AXA 2016 Net Profit Rises 4%

February 23 2017 - 1:32AM

Dow Jones News

By Noemie Bisserbe

PARIS--French insurer AXA SA (CS.FR) on Thursday reported a 4%

rise in net profit in 2016, as a strong life and savings business

offset lower asset management revenue.

Europe's second-largest insurer by market value said net profit

increased to 5.83 billion euros ($6.16 billion) in 2016 from

EUR5.62 billion a year earlier. That was just below analysts'

estimate of EUR5.84 billion, according to data provider

FactSet.

Revenue rose 2% at EUR100.19 billion.

AXA's earnings this year highlight the group's strategy of

investing in fast-growing businesses and emerging markets to revive

growth amid persistently low interest rates.

Revenue at its life and savings division was up 2% at EUR60.3

billion, while asset management revenue fell 3% to EUR3.71 billion.

Property and casualty revenue was 3% higher at EUR35.6 billion.

Life and savings annual premium equivalent, known as APE, was up

2% at the end of December. APE measures new business growth for

life insurance by combining the value of payments on new regular

premium policies, and 10% of the value of payments made on

one-time, single-premium products.

The company said its solvency ratio--a key measure of an

insurance company's financial strength--stood at 197% at the end of

December, down from 205% a year earlier.

The company's board proposed a dividend of EUR1.16, up from

EUR1.1 last year.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

February 23, 2017 01:17 ET (06:17 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

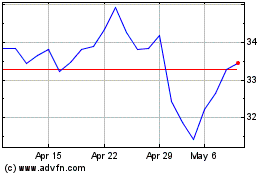

Axa (EU:CS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Axa (EU:CS)

Historical Stock Chart

From Sep 2023 to Sep 2024