Honeywell Seeking Buyer for Building Solutions Business

February 24 2016 - 1:30PM

Dow Jones News

Honeywell International Inc., which has been trying to

orchestrate a megamerger with United Technologies Corp., has also

quietly been shopping a unit that provides safety and other

services to commercial buildings, in the latest sign of the

industrial conglomerate's effort to reshape itself through deal

making.

About three months ago, Honeywell began soliciting interest in

its so-called building-solutions business, which could be worth

between $3 billion and $4 billion, according to people familiar

with the matter. Bankers at Goldman Sachs Group Inc. have been

helping with the sales process, targeting other buildings-systems

companies, the people said.

Additional details were unavailable and it isn't clear whether

Honeywell would sell the business if it succeeded in merging with

United Technologies. In any event, as always, there may be no deal

at all.

The potential asset sale comes just days after it surfaced that

Honeywell has explored a merger deal with United Technologies.

Talks between the two companies had been going on for several

months, but United Technologies now says that combining two of the

biggest players in the aerospace and commercial-building equipment

businesses "would face insurmountable regulatory obstacles and

strong customer opposition."

Still, Honeywell has signaled that it isn't ready to give up yet

on a merger with United Technologies, which would be one of the

biggest deals at a time when such activity is booming.

Honeywell's building-solutions business is part of the company's

automation and control solutions, or ACS, unit. In 2015, Honeywell

had $38.6 billion in revenue, with $14 billion of that coming from

ACS. The asset Honeywell is currently trying to sell is a piece of

the building-solutions and distribution business within ACS that

accounted for $4.6 billion in revenue in 2015. It installs and

maintains systems that keep facilities safe from fire and other

emergencies and energy efficient, according to Honeywell's

website.

Honeywell, whose shares are down about 6% since its bid for

United Technologies became public, currently has a market

capitalization of $77 billion.

Based in Morris Plains, N.J., Honeywell makes everything from

aircraft guidance systems and gas meters to rubber gloves. While

many competitors have narrowed down and sold off divisions,

Honeywell has until now taken the opposite tack under Chief

Executive Dave Cote, who has done dozens of acquisitions and kept

the company a sprawling conglomerate.

Despite volatile markets, there has been a flurry of deal

activity in the industrial sector this year. Last month, Johnson

Controls Inc. agreed to buy Tyco International PLC for roughly $15

billion. The deal would create a giant provider of

commercial-building systems, and likely sidelines both companies

from bidding on the Honeywell division, some of the people

said.

Last week, private-equity firm Apollo Global Management LLC

agreed to buy ADT Corp. in a deal that values the burglar-alarm

vendor at more than $13 billion including debt.

Honeywell is working with Centerview Partners and Lazard on its

pursuit of United Technologies, according to people familiar with

the matter. United Technologies is working with J.P. Morgan Chase

& Co. It is possible other advisers could be added to either

side should the potential deal progress.

Write to Dana Cimilluca at dana.cimilluca@wsj.com and Ted Mann

at ted.mann@wsj.com

(END) Dow Jones Newswires

February 24, 2016 13:15 ET (18:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

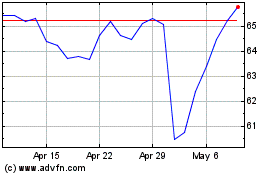

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Aug 2024 to Sep 2024

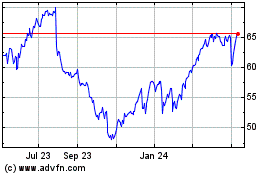

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Sep 2023 to Sep 2024