Current Report Filing (8-k)

June 19 2015 - 4:50PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 16, 2015

ISIS PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

000-19125

|

|

33-0336973

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

2855 Gazelle Court

Carlsbad, CA 92010

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (760) 931-9200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On June 16, 2015, Isis Pharmaceuticals, Inc. (“Isis”) and Morgan Stanley Private Bank, National Association (“Morgan Stanley”) entered into a Line of Credit Agreement (the “Credit Agreement”).

Under the Credit Agreement, Morgan Stanley will provide a maximum of $20,000,000 of revolving credit to Isis for general working capital non-purpose uses. The amounts advanced to Isis under the Credit Agreement bear interest at Isis’ option, at (i) a floating rate equal to the one-month LIBOR in effect from time to time plus 1.25% per annum, (ii) a fixed rate equal to LIBOR plus 1.25% for a period of one, two, three, four, six, or twelve months as elected by Isis, or (iii) a fixed rate equal to the LIBOR swap rate during the period of the loan.

The Credit Agreement includes customary affirmative and negative covenants including, among others, financial covenants related to Isis’ liquidity and assets to debt ratio and covenants limiting Isis’ ability to merge with an entity that does not assume Isis’ obligations under the Credit Agreement, dispose of assets for less than fair market value, or change its business to a business other than research, development, or commercialization of therapeutics or diagnostics. The Credit Agreement provides that each of the following events is an event of default, which may result in acceleration of the amounts payable under the Credit Agreement:

|

· |

Isis fails to timely pay amounts due and payable under the Credit Agreement; |

|

· |

Any representation or warranty made by Isis proves to have been incorrect or misleading in any material respect; |

|

· |

Isis fails to perform or observe certain terms, covenants or agreements under the Credit Agreement and does not cure such failure where curable; |

|

· |

Isis fails to pay amounts due on any debts where such debt has a principal amount in excess of $25 million, and Isis has not promptly cured such failure following written notice by Morgan Stanley to Isis; |

|

· |

Isis dissolves, liquidates, terminates operations, stops generally paying its debts, becomes insolvent or enters bankruptcy proceedings; |

|

· |

A final judgement or order for the payment in excess of $25 million (excluding amounts covered by insurance) is rendered against Isis that has not been discharged or stayed; |

|

· |

Any lien granted pursuant to the Credit Agreement or related agreement ceases to be a valid first priority lien or any such agreement covering such lien becomes invalid or subject to actions by Isis to discontinue such agreement, and Isis fails to remedy such situation within 10 days of notice from Morgan Stanley; or |

|

· |

Isis or certain affiliates becomes subject to specified sanctions or be named as engaging in criminal activities or other wrongdoing. |

Any amounts outstanding under the Credit Agreement will be secured by Isis’ investments held in an account at Morgan Stanley.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

Reference is made to the disclosures set forth in Item 1.01 above, and are incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Isis Pharmaceuticals, Inc.

|

| |

|

|

Dated: June 19, 2015

|

By:

|

/s/ B. Lynne Parshall

|

| |

|

B. Lynne Parshall

|

| |

|

Chief Operating Officer

|

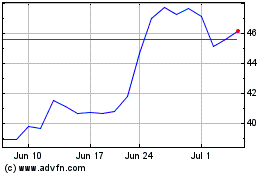

Ionis Pharmaceuticals (NASDAQ:IONS)

Historical Stock Chart

From Mar 2024 to Apr 2024

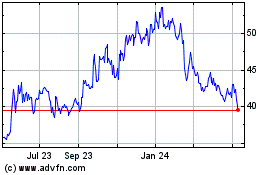

Ionis Pharmaceuticals (NASDAQ:IONS)

Historical Stock Chart

From Apr 2023 to Apr 2024