Antipodean Currencies Rise On Soaring Commodity Prices

June 28 2017 - 11:02PM

RTTF2

Antipodean currencies such as the Australian and the New Zealand

dollars strengthened against their major counterparts in the Asian

session on Thursday, as Asian stock markets traded in positive

territory, tracking the overnight gains on Wall Street and higher

commodity prices.

Investors are also digesting comments from major central banks

that indicate interest rates may be heading higher.

Bank of England Governor Mark Carney said Wednesday that

monetary stimulus may need to be withdrawn to some extent in

future, implying interest rates may be raised. In addition, Bank of

Canada Governor Stephen Poloz told CNBC that previous rate cuts

"have done their job."

The crude oil delivery for August is currently up by 0.26

percent or $45.00 per barrel. Crude oil prices rose Wednesday as

U.S. government data showed a significant drop in gasoline

stockpiles. The U.S. Energy Information Administration (EIA)

released its weekly petroleum status report showing that the

gasoline stocks fell by 894,000 barrels, compared with analysts'

expectations for a larger drop.

However, U.S. commercial crude inventories increased by 100,000

barrels last week, EIA said.

In other economic news, data from the Housing Industry

Association showed that new home sales in Australia increased for

the second straight month in May. Total home sales climbed 1.1

percent month-over-month in May, faster than the 0.8 percent rise

in April.

Data from ANZ Bank showed business confidence in New Zealand

strengthened notably in June to the strongest level in nine months.

The business confidence index climbed to 24.8 in June from 14.9 in

the previous month. Moreover, this was the highest score since

September 2016.

Wednesday, the Australian and the New Zealand dollars showed

mixed trading against their major rivals. While the aussie rose

against the U.S. dollar and the yen, it fell against the euro.

Meanwhile, the NZ dollar fell against the U.S. dollar and the

euro, but rose against the yen.

In the Asian trading, the Australian dollar rose to nearly a

3-month high of 0.7665 against the U.S. dollar and more than a

3-month high of 86.01 against the yen, from yesterday's closing

quotes of 0.7638 and 85.79, respectively. If the aussie extends its

uptrend, it is likely to find resistance around 0.77 against the

greenback and 88.00 against the yen.

The aussie advanced to 1.4875 against the euro, from yesterday's

closing value of 1.4881. On the upside, 1.44 is seen as the next

resistance level for the aussie.

Against the New Zealand and the Canadian dollars, the aussie

edged up to 1.0467 and 0.9984 from yesterday's closing quotes of

1.0457 and 0.9963, respectively. The aussie may test resistance

level around 1.06 against the kiwi and 1.02 against the loonie.

The NZ dollar rose to nearly a 4-1/2-month high of 82.26 against

the yen and a 2-day high of 0.7332 against the U.S. dollar, from

yesterday's closing quotes of 82.04 and 0.7304, respectively. If

the kiwi extends its uptrend, it is likely to find resistance

around 83.00 against the yen and 0.74 against the greenback.

Against the euro, the kiwi advanced to 1.5542 from yesterday's

closing value of 1.5573. The kiwi is likely to find resistance

around the 1.51 region.

Looking ahead, U.K. mortgage approvals data and M4 money supply

data for May, Eurozone business climate index for June and German

flash CPI data for June are due to be released later in the

day.

In the New York session, U.S. GDP data for the first quarter,

U.S. weekly jobless claims for the week ended June 24 are slated

for release.

At 2:30 pm ET, European Central Bank Executive board member

Ignazio Angeloni will give a dinner speech at the Florence School

of Banking & Finance Executive Seminar on Financing Banking

Resolution in Florence, Italy.

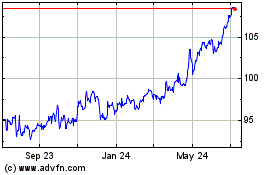

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

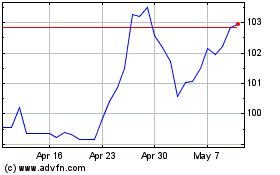

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024