Telefonica Suspends IPO of Telxius Infrastructure Unit--Update

September 29 2016 - 1:08PM

Dow Jones News

By Jeannette Neumann

MADRID--Telefónica SA (TEF) said it is suspending the initial

public offering of its Telxius infrastructure unit because offers

from potential investors "undervalued the business."

The scuttled deal throws a wrench in the Spanish

telecommunication giant's efforts to quickly raise funds to whittle

down more than EUR50 billion ($56.1 billion) in debt. The company

is seeking to ease concerns among investors and credit rating firms

that it is taking steps improve its financial health.

Telefónica said it will continue to explore other alternatives

for the Telxius unit, according to a regulatory filing published

Thursday.

Earlier this month, Telefónica said it planned to float a

minority stake of at least 25% of the infrastructure unit before

year's end.

The Madrid-based company is separately laying the groundwork for

a potential IPO of its British mobile operator O2. The company

tried to sell the U.K. unit to CK Hutchison Holdings Ltd. (0001.HK)

last year, a deal which was eventually quashed by the European

Commission.

Credit-rating firms such as Moody's Investors Service have said

they want to see Telefónica make progress on paring down its debt

to maintain its credit rating. Investors have been concerned that

the company's debt could jeopardize its dividend. Telefónica has

said its dividend this year is covered.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

September 29, 2016 12:53 ET (16:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

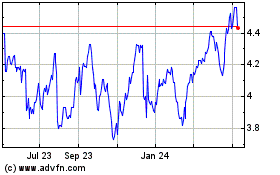

Telefonica (NYSE:TEF)

Historical Stock Chart

From Aug 2024 to Sep 2024

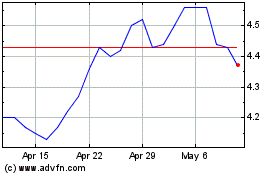

Telefonica (NYSE:TEF)

Historical Stock Chart

From Sep 2023 to Sep 2024