The Bancorp, Inc. (NASDAQ:TBBK), a financial holding company,

provides June 30, 2015 highlights for market update call scheduled

for September 30, 2015, 8:30 a.m. Eastern time. Please see The

Bancorp’s 10-Q for the quarter ended June 30, 2015 for detailed

financial statements and other financial information.

Highlights as of June 30, 2015*:

Progress in transition to lower risk loan portfolio

- Total loans in continuing operations

increased 31% to $1.25 billion

- Securities-Backed Lines of Credit

increased 39% to $512.3 million

- Leasing increased 19% to $221.1

million

- Loans in the discontinued operation

were reduced to $629.3 million

Progress in balance sheet management

- $900 million in non-strategic deposits

to be exited in Q4 2015

Progress in meeting BSA regulatory expectations

- Significant progress of BSA

remediation

Progress in earnings transition to lower risk model

- Loan growth in continuing loans is

impacting earnings – $16.7 million in pre-tax earnings adjusted for

fees related to BSA and restatement

Frank M. Mastrangelo, The Bancorp’s Chief Executive Officer

said, “We continue to make significant progress away from what our

experience and cyclical downturns for the industry have indicated

to be a more risky line of business, namely regional commercial

real estate lending. Our discontinuance of that line of business is

being offset by significant growth in our SBLOC and other loan

categories, which we believe have a better risk adjusted return.

The lower risk profile of SBLOC loans is confirmed by their lower

capital requirements and de minimus losses, and is our largest

lending line of business. We have made significant progress in

addressing regulatory expectations and look forward to fully

satisfying all such expectations as soon as practicable.

Historically our performance ratios, including capital, have been

impacted by excess deposits maintained at the Federal Reserve Bank.

In the fourth quarter we anticipate that we will exit approximately

$900 million of non-strategic deposit relationships. This balance

sheet management will not decrease profitability, but will more

accurately reflect average assets and capital ratios. As of June

30, 2015, we remain well capitalized with a book value of $8.36 per

share.”

Non-recurring Expense during the Six-Months Ended June 30,

2015 ($ in thousands):

Continuing Operations: BSA consultant and lookback fees $

14,956 Regulatory related legal fees 1,276

Discontinued operations:

Restatement related audit fees 1,525 Other real estate owned

expense 1,124 Pre-tax loss-continuing operations (9,417 ) Pre-tax

income-continuing operations

7,196

Pre-tax income after analyses of non-recurring fees $ 16,660

Continuing Operations - Loan Portfolio

June 30,

June 30,

2015

2014

SBA non real estate $ 63,390 $ 60,546

SBA commercialmortgage

85,234 90,316 SBA construction 16,977 9,936 Total SBA

loans 165,601 160,798 Direct lease financing 222,169 185,878 SBLOC

512,269 367,598 Other specialty lending 32,118 38,416 Other

consumer loans 27,044 40,896 959,201 793,586

Unamortized loan feesand costs

8,832 8,169

Loans, net of deferredloan costs

$ 968,033 $ 801,755

Continuing operationsloans held for

sale

284,051 154,474 Total $ 1,252,084 $ 956,229

June 30,

June 30,

2015

2014

Discontinued Loans

$

629,314

$

1,108,972

Capital Ratios

Tier 1capitaltoaverageassetsratio

Tier 1capital

torisk-weightedassetsratio

Totalcapital

torisk-weightedassetsratio

Commonequity tier1 to

riskweightedassets

As of June 30,

2015

The Bancorp 6.46 % 13.68 % 13.88 % 13.68 % The

Bancorp Bank 6.08 % 12.89 % 13.08 % 12.89 %

"Well capitalized" institution (under

FDICregulations-Basel III)

5.00 % 8.00 % 10.00 % 6.50 %

As of December 31,

2014

The Bancorp 7.07 % 11.54 % 11.67 % n/a The Bancorp Bank 6.46 %

10.46 % 10.59 % n/a "Well capitalized" institution (under FDIC

regulations) 5.00 % 6.00 % 10.00 % n/a

Market Update Conference Call Webcast

Interested parties may access the LIVE webcast of The Bancorp's

Market Update Conference Call at 8:30 AM ET Wednesday, September

30, 2015 by clicking on the webcast link on The Bancorp's homepage

at www.thebancorp.com. Or, you may dial 877.703.6102, access code

78556593. You may listen to the replay of the webcast following the

live call on The Bancorp's investor relations website or

telephonically until Wednesday, October 7, 2015 by dialing

888.286.8010, access code 90377196.

About The Bancorp

The Bancorp (NASDAQ: TBBK), with operations in the United States

and Europe, is a family of financial service companies dedicated to

setting a new standard in financial services and payments

innovation. The Bancorp specializes in providing private-label

banking and technology solutions for non-bank companies ranging

from entrepreneurial start-ups to those on the Fortune 500. The

Bancorp Bank, one of The Bancorp’s financial institutions, has been

recognized as a National Preferred SBA Lender, a top custodian of

Health Savings Accounts, a top ACH originator, a top merchant

acquirer and is the leading issuer of prepaid cards.

thebancorp.com

Forward-Looking Statements

Statements in this earnings release regarding The Bancorp,

Inc.’s business, which are not historical facts, are

"forward-looking statements" that involve risks and uncertainties.

These statements may be identified by the use of forward-looking

terminology, including but not limited to the words “may,”

“believe,” “will,” “expect,” “look,” “anticipate,” “estimate,”

“continue,” or similar words. For further discussion of the risks

and uncertainties to which these forward-looking statements may be

subject, see The Bancorp, Inc.’s filings with the SEC, including

the “Risk Factors” sections of The Bancorp Inc.’s filings. These

risks and uncertainties could cause actual results to differ

materially from those projected in the forward-looking statements.

The forward-looking statements speak only as of the date of this

presentation. The Bancorp, Inc. does not undertake to publicly

revise or update forward-looking statements in this presentation to

reflect events or circumstances that arise after the date of this

presentation, except as may be required under applicable law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150930005484/en/

The Bancorp, Inc.Andres Viroslav,

215-861-7990aviroslav@thebancorp.com

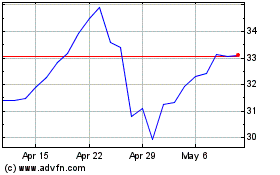

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Aug 2024 to Sep 2024

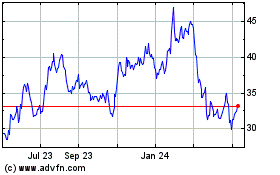

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Sep 2023 to Sep 2024