Regulatory News:

CARMAT (FR0010907956, Paris:ALCAR), the designer and developer

of the world's most advanced total artificial heart project, aiming

to provide a therapeutic alternative for people suffering from

end-stage heart failure, announces that it is today taking out a

new contingent equity line with Kepler Cheuvreux.

This new framework agreement foresees a maximum of 3 successive

tranches of 12 months each, consisting in an initial tranche of €20

million beginning of the day the agreement is signed, followed by

two optional tranches of €15 million each.

CARMAT retains control of the pace of the financial support

provided by Kepler Cheuvreux, and can terminate the contract at any

time.

“This flexible solution will allow CARMAT to focus on the

success of the clinical trial program”, says Marcello Conviti,

Chief Executive Officer of CARMAT. He continues: “We thus have

sufficient room to maneuver and financial security to pursue our

development and to calmly look at all the financing options

available to the Company as the project moves forward.”

Within the context of this set-up, and subject to the conditions

defined by the two parties being met, Kepler Cheuvreux has made a

firm and definitive commitment to subscribe to a total of €20

million over the coming 12 months, at a pace and at the times it

wishes, which would result in the issuance of approximately 303

8651 new CARMAT shares2, or 6.5% of the Company’s current share

capital.

This contingent equity line will allow the Company to strengthen

its cash prospects and will provide it with heightened visibility

regarding its financing plan. It supplements CARMAT’s current cash

position (€7.7 million) and the other sources of financing to which

it has access, notably including Bpifrance funding (€5.3 received

in December 2014) and research tax credit. Moreover, the Company

will publish its 2014 annual results on February 11, 2015, once its

accounts have been approved by the Board.

The issuance price of these shares will depend on CARMAT’s

prevailing share price, discounted by no more than 6%. This

discount will enable Kepler Cheuvreux to be a financial

intermediary and an underwriter within the framework of a firm

commitment.

This new financing agreement terminates the previous contract

put in place with Kepler Cheuvreux in June 2013, and reflects the

mutual trust that exists between CARMAT and this partner.

As a guideline, should the contingent equity line be drawn upon

for €20 million at an issuance price (post discount) of € 65,822 a

shareholder holding 1% of the Company’s share capital would see his

or her shareholding reduced to 0.94% of the Company’s share

capital3.

This financing has been put in place pursuant to the ninth

resolution approved by the Shareholder Meeting held on April 2,

2014.

The number of shares issued within the framework of this

contract and admitted for trading on Alternext will notably be the

subject of Euronext notices.

1 Based on the closing price on January 23, 20152 Resulting in

the issuance of 303 865 new shares3 Based on the number of

CARMAT shares at December 31, 2014, i.e. 4 380 020

shares.

●●●

About CARMAT: the world’s most advanced total artificial

heart project

A credible response to end-stage heart failure: CARMAT

aims to eventually provide a response to a major public health

issue associated with heart disease, the world’s leading cause of

death: chronic and acute heart failure. By pursuing the development

of its total artificial heart, CARMAT intends to overcome the

well-known shortfall in heart transplants for the tens of thousands

of people suffering from irreversible end-stage heart failure, the

most seriously affected of the 20 million patients with this

progressive disease in Europe and the United States.

The result of combining two types of unique expertise:

the medical expertise of Professor Carpentier, known throughout the

world for inventing Carpentier-Edwards® heart valves, which

are the most used in the world, and the technological expertise of

Airbus Group, world aerospace leader.

Imitating the natural heart: given its size, the choice

of structural materials and its innovative physiological functions,

CARMAT’s total artificial heart could, assuming the necessary

clinical trials are successful, potentially benefit the lives of

thousands of patients a year with no risk of rejection and with a

good quality of life.

A project leader acknowledged at a European level: with

the backing of the European Commission, CARMAT has been granted the

largest subsidy ever given to an SME by Bpifrance; a total of €33

million.

Strongly committed, prestigious founders and

shareholders: Airbus Group, Professor Alain Carpentier, the

Centre Chirurgical Marie Lannelongue, Truffle Capital, a leading

European venture capital firm, and the thousands of institutional

and individual shareholders who have placed their trust in

CARMAT.

For more information: www.carmatsa.com

●●●

Disclaimer

This press release and the information contained herein do not

constitute an offer to sell or subscribe to, or a solicitation of

an offer to buy or subscribe to, shares in CARMAT ("the Company")

in any country. This press release contains forward‐looking

statements that relate to the Company’s objectives. Such

forward‐looking statements are based solely on the current

expectations and assumptions of the Company’s management and

involve risk and uncertainties. Potential risks and uncertainties

include, without limitation, whether the Company will be successful

in implementing its strategies, whether there will be continued

growth in the relevant market and demand for the Company’s

products, new products or technological developments introduced by

competitors, and risks associated with managing growth. The

Company’s objectives as mentioned in this press release may not be

achieved for any of these reasons or due to other risks and

uncertainties.

No guarantee can be given as to any of the events anticipated by

the forward-looking statements, which are subject to inherent

risks, including those described in the Document de Référence filed

with the Autorité des Marchés Financiers under number D.14-0145 on

March 17, 2014 and the Note d’Opération that was approved with visa

no. 11-308 on July 11, 2011, changes in economic conditions, the

financial markets or the markets in which CARMAT operates. In

particular, no guarantee can be given concerning the Company’s

ability to finalize the development, validation and

industrialization of the prosthesis and the equipment required for

its use, to manufacture the prostheses, satisfy the requirements of

the ANSM, enroll patients, obtain satisfactory clinical results,

perform the clinical trials and tests required for CE marking and

to obtain the CE mark. CARMAT products are currently exclusively

used within the framework of clinical trials. They are not

available outside these trials or for sale.

CARMATMarcello ConvitiCEOPatrick

CoulombierCOOValérie LeroyDirector of Marketing &

Investor RelationsTel.: +33 (0)1 39 45 64

50contact@carmatsas.comorKepler CheuvreuxThierry du

BoislouveauTel.: +33 (0)6 01 06 60

20thierry.du-boislouveau@keplercf.comorNewCapInvestor

Relations & Strategic CommunicationsDusan

OresanskyEmmanuel HuynhTel.: +33 (0)1 44 71 94

94carmat@newcap.frorAlize RPPress RelationsCaroline

CarmagnolTel.: +33 (0)1 44 54 36 66camat@alizerp.com

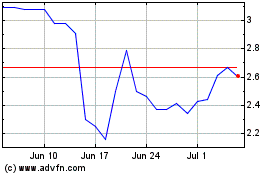

Carmat (EU:ALCAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

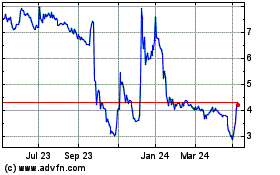

Carmat (EU:ALCAR)

Historical Stock Chart

From Apr 2023 to Apr 2024