Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31,

2015

|

|

|

|

|

|

|

|

Additions to/(deductions from) net assets attributable to:

|

|

|

|

|

|

Investment income:

|

|

|

Net depreciation in fair value of investments

|

$

|

(37,201,568

|

)

|

|

Interest and dividends

|

29,087,842

|

|

|

|

|

|

Contributions:

|

|

|

Participant

|

51,124,988

|

|

|

Employer

|

31,637,097

|

|

|

Rollovers

|

4,408,012

|

|

|

|

|

|

Benefits paid directly to participants

|

(96,156,581

|

)

|

|

|

|

|

Net decrease

|

(17,100,210

|

)

|

|

|

|

|

Net assets available for benefits:

|

|

|

Beginning of year

|

872,762,518

|

|

|

End of year

|

$

|

855,662,308

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

|

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements

December 31, 2015

1. Description of Plan

The following description of the Zions Bancorporation Payshelter 401(k) and Employee Stock Ownership Plan (“the Plan”) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a single employer defined contribution plan designed to provide retirement benefits for eligible employees under a pretax salary reduction arrangement with a specified employer matching contribution and a discretionary noncontributory profit sharing feature. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). From time to time, the Plan has been restated and amended. Fidelity Management Trust Company (“Fidelity”) is the trustee of the Plan. Zions Bancorporation (“the Company”) is the Plan sponsor. The Company’s Benefits Committee (“the Benefits Committee”) administers the Plan.

Eligibility

Participation in the Plan is voluntary. Any nonexcluded employee (as defined in the Plan provisions) at least 21 years of age is eligible to participate. To be eligible for the noncontributory profit sharing feature, participants must meet other criteria, including 1,000 hours of service.

Contributions

Participants may contribute up to 80% of their pretax annual compensation subject to the annual maximum allowed participant contribution, which was $18,000 for

2015

. Under applicable law, participants attaining the age of 50 during or prior to

2015

are eligible to make catch-up contributions. The Company provides a matching contribution of 100% for the first 3% of the participant’s compensation and 50% for the remaining 2%.

Contributions by the Company under the noncontributory profit sharing feature are discretionary. Contribution rates may range up to 6% of participants’ compensation based on the Company’s return on average common equity, as defined, for the Plan year.

These contributions are approved and made subsequent to the end of the Plan year. For the

2015

Plan year, the Company contributed $6,065,776 under this profit sharing

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

1. Description of Plan (continued)

feature, which was made in February

2016

and is included in employer contributions in the statement of changes in net assets available for benefits for the year ended December 31,

2015

and employer contributions receivable in the statements of net assets available for benefits as of December 31, 2015.

Forfeitures used to offset Company contributions were $388,065 in

2015

, which was the amount of forfeitures outstanding at December 31,

2014

. At December 31,

2015

, the amount of forfeitures outstanding was $352,113.

The Plan allows for Roth 401(k) contributions consistent with the requirements of §402A of the Internal Revenue Code (“the Code”). Such contributions include rollovers from other Roth deferral accounts as described in Code §402A(e)(1) and only to the extent the rollovers are permitted under Code §402(c). Roth contributions are treated as elective deferrals at the option of the participant for all purposes under the Plan, including determination and allocation of the Company’s matching contributions.

The Plan allows rollovers by participants from nonaffiliated qualifying plans.

Participant Accounts

Each participant’s fund account is credited with the participant’s contributions and allocations of the Company’s contributions and Plan earnings. Investment income or loss is allocated based on the investment shares held in the participant’s account in relation to the total investment shares of the Plan. However, income or loss from trading of the Company’s common stock, which is done on a real-time basis, is identified and charged directly to the participant’s account without regard to the allocation process.

Vesting and Payment of Benefits

Participant and Company matching contributions plus investment earnings are immediately vested. Company contributions under the noncontributory profit sharing feature vest according to the following schedule:

|

|

|

|

|

|

|

|

|

|

|

Years of vesting service

|

|

Percent vested

|

|

Years of vesting service

|

|

Percent vested

|

|

|

|

|

|

|

|

|

|

Less than 2

|

|

None

|

|

4

|

|

60%

|

|

2

|

|

20%

|

|

5 or more

|

|

100%

|

|

3

|

|

40%

|

|

|

|

|

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

1. Description of Plan (continued)

Nonvested amounts forfeited by terminated participants are used first to reduce the Company’s profit sharing contributions. If Company profit sharing contributions are not made during a given Plan year, any amounts forfeited may be used at the Company’s election to reduce the Company’s matching contribution, offset administrative expenses, allocate directly to participants’ accounts, or any combination of the foregoing. Participants are 100% vested if employed by the Company when normal retirement age is attained. Benefits are eligible to be paid upon death, disability, retirement, or termination of employment, or may be paid earlier subject to Plan provisions. Benefits are paid in shares of stock, cash, or a combination of the two, depending on the participant’s investment options.

Investment Options

Participant contributions can be directed subject to Plan provisions into various Plan investment options, including the Company’s common stock. The Company’s matching contributions and amounts contributed under the noncontributory profit sharing feature are invested in the Company’s common stock purchased in the open market. Participants may immediately diversify to other Plan investments up to 100% of their existing investments in the Company’s common stock received as Company matching contributions. However, three years of participation in the Plan is required before participants can diversify their investments in the Company’s common stock resulting from the Company’s profit sharing contributions.

Participant Loans

Participants may borrow from their fund accounts in amounts from $1,000 up to the lesser of $50,000 or 50% of their vested account balance, as defined. Loan terms cannot exceed five years, or ten years if used for the purchase of a primary residence. The loans are secured by the balance in the participants’ accounts and are repaid at a specified rate of interest through direct payroll deductions.

Plan Termination

Although the Company has not expressed any intent to do so, it has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. If the Plan were terminated, each participant would become 100% vested and would receive a distribution of assets equal to the value of the participant’s account.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

2. Significant Accounting Policies

Basis of Presentation

The accompanying financial statements are prepared using the accrual basis of accounting under generally accepted accounting principles (“GAAP”).

Investment Valuation and Income Recognition

Investments are reported at fair value as further described in Note 4. The statements of net assets available for benefits include an adjustment from fair value to contract value for the Plan’s investment in a common collective trust fund. This investment is through participation in the Fidelity Managed Income Portfolio II – Class 2 fund, which includes investment contracts that are fully benefit-responsive. As such, contract value is considered the more relevant measurement because participants would receive this value if they were to initiate permitted transactions under the terms of the Plan. Contract value of the common collective trust fund represents contributions plus earnings, less participant withdrawals and administrative expenses.

Purchases and sales of investments are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date.

Notes Receivable from Participants

Notes receivable from participants represent participant loans recorded at their unpaid principal balance plus any accrued interest. Interest income on notes receivable from participants is recorded when earned. The amount for

2015

was $783,520 and was included in interest and dividends in the statement of changes in net assets available for benefits. Loan documentation and processing fees are charged to the participants’ accounts. No allowance for credit losses was recorded at December 31,

2015

or

2014

. If a participant ceases to make loan repayments and the Benefits Committee deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

2. Significant Accounting Policies (continued)

Concentration of Investments

The Plan’s net assets available for benefits at December 31,

2015

and

2014

include investments in the Company’s common stock of $229,005,214 (8,385,957 shares) and $243,032,770 (8,510,965 shares), respectively. These investments represent a 4.1% and 4.2% ownership of the Company’s outstanding common stock at December 31,

2015

and

2014

, respectively.

New Accounting Pronouncement

In July 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-12,

Plan Accounting:Defined Contribution Pension Plans (Topic 962)

. This new guidance has three parts. Under Part I, fully benefit-responsive investment contracts are measured, presented, and disclosed only at contract value. Part II eliminates the requirement to (1) disclose individual investments that represent 5 percent or more of net assets available for benefits and (2) disaggregate and disclose net appreciation or depreciation in fair value of investments by general type, either on the face of the financial statements or in the notes. Part III is not applicable to the plan. The guidance is effective for fiscal years beginning after December 15, 2015. Plans can early adopt any part of the guidance and is to be applied retrospectively. The Plan will adopt this new guidance when it becomes effective for the Plan year beginning January 1, 2016.

In May 2015, the FASB issued ASU 2015-7,

Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) (a consensus of the Emerging Issues Task Force).

This new accounting guidance under Accounting Standards Codification 820,

Fair Value Measurement

, requires that investments for which fair value is measured at net asset value (or its equivalent) using the practical expedient should not be categorized in the fair value hierarchy. The guidance is effective for fiscal years beginning after December 15, 2015. Adoption is retrospective and earlier application is permitted. The Plan will adopt this new guidance when it becomes effective for the Plan year beginning January 1, 2016.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

3. Investments

As trustee of the Plan, Fidelity holds the Plan’s investments and executes all investment transactions. The fair value of individual investments that represents 5% or more of the fair value of the Plan’s net assets available for benefits is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

2015

|

|

2014

|

|

|

|

|

|

|

Zions Bancorporation common stock

|

$

|

229,005,214

|

|

|

$

|

243,032,770

|

|

|

Fidelity Managed Income Portfolio II – Class 2

|

78,159,500

|

|

|

78,467,298

|

|

|

Fidelity Contrafund K

|

56,781,756

|

|

|

56,153,268

|

|

During

2015

, the Plan’s investments (including investments purchased and sold, as well as held during the year) depreciated in fair value as determined by quoted market prices as follows:

|

|

|

|

|

|

|

|

Zions Bancorporation common stock

|

$

|

(8,335,595

|

)

|

|

Registered investment companies

and real estate joint venture

|

(28,865,973

|

)

|

|

|

$

|

(37,201,568

|

)

|

The Plan’s investment activity in the Company’s common stock for

2015

includes nonparticipant-directed and participant-directed transactions. Because the investment activity cannot be split between these types of transactions, the entire investment is reflected as nonparticipant-directed.

Significant changes in net assets during

2015

relating to nonparticipant-directed and participant-directed transactions of the Company’s common stock are as follows:

|

|

|

|

|

|

|

|

Net depreciation in fair value

|

$

|

(8,335,595

|

)

|

|

Interest and dividends

|

1,889,465

|

|

|

Contributions

|

40,274,958

|

|

|

Net transfers to other investments

|

(26,549,785

|

)

|

|

Benefits paid directly to participants

|

(21,306,599

|

)

|

|

Net decrease in net assets

|

(14,027,556

|

)

|

|

|

|

|

Net assets at beginning of year

|

243,032,770

|

|

|

Net assets at end of year

|

$

|

229,005,214

|

|

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

4. Fair Value

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. To measure fair value, a hierarchy has been established that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs. This hierarchy uses three levels of inputs to measure the fair value of assets and liabilities as follows:

|

|

|

|

Level 1

|

Quoted prices in active markets for identical assets or liabilities that the Plan has the ability to access. For the Plan, Level 1 includes the Company’s common stock and registered investment companies.

|

|

|

|

|

Level 2

|

Observable inputs other than Level 1 including quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly for substantially the full term of the asset or liability. Level 2 inputs include the following:

|

• Quoted prices for similar assets or liabilities in active markets;

• Quoted prices for identical or similar assets or liabilities in inactive markets;

•

Observable inputs other than quoted prices that are used in the valuation of assets or liabilities (e.g., interest rate and yield curve quotes at commonly quoted intervals);

•

Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

For the Plan, Level 2 includes the common collective trust fund.

|

|

|

|

Level 3

|

Unobservable inputs for the asset or liability (i.e., supported by little or no market activity) whose value is determined by pricing models, discounted cash flow methodologies, or similar techniques. Level 3 inputs include management’s own assumption about the assumptions that market participants would use in pricing the asset or liability (including assumptions about risk). For the Plan, Level 3 includes the real estate joint venture.

|

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

4. Fair Value (continued)

The level in the fair value hierarchy within which the fair value measurement is classified is determined based on the lowest level input that is significant to the fair value measure in its entirety.

The following describes the assets and the valuation methodologies used to measure their fair value:

Company common stock – Shares of the Company’s common stock are valued at the last reported sales price on the last business day of the Plan year in the active market where individual securities are traded.

Common collective trust fund – This trust holds the Fidelity Managed Income Portfolio II – Class 2 fund discussed in Note 2. The fund is a stable value fund designed to deliver safety and stability by preserving principal while earning interest income. It invests in investment contracts (wrap contracts) issued by insurance companies and other financial institutions, fixed income securities (e.g., U.S. Treasury and agency bonds, corporate bonds, mortgage- and asset-backed securities, and bond funds), and money market funds. It may also invest in futures contracts, option contracts, and swap agreements. Redemptions prompted by certain events (e.g., termination of the fund, changes in laws or regulations) may be paid at fair value, which may be less than book value. Participation units in the fund are valued at the net asset value (“NAV”) as the practical expedient as determined by the trustee. As further discussed in Note 2, the contract value of the fund differs from fair value and is considered the more relevant measurement.

Registered investment companies – These mutual funds are valued at quoted market prices for shares held by the Plan at year-end.

Real estate joint venture – During 2015, the joint venture sold its last remaining real estate tract and made its final distribution. At December 31, 2015, the only remaining asset was an investment in Fidelity institutional prime money market fund. Prior its final distribution in 2015, the joint venture’s investments included commercial and residential real estate properties which are now fully liquidated. Participation units in the Fidelity institutional prime money market fund are valued at the net asset value (“NAV”) as the practical expedient for fair value. The portfolio is designated an institutional money market fund where the NAV of the fund’s shares float, fluctuating with changes in the values of the portfolio’s securities.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

4. Fair Value (continued)

Assets measured at fair value on a recurring basis within the fair value hierarchy are summarized as follows at December 31,

2015

and

2014

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2015

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Zions Bancorporation common stock

|

$

|

229,005,214

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

229,005,214

|

|

|

Common collective trust fund

|

|

|

|

78,159,500

|

|

|

|

|

78,159,500

|

|

|

Registered investment companies:

|

|

|

|

|

|

|

|

|

Domestic

|

|

348,562,399

|

|

|

|

|

|

|

348,562,399

|

|

|

International

|

|

38,410,868

|

|

|

|

|

|

|

38,410,868

|

|

|

Lifecycle

|

|

136,854,928

|

|

|

|

|

|

|

136,854,928

|

|

|

|

|

523,828,195

|

|

|

|

|

|

|

523,828,195

|

|

|

Money market funds

|

|

|

|

75,590

|

|

|

|

|

75,590

|

|

|

|

|

$

|

752,833,409

|

|

|

$

|

78,235,090

|

|

|

$

|

—

|

|

|

$

|

831,068,499

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2014

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Zions Bancorporation common stock

|

$

|

243,032,770

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

243,032,770

|

|

|

Common collective trust fund

|

|

|

|

78,467,298

|

|

|

|

|

78,467,298

|

|

|

Registered investment companies:

|

|

|

|

|

|

|

|

|

Domestic

|

|

359,247,978

|

|

|

|

|

|

|

359,247,978

|

|

|

International

|

|

39,715,146

|

|

|

|

|

|

|

39,715,146

|

|

|

Lifecycle

|

|

121,791,520

|

|

|

|

|

|

|

121,791,520

|

|

|

|

|

520,754,644

|

|

|

|

|

|

|

520,754,644

|

|

|

Real estate joint venture

|

|

|

|

|

|

87,979

|

|

|

87,979

|

|

|

|

|

$

|

763,787,414

|

|

|

$

|

78,467,298

|

|

|

$

|

87,979

|

|

|

$

|

842,342,691

|

|

No transfers of investments occurred among Levels 1, 2, or 3 during 2015.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

4. Fair Value (continued)

The following presents additional information as of December 31, 2015 and 2014 for the common collective trust fund whose fair value is based on NAV per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value

at December 31,

|

|

Investment

|

|

Unfunded commitments

|

|

Redemption

|

|

|

|

|

|

|

|

|

|

|

|

2015:

|

|

$

|

78,159,500

|

|

|

Common collective trust fund

|

|

none

|

|

Any business day, subject to certain restrictions; however, actual redemption values may vary from recorded amounts at December 31, 2015 (see previous discussion).

|

|

2014:

|

|

$

|

78,467,298

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Transactions with Parties-in-Interest

During

2015

, the Plan received dividends for the Company’s common stock of $1,822,635. Purchases and sales of the Company’s common stock in

2015

were $53,678,777 and $59,054,153 respectively. The amount of purchases included approximately $10.5 million of exchanges that were made by participants from other investments in the Plan during

2015

.

6. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

7. Reconciliation of Financial Statements to Form 5500

The following reconciles net assets available for benefits in the accompanying financial statements to net assets in the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2015

|

|

2014

|

|

Net assets available for benefits in accompanying financial statements

|

|

$

|

855,662,308

|

|

|

$

|

872,762,518

|

|

|

Add adjustment between fair value and contract value related to fully benefit-responsive investment contracts held in common collective trust fund

|

|

557,139

|

|

|

1,129,340

|

|

|

Net assets in Form 5500

|

|

$

|

856,219,447

|

|

|

$

|

873,891,858

|

|

The following reconciles the net decrease in the statement of changes in net assets available for benefits to net income in the Form 5500 for the year ended December 31,

2015

:

|

|

|

|

|

|

|

|

|

Net decrease in statement of changes in net assets available

for benefits

|

|

$

|

(17,100,210

|

)

|

|

|

|

|

|

Adjustment between fair value and contract value related to fully benefit-responsive investment contracts held in common collective trust fund:

|

|

|

|

|

|

|

|

Less: Amount at December 31, 2014

|

|

(1,129,340

|

)

|

|

Add: Amount at December 31, 2015

|

|

557,139

|

|

|

Net income in Form 5500

|

|

$

|

(17,672,411

|

)

|

8. Income Tax Status

The Plan has received a determination letter from the Internal Revenue Service (“IRS”) dated September 17, 2013, stating that the Plan is qualified under Section 401(a) of the Code and therefore, the related trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The Plan administrator has indicated that it will take the necessary steps, if any, to bring the Plan’s operations into compliance with the Code.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Notes to Financial Statements (continued)

8. Income Tax Status (continued)

Plan management evaluates any uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31,

2015

, there are no uncertain tax positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions.

The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits in progress for any tax periods. The Plan administrator believes the Plan is no longer subject to income tax examinations for years prior to 2012.

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

EIN: 87-0227400 Plan: 006

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower,

Lessor, or Similar Party

|

|

(c)

Description of Investment

|

|

(d)

Cost of Remain-

ing Assets (1)

|

|

(e)

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTMENTS

|

|

|

|

|

|

|

|

|

|

Zions Bancorporation common stock

|

|

|

|

|

|

*

|

|

|

ZIONS BANCORPORATION

|

COMMON STOCK (8,385,957 shares)

|

|

$

|

232,647,142

|

|

|

$

|

229,005,214

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common collective trust fund

|

|

|

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

MANAGED INCOME PORTFOLIO II CL 2 (77,602,360 units)

|

78,159,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registered investment companies

|

|

|

|

|

|

|

|

Domestic

|

|

|

|

|

|

|

|

|

|

COLUMBIA

|

|

ACORN USA Y (481,726 shares)

|

|

|

|

11,074,873

|

|

|

|

|

AMERICAN BEACON FUNDS

|

|

LARGE CAP VALUE INSTITUTIONAL (1,137,567 shares)

|

|

27,824,897

|

|

|

|

|

T. ROWE PRICE

|

|

EMERGING MARKETS STOCK (180,677 shares)

|

|

5,149,308

|

|

|

|

|

VANGUARD

|

|

REIT INDEX FUND INSTITUTIONAL (457,480 shares)

|

|

8,001,320

|

|

|

|

|

PIMCO FUNDS

|

|

TOTAL RETURN INSTITUTIONAL (2,165,984 shares)

|

|

21,811,460

|

|

|

|

|

WELLS FARGO ADV

|

|

SPECIAL SMALL CAP VALUE ADMIRAL (424,200 shares)

|

|

11,372,809

|

|

|

|

|

VANGUARD

|

|

MID CAP INDEX INSTITUTIONAL (652,855 shares)

|

|

21,446,286

|

|

|

|

|

VANGUARD

|

|

SMALL CAP INDEX INSTITUTIONAL (332,832 shares)

|

|

17,656,720

|

|

|

|

|

VICTORY FUNDS

|

|

DIVERSIFIED STOCK I (361,997 shares)

|

|

6,573,864

|

|

|

|

|

LEGG MASON

|

|

CLEARBRIDGE AGGRESSIVE GROWTH (52,630 shares)

|

|

10,846,051

|

|

|

|

|

LOOMIS SAYLES FUNDS

|

|

BOND INSTITUTIONAL (610,752 shares)

|

|

|

|

7,866,492

|

|

|

|

|

PIMCO FUNDS

|

|

COMMODITY REAL RETURN INST (217,778 shares)

|

|

1,374,178

|

|

|

|

|

VANGUARD

|

|

INFLATION PROTECTED INSTITUTIONAL (478,875 shares)

|

|

4,918,044

|

|

|

|

|

VANGUARD

|

|

SELECTED VALUE (591,827 shares)

|

|

|

|

15,298,737

|

|

|

|

|

VANGUARD

|

|

SHORT-TERM INV GRADE ADMIRAL (78,040 shares)

|

|

824,106

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT INCOME (205,671 shares)

|

|

2,560,607

|

|

|

|

|

JANUS

|

|

ENTERPRISE N FUND (387,118 shares)

|

|

|

|

33,543,772

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

CONTRAFUND K (574,249 shares)

|

|

|

|

56,781,756

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

CAPITAL & INCOME (1,197,838 shares)

|

|

|

|

10,960,217

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

BALANCED K (781,073 shares)

|

|

|

|

16,574,362

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

SPARTAN TOTAL MARKET INDEX INST (142,376 shares)

|

|

8,351,765

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

SPARTAN 500 INDEX INSTITUTIONAL (541,383 shares)

|

|

38,876,703

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

SPARTAN U.S. BOND INDEX (772,330 shares)

|

|

8,874,072

|

|

|

|

|

|

|

|

|

|

|

348,562,399

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

EIN: 87-0227400 Plan: 006

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower,

Lessor, or Similar Party

|

|

(c)

Description of Investment

|

|

(d)

Cost of Remain-

ing Assets (1)

|

|

(e)

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International

|

|

|

|

|

|

|

|

|

|

OAKMARK

|

|

INTERNATIONAL I (473,682 shares)

|

|

|

|

$

|

10,117,842

|

|

|

|

|

AMERICAN FUNDS

|

|

EUROPACIFIC GROWTH R6 (103,985 shares)

|

|

4,712,598

|

|

|

|

|

BLACKROCK FUNDS

|

|

INTERNATIONAL OPPS INSTITUTIONAL (216,919 shares)

|

|

6,978,277

|

|

|

|

|

LOOMIS SAYLES FUNDS

|

|

GLOBAL BOND INSTITUTIONAL (126,024 shares)

|

|

1,870,200

|

|

|

|

|

MORGAN STANLEY

|

|

INST INTERNATIONAL REAL ESTATE (119,840 shares)

|

|

2,242,214

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

|

SPARTAN INTERNATIONAL INDEX (347,613 shares)

|

|

12,489,737

|

|

|

|

|

|

|

|

|

|

|

38,410,868

|

|

|

|

|

Lifecycle

|

|

|

|

|

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2010 (306,032 shares)

|

|

7,614,084

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2015 (587,149 shares)

|

|

8,355,126

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2020 (1,094,685 shares)

|

|

29,720,700

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2025 (1,266,003 shares)

|

|

19,774,971

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2030 (781,300 shares)

|

|

21,657,626

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2035 (668,733 shares)

|

|

11,261,457

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2040 (663,763 shares)

|

|

18,884,047

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2045 (517,898 shares)

|

|

9,208,220

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2050 (280,207 shares)

|

|

7,983,084

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2055 (69,059 shares)

|

|

2,129,087

|

|

|

|

|

VANGUARD

|

|

TARGET RETIREMENT 2060 (9,795 shares)

|

|

266,526

|

|

|

|

|

|

|

|

|

|

|

136,854,928

|

|

|

|

|

|

|

|

|

|

|

523,828,195

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

FIDELITY INVESTMENTS

|

PRIME INST MONEY MARKET FUND (75,590 shares)

|

|

75,590

|

|

|

|

|

|

|

|

|

|

|

$

|

831,068,499

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECEIVABLES

|

|

|

|

|

|

|

|

*

|

|

|

Notes receivable from participants

|

Interest rates ranging from 4.25% to 9.25%, with maturities through November 2025

|

|

|

|

$

|

17,756,969

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

|

Indicates party-in-interest to the Plan.

|

|

|

|

|

|

(1

|

)

|

|

Only provided for nonparticipant-directed investments.

|

|

|

|

|

Zions Bancorporation Payshelter 401(k) and

Employee Stock Ownership Plan

Schedule H, Line 4j – Schedule of Reportable Transactions

EIN: 87-0227400 Plan: 006

Year Ended December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

Identity of Party Involved

|

|

(b)

Description of Assets

|

|

(c)

Purchase Price

|

|

(d)

Selling

Price

|

|

(g)

Cost of

Asset

|

|

(h)

Current Value of Asset on Trans-

action Date

|

|

(i)

Net Gain (Loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Category 3 – Any transaction within the plan year involving securities of the same issue if within the plan year any series of transactions with respect to such securities amount in the aggregate to more than 5% of the current value of the plan assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zions Bancorporation

|

|

Common Stock

|

|

$

|

53,678,777

|

|

|

$

|

—

|

|

|

$

|

53,678,777

|

|

|

|

$

|

53,678,777

|

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zions Bancorporation

|

|

Common Stock

|

|

—

|

|

|

59,054,153

|

|

|

56,107,718

|

|

|

|

59,054,153

|

|

|

|

2,946,435

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No category 1, 2 or 4 reportable transactions occurred during 2015.

Columns (e) and (f) are not applicable.

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Benefits Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ZIONS BANCORPORATION PAYSHELTER 401(K) AND EMPLOYEE STOCK OWNERSHIP PLAN

|

June 22, 2016

|

|

|

|

|

|

|

|

By:

|

/s/ Paul E. Burdiss

|

|

|

Name:

|

PAUL E. BURDISS,

|

|

|

|

Executive Vice President and Chief Financial Officer of Zions Bancorporation

|

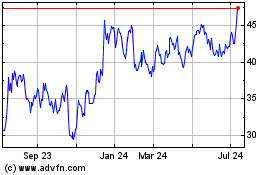

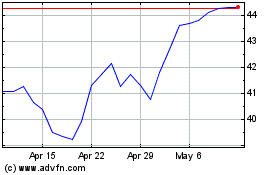

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Apr 2023 to Apr 2024