Dollar Tree Swings to a Loss -- Update

September 01 2015 - 2:43PM

Dow Jones News

By Lisa Beilfuss

Dollar Tree Inc. swung to a loss in its latest quarter as the

discount retailer integrates its recently acquired rival.

The Virginia-based chain, which in July completed its $9 billion

acquisition of Family Dollar Inc., now operates nearly 14,000

stores across the U.S. and Canada.

Adjusted profit rose and sales benefited from the addition of

new stores, but the 48% revenue increase fell short of analysts'

expectations. Shares in the company fell 8% in afternoon trading,

erasing much of their year-to-date gain.

Dollar stores like Dollar Tree have poached market share from

bigger rivals such as Wal-Mart Stores Inc. by offering

less-expensive, everyday products and by scattering more

small-footprint stores in locations that make it easy for shoppers

to run errands quickly.

And in the second quarter, Dollar Tree again outperformed

Wal-Mart: Sales at stores open at least a year rose 2.7% compared

with a 1.5% increase at Wal-Mart. However, the sales, which exclude

the newly acquired Family Dollar stores, fell short of the 3.3%

increase analysts anticipated and were a bit shy of the 2.8% gain

competitor Dollar General Corp. reported last week. Adjusted for

swings in the Canadian dollar, same-store sales grew 2.4% in the

latest period. The gain came amid increased traffic and a higher

average ticket.

Chief Executive Bob Sasser said Dollar Tree has "quickly

initiated our integration plan" and the company is on track to

deliver $300 million in annual run-rate synergies by the end of the

third year after the acquisition.

The synergy piece, Chief Financial Officer Kevin Wampler said on

a call with analysts, "is going to be a bit of a marathon not a

sprint."

According to Cantor Fitzgerald analyst Laura Champine,

"management's synergy estimates appear very conservative," and

don't include operational improvements expected as Family Dollar

stores "benefit from Dollar Tree's strong management and superior

merchandising team."

Still, Ms. Champine is looking for a gross margin of 32.9% this

year, up from the 28.4% the company reported for the second quarter

but below the 34.2% a year ago. Some of the difference is

structural--Family Dollar margins were lower and the product mix is

different--and long-term gross margin for the combined company is

seen as below stand-alone Dollar Tree's gross margin, Ms. Champine

said.

As a result of the acquisition and integration, Dollar Tree said

it would refrain from providing earnings guidance for the current

quarter and pulled its per-share profit guidance for the full year.

Previously, the company said it expected to earn an adjusted $3.32

to $3.47 this year.

As part of the regulatory clearance for the merger, Dollar Tree

is required to sell 330 Family Dollar stores. Mr. Wampler said

those stores represent about $45.5 million in annual operating

income. In addition to losing that income, the CFO said the company

also expects to incur $5 million to $10 million in related

expenses.

For the business year ending in January, the retailer expects to

report revenue of $15.3 billion to $15.52 billion, based on a low

single-digit increase in same-store sales and short of the $15.57

billion analysts predicted.

Overall, Dollar Tree reported a loss of $98 million, or 46 cents

a share, down from a profit of $121.5 million, or 59 cents, a year

earlier. Excluding merger-related costs, among other items,

per-share profit fell to 25 cents from 61 cents. In the Dollar Tree

segment--reflecting stand-alone, premerger results--earnings per

share rose to 67 cents from 61 cents.

Revenue rose 48% to $3.01 billion. Family Dollar contributed

$811.6 million.

The company had guided for adjusted earnings per share of 63

cents to 68 cents.

Analysts, according to Thomson Reuters, predicted revenue of

$3.04 billion.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 01, 2015 14:28 ET (18:28 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

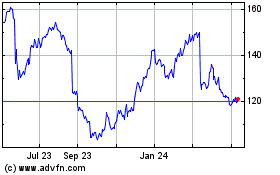

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

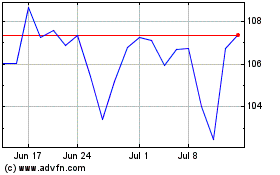

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024