William Hill Boss Pay Deal Scrapes Through As Investors Protest

May 08 2012 - 8:53AM

Dow Jones News

U.K. bookmaker William Hill PLC (WMH.LN) Tuesday became the

latest company to face the threat of a shareholder rebellion as

investors voiced serious concerns over plans to award a GBP1.2

million "retention bonus" to its chief executive.

Just under 50% of shareholders opposed the resolution to award

the bonus to Ralph Topping, but there was a sufficient number of

votes to carry the proposal, which also sees Topping receive an

8.3% pay rise.

"Whilst we recognize that some shareholders are not supportive

of this one-off agreement, we believe that there is widespread

appreciation of the very significant contribution of Ralph Topping

to the success of William Hill," said Chairman Gareth Davis.

The backlash adds to the gathering storm of shareholder

discontent over the perception of excessive boardroom pay. Earlier

Tuesday, Andrew Moss, chief executive of U.K. insurance group Aviva

PLC (AV.LN), announced his resignation after shareholders rejected

a proposed GBP2.69 million pay packet.

Last week, the chief executives of AstraZeneca PLC (AZN.LN) and

Trinity Mirror (TNI.LN) also quit after investors challenged their

pay.

Topping, who joined William Hill nearly 40 years ago and became

chief executive in 2008, will now receive annual pay in excess of

GBP1.7 million, while the retention fee means he will stay at the

company until at least December 2013.

The bookmaker's shares have risen 32% since the start of the

year as it has improved its online betting facilities, while net

revenue increased 12% in the first quarter.

At 1218 GMT, William Hill shares were down 4.8 pence, or 1.8%,

at 267.1 pence.

-By Peter Evans, Dow Jones Newswires; 44-20-7842-9308;

peter.evans@dowjones.com

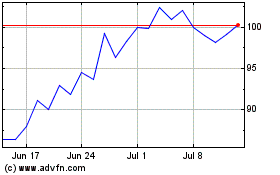

Reach (LSE:RCH)

Historical Stock Chart

From Aug 2024 to Sep 2024

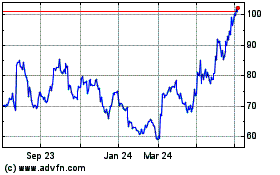

Reach (LSE:RCH)

Historical Stock Chart

From Sep 2023 to Sep 2024