6 | % |

Total OshKosh | 434 |

| | 0.5 | % | | (835 | ) | | (1.1 | )% | | | 2,453 |

| | 1.4 | % | | (3,298 | ) | | (2.1 | )% |

International (b) (c) | 6,236 |

| | 9.4 | % | | 7,107 |

| | 11.6 | % | | | 12,747 |

| | 9.4 | % | | 11,143 |

| | 8.5 | % |

Corporate expenses (d) (e) | (23,256 | ) | | | | (29,964 | ) | | | | | (49,705 | ) | |

|

| | (59,852 | ) | |

|

|

Total operating income | $ | 61,952 |

| | 10.1 | % | | $ | 47,347 |

| | 8.2 | % | | | $ | 146,457 |

| | 11.3 | % | | $ | 108,878 |

| | 8.9 | % |

| |

(a) | Includes eCommerce results. |

| |

(b) | Net sales includes international retail, eCommerce, and wholesale sales. Operating income includes international licensing income. |

| |

(c) | Includes charges associated with the revaluation of the Company’s contingent consideration related to the Company’s 2011 acquisition of Bonnie Togs of approximately $1.4 million for the fiscal quarter ended July 4, 2015, and $1.9 million and $0.5 million for each of the two-fiscal-quarter periods ended July 4, 2015 and June 28, 2014, respectively. The charge associated with the revaluation for the fiscal quarter ended June 28, 2014 was not material. Also includes expenses of approximately $0.9 million and $0.5 million for the second quarter of fiscal 2014 and for the first two quarters of fiscal 2014, respectively, related to the Company’s exit from Japan retail operations. |

| |

(d) | Corporate expenses include expenses related to incentive compensation, stock-based compensation, executive management, severance and relocation, finance, building occupancy, information technology, certain legal fees, consulting, and audit fees. |

| |

(e) | Includes the following charges: |

|

| | | | | | | | | | | | | | | |

| Fiscal quarter ended | | Two fiscal quarters ended |

(dollars in millions) | July 4,

2015 | | June 28,

2014 | | July 4,

2015 | | June 28,

2014 |

Closure of distribution facility in Hogansville, GA (1) | $ | — |

| | $ | 0.3 |

| | $ | — |

| | $ | 0.6 |

|

Office consolidation costs | $ | — |

| | $ | 4.6 |

| | $ | — |

| | $ | 6.6 |

|

Amortization of tradenames | $ | 2.1 |

| | $ | 5.6 |

| | $ | 4.4 |

| | $ | 11.9 |

|

(1) Continuing operating costs associated with the closure of the Company’s distribution facility in Hogansville, Georgia.

This facility was sold in December 2014.

CARTER’S, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except for share data)

(unaudited)

|

| | | | | | | | | | | |

| July 4, 2015 | | January 3, 2015 | | June 28, 2014 |

ASSETS | | | | | |

Current assets: | | | | | |

Cash and cash equivalents | $ | 244,301 |

| | $ | 340,638 |

| | $ | 207,920 |

|

Accounts receivable, net | 157,145 |

| | 184,563 |

| | 133,885 |

|

Finished goods inventories | 544,256 |

| | 444,844 |

| | 538,233 |

|

Prepaid expenses and other current assets | 48,475 |

| | 34,788 |

| | 43,684 |

|

Deferred income taxes | 31,871 |

| | 36,625 |

| | 36,534 |

|

Total current assets | 1,026,048 |

| | 1,041,458 |

| | 960,256 |

|

Property, plant, and equipment, net of accumulated depreciation of $263,580, $245,011, and $233,812 | 353,138 |

| | 333,097 |

| | 325,675 |

|

Tradenames and other intangibles, net | 312,836 |

| | 317,297 |

| | 318,346 |

|

Goodwill | 178,753 |

| | 181,975 |

| | 186,173 |

|

Deferred debt issuance costs, net | 5,952 |

| | 6,677 |

| | 7,407 |

|

Other assets | 12,842 |

| | 12,592 |

| | 11,305 |

|

Total assets | $ | 1,889,569 |

| | $ | 1,893,096 |

| | $ | 1,809,162 |

|

| | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

Current liabilities: | | | | | |

Accounts payable | $ | 145,809 |

| | $ | 150,243 |

| | $ | 164,199 |

|

Other current liabilities | 76,451 |

| | 97,728 |

| | 75,561 |

|

Total current liabilities | 222,260 |

| | 247,971 |

| | 239,760 |

|

| | | | | |

Long-term debt | 586,298 |

| | 586,000 |

| | 586,000 |

|

Deferred income taxes | 119,230 |

| | 121,536 |

| | 114,878 |

|

Other long-term liabilities | 158,842 |

| | 150,905 |

| | 148,152 |

|

Total liabilities | 1,086,630 |

| | 1,106,412 |

| | 1,088,790 |

|

| | | | | |

Commitments and contingencies | | | | | |

| | | | | |

Stockholders' equity: | | | | | |

Preferred stock; par value $.01 per share; 100,000 shares authorized; none issued or outstanding at July 4, 2015, January 3, 2015, and June 28, 2014 | — |

| | — |

| | — |

|

Common stock, voting; par value $.01 per share; 150,000,000 shares authorized; 52,331,208, 52,712,193, and 53,311,864 shares issued and outstanding at July 4, 2015, January 3, 2015 and June 28, 2014, respectively | 523 |

| | 527 |

| | 533 |

|

Additional paid-in capital | — |

| | — |

| | — |

|

Accumulated other comprehensive loss | (29,275 | ) | | (23,037 | ) | | (10,050 | ) |

Retained earnings | 831,691 |

| | 809,194 |

| | 729,889 |

|

Total stockholders' equity | 802,939 |

| | 786,684 |

| | 720,372 |

|

Total liabilities and stockholders' equity | $ | 1,889,569 |

| | $ | 1,893,096 |

| | $ | 1,809,162 |

|

CARTER’S, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(dollars in thousands)

(unaudited)

|

| | | | | | | |

| Two fiscal quarters ended |

| July 4, 2015 | | June 28, 2014 |

Cash flows from operating activities: | | | |

Net income | $ | 85,897 |

| | $ | 60,193 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 30,338 |

| | 29,679 |

|

Amortization of tradenames | 4,429 |

| | 11,877 |

|

Accretion of contingent consideration | 809 |

| | 451 |

|

Amortization of debt issuance costs | 678 |

| | 763 |

|

Non-cash stock-based compensation expense | 9,560 |

| | 9,829 |

|

Unrealized foreign currency exchange loss, net | 84 |

| | — |

|

Income tax benefit from stock-based compensation | (6,890 | ) | | (3,750 | ) |

Loss on disposal of property, plant, and equipment | 90 |

| | 544 |

|

Deferred income taxes | 1,886 |

| | (5,626 | ) |

Effect of changes in operating assets and liabilities: | | | |

Accounts receivable | 28,649 |

| | 59,761 |

|

Inventories | (103,379 | ) | | (120,383 | ) |

Prepaid expenses and other assets | (14,244 | ) | | (9,979 | ) |

Accounts payable and other liabilities | (10,775 | ) | | (235 | ) |

Net cash provided by operating activities | 27,132 |

| | 33,124 |

|

| | | |

Cash flows from investing activities: | | | |

Capital expenditures | (50,284 | ) | | (61,300 | ) |

Proceeds from sale of property, plant, and equipment | 43 |

| | 134 |

|

Net cash used in investing activities | (50,241 | ) | | (61,166 | ) |

| | | |

Cash flows from financing activities: | | | |

Payments of debt issuance costs | — |

| | (114 | ) |

Borrowings under secured revolving credit facility | 20,349 |

| | — |

|

Payments on secured revolving credit facility | (20,000 | ) | | — |

|

Repurchase of common stock | (48,894 | ) | | (36,080 | ) |

Dividends paid | (23,143 | ) | | (20,380 | ) |

Income tax benefit from stock-based compensation | 6,890 |

| | 3,750 |

|

Withholdings from vesting of restricted stock | (12,377 | ) | | (4,251 | ) |

Proceeds from exercise of stock options | 4,560 |

| | 6,548 |

|

Net cash used in financing activities | (72,615 | ) | | (50,527 | ) |

| | | |

Effect of exchange rate changes on cash | (613 | ) | | (57 | ) |

Net decrease in cash and cash equivalents | (96,337 | ) | | (78,626 | ) |

Cash and cash equivalents, beginning of period | 340,638 |

| | 286,546 |

|

Cash and cash equivalents, end of period | $ | 244,301 |

| | $ | 207,920 |

|

CARTER’S, INC.

RECONCILIATION OF GAAP TO ADJUSTED RESULTS

(dollars in millions, except earnings per share)

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal quarter ended July 4, 2015 |

| Gross Margin | | % Net Sales | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Net Income | | Diluted EPS |

As reported (GAAP) | $ | 262.9 |

| | 42.9 | % | | $ | 209.3 |

| | 34.2 | % | | $ | 62.0 |

| | 10.1 | % | | $ | 36.1 |

| | $ | 0.68 |

|

Amortization of tradenames (a) | — |

| | | | (2.1 | ) | | | | 2.1 |

| | | | 1.3 |

| | 0.02 |

|

Revaluation of contingent consideration (b) | — |

| | | | (1.4 | ) | | | | 1.4 |

| | | | 1.4 |

| | 0.03 |

|

As adjusted (c) | $ | 262.9 |

| | 42.9 | % | | $ | 205.8 |

| | 33.6 | % | | $ | 65.4 |

| | 10.7 | % | | $ | 38.8 |

| | $ | 0.73 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Two fiscal quarters ended July 4, 2015 |

| Gross Margin | | % Net Sales | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Net Income | | Diluted EPS |

As reported (GAAP) | $ | 546.9 |

| | 42.2 | % | | $ | 420.5 |

| | 32.4 | % | | $ | 146.5 |

| | 11.3 | % | | $ | 85.9 |

| | $ | 1.62 |

|

Amortization of tradenames (a) | — |

| | | | (4.3 | ) | | | | 4.3 |

| | | | 2.7 |

| | 0.05 |

|

Revaluation of contingent consideration (b) | — |

| | | | (1.9 | ) | | | | 1.9 |

| | | | 1.9 |

| | 0.03 |

|

As adjusted (c) | $ | 546.9 |

| | 42.2 | % | | $ | 414.3 |

| | 31.9 | % | | $ | 152.7 |

| | 11.8 | % | | $ | 90.5 |

| | $ | 1.70 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal quarter ended June 28, 2014 |

| Gross Margin | | % Net Sales | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Net Income | | Diluted EPS |

As reported (GAAP) | $ | 245.5 |

| | 42.8 | % | | $ | 206.3 |

| | 35.9 | % | | $ | 47.3 |

| | 8.2 | % | | $ | 25.9 |

| | $ | 0.48 |

|

Amortization of tradenames (a) | — |

| | | | (5.6 | ) | | | | 5.6 |

| | | | 3.5 |

| | 0.07 |

|

Office consolidation costs (d) | — |

| | | | (4.6 | ) | | | | 4.6 |

| | | | 2.9 |

| | 0.05 |

|

Japan retail operations exit | — |

| | | | (0.9 | ) | | | | 0.9 |

| | | | 0.6 |

| | 0.01 |

|

Closure of distribution facility (Hogansville, GA) | — |

| | | | (0.3 | ) | | | | 0.3 |

| | | | 0.2 |

| | — |

|

As adjusted (c) | $ | 245.5 |

| | 42.8 | % | | $ | 194.8 |

| | 33.9 | % | | $ | 58.8 |

| | 10.2 | % | | $ | 33.1 |

| | $ | 0.61 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Two fiscal quarters ended June 28, 2014 |

| Gross Margin | | % Net Sales | | SG&A | | % Net Sales | | Operating Income | | % Net Sales | | Net Income | | Diluted EPS |

As reported (GAAP) | $ | 507.2 |

| | 41.3 | % | | $ | 416.4 |

| | 34.0 | % | | $ | 108.9 |

| | 8.9 | % | | $ | 60.2 |

| | $ | 1.11 |

|

Amortization of tradenames (a) | — |

| | | | (11.9 | ) | | | | 11.9 |

| | | | 7.5 |

| | 0.14 |

|

Office consolidation costs (d) | — |

| | | | (6.6 | ) | | | | 6.6 |

| | | | 4.2 |

| | 0.08 |

|

Revaluation of contingent consideration (b) | — |

| | | | (0.5 | ) | | | | 0.5 |

| | | | 0.5 |

| | 0.01 |

|

Closure of distribution facility (Hogansville, GA) | — |

| | | | (0.6 | ) | | | | 0.6 |

| | | | 0.4 |

| | 0.01 |

|

Japan retail operations exit | (1.0 | ) | | | | (1.5 | ) | | | | 0.5 |

| | | | 0.3 |

| | 0.01 |

|

As adjusted (c) | $ | 506.2 |

| | 41.2 | % | | $ | 395.4 |

| | 32.3 | % | | $ | 128.9 |

| | 10.5 | % | | $ | 73.0 |

| | $ | 1.35 |

|

| |

(a) | Amortization of H.W. Carter and Sons tradenames acquired in 2013. |

| |

(b) | Revaluation of the contingent consideration liability associated with the Company’s acquisition of Bonnie Togs in 2011. |

| |

(c) | In addition to the results provided in this earnings release in accordance with GAAP, the Company has provided adjusted, non-GAAP financial measurements that present gross margin, SG&A, operating income, net income, and net income on a diluted share basis excluding the adjustments discussed above. The Company believes these adjustments provide a meaningful comparison of the Company’s results. The adjusted, non-GAAP financial measurements included in this earnings release should not be considered as an alternative to net income or as any other measurement of performance derived in accordance with GAAP. The adjusted, non-GAAP financial measurements are presented for informational purposes only and are not necessarily indicative of the Company’s future condition or results of operations. |

| |

(d) | Costs associated with office consolidation including severance, relocation, accelerated depreciation, and other charges. |

Note: Results may not be additive due to rounding.

CARTER’S, INC.

RECONCILIATION OF GAAP TO ADJUSTED RESULTS

(dollars in millions, except earnings per share)

(unaudited) |

| | | | | | | | | | | | | | | | | | | |

| Fiscal quarter ended September 27, 2014 |

| Gross Margin | | SG&A | | Operating Income | | Net Income | | Diluted EPS |

As reported (GAAP) | $ | 321.2 |

| | $ | 221.9 |

| | $ | 110.5 |

| | $ | 65.9 |

| | $ | 1.23 |

|

Amortization of tradenames (a) | — |

| | (2.3 | ) | | 2.3 |

| | 1.5 |

| | 0.03 |

|

Revaluation of contingent consideration (b) | — |

| | (0.4 | ) | | 0.4 |

| | 0.4 |

| | 0.01 |

|

Closure of distribution facility (Hogansville, GA) | — |

| | (0.2 | ) | | 0.2 |

| | 0.1 |

| | — |

|

As adjusted (c) | $ | 321.2 |

| | $ | 219.0 |

| | $ | 113.4 |

| | $ | 67.9 |

| | $ | 1.27 |

|

|

| | | | | | | | | | | | | | | | | | | |

| Fiscal year ended January 3, 2015 (53 weeks) |

| Gross Margin | | SG&A | | Operating Income | | Net Income | | Diluted EPS |

As reported (GAAP) | $ | 1,184.4 |

| | $ | 890.3 |

| | $ | 333.3 |

| | $ | 194.7 |

| | $ | 3.62 |

|

Amortization of tradenames (a) | — |

| | (16.4 | ) | | 16.4 |

| | 10.4 |

| | 0.19 |

|

Office consolidation costs (d) | — |

| | (6.6 | ) | | 6.6 |

| | 4.2 |

| | 0.08 |

|

Revaluation of contingent consideration (b) | — |

| | (1.3 | ) | | 1.3 |

| | 1.3 |

| | 0.03 |

|

Closure of distribution facility (Hogansville, GA) | — |

| | (0.9 | ) | | 0.9 |

| | 0.6 |

| | 0.01 |

|

Japan retail operations exit | (1.0 | ) | | (1.5 | ) | | 0.5 |

| | 0.3 |

| | 0.01 |

|

As adjusted (c) | $ | 1,183.4 |

| | $ | 863.3 |

| | $ | 359.3 |

| | $ | 211.5 |

| | $ | 3.93 |

|

| |

(a) | Amortization of H.W. Carter and Sons tradenames acquired in 2013. |

| |

(b) | Revaluation of the contingent consideration liability associated with the Company’s acquisition of Bonnie Togs in 2011. |

| |

(c) | In addition to the results provided in this earnings release in accordance with GAAP, the Company has provided adjusted, non-GAAP financial measurements that present gross margin, SG&A, operating income, net income, and net income on a diluted share basis excluding the adjustments discussed above. The Company believes these adjustments provide a meaningful comparison of the Company’s results. The adjusted, non-GAAP financial measurements included in this earnings release should not be considered as an alternative to net income or as any other measurement of performance derived in accordance with GAAP. The adjusted, non-GAAP financial measurements are presented for informational purposes only and are not necessarily indicative of the Company’s future condition or results of operations. |

| |

(d) | Costs associated with office consolidation including severance, relocation, accelerated depreciation, and other charges. |

Note: Results may not be additive due to rounding.

CARTER’S, INC.

RECONCILIATION OF NET INCOME ALLOCABLE TO COMMON SHAREHOLDERS

(unaudited)

|

| | | | | | | | | | | | | | | | |

| Fiscal quarter ended | | | Two fiscal quarters ended |

| July 4,

2015 | | June 28,

2014 | | | July 4,

2015 | | June 28,

2014 |

Weighted-average number of common and common equivalent shares outstanding: | | | | | | | | |

Basic number of common shares outstanding | 52,020,386 |

| | 52,836,070 |

| | | 52,069,800 |

| | 53,004,264 |

|

Dilutive effect of equity awards | 526,016 |

| | 455,116 |

| | | 514,121 |

| | 478,426 |

|

Diluted number of common and common equivalent shares outstanding | 52,546,402 |

| | 53,291,186 |

| | | 52,583,921 |

| | 53,482,690 |

|

As reported on a GAAP Basis: | | | | | | | | |

Basic net income per common share: | | | | | | | | |

Net income | $ | 36,105 |

| | $ | 25,897 |

| | | $ | 85,897 |

| | $ | 60,193 |

|

Income allocated to participating securities | (305 | ) | | (345 | ) | | | (847 | ) | | (812 | ) |

Net income available to common shareholders | $ | 35,800 |

| | $ | 25,552 |

| | | $ | 85,050 |

| | $ | 59,381 |

|

Basic net income per common share | $ | 0.69 |

| | $ | 0.48 |

| | | $ | 1.63 |

| | $ | 1.12 |

|

Diluted net income per common share: | | | | | | | | |

Net income | $ | 36,105 |

| | $ | 25,897 |

| | | $ | 85,897 |

| | $ | 60,193 |

|

Income allocated to participating securities | (303 | ) | | (343 | ) | | | (840 | ) | | (807 | ) |

Net income available to common shareholders | $ | 35,802 |

| | $ | 25,554 |

| | | $ | 85,057 |

| | $ | 59,386 |

|

Diluted net income per common share | $ | 0.68 |

| | $ | 0.48 |

| | | $ | 1.62 |

| | $ | 1.11 |

|

As adjusted (a): | | | | | | | | |

Basic net income per common share: | | | | | | | | |

Net income | $ | 38,805 |

| | $ | 33,120 |

| | | $ | 90,518 |

| | $ | 72,986 |

|

Income allocated to participating securities | (329 | ) | | (443 | ) | | | (893 | ) | | (989 | ) |

Net income available to common shareholders | $ | 38,476 |

| | $ | 32,677 |

| | | $ | 89,625 |

| | $ | 71,997 |

|

Basic net income per common share | $ | 0.74 |

| | $ | 0.62 |

| | | $ | 1.72 |

| | $ | 1.36 |

|

Diluted net income per common share: | | | | | | | | |

Net income | $ | 38,805 |

| | $ | 33,120 |

| | | $ | 90,518 |

| | $ | 72,986 |

|

Income allocated to participating securities | (326 | ) | | (440 | ) | | | (886 | ) | | (983 | ) |

Net income available to common shareholders | $ | 38,479 |

| | $ | 32,680 |

| | | $ | 89,632 |

| | $ | 72,003 |

|

Diluted net income per common share | $ | 0.73 |

| | $ | 0.61 |

| | | $ | 1.70 |

| | $ | 1.35 |

|

| |

(a) | In addition to the results provided in this earnings release in accordance with GAAP, the Company has provided adjusted, non-GAAP financial measurements that present per share data excluding the adjustments discussed above. The Company has excluded $2.7 million and $4.6 million in after-tax expenses from these results for the fiscal quarter and two fiscal quarters ended July 4, 2015, respectively. The Company has excluded $7.2 million and $12.8 million in after-tax expenses from these results for the fiscal quarter and two fiscal quarters ended June 28, 2014, respectively. |

RECONCILIATION OF U.S. GAAP AND NON-GAAP INFORMATION

(unaudited)

The following table provides a reconciliation of EBITDA and Adjusted EBITDA for the periods indicated to net income, which is the most directly comparable financial measure presented in accordance with GAAP:

|

| | | | | | | | | | | | | | | | | | | |

| Fiscal quarter ended | | Two fiscal quarters ended | | Four fiscal quarters ended |

| July 4, 2015 | | June 28, 2014 | | July 4, 2015 | | June 28, 2014 | | July 4,

2015 |

(dollars in millions) | | | | | | | | | |

Net income | $ | 36.1 |

| | $ | 25.9 |

| | $ | 85.9 |

| | $ | 60.2 |

| | $ | 220.4 |

|

Interest expense | 6.9 |

| | 6.9 |

| | 13.6 |

| | 13.8 |

| | 27.5 |

|

Interest income | (0.2 | ) | | (0.1 | ) | | (0.3 | ) | | (0.3 | ) | | (0.4 | ) |

Income tax expense | 21.0 |

| | 14.9 |

| | 47.2 |

| | 34.8 |

| | 120.6 |

|

Depreciation and amortization (a) | 17.6 |

| | 20.0 |

| | 34.8 |

| | 41.6 |

| | 68.1 |

|

EBITDA | $ | 81.4 |

| | $ | 67.5 |

| | $ | 181.2 |

| | $ | 150.0 |

| | $ | 436.2 |

|

| | | | | | | | | |

Adjustments to EBITDA | | | | | | | | | |

Office consolidation costs (b) (c) | $ | — |

| | $ | 4.6 |

| | $ | — |

| | $ | 6.5 |

| | $ | — |

|

Revaluation of contingent consideration (d) | 1.4 |

| | — |

| | 1.9 |

| | 0.5 |

| | 2.8 |

|

Closure of distribution facility (Hogansville, GA) (c) | — |

| | 0.3 |

| | — |

| | 0.6 |

| | 0.3 |

|

Japan retail operations exit (c) | — |

| | 0.6 |

| | — |

| | (0.4 | ) | | 0.1 |

|

Adjusted EBITDA | $ | 82.8 |

| | $ | 73.0 |

| | $ | 183.1 |

| | $ | 157.3 |

| | $ | 439.4 |

|

| |

(a) | Includes amortization of acquired tradenames. |

| |

(b) | Costs associated with office consolidation including severance, relocation, and other charges. |

| |

(c) | Amounts exclude costs related to accelerated depreciation as such amounts are included in the total of depreciation and amortization above. |

| |

(d) | Revaluation of the contingent consideration liability associated with the Company’s acquisition of Bonnie Togs in 2011. |

Note: Results may not be additive due to rounding.

EBITDA and Adjusted EBITDA are supplemental financial measures that are not defined or prepared in accordance with GAAP. We define EBITDA as net income before interest, income taxes, and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items described in the footnotes (a) - (e) to the table above.

We present EBITDA and Adjusted EBITDA because we consider them important supplemental measures of our performance and believe they are frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry.

The use of EBITDA and Adjusted EBITDA instead of net income or cash flows from operations has limitations as an analytical tool, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. EBITDA and Adjusted EBITDA do not represent net income or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. While EBITDA, Adjusted EBITDA and similar measures are frequently used as measures of operations and the ability to meet debt service requirements, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation. EBITDA and Adjusted EBITDA do not reflect the impact of earnings or charges resulting from matters that we consider not to be indicative of our ongoing operations. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as discretionary cash available to us for working capital, debt service and other purposes.

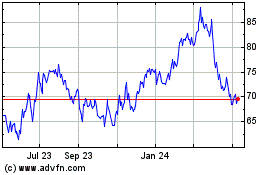

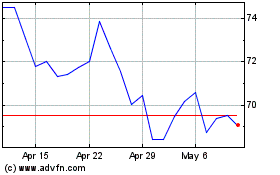

Carters (NYSE:CRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carters (NYSE:CRI)

Historical Stock Chart

From Apr 2023 to Apr 2024