CORRECT: Aviva CEO Moss Quits As Shareholder Rebellion Gathers Pace

May 08 2012 - 3:16AM

Dow Jones News

British insurance group Aviva PLC (AV.LN) Tuesday said Chief

Executive Officer Andrew Moss would stand down with immediate

effect, the latest U.K. CEO to leave amid investor anger over

pay.

Moss is the third FTSE 100 CEOs to stand down in recent weeks as

a shareholder rebellion over the gap between corporate performance

and pay gathers pace. Last week, the chief executives of

AstraZeneca PLC (AZN.LN) and Trinity Mirror PLC (TNI.LN) also quit

after investors challenged their pay.

Moss' departure comes shortly after investors in Aviva rejected

the group's remuneration report--and Moss' GBP2.69 million pay

packet--only the fourth time this has happened to a FTSE 100

company, and a failed attempt by the company to contain investor

ire.

Roughly 54% of shareholders opposed the 2011 pay report in a

nonbinding vote last week, at a time of an increasing and more

vociferous backlash against what many consider excessive executive

pay in the financial sector. The rebuke came even as Aviva said

earlier in the week that it would review its pay policy in the face

of shareholder pressure.

Aviva said Tuesday that Chairman-Designate John McFarlane would

become interim executive deputy chairman with immediate effect and

executive chairman from July 1, pending the appointment of a new

chief executive.

Aviva's chairman, Colin Sharman, said Tuesday that Moss had

approached him with the decision that he felt it was in the best

interests of the company for him to step aside

"We should acknowledge the progress that has been achieved under

Andrew Moss' leadership," Sharman said in a statement.

"Through the global financial crisis, he led the consolidation

of our international presence and the integration of 40 brands into

the very powerful single Aviva brand. He reduced the cost base,

improved operational performance and more recently began the

implementation of the strategic focus, with the sale of RAC, the

deconsolidation of Delta Lloyd and a number of overseas

disposals."

Nevertheless, Sharman said that McFarlane would undertake a

review of Aviva's business to make sure it was in the right

business segments and markets.

The U.K. insurer Aviva said a week ago that it would review its

remuneration policy in response to mounting shareholder pressure on

pay, and that Moss had turned down a proposed 2012 salary increase

of 4.8%. His 2011 pay packet was up 8.5% from GBP2.47 million in

2010.

Two major shareholder bodies had previously raised concerns

about Aviva's pay.

Pensions & Investment Research Consultants, a shareholder

advisory service, recommended that its members vote against the

remuneration report. The influential Association of British

Insurers, whose members control roughly 12% of the U.K. stock

market and which is supporting the government's proposal to make a

say on pay binding, asked investors to consider carefully their

vote on Aviva executive pay but said it wasn't offering guidance on

how shareholders should vote.

- By Jessica Hodgson; Dow Jones Newswires; +44207 8429373;

jessica.hodgson@dowjones.com.

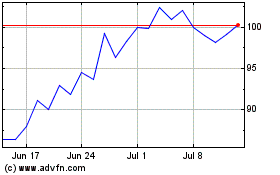

Reach (LSE:RCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

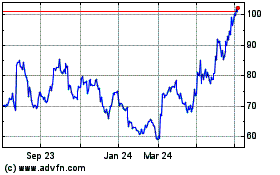

Reach (LSE:RCH)

Historical Stock Chart

From Apr 2023 to Apr 2024