During the 26 weeks ended 28 June 2015, the Group entered into

transactions, in the ordinary course of business, with related

parties. Transactions entered into and trading balances outstanding

at 28 June 2015, with related parties, are as follows:

Amounts

Sales owed

to by

related related

party party

GBP000 GBP000

Associates and joint ventures

28 June 2015 11,517 1,855

29 June 2014 9,688 571

28 December 2014 19,157 1,445

14. ANALYSIS OF NET DEBT

(Unaudited) (Unaudited)

At At At

28 June 29 June 28 December

2015 2014 2014

GBP000 GBP000 GBP000

Cash and cash equivalents 30,134 43,611 33,743

Bank revolving facility (8,301) (29,797) (5,447)

Bank loan EBT - (15,000) (15,000)

Finance leases (29) (93) (60)

Other loans (2,599) (2,455) (2,278)

Net cash / (debt) 19,205 (3,734) 10,958

------------ ------------ ------------

15. PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties facing the Group in terms

of preventing or restricting execution of our strategy during the

period under review and for the remainder of the financial period

have not materially changed from those set out on pages 20 to 24 of

the Domino's Pizza Group plc Annual Report and Accounts 2014.

However, the Company has appointed a new Chief Financial Officer

and, therefore, this is no longer considered to be a risk for the

remainder of the financial period.

In summary, the Group is exposed to the following main

risks:

o Business Strategy

o Strategic direction - the risk of implementing a strategy in

newer markets such as Germany, Switzerland, Liechtenstein and

Luxembourg that does not achieve the desired outcomes

o Germany - Germany remains a challenge and the Group is

dedicated to focusing on its success and growth

o Food Production, Storage and Suppliers

o Failure of a critical supplier - we are reliant upon the

continued operation of various third-party suppliers who provide

raw materials

o Food safety and compliance - The Supply Chain Centres must

comply with applicable food safety rules and regulations and our

franchisees must ensure that all stores are also compliant

o Production issues or destruction on Supply Chain Centres - One

of the key functions of the business is production of dough and the

distribution of food and other store items by our Supply Chain

Centres

o Competition

o Competitors and consumer trends - failure to compete on

product, service and quality and changes in consumer tastes, brand

relevance and demographic trends

o Franchisees

o Material deterioration in relationships with franchisees -

relationships with franchisees are key to the Group's success as

the franchisees drive a large part of the business

o Commercial leverage of large franchisees - certain franchisees

are now of considerable scale and therefore there is a risk that

should these franchisees be allowed to expand further they could

attempt to leverage off their size with a view to gaining

preferential treatment from the Group

o Brand Reputation

o Reputational damage or loss of confidence in the brand - any

significant act, omission or harmful allegation that is made in

public in relation to the brand could lead to significant media

interest and potentially bad publicity

o Information Technology and Security

o Data protection and security - significant failure in, or

successful attacks on, our IT infrastructure, systems and processes

could impact online sales and place customer data at risk of loss

or theft

o Property

o Store growth - continuing acquisition and development of

property sites carries inherent risk as challenges exist in

relation to finding new sites, obtaining planning permission (or

other consents and compliance) in the countries in which the Group

operates

o People

o Employees - failure to attract, retain, develop and motivate

the best people at all levels

o Corporate Governance

o Internal controls, fraud and compliance - ensuring the Group

has the appropriate internal controls and policies

A copy of the Annual Report and Accounts 2014 is available at

corporate.dominos.co.uk

RESPONSIBILITY STATEMENT

Each of the Directors, whose names and functions appear below,

confirm to the best of their knowledge that the condensed interim

financial statements have been prepared in accordance with IAS 34,

'Interim Financial Reporting', as issued by the IASB and adopted by

the European Union and that the interim management report herein

includes a fair review of the information required by the

Disclosure and Transparency Rules (DTR), namely:

-- DTR 4.2.7 (R): an indication of important events that have

occurred during the six month period ended 28 June 2015 and their

impact on the condensed interim financial statements, and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

-- DTR 4.2.8 (R): any related party transactions in the six

month period ended 28 June 2015 that have materially affected, and

any changes in the related party transactions described in the

Annual Report and Accounts 2014 that could materially affect the

financial position or performance of the enterprise during that

period.

The Directors of Domino's Pizza Group plc as at the date of this

announcement are as set out below:

Stephen Hemsley, Non-executive Chairman

Colin Halpern*, Non-executive Vice-Chairman

David Wild, Chief Executive Officer

Paul Doughty, Chief Financial Officer

Kevin Higgins*

Ebbe Jacobsen*

Michael Shallow*

Helen Keays*

Steve Barber*

*Non-executive Directors

A list of the current Directors is maintained on the Domino's

Pizza Group plc website at: corporate.dominos.co.uk.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of financial information differs from

the legislation in other jurisdictions.

This responsibility statement was approved by the Board of

Directors on 27 July 2015 and is signed on its behalf by Paul

Doughty, Chief Financial Officer.

By order of the Board

Paul Doughty

Chief Financial Officer

28 July 2015

INDEPENDENT REVIEW REPORT TO DOMINO'S PIZZA GROUP PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

26 weeks ended 28 June 2015 which comprises the Group Income

Statement, Group Statement of Comprehensive Income, Group Balance

Sheet, Group Statement of Changes in Equity, Group Cash Flow

Statement and the related notes. We have read the other information

contained in the half yearly financial report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of

financial statements.

This report is made solely to the company in accordance with

guidance contained in International Standard on Review Engagements

2410 (UK and Ireland) "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the

Auditing Practices Board. To the fullest extent permitted by law,

we do not accept or assume responsibility to anyone other than the

company, for our work, for this report, or for the conclusions we

have formed.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting", as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

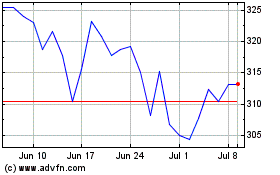

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Domino's Pizza (LSE:DOM)

Historical Stock Chart

From Apr 2023 to Apr 2024