Kiwi Extends Fall

January 20 2015 - 11:40PM

RTTF2

The New Zealand dollar extended declines against the other major

currencies in the early Asian session on Wednesday after quarterly

consumer price inflation data released earlier in the day showed

that the nation slipped into deflation.

Data released by the Statistics New Zealand showed that consumer

prices in New Zealand were down 0.2 percent on quarter in the

fourth quarter of 2014. This missed expectations for a flat reading

following three straight quarters of 0.3 percent gain.

On a yearly basis, consumer prices climbed 0.8 percent - also

below forecasts for 0.9 percent and down from 1.0 percent in the

previous three months.

Tuesday, the NZ dollar fell 1.73 percent against the U.S.

dollar, 0.74 percent against the yen, 1.22 percent against the euro

and 1.25 percent against the Australian dollar.

In the early Asian trading today, the NZ dollar fell to a

1-1/2-month low of 1.0710 against the Australian dollar and more

than a 2-week low of 0.7622 against the U.S. dollar from

yesterday's early highs of 1.0533 and 0.7781, respectively. The

kiwi is likely to find support around 1.08 against the aussie and

0.75 against the greenback.

Against the euro, the kiwi slipped to a 5-day low of 1.5147 from

yesterday's early highs of 1.4885 and held steady thereafter.

The kiwi dropped to a 1-week low of 90.38 against the yen, from

yesterday's closing quote of 90.72. If the kiwi extends its

downtrend, it is likely to find support around the 89.79 area.

Looking ahead, U.K. unemployment rate for November, claimant

count rate for December and Bank of England's minutes from its

January policy meeting and Switzerland ZEW survey economic

expectation index for January are due to be released in the

European session.

In the New York session, U.S. building permits and housing

starts for December and Canada wholesale sales data for November

are scheduled for release.

At 7:00 am ET, Bank of England Deputy Governor Minouche Shafik

will deliver a speech on financial markets in Brussels.

At 10:00 am ET, the Bank of Canada will announce its decision on

interest rates and release its quarterly monetary policy report.

Economists expect the key rate to be kept unchanged at 1.00

percent. Subsequently, Bank of Canada Governor Stephen Poloz and

Senior Deputy Governor Carolyn Wilkins are due top hold a news

conference to explain the rate decision and the monetary policy

report.

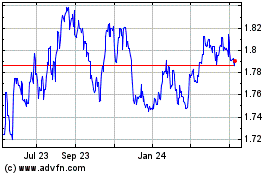

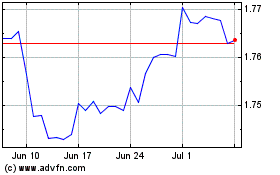

Euro vs NZD (FX:EURNZD)

Forex Chart

From Aug 2024 to Sep 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

From Sep 2023 to Sep 2024