ITV Profit Rises; Pays Special Dividend -- Update

March 02 2016 - 8:38AM

Dow Jones News

(Rewrites, adds detail.)

By Simon Zekaria

LONDON--ITV PLC (ITV.LN) on Wednesday recorded a rise in yearly

profit and is paying a special dividend worth hundreds of millions

of dollars, but shares in the U.K.'s biggest over-the-air

commercial broadcaster dipped after it flagged falling viewing

figures and warned about its advertising revenue.

ITV said its net profit in the year to Dec. 31 increased to 495

million pounds ($692 million) from GBP466 million in 2014. Revenue

from external sources rose 15% year-over-year to GBP2.97 billion.

Revenue at ITV Studios, its production arm, jumped 33% to GBP1.24

billion.

Advertising revenue was up 6% at GBP1.72 billion in 2015.

However, it said the European soccer tournament, Euro 2016, is

expected to alter advertising revenue this year: The first quarter,

before the tournament begins, is expected to be "flat" and

"marginally behind the market," while the second quarter is seen as

"positive" because advertising will rise during the soccer

championships.

The share of viewers for ITV's main channels was down 3% over

the year, with some shows not performing as well as had been

expected, it said. ITV said it still expects to outperform the

television advertising market in 2016, boosted by audiences of its

shows and live sport, including soccer and rugby.

It proposes a final dividend of 4.1 pence per share, making a

full-year dividend of 6 pence per share--up from 4.7 pence last

year--and ahead of its guidance. It is also proposing a special

dividend of 10 pence. Last year, it paid out a dividend of 6.25

pence.

"ITV delivered another strong year as we continue to grow and

strengthen the business in the U.K. and internationally," said

Chief Executive Adam Crozier.

At 1251 GMT, shares fell 3.9% to 240 pence, valuing the company

at GBP10.1 billion.

Numis analyst Paul Richards said the results are strong and

ahead of expectations, but added investors may be disappointed by

the advertising outlook, even if the share price reaction is

"rather harsh".

Mr. Crozier told reporters said it is "pretty normal" that

advertising money will "shift around" during the period of a major

soccer tournament, but said the expanded competition and

participation of countries in the British Isles will boost the

broadcaster.

ITV has been growing its production business and raising its

international profile as it lowers its reliance on advertising

revenue and revenue from the U.K.. ITV Studios has doubled its

revenue over the last six years and now more than half of ITV's

income is from outside the U.K.

It has also boosted ITV Studios with bolt-on acquisitions to

grow its reach.

Analysts said ITV is an acquisition target in the

fast-consolidating media industry. U.S. cable giant Liberty Global

PLC (LBTYA) has taken a 9.9% stake in ITV for hundreds of million

of dollars.

And CCS Insight analyst Paolo Pescatore said U.K.

telecommunications group BT Group PLC (BT.A.LN), which is building

up its sports channels, also may show interest.

"We still firmly believe that ITV remains a takeover target,

especially from the likes of BT. The move makes perfect sense and

would be a key part of BT's growing aspirations in television."

Liberty Global wasn't immediately available for comment. BT

declined to comment.

Mr. Crozier rejected talk that ITV is a target.

"I do not think of us as a takeover target at all," he said. "If

anything, we are a consolidator of companies," Mr. Crozier added,

saying the company is focused on growing the business.

--Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

March 02, 2016 08:23 ET (13:23 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

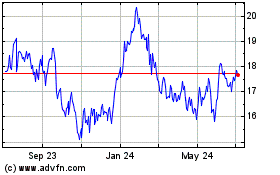

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Mar 2024 to Apr 2024

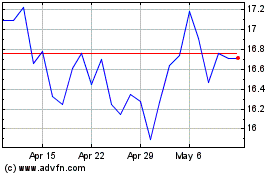

Liberty Global (NASDAQ:LBTYA)

Historical Stock Chart

From Apr 2023 to Apr 2024