UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 11, 2015

Career Education Corporation

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

0-23245 |

|

36-3932190 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 231 N. Martingale Rd., Schaumburg, IL |

|

60173 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (847) 781-3600

Not applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry into a Material Definitive Agreement. |

Item 2.03 is incorporated by reference into this

Item 1.01.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

Effective as of December 11, 2015, Career Education Corporation (the “Company”) and its wholly-owned subsidiary, CEC Educational

Services, LLC (“CEC-ES”), and the subsidiary guarantors thereunder entered into a Fourth Amendment (the “Fourth Amendment”) to their Amended and Restated Credit Agreement, dated as of December 13, 2013 (the

“Credit Agreement”), with BMO Harris Bank N.A. (“BMO Harris”), in its capacities as the sole lender, the letter of credit issuer and the administrative agent for the lenders from time to time parties thereto and the

letter of credit issuer thereunder.

The Fourth Amendment, among other things: (i) decreases the revolving credit facility to $95 million;

(ii) extends the maturity date of the revolving credit facility to December 31, 2018; (iii) modifies the definitions of “Base Rate” and “LIBOR”; (iv) requires that for any date occurring after

December 31, 2015, the Lenders thereunder shall be required to approve each credit extension (other than letter of credit extensions); and (v) requires the borrowers to maintain, as of the last day of each fiscal quarter, a balance of

cash, cash equivalents and permitted investments in domestic accounts of at least $110 million. The requirement that the borrowers maintain a minimum cash, cash equivalents and permitted investments balance is not necessarily indicative of the

Company’s expectations regarding its future cash and investments balance.

As of December 10, 2015, no revolving loans were drawn under the

Credit Agreement, as amended.

The Credit Agreement, as amended, continues to provide that (i) accrued interest is payable (x) in the case of a

LIBOR-based loan, at the end of each respective interest period (or, in the case of an interest period in excess of three months, on the dates that fall every three months after the beginning of such interest period) in arrears, and (y) in the

case of a base rate-based loan, on the last business day of each month in arrears; (ii) accrued commitment fees are payable quarterly in arrears, and the administrative agent fee is payable on the closing date and on each anniversary thereof,

in advance; (iii) principal is payable at maturity; (iv) the Company and CEC-ES may prepay amounts outstanding, or terminate or reduce the commitments, under the Credit Agreement upon three or five business days’ prior notice,

respectively, in each case without premium or penalty; and (v) the loans and letter of credit obligations thereunder are secured by 100% cash collateral. The Credit Agreement, as amended, and the ancillary documents executed in connection

therewith contain customary affirmative, negative and financial maintenance covenants, representations and warranties, events of default, and rights and remedies upon the occurrence of any event of default thereunder, including rights to accelerate

the loans, terminate the commitments and realize upon the collateral securing the obligations under the Credit Agreement.

There is no material

relationship between the Company or any of its subsidiaries or affiliates and BMO Harris, other than in respect of the Credit Agreement, as amended, and certain banking relationships, all of which have been entered into in the ordinary course of

business.

The foregoing descriptions of the Fourth Amendment and the Credit Agreement do not purport to be complete and are subject to, and qualified in

their entirety by, reference to the Credit Agreement previously filed as Exhibit 99.1 to our Form 8-K filed on January 2, 2014, which is incorporated herein by reference, and the Fourth Amendment, which is attached as Exhibit 99.1 to this Form

8-K and is incorporated herein by reference.

| Item 2.05. |

Costs Associated With Exit or Disposal Activities. |

On December 15, 2015, the Board of Directors

(the “Board”) of the Company approved the teach-out of the Company’s 16 Culinary Arts campuses (“LCB”). The Board had previously approved a plan to sell LCB on December 18, 2014. The Company was engaged in

advanced negotiations with a potential buyer interested in acquiring LCB; however, these discussions, and discussions with alternative parties, did not ultimately lead to an agreement the Company believed was suitable to complete a transfer of

ownership that would protect student, faculty and stockholder interests. The decision to teach-out LCB is aligned with the Company’s strategic decision announced in May 2015 to divest or teach-out the remaining institutions of its former Career

Colleges segment and to focus its resources and attention on its universities – Colorado Technical University (CTU) and American InterContinental University (AIU). All LCB campuses are projected to remain open until September 2017 to offer

current students the reasonable opportunity to complete their program of study. LCB contributed $128.2 million and $172.6 million of revenue and ($43.5) million and ($66.6) million of operating losses for the nine months ended September 30,

2015 and for the year ended December 31, 2014, respectively. As a result of the decision to teach-out the Le Cordon Bleu campuses, the results of operations for these campuses will now be reported within continuing operations.

The Company expects to record approximately $52 million to $64 million of restructuring charges related to the teach-out of LCB. These estimated charges are

based on several assumptions, including the timing of campus teach-outs, amount of estimated sublease income related to our real estate lease obligations and estimated severance charges based upon timing of staff departures and are subject to

change. These costs primarily relate to severance and retention charges (approximately $12 million - $14 million); costs associated with exiting lease obligations, net of estimated sublease

income (approximately $35 million - $40 million); and non-cash long-term asset impairment charges (approximately $5 million - $10 million). The impairment charges and severance and related charges will primarily be recorded during the fourth quarter

of 2015 and the lease charges will be recorded at the time each facility is vacated, which is expected to be during 2017. These amounts will result in actual cash outlay through 2017 for severance related charges and, for lease obligations, from the

teach-out date through varying dates based on each respective lease end date, with the latest lease expiring during 2022.

The Company has previously

provided certain estimates regarding its future cash and investments balances, operating margins and adjusted EBITDA for the Transitional Group and discontinued operations. These estimates assumed a completed sale of LCB, among other things, and

therefore the decision to teach out LCB impacts the information previously provided and it should no longer be relied upon. The Company continues to expect to maintain cash, cash equivalents, restricted cash and investments balances of approximately

$190 million in 2015 excluding the timing impact of outstanding checks, deposits and other transfers. The Company continues to expect those balances to decrease in 2016 as compared to 2015, although the LCB teach-out decision has a favorable impact

to previous 2016 expectations primarily due to the previous expectation of a payment to the buyer upon the completion of a sale. The long-term cash impact of a teach-out decision versus a sale decision depends on our ability to minimize the impacts

of the future lease obligations discussed above. The Company intends to provide updated information, to the extent deemed appropriate, at the time of its announcement of the Company’s financial results for the year ended December 31, 2015.

The Company issued a press release on December 16, 2015 regarding its intention to teach out LCB, a copy of which is attached as Exhibit 99.2.

Cautionary Statement Regarding Forward-Looking Statements

Except for the historical and present factual information contained herein, the matters set forth in this Form 8-K, including statements identified by words

such as “expect,” “estimate,” “believe,” “will,” “anticipate,” “intend, ““continue” and similar expressions, are forward-looking statements as defined in Section 21E of the

Securities Exchange Act of 1934, as amended. These statements are based on information currently available to us and are subject to various assumptions, risks, uncertainties and other factors that could cause our results of operations, financial

condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. In particular, the estimates provided above for company-wide cash balances are based on the

following key assumptions and factors, among others: (i) flat-to-modest total enrollment growth within the University Group over time; (ii) teach-outs to occur as planned and performance consistent with historical experience;

(iii) achievement of rates of recovery for our real estate lease obligations which are consistent with historical experience; (iv) right-sizing of our Corporate expense structure to serve primarily online institutions; (vi) no

material changes in the legal or regulatory environment; and (v) consistent working capital movements in line with historical operating trends. Although these estimates and assumptions are based upon management’s good faith beliefs

regarding current events and actions that we may undertake in the future, actual results could differ materially from these estimates.

Except as

expressly required by the federal securities laws, we undertake no obligation to update or revise such factors or any of the forward-looking statements contained herein to reflect future events, developments or changed circumstances, or for any

other reason. Risks and uncertainties, the outcomes of which could have a material and adverse effect, include, but are not limited to, the following: negative trends in the real estate market which could impact the costs related to teaching out

campuses and the success of our initiatives to reduce our real estate obligations; declines in enrollment; our ability to achieve anticipated cost savings and business efficiencies; rulemaking by the U.S. Department of Education or any state and

increased focus by Congress, the President and governmental agencies on for-profit education institutions; our continued compliance with and eligibility to participate in Title IV Programs under the Higher Education Act of 1965, as amended, and the

regulations thereunder (including the gainful employment and financial responsibility standards prescribed by the U.S. Department of Education), as well as national and regional accreditation standards and state regulatory requirements; the impact

of management changes; our ability to successfully defend litigation and other claims brought against us; and changes in the overall U.S. or global economy. Further information about these and other relevant risks and uncertainties may be found in

the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and its subsequent filings with the Securities and Exchange Commission.

| Item 2.06. |

Material Impairments. |

Item 2.05 of this Form 8–K, including the anticipated recognition of

long-term asset impairment charges, is incorporated by reference in this Item 2.06.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description of Exhibits |

|

|

| 99.1 |

|

Fourth Amendment to Amended and Restated Credit Agreement dated as of December 11, 2015 |

|

|

| 99.2 |

|

Press release of the Company dated December 16, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

CAREER EDUCATION CORPORATION

|

|

|

| By: |

|

/s/ David Rawden |

|

|

David Rawden |

|

|

Interim Chief Financial Officer |

Date: December 16, 2015

Exhibit Index

|

|

|

| Exhibit

Number |

|

Description of Exhibits |

|

|

| 99.1 |

|

Fourth Amendment to Amended and Restated Credit Agreement dated as of December 11, 2015 |

|

|

| 99.2 |

|

Press release of the Company dated December 16, 2015 |

Exhibit 99.1

FOURTH AMENDMENT TO

AMENDED AND RESTATED CREDIT AGREEMENT

This Fourth Amendment to Amended and Restated Credit Agreement (herein, this “Amendment”) is entered into as of

December 11, 2015, by and among CAREER EDUCATION CORPORATION, a Delaware corporation (the “Company”), CEC EDUCATIONAL SERVICES, LLC, an Illinois limited

liability company (“CECE”; the Company and CECE shall be referred to herein as the “Borrowers” and individually as a “Borrower”), certain of the direct and indirect Domestic Subsidiaries of the

Company, as Subsidiary Guarantors (the Borrowers and the Subsidiary Guarantors collectively referred to herein as the “Loan Parties”), and BMO Harris Bank N.A., in its capacity as Administrative Agent, L/C Issuer and the

sole Lender (in such capacities, “BMO Harris”).

PRELIMINARY STATEMENTS

A. The Borrowers, the Subsidiary Guarantors and BMO Harris entered into a certain Amended and Restated Credit Agreement, dated as of

December 30, 2013, as amended (the “Credit Agreement”). All capitalized terms used herein without definition shall have the same meanings herein as such terms have in the Credit Agreement.

B. The Borrowers have requested that BMO Harris make certain amendments to the Credit Agreement, and BMO Harris is willing to do so under the

terms and conditions set forth in this Amendment.

NOW, THEREFORE, for good and valuable consideration, the

receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

Subject to the satisfaction of the conditions precedent set forth

in Section 2 below, the Credit Agreement shall be and hereby is amended, effective as of the date hereof, as follows:

1.1. The

following defined terms appearing in Section 1.01 of the Credit Agreement shall be amended and restated to read in their entirety as follows:

“Aggregate Commitments” means the Commitments of all the Lenders, which as of December 11, 2015, equals

$95,000,000 in the aggregate.

“Base Rate” means, for any day, the rate per annum equal to the greatest

of: (a) the rate of interest announced or otherwise established by the Administrative Agent from time to time as its prime commercial rate as in effect on such day, with any change in the Base Rate resulting from a change in said prime

commercial rate to be effective as of the date of the relevant change in said

prime commercial rate (it being acknowledged and agreed that such rate may not be the Administrative Agent’s best or lowest rate), (b) the sum of (i) the rate determined by the

Administrative Agent to be the average (rounded upward, if necessary, to the next higher 1/100 of 1%) of the rates per annum quoted to the Administrative Agent at approximately 10:00 a.m. (Chicago time) (or as soon thereafter as is

practicable) on such day (or, if such day is not a Business Day, on the immediately preceding Business Day) by two or more Federal funds brokers selected by the Administrative Agent for sale to the Administrative Agent at face value of Federal funds

in the secondary market in an amount equal or comparable to the principal amount for which such rate is being determined, plus (ii) 1/2 of 1%, and (c) the LIBOR Quoted Rate for such day plus 1.50%. As used herein, the term

“LIBOR Quoted Rate” means, for any day, the rate per annum equal to the quotient of (i) the rate per annum (rounded upwards, if necessary, to the next higher one hundred-thousandth of a

percentage point) for deposits in U.S. Dollars for a one-month interest period as reported on the applicable Bloomberg screen page (or such other commercially available source providing such quotations as may

be designated by the Administrative Agent from time to time) as of 11:00 a.m. (London, England time) on such day (or, if such day is not a Business Day, on the immediately preceding Business Day) divided by (ii) one (1) minus the

Eurodollar Reserve Percentage, provided that in no event shall the “LIBOR Quoted Rate” be less than 0.00%.

“Domestic Cash” means, at any time the same is determined, the sum of (i) unrestricted cash and Cash

Equivalents of the Loan Parties and their Domestic Subsidiaries maintained at financial institutions located in the United States at such time, plus (ii) unrestricted Investments of the Loan Parties and their Domestic Subsidiaries permitted by

Section 7.02(a)(ii) and Section 7.02(a)(iii) constituting marketable securities maintained at financial institutions located in the United States at such time, plus (iii) cash maintained in the Collateral Account to secure the

outstanding L/C Obligations at such time.

“Letter of Credit Sublimit” means an amount equal to

$60,000,000. The Letter of Credit Sublimit is part of, and not in addition to, the Aggregate Commitments.

“LIBOR” means, for an Interest Period for a Borrowing of Eurodollar Loans, (a) the LIBOR Index Rate for

such Interest Period, if such rate is available, and (b) if the LIBOR Index Rate cannot be determined, the arithmetic average of the rates of interest per annum (rounded upwards, if necessary, to the nearest 1/100 of 1%) at which deposits in

U.S. Dollars in immediately available funds are offered to the Administrative Agent at 11:00 a.m. (London, England time) two (2) Business Days before the beginning of such Interest Period by three (3) or more major banks in the

interbank eurodollar market selected by the Administrative Agent for delivery on the first day of and for a period equal to such Interest Period and in an amount equal or comparable to the principal amount of the Eurodollar Loan scheduled to be made

as part of such Borrowing, provided that in no event shall “LIBOR” be less than 0.00%.

-2-

“Maturity Date” means the later of (a) December 31, 2018

and (b) if maturity is extended pursuant to Section 2.14, such extended maturity date as determined pursuant to such Section; provided, however, that, in each case, if such date is not a Business Day, the Maturity Date

shall be the next preceding Business Day.

1.2. Section 2.03(a)(ii)(A) of the Credit Agreement shall be amended and restated to read

in its entirety as follows:

(A) subject to Section 2.03(b)(iii), the expiry date of the requested Letter of Credit

would occur more than twenty-four months after the date of issuance or last extension, unless the Required Lenders have approved such expiry date; or

1.3. Section 4.02(d) of the Credit Agreement shall be amended and restated to read in its entirety as follows:

(d) (i) The Total Outstandings after giving effect to the Credit Extension shall not exceed the Minimum Collateral Amount,

and (ii) for any date ending after December 31, 2015, the Administrative Agent shall have received written consent from the Lenders approving the Credit Extension unless such Credit Extension constitutes an L/C Credit Extension.

1.4. Section 5.13 of the Credit Agreement shall be amended and restated to read in its entirety as follows:

5.13 Subsidiaries; Equity Interests. As of December 11, 2015, the Company does not have any Subsidiaries other than

those specifically disclosed in Part (a) of Schedule 5.13 and, as of December 11, 2015, neither Borrower has any equity investments in any other corporation or entity other than those specifically disclosed in Part (b) of

Schedule 5.13.

1.5. Section 6.01(c) of the Credit Agreement shall be amended and restated to read in its entirety as

follows:

(c) Intentionally Omitted.

1.6. Section 6.02(a) and Section 6.02(b) of the Credit Agreement shall be amended and restated to read in their entirety as follows:

(a) as soon as available, and in any event no later than 30 days after the end of each fiscal year of the Company, a

copy of the consolidated and consolidating operating budget for the Company and its Subsidiaries for the then

-3-

current fiscal year, such operating budget to show the projected consolidated and consolidating revenues, expenses and balance sheet of the Company and its Subsidiaries on a quarter-by-quarter basis, such operating budget to be in reasonable detail prepared by the Company and in form satisfactory to the Administrative Agent;

(b) as soon as available, and in any event no later than 45 days after the end of each fiscal quarter of each fiscal year

of the Company, a duly completed Compliance Certificate signed by a Responsible Officer of the Company;

1.7. Section 7.05(f) of the

Credit Agreement shall be amended and restated to read in its entirety as follows:

(f) (i) Dispositions of Subsidiaries of

the Company, or of assets or lines of businesses comprising campus locations, including those as of December 9, 2015 as set forth in Schedule 7.05 hereto, provided, that those that are not set forth in Schedule 7.05 shall be permitted so

long as no Default has occurred and is continuing or would result therefrom, and (ii) the Disposition of all of the equity interests in Le Cordon Bleu North America, LLC and its related entities, CEC Food and Beverage LLC, Kitchen Academy,

Inc., TCA Group, Inc., TCA Beverages, Inc., Scottsdale Culinary Institute, Ltd., Le Cordon Bleu College of Culinary Arts, Inc., LCB Culinary Schools, LLC, California Culinary Academy, Inc. and The Cooking and Hospitality Institute of Chicago, Inc.,

(collectively the “Le Cordon Bleu Business”) or all of the assets of the Le Cordon Bleu Business so long as (i) no Default has occurred and is continuing or would result from such Disposition and (ii) after giving effect

to such Disposition, the Domestic Cash shall not be less than $110,000,000;

1.8. Section 7.11 of the Credit Agreement shall be

amended and restated to read in its entirety as follows:

7.11 Minimum Domestic Cash. Permit, as of the last day of

each fiscal quarter, commencing with the fiscal quarter ending December 31, 2015, the Domestic Cash to be less than $110,000,000.

1.9. Schedule 2.01 of the Credit Agreement shall be amended and replaced by Schedule 2.01 attached hereto.

1.10. Schedule 5.13 of the Credit Agreement shall be amended and replaced by Schedule 5.13 attached hereto.

1.11. Schedule 7.05 of the Credit Agreement shall be amended and replaced by Schedule 7.05 attached hereto.

-4-

1.12. Exhibit C to the Credit Agreement shall be amended and replaced by Exhibit C attached

hereto.

| SECTION 2. |

CONDITIONS PRECEDENT. |

This Amendment shall become effective upon

satisfaction of the following conditions:

(a) Receipt by BMO Harris of this Amendment fully executed by the Loan Parties.

(b) Receipt by BMO Harris of each Loan Party’s Board of Directors (or similar governing body) authorizing the execution, delivery and

performance of this Amendment, together with specimen signatures of the persons authorized to execute such documents on each Borrower’s behalf, all certified in each instance by its Secretary or Assistant Secretary (or comparable Responsible

Officer).

(b) Receipt by BMO Harris of certificates of good standing for each Loan Party (dated no earlier than 30 days prior to the

date hereof) from the office of the secretary of the state of its incorporation or organization, and with respect to the Company, the State of Illinois.

(d) Receipt by BMO Harris of the favorable written opinion of counsel to each Borrower (which may be from such Borrower’s internal legal

counsel), in form and substance reasonably satisfactory to BMO Harris.

(e) Receipt by BMO Harris of a non-refundable upfront fee equal to

0.50% of the Aggregate Commitments as of the date hereof after giving effect to this Amendment.

| SECTION 3. |

REPRESENTATIONS. |

3.1. In order to induce BMO Harris to execute and deliver this

Amendment, the Loan Parties hereby represents to BMO Harris that as of the date hereof (a) the representations and warranties set forth in Article V of the Credit Agreement are and shall be and remain true and correct in all material respects

(without duplication of materiality qualifiers) (except that the representations contained in Section 5.05 shall be deemed to refer to the most recent Audited Financial Statements and unaudited consolidated financial statements of the Company

and its Subsidiaries delivered to BMO Harris) and (b) no Default has occurred and is continuing under the Credit Agreement or shall result after giving effect to this Amendment.

3.2. Each Loan Party hereby represents and warrants that there has been no amendment, modification, supplement or restatement to such Loan

Party’s Organizational Documents since December 30, 2013 (or October 31, 2014 with respect to Sanford-Brown Group, Inc.), and such Loan Party’s Organizational Documents are in full force

and effect as of the date hereof.

-5-

| SECTION 4. |

MISCELLANEOUS. |

4.1. CECE heretofore executed and delivered to BMO Harris that

certain Security Agreement, as amended. The Borrowers hereby acknowledge and agree that the Liens created and provided for by the Security Agreement continue to secure the Secured Obligations (as defined in the Security Agreement); and the Security

Agreement and the rights and remedies of BMO Harris thereunder, the obligations of CECE thereunder, and the Liens created and provided for thereunder remain in full force and effect and shall not be affected, impaired or discharged hereby. Nothing

herein contained shall in any manner affect or impair the priority of the Liens and security interests created and provided for by the Security Agreement as to the indebtedness which would be secured thereby prior to giving effect to this Amendment.

4.2. Except as specifically amended herein, the Credit Agreement shall continue in full force and effect in accordance with its original

terms. Reference to this specific Amendment need not be made in the Credit Agreement, the Note, or any other instrument or document executed in connection therewith, or in any certificate, letter or communication issued or made pursuant to or with

respect to the Credit Agreement, any reference in any of such items to the Credit Agreement being sufficient to refer to the Credit Agreement as amended hereby.

4.3. The Borrowers agrees to pay on demand all costs and expenses of or incurred by the Bank in connection with the negotiation, preparation,

execution and delivery of this Amendment, including the fees and expenses of counsel for BMO Harris, in each case as required under Section 11.04 of the Credit Agreement.

4.4. This Amendment may be executed in any number of counterparts, and by the different parties on different counterpart signature pages, all

of which taken together shall constitute one and the same agreement. Any of the parties hereto may execute this Amendment by signing any such counterpart and each of such counterparts shall for all purposes be deemed to be an original. Delivery of a

counterpart hereof by facsimile transmission or by e-mail transmission of an Adobe portable document format file (also known as a “PDF” file) shall be effective as delivery of a manually executed

counterpart hereof. This Amendment shall be governed by, and construed in accordance with, the internal laws of the State of Illinois.

[SIGNATURE PAGES TO FOLLOW]

-6-

This Fourth Amendment to Amended and Restated Credit Agreement is entered into as of the date and

year first above written.

|

|

|

| “BORROWERS” |

|

| CAREER EDUCATION CORPORATION |

|

|

| By: |

|

/s/ Kenneth R. Zilch |

| Name: |

|

Kenneth R. Zilch |

| Title: |

|

Senior Vice President, Corporate Tax, Risk and Real Estate and Treasurer |

|

| CEC EDUCATIONAL SERVICES, LLC |

|

|

| By: |

|

/s/ Kenneth R. Zilch |

| Name: |

|

Kenneth R. Zilch |

| Title: |

|

Treasurer |

[Signature Page to

Fourth Amendment to Amended and Restated Credit Agreement]

|

|

|

| “GUARANTORS” |

|

| AMERICAN INTERCONTINENTAL UNIVERSITY, INC. |

| BRIARCLIFFE COLLEGE, INC. |

| COLORADO TECHNICAL UNIVERSITY, INC. |

| INTERNATIONAL ACADEMY OF MERCHANDISING & DESIGN, INC. |

| SANFORD-BROWN GROUP, INC. (f/k/a International Academy of Merchandising & Design, Ltd.) |

| SANFORD-BROWN, LIMITED |

| SCOTTSDALE CULINARY INSTITUTE, LTD. |

| AIU ONLINE, LLC |

| LE CORDON BLEU NORTH AMERICA, LLC |

| MARLIN ACQUISITION CORP. |

|

|

| By: |

|

/s/ Kenneth R. Zilch |

| Name: |

|

Kenneth R. Zilch |

| Title: |

|

Treasurer |

[Signature Page to

Fourth Amendment to Amended and Restated Credit Agreement]

|

|

|

|

|

| Accepted and agreed to. |

|

| BMO HARRIS BANK N.A., in its capacity as Administrative Agent, L/C Issuer and sole Lender |

|

|

| By |

|

/s/ L. M. Junior Del Brocco |

|

|

Name |

|

L. M. Junior Del Brocco |

|

|

Title |

|

Director |

[Signature Page to

Fourth Amendment to Amended and Restated Credit Agreement]

SCHEDULE 2.01

COMMITMENTS

AND

APPLICABLE PERCENTAGES

|

|

|

|

|

|

|

|

|

| Lender |

|

Commitment |

|

|

Applicable

Percentage |

|

|

|

|

| BMO Harris Bank N.A. |

|

$ |

95,000,000 |

|

|

|

100.00 |

% |

|

|

|

| Total |

|

$ |

95,000,000 |

|

|

|

100.00 |

% |

SCHEDULE 5.13

SUBSIDIARIES; OTHER EQUITY INVESTMENTS;

EQUITY INTERESTS IN THE BORROWER

“The Katharine Gibbs Corporation - Melville”

AIU Online, LLC

American InterContinental University, Inc.

American InterContinental University-London, Ltd. U.S.

Briarcliffe College, Inc.

BIPL, LLC

California Culinary Academy, Inc.

California Culinary Academy,

LLC

Career Education Student Finance LLC

CEC Educational

Services, LLC

CEC Employee Group, LLC

CEC Europe, LLC

CEC Food and Beverage LLC

CEC Insurance Agency, LLC

CEC Leasing, LLC

CEC Real Estate Holding, Inc.

Colorado Tech, Inc.

Colorado Technical University, Inc.

Education and Training, Incorporated

Harrington Institute of

Interior Design, Inc.

International Academy of Design & Technology Nashville, LLC

International Academy of Design & Technology-Detroit, Inc.

International Academy of Merchandising & Design, Inc.

Kitchen Academy, Inc.

LCB Culinary Schools, LLC

Le Cordon Bleu College Of Culinary Arts, Inc., A Private Two-Year College

Le Cordon Bleu North America, LLC

Market Direct, Inc.

Marlin Acquisition Corp.

Moco Holding, Inc.

Sanford-Brown College, Inc., A Private Two-Year College

Sanford-Brown College, LLC

Sanford-Brown Group, Inc.

Sanford-Brown MN, Inc.

Sanford-Brown, Limited

SBC Health Midwest, Inc.

School of Computer Technology, Inc.

Scottsdale Culinary Institute, Ltd.

TCA Beverages, Inc.

TCA Group, Inc.

The Cooking and Hospitality Institute of Chicago, Inc.

The

Katharine Gibbs School of Norwalk, Inc.

The Katharine Gibbs School of Providence, Inc.

Words of Wisdom, LLC

| Part (b). |

Other Equity Investments. |

| 1. |

CCKF, Limited (Ireland) - 15% Equity Ownership |

| 2. |

SIMTICS Limited (New Zealand) - < 10% Equity Ownership |

SCHEDULE 7.05

DISCONTINUED OPERATIONS

(As of December 9, 2015)

AIU South

Florida, Weston FL

Briarcliffe College, Bethpage, NY

Briarcliffe College, Patchogue, NY

Brooks Institute,

Santa Barbara, CA

Collins College, Phoenix, AZ

Colorado Technical University, North Kansas City, North Kansas City, MO

Colorado Technical University, Pueblo, Pueblo, CO

Colorado Technical University, Sioux Falls, Sioux Falls, SD

Harrington Institute of Design, Chicago, IL

Le Cordon

Bleu College (or Institute) of Culinary Arts (“LCB”) LCB Pittsburgh, Pittsburgh, PA

Le Cordon Bleu College of Culinary Arts LCB-St.

Louis, St. Peters, MO

Missouri College, Brentwood, MO

International Academy of Design & Technology (“IADT”):

IADT Nashville, Nashville, TN

IADT Detroit, Troy,

MI

IADT Sacramento, Sacramento, CA

IADT

Schaumburg, Schaumburg, IL

Sanford-Brown College (“SBC”):

SBC Atlanta, Atlanta, GA

SBC Austin, Austin, TX

SBC Boston, Boston, MA

SBC Brooklyn Center,

Brooklyn Center, MN

SBC Chicago, Chicago, IL

SBC Cleveland, Cleveland, OH

SBC Collinsville,

Collinsville IL

SBC Columbus, Columbus, OH

SBC Dallas, Dallas, TX

SBC Dearborn, Dearborn, MI

SBC Ft. Lauderdale, Fort Lauderdale, FL

SBC

Farmington, Farmington, CT

SBC Fenton, Fenton, MO

SBC Grand Rapids, Grand Rapids, MI

SBC Hazelwood,

Hazelwood, MO

SBC Hillside, Hillside, IL

SBC Houston, Houston, TX

SBC Houston North Loop, Houston, TX

SBC Indianapolis,

Indianapolis, IN

SBC Las Vegas, Henderson, NV

SBC Jacksonville, Jacksonville, FL

SBC Mendota Heights,

Mendota Heights, MN

SBC Milwaukee, Milwaukee, WI

SBC Online, Tampa, FL

SBC Orlando, Orlando, FL

SBC Phoenix, Phoenix, AZ

SBC Portland, Portland,

OR

SBC San Antonio, San Antonio, TX

SBC

Seattle, Tukwila, WA

SBC Skokie, Skokie, IL

SBC St. Peters, St. Peters, MO

SBC Tampa, Tampa,

FL

SBC Tinley Park, Tinley Park, IL

SBC Tysons

Corner, McLean, VA

Sanford-Brown Institute (“SBI”):

SBI Cranston, Cranston, RI

SBI Garden City, Garden

City, NY

SBI Iselin, Iselin, NY

SBI Landover,

Landover, MD

SBI Melville, Melville, NY

SBI

New York City, New York, NY

SBI Orlando, Orlando, FL

SBI Pittsburgh, Pittsburgh, PA

SBI Trevose, Trevose,

PA

SBI White Plains, White Plains, NY

SBI

Wilkins Township, Pittsburgh, PA

SBI Campus-an affiliate of Sanford-Brown, Melville, NY

EXHIBIT C

CAREER EDUCATION CORPORATION

CEC EDUCATIONAL SERVICES, LLC

COMPLIANCE CERTIFICATE

|

|

|

|

|

| To: |

|

BMO Harris Bank N.A., as Administrative Agent under, and the Lenders party to, the Credit Agreement described below |

|

|

This Compliance Certificate is furnished to the Administrative Agent and the Lenders pursuant to that certain

Amended and Restated Credit Agreement dated as of December 30, 2013, among Career Education Corporation, CEC Educational Services, LLC and you (as extended, renewed, modified, amended or restated from time to time, the “Credit

Agreement”). Unless otherwise defined herein, the terms used in this Compliance Certificate have the meanings ascribed thereto in the Credit Agreement.

THE UNDERSIGNED HEREBY CERTIFIES THAT:

1. The officer executing this Compliance Certificate is the duly elected

of Career Education Corporation;

2. The officer executing this Compliance Certificate has reviewed the terms of the Credit Agreement and has made, or has caused to be made

under his/her supervision, a detailed review of the transactions and conditions of the Company and its Subsidiaries during the accounting period covered by the attached financial statements;

3. The examinations described in paragraph 2 did not disclose, and such officer has no knowledge of, the existence of any condition or

the occurrence of any event which constitutes a Default during or at the end of the accounting period covered by the attached financial statements or as of the date of this Compliance Certificate, except as set forth below;

4. The financial statements required by Section 6.01 of the Credit Agreement and being furnished to you concurrently with this

Compliance Certificate were prepared in accordance with GAAP and, fairly present in all material respects the financial condition, results of operations, shareholders equity and cash flows of the Company and its Subsidiaries in accordance with GAAP,

subject, in each case, in respect of interim statements to normal year-end adjustments and the absence of footnotes; and

C-1

Compliance Certificate

5. The Schedule I hereto sets forth financial data and computations evidencing the

Borrower’s compliance with certain covenants of the Credit Agreement, all of which data and computations are, to the best of such officer’s knowledge, true, complete and correct and have been made in accordance with the relevant Sections

of the Credit Agreement.

Described below are the exceptions, if any, to paragraph 3 by listing, in detail, the nature of the

condition or event, the period during which it has existed and the action which the Borrowers have taken, is taking, or proposes to take with respect to each such condition or event:

The foregoing certifications, together with the computations set forth in Schedule I hereto and the

financial statements delivered with this Certificate in support hereof, are made and delivered this day of

20 .

|

|

|

|

|

| CAREER EDUCATION CORPORATION |

|

|

| By |

|

|

|

|

Name |

|

|

|

|

Title |

|

|

C-2

Compliance Certificate

SCHEDULE I

TO COMPLIANCE CERTIFICATE

CAREER EDUCATION CORPORATION

CEC EDUCATIONAL SERVICES, LLC

COMPLIANCE CALCULATIONS

FOR AMENDED AND RESTATED

CREDIT AGREEMENT DATED AS OF DECEMBER 30, 2013

CALCULATIONS AS OF

, (THE “CALCULATION DATE”)

|

|

|

|

|

|

|

|

|

| A. |

|

Minimum Domestic Cash (Section 7.11) |

|

|

|

|

|

|

|

|

|

|

1. |

|

Unrestricted cash and Cash Equivalents |

|

$ |

|

|

|

|

|

|

|

|

2. |

|

Unrestricted marketable securities |

|

$ |

|

|

|

|

|

|

|

|

3. |

|

Cash maintained in the Collateral Account to secure L/C Obligations |

|

$ |

|

|

|

|

|

|

|

|

4. |

|

Sum of lines A1, A2 and A3 |

|

$ |

|

|

|

|

|

|

|

|

5. |

|

Line A4 shall not be less than |

|

$ |

110,000,000 |

|

|

|

|

|

|

|

6. |

|

The Borrowers are in compliance (circle yes or no) |

|

|

yes/no |

|

C-3

Compliance Certificate

Exhibit 99.2

CAREER EDUCATION ANNOUNCES PLANNED DISCONTINUATION OF LE CORDON BLEU OPERATIONS

Company Also Announces Extension of Credit Agreement with its Lender

Schaumburg, Ill. (December 16, 2015) – Career Education Corporation (NASDAQ: CECO) today announced that it will begin a gradual process of discontinuing

the operations of its Le Cordon Bleu North America colleges of culinary arts. Le Cordon Bleu will no longer enroll new students after the January 2016 student cohort begins classes. The Company also announced that it has extended its credit

agreement with its lender.

TEACH-OUT OF LE CORDON BLEU

Career Education had previously been engaged in advanced negotiations with a potential buyer interested in acquiring all of the Company’s Le Cordon Bleu

campuses. These discussions, and discussions with alternative parties, did not ultimately lead to an agreement the Company felt was suitable to complete a transfer of ownership that would protect student, faculty and stockholder interests. The

decision to teach out the Le Cordon Bleu campuses is aligned with the Company’s strategic decision to divest or teach-out the remaining institutions of its former Career Colleges segment, which was previously announced in May 2015. As part of a

“teach-out,” students making reasonable academic progress will have the opportunity to complete their program. All Le Cordon Bleu campuses are projected to remain open until September 2017.

“New federal regulations make it difficult to project the future for career schools that have higher operating costs, such as culinary schools that

require expensive commercial kitchens and ongoing food costs,” said Todd Nelson, president and CEO of Career Education. “Despite our best efforts to find a new caretaker for these well-renowned culinary colleges, we could not reach an

agreement that we believe was in the best interests of both our students and our stockholders. As discussions progressed, we continued to evaluate the decision taking into consideration factors including the economics between a sale and teach-out,

impacts to students and stockholders and execution risk. By moving forward with a teach-out process we are better able to protect student interests and also retain all of the rights that we currently have to the Le Cordon Bleu brand. We will

continue with our plan to refocus Career Education’s resources on predominantly online university education as we endeavor to provide students attending schools in ‘teach-out’ with appropriate resources to complete their program of

study.”

Le Cordon Bleu North America offers hands-on educational programs in culinary arts, as well as patisserie and baking, to students at 16

campuses located in cities across the United States. It contributed $128.2 million and $172.6 million of revenue and ($43.5) million and ($66.6) million of operating losses for the nine months ended September 30, 2015 and for the year ended

December 31, 2014, respectively. As a result of the decision to teach-out the Le Cordon Bleu campuses, the results of operations for these campuses will now be reported within continuing operations.

The Company expects to record approximately $52 million to $64 million of restructuring charges related to the teach-out of the Le Cordon Bleu campuses. These

estimated charges are based on several assumptions, including the timing of campus teach-outs, amount of estimated sublease income related to our real estate lease obligations and estimated severance charges based upon timing of staff departures and

are subject to change. These costs primarily relate to severance and retention charges (approximately $12 million - $14 million); costs associated with exiting lease obligations, net of estimated sublease income (approximately $35 million - $40

million); and non-cash long-term asset impairment charges (approximately $5 million - $10 million). The impairment charges and severance and related charges will primarily be recorded during the fourth quarter of 2015 and the lease charges will be

recorded at the time each facility is vacated, which is expected to be during 2017. These amounts will result in actual cash outlay through 2017 for severance related charges and, for lease obligations, from the teach-out date through varying dates

based on each respective lease end date, with the latest lease expiring during 2022.

The Company has previously provided certain estimates regarding its future cash and investments balances,

operating margins and adjusted EBITDA for its Transitional Group reporting segment and discontinued operations. These estimates assumed a completed sale of the Le Cordon Bleu campuses, among other things, and therefore the decision to teach out Le

Cordon Bleu impacts the information previously provided and it should no longer be relied upon. The Company continues to expect to maintain cash, cash equivalents, restricted cash and investments balances of approximately $190 million in 2015

excluding the timing impact of outstanding checks, deposits and other transfers. The Company continues to expect those balances to decrease in 2016 as compared to 2015, although the Le Cordon Bleu teach-out decision has a favorable impact to

previous 2016 expectations primarily due to the previous expectation of a payment to the buyer upon the completion of a sale. The long-term cash impact of a teach-out decision versus a sale decision depends on our ability to minimize the impacts of

the future lease obligations discussed above. The Company intends to provide updated information, to the extent deemed appropriate, at the time of its announcement of the Company’s financial results for the year ended December 31, 2015.

AMENDED CREDIT AGREEMENT

The Company also announced

today that it has executed an amendment to its agreement with its lender, BMO Harris Bank, which extends the terms of the Credit Agreement to December 31, 2018 and revises certain covenants. The amended agreement provides for a $95 million

revolving credit facility which reflects the reduced size of ongoing operations and the long-term operating cost structure of Career Education’s business. The cash collateral requirements of the Credit Agreement remain unchanged.

Nelson concluded, “We are pleased that our lender has recognized the success that our restructuring and transformational actions have had on our business

and thus has agreed to extend the agreement as well as modify the covenants associated with our lending agreement to reflect our ongoing business.”

ABOUT CAREER EDUCATION CORPORATION

Career

Education’s academic institutions offer a quality education to a diverse student population in a variety of disciplines through online, on-ground and hybrid learning programs. Our two universities – American InterContinental University

(“AIU”) and Colorado Technical University (“CTU”) – provide degree programs through the master’s or doctoral level as well as associate and bachelor’s levels. Both universities predominantly serve students online

with career-focused degree programs that are designed to meet the educational demands of today’s busy adults. AIU and CTU continue to show innovation in higher education, advancing new personalized learning technologies like their

intellipath™ adaptive learning platform that allow students to more efficiently pursue earning a degree by receiving course credit for knowledge they can already demonstrate. Career Education is committed to providing quality education

that closes the gap between learners who seek to advance their careers and employers needing a qualified workforce.

A listing of individual campus

locations and web links to Career Education’s institutions can be found at www.careered.com.

Except for the historical and present factual

information contained herein, the matters set forth in this release, including statements identified by words such as “expect,” “estimate,” “believe,” “will,” “anticipate,” “intend,”

“continue” and similar expressions, are forward-looking statements as defined in Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on information currently available to us and are subject to

various assumptions, risks, uncertainties and other factors that could cause our results of operations, financial condition, cash flows, performance, business prospects and opportunities to differ materially from those expressed in, or implied by,

these statements. In particular, the estimates provided above for company-wide cash balances are based on the following key assumptions and factors, among others: (i) flat-to-modest total enrollment growth within the University Group over time;

(ii) teach-outs to occur as planned and performance consistent with historical experience; (iii) achievement of rates of recovery for our real estate lease obligations which are consistent with historical experience; (iv) right-sizing

of our Corporate expense structure to serve primarily online institutions; (vi) no material changes in the legal or regulatory environment; and (v) consistent working capital movements in line with historical operating trends. Although

these estimates and assumptions are based upon management’s good faith beliefs regarding current events and actions that we may undertake in the future, actual results could differ materially from these estimates.

Except as expressly required by the federal securities laws, we undertake no obligation to update or revise

such factors or any of the forward-looking statements contained herein to reflect future events, developments or changed circumstances, or for any other reason. Risks and uncertainties, the outcomes of which could have a material and adverse effect,

include, but are not limited to, the following: negative trends in the real estate market which could impact the costs related to teaching out campuses and the success of our initiatives to reduce our real estate obligations; declines in enrollment;

our ability to achieve anticipated cost savings and business efficiencies; rulemaking by the U.S. Department of Education or any state and increased focus by Congress, the President and governmental agencies on for-profit education institutions; our

continued compliance with and eligibility to participate in Title IV Programs under the Higher Education Act of 1965, as amended, and the regulations thereunder (including the gainful employment and financial responsibility standards prescribed by

the U.S. Department of Education), as well as national and regional accreditation standards and state regulatory requirements; the impact of management changes; our ability to successfully defend litigation and other claims brought against us; and

changes in the overall U.S. or global economy. Further information about these and other relevant risks and uncertainties may be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and its

subsequent filings with the Securities and Exchange Commission.

CONTACT

Investors:

Alpha IR Group

Chris Hodges or Sam Gibbons

(312) 445-2870

CECO@alpha-ir.com

Or

Media:

Career Education Corporation

Jeff Cooper

(847) 585-2600

media@careered.com

###

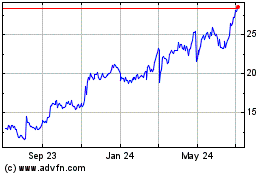

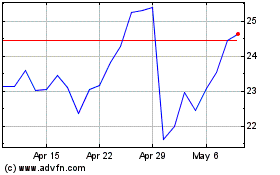

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Aug 2024 to Sep 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Sep 2023 to Sep 2024