Boston Properties Reports Higher Profit on Sales Gains, Raises FFO Projections

October 29 2015 - 6:30PM

Dow Jones News

By Maria Armental

Boston Properties Inc.'s (BXP) third-quarter profit rose on

gains from real-estate sales even as more of its properties went

vacant.

Citing market conditions, such as rental rates and occupancy

levels, the Boston-based real-estate investment trust raised its

projection for funds from operations, a key metric for REITs, to

$5.46 to $5.48 a share, compared with its earlier view of $5.37 to

$5.45 a share. In 2014, it made $5.26 a share.

For 2016, it projects FFO of $5.50 to $5.70 a share, compared

with analysts' projected $5.78 a share, according to Thomson

Reuters.

Meanwhile for the current quarter, it projects FFO of $1.39 to

$1.41 a share, compared with analysts' forecasts of $1.39 a share,

according to Thomson Reuters.

Boston Properties defines funds from operations as net income

less real-estate-related depreciation and amortization along with

impairment losses or gains or losses associated with disposition

activities.

The REIT, which focuses on office space, has said it expects

results to benefit from the expansion of the life sciences and

technology industry in the Boston area, which accounts for nearly a

third of its square footage.

It gave its John Hancock Tower, on Boston's Back Bay, a facelift

that it has said it expects to attract new tenants at a 40%

premium. But company officials have said they expected much of that

space to remain vacant until at least the second half of 2016.

Overall, Boston Properties reported a profit of $186.7 million,

or $1.20 a share, compared with $130.4 million, or 83 cents a

share, a year earlier. FFO were $1.41 a share, compared with $1.46

a share a year earlier, above its projected $1.34 to $1.36 a

share.

Revenue rose to $629.9 million from $618.8 million, compared

with analysts' projected $610.8 million.

The percentage of leased properties in its portfolio fell to

91.3%, from 91.7% as of Dec. 31, the company said.

The percentage of leased property in San Francisco, where a tech

boom is fueling demand and adding pressure to the city's cap on

office-space development under Proposition M, improved to 88.6%

from 88.3% as of Dec. 31.

Shares, inactive in late trading, closed at $122.78 on Thursday,

down 5% for the year.

Write to Maria Armental at maria.armental@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 18:15 ET (22:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

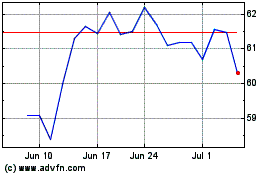

BXP (NYSE:BXP)

Historical Stock Chart

From Aug 2024 to Sep 2024

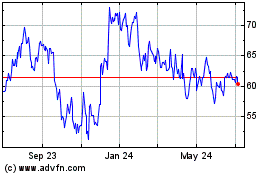

BXP (NYSE:BXP)

Historical Stock Chart

From Sep 2023 to Sep 2024