U.S. Existing Home Sales Down 4.8% in August

September 21 2015 - 10:50AM

Dow Jones News

WASHINGTON—The pace of home sales slowed sharply last month, a

possible sign that rising prices are causing home buyers to pull

back.

The pace of existing home sales fell 4.8% last month from July

to a seasonally adjusted rate of 5.31 million, the National

Association of Realtors said Monday. That was the largest

month-to-month decline since January, when sales fell 4.9%. Sales

for July were revised down slightly to 5.58 million from 5.59

million.

Economists surveyed by The Wall Street Journal had expected

August sales would drop 1.1% to 5.53 million.

Home sales were down particularly steeply in the South, where

they fell 6.6%, and in the West, where they fell 7.8%. Lawrence

Yun, NAR chief economist, said those drops suggested home buyers

were hurt by rising prices.

From a year ago, home sales were up 6.2%.

"Even with the decline, I believe we are comfortably set for the

best home sales year in eight years," Mr. Yun said.

The median sales price in August was $228,700, which is 4.7%

above the median price a year ago.

Housing has been a bright spot this summer, with measures of

home builder confidence and applications for building permits

rising more than expected. August housing starts, on the other

hand, fell 3% from the previous month but analysts attributed the

drop to the end of an affordable housing tax credit in New York

rather than weakness in the market.

Buyers have been buoyed by a stronger labor market and

historically low interest rates, which serve as an incentive to buy

homes. Last week, the Federal Reserve said it planned to hold

interest rates near zero for at least one more month, which could

give the housing market more room to grow.

On Thursday, Federal Reserve Chairwoman Janet Yellen noted the

improvements in the housing market although she added the market is

nowhere near its prerecession levels.

"We are envisioning further improvements in the housing market,"

she said. "It remains very depressed."

Mr. Yun said he wasn't concerned about higher interest

rates.

"Fed policy changes will haven't too big an impact on mortgage

rates," he said.

Mr. Yun said he expected mortgage rates to rise to 4.1% by the

end of the year and to 5.0% by the end of next year.

News Corp, owner of The Wall Street Journal, also owns Move

Inc., which operates a website and mobile products for the National

Association of Realtors.

Write to David Harrison at david.harrison@wsj.com and Jeffrey

Sparshott at jeffrey.sparshott@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 21, 2015 10:35 ET (14:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

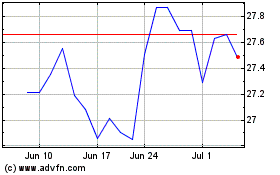

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

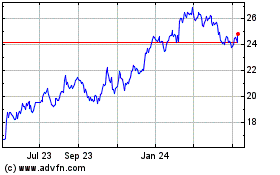

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024