Adidas Signs Eyewear Licensing Deal

September 03 2015 - 12:50PM

Dow Jones News

German sportswear firm Adidas AG said Thursday it had signed a

license agreement with a small Italian company, Italia Independent

SpA, to make eyewear for its Adidas Originals collection, as both

firms try to boost their brands by tapping into a larger customer

base with medium-priced eyewear.

The agreement, which will last four years, also marks a

different approach to licensing, typically one of the most

important sources of revenues for eyewear makers, at a time when

the sector is undergoing massive reorganization. Companies such as

Luxottica—a sector giant with €7.7 billion ($8.54 billion) in

annual revenue—have made their fortune through signing licensing

agreements with luxury goods houses such as Armani and Chanel.

Others, like French conglomerate Kering SA—owner of Gucci and Saint

Laurent—have recently decided to bring eyewear production in-house

to have a closer tie on distribution and full revenues rather than

only royalties.

Adidas has been trying to lift its street cred lately after

losing market share in the sportswear and apparel segments in the

U.S. Its Adidas Originals line is aimed at a young and urban crowd

and includes streetwear, retro sneakers and accessories like bags,

hats and watches. Last year, Adidas signed a design and marketing

deal with rapper Kanye West to boost sales at its Originals unit.

It also collaborates with other famous artists including singer

Rita Ora and rapper Pharrell Williams.

In the first half of the year, Adidas reported a double-digit

sales increase at its Originals business.

Unlike traditional licensing agreements, the new eyewear

collection will bear both companies' names. Italia Independent,

founded in 2007, says it will try to build brand awareness through

its association with Adidas. "This deal comes at a time when we

need an important communication boost," said Italia Independent's

Chief Executive Andrea Tessitore.

The new eyewear will have an average price of €90—lower than

most luxury-goods firms' products which, according to Mr.

Tessitore, is the largest share of the market.

"There's a strong appetite for aspirational products at an

adequate price," said Mr. Tessitore. "The share of the luxury

eyewear segment, with prices over €200, makes only about 10% of the

total market in Europe, but there are so many players there. The

bulk of sales are in the lower price segment."

Italia Independent, whose annual revenues were €33 million, up

32% compared with the previous year, is trying to cash in on the

deal, both in terms of increasing popularity and sales. But many

other players have taken opposing strategies as licensing is seen

as increasingly unstable.

Recently, Kering decided to cancel its licensing agreement with

another Italian eyewear maker, Safilo, which had a significant part

of its revenues coming from the deal. Kering said that it estimated

that the group's eyewear sales, which includes products for 11

brands, could be about €350 million, but because of the licensing

agreement in place, the French conglomerate only got a tiny portion

of it in royalties.

Given the instability of the licensing business, Safilo recently

decided to also focus on proprietary brands to avoid being too

dependent on licensing, Chief Executive Luisa Delgado said in an

interview last year.

Luxottica, on the other hand, has always kept a fairer balance

between its own brands, such as Ray-Ban and Oakley, its retail

activities and the licensing agreements with luxury houses, which

supported the company's constant growth in the last decades.

The new collection will be presented in January 2016, the

companies said.

Write to Manuela Mesco at manuela.mesco@wsj.com and Ellen

Emmerentze Jervell at ellen.jervell@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 03, 2015 12:35 ET (16:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

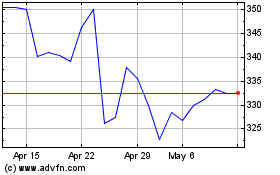

Kering (EU:KER)

Historical Stock Chart

From Apr 2024 to May 2024

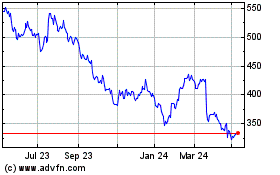

Kering (EU:KER)

Historical Stock Chart

From May 2023 to May 2024