UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2016

RED ROBIN GOURMET BURGERS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | 001-34851 |

84-1573084 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

6312 S. Fiddler’s Green Circle, Suite 200N Greenwood Village, Colorado | 80111 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (303) 846-6000

Not Applicable

(Former name or former address, if changed since last report.)

___________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

ITEM 2.02 | Results of Operations and Financial Condition |

On February 12, 2016, Red Robin Gourmet Burgers, Inc. (the “Company”) issued a press release describing selected financial results for the fourth fiscal quarter and fiscal year ended December 27, 2015. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. A copy of the supplemental financial information for the fourth fiscal quarter and fiscal year ended December 27, 2015, that will be referred to during today’s investor conference call and webcast is being furnished as Exhibit 99.2 to this Form 8-K.

The information in this Item 2.02, including the information set forth in Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

| |

ITEM 5.02 | Results of Operations and Financial Condition |

(b) See disclosure contained in 5.02(c) below.

(c) On February 11, 2016, the Board of Directors of the Company appointed Denny Marie Post as President of the Company, a promotion from her previous position of Executive Vice President and Chief Concept Officer. The President title was previously held by Stephen Carley, who will continue as the Company’s Chief Executive Officer. Also on February 11, 2016, the Board of Directors of the Company appointed Stuart Brown as Executive Vice President and Chief Financial Officer. Mr. Brown previously held the title Senior Vice President and Chief Financial Officer. Both appointments are effective immediately.

Neither Ms. Post nor Mr. Brown has any family relationships that are required to be disclosed under Item 401(d) of Regulation S-K, and neither is a party to any transaction requiring disclosure under Item 404(a) of Regulation S-K. The information required by Items 4.01(b) and (e) of Regulation S-K for each of Ms. Post and Mr. Brown is hereby incorporated by reference to the Company’s Annual Report on Form 10-K for the fiscal year ended December 28, 2014, as filed with the Securities and Exchange Commission on February 20, 2015.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| |

Exhibit No. | Description |

99.1 | Red Robin Gourmet Burgers, Inc. Press Release dated February 12, 2016. |

99.2 | Supplemental Financial Information dated February 12, 2016, provided by Red Robin Gourmet Burgers, Inc. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

RED ROBIN GOURMET BURGERS, INC.

Date: February 12, 2016

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: Executive Vice President and Chief Financial Officer

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

99.1 | Red Robin Gourmet Burgers, Inc. Press Release dated February 12, 2016. |

99.2 | Supplemental Financial Information dated February 12, 2016 provided by Red Robin Gourmet Burgers, Inc. |

Exhibit 99.1

Red Robin Gourmet Burgers Reports Results for the Fiscal Fourth Quarter and Year Ended December 27, 2015 and Announces Executive Promotions

Greenwood Village, CO – February 12, 2016 – Red Robin Gourmet Burgers, Inc., (NASDAQ: RRGB), a casual dining restaurant chain serving an innovative selection of high-quality gourmet burgers in a family-friendly atmosphere, today reported financial results for the quarter and year ended December 27, 2015.

In addition, the Company announced that Denny Marie Post has been promoted to President from Executive Vice President and Chief Concept Officer. Further, Stuart Brown has been promoted to Executive Vice President from Senior Vice President and will remain as Chief Financial Officer.

Fiscal Year 2015 Financial Highlights

| |

• | Total revenues were $1.3 billion, an increase of 9.7% over 2014 |

| |

• | Comparable restaurant revenue increased 2.1% over 2014 |

| |

• | Adjusted earnings per diluted share was $3.32 compared to $2.66 in 2014, an increase of 24.8% (See Schedule I) |

Fourth Quarter 2015 Financial Highlights

| |

• | Total revenues were $286.3 million, an increase of 1.5% over the same period a year ago |

| |

• | Comparable restaurant revenue decreased 2.0% from the same period a year ago (using constant currency rates) |

| |

• | Restaurant-level operating profit, as a percent of restaurant revenue, increased to 21.9% from 21.3% in the fourth quarter of 2014 (see Schedule II) |

| |

• | Net income increased to $11.7 million from $3.9 million in the fourth quarter of 2014 |

| |

• | Adjusted EBITDA increased 12.4% to $35.0 million from $31.1 million in the fourth quarter of 2014 (see Schedule III) |

| |

• | GAAP earnings per diluted share was $0.84. Adjusted earnings per diluted share was $0.86, an increase of 30.3% from the same period a year ago (See Schedule I) |

Net income for the fourth quarter ended December 27, 2015 was $11.7 million compared to $3.9 million for the same period a year ago. For the fiscal year ended December 27, 2015, net income was $47.7 million, an increase of 46.5% compared to $32.6 million for the fiscal year ended December 28, 2014. Earnings per diluted share for fiscal year 2015 was $3.36 compared to $2.25 a year ago, an increase of 49.3%.

Adjusted net income increased 28.2% to $12.0 million for the fourth quarter ended December 27, 2015, from $9.4 million for the same period a year ago. Earnings per diluted share on an adjusted basis for the fourth quarter 2015 was $0.86 compared to $0.66 a year ago, an increase of 30.3%. Adjusted net income for fiscal year 2015 increased 22.8% to $47.1 million from $38.4 million in fiscal year 2014. Earnings per diluted share on an adjusted basis for fiscal year 2015 was $3.32 compared to $2.66 a year ago, an increase of 24.8%. See Schedule I for a reconciliation of adjusted net income and adjusted earnings per share (each, a non-GAAP financial measure) to net income and earnings per share, respectively.

“Despite a challenging end to 2015, our comparable restaurant revenue for the year increased 2.1%, marking our sixth consecutive year of taking market share from peers. We believe our outperformance is sustainable going forward due to our intense guest focus along with our RED2 roadmap we laid out earlier this year,” said Steve Carley, Red Robin Gourmet Burgers, Inc. chief executive officer. “In 2016, we expect to complete our Brand Transformation Initiative and have a strong lineup of craveable new food and beverage offerings, both of which are critical in this competitive environment and to setting pace for our success over the next five years.”

Operating Results

Total Company revenues, which primarily include Company-owned restaurant revenue and franchise royalties, increased 1.5% to $286.3 million in the fourth quarter of 2015 from $282.1 million in the fourth quarter of 2014. A $10.8 million increase in revenue from new restaurant openings, net of closures, and a $0.4 million increase in franchise and other revenue were partially offset by a $5.3 million, or 2.0% decrease in comparable restaurant revenue and a $1.7 million unfavorable foreign exchange impact.

System-wide restaurant revenue (including franchised units) for the fourth quarter of 2015 totaled $352.1 million, compared to $348.0 million for the fourth quarter in 2014. System-wide restaurant revenue for fiscal year 2015 totaled $1.6 billion, compared to $1.5 billion in 2014 at constant currency rates.

Comparable revenue increased 2.1% in fiscal year 2015 compared to 2014, driven by a 2.5% increase in average guest check and offset by a 0.4% decrease in guest counts. Using constant currency rates, comparable revenue decreased 2.0% in the fourth quarter of 2015 compared to the same period a year ago, driven by a 4.6% decrease in guest counts offset by a 2.6% increase in average guest check. Comparable restaurants are those Company-owned restaurants that have operated five full quarters during the period presented, and such restaurants are only included in the comparable metrics if they are comparable for the entirety of both periods presented. The Canadian restaurants were added to the comparable restaurant group in the fourth quarter of 2015 and are not included in the 2015 fiscal year comparable restaurant group.

Restaurant-level operating profit margin (a non-GAAP financial measure) was 21.9% in the fourth quarter of 2015 compared to 21.3% in the same period a year ago, an improvement of 60 basis points. The improved margin resulted from a 180 basis point decrease in cost of sales, partially offset by an 80 basis point increase in labor costs, a 30 basis point increase in occupancy costs and 10 basis points increase in other restaurant operating expenses. Schedule II of this earnings release defines restaurant-level operating profit, discusses why it is a useful metric for investors, and reconciles this metric to income from operations and net income.

Restaurant Revenue Performance (1)

|

| | | | | | | |

| Q4 2015 | | Q4 2014 |

Average weekly sales per unit: |

| | |

Company-owned – Total (2) | $ | 55,104 |

| | $ | 56,652 |

|

Company-owned – Comparable (2) | $ | 55,254 |

| | $ | 56,364 |

|

Franchised units – Comparable | $ | 58,837 |

| | $ | 58,891 |

|

Total operating weeks: |

| | |

Company-owned units | 5,092 |

| | 4,864 |

|

Franchised units | 1,188 |

| | 1,181 |

|

_________________________________________________________

| |

(1) | Excludes Red Robin Burger Works® fast casual restaurants, which had 120 and 85 operating weeks in the fourth quarter of 2015 and 2014 |

| |

(2) | Calculated using constant currency rates. Using historical currency rates, the average weekly sales per unit in the fourth quarter of 2014 for Company-owned – Total and Company-owned – Comparable was $57,002 and $56,726. |

Other Results

Depreciation and amortization costs increased to $18.5 million in the fourth quarter of 2015 from $16.4 million in the fourth quarter of 2014. The increased depreciation was primarily related to restaurants remodeled under the Brand Transformation Initiative and new restaurants opened since the fourth quarter 2014, partially offset by a change in estimated useful lives of certain assets.

General and administrative costs were $21.3 million, or 7.4% of total revenues, in the fourth quarter of 2015, compared to $22.1 million, or 7.8% of revenues in the same period a year ago. The decrease of $0.8 million resulted primarily from decreased incentive-related compensation.

Selling expenses decreased to $8.0 million, or 2.8% of total revenues, in the fourth quarter of 2015, compared to $9.5 million, or 3.4% of total revenues in the prior year.

Pre-opening costs, including acquisition-related costs, were $2.4 million in the fourth quarter of 2015, compared to $1.2 million in the same period a year ago. The increase in restaurant pre-opening costs was due to the timing of restaurant openings in 2015, as 11 of our 24 restaurant openings in fiscal year 2015 occurred during the fourth quarter.

In the fourth quarter of 2015, the Company determined that two Company-owned restaurants were impaired, recognizing a non-cash pre-tax impairment charge of $0.6 million.

The Company's fiscal year 2015 effective tax rate was 24.6%, compared to a 22.2% effective tax rate in fiscal year 2014.

Restaurant Development

As of the end of the fourth quarter of 2015, there were 429 Company-owned Red Robin® restaurants, ten Red Robin Burger Works® and 99 franchised Red Robin restaurants, for a total of 538 restaurants. During the fourth quarter, the Company opened 11 full-size Red Robin restaurants, bringing the total restaurant openings for the year to 24.

Under the Brand Transformation Initiative, the Company completed 157 restaurant remodels during fiscal year 2015. The Company has over 325 restaurants conforming to its new brand standards as of the end of fiscal year 2015, including new restaurant openings.

Balance Sheet and Liquidity

As of December 27, 2015, the Company had cash and cash equivalents of $22.7 million and total debt of $210.8 million, including $8.0 million of capital lease liabilities. The Company increased debt by $63.0 million since the beginning of fiscal year 2015.

Cash generated from operations in 2015 totaled $140.9 million compared to $123.6 million in 2014. Capital investments in 2015 totaled $168.8 million, compared to $155.2 million in the prior year.

During the fourth quarter of 2015, the Company purchased 419,481 shares of the Company’s common stock for $29.4 million. In 2015, the Company purchased a total of 556,049 shares of the Company’s common stock for $40.0 million. As of December 27, 2015, there was approximately $10.0 million remaining under the current board authorization for stock repurchases.

On February 11, 2016, the Company’s board of directors re-authorized the Company’s share repurchase program, and approved the repurchase of up to a total of $100 million of the Company’s common stock. The share repurchase authorization was effective as of February 11, 2016, and will terminate upon completing repurchases of $100 million of common stock unless otherwise terminated by the board. Pursuant to the repurchase program, purchases may be made from time to time at the Company’s discretion and the Company is not obligated to acquire any particular amount of common stock.

Outlook for 2016

Red Robin’s 2016 fiscal year consists of 52 weeks and will end on December 25, 2016 (“2016”).

The Company expects total revenues to grow between 8.5% and 9.5% in 2016, comprised of comparable revenue growth in the low single digits and the remainder due to increased operating weeks associated with locations opened in 2015 and 2016. The Company plans to open approximately 25 new Red Robins and five Burger Works in 2016.

Earnings before interest taxes and depreciation (EBITDA) is expected to range between $155 million and $165 million in 2016. EBITDA is a non-GAAP number and defined in Schedule III.

Depreciation and amortization is projected to be between $82 million and $84 million in 2016 while interest expense is expected to be approximately $5 million. The 2016 annual tax rate is projected to be approximately 25.5%.

The Company expects capital investments to range between $150 million and $155 million. In addition to new restaurant openings, the Company expects to remodel around 70 locations as part of its Brand Transformation Initiative.

The sensitivity of the Company’s earnings per diluted share to a 1% change in guest counts for fiscal year 2016 is estimated to be $0.34 on an annualized basis. Additionally, a 10 basis point change in restaurant-level operating profit margin is expected to impact earnings per diluted share by approximately $0.09, and a change of approximately $143,000 in pre-tax income or expense is equivalent to approximately $0.01 per diluted share.

Investor Conference Call and Webcast

Red Robin will host an investor conference call to discuss its fourth quarter 2015 results today at 10:00 a.m. ET. The conference call number is (800) 750-4984, or for international callers (913) 312-0860. The financial information that the Company intends to discuss during the conference call is included in this press release and will be available on the “Investors” link of the Company’s website at www.redrobin.com. Prior to the conference call, the Company will post supplemental financial information that will be discussed during the call and live webcast.

To access the supplemental financial information and webcast, please visit www.redrobin.com and select the “Investors” link from the menu. A replay of the live conference call will be available from two hours after the call until midnight on Friday,

February 19, 2016. The replay can be accessed by dialing (877) 870-5176, or (858) 384-5517 for international callers. The conference ID is 9549831.

About Red Robin Gourmet Burgers, Inc. (NASDAQ: RRGB)

Red Robin Gourmet Burgers, Inc. (www.redrobin.com), a casual dining restaurant chain founded in 1969 that operates through its wholly-owned subsidiary, Red Robin International, Inc., and under the trade name Red Robin Gourmet Burgers and Brews, is the Gourmet Burger Authority™, famous for serving more than two dozen craveable, high-quality burgers with Bottomless Steak Fries® in a fun environment welcoming to guests of all ages. Whether a family dining with kids, adults grabbing a drink at the bar, or teens enjoying a meal, Red Robin offers an unparalleled experience for its guests. In addition to its many burger offerings, Red Robin serves a wide variety of salads, soups, appetizers, entrees, desserts and signature beverages. Red Robin offers a variety of options behind the bar, including its extensive selection of local and regional beers, and innovative adult beer shakes and cocktails, earning the restaurant a VIBE Vista Award for Best Beer Program in a Multi-Unit Chain Restaurant. There are more than 530 Red Robin restaurants across the United States and Canada, including Red Robin Burger Works® locations and those operating under franchise agreements. Red Robin… YUMMM®! Connect with Red Robin on Facebook, Instagram, and Twitter.

Forward-Looking Statements

Forward-looking statements in this press release regarding our strategic initiatives, future performance, revenues, EBITDA, capital investments, anticipated number and timing of new restaurant openings (including Red Robin Burger Works) and operating weeks, the anticipated number and timing of restaurant remodels under the Brand Transformation Initiative, anticipated costs, expenses including depreciation, amortization, and interest expense, tax rate, sensitivity of earnings per share and other projected financial measures, statements under the heading “Outlook for 2016” and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “expect,” “believe,” “anticipate,” “intend,” “plan,” “project,” “will” or “estimate,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. We undertake no obligation to update such statements to reflect events or circumstances arising after such date, and we caution investors not to place undue reliance on any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the effectiveness of our business improvement initiatives, effectiveness of our marketing strategies and initiatives to achieve restaurant sales growth; the ability to fulfill planned expansion and restaurant remodeling; the cost and availability of key food products, labor, and energy; our ability to achieve anticipated revenue and cost savings from our anticipated new technology systems and tools in the restaurants and other initiatives; availability of capital or credit facility borrowings; our ability to increase our to-go and other offerings; the adequacy of cash flows or available debt resources to fund operations and growth opportunities; federal, state, and local regulation of our business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission.

For media relations questions contact:

Jennifer DeNick, Coyne PR

(973) 588-2000

For investor relations questions contact:

Stuart Brown, Chief Financial Officer

(303) 846-6000

RED ROBIN GOURMET BURGERS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Twelve Weeks Ended | | Fifty-two Weeks Ended |

| | December 27, 2015 | | December 28, 2014 | | December 27, 2015 | | December 28, 2014 |

Revenues: | | | | | | | | |

Restaurant revenue | | $ | 282,189 |

| | $ | 278,439 |

| | $ | 1,238,898 |

| | $ | 1,129,135 |

|

Franchise royalties, fees and other revenue | | 4,111 |

| | 3,670 |

| | 18,694 |

| | 16,967 |

|

Total revenues | | 286,300 |

| | 282,109 |

| | 1,257,592 |

| | 1,146,102 |

|

| | | | | | | | |

Costs and expenses: | | | | | | | | |

Restaurant operating costs (exclusive of depreciation

and amortization shown separately below): | | | | | | | | |

Cost of sales | | 66,825 |

| | 71,071 |

| | 304,637 |

| | 287,221 |

|

Labor | | 93,551 |

| | 90,246 |

| | 403,517 |

| | 372,657 |

|

Other operating | | 36,260 |

| | 35,229 |

| | 154,344 |

| | 140,972 |

|

Occupancy | | 23,846 |

| | 22,612 |

| | 100,007 |

| | 86,734 |

|

Depreciation and amortization | | 18,493 |

| | 16,364 |

| | 77,374 |

| | 64,579 |

|

General and administrative | | 21,257 |

| | 22,103 |

| | 103,005 |

| | 94,751 |

|

Selling | | 8,027 |

| | 9,481 |

| | 40,074 |

| | 37,407 |

|

Pre-opening costs and acquisition costs | | 2,445 |

| | 1,220 |

| | 7,008 |

| | 8,264 |

|

Asset impairment charge | | 581 |

| | 8,833 |

| | 581 |

| | 8,833 |

|

Total costs and expenses | | 271,285 |

| | 277,159 |

| | 1,190,547 |

| | 1,101,418 |

|

| | | | | | | | |

Income from operations | | 15,015 |

| | 4,950 |

| | 67,045 |

| | 44,684 |

|

| | | | | | | | |

Other expense: | | | | | | | | |

Interest expense, net and other | | 747 |

| | 690 |

| | 3,809 |

| | 2,825 |

|

| | | | | | | | |

Income before income taxes | | 14,268 |

| | 4,260 |

| | 63,236 |

| | 41,859 |

|

Provision for income taxes | | 2,577 |

| | 321 |

| | 15,532 |

| | 9,298 |

|

Net income | | $ | 11,691 |

| | $ | 3,939 |

| | $ | 47,704 |

| | $ | 32,561 |

|

Earnings per share: | | | | | | | | |

Basic | | $ | 0.85 |

| | $ | 0.28 |

| | $ | 3.40 |

| | $ | 2.29 |

|

Diluted | | $ | 0.84 |

| | $ | 0.28 |

| | $ | 3.36 |

| | $ | 2.25 |

|

Weighted average shares outstanding: | | | | | | | | |

Basic | | 13,798 | | 14,028 | | 14,042 | | 14,237 |

Diluted | | 13,952 | | 14,215 | | 14,216 | | 14,447 |

RED ROBIN GOURMET BURGERS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

|

| | | | | | | | |

| | (Unaudited) December 27, 2015 | | December 28, 2014 |

Assets: | | | | |

Current Assets: | | | | |

Cash and cash equivalents | | $ | 22,705 |

| | $ | 22,408 |

|

Accounts receivable, net | | 27,760 |

| | 23,740 |

|

Inventories | | 28,223 |

| | 25,947 |

|

Prepaid expenses and other current assets | | 18,052 |

| | 23,160 |

|

Deferred tax asset and other | | — |

| | 4,677 |

|

Total current assets | | 96,740 |

| | 99,932 |

|

| | | | |

Property and equipment, net | | 603,686 |

| | 496,262 |

|

Goodwill | | 81,957 |

| | 84,115 |

|

Intangible assets, net | | 39,573 |

| | 42,479 |

|

Other assets, net | | 18,023 |

| | 13,101 |

|

Total assets | | $ | 839,979 |

| | $ | 735,889 |

|

| | | | |

Liabilities and Stockholders’ Equity: | | | | |

Current Liabilities: | | | | |

Trade accounts payable | | $ | 23,392 |

| | $ | 28,522 |

|

Construction related payables | | 28,692 |

| | 15,652 |

|

Accrued payroll and payroll related liabilities | | 47,587 |

| | 47,362 |

|

Unearned revenue | | 48,392 |

| | 45,049 |

|

Accrued liabilities and other | | 29,610 |

| | 27,084 |

|

Total current liabilities | | 177,673 |

| | 163,669 |

|

| | | | |

Deferred rent | | 66,470 |

| | 57,341 |

|

Long-term debt | | 202,875 |

| | 139,375 |

|

Long-term portion of capital lease obligations | | 7,441 |

| | 7,938 |

|

Other non-current liabilities | | 11,209 |

| | 7,795 |

|

Total liabilities | | 465,668 |

| | 376,118 |

|

| | | | |

Stockholders’ Equity: | | | | |

Common stock; $0.001 par value: 45,000 shares authorized; 17,851 and 17,851 shares issued; 13,628 and 14,043 shares outstanding | | 18 |

| | 18 |

|

Preferred stock, $0.001 par value: 3,000 shares authorized; no shares issued and outstanding | | — |

| | — |

|

Treasury stock 4,223 and 3,808 shares, at cost | | (167,339 | ) | | (132,252 | ) |

Paid-in capital | | 205,995 |

| | 200,617 |

|

Accumulated other loss, net of tax | | (5,379 | ) | | (1,924 | ) |

Retained earnings | | 341,016 |

| | 293,312 |

|

Total stockholders’ equity | | 374,311 |

| | 359,771 |

|

Total liabilities and stockholders’ equity | | $ | 839,979 |

| | $ | 735,889 |

|

Schedule I

Reconciliation of Non-GAAP Results to GAAP Results

(In thousands, except per share data)

In addition to the results provided in accordance with Generally Accepted Accounting Principles (“GAAP”) throughout this press release, the Company has provided non-GAAP measurements which present the 12 and 52 weeks ended December 27, 2015 and the 12 and 52 weeks ended December 28, 2014, net income and basic and diluted earnings per share, excluding the effects of a change in accounting estimate for gift card breakage. The Company believes that the presentation of net income and earnings per share exclusive of the identified item gives the reader additional insight into the ongoing operational results of the Company. This supplemental information will assist with comparisons of past and future financial results against the present financial results presented herein. Income tax expense related to the change in accounting estimate was calculated based on the change in the total tax provision calculation after adjusting for the identified item. The non-GAAP measurements are intended to supplement the presentation of the Company’s financial results in accordance with GAAP.

|

| | | | | | | | | | | | | | | | |

| | Twelve Weeks Ended | | Fifty-two Weeks Ended |

| | December 27, 2015 | | December 28, 2014 | | December 27, 2015 | | December 28, 2014 |

Net income as reported | | $ | 11,691 |

| | $ | 3,939 |

| | $ | 47,704 |

| | $ | 32,561 |

|

Asset impairment charge | | 581 |

| | 8,833 |

| | 581 |

| | 8,833 |

|

Change in estimate for gift card breakage | | — |

| | — |

| | (1,369 | ) | | — |

|

Executive transition costs | | — |

| | — |

| | — |

| | 544 |

|

Income tax benefit (expense) | | (227 | ) | | (3,379 | ) | | 212 |

| | (3,562 | ) |

Adjusted net income | | $ | 12,045 |

| | $ | 9,393 |

| | $ | 47,128 |

| | $ | 38,376 |

|

| | | | | | | | |

Basic net income per share: | | | | | | | | |

Net income as reported | | $ | 0.85 |

| | $ | 0.28 |

| | $ | 3.40 |

| | $ | 2.29 |

|

Asset impairment charge | | 0.04 |

| | 0.63 |

| | 0.04 |

| | 0.62 |

|

Change in estimate for gift card breakage | | — |

| | — |

| | (0.10 | ) | | — |

|

Executive transition costs | | — |

| | — |

| | — |

| | 0.04 |

|

Income tax benefit (expense) | | (0.02 | ) | | (0.24 | ) | | 0.02 |

| | (0.25 | ) |

Adjusted earnings per share - basic | | $ | 0.87 |

| | $ | 0.67 |

| | $ | 3.36 |

| | $ | 2.70 |

|

| | | | | | | | |

Diluted net income per share: | | | | | | | | |

Net income as reported | | $ | 0.84 |

| | $ | 0.28 |

| | $ | 3.36 |

| | $ | 2.25 |

|

Asset impairment charge | | 0.04 |

| | 0.62 |

| | 0.04 |

| | 0.62 |

|

Change in estimate for gift card breakage | | — |

| | — |

| | (0.09 | ) | | — |

|

Executive transition costs | | — |

| | — |

| | — |

| | 0.04 |

|

Income tax benefit (expense) | | (0.02 | ) | | (0.24 | ) | | 0.01 |

| | (0.25 | ) |

Adjusted earnings per share - diluted | | $ | 0.86 |

| | $ | 0.66 |

| | $ | 3.32 |

| | $ | 2.66 |

|

| | | | | | | | |

Weighted average shares outstanding | | | | | | | | |

Basic | | 13,798 |

| | 14,028 |

| | 14,042 |

| | 14,237 |

|

Diluted | | 13,952 |

| | 14,215 |

| | 14,216 |

| | 14,447 |

|

Schedule II

Reconciliation of Non-GAAP Restaurant-Level Operating Profit to Income

from Operations and Net Income

(In thousands)

The Company believes that restaurant-level operating profit is an important measure for management and investors because it is widely regarded in the restaurant industry as a useful metric by which to evaluate restaurant-level operating efficiency and performance. The Company defines restaurant-level operating profit to be restaurant revenue minus restaurant-level operating costs, excluding restaurant closures and impairment costs. The measure includes restaurant- level occupancy costs, which include fixed rents, percentage rents, common area maintenance charges, real estate and personal property taxes, general liability insurance, and other property costs, but excludes depreciation related to restaurant buildings and leasehold improvements. The measure excludes depreciation and amortization expense, substantially all of which is related to restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlay for the restaurants. The measure also excludes selling, general, and administrative costs, and therefore excludes occupancy costs associated with selling, general, and administrative functions, and pre-opening costs. The Company excludes restaurant closure costs as they do not represent a component of the efficiency of continuing operations. Restaurant impairment costs are excluded, because, similar to depreciation and amortization, they represent a non-cash charge for the Company’s investment in its restaurants and not a component of the efficiency of restaurant operations. Restaurant-level operating profit is not a measurement determined in accordance with generally accepted accounting principles (“GAAP”) and should not be considered in isolation, or as an alternative, to income from operations or net income as indicators of financial performance. Restaurant-level operating profit as presented may not be comparable to other similarly titled measures of other companies. The table below sets forth certain unaudited information for the 12 and 52 weeks ended December 27, 2015 and the 12 and 52 weeks ended December 28, 2014, expressed as a percentage of total revenues, except for the components of restaurant-level operating profit, which are expressed as a percentage of restaurant revenue. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Weeks Ended | | Fifty-two Weeks Ended |

| | December 27, 2015 | | December 28, 2014 | | December 27, 2015 | | December 28, 2014 |

Restaurant revenues | | $ | 282,189 |

| | 98.6 | % | | $ | 278,439 |

| | 98.7 | % | | $ | 1,238,898 |

| | 98.5 | % | | $ | 1,129,135 |

| | 98.5 | % |

Restaurant operating costs (exclusive of depreciation and amortization shown separately below): | | | | | | | | | | | | | | | | |

Cost of sales | | 66,825 |

| | 23.7 | % | | 71,071 |

| | 25.5 | % | | 304,637 |

| | 24.6 | % | | 287,221 |

| | 25.4 | % |

Labor | | 93,551 |

| | 33.2 | % | | 90,246 |

| | 32.4 | % | | 403,517 |

| | 32.6 | % | | 372,657 |

| | 33.0 | % |

Other operating | | 36,260 |

| | 12.8 | % | | 35,229 |

| | 12.7 | % | | 154,344 |

| | 12.4 | % | | 140,972 |

| | 12.5 | % |

Occupancy | | 23,846 |

| | 8.4 | % | | 22,612 |

| | 8.1 | % | | 100,007 |

| | 8.1 | % | | 86,734 |

| | 7.7 | % |

Restaurant-level operating profit | | 61,707 |

| | 21.9 | % | | 59,281 |

| | 21.3 | % | | 276,393 |

| | 22.3 | % | | 241,551 |

| | 21.4 | % |

| | | | | | | | | | | | | | | | |

Add – Franchise royalties, fees and other revenue | | 4,111 |

| | 1.4 | % | | 3,670 |

| | 1.3 | % | | 18,694 |

| | 1.5 | % | | 16,967 |

| | 1.5 | % |

Deduct – other operating: | | | | | | | | | | | | | | | | |

Depreciation and amortization | | 18,493 |

| | 6.5 | % | | 16,364 |

| | 5.8 | % | | 77,374 |

| | 6.2 | % | | 64,579 |

| | 5.6 | % |

General and administrative expenses | | 21,257 |

| | 7.4 | % | | 22,103 |

| | 7.8 | % | | 103,005 |

| | 8.2 | % | | 94,751 |

| | 8.3 | % |

Selling | | 8,027 |

| | 2.8 | % | | 9,481 |

| | 3.4 | % | | 40,074 |

| | 3.2 | % | | 37,407 |

| | 3.3 | % |

Pre-opening & acquisition costs | | 2,445 |

| | 0.9 | % | | 1,220 |

| | 0.4 | % | | 7,008 |

| | 0.6 | % | | 8,264 |

| | 0.7 | % |

Asset impairment charge | | 581 |

| | 0.2 | % | | 8,833 |

| | 3.1 | % | | 581 |

| | 0.0 | % | | 8,833 |

| | 0.8 | % |

Total other operating | | 50,803 |

| | 17.8 | % | | 58,001 |

| | 20.5 | % | | 228,042 |

| | 18.2 | % | | 213,834 |

| | 18.7 | % |

| | | | | | | | | | | | | | | | |

Income from operations | | 15,015 |

| | 5.2 | % | | 4,950 |

| | 1.8 | % | | 67,045 |

| | 5.3 | % | | 44,684 |

| | 3.9 | % |

| | | | | | | | | | | | | | | | |

Interest expense, net and other | | 747 |

| | 0.2 | % | | 690 |

| | 0.3 | % | | 3,809 |

| | 0.3 | % | | 2,825 |

| | 0.2 | % |

Income tax expense | | 2,577 |

| | 0.9 | % | | 321 |

| | 0.1 | % | | 15,532 |

| | 1.2 | % | | 9,298 |

| | 0.8 | % |

Total other | | 3,324 |

| | 1.1 | % | | 1,011 |

| | 0.4 | % | | 19,341 |

| | 1.5 | % | | 12,123 |

| | 1.1 | % |

| | | | | | | | | | | | | | | | |

Net income | | $ | 11,691 |

| | 4.1 | % | | $ | 3,939 |

| | 1.4 | % | | 47,704 |

| | 3.8 | % | | 32,561 |

| | 2.8 | % |

Certain percentage amounts in the table above do not total due to rounding as well as the fact that components of restaurant-level operating profit are expressed as a percentage of restaurant revenue and not total revenues.

Schedule III

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

(In thousands, unaudited)

The Company defines EBITDA as net income before interest expense, provision for income taxes, depreciation and amortization, and non-cash stock based compensation. EBITDA and adjusted EBITDA are presented because the Company believes that investors' understanding of our performance is enhanced by including these non-GAAP financial measures as a reasonable basis for evaluating our ongoing results of operations without the effect of non-cash charges such as depreciation and amortization expenses and asset disposals, stock-based compensation, closure costs and asset impairment charges. EBITDA and adjusted EBITDA are supplemental measures of operating performance that do not represent and should not be considered as alternatives to net income or cash flow from operations, as determined by GAAP, and our calculation thereof may not be comparable to that reported by other companies. Adjusted EBITDA further adjusts EBITDA to reflect the additions and eliminations shown in the table below. The use of adjusted EBITDA as a performance measure permits a comparative assessment of our operating performance relative to our performance based on our GAAP results, while isolating the effects of some items that vary from period to period without any correlation to core operating performance. Adjusted EBITDA as presented may not be comparable to other similarly-titled measures of other companies, and our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by excluded or unusual items.

|

| | | | | | | | | | | | | | | | |

| | Twelve Weeks Ended | | Fifty-two Weeks Ended |

| | December 27, 2015 | | December 28, 2014 | | December 27, 2015 | | December 28, 2014 |

Net income as reported | | $ | 11,691 |

| | $ | 3,939 |

| | $ | 47,704 |

| | $ | 32,561 |

|

Interest expense, net | | 959 |

| | 720 |

| | 3,629 |

| | 2,955 |

|

Provision for income taxes | | 2,577 |

| | 321 |

| | 15,532 |

| | 9,298 |

|

Depreciation and amortization | | 18,493 |

| | 16,364 |

| | 77,374 |

| | 64,579 |

|

Non-cash stock based compensation | | 681 |

| | 959 |

| | 4,724 |

| | 4,167 |

|

EBITDA | | 34,401 |

| | 22,303 |

| | 148,963 |

| | 113,560 |

|

| | | | | | | | |

Asset impairment charge | | 581 |

| | 8,833 |

| | 581 |

| | 8,833 |

|

Change in estimate for gift card breakage | | — |

| | — |

| | (1,369 | ) | | — |

|

Executive transition | | — |

| | — |

| | — |

| | 544 |

|

Adjusted EBITDA | | $ | 34,982 |

| | $ | 31,136 |

| | $ | 148,175 |

| | $ | 122,937 |

|

CLASSIFIED – INTERNAL USE Fourth Quarter 2015 Results February 12, 2016

2CLASSIFIED – INTERNAL USE Forward-Looking Statements Forward-looking statements in this press release regarding our strategic initiatives, future performance, revenues, EBITDA, capital investments, anticipated number and timing of new restaurant openings (including Red Robin Burger Works) and operating weeks, the anticipated number and timing of restaurant remodels under the Brand Transformation Initiative, anticipated costs, expenses including depreciation, amortization, and interest expense, tax rate, sensitivity of earnings per share and other projected financial measures, statements under the heading “Outlook for 2016” and all other statements that are not historical facts, are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be reasonable and speak only as of the date on which such statements are made. Without limiting the generality of the foregoing, words such as “expect,” “believe,” “anticipate,” “intend,” “plan,” “project,” “will” or “estimate,” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. We undertake no obligation to update such statements to reflect events or circumstances arising after such date, and we caution investors not to place undue reliance on any such forward-looking statements. Forward- looking statements involve risks and uncertainties that could cause actual results to differ materially from those described in the statements based on a number of factors, including but not limited to the following: the effectiveness of our business improvement initiatives, effectiveness of our marketing strategies and initiatives to achieve restaurant sales growth; the ability to fulfill planned expansion and restaurant remodeling; the cost and availability of key food products, labor, and energy; our ability to achieve anticipated revenue and cost savings from our anticipated new technology systems and tools in the restaurants and other initiatives; availability of capital or credit facility borrowings; our ability to increase our to-go and other offerings; the adequacy of cash flows or available debt resources to fund operations and growth opportunities; federal, state, and local regulation of our business; and other risk factors described from time to time in the Company’s Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) filed with the U.S. Securities and Exchange Commission. This presentation may also contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period-to- period comparisons. For a reconciliation of non-GAAP measures presented in this document, see the Appendix of this presentation or the Schedules to the Q4 press release posted on redrobin.com.

3CLASSIFIED – INTERNAL USE Red Robin FY 2015 Results • Comparable restaurant revenue growth of 2.1% • Adjusted EBITDA growth of 20.5% to $148.2 million • Adjusted diluted EPS growth of 24.8% to $3.32 per share Note: EBITDA and EPS numbers are adjusted to exclude asset impairments, a one-time benefit from gift card breakage estimates in 2015 and executive transition costs in 2014. See reconciliation in Appendix.

4CLASSIFIED – INTERNAL USE Red Robin Q4-2015 Results • Total revenues increased 1.5% • Comparable restaurant revenue down 2.0%, at constant currency rates • Restaurant-level operating profit was 21.9% compared to 21.3% in prior year • Adjusted diluted EPS was $0.86, an increase of 30.3% over prior year • Adjusted EBITDA was $35.0 million, an increase of 12.4% over prior year • Opened 11 Red Robin® restaurants NOTE: See reconciliations of restaurant-level operating profit in Appendix.

5CLASSIFIED – INTERNAL USE Brand Transformation Initiative Progress • Completed 57 remodels to new brand standards during Q4 2015 for a total of 157 transformations in FY 2015. Over 325 restaurants now conform to new brand standards, including new restaurant openings • Plan to transform 70 additional restaurants in 2016 Patriot Place restaurant in Foxboro, MA

CLASSIFIED – INTERNAL USE 6 Financial Update

7CLASSIFIED – INTERNAL USE Q4-15 Sales Highlights ????? ???? ????? ????? ???? ????? ?????? ????????? ???? ????? ????????? ???? ????? ?????? ?????????????????? ??????? ??????? ??????? ??????? ???? ????????????? ????????????? ???? ????????????? ???????? ??????? ??????? ??????? ??????? ???? ????????????? ????????????? ???? ????????????? ??????????????? ????? ???? ???? ???? ????????? ???? ???? ???? ???? ???????????? ????? ???? ????? ????? ??????????????????????? ???? ???? ???? ???? ????????????? ?????? ??????????????? ? ????? ??????? ??????? ????? ??????? ??????? ???? ????????????? ?????? ?????????????????? ? ???? ??????? ??????? ?????? ??????? ??????? ???? ????? ???????????????? ?????? ??????????????????????????? ? ???? ??????? ??????? ???? ??????? ??????? ???? ???????????????????? ??????? ?????? ?????? ???? ?????? ?????? ???? ??????? ??????????????? ???? ???? ??? ?????? ??? ??? ????? ??? ?????????????????? ???? ???? ???? ??? ?????????????????????????? ????? ??????????????????????? ??? ????????????????????????????????????? ???????

8CLASSIFIED – INTERNAL USE Q4-15 Restaurant Results ? ???????????????? ???????? ????? ???????????????? ???????? ????? ????????? ????????????? ???? ???????? ????? ????? ??? ??? ????? ????? ????? ???????? ??????????????? ????? ????? ??? ???? ????????? ???? ???? ??? ???? ????????????????? ???????????????? ?????????? ????? ????? ??????

9CLASSIFIED – INTERNAL USE ?????? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ?????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ?? ?? ?? ?? ???? ???? ???? ????????????? ???????????? ???????????? ???????????? Adjusted EBITDA ($ in millions) ? ??????????????????????????????????????????????????????????????? ?????????

10CLASSIFIED – INTERNAL USE Adjusted Earnings Per Diluted Share ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ?? ?? ?? ?? ???? ???? ???? ?? ????????????????????????????????????????????????????????????????????????????????????????????????????????????? ????????????? ?????????? ?????????? ??????????

11CLASSIFIED – INTERNAL USE Comparable Restaurant Revenue Trend(1) ???? ???? ???? ???? ???? ???? ???? ????? ????? ????? ???? ???? ???? ???? ???? ???? ???? ????? ????? ????? ????? ????? ????? ????? ????? ??????????????????????????????????????????

12CLASSIFIED – INTERNAL USE Taking Market Share – Year Over Year ???? ???? ???? ???? ???? ???? ????? ???? ???? ???? ???? ?????????? ????? ???? ???? ???? ???? ???? ???? ???? ???? ???? ?? ?? ?? ?? ?????????????????????????????? ???? ???? ???? ????????????????????????????????????????????????????????????????????????????????????????????????? ???????????? ????????????

13CLASSIFIED – INTERNAL USE Taking Market Share – Year Over Year ???? ???? ???? ???? ???? ???? ????? ???? ???? ???? ???? ????? ????? ????? ????? ????? ???? ???? ???? ???? ???? ???? ???? ???? ???? ???? ???? ?? ?? ?? ?? ???????????????????????????????? ???? ???? ???? ????????????????????????????????????????????????????????????????????????????????????????????????? ???????????? ????????????

14CLASSIFIED – INTERNAL USE ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ?? ?? ?? ?? ???? ???? ???? ??? ??? ??? ??? Restaurant Level Operating Profit (1) Margins ?? ??? ????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????? ?????????????????????? ??? ??????????????????????????????????????????????????????????????????????? ?????? ??????????????????????????????????????????????????????????????????? ????????????????????????????????????????????????????????????????????????????????????

15CLASSIFIED – INTERNAL USE 2016 Outlook • Total revenue growth between 8.5% and 9.5% • Comparable restaurant revenue growth in low single digits • EBITDA is expected to range between $155 and $165 million • Open approximately 25 new Red Robin restaurants, 5 Red Robin Burger Works, and complete around 70 remodels • Depreciation and amortization projected to be between $82 and $84 million • Interest expense expected to be approximately $5 million and the income tax rate is expected to be approximately 25.5% • Capital investments expected to be between $150 and $155 million

16CLASSIFIED – INTERNAL USE Project RED: Five Year Track Record of Great Returns • Tavern to Finest Barbell • Brand Transformation • Red Robin Royalty™ • ‘Take Back the Bar’ • Apps/Drinks/Desserts • “robin” – Server’s Sidekick • New Restaurants • Remodels • Burger Works • New Market Entries • Franchise Acquisitions • Stock Buy-Backs • Table Top and Other Technology ??????? ??????? ?????????????????? • Project Blueprint • Labor Management System • iLearning • Pay at the Table/Ziosk • Human Capital Management Delivered Improved Margins and Improved Guest Experience

17CLASSIFIED – INTERNAL USE Steady Growth: 2010 to 2015 ? ?? ?? ?? ?? ??? ??? ??? ??? ??? ??? ????? ????? ????? ????? ????? ???? ???? ???? ???? ???? ???? ????????????????????????????? ??????? ??????? ??????????????? EBITDA CAGR: 14.1% Revenue CAGR: 7.8% ????????????????????????????????????????????????????????????????????????????????? ?????????? ??????????????? Rev EBITDA

18CLASSIFIED – INTERNAL USE GOAL: DOUBLE EBITDA OVER 5 YEARS • Seating Utilization/Turns • 12+12 Brews Initiative • To-Go • Burger Works – channel growth • Catering • Hispanic • Order-Ahead • Delivery • Complete BTI remodels • Restaurant-level Technology • Midsize Unit Emphasis • Franchise Acquisitions • Stock Buy-Backs • Increased Pace of Growth • Supply Chain Management System • Service Models • G&A Leverage Revenue Expense Capital Deployment Project RED?

CLASSIFIED – INTERNAL USE 19 Marketing Update

20CLASSIFIED – INTERNAL USE Holiday Promotion • #NameThatChickenBurger • First Chicken Burger in the Finest Line • Mad Love Burger • LTO On Finest Line

21CLASSIFIED – INTERNAL USE Traffic Driving Initiatives • 12 Days of Burgers • Double Tavern Double Plus

22CLASSIFIED – INTERNAL USE In Closing ??

23CLASSIFIED – INTERNAL USE Thank you to all of our Team Members! ??

CLASSIFIED – INTERNAL USE 24 Appendix

25CLASSIFIED – INTERNAL USE Adjusted Net Income ???? ????? ???? ???? ????? ???? ???? ???? ????? ????? ???? ????? ???? ???? ???? ???? ????? ????? ????? ????? ?? ?? ?? ?? ???? ???? ???? ($ in millions) ?? ????????????????????????????????????????????????????? ????????????? ????????? ???????????? ??????????? ???????????

26CLASSIFIED – INTERNAL USE ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ????? ???? ???? ????? ????? ????? ????? ????? ????? ????? ????? ?? ?? ?? ?? ???? ???? ???? Cash Flow from Operations ($ in millions) ?? ???????????? ???????????? ????????????

27CLASSIFIED – INTERNAL USE Q4-15 Commodity Update ?? % of Total COGS in Q4-15 Market vs. Contract Ground beef 13.1% Market Steak fries 10.9% Contract through 10/16 Poultry 10.8% 100% covered thru 12/16 Meat 7.9% Bacon through 3/16; Prime rib through 9/16 Produce 7.5% 90% contracted through 8/16 Bread 6.5% Contract through 12/16 Seafood 2.9% Cod through 6/16; Shrimp through 6/16 Fry oil 1.7% Contract through 9/16

28CLASSIFIED – INTERNAL USE EBITDA and Adjusted EBITDA Reconciliation to Net Income ?? 2013 2014 2015 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income as reported $ 9,480 $11,139 $4,661 $6,959 $11,944 $9,470 $ 7,208 $3,939 $16,565 $11,166 $8,282 $11,691 Adjustments to net income: Income tax expense 2,977 3,576 1,517 940 4,424 3,521 1,032 321 6,220 4,410 2,325 2,577 Interest expense, net 1,052 623 558 399 689 619 927 720 1,088 805 777 959 Depreciation and amortization 17,834 13,319 13,436 13,611 18,886 14,120 15,209 16,364 23,003 17,260 18,618 18,493 Non-cash stock-based compensation 1,192 1,050 857 724 1,009 1,021 1,178 959 1,446 1,403 1,194 681 EBITDA $32,535 $29,707 $21,029 $22,633 $36,952 $28,751 $25,554 $22,303 $48,322 $35,044 $31,196 $34,401 Change in estimate for gift card breakage - - - - - - - - (1,369) - - - Executive transition & severance - - - - - 544 - - - - - - Impairment and closure charges - - - 1,517 - - - 8,833 - - - 581 Non-recurring special bonus - - - 1,626 - - - - - - - - Adjusted EBITDA $32,535 $29,707 $21,029 $25,776 $36,952 $29,295 $25,554 $31,136 $46,953 $35,044 $31,196 $34,982 ($ in thousands)

29CLASSIFIED – INTERNAL USE Reconciliation of Adjusted Net Income to Net Income and Adjusted Earnings Per Diluted Share to Earnings Per Diluted Share ?? 2013 2014 2015 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income as reported $ 9,480 $11,139 $ 4,661 $ 6,959 $11,944 $ 9,470 $ 7,208 $ 3,939 $16,565 $11,166 $ 8,282 $11,691 Adjustments to net income: Change in estimate for gift card breakage - - - - - - - - (1,369) - - - Executive transition & severance - - - - - 544 - - - - - - Impairment and closure charges - - - 1,517 - - - 8,833 - - - 581 Non-recurring special bonus - - - 1,626 - - - - - - - - Income tax expense of adjustments - - - (974) - (183) - (3,379) 439 - - (227) Adjusted net income $ 9,480 $11,139 $ 4,661 $ 9,128 $11,944 $ 9,831 $ 7,208 $ 9,393 $ 15,635 $11,166 $ 8,282 $ 12,045 Diluted net income per share: Net income as reported $ 0.66 $ 0.77 $ 0.32 $ 0.48 $ 0.82 $ 0.65 $ 0.50 $ 0.28 $ 1.16 $ 0.78 $ 0.58 $ 0.84 Adjustments to net income: Change in estimate for gift card breakage - - - - - - - - (0.09) - - - Executive transition & severance - - - - - 0.04 - - - - - - Impairment and closure charges - - - 0.10 - - - 0.62 - - - 0.04 Non-recurring special bonus - - - 0.11 - - - - - - - - Income tax expense of adjustments - - - (0.07) - (0.01) - (0.24) 0.03 - - (0.02) Adjusted EPS – diluted $ 0.66 $ 0.77 $ 0.32 $ 0.62 $ 0.82 $ 0.68 $ 0.50 $ 0.66 $ 1.10 $ 0.78 $ 0.58 $ 0.86 ($ in thousands, except per share data)

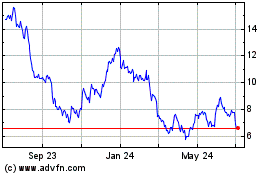

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

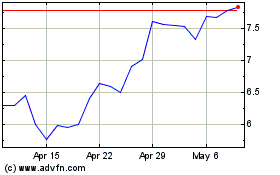

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Apr 2023 to Apr 2024