Today's Top Supply Chain and Logistics News From WSJ

March 22 2017 - 7:06AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Concerns over price-fixing in shipping are spreading just as

global container lines are preparing to line up in powerful new

alliances. The U.S. Justice Department effectively disclosed an

investigation into the liner companies, the WSJ's Costas Paris

reports, by crashing a meeting of top industry executives and

issued subpoenas to companies including Maersk Line, a unit of

Danish conglomerate A.P. Moller Maersk A/S and Germany's

Hapag-Lloyd AG. The probe comes as carriers are undertaking big

changes following a crushing downturn, consolidating businesses

while exerting new discipline on operations and pricing. They're

also resetting operations this spring under three big alliances

that will divide an enormous share of containerized goods on major

trade lanes. The shipping lines are seeing freight rates rise at a

substantial pace off last year's historic lows, increases carriers

say are the result of tight capacity. Recent probes in the

automobile-shipping and airfreight business suggest investigators

won't easily let go of questions over collusion, however.

When the owners of a shoe factory at the heart of China's

industrial base starts looking for lower-cost operations in the

U.S., it's clear that big shifts are underway in global

manufacturing. The scouting by Dongguan Winwin Industrial, which

makes high-quality sneakers and casual shoes for big American

companies, is part of a trend that began long before Donald Trump's

angry election rhetoric highlighted China's manufacturing power,

the WSJ's Andrew Browne reports. The exit of U.S. factory jobs from

the country is roughly matched by posts coming in, according to the

nonprofit Reshoring Initiative, a response to changes in

supply-chain economics, including rising wages and taxes in China

and the costly, slow shipping path to market. Lower real-estate and

energy costs in the U.S. add to the new calculations, but the

biggest change is on the factory floor. Manufacturing executives

say new automation helps defray labor costs, changing the formula

for measuring factories in China against those in the U.S.

FedEx Corp. insists its investment in ground operations will pay

off in coming years , but the business is weighing on earnings

growth this year. The express giant reported a $562 million net

profit in the third quarter as revenue jumped 18% to $15 billion,

the WSJ's Maria Armental reports. But FedEx also cut its projected

earnings for the current fiscal year as it copes with the costs of

integrating its TNT Express acquisition and of adjusting to more

expensive e-commerce deliveries. Those distribution costs helped

pull down profit margins at the express and ground divisions in a

quarter that included peak-season holiday shipping. FedEx even lost

some residential delivery business to what it calls its own "yield

management actions." That means the company insisted on higher

prices, a strategy FedEx is likely to maintain until its

investments make online deliveries cheaper and easier to

deliver.

SUPPLY CHAIN STRATEGIES

The logistics real-estate market may be due for a big upheaval.

Blackstone Group LP is gearing up to unload its European warehouse

property arm, the WSJ's Art Patnaude reports, in a sale that comes

as Global Logistic Properties Ltd. prepares to sell its own set of

logistics sites around the world. Blackstone, the U.S.

private-equity giant, has been working simultaneously toward a sale

or initial public offering for Logicor, which it created in 2012 to

operate industrial properties across Europe. The sales signal a

global shift in ownership of logistics properties as the strong

expansion of e-commerce is boosting the value of logistics sites

and upending entrenched patterns of distribution. Experts believe a

Blackstone sale could surpass $10 billion. One question hanging

over any sale is how the Blackstone sites will fit into a

distribution landscape that may change as online shopping grows and

the U.K. exits the European Union.

QUOTABLE

IN OTHER NEWS

A bankruptcy judge approved a reorganization plan to bring

Ultrapetrol (Bahamas) Ltd., owner of one of the largest cargo

fleets in South America, out of chapter 11. (WSJ)

The U.S. and Britain banned passengers from carrying most large

electronics in the cabin on flights from a handful of countries in

the Middle East and North Africa. (WSJ)

The dollar fell to its lowest level in more than four months.

(WSJ)

Copper prices are falling on hopes that supply disruptions in

Chile and Indonesia could be ending. (WSJ)

European Union leaders will meet April 29 to agree on guidelines

for Brexit negotiations with Britain. (WSJ)

U. K. consumer prices rose at their fastest pace in nearly 3 1/2

years in February. (WSJ)

European Union and Japan's leaders vow to fast-track talks on a

trade deal aimed at boosting exports and countering U.S.

protectionism. (WSJ)

General Mills Inc.'s fiscal third-quarter sales in North America

fell 7% from a year ago. (WSJ)

Wal-Mart Stores Inc. is starting an internal venture called

Store No. 8 meant to incubate new online retail businesses. ( New

York Times)

Amazon.com Inc is expanding a program to remove counterfeit

goods from its website. (Reuters)

Taiwan Semiconductor Manufacturing Co. is considering placing a

multibillion-dollar microchip fabrication plant in the U.S.

(Bloomberg)

App-based grocery delivery service Shipt is rolling out Costco

Wholesale Corp. home delivery in Tampa, Fla. (Business

Journals)

The Saint Lawrence Seaway navigation season opened at the St.

Lambert Lock in Montreal. (MarineLink)

The New York Shipping Exchange, which aims to provide a platform

to set contracts for future ocean shipping, gained $8.5 million in

funding. (American Shipper)

The American Trucking Associations truck tonnage index fell 2.6%

from January to February. (Logistics Management)

Whole Foods Market Inc. adopted new sourcing guidelines for tuna

in the grocer's prepared foods department. (MarketWatch)

Chinese imports of U.S. lobsters are soaring. (WBZ)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 22, 2017 06:51 ET (10:51 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

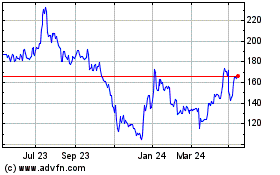

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

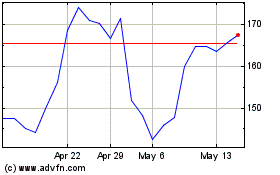

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

From Apr 2023 to Apr 2024