Current Report Filing (8-k)

November 06 2014 - 2:22PM

Edgar (US Regulatory)

|

| |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

WASHINGTON, D.C. 20549 |

|

|

FORM 8-K |

|

|

CURRENT REPORT |

|

|

Pursuant to Section 13 or 15(d) of |

the Securities Exchange Act of 1934 |

|

|

Date of Report (Date of Earliest Event Reported) November 6, 2014 |

|

|

NATIONAL WESTERN LIFE INSURANCE COMPANY |

(Exact Name of Registrant as Specified in Its Charter) |

|

|

COLORADO | 84-0467208 |

(State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification Number) |

| |

| |

2-17039 |

(Commission File Number) |

| |

| |

850 EAST ANDERSON LANE, AUSTIN, TEXAS | 78752-1602 |

(Address of Principal Executive Offices) | (Zip code) |

| |

| |

(512) 836-1010 |

(Registrant's Telephone Number, Including Area Code) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 cfr 240.14D-2(B)) |

|

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 cfr 240.13E-4(C)) |

Item 2.02 Results of Operations and Financial Condition

On November 6, 2014, National Western Life Insurance Company ("Company") announced via press release the Company's financial results for the quarter and nine months ended September 30, 2014. A copy of the Company's press release is attached hereto as Exhibit 99.1. This Form 8-K and the attached exhibit are provided under Item 9.01 of Form 8-K and are furnished to, but not filed with, the Securities and Exchange Commission.

The press release is available at the Company's website, www.nationalwesternlife.com.

|

| | | |

Item 9.01 Financial Statements and Exhibits |

|

( d ) Exhibits |

|

Exhibit No. | Description |

| |

99.1 | Press Release dated November 6, 2014 |

|

|

|

|

| | | |

SIGNATURE |

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

|

| NATIONAL WESTERN LIFE INSURANCE COMPANY |

|

Date: November 6, 2014 | /S/Brian M. Pribyl |

| Brian M. Pribyl |

| Senior Vice President, |

| Chief Financial Officer |

| and Treasurer |

|

|

|

| | | |

EXHIBIT INDEX |

|

Exhibit | | Description |

| | |

99.1 | | Press Release of National Western Life Insurance Company issued November 6, 2014 reporting financial results for the quarter and nine months ended September 30, 2014.

|

FOR IMMEDIATE RELEASE EXHIBIT 99.1

National Western Life Announces 2014 Third Quarter Earnings

Austin, Texas, November 6, 2014 ‑ Ross R. Moody, President of National Western Life Insurance Company (Nasdaq: NWLI), announced today third quarter 2014 consolidated net earnings of $28.5 million, or $8.05 per diluted Class A common share, compared with consolidated net earnings of $24.8 million, or $7.00 per diluted Class A common share, for the third quarter of 2013. For the nine months ended September 30, 2014, the Company reported consolidated net earnings of $77.5 million, or $21.91 per diluted Class A common share, compared with $68.4 million, or $19.32 per diluted Class A common shares, a year ago. The Company's book value per share increased to $421.91 as of September 30, 2014 from $416.89 at June 30, 2014.

The Company reported earnings from operations, excluding net realized gains and losses on investments, of $27.1 million for the three months ended September 30, 2014, or $7.65 per diluted Class A common share, compared to $22.6 million, or $6.40 per diluted Class A common share, in the same period for 2013. Mr. Moody commented on the earnings results saying, "The profitability levers of our business continue to perform well. The third quarter results benefited from favorable mortality experience as well as our emphasis on managing operating expenses commensurate with business levels." Earnings from operations for the nine months ended September 30, 2014 increased 15% over the comparable prior year period. Mr. Moody observed that the Company's increased profitability was achieved despite continuing market challenges. "As most are aware, the interest rate environment has not been very conducive for some time in obtaining higher yields on credit instruments such as investment grade corporate bonds we purchase to support our policy obligations. Our commitment to credit quality, prudent diversification, and careful matching of asset durations with policyholder liabilities is a discipline we dedicate ourselves to in maintaining National Western's reputation for financial soundness and stability," Mr. Moody indicated.

Insurance revenues for the quarter ended September 30, 2014 increased to $154.0 million compared to $149.3 million in the third quarter of 2013. Mr. Moody noted, "We are please with our growth as this year has been a challenging one for the life insurance industry. The tepid economic recovery has not generated meaningful gains in consumer personal income thus muting the demand for life insurance products. The Company's portfolio of life and annuity products with equity-index crediting mechanisms continue to stand out in this environment as the driver of new product sales and additions to our level of business in force from which we generate insurance revenues."

Founded in 1956, National Western Life is a stock life insurance company offering a broad portfolio of individual universal life, whole life and term insurance plans, annuity products, and investment contracts meeting the financial needs of its customers in 49 states as well as residents of various countries in Central and South America, the Caribbean, Eastern Europe, Asia, and the Pacific Rim. The Company has approximately 270 employees and 20,100 contracted independent agents, brokers, and consultants, and at September 30, 2014, maintained total assets of $11.3 billion, stockholders' equity of $1.5 billion, and life insurance in force of $22.7 billion.

Caution Regarding Forward-Looking Statements:

This press release contains statements which are or may be viewed as forward-looking within the meaning of The Private Securities Litigation Reform Act of 2005. Forward-looking statements relate to future operations, strategies, financial results or other developments, and are subject to assumptions, risks, and uncertainties. Factors that may cause actual results to differ materially from those contemplated in these forward-looking statements can be found in the Company's Form 10-K filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement was made and the Company undertakes no obligation to update such forward-looking statements. There can be no assurance that other factors not currently anticipated by the Company will not materially and adversely affect our results of operations. Investors are cautioned not to place undue reliance on any forward-looking statements made by us or on our behalf.

National Western Life Insurance Company

News Release - Page 2

Summary of Consolidated Operating Results (Unaudited)

(In thousands except per share data)

|

| | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Revenues: | | | | | | | |

Revenues, excluding investment and index option gains | 153,973 |

| | 149,292 |

| | 468,440 |

| | 468,145 |

|

Realized and unrealized gains on index options | 3,479 |

| | 35,615 |

| | 49,278 |

| | 126,739 |

|

Realized gains on investments | 2,169 |

| | 3,285 |

| | 6,747 |

| | 7,199 |

|

Total revenues | 159,621 |

| | 188,192 |

| | 524,465 |

| | 602,083 |

|

| | | | | | | |

Earnings: | | | | | | | |

Earnings from operations | 27,056 |

| | 22,646 |

| | 73,089 |

| | 63,725 |

|

Net realized gains on investments | 1,410 |

| | 2,136 |

| | 4,386 |

| | 4,680 |

|

Net earnings | 28,466 |

| | 24,782 |

| | 77,475 |

| | 68,405 |

|

| | | | | | | |

Net earnings attributable to Class A shares | 27,661 |

| | 24,081 |

| | 75,284 |

| | 66,470 |

|

| | | | | | | |

Basic Earnings Per Class A Share: | | | | | | | |

Earnings from operations | 7.65 |

| | 6.41 |

| | 20.68 |

| | 18.03 |

|

Net realized gains on investments | 0.40 |

| | 0.60 |

| | 1.24 |

| | 1.32 |

|

Net earnings | 8.05 |

| | 7.01 |

| | 21.92 |

| | 19.35 |

|

| | | | | | | |

Basic Weighted Average Class A Shares | 3,436 |

| | 3,435 |

| | 3,435 |

| | 3,435 |

|

| | | | | | | |

Diluted Earnings Per Class A Share: | | | | | | | |

Earnings from operations | 7.65 |

| | 6.40 |

| | 20.67 |

| | 18.00 |

|

Net realized gains on investments | 0.40 |

| | 0.60 |

| | 1.24 |

| | 1.32 |

|

Net earnings | 8.05 |

| | 7.00 |

| | 21.91 |

| | 19.32 |

|

| | | | | | | |

Diluted Weighted Average Class A Shares | 3,438 |

| | 3,439 |

| | 3,437 |

| | 3,440 |

|

Investor Relations Contact:

Brian M. Pribyl - Senior Vice President, Chief Financial Officer and Treasurer

(512) 836-1010

bpribyl@nationalwesternlife.com

www.nationalwesternlife.com

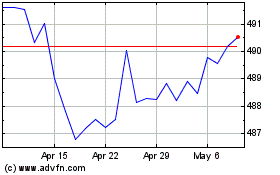

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Aug 2024 to Sep 2024

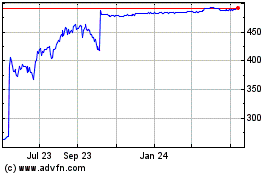

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Sep 2023 to Sep 2024