TIDMGEMD

RNS Number : 2526F

Gem Diamonds Limited

11 November 2015

11 November 2015

GEM DIAMONDS LIMITED

Trading update for Q3 2015

Gem Diamonds Limited (LSE: GEMD) ("Gem Diamonds" or the

"Company" or the "Group") is pleased to report a Trading Update

detailing the Company's operational and sales performance for the

Period 1 July 2015 to 30 September 2015 ("Q3 2015") or ("the

Period").

Letšeng:

Prices firm, costs down and production up

-- Revised 2015 production and cost guidance following strong

operational performance and cost discipline

-- Average price of US$ 2 578 per carat was achieved in Q3 2015

-- 13 rough diamonds achieved a value of greater than US$ 1.0

million each, including an exceptional

quality 357 carat Type IIa white diamond which achieved US$ 19.3 million on tender

-- A total of three diamonds of over 100 carats each were sold in the Period

-- Zero Lost Time Injuries (LTIs) at Letšeng for the past 365 days

Ghaghoo:

Grade remains higher than reserve and carat production up

-- Average recovered grade of 29.1 cpht (compared to the average reserve grade of 27.8 cpht)

-- Five development tunnels being mined, with a further four tunnels being developed

-- 115 diamonds greater than 4.8 carats each were recovered

during the Period, including 13 diamonds larger than 10.8

carats

-- 31 923 carats recovered during the Period, including two blue

rough diamonds weighing 2.2 carats and 1.5 carats

-- Second parcel sold in July achieving an average price of US$

165 per carat, bringing the total average

US$ per carat achieved for the year to date to US$ 176 per carat

-- Zero LTIs at Ghaghoo for the past 365 days

Financial:

-- Group cash on hand of US$ 86.1 million cash as at 30

September 2015, of which US$ 72.0 million attributable to Gem

Diamonds

-- Group has drawn down US$ 32.1 million of its available

facilities, resulting in net cash position of US$ 54.0 million

-- During the Period, Letšeng paid dividends of US$ 20.2

million, which resulted in a net cash flow of US$ 12.7 million to

Gem Diamonds and a cash outflow from the Group as a result of

withholding taxes of US$ 1.4 million and payment of the Government

of Lesotho's dividend portion of US$ 6.1 million.

Gem Diamonds' CEO, Clifford Elphick commented:

"It is pleasing to see that the prices achieved for Letšeng's

diamonds during the third quarter have remained robust despite the

challenging market conditions experienced throughout this Period.

The large high quality diamonds, for which Letšeng is renowned,

have contributed to a strong Q3 2015 average price of US$ 2 578 per

carat.

Letšeng has also delivered a strong operational performance,

with ore treated, grade and carat recoveries ahead of those of the

previous quarter and expected to exceed original full year

guidance.

Ghaghoo continues its ramp up, with ore treated and carats

recovered up over 30% on the previous quarter. The Ghaghoo

production faces a very challenging market at present."

1. Diamond Market

Prices for the large, high value rough production from Letšeng

remained robust during the Period, achieving an average of US$ 2

578 per carat, amid continued liquidity constraints, high inventory

levels and the slowdown of the Chinese economy. The general

sentiment in the diamond market remained cautious, and with

continuing global macro-economic uncertainty, has placed further

downward pressure on both rough and polished diamond prices.

Following the Hong Kong Diamond and Jewellery Show in September

2015, focus has now turned to the US market and the approaching

year-end holiday sales as diamantaires look to sell down polished

diamond inventories.

2. Letšeng

Gem Diamonds holds a 70% shareholding in Letšeng Diamonds (Pty)

Ltd ("Letšeng") in partnership with the Government of the Kingdom

of Lesotho which owns the remaining 30%.

2.1 Production

Q3 2015 H1 2015 9 months to 30 September 2015

------------------------- ---------- ----------- ------------------------------

Waste stripped (tonnes) 6 244 432 11 364 784 17 609 216

------------------------- ---------- ----------- ------------------------------

Ore treated (tonnes) 1 758 295 3 110 351 4 868 646

------------------------- ---------- ----------- ------------------------------

Carats recovered 29 460 50 019 79 479

------------------------- ---------- ----------- ------------------------------

Grade recovered (cpht) 1.68 1.61 1.63

------------------------- ---------- ----------- ------------------------------

During the Period, 6.24 million tonnes of waste were mined, in

line with the revised life of mine plan which will allow increased

levels of higher grade ore from the Satellite pipe to be mined

annually.

Following the Plant 2 Phase 1 upgrade, ore processed through the

plant is currently achieving the planned head feed tonnage which

will increase throughput by 250 000 tonnes on an annualised

basis.

Letšeng's Plants 1 and 2 treated a total of 1.47 million tonnes

of ore during the Period, of which 55% was sourced from the Main

Pipe and 45% from the Satellite pipe. The balance of the ore (0.29

million tonnes) was treated through the Alluvial Ventures

contractor plant, of which 70% was sourced from the Main pipe and

30% from stockpiles.

Following on from the good progress made in the Satellite pipe

waste stripping, the year to date contribution of ore from the

Satellite pipe has already reached 1.58 million tonnes against the

initial full year target of 1.65 million tonnes and is now expected

to reach 1.8 million tonnes by year end.

2.2 Rough Diamond Sales and Diamonds Extracted for Manufacturing

Q3 2015* H1 2015* 9 months to 30 September 2015*

---------------------------- --------- --------- -------------------------------

Carats sold 25 460 46 961 72 421

---------------------------- --------- --------- -------------------------------

Total value (US$ millions) 65.6 106 .3 171.9

---------------------------- --------- --------- -------------------------------

Achieved US$/ct 2 578 2 264 2 374

---------------------------- --------- --------- -------------------------------

*Includes carats extracted at rough value for polishing.

Two Letšeng tenders were held in the Period, achieving an

average price of US$ 2 578* per carat, bringing the 12 month

rolling average at 30 September 2015 to US$ 2 303* per carat.

33 carats were extracted for own manufacturing during the Period

at a rough value of US$ 1.0 million.

2.3 Letšeng revised guidance for 2015

Guidance has been revised from that previously reported in March

2015.

FY 2015 FY 2015

--------------------------- ---------------- -----------------

Revised Guidance Previous Guidance

September 2015 March 2015

--------------------------- ---------------- -----------------

Waste tonnes mined (Mt) 23.5 - 24.5 22 - 24

--------------------------- ---------------- -----------------

Ore treated (Mt) 6.5 - 6.7 6.3 - 6.5

--------------------------- ---------------- -----------------

Carats recovered (Kct) 105 - 108 102 - 107

--------------------------- ---------------- -----------------

Carats sold (Kct) 103 - 105 102 - 107

--------------------------- ---------------- -----------------

Direct cash costs (before

waste) per tonne treated

(Maloti) 140 - 150 145 - 155

--------------------------- ---------------- -----------------

Mining waste cash costs

per tonne of waste mined

(Maloti) 26 - 28 28 - 30

--------------------------- ---------------- -----------------

Operating costs per tonne

treated(1) (Maloti) 205 - 225 210 - 230

--------------------------- ---------------- -----------------

1. Operating costs per tonne excludes royalty, selling costs,

depreciation and mine amortisation, but includes inventory, waste

and ore stockpile adjustments.

3. Ghaghoo

Gem Diamonds' wholly-owned subsidiary, Gem Diamonds Botswana, is

currently developing the Ghaghoo mine ("Ghaghoo") in Botswana.

Q3 2015 H1 2015 9 months to 30 September 2015

------------------------ -------- -------- ------------------------------

Ore treated (tonnes) 109 751 132 125 241 876

------------------------ -------- -------- ------------------------------

Carats recovered 31 922 35 283 67 205

------------------------ -------- -------- ------------------------------

Grade recovered (cpht) 29.1 26.7 27.8

------------------------ -------- -------- ------------------------------

All ore mined is being sourced from tunnels one to five on Level

1. Production build up is continuing. Development of the next four

tunnels is well advanced in order to generate reserves for

sustainable production. The water at the rim tunnel has been

successfully sealed and development has now progressed through the

fissure area.

(MORE TO FOLLOW) Dow Jones Newswires

November 11, 2015 02:00 ET (07:00 GMT)

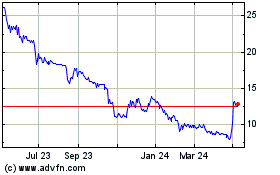

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Aug 2024 to Sep 2024

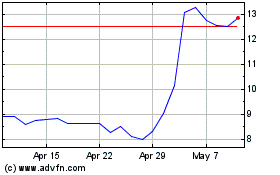

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Sep 2023 to Sep 2024