Premier Oil PLC Revised conversion price for convertible bonds (2573A)

March 23 2017 - 3:00AM

UK Regulatory

TIDMPMO

RNS Number : 2573A

Premier Oil PLC

23 March 2017

This announcement has been determined to contain inside

information

PREMIER OIL PLC

("Premier")

Revised conversion price for Premier's convertible bonds

23 March 2017

Further to the announcement on 1 March 2017 setting out the

proposed changes to the terms of its $245m convertible bonds,

Premier today confirms the amended conversion price will be 74.71p,

a premium of 20% to the volume weighted average price of Premier's

shares over the period from 1 March to 22 March 2017 (inclusive).

The exchange rate to be used on any future conversion of the bonds

will be re-set to a fixed rate of $1.2280/GBP.

As previously announced, Premier will seek to implement the

amendments to the terms of the convertible bonds by way of

extraordinary resolution at a meeting of the convertible

bondholders. The amendments will become effective on completion of

Premier's refinancing.

Enquiries

Premier Oil plc Tel: 020 7730 1111

Tony Durrant (CEO)

Richard Rose (Finance Director)

Bell Pottinger Tel: 020 3772 2570

Lorna Cobbett

Henry Lerwill

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUUOWRBUAOUAR

(END) Dow Jones Newswires

March 23, 2017 03:00 ET (07:00 GMT)

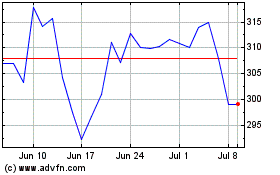

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Apr 2023 to Apr 2024