Jack in the Box: Traffic Steady But Sales Hurt By Discounting

November 19 2009 - 3:24PM

Dow Jones News

Jack in the Box Inc.'s (JACK) customer traffic is holding steady

but aggressive discounting by competitors and weak sales of drinks

and sides is hurting the check average, Linda Lang, chairman and

chief executive of the chain, said Thursday.

High unemployment, especially among its core customers of young

men and Hispanics, and a high concentration of stores in areas like

California is also contributing to weak same-store sales, which

fell 10% at company-operated Jack in the Box stores in the early

part of its fiscal first-quarter. Jack in the Box also late

Wednesday issued fiscal 2010 earnings guidance well below analyst

estimates, sending shares down $1.60, or 8%, to $18.43 in recent

trading.

Going forward, Jack in the Box, which competes with McDonald's

Corp. (MCD) and Burger King Holdings Inc. (BKC), plans to rely less

on $1 hamburgers, and more on value-priced combo meals and new

premium products to help improve sales. The burger chain has

restructured its marketing calendar so that it can hammer home

simultaneous messages on new premium products and bundled meals,

including offerings at breakfast.

Jack in the Box also hopes to see some of its top competitors

let up on aggressive discounts that are putting pressure on

profits. The company cited Burger King's latest $1 double

cheeseburger offer as cutting into its turf, but questioned whether

that and other aggressive plays by competitors would last.

"They probably have some incentive to become more rational now,"

Jack in the Box Chairman and Chief Executive Linda Lang said

Thursday on an earnings call.

Jack in the Box, with about 2,200 stores, appears willing to

give up some market share in order to protect its profit margin.

Having staked a position as premium fast-food operator, Jack in the

Box wants to be able to hold onto that perception.

The could leave more room for McDonald's, by far the largest

player in the category with close to 14,000 U.S. restaurants, to

pick up more share. McDonald's last week said it would expand its

store-remodeling program. It also plans to devote more of its

advertising spending to value messages and is considering a $1

breakfast value meal early next year.

While sales struggle, Jack in the Box is benefiting from a

program of cost cuts and lower food prices, which helped its fiscal

fourth-quarter earnings rise a bigger-than-expected 51%.

Helping the rise was a sale of company-owned stores to

franchisees. The company plans to have half of its stores owned by

franchisees in 2010, which would put it on its way toward a goal of

having at least 70% in the hands of franchisees by the end of

fiscal 2013.

-By Paul Ziobro, Dow Jones Newswires; 212-416-2194;

paul.ziobro@dowjones.com

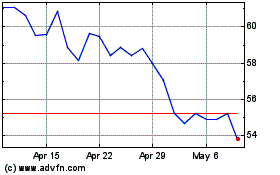

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Mar 2024 to Apr 2024

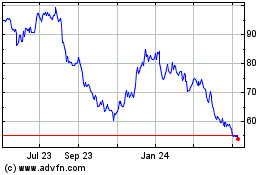

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Apr 2023 to Apr 2024