UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2015

Array BioPharma Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-16633 | 84-1460811 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

|

| | |

3200 Walnut Street, Boulder, Colorado 80301 |

(Address of principal executive offices, including Zip Code) |

|

(303) 381-6600 |

(Registrant’s telephone number, including area code) |

|

|

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

__ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

__ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

__ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

__ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

In this report, “Array BioPharma,” “Array,” “we,” “us” and “our” refer to Array BioPharma Inc., unless the context otherwise provides.

Item 2.02 Results of Operations and Financial Condition.

On August 3, 2015, Array BioPharma Inc. issued a press release reporting results for the fourth quarter and full year of fiscal year ending June 30, 2015, the full text of which is attached hereto as Exhibit 99.1. The information in Item 2.02 of this Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

| | |

Exhibit No. | | Description |

99.1 | | Press release dated August 3, 2015 entitled “Array BioPharma Reports Financial Results for the Fourth Quarter and Full Year of Fiscal 2015” |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

Date: August 3, 2015 | | Array BioPharma Inc. |

| | | |

| | By: | /s/ DAVID HORIN |

| | | David Horin |

| | | Chief Financial Officer |

| | | |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

99.1 | | Press release dated August 3, 2015 entitled “Array BioPharma Reports Financial Results for the

Fourth Quarter and Full Year of Fiscal 2015” |

Press Release

CONTACT: Tricia Haugeto

(303) 386-1193

thaugeto@arraybiopharma.com

ARRAY BIOPHARMA REPORTS FINANCIAL RESULTS FOR THE

FOURTH QUARTER AND FULL YEAR OF FISCAL 2015

- Top-line results from binimetinib and encorafenib pivotal trials and

first NDA submission expected in fiscal year 2016 -

- Positive data recently presented in BRAF-mutant melanoma (binimetinib and encorafenib), BRAF-mutant colorectal cancer (encorafenib) and Neurofibromatosis Type 1 (selumetinib) -

Boulder, Colo., (August 3, 2015) - Array BioPharma Inc. (NASDAQ: ARRY) today reported results for the fourth quarter and full year of its fiscal year ended June 30, 2015.

Ron Squarer, Chief Executive Officer of Array, noted, “Binimetinib and encorafenib, two innovative oncology products in Phase 3, are on track for regulatory submissions in 2016. Additional data shared over the summer in BRAF-mutant melanoma and BRAF-mutant colorectal cancer further validate the value of these programs by showing the potential for differentiation compared to other approaches. Binimetinib and encorafenib have accelerated our path to commercialization and provide us with opportunities to test these broadly active products across a number of indications.”

Array ended the quarter with $185.1 million in cash, cash equivalents, marketable securities and accounts receivable. Accounts receivable as of June 30, 2015 primarily consists of current receivables expected to be repaid by Novartis within three months. Revenue for the fourth quarter of fiscal 2015 was $12.3 million, compared to $6.0 million for the same period last year. The $6.3 million increase in revenue from the prior period was primarily due to $5.7 million in reimbursable research and development expenses from Novartis. Cost of partnered programs for the fourth quarter of fiscal 2015 was $7.0 million, compared to $11.4 million for the same period last year. Research and development expense was $18.6 million, compared to $14.5 million in the same prior year period. The increase in research and development expense and corresponding decrease in cost of partnered programs is related to binimetinib and encorafenib being recently classified in research and development for the last three months of the fiscal year, rather than in the cost of partnered programs. Net loss for the fourth quarter was $12.7 million, or ($0.09) per share (diluted), and was $28.2 million, or ($0.22) per share (diluted), for the same period in fiscal 2014.

Array reported revenue of $51.9 million for the fiscal year ended June 30, 2015, compared to revenue of $42.1 million for fiscal 2014. Cost of partnered programs was $44.4 million, compared to $46.0 million in the same period last year. Net income for the fiscal year ended June 30, 2015 was $9.4 million, or $0.07 per share (diluted), compared to a net loss of $85.3 million, or ($0.69) per share (diluted), reported in fiscal 2014.

KEY PIPELINE UPDATES

Binimetinib (MEK162) and Encorafenib (LGX818) - NEMO and COLUMBUS (Part 1) enrollment complete, awaiting top-line results in 2H 2015 and 1H 2016, respectively; BRAF trial results presented at ASCO and ESMO GI

BRAF melanoma results

Preliminary data from a Phase 1b/2 trial of the combination of binimetinib and encorafenib in BRAF melanoma patients were shared at the 2015 annual meeting of the American Society of Clinical Oncology (ASCO). Results in patients who were BRAF-inhibitor treatment naïve showed encouraging clinical activity consistent with other

MEK/BRAF inhibitor combinations in this patient population. In addition, the combination showed good tolerability and a potentially differentiated safety profile relative to other MEK/BRAF inhibitor combinations is emerging in the dose range currently being studied in the Phase 3 COLUMBUS trial.

In the study, patients were treated with binimetinib 45 mg twice daily (BID) and increasing doses of encorafenib once daily (QD). The encorafenib doses were over the range of 50 to 800 mg and included doses of 400 and 450 mg, which are comparable to the 450 mg dose being used in the Phase 3 COLUMBUS trial. This was followed by an expansion phase at the maximum tolerated dose of 600 mg QD. The objective response rate (ORR, confirmed complete response or partial response) reported in the trial was 75% (41 of 55) for BRAF-naïve patients, including a 78% (7 of 9) response rate for patients treated with the encorafenib 400/450 mg dose. The estimated median overall progression-free survival for BRAF-naïve patients was 11.3 months. Preliminary data from the study also indicate that in combination with binimetinib, encorafenib was tolerated at doses up to 600 mg, twice its single-agent maximum tolerated dose. At the 400/450 mg dose of encorafenib, a differentiated safety profile relative to other MEK/BRAF inhibitor combinations is emerging, including lower incidence of all-grade pyrexia, rash and photosensitivity.

Array expects to present additional preliminary combination data of binimetinib and encorafenib in BRAF melanoma patients from an ongoing 140-patient Phase 2 trial (LOGIC-2) at the 2015 European Cancer Congress (ECC) in September. LOGIC-2 utilizes the same binimetinib and encorafenib dose levels that are currently being studied in the COLUMBUS trial and will provide a further opportunity to demonstrate the safety profile of this combination in a large, independent data set.

BRAF colorectal cancer results

At the 2015 ESMO World Congress of Gastrointestinal Cancer, Array shared preliminary results from a 100-patient, randomized Phase 2 trial testing the combination of encorafenib and cetuximab, an EGFR inhibitor, with or without the addition of alpelisib, a PI3K inhibitor, in patients with BRAF colorectal cancer (BRAF CRC). Results from the study indicate that these combinations can be administered with good tolerability and show promising clinical activity in this patient population with high unmet medical need. Patient enrollment is now complete in the Phase 2 study.

Preliminary results show an ORR and disease control rate (complete or partial response or stable disease) of 29% and 81%, respectively, for patients receiving the combination of encorafenib and cetuximab (encorafenib doublet), and 35% and 79%, respectively, for patients receiving the combination of encorafenib, cetuximab and alpelisib (encorafenib triplet). Across both the encorafenib doublet and triplet treatment groups, most treatment related adverse events were grade 1 or 2 with few grade 3 or 4 adverse events.

These results are consistent with the results reported for the Phase 1b portion of the trial and are encouraging when compared to currently available therapies for BRAF CRC patients, as well as to other recently published investigational approaches in this population, providing Array with the opportunity to pursue a potentially first- and best-in-class treatment for these patients. Historically, response rates are very low for either single-agent EGFR or RAF inhibitor therapy in patients with BRAF CRC, which suggests a synergistic effect for the combination of encorafenib and cetuximab in this population.

Update on Phase 3 trials and European partnership

In April 2015, the NEMO Phase 3 study completed patient enrollment. With enrollment complete, Array reaffirms a projected regulatory filing of binimetinib in NRAS melanoma during the first half of 2016. Data from a combination trial with binimetinib and LEE011, a CDK 4/6 inhibitor, in NRAS melanoma will be shared at an oral presentation at the ECC 2015.

In addition, the COLUMBUS (Part 1) study also completed enrollment in April 2015, leading Array to reaffirm a projected regulatory filing of binimetinib and encorafenib in BRAF melanoma during 2016. Patient enrollment

continues in Part 2 of COLUMBUS. The MILO Phase 3 trial in patients with low-grade serous ovarian cancer continues to enroll patients, and Array estimates the availability of top-line data from MILO, along with a projected regulatory filing, in 2017.

Array continues to engage in discussions to identify a partner for Europe for both binimetinib and encorafenib and will provide further updates when appropriate.

Selumetinib (partnered with AstraZeneca) - SUMIT trial update; three additional registration trials advancing, including SELECT-1 (NSCLC), ASTRA (thyroid cancer) and neurofibromatosis type 1 (NF1); NF1 results presented at scientific conference

The Phase 3 study of selumetinib in combination with dacarbazine for the treatment of patients with metastatic uveal melanoma did not meet its primary endpoint of progression free survival. This combination therapy showed an adverse event profile generally consistent with current knowledge of the safety profiles of dacarbazine and selumetinib. A full evaluation of the data is ongoing. AstraZeneca and Array do not believe the results from this trial inform the outcome of the ongoing selumetinib registration studies in second-line KRAS-mutant non-small cell lung cancer (SELECT-1), thyroid cancer (ASTRA) or neurofibromatosis 1 (NF1). These trials are in distinct patient populations and are being conducted in combination with different agents or are being studied as a single agent. AstraZeneca expects to share top-line results from SELECT-1 in 2016.

In June 2015, interim results from a Phase 1 trial in children and young adults with NF1 and plexiform neurofibromas (PNs) were presented at the Children’s Tumor Foundation NF conference. NF is a genetic disorder that can cause typically non-malignant tumors, or PNs, to grow on nerves throughout the body. These tumors can be very disfiguring, painful and disabling. Most tumors are inoperable, while some patients undergo, often repeated surgical procedures. NF1 also causes a number of other health issues, including deafness, blindness, learning disabilities, bone abnormalities and sometimes cancer. PNs exhibit the most rapid growth in young children, and therefore early intervention in children with growing PNs may result in the greatest clinical benefit. NF1, which appears in approximately one in 3,000 people, or 100,000 in the United States, has no cure. In the study, 66% (16 of 24) of patients treated with selumetinib achieved a partial response (defined in this disease by a 20% reduction in tumor size) and all patients remained on study with a median of 18 cycles (1 cycle = 28 days, range, 6-43). Improvement in function, and reduction in PN-related pain and disfigurement were also observed. The most frequent adverse events were acneiform rash, increased creatine kinase and gastrointestinal effects. Consistent volume decreases of large PNs had not been reported in prior studies with other therapies. A registration trial of selumetinib for inoperable PN is underway.

ARRY-797 (ARRY-371797) - Phase 2 trial enrolling patients with LMNA A/C-related dilated cardiomyopathy (DCM)

Array is enrolling a 12-patient Phase 2 study to evaluate the effectiveness and safety of ARRY-797 in patients with LMNA A/C-related DCM, a serious, genetic cardiovascular disease. By age 45, approximately 70% of patients with LMNA A/C-related DCM experience cardiovascular death, transplant or a major cardiac event. Currently, we have patients on this trial past 48 weeks and ARRY-797 has been well-tolerated. Patients completing this Phase 2 trial are being enrolled in a roll-over study to continue treatment. Interim data continue to be encouraging for multiple endpoints across patients, but further data are needed to fully assess the magnitude, consistency and durability of effects.

Filanesib (ARRY-520) -Two Phase 2 studies continue to advance

Filanesib is a highly selective, targeted KSP inhibitor with a mechanism of action distinct from currently available myeloma therapies, such as immunomodulatory drugs and proteasome inhibitors. Two studies with filanesib continue to advance in patients with relapsed / refractory multiple myeloma: a randomized Phase 2 Kyprolis® (carfilzomib) combination study (ARRAY-520-216) and the AfFIRM trial, a global Phase 2 single agent study. Array plans to share additional results later this year. Data from these trials will inform next steps.

OPERATIONAL CHANGES

Array divests its Chemistry, Manufacturing and Controls operations

In June 2015, Accuratus Lab Services acquired Array’s chemistry, manufacturing and controls (CMC) operation. Accuratus will continue to support the CMC services requirements of Array.

CONFERENCE CALL INFORMATION

Array will hold a conference call on Monday, August 3, 2015 at 9:00 a.m. Eastern Time to discuss these results. Ron Squarer, Chief Executive Officer, will lead the call.

Date: Monday, August 3, 2015

Time: 9:00 a.m. Eastern Time

Toll-Free: (844) 464-3927

Toll: (765) 507-2598

Pass Code: 68380312

Webcast, including Replay and Conference Call Slides: http://edge.media-server.com/m/p/999aon7i/lan/en

About Array BioPharma

Array BioPharma Inc. is a biopharmaceutical company focused on the discovery, development and commercialization of targeted small molecule drugs to treat patients afflicted with cancer. Six registration studies are currently advancing. These programs include three cancer drugs, binimetinib (MEK162 / wholly-owned), encorafenib (LGX818 / wholly-owned) and selumetinib (AstraZeneca). For more information on Array, please go to www.arraybiopharma.com.

Forward-Looking Statement

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about the timing of the announcement of the results of clinical trials for our proprietary and our partnered programs, the timing of the completion or initiation of further development of our wholly-owned and our partnered programs, including the timing of regulatory filings, expectations that events will occur that will result in greater value for Array, the potential for the results of ongoing preclinical and clinical trials to support regulatory approval or the marketing success of a drug candidate, our ability to partner our proprietary drug candidates for up-front fees, milestone and/or royalty payments, our future plans to progress and develop our proprietary programs and the plans of our collaborators to progress and develop programs we have licensed to them, and our plans to build a late-stage development company. These statements involve significant risks and uncertainties, including those discussed in our most recent annual report filed on Form 10-K, in our quarterly reports filed on Form 10-Q, and in other reports filed by Array with the Securities and Exchange Commission. Because these statements reflect our current expectations concerning future events, our actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors. These factors include, but are not limited to, our ability to continue to fund and successfully progress internal research and development efforts and to create effective, commercially-viable drugs; risks associated with our dependence on our collaborators for the clinical development and commercialization of our out-licensed drug candidates; the ability of our collaborators and of Array to meet objectives tied to milestones and royalties; our ability to effectively and timely conduct clinical trials in light of increasing costs and difficulties in locating appropriate trial sites and in enrolling patients who meet the criteria for certain clinical trials; risks associated with our dependence on third-party service providers to successfully conduct clinical trials within and outside the United States; our ability to achieve and maintain profitability and maintain sufficient cash resources; the extent to which the pharmaceutical and biotechnology industries are willing to in-license drug candidates for their product pipelines and to collaborate with and fund third parties on their drug discovery activities; our ability to out-license our proprietary candidates on favorable terms; and our ability to attract and retain experienced scientists and management. We are providing this information as of August 3, 2015. We undertake no duty to update any

forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements or of anticipated or unanticipated events that alter any assumptions underlying such statements.

-more-

Array BioPharma Inc.

Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| June 30, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenue | | | | | | | |

License and milestone revenue | $ | — |

| | $ | 1,472 |

| | $ | 20,367 |

| | $ | 25,111 |

|

Collaboration and other revenue | 12,320 |

| | 4,539 |

| | 31,542 |

| | 16,967 |

|

Total revenue | 12,320 |

| | 6,011 |

| | 51,909 |

| | 42,078 |

|

| | | | | | | |

Operating expenses | | | | | | | |

Cost of partnered programs | 6,977 |

| | 11,441 |

| | 44,392 |

| | 45,965 |

|

Research and development for proprietary programs | 18,618 |

| | 14,502 |

| | 54,442 |

| | 49,824 |

|

General and administrative | 8,369 |

| | 5,851 |

| | 31,433 |

| | 21,907 |

|

Total operating expenses | 33,964 |

| | 31,794 |

| | 130,267 |

| | 117,696 |

|

Gain on the Binimetinib and Encorafenib Agreements, net | — |

| | — |

| | 80,010 |

| | — |

|

Gain on sale of CMC, net | 1,641 |

| | — |

| | 1,641 |

| | — |

|

Income (loss) from operations | (20,003 | ) | | (25,783 | ) | | 3,293 |

| | (75,618 | ) |

| | | | | | | |

Other income (expense) | | | | | | | |

Realized gain from marketable securities, net | 9,853 |

| | — |

| | 16,255 |

| | — |

|

Interest income | 32 |

| | 16 |

| | 68 |

| | 77 |

|

Interest expense | (2,616 | ) | | (2,470 | ) | | (10,247 | ) | | (9,716 | ) |

Total other income (expense), net | 7,269 |

| | (2,454 | ) | | 6,076 |

| | (9,639 | ) |

| | | | | | | |

Net income (loss) | $ | (12,734 | ) | | $ | (28,237 | ) | | $ | 9,369 |

| | $ | (85,257 | ) |

| | | | | | | |

Net earnings (loss) per share – basic | $ | (0.09 | ) | | $ | (0.22 | ) | | $ | 0.07 |

| | $ | (0.69 | ) |

Net earnings (loss) per share – diluted | $ | (0.09 | ) | | $ | (0.22 | ) | | $ | 0.07 |

| | $ | (0.69 | ) |

| | | | | | | |

Weighted average shares outstanding – basic | 141,393 |

| | 126,815 |

| | 136,680 |

| | 123,403 |

|

Weighted average shares outstanding – diluted | 141,393 |

| | 126,815 |

| | 141,692 |

| | 123,403 |

|

Summary Balance Sheet Data

(Unaudited)

(In thousands)

|

| | | | | | | | |

| | June 30, 2015 | | June 30, 2014 |

| | | | |

Cash, cash equivalents, marketable securities and accounts receivable | | $ | 185,129 |

| | $ | 117,067 |

|

Property, plant and equipment, gross | | 58,438 |

| | 90,447 |

|

Working capital | | 148,623 |

| | 68,943 |

|

Total assets | | 198,207 |

| | 136,625 |

|

Long-term debt, net | | 107,280 |

| | 101,524 |

|

Total stockholders' equity (deficit) | | 42,653 |

| | (25,721 | ) |

###

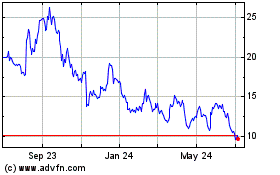

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

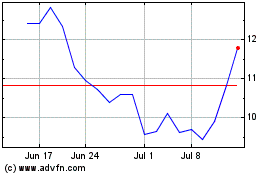

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Apr 2023 to Apr 2024