Bank of Ireland(Governor&Co) 2016 Supervisory Review and Evaluation Process (6594Q)

December 01 2016 - 2:01AM

UK Regulatory

TIDMBKIR

RNS Number : 6594Q

Bank of Ireland(Governor&Co)

01 December 2016

The Governor and Company of the Bank of Ireland (the

"Group")

2016 Supervisory Review and Evaluation Process

1 December 2016

The Group has been notified by the European Central Bank of the

outcome of the 2016 Supervisory Review and Evaluation Process

(SREP).

The decision requires that the Group maintains a Common Equity

Tier 1 ("CET 1") ratio of 8.0% on a transitional basis from 1

January 2017; this includes the Pillar 2 requirement (P2R) but

excludes the Pillar 2 guidance (P2G). This requirement of 8%

includes a Pillar 1 requirement of 4.5%, a Pillar 2 requirement of

2.25% and a capital conservation buffer for 2017 of 1.25%.

This requirement compares to the Group's latest reported

transitional CET 1 ratio of 13.0% at the end of September 2016.

Under the Maximum Distributable Amount ("MDA") framework, the

MDA trigger level will be 8.0% from 1 January 2017.

Ends

For further information please contact:

Bank of Ireland

Andrew Keating Group Chief Financial Officer +353 (0)766 23

5141

Alan Hartley Director of Group Investor Relations +353 (0)766 23

4850

Pat Farrell Head of Communications +353 (0)766 23 4770

Forward-Looking Statement

This document contains certain forward-looking statements with

respect to certain of the Bank of Ireland Group's (the "Group")

plans and its current goals and expectations relating to its future

financial condition and performance, the markets in which it

operates, and its future capital requirements. These

forward-looking statements often can be identified by the fact that

they do not relate only to historical or current facts. Generally,

but not always, words such as 'may,' 'could,' 'should,' 'will,'

'expect,' 'intend,' 'estimate,' 'anticipate,' 'assume,' 'believe,'

'plan,' 'seek,' 'continue,' 'target,' 'goal', 'would,' or their

negative variations or similar expressions identify forward-looking

statements, but their absence does not mean that a statement is not

forward looking. Examples of forward-looking statements include

among others, statements regarding the Group's near term and longer

term future capital requirements and ratios, level of ownership by

the Irish Government, loan to deposit ratios, expected impairment

charges, the level of the Group's assets, the Group's financial

position, future income, business strategy, projected costs,

margins, future payment of dividends, the implementation of changes

in respect of certain of the Group's pension schemes, estimates of

capital expenditures, discussions with Irish, United Kingdom,

European and other regulators and plans and objectives for future

operations.

Nothing in this document should be considered to be a forecast

of future profitability or financial position and none of the

information in this document is or is intended to be a profit

forecast or profit estimate. Any forward-looking statement speaks

only as at the date it is made. The Group does not undertake to

release publicly any revision to these forward-looking statements

to reflect events, circumstances or unanticipated events occurring

after the date hereof.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGLBDDUXGBGLB

(END) Dow Jones Newswires

December 01, 2016 02:01 ET (07:01 GMT)

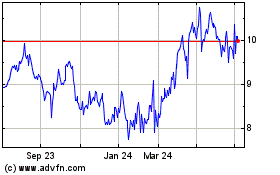

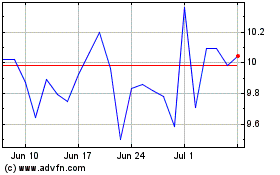

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Apr 2023 to Apr 2024