UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 28, 2015

RED ROBIN GOURMET BURGERS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-34851 |

|

84-1573084 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

|

6312 S. Fiddler’s Green Circle, Suite 200N

Greenwood Village, Colorado |

|

80111 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (303) 846-6000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

In October 2014, the Board of Directors (the “Board”) of Red Robin Gourmet Burgers, Inc. (the “Company”) adopted the Red Robin Gourmet Burgers, Inc. Cash Incentive Plan (the “Cash Incentive Plan”), subject to requisite stockholder approval. On May 28, 2015, the Cash Incentive Plan was approved by the Company’s stockholders at the Company’s 2015 annual meeting of stockholders (the “2015 Annual Meeting”).

The Cash Incentive Plan is designed to provide annual and multi-year cash incentives to members of the Company’s senior management team based on the achievement of pre-established, objective performance goals in accordance with the “qualified performance based compensation” rules of Section 162(m) of the Internal Revenue Code. Awards may be granted to any members of the Company’s senior management team designated as participants for each applicable performance period by the plan administrator, which will generally be the Compensation Committee of the Board (the “Committee”).

Under the Cash Incentive Plan, the Committee may establish the duration of up to two performance periods beginning in any calendar year, but no performance period may last for more than three years. Within 90 days of each performance period, the Committee will establish: (i) the performance goals and underlying performance criteria for the performance period and (ii) the formula or other methodology used to determine the amount of any earned bonus award. After the end of each performance period, the Committee will review and certify the level of attainment of the performance goals for the performance period and calculate the potential bonus award amounts for each participant based on the pre-specified formula or other methodology. The maximum amount of compensation payable as a performance award under the Cash Incentive Plan for any performance period is $3 million multiplied by the number of years (or portion thereof) in the performance period.

The foregoing summary of the Cash Incentive Plan is qualified in its entirety by reference to the actual terms of the Cash Incentive Plan, which is attached as Exhibit 10.1 hereto and incorporated herein by reference.

ITEM 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On February 11, 2015, the Board approved an amendment to the Restated Certificate of Incorporation of the Company, dated as of May 24, 2012, to increase the number of authorized shares of common stock of the Company (the “Charter Amendment”), subject to requisite stockholder approval. On May 28, 2015, the Charter Amendment was approved by the Company’s stockholders at the 2015 Annual Meeting and filed with the Secretary of State of the State of Delaware.

The Charter Amendment increases the number of authorized shares of common stock of the Company from 30,000,000 shares, par value $0.001 per share, to 45,000,000 shares, par

2

value $0.001 per share. The Charter Amendment does not change the authorized number of shares of preferred stock of the Company.

The foregoing summary of the Charter Amendment is qualified in its entirety by reference to the full text of a conformed copy of the Restated Certificate of Incorporation of the Company reflecting the Charter Amendment, dated as of May 28, 2015, which is attached as Exhibit 3.1 hereto and incorporated herein by reference.

ITEM 5.07 Submission of Matters to a Vote of Security Holders

The Company held the 2015 Annual Meeting on May 28, 2015 at its corporate headquarters in Greenwood Village, Colorado. Of the 14,114,025 shares of common stock issued and outstanding as of the record date, 13,253,762 shares of common stock (approximately 93.9%) were present or represented by proxy at the 2015 Annual Meeting. The Company’s stockholders elected all of the directors nominated by the Board; approved, on an advisory basis, the Company’s executive compensation; approved the adoption of the Cash Incentive Plan; approved the Charter Amendment; and ratified the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 27, 2015. The vote results for the matters submitted to stockholders are as follows:

1. Election of directors:

|

Name |

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER

NON-VOTES |

|

% OF VOTES

CAST |

|

|

Robert B. Aiken |

|

12,534,302 |

|

25,019 |

|

535 |

|

693,905 |

|

99.8 |

% |

|

Stephen E. Carley |

|

12,534,889 |

|

24,433 |

|

535 |

|

693,905 |

|

99.8 |

% |

|

Cambria W. Dunaway |

|

12,531,865 |

|

27,463 |

|

529 |

|

693,905 |

|

99.8 |

% |

|

Lloyd L. Hill |

|

12,530,999 |

|

28,020 |

|

838 |

|

693,905 |

|

99.8 |

% |

|

Richard J. Howell |

|

12,533,819 |

|

25,202 |

|

836 |

|

693,905 |

|

99.8 |

% |

|

Glenn B. Kaufman |

|

12,534,652 |

|

24,670 |

|

535 |

|

693,905 |

|

99.8 |

% |

|

Pattye L. Moore |

|

12,532,565 |

|

26,763 |

|

529 |

|

693,905 |

|

99.8 |

% |

|

Stuart I. Oran |

|

12,417,561 |

|

141,759 |

|

537 |

|

693,905 |

|

98.9 |

% |

2. Approval, on an advisory basis, of the Company’s executive compensation:

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-

VOTES |

|

% OF VOTES

CAST |

|

|

12,426,701 |

|

125,560 |

|

7,596 |

|

693,905 |

|

99.0 |

% |

3

3. Approval of the adoption of the Company’s Cash Incentive Plan:

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-

VOTES |

|

% OF VOTES

CAST |

|

|

12,167,751 |

|

386,154 |

|

5,952 |

|

693,905 |

|

96.9 |

% |

4. Approval of the amendment to the Company’s Restated Certificate of Incorporation to increase authorized shares:

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-

VOTES |

|

% OF SHARES

OUTSTANDING |

|

|

12,572,602 |

|

675,332 |

|

5,828 |

|

0 |

|

89.1 |

% |

5. Ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 27, 2015:

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-

VOTES |

|

% OF VOTES

CAST |

|

|

13,084,077 |

|

168,059 |

|

1,626 |

|

0 |

|

98.7 |

% |

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

3.1 |

|

Restated Certificate of Incorporation of Red Robin Gourmet Burgers, Inc., dated as of May 28, 2015 |

|

10.1 |

|

Red Robin Gourmet Burgers, Inc. Cash Incentive Plan, effective as of May 28, 2015 |

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 29, 2015

|

|

RED ROBIN GOURMET BURGERS, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ Michael L. Kaplan |

|

|

Name: |

Michael L. Kaplan |

|

|

Title: |

Chief Legal Officer |

5

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

3.1 |

|

Restated Certificate of Incorporation of Red Robin Gourmet Burgers, Inc., dated as of May 28, 2015 |

|

10.1 |

|

Red Robin Gourmet Burgers, Inc. Cash Incentive Plan, effective as of May 28, 2015 |

6

Exhibit 3.1

CONFORMED COPY OF

RESTATED CERTIFICATE OF INCORPORATION

OF

RED ROBIN GOURMET BURGERS, INC.

(Conformed copy giving effect to all amendments since the date of the filing of the Restated Certificate of Incorporation on May 24, 2012.)

FIRST: The name of the Corporation is Red Robin Gourmet Burgers, Inc.

SECOND: The address of the registered office of the Corporation in the State of Delaware is 2711 Centerville Road, Suite 400, Wilmington, Delaware 19808, in the county of New Castle. The name of the registered agent of the Corporation at that address is Corporation Service Company.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the Delaware General Corporation Law.

FOURTH: A. The total number of shares of all classes of stock which the Corporation shall have authority to issue is Forty-Eight Million (48,000,000) shares, consisting of Forty-Five Million (45,000,000) shares of Common Stock, par value $0.001 per share (the “Common Stock”) and Three Million (3,000,000) shares of Preferred Stock, par value $0.001 per share (the “Preferred Stock”).

B. The board of directors is authorized, subject to any limitations prescribed by law, to provide for the issuance of shares of Preferred Stock in series, and by filing a certificate pursuant to the applicable law of the State of Delaware (such certificate being hereinafter referred to as a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers, preferences, and rights of the shares of each such series and any qualifications, limitations or restrictions thereof. The number of authorized shares of Preferred Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the Common Stock, without a vote of the holders of the Preferred Stock, or of any series thereof, unless a vote of any such holders is required pursuant to the terms of any Preferred Stock Designation.

C. Each outstanding share of Common Stock shall entitle the holder thereof to one vote on each matter properly submitted to the stockholders of the Corporation for their vote; provided, however, that, except as otherwise required by law, holders of Common Stock shall not be entitled to vote on any amendment to this Restated Certificate of Incorporation (including any Certificate of Designations relating to any series of Preferred Stock) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon by law or pursuant to this Restated Certificate of Incorporation (including any Certificate of Designations relating to any series of Preferred Stock).

FIFTH: The following provisions are inserted for the management of the business and the conduct of the affairs of the Corporation, and for further definition, limitation and regulation of the powers of the Corporation and of its directors and stockholders:

A. The business and affairs of the Corporation shall be managed by or under the direction of the board of directors. In addition to the powers and authority expressly conferred upon them by statute or by this Restated Certificate of Incorporation or the by-laws of the Corporation, the directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation.

B. The directors of the Corporation need not be elected by written ballot unless the by-laws so provide.

C. Any action required or permitted to be taken by the stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders of the Corporation and may not be effected by any consent in writing by such stockholders.

D. Special meetings of stockholders of the Corporation may be called only by the Chairman of the Board, the Chief Executive Officer, the board of directors acting pursuant to a resolution adopted by a majority of the Whole Board or by holders of at least ten percent (10%) of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class. For purposes of this Restated Certificate of Incorporation, the term “Whole Board” shall mean the total number of authorized directors whether or not there exist any vacancies in previously authorized directorships.

SIXTH: A. Subject to the rights of the holders of any series of Preferred Stock to elect additional directors under specified circumstances, the number of directors shall be fixed from time to time exclusively by the board of directors pursuant to a resolution adopted by a majority of the Whole Board. Subject to the other provisions of this paragraph, the board of directors is and shall remain divided into three classes, with the directors in each class serving for a term expiring at the third annual meeting of stockholders held after their election. Subject to the rights of holders of Preferred Stock to elect additional directors under specified circumstances, the terms of the members of the board of directors shall be as follows: (i) at the annual meeting of stockholders to be held in 2012, the directors whose terms expire at that meeting or such directors’ successors shall be elected to hold office for a one-year term expiring at the annual meeting of stockholders to be held in 2013; (ii) at the annual meeting of stockholders to be held in 2013, the directors whose terms expire at that meeting or such directors’ successors shall be elected to hold office for a one-year term expiring at the annual meeting of stockholders to be held in 2014; and (iii) at the annual meeting of stockholders to be held in 2014 and at each annual meeting of stockholders thereafter, all directors shall be elected for a one-year term expiring at the next annual meeting after their election. The classification of the directors shall terminate at the annual meeting of stockholders to be held in 2014, and all directors, thereafter, shall be elected in accordance with clause (iii) above. Notwithstanding the foregoing provisions, each director shall serve until his or her successor is duly elected and qualified, or until his or her death, resignation or removal.

2

B. Subject to the rights of the holders of any series of Preferred Stock then outstanding, newly created directorships resulting from any increase in the authorized number of directors or any vacancies in the board of directors resulting from death, resignation, retirement, disqualification, removal from office or other cause shall, unless otherwise required by law or by resolution of the board of directors, be filled only by a majority vote of the directors then in office, though less than a quorum, and not by stockholders. Any director so chosen to fill a vacancy in a class or a newly created directorship of a class prior to the annual meeting of stockholders to be held in 2014 shall hold office for a term that shall coincide with the remaining term of that class. Any director so chosen to fill a vacancy or a newly created directorship at or following the annual meeting of stockholders to be held in 2014 shall hold office for a term expiring at the next annual meeting of stockholders. No decrease in the authorized number of directors shall shorten the term of any incumbent director.

C. Advance notice of stockholder nominations for the election of directors and of business to be brought by stockholders before any meeting of the stockholders of the Corporation shall be given in the manner provided in the by-laws of the Corporation.

D. Subject to the rights of the holders of any series of Preferred Stock then outstanding, any director, or the entire board of directors, may be removed from office (i) at any time prior to the annual meeting of stockholders to be held in 2014, at any time, but only for cause, and (ii) at any time at or after the annual meeting of stockholders to be held in 2014, with or without cause, in each of clauses (i) and (ii) only by the affirmative vote of the holders of at least sixty six and two thirds percent (66 2/3%) of the voting power of all of the then-outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class.

E. When a quorum is present at any meeting for the election of directors, a nominee for director shall be elected by the stockholders at such meeting if the votes cast “for” such nominee’s election exceed the votes cast “against” (or “withheld” from) such nominee’s election (with “abstentions” and “broker non-votes” not counted as a vote either “for” or “against” that director’s election); provided, that directors shall be elected by a plurality of the votes cast at any meeting of stockholders for which (i) the secretary of the corporation receives a notice that a stockholder has nominated a person for election to the board of directors in compliance with the advance notice requirements for stockholder nominees for a director set forth in Article SIXTH, Section C hereof and (ii) such nomination has not been rejected by the company for any reason or withdrawn by such stockholder on or before the tenth business day before the corporation first mails its notice of meeting to the stockholders. In the event the votes cast “against” (or “withheld” from) the nominee exceed the votes cast “for” such nominee (with “abstentions” and “broker non-votes” not counted as a vote either “for” or “against” that director’s election) (a “No Vote”), the resulting vacancy shall be filled only by a majority vote of the directors then in office, though less than a quorum (and not by stockholders), and the directors so chosen shall serve for a term expiring at the annual meeting of stockholders at which the term of office of the class to which they have been elected expires or until such director’s successor shall have been duly elected and qualified. In no event shall the Board nominate or elect a person to the Board who has received a No Vote subsequent to the adoption of this provision.

3

SEVENTH: The board of directors is expressly empowered to adopt, amend or repeal by-laws of the Corporation. Any adoption, amendment or repeal of the by-laws of the Corporation by the board of directors shall require the approval of a majority of the Whole Board. The stockholders shall also have power to adopt, amend or repeal the by-laws of the Corporation; provided, however, that, in addition to any vote of the holders of any class or series of stock of the Corporation required by law or by this Restated Certificate of Incorporation, the affirmative vote of the holders of at least sixty six and two thirds percent (66 2/3%) of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required to adopt, amend or repeal any provision of the by-laws of the Corporation.

EIGHTH: A director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law, or (iv) for any transaction from which the director derived an improper personal benefit. If the Delaware General Corporation Law is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the Delaware General Corporation Law, as so amended.

Any repeal or modification of the foregoing paragraph by the stockholders of the Corporation shall not adversely affect any right or protection of a director of the Corporation existing at the time of such repeal or modification.

NINTH: The Corporation reserves the right to amend or repeal any provision contained in this Restated Certificate of Incorporation in the manner prescribed by the laws of the State of Delaware and all rights conferred upon stockholders are granted subject to this reservation; provided, however, that, notwithstanding any other provision of this Restated Certificate of Incorporation or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any vote of the holders of any class or series of the stock of this corporation required by law or by this Restated Certificate of Incorporation, the affirmative vote of the holders of at least sixty six and two thirds percent (66-2/3%) of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of Directors, voting together as a single class, shall be required to amend or repeal this Article NINTH, Sections C or D of Article FIFTH, Article SIXTH, Article SEVENTH, or Article EIGHTH.

[Remainder of Page Intentionally Left Blank]

4

IN WITNESS WHEREOF, this conformed copy of the Restated Certificate of Incorporation has been duly executed by a duly authorized officer of the Corporation on the 28th day of May, 2015.

|

|

RED ROBIN GOURMET BURGERS, INC., |

|

|

|

|

|

|

|

|

By: |

/s/ Michael L. Kaplan |

|

|

|

Name: |

Michael L. Kaplan |

|

|

|

Title: |

Senior Vice President and |

|

|

|

|

Chief Legal Officer |

5

Exhibit 10.1

RED ROBIN GOURMET BURGERS, INC.

CASH INCENTIVE PLAN

Effective upon Approval by the Stockholders: May 28, 2015

SECTION 1. ESTABLISHMENT; PURPOSE

Red Robin Gourmet Burgers, Inc. (the “Company”) hereby establishes the Red Robin Gourmet Burgers, Inc. Cash Incentive Plan (the “Plan”) for the benefit of certain members of the Company’s senior management team. The purposes of the Plan are to (i) place a significant portion of the compensation of Plan participants at risk by tying such compensation to specific measurable goals designed to drive shareholder value, and (ii) exempt bonuses paid hereunder from the deduction limitations of Code Section 162(m). The Plan is intended to encourage initiative, resourcefulness, teamwork, motivation, and efficiency on the part of the Participants that will result in financial success for both the stockholders of the Company and the Participants.

SECTION 2. CERTAIN DEFINITIONS

“Board” means the Board of Directors of the Company.

“Cause” shall have the definition set forth in any employment, severance, change in control, or similar agreement between the Company and the Participant; provided, however, that if the Participant does not have such an agreement, the term Cause shall mean (a) Participant’s continual or deliberate neglect in the performance of his or her material duties; (b) Participant’s failure to devote substantially all of his or her working time to the business of the Company and its subsidiaries; (c) Participant’s failure to follow the lawful directives of the Board in any material respect; (d) Participant’s engaging in misconduct in connection with the performance of any of his duties, including, without limitation, falsifying or attempting to falsify documents, books or records of the Company or its subsidiaries, misappropriating or attempting to misappropriate funds or other property, or securing or attempting to secure any personal profit in connection with any transaction entered into on behalf of the Company or its subsidiaries; (e) the violation by Participant, in any material respect, of any policy or of any code or standard of behavior or conduct generally applicable to employees of the Company or its subsidiaries; (f) Participant’s breach of any non-competition, non-interference, non-disclosure, confidentiality or other similar agreement executed by Participant with the Company or any of its subsidiaries or other act of disloyalty to the Company or any of its subsidiaries (including, without limitation, aiding a competitor or unauthorized disclosure of confidential information); or (g) Participant’s engaging in conduct which is reasonably likely to result in material injury to the reputation of the Company or any of its subsidiaries, including, without limitation, commission of a felony, fraud, embezzlement or other crime involving moral turpitude; provided, however, Participant will not be deemed to have been terminated for Cause in the case of clauses (a), (b), (d) and (e) above, unless any such failure or material breach is not fully corrected prior to the expiration of the ten (10) business day period following delivery to Participant of the Company’s written notice that

specifies in detail of the alleged Cause event(s) and the Company’s intention to terminate his employment for Cause. Notwithstanding the foregoing, the Committee may, coincident with the Committee’s establishment of Performance Goals for any Performance Period, establish in writing a different definition of Cause that shall be used for such Performance Period or for any particular Participant for such Performance Period.

“Change in Control” means any of the following:

(a) The acquisition by any individual, entity or group (a “Person”) (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of more than 50% or more of either (1) the then-outstanding shares of common stock of the Company (the “Outstanding Company Common Stock”) or (2) the combined voting power of the then-outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”); provided, however, that, for purposes of this definition, the following acquisitions shall not constitute a Change in Control; (A) any acquisition directly from the Company, (B) any acquisition by the Company, (C) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Corporation or any affiliate of the Company or a successor, or (D) any acquisition by any entity pursuant to a transaction that complies with subsection (c)(1), (c)(2) or (c)(3) below;

(b) A majority of the individuals who, as of the date the Plan is adopted (the “Effective Date”), serve on the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the Effective Date whose election, or nomination for election by the Company’s stockholders, was approved by a vote of at least two-thirds of the directors then comprising the Incumbent Board (including for these purposes, the new members whose election or nomination was so approved, without counting the member and his predecessor twice) shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board;

(c) Consummation of a reorganization, merger, statutory share exchange or consolidation or similar corporate transaction involving the Company or any of its subsidiaries, a sale or other disposition of all or substantially all of the assets of the Company, or the acquisition of assets or stock of another entity by the Company or any of its subsidiaries (each, a “Business Combination”), in each case unless, following such Business Combination, (1) all or substantially all of the individuals and entities that were the beneficial owners of the Outstanding Company Common Stock and the Outstanding Company Voting Securities immediately prior to such Business Combination beneficially own, directly or indirectly, more than 50% of the then-outstanding shares of common stock and the combined voting power of the then-outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the entity resulting from such Business Combination (including, without limitation, an entity that, as a result of such transaction, owns the Corporation or all or substantially all of the Corporation’s

2

assets directly or through one or more subsidiaries (a “Parent”)) in substantially the same proportions as their ownership immediately prior to such Business Combination of the Outstanding Company Common Stock and the Outstanding Company Voting Securities, as the case may be, (2) no Person (excluding any entity resulting from such Business Combination or a Parent or any employee benefit plan (or related trust) of the Company or such entity resulting from such Business Combination or Parent) beneficially owns, directly or indirectly, more than 50% of, respectively, the then-outstanding shares of common stock of the entity resulting from such Business Combination or the combined voting power of the then-outstanding voting securities of such entity, except to the extent that the ownership in excess of more than 50% existed prior to the Business Combination, and (3) at least a majority of the members of the board of directors or trustees of the entity resulting from such Business Combination or a Parent were members of the Incumbent Board at the time of the execution of the initial agreement or of the action of the Board providing for such Business Combination; or

(d) Approval by the stockholders of the Company of a complete liquidation or dissolution of the Company.

Notwithstanding the foregoing, the Committee may, coincident with the Committee’s establishment of Performance Goals for any Performance Period, establish in writing a different definition of Change in Control that shall be used for such Performance Period or for any particular Participant for such Performance Period.

“Code” means the Internal Revenue Code of 1986, as amended.

“Code Section 162(m)” means Section 162(m) of the Code and the applicable Treasury Regulations and other guidance issued thereunder.

“Code Section 409A” means Section 409A of the Code and the applicable Treasury Regulations and other guidance issued thereunder.

“Committee” means a committee comprised of two or more directors, all of whom are “outside directors,” as defined in Treasury Regulation Section 1.162-27(e)(3). In the absence of an explicit Board delegation to the contrary, the Committee shall be the Compensation Committee of the Board (or if one exists, the 162(m) subcommittee of the Compensation Committee).

“Participant” means any member of senior management of the Company who is selected to participate in the Plan for a Performance Period in accordance with Section 4, below.

“Disability” shall have the definition set forth in any employment, severance, change in control, or similar agreement between the Company and the Participant; provided, however, that if the Participant does not have such an agreement, the term Disability shall mean a physical or mental impairment which substantially limits a major life activity of the Participant and which renders Participant unable to perform the essential functions of his position, even with reasonable accommodation which does not impose an undue hardship on the Company. The Company reserves the right, in good faith, to make the determination of Disability under this Plan based upon information supplied by Participant and/or his medical personnel, as well as information

3

from medical personnel (or others) selected by the Company or its insurers. Notwithstanding the foregoing, the Committee may, coincident with the Committee’s establishment of Performance Goals for any Performance Period, establish in writing a different definition of Disability that shall be used for such Performance Period or for any particular Participant for such Performance Period.

“Performance Goals” means the specific, measurable goals set by the Committee for any given Performance Period. Performance Goals may include multiple goals and may be based on one or more operational or financial criteria. In setting the Performance Goals for any Performance Period, the Committee may include one or any combination of the following criteria in either absolute or relative terms, for the Company or any subsidiary or business unit thereof: (a) stock price, (b) total shareholder return, (c) return on assets, return on equity, return on capital employed, or economic value added, (d) measures of growth such as number of units or comparable sales, (e) measures of profitability including, but not limited to, earnings per share, corporate or business unit net income, net income before extraordinary or one-time items, earnings before interest and taxes or earnings before interest, taxes, depreciation and amortization, (f) cash flow from operations, (g) levels of operating expense or other expense items reported on the Company’s income statement, (h) core and non-core product development and growth, (i) infrastructure development for business units or administrative departments (such as marketing, IT, and human resources), (j) measures of efficiency, (k) satisfactory completion of a major project or organizational initiative set in advance by the Committee, (l) measures of safety or quality, (m) revenue and/or sales, (n) market share, including, but not limited to, guest count or traffic count, (o) customer satisfaction, (p) employee engagement, including, but not limited to, employee retention and measures of employee satisfaction, and (q) strategic sales or acquisitions in compliance with specific criteria set forth in advance by the Committee.

“Performance Period” means one or more periods of time, which may be of varying and overlapping durations, as the Committee may select, over which the attainment of one or more Performance Goals will be measured for the purpose of determining a Participant’s right to, and the payment of, a bonus award granted under the terms of the Plan.

“Retirement” means the voluntary termination of employment by Participant from the Company if at the date of termination the Participant is at least 60 years of age and has completed at least five years of service with the Company. Notwithstanding the foregoing, the Committee may, coincident with the Committee’s establishment of Performance Goals for any Performance Period, establish in writing a different definition of Retirement that shall be used for such Performance Period or for any particular Participant for such Performance Period.

“Treasury Regulations” means the Treasury Regulations promulgated under the Code.

SECTION 3. ADMINISTRATION

The Plan shall be administered by the Committee, and the Committee shall have full authority to administer the Plan, including authority to interpret and construe any provision of the Plan and to adopt such rules for administering the Plan as it may deem necessary to comply with the requirements of the Code, or to conform to any regulation or any change in any law or

4

regulation applicable thereto. The Committee may delegate any of its responsibilities under the Plan other than such responsibilities that are explicitly reserved for Committee action pursuant to Code Section 162(m). The Committee’s decisions shall be final and binding upon all parties, including the Company, stockholders, and Participants.

SECTION 4. PERFORMANCE PERIODS; ELIGIBILITY

The Committee may, but need not, establish up to two (2) different Performance Periods beginning in any calendar year, with each such Performance Period to extend for such duration of three (3) years or less as may be determined by the Committee in its sole and absolute discretion. Within ninety (90) days after the beginning of any such Performance Period, but in no event after twenty-five (25) percent of the Performance Period has elapsed, the Committee shall designate in writing those members of senior management of the Company who shall be Participants in the Plan for such Performance Period. Only those individuals selected to be Participants shall be eligible to earn bonus awards under the Plan.

SECTION 5. ESTABLISHMENT OF PERFORMANCE GOALS; DETERMINATION OF AWARDS

5.1 Establishment of Performance Goals; Bonus Formulas. Within ninety (90) days after the beginning of a Performance Period, but in no event after twenty-five (25) percent of the Performance Period has lapsed, the Committee shall establish in writing (i) the Performance Goals and the underlying performance criteria applicable to the Performance Period, and (ii) the formula or methodology for determining the bonus award payable (if any) to each Participant for such Performance Period upon attainment of the specified Performance Goals. Performance Goals must be objective and must satisfy the third-party objectivity standards under Code Section 162(m). Notwithstanding the foregoing, at the time such Performance Goals are established, the Committee may determine that the Performance Goals shall be adjusted to account for any unusual items or specified events or occurrences during the Performance Period. In addition, unless otherwise provided by the Committee at the time the Performance Goals are established, the Performance Goals shall be adjusted to exclude the effect of any of the following events that occur during the Performance Period: (i) asset write-downs, (ii) extraordinary litigation, claims, judgments, or settlements, (iii) the effect of changes in tax law, accounting principles or other such laws or provisions affecting reported results, (iv) accruals for reorganization and restructuring programs, (v) material changes to invested capital from pension and post-retirement benefits-related items and similar non-operational items, and (vi) any other extraordinary, unusual, non-recurring or non-comparable items (A) as described in management’s discussion and analysis of financial condition and results of operations appearing in the Company’s Annual Report to stockholders, (B) as described in Accounting Standards Codification Topic 225 (or successor guidance thereto) or (C) as publicly announced by the Company in a press release or conference call relating to the Company’s results of operations or financial condition for a completed quarterly or annual fiscal period.

5.2 Certification of Results; Calculation of Bonuses. As soon as reasonably practicable after the close of the Performance Period, the Committee shall determine bonus awards to be paid under the terms of the Plan. Any payments made under this Plan shall be

5

contingent upon achieving the Performance Goals set in advance for the Performance Period in question. The Committee shall certify in writing prior to approval of any awards that such Performance Goals have been satisfied (a unanimous written consent or approved minutes of the Committee may be used for this purpose).

5.3 Committee Discretion to Reduce Awards. The Committee may, in its sole and absolute discretion, reduce the bonus awards to which any Participant is otherwise due for any Performance Period if it believes that such reduction is in the best interest of the Company and its stockholders, but any reduction cannot result in any increase in the bonus award of one or more other Participants for such Performance Period. The Committee has no discretion to increase the bonus award otherwise payable to any Participant for any Performance Period.

5.4 Maximum Awards. The maximum bonus award that may be paid to any Participant for any Performance Period shall be (x) 3,000,000, multiplied by (y) the number of years (or portion thereof) in the Performance Period.

SECTION 6. PAYMENT OF AWARDS

Coincident with the Committee’s establishment of Performance Goals for any Performance Period, the Committee shall also establish in writing when bonus awards for such Performance Period (if any) shall be paid, including (but not limited to) the effect that a Participant’s death, Disability, or termination without Cause, or a Change of Control of the Company, may have on the payment of such awards. All payment terms shall be intended to comply with Code Section 409A. Payment may be made in the form of cash or Company common stock (including Company common stock that is subject to forfeiture), or any combination thereof, as determined by the Committee in its sole and absolute discretion.

SECTION 7. GENERAL PROVISIONS

7.1 Nonassignability. A Participant shall have no right to assign or transfer any interest under this Plan.

7.2 No Contract of Employment. Nothing in this Plan shall confer upon the Participant the right to maintain his relationship with the Company or any affiliate as an employee, nor shall it interfere in any way with any right of the Company, or any such affiliate, to terminate its relationship with the Participant at any time for any reason whatsoever, with or without Cause.

7.3 Amendment and Termination. The Board may from time to time alter, amend, suspend, or discontinue the Plan, including, where applicable, any modifications or amendments as it shall deem advisable in order that the Plan not be subject to the limitations on deductibility contained in Code Section 162(m), or to conform to any regulation or to any change in law or regulation applicable thereto; provided, however, that no such action shall adversely affect the rights and obligations of the Participants with respect to the bonus amount payable under the Plan at the time of such alteration, amendment, suspension, or discontinuance, except as may be

6

required in order to comply with the requirements of Code Section 162(m) or Code Section 409A.

7.4 Section 409A of the Code. This Plan, including any payment terms established in accordance with Section 6, above, shall be established, administered, and operated in the good faith determination of the Board or the Committee to comply with or be exempt from Code Section 409A. Although the Company intends to administer the Plan so that it complies with or is exempt from the requirements of Code Section 409A, the Company does not warrant that any bonus amount payable under the Plan will not be subject to the tax imposed by Code Section 409A or will otherwise qualify for favorable tax treatment under any other provision of federal, state, local, or foreign law. The Company shall not be liable to any Participant for any tax, interest, or penalties the Participant might owe as a result of his or her participation in the Plan.

7.5 Tax Withholding. The Company shall withhold all applicable taxes from any bonus awards payable hereunder, including any foreign, federal, state, and local taxes.

7.6 Applicable Law. This Plan shall be construed in accordance with provisions of the laws of the State of Colorado, without regards to the conflicts of laws provisions of such state.

SECTION 8. EFFECTIVE DATE

This Red Robin Gourmet Burgers, Inc. Cash Incentive Plan was adopted by the Board of Directors on October 29, 2014, and shall become effective upon approval by the stockholder of the Company. Once approved by the Company’s stockholders, it shall remain in effect, subject to amendment from time to time.

7

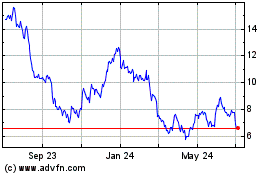

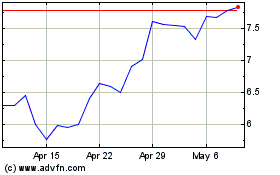

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Apr 2023 to Apr 2024