Filed pursuant to Rule 424(b)(5)

Registration No. 333–182298

PROSPECTUS SUPPLEMENT

To Prospectus dated September 25, 2012

$172,139

MGT Capital Investments,

Inc.

Common Stock

We are offering for sale pursuant to this prospectus

shares of common stock having an aggregate offering price of $172,139. The purchase price for each share is $0.25.

Investing in our securities involves

a high degree of risk. See "Risk Factors" beginning on page S-5 of this prospectus supplement and on page 12

of the accompanying prospectus and the documents incorporated by reference herein for a discussion of information that should

be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement

and the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We are not paying underwriting discounts or

commissions, so the proceeds to us, before expenses, will be approximately $172,139. We estimate the total expenses of this offering

will be approximately $11,000.

We expect to deliver the securities sold in

this offering on or about December 22, 2015 against payment in immediately available funds.

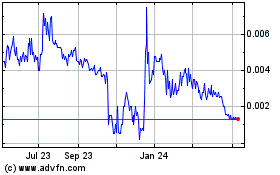

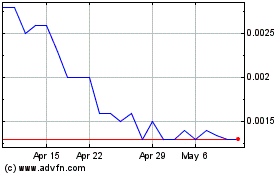

Our common stock is listed on the NYSE MKT

under the symbol “MGT.” The last reported sale price of our common stock on December 17, 2015, was $0.22 per share.

As of December 17, 2015, the aggregate market value of our common stock held by non–affiliates was approximately $3,181,000

based on an aggregate of 17,209,665 shares outstanding, of which 14,460,118 were held by non–affiliates, and the closing

price of the common stock on the NYSE MKT of $0.22 per share. During the twelve calendar months preceding the date of this prospectus,

we have sold $1,707,676 securities in reliance on General Instruction I.B.6 of Form S–3.

The date of this prospectus supplement is December

17, 2015.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus relate to a registration statement (No. 333––182298) that we filed with the Securities

and Exchange Commission (the "SEC") using a "shelf" registration process. Under this shelf registration process,

we may, from time to time, sell up to $10 million in the aggregate of any combination of common stock, preferred stock, debt securities,

warrants, rights or units, or any combination of the foregoing securities.

This prospectus supplement

and the accompanying prospectus provide specific information about the offering by us of our securities under the shelf registration

statement. This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into

this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, including the documents

incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus, we are referring

to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus

supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference

that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information

in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document

having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement

in the document having the later date modifies or supersedes the earlier statement.

You should rely only on

the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have

not, and the placement agent has not, authorized anyone to provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it. We are not, and the placement agent is not, making an offer to

sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing

in this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference in this prospectus supplement

and the accompanying prospectus, is accurate only as of the date of those respective documents. Our business, financial condition,

results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying

prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, in their

entirety before making an investment decision. You should also read and consider the information in the documents to which we have

referred you in the sections of this prospectus supplement entitled "Where You Can Find More Information" and "Incorporation

of Certain Documents by Reference."

In this prospectus supplement,

“MGT,” the “Company,” “we,” “us,” and “our” and similar terms refer

to MGT Capital Investments, Inc. and its subsidiaries on a consolidated basis. All references in this prospectus supplement to

our consolidated financial statements include, unless the context indicates otherwise, the related notes.

This prospectus supplement,

the accompanying prospectus and the information incorporated herein and therein by reference include trademarks, service marks

and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference

into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD––LOOKING

INFORMATION

In addition to historical

information, this prospectus supplement and the accompanying prospectus, including the information incorporated by reference into

this prospectus supplement and the accompanying prospectus, contains statements relating to future events or our future financial

position, business strategy, budgets, projected costs, plans and objectives of management for future operations. These statements

are forward––looking statements within the meaning of the United States Private Securities Litigation Reform Act of

1995. Generally, words such as “may,” “will,” “should,” “could,” “would,”

“anticipate,” “expect,” “intend,” “estimate,” “plan,” “project,”

“continue,” “goal” and “believe,” or other variations on these and other similar expressions

identify forward––looking statements. Forward––looking statements are only predictions and, as such, are

not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Forward––looking

statements are based upon our assumptions as to future events or our future financial performance that may not prove to be accurate.

These statements speak only as of the date they were made, and we undertake no obligation to publicly update or revise any forward––looking

statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions,

the forward––looking events and circumstances discussed in this report may not occur as contemplated, and actual results

could differ materially from those anticipated or implied by the forward––looking statements. The forward––looking

statements, as well as our prospects as a whole, are subject to risks and uncertainties, including the following:

| |

· |

Our history of losses; |

| |

· |

Our need for additional capital; |

| |

· |

The pace of technological change in our industry; |

| |

· |

Our ability to gain commercial acceptance of our products; |

| |

· |

Our ability to protect our intellectual property; |

| |

· |

The outcome of litigation related to our intellectual property; |

| |

· |

The effect of competition from other technologies; |

| |

· |

Our dependence on key business and sales relationships; and |

| |

· |

Our ability to attract and retain key executives and other highly skilled employees. |

For more information regarding

these risks and uncertainties as well as certain additional risks that we face, investors should review the risks described in

this prospectus supplement and the accompanying prospectus and those incorporated by reference into this prospectus supplement

and the accompanying prospectus, including those risks contained in our most recent Annual Report on Form 10–K and

our subsequent Quarterly Reports on Form 10––Q, as updated by our subsequent filings under the Exchange Act. We caution

you not to place undue reliance on these forward–looking statements, which are current only as of the date on which

we filed this prospectus supplement.

PROSPECTUS SUPPLEMENT SUMMARY

This summary contains

basic information about us, our common stock and this offering. It highlights selected information contained in or incorporated

by reference in this prospectus supplement and the accompanying prospectus. Because this is a summary, it does not contain all

of the information that you should consider before investing in the common stock. Before making an investment decision, you should

read carefully this entire prospectus supplement, including the section entitled “Risk Factors,” the accompanying prospectus,

our financial statements and the accompanying notes to the financial statements and the other documents incorporated by reference

into this prospectus supplement and the accompanying prospectus.

MGT Capital Investments, Inc.

General

MGT Capital Investments,

Inc. (“MGT,” “the Company,” “we,” “us”) is a Delaware corporation incorporated

in 2000. The Company was originally incorporated in Utah in 1977. MGT is comprised of the parent company, majority–owned

subsidiary MGT Gaming, Inc. (“MGT Gaming”) and wholly–owned subsidiaries Medicsight, Inc. (“Medicsight”),

MGT Studios, Inc. (“MGT Studios”) and its minority–owned subsidiary M2P Americas, Inc., and MGT Sports, Inc.

(“MGT Sports”). The Company also owns 10.0% of DraftDay Gaming Group, Inc. (“DDGG”).

MGT and its subsidiaries

are principally engaged in the business of acquiring, developing and monetizing assets in the online and mobile gaming space as

well as the social casino industry. MGT’s portfolio of assets in the online, mobile gaming and social casino gaming space

includes MGTPlay.com and Slot Champ. The Company also provides a white label service to third party marketers.

In addition, MGT Gaming

owns three U.S. patents covering certain features of casino slot machines. Both patents were asserted against alleged infringers

in various actions in federal court in Mississippi. On July 29, 2015, MGT, Aruze America, Aruze Macau, and Penn agreed, through

their respective counsel, to settle all pending disputes, including terminating the Mississippi litigation and all proceedings

at the PTO. The parties have subsequently jointly terminated the Mississippi litigation and the PTO proceedings.

On September 8,

2015, the Company and MGT Sports entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Viggle,

Inc. (“Viggle”) and Viggle’s subsidiary DDGG, pursuant to which Viggle acquired all of the assets of the DraftDay.com

business (the “DraftDay Business”) from the Company and MGT Sports. In exchange for the acquisition of the DraftDay

Business, Viggle paid MGT Sports the following: (a) 1,269,342 shares of Viggle’s common stock, par value $0.001 per share,

(b) a promissory note in the amount of $234,000 due September 29, 2015, (c) a promissory note in the amount of $1,875,000 due March 8,

2016, and (d) 2,550,000 shares of common stock of DDGG. In addition, in exchange for providing certain transitional services, DDGG

will issue to MGT Sports a warrant to purchase 1,500,000 shares of DDGG common stock at an exercise price of $0.40 per share. Following

consummation of the transactions in the Asset Purchase Agreement, including certain agreements between Viggle and third parties,

MGT Sports owns 2,550,000 shares of DDGG common stock, Viggle owns 11,250,000 shares of DDGG common, and Sportech, Inc. owns 9,000,000

shares of DDGG common stock.

On October 8, 2015, the

Company entered into separate subscription agreements with accredited investors relating to the issuance and sale of $700 of units

at a purchase price of $0.25 per unit, with each unit consisting of one share of the Company’s common stock, and a three

year warrant to purchase two shares of common stock at an initial exercise price of $0.25 per share. The Company has undertaken

to register the shares and shares underlying the warrants within 30 days following the closing and to use its best efforts to have

the registration statement declared effective 60 days from the filing date. The investors have a 50% right of participation in

future securities offerings of the Company for a period of one year from the closing. The Company agreed not to issue new equity

securities, subject to certain exceptions, without the approval of the lead investor for a period of five months from the closing

and not to issue any securities pursuant to an at––the––market offering until the earlier of (i) the six

month anniversary of the closing or (ii) such date as the closing price of the common stock is at least $0.75 for five consecutive

trading days and the registration statement has been declared effective.

Prior to receipt of shareholder

approval, the warrants in the aggregate shall not be exercisable into more than 19.99% of the number of shares of Common Stock

outstanding as of the closing date. The warrants are exercisable on the earlier of (i) one year from the date of issue

or (ii) the occurrence of certain corporate events, including a private or public financing, subject to approval of the lead investor

in the financing, in which the Company receives gross proceeds of at least $7,500,000; a spinoff; one or more acquisitions or sales

by the Company of certain assets approved by the stockholders of the Company; or a merger, consolidation, recapitalization, or

reorganization approved by the stockholders of the Company (each, a “Qualifying Transaction”). The warrants may be

exercised by means of a “cashless exercise” following the four month anniversary of the date of issue, provided that

the Company has consummated a Qualifying Transaction and there is no effective registration statement registering the resale of

the shares of common stock underlying the warrants. The Company is prohibited from effecting an exercise of any warrant to the

extent that, as a result of any such exercise, the holder would beneficially own more than 4.99% of the number of shares of common

stock outstanding immediately after giving effect to the issuance of shares of common stock upon exercise of such warrant, which

beneficial ownership limitation may be increased by the holder up to, but not exceeding, 9.99%. The warrants are also subject to

certain adjustments upon certain actions by the Company as outlined in the warrants.

Outside of the business

of acquiring, developing and monetizing assets in the online, mobile gaming and casino gaming space, MGT’s wholly owned subsidiary

Medicsight owns U.S. Food and Drug Administration approved medical imaging software and has designed an automated carbon dioxide

insufflation device which receives royalties on a per–unit basis from an international manufacturer on which the Company

receives royalties from an international distributor.

Strategy

MGT and its subsidiaries

are principally engaged in the business of acquiring, developing and monetizing assets in the online and mobile gaming space, as

well as the casino industry. The Company’s acquisition strategy is designed to obtain control of assets with a focus on risk

mitigation coupled with large potential upside. We plan to build our portfolio by seeking out large social and real money gaming

opportunities via extensive research and analysis. Next, we will attempt to secure controlling interests for modest cash and/or

stock outlays. MGT then budgets and funds operating costs to develop business operations and tries to motivate sellers with equity

upside. While the ultimate objective is to operate businesses for free cash flow, there may be opportunities where we sell or otherwise

monetize certain assets.

There can be no assurance

that any acquisitions will occur at all, or that any such acquisitions will be accretive to earnings, book value and other financial

metrics, or that any such acquisitions will generate positive returns for Company stockholders. Furthermore, it is contemplated

that any acquisitions may require the Company to raise capital; such capital may not be available on terms acceptable to the Company,

if at all.

Competition

MGT encounters intense

competition in all its businesses, in many cases from larger companies with greater financial resources such as Zynga, Inc. (NASDAQ:

ZNGA) and Caesars Interactive, Inc., a subsidiary of Caesars Acquisition Company (NASDAQ: CACQ) which focus on social and real

money online gaming.

Employees

Currently, the Company

and its subsidiaries have four full–time employees. None of our employees is represented by a union and we believe our

relationships with our employees are good.

Legal Proceedings

On April 21, 2015, Gioia

Systems, LLC (“Gioia”) filed a complaint against the Company, the Company’s majority owned subsidiary, MGT Interactive,

LLC, Robert Ladd and Robert Traversa with the United States District Court for the Southern District of New York. MGT Interactive,

LLC was also included as a derivative plaintiff in the action. Gioia Systems, LLC’s complaint asserts claims for breach

of contract and breach of fiduciary duty relating to the September 3, 2013 Contribution Agreement and related agreements between

Gioia, the Company and MGT Interactive, LLC. This litigation was settled on October 2, 2015.

On November 2, 2012, MGT

Gaming filed a lawsuit (No. 3:12–cv–741) in the United States District Court for the Southern District of Mississippi

alleging patent infringement against certain companies which either manufacture, sell or lease gaming systems alleged to be in

violation of MGT Gaming’s patent rights, or operate casinos that offer gaming systems that are alleged to be in violation

of MGT Gaming’s ’088 patent, including Penn National Gaming, Inc. (“Penn”), and Aruze Gaming America, Inc.

(“Aruze America”). An amended complaint added the ’554 patent, a continuation of the ’088 patent. The allegedly

infringing products include “Amazon Fishing” and “Paradise Fishing.”. By motion filed on May 12, 2014,

Aruze America sought a stay pending resolution of a Petition filed by a co–defendant for Inter Parties Review (“IPR”)

with the Patent Trial and Appeal Board (“PTAB”) of the United States Patent and Trademark Office (“PTO”),

challenging the’088 patent. As a result, the Mississippi action was stayed and remains stayed at present. Aruze America and

its sister company, Aruze Macau, subsequently filed additional IPR Petitions seeking review of the ’088 and ‘554 patents.

Aruze America also filed a Request for Ex Parte Re–examination of the ’088 patent. Aruze America’s Re–examination

Request has been denied. Both Aruze IPR Petitions remain pending. On July 29, 2015, MGT, Aruze America, Aruze Macau, and Penn agreed,

through their respective counsel, to settle all pending disputes, including the Mississippi litigation and all proceedings at the

PTO. The parties have subsequently jointly terminated the Mississippi litigation and the PTO proceedings.

Corporate Information

Our principal executive

offices are located at 500 Mamaroneck Avenue, Suite 320, Harrison, NY 10528. The telephone number at our principal executive offices

is (914) 630––7430. Our website address is www.mgtci.com. Information contained on our website is not deemed part of

this prospectus supplement or the accompanying prospectus.

Summary of the Offering

The following is a brief

summary of certain terms of this offering and is not intended to be complete.

| Securities offered by us |

|

688,556 shares of common stock having an aggregate offering price of $172,139. |

| |

|

|

| Offering price |

|

$0.25 per share. |

| |

|

|

| Common stock outstanding before this offering |

|

17,209,665 shares of common stock are outstanding as of December 17, 2015. |

| |

|

|

| Common stock to be outstanding after this offering |

|

17,895,221 |

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from the offering for general corporate purposes. See "Use of Proceeds" on

page S-18. |

| |

|

|

| Risk factors |

|

Investing in our securities involves significant risks. See "Risk Factors" on page S-5. |

| |

|

|

| NYSE MKT symbol |

|

MGT |

RISK FACTORS

Investing in our common

stock involves risk. You should carefully consider the risk factors disclosed below, and the other information contained in this

prospectus supplement and the accompanying prospectus, before acquiring any of our common stock. These risks could have a material

adverse effect on our business, results of operations or financial condition and cause the value of our common stock to decline.

You could lose all or part of your investment.

This prospectus supplement

and the accompanying prospectus also contain or incorporate by reference forward––looking statements that involve risks

and uncertainties. Our actual results could differ materially from those anticipated in the forward––looking statements

as a result of certain factors, including the risks faced by us described or incorporated by reference in this prospectus supplement

and accompanying prospectus. See “Cautionary Statement Regarding Forward––Looking Information.”

If any of these risks

actually occurs, our business could be materially harmed. These risks and uncertainties are not the only ones faced by us. Additional

risks and uncertainties, including those of which we are currently unaware or that are currently deemed immaterial, may also materially

and adversely affect our business, financial condition, cash flows, prospects and the price of our common stock.

Company Specific Risks

Our assets are highly

concentrated in the online mobile and gaming business; if we and our partners are unable to grow online mobile and gaming revenues

or find alternative sources of revenue, our financial results will suffer.

Software, devices and

gaming accounted for substantially all of our revenues for the year ended December 31, 2014 and the six months ended June 30, 2015.

Our success depends upon customers choosing to our online, mobile and casino gaming offerings. Decisions by customers not to adopt

our products at projected rates, or changes in market conditions, may adversely affect the use or distribution of our products.

Because of our revenue concentration, such shortfalls or changes could have a negative impact on our financial results, and our

financial condition and/or liquidity will suffer.

Our acquisition activities

may disrupt our ongoing business, may involve increased expenses and may present risks not contemplated at the time of the transactions.

We have acquired, and

may continue to acquire, companies, products and technologies that complement our strategic direction. Acquisitions involve significant

risks and uncertainties, including:

| |

· |

diversion of management time and a shift of focus from operating the businesses to issues related to integration and administration; |

| |

· |

inability to successfully integrate the acquired technology and operations into our business and maintain uniform standards, controls, policies and procedures; |

| |

· |

challenges retaining key employees, customers and other business partners of the acquired business; inability to realize synergies expected to result from an acquisition; |

| |

· |

an impairment of acquired goodwill and other intangible assets in future periods would result in a charge to earnings in the period in which the write–down occurs; the internal control environment of an acquired entity may not be consistent with our standards and may require significant time and resources to improve; |

| |

· |

in the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political and regulatory risks associated with specific countries; |

| |

· |

and liability for activities of the acquired companies before the acquisition, including violations of laws, rules and regulations, commercial disputes, tax liabilities and other known and unknown liabilities. |

Because acquisitions are

inherently risky, our transactions may not be successful and may, in some cases, harm our operating results or financial condition.

The mobile game application

business is still developing, and our efforts to develop mobile games may prove unsuccessful, or even if successful, it may take

more time than we anticipate to achieve significant revenues from this activity because, among other reasons:

| |

· |

we may have difficulty optimizing the monetization of our mobile games due to our relatively limited experience creating games that include micro–transaction capabilities, advertising and offers; |

| |

· |

we intend to continue to develop substantially all of our games based upon our own intellectual property, rather than well–known licensed brands, and we may encounter difficulties in generating sufficient consumer interest in and downloads of our games, particularly since we have had relatively limited success generating significant revenues from games based on our own intellectual property; |

| |

· |

many well–funded public and private companies have released, or plan to release, mobile games, and this competition will make it more difficult for us to differentiate our games and derive significant revenues from them; |

| |

· |

mobile games have a relatively limited history, and it is unclear how popular this style of game will become or remain or its revenue potential; |

| |

· |

our mobile strategy assumes that a large number of players will download our games because they are free and that we will subsequently be able to effectively monetize the games; however, players may not widely download our games for a variety of reasons, including poor consumer reviews or other negative publicity, ineffective or insufficient marketing efforts; |

| |

· |

even if our games are widely downloaded, we may fail to retain users or optimize the monetization of these games for a variety of reasons, including poor game design or quality, lack of community features, gameplay issues such as game unavailability, long load times or an unexpected termination of the game due to data server or other technical issues, or our failure to effectively respond and adapt to changing user preferences through game updates; |

| |

· |

the billing and provisioning capabilities of some smartphones and tablets are currently not optimized to enable users to purchase games or make in–app purchases, which make it difficult for users of these smartphones and tablets to purchase our games or make in–app purchases and could reduce our addressable market; and |

| |

· |

the Federal Trade Commission has indicated that it intends to review issues related to in–app purchases, particularly with respect to games that are marketed primarily to minors, and the commission might issue rules significantly restricting or even prohibiting in–app purchases or name us as a defendant in a future class–action lawsuit. |

If we do not achieve a

sufficient return on our investment with respect to this business model, it will negatively affect our operating results and may

require us to make change to our business strategy.

The markets in which

we operate are highly competitive, and many of our competitors have significantly greater resources than we do.

Developing, distributing

and selling mobile and online games is a highly competitive business, characterized by frequent product introductions and rapidly

emerging new platforms, technologies and storefronts. For end users, we compete primarily on the basis of game quality, brand and

customer reviews. We also compete for experienced and talented employees.

We compete with a continually

increasing number of companies, including Zynga, King Digital, and Glu. In addition, given the open nature of the development and

distribution for smartphones and tablets, we also compete or will compete with a vast number of small companies and individuals

who are able to create and launch games and other content for these devices using relatively limited resources and with relatively

limited start–up time or expertise.

Some of our competitors

and our potential competitors have one or more advantages over us, which include:

| |

· |

significantly greater financial resources; |

| |

· |

greater experience with the mobile games business model and more effective game monetization; |

| |

· |

stronger brand and consumer recognition regionally

or worldwide;

|

| |

· |

stronger strategy which may reach our target

audience better than our current strategy;

|

| |

· |

greater experience integrating community features into their games and increasing the revenues derived from their users; |

| |

· |

the capacity to leverage their marketing expenditures across a broader portfolio of mobile and non–mobile products; |

| |

· |

larger installed customer bases from related platforms, such as console gaming or social networking websites, to which they can market and sell mobile games; |

| |

· |

more substantial intellectual property of their own from which they can develop games without having to pay royalties; |

| |

· |

lower labor and development costs and better overall economies of scale; |

| |

· |

greater platform–specific focus, experience and expertise; and |

| |

· |

broader global distribution and presence. |

If we are unable to compete

effectively or we are not as successful as our competitors in our target markets, our sales could decline, our margins could decline

and we could lose market share, any of which would materially harm our business, operating results and financial condition.

Inflation and future

expectations of inflation influence consumer spending on entertainment such as online gaming and gambling.

As a result, our profitability

and capital levels may be impacted by inflation and inflationary expectations. Additionally, inflation’s impact on our operating

expenses may affect profitability to the extent that additional costs are not recoverable through increased cost of consumer acquisition

for our portfolio of online, mobile gaming and casino gaming offerings.

Consumer tastes are

continually changing and are often unpredictable, and we compete for consumer discretionary spending against other forms of entertainment;

if we fail to develop and publish new mobile games that achieve market acceptance, our sales would suffer.

Our mobile game business

depends on developing and publishing mobile games that consumers will want to download and spend time and money playing. We must

continue to invest significant resources in research and development, analytics and marketing to introduce new games and continue

to update our successful mobile games, and we often must make decisions about these matters well in advance of product release

to timely implement them. Our success depends, in part, on unpredictable and volatile factors beyond our control, including consumer

preferences, competing games, new mobile platforms and the availability of other entertainment activities. If our games and related

applications do not meet consumer expectations, or they are not brought to market in a timely and effective manner, our business,

operating results and financial condition would be harmed. Even if our games are successfully introduced and initially adopted,

a failure to continue to update them with compelling content or a subsequent shift in the entertainment preferences of consumers

could cause a decline in our games’ popularity that could materially reduce our revenues and harm our business, operating

results and financial condition. Furthermore, we compete for the discretionary spending of consumers, who face a vast array of

entertainment choices, including games played on personal computers and consoles, television, movies, sports and the Internet.

If we are unable to sustain sufficient interest in our games compared to other forms of entertainment, our business and financial

results would be seriously harmed.

If we do not successfully

establish and maintain awareness of our brand and games, if we incur excessive expenses promoting and maintaining our brand or

our games or if our games contains defects or objectionable content, our operating results and financial condition could be harmed.

We believe that establishing

and maintaining our brand is critical to establishing a direct relationship with end users who purchase our products from direct–to–consumer

channels and to maintaining our existing relationships with distributors and content licensors, as well as potentially developing

new such relationships. Increasing awareness of our brand and recognition of our games is particularly important in connection

with our strategic focus of developing games based on our own intellectual property. Our ability to promote our brand and increase

recognition of our games depends on our ability to develop high–quality, engaging games. If consumers, digital storefront

owners and branded content owners do not perceive our existing games as high–quality or if we introduce new games that are

not favorably received by them, then we may not succeed in building brand recognition and brand loyalty in the marketplace. In

addition, globalizing and extending our brand and recognition of our games is costly and involves extensive management time to

execute successfully, particularly as we expand our efforts to increase awareness of our brand and games among international consumers.

Although we have significantly increased our sales and marketing expenditures in connection with the launch of our games, these

efforts may not succeed in increasing awareness of our brand or the new games. If we fail to increase and maintain brand awareness

and consumer recognition of our games, our potential revenues could be limited, our costs could increase and our business, operating

results and financial condition could suffer.

If we fail to deliver

our games at the same time as new mobile devices are commercially introduced, our sales may suffer.

Our business depends,

in part, on the commercial introduction of new mobile devices with enhanced features, including larger, higher resolution color

screens, improved audio quality, and greater processing power, memory, battery life and storage. For example, the introduction

of new and more powerful versions of Apple’s iPhone and iPad and devices based on Google’s Android operating system,

have helped drive the growth of the mobile games market.

We will need additional

capital to continue our operation.

We may need to obtain

additional financing for advertising, promotion and acquisition of additional products. The Company is constantly looking for new

sources of revenue that will help fund our business. There can be no assurances that this will be achieved.

If we successfully raise

additional funds through the issuance of debt, we will be required to service that debt and are likely to become subject to restrictive

covenants and other restrictions contained in the instruments governing that debt, which may limit our operational flexibility.

If we raise additional funds through the issuance of equity securities, then those securities may have rights, preferences or privileges

senior to the rights of holders of our Common stock, and holders of our Common stock will experience dilution.

We cannot be certain

that such additional debt or equity financing will be available to us on favorable terms when required, or at all. If we cannot

raise funds in a timely manner, or on acceptable terms, we may not be able to promote our brand, develop or enhance our products

and services, take advantage of future opportunities or respond to competitive pressures or unexpected requirements, and we may

be required to reduce or limit operations.

The effect of the

"Unlawful Internet Gambling Enforcement Act."

During the 2006, the US

Government approved the "Unlawful Internet Gambling Enforcement Act". This law restricts the acceptance of financial

instruments, such as credit cards or electronic fund transfers, for transactions incurred for internet gambling. The bill enables

state and federal Attorneys General to request that injunctions be issued to any party, such as financial institutions and internet

service providers, to assist in the prevention or restraint of illegal internet gambling.

Compliance with state

rules and regulations.

Various states have laws

restricting gambling and skill based gaming. The Company believes that we are in compliance with the rules and regulations in the

states we operate. However, there can be no assurance that the state officials will have the same view. In the event that we are

accused of violating such gambling laws and restrictions, our gaming business may be disallowed or prohibited in these states.

Furthermore, there can be no assurance that no new rules and regulations restricting our business will be adopted in the states

we operate. If such restrictive rules and regulations are adopted, we may incur additional costs in complying with the rules and

regulations or we may have to cease operation in these state(s).

We have capacity constraints

and system development risks that could damage our customer relations or inhibit our possible growth, and we may need to expand

our management systems and controls quickly, which may increase our cost of operations.

Our success and our ability

to provide high quality customer service largely depends on the efficient and uninterrupted operation of our computer and communications

systems and the computers and communication systems of our third party vendors in order to accommodate any significant numbers

or increases in the numbers of consumers using our service. Our success also depends upon our and our vendors' abilities to rapidly

expand transaction–processing systems and network infrastructure without any systems interruptions in order to accommodate

any significant increases in use of our service.

We and our service providers

may experience periodic systems interruptions and infrastructure failures, which we believe will cause customer dissatisfaction

and may adversely affect our results of operations. Limitations of technology infrastructure may prevent us from maximizing our

business opportunities.

Increased security

risks of online commerce may deter future use of our website, which may adversely affect our ability to generate revenue.

Concerns over the security

of transactions conducted on the internet and the privacy of consumers may also inhibit the growth of the internet and other online

services generally, and online commerce in particular. Failure to prevent security breaches could significantly harm our business

and results of operations. We cannot be certain that advances in computer capabilities, new discoveries in the field of cryptography,

or other developments will not result in a compromise or breach of the algorithms used to protect our transaction data. Anyone

who is able to circumvent our or our vendors' security measures could misappropriate proprietary information, cause interruptions

in our operations or damage our brand and reputation. We may be required to incur significant costs to protect against security

breaches or to alleviate problems caused by breaches. Any well–publicized compromise of security could deter people from

using the internet to conduct transactions that involve transmitting confidential information or downloading sensitive materials,

which would have a material adverse effect on our business.

We face the risk of

system failures, which would disrupt our operations.

A disaster could severely

damage our business and results of operations because our services could be interrupted for an indeterminate length of time. Our

operations depend upon our ability to maintain and protect our computer systems.

Our systems and operations

are vulnerable to damage or interruption from fire, floods, earthquakes, hurricanes, power loss, telecommunications failures, break–ins,

sabotage and similar events. The occurrence of a natural disaster or unanticipated problems at our principal business headquarters

or at a third–party facility could cause interruptions or delays in our business, loss of data or render us unable to provide

our services. In addition, failure of a third–party facility to provide the data communications capacity required by us,

as a result of human error, natural disaster or other operational disruptions, could cause interruptions in our service. The occurrence

of any or all of these events could adversely affect our reputation, brand and business.

We face risks of claims

from third parties for intellectual property infringement that could adversely affect our business.

Litigation regarding intellectual

property rights is common in the internet and software industries. We expect that internet technologies and software products and

services may be increasingly subject to third–party infringement claims as the number of competitors in our industry segment

grows and the functionality of products in different industry segments overlaps. There can be no assurance that our services do

not or will not in the future infringe the intellectual property rights of third parties. Royalty or licensing agreements, if required,

may not be available on acceptable terms, if at all. A successful claim of infringement against us and our failure or inability

to license the infringed or similar technology could adversely affect our business.

We may not be able

to protect our internet domain names, which is important to our branding strategy.

Our internet domain names

are an extremely important part of our business. Governmental agencies and their designees generally regulate the acquisition and

maintenance of domain names. The regulation of domain names in the United States and in foreign countries may be subject to change.

Governing bodies may establish additional top–level domains, appoint additional domain name registrars or modify the requirements

for holding domain names. As a result, we may be unable to acquire or maintain relevant domain names in all countries in which

we conduct business. Furthermore, the relationship between regulations governing domain names and laws protecting trademarks and

similar proprietary rights is unclear. Therefore, we may be unable to prevent third parties from acquiring domain names that are

similar to, infringe upon or otherwise decrease the value of our trademarks and other proprietary rights.

If we are unable to

maintain our popularity with third party search engines then our customer base, and therefore, our revenue will not continue to

grow.

Due to our limited capital

we do not run large advertising campaigns. Our competitors may have more resources to drive traffic to their websites in order

to optimize their internet search ranking position, including the ability to conduct national television and radio advertising

campaigns advertising our competitors’ websites. We are reliant on third party search engines such as Google and Yahoo! to

provide prospective customers with links to facilitate traffic to our internet domain. We believe that these search engines are

important in order to facilitate broad market acceptance of our service and thus enhance our sales. We continue to look for new

methods to optimize our ranking position with various internet search engines, including the maintenance of reciprocal links with

complementary third party sites.

Our financial position

and results of operations will vary depending on a number of factors, most of which are out of our control.

We anticipate that our

operating results will vary widely depending on a number of factors, some of which are beyond our control. These factors are likely

to include:

| |

· |

demand for our online and mobile services by consumers; |

| |

· |

costs of attracting consumers to our offerings, including costs of receiving exposure on third–party websites; |

| |

· |

costs related to forming strategic relationships; |

| |

· |

loss of strategic relationships; |

| |

· |

our ability to significantly increase our distribution channels; |

| |

· |

competition from companies offering same or similar products and services and from companies with much deeper financial, technical, marketing and human resources; |

| |

· |

the amount and timing of operating costs and

capital expenditures relating to expansion of our operations;

|

| |

· |

costs and delays in introducing new services and improvements to existing services; and |

| |

· |

changes in the growth rate of internet usage and acceptance by consumers of electronic commerce. |

Because we have a limited

operating history, it is difficult to accurately forecast the revenues that will be generated from our current and proposed future

product offerings.

If we are unable to

meet the changing needs of our industry, our ability to compete will be adversely affected.

We operate in an intensely

competitive industry. To remain competitive, we must be capable of enhancing and improving the functionality and features of our

online services. The internet gaming industry is rapidly changing. If competitors introduce new products and services embodying

new technologies, or if new industry standards and practices emerge, our existing services, technology and systems may become obsolete.

There can be no assurances that we will be successful in responding quickly, cost effectively and adequately to new developments

or that funds will be available to respond at all. Any failure by us to respond effectively would significantly harm our business,

operating results and financial condition.

Our future success will

depend on our ability to accomplish the following:

| |

· |

license and develop leading technologies useful in our business; |

| |

· |

develop and enhance our existing products and services; |

| |

· |

develop new services and technologies that address the increasingly sophisticated and varied needs of prospective consumers; and |

| |

· |

respond to technological advances and emerging industry standards and practices on a cost–effective and timely basis. |

Developing internet

services and other proprietary technology entails significant technical and business risks, as well as substantial costs. We may

use new technologies ineffectively, or we may fail to adapt our services, transaction processing systems and network infrastructure

to user requirements or emerging industry standards. If our operations face material delays in introducing new services, products

and enhancements, our users may forego the use of our services and use those of our competitors. These factors could have a material

adverse effect on our financial position and results of operations.

Our business may be

subject to government regulation and legal uncertainties that may increase the costs of operating our web portal, limit our ability

to attract users, or interfere with future operations of the Company.

There are currently few

laws or regulations directly applicable to access to, or commerce on, the internet. Due to the increasing popularity and use of

the internet, it is possible that laws and regulations may be adopted, covering issues such as user privacy, defamation, pricing,

taxation, content regulation, quality of products and services, and intellectual property ownership and infringement. Such legislation

could expose the Company to substantial liability as well as dampen the growth in use of the internet, decrease the acceptance

of the internet as a communications and commercial medium, or require the Company to incur significant expenses in complying with

any new regulations.

The applicability to the

internet of existing laws governing issues such as gambling, property ownership, copyright, defamation, obscenity and personal

privacy is uncertain. The Company may be subject to claims that our services violate such laws. Any new legislation or regulation

in the United States or abroad or the application of existing laws and regulations to the internet could damage our business. In

addition, because legislation and other regulations relating to online games vary by jurisdiction, from state to state and from

country to country, it is difficult for us to ensure that our players are accessing our portal from a jurisdiction where it is

legal to play our games. We therefore, cannot ensure that we will not be subject to enforcement actions as a result of this uncertainty

and difficulty in controlling access.

In addition, our business

may be indirectly affected by our suppliers or customers who may be subject to such legislation. Increased regulation of the internet

may decrease the growth in the use of the internet or hamper the development of internet commerce and online entertainment, which

could decrease the demand for our services, increase our cost of doing business or otherwise have a material adverse effect on

our business, results of operations and financial condition.

New legislation, regulations

or court rulings related to enforcing patents could harm our business and operating results.

If Congress, the U.S.

Patent and Trademark Office (the “USPTO”) or courts implement new legislation, regulations or rulings that impact the

patent enforcement process or the rights of patent holders, these changes could negatively affect our business model. For example,

limitations on the ability to bring patent enforcement claims, limitations on potential liability for patent infringement, lower

evidentiary standards for invalidating patents, increases in the cost to resolve patent disputes and other similar developments

could negatively affect our ability to assert our patent or other intellectual property rights.

In addition, the Leahy–Smith

America Invents Act of 2011 (or the Leahy–Smith Act) includes a number of significant changes to United States patent law.

These changes include provisions that affect the way patent applications will be prosecuted and also affect patent litigation.

The USPTO implementation has increased the uncertainties and costs surrounding the prosecution of patent applications and the enforcement

or defense of our issued patents, all of which could have a material adverse effect on our business and financial condition.

Further, and in general,

it is impossible to determine the extent of the impact of any new laws, regulations or initiatives that may be proposed, or whether

any of the proposals will become enacted as laws. Compliance with any new or existing laws or regulations could be difficult and

expensive, affect the manner in which we conduct our business and negatively impact our business, prospects, financial condition

and results of operations.

If we are unable to

license or otherwise monetize our intellectual property or generate revenue and profit through those assets, there is a significant

risk that our intellectual property monetization strategy will fail.

Effective June 1, 2012,

we acquired an interest in the ‘088 Patent, entitled “Gaming Device Having a Second Separate Bonusing Event”

that we plan to license or otherwise monetize. On August 6, 2013, the Company was issued United States Patent number 8,500,554

entitled, "Gaming Device Having a Second Bonusing Event" (the "554 Patent"). The '554 Patent is a continuation

of the key patent already owned by the Company. If our efforts to generate revenue from the ‘088 Patent fail, we will incur

significant losses and may be unable to acquire additional intellectual property assets. If this occurs, our patent monetization

strategy will likely fail. In the third quarter of 2015 we terminated the litigation and the PTO proceedings related to these patents.

We plan to commence

additional legal proceedings against companies in the gaming industry to enforce our intellectual property rights, and we expect

such litigation to be time–consuming, which may adversely affect our financial condition and ability to operate our business.

To license or otherwise

monetize the ‘088 Patent, we have commenced legal proceedings against the owners of gaming devices pursuant to which we allege

that such companies infringed on the Patent. Our viability will be highly dependent on the outcome of this litigation, and there

is a risk that we may be unable to achieve the results that we desire from such litigation, which failure would harm our overall

business. In addition, the potential defendants in the litigation are much larger than us and have substantially greater resources,

which could make our litigation efforts more difficult.

Disputes regarding the

assertion of patents and other intellectual property rights are highly complex and technical. Once initiated, we may be forced

to litigate against others to enforce or defend our intellectual property rights or to determine the validity and scope of other

parties’ proprietary rights. The defendants or other third parties involved in potential lawsuits may allege defenses and/or

file counterclaims in an effort to avoid or limit liability and damages for patent infringement. If such defenses or counterclaims

are successful, they may preclude our ability to derive licensing revenue from our patents. A negative outcome of any such litigation,

or one or more claims contained within any such litigation, could materially and adversely impact our business.

The protection of

our intellectual property may be uncertain and we may face claims of others.

Although we have received

patents and have filed patent applications with respect to certain aspects of our technology, we generally do not rely on patent

protection with respect to our products and technologies. Instead, we rely primarily on a combination of trade secret and copyright

law, employee and third party non–disclosure agreements and other protective measures to protect intellectual property rights

pertaining to our products and technologies. Such measures may not provide meaningful protection of our trade secrets, know how

or other intellectual property in the event of any unauthorized use, misappropriation or disclosure. Others may independently develop

similar technologies or duplicate our technologies. In addition, to the extent that we apply for any patents, such applications

may not result in issued patents or, if issued, such patents may not be valid or of value. Third parties could, in the future,

assert infringement or misappropriation claims against us with respect to our current or future products and technologies, or we

may need to assert claims of infringement against third parties. Any infringement or misappropriation claim by us or against us

could place significant strain on our financial resources, divert management’s attention from our business and harm our reputation.

The costs of prosecuting or defending an intellectual property claim could be substantial and could adversely affect our business,

even if we are ultimately successful in prosecuting or defending any such claims. If our products or technologies are found to

infringe the rights of a third party, we could be required to pay significant damages or license fees or cease production, any

of which could have material adverse effect on our business. If a claim is brought against us, or we ultimately prove unsuccessful

on the claims on our merits, this could have a material adverse effect on our business, financial condition, results of operations

and future prospects.

Any failure to maintain

or protect our patent assets or other intellectual property rights could significantly impair our return on investment from such

assets and harm our brand, our business and our operating results.

Our ability to compete

in the intellectual property market largely depends on the superiority, uniqueness and value of our acquired patent assets and

other intellectual property. To protect our proprietary rights, we will rely on a combination of patent, trademark, copyright and

trade secret laws, confidentiality agreements with our employees and third parties, and protective contractual provisions. No assurances

can be given that any of the measures we undertake to protect and maintain our intellectual property assets will have any measure

of success.

Following the acquisition

of patent assets, we will likely be required to spend significant time and resources to maintain the effectiveness of those assets

by paying maintenance fees and making filings with the USPTO. We may acquire patent assets, including patent applications, which

require us to spend resources to prosecute the applications with the USPTO. Further, there is a material risk that patent related

claims (such as, for example, infringement claims (and/or claims for indemnification resulting therefrom), unenforceability claims,

or invalidity claims) will be asserted or prosecuted against us, and such assertions or prosecutions could materially and adversely

affect our business. Regardless of whether any such claims are valid or can be successfully asserted, defending such claims could

cause us to incur significant costs and could divert resources away from our other activities.

Despite our efforts to

protect our intellectual property rights, any of the following or similar occurrences may reduce the value of our intellectual

property:

| |

· |

our applications for patents, trademarks and copyrights may not be granted and, if granted, may be challenged or invalidated; |

| |

· |

issued trademarks, copyrights, or patents may not provide us with any competitive advantages versus potentially infringing parties; |

| |

· |

our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology; or |

| |

· |

our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we acquire and/or prosecute. |

Moreover, we may

not be able to effectively protect our intellectual property rights in certain foreign countries where we may do business in the

future or from which competitors may operate. If we fail to maintain, defend or prosecute our patent assets properly, the value

of those assets would be reduced or eliminated, and our business would be harmed.

We are in a developing

industry with limited revenues from operations.

We have incurred significant

operating losses since inception and generate limited revenues from operations. As a result, we have generated negative cash flows

from operations and have an accumulated deficit of $299,163,000 as of December 31, 2014 and $301,285,000 as of June 30, 2015. We are operating

in a developing industry based on new technologies and our primary source of funds to date has been through the issuance of securities

and borrowing funds. There can be no assurance that management’s efforts will be successful or that the products we develop

and market will be accepted by consumers. If our products are ultimately unsuccessful in the market, this could have a material

adverse effect on our business, financial condition, results of operations and future prospects.

We face financial

risks as we are a developing company.

We have incurred significant

operating losses since inception and have limited revenue from operations. As a result, we have generated negative cash flows from

operations and our cash balances continue to reduce. While we are optimistic and believe appropriate actions are being taken to

mitigate this, there can be no assurance that attempts to reduce cash outflows will be successful and this could have a material

adverse effect on our business, financial condition, results of operations.

There is no assurance

that we will be able to continue as a going concern.

We are operating in a

developing industry based on new technology and our primary source of funds to date has been through issuances of securities. We

intend to raise additional capital through equity investors. We need to raise additional capital in order to be able to accomplish

our business plan objectives. Management believes that we will be successful in obtaining additional financing based on our history

of raising funds; however, no assurance can be provided that we will be able to do so. There is no assurance that any funds we

raise will be sufficient to enable us to attain profitable operations or continue as a going concern. If adequate funds are not

available to us, we may be required to curtail operations significantly or to obtain funds through entering into arrangements with

collaborative partners or others that may require us to relinquish rights to certain of our technologies or products that we would

not otherwise relinquish. There can be no assurance that such a plan will be successful.

We may fail to attract

and retain qualified personnel.

There is intense competition

from other companies, research and academic institutions, government entities and other organizations for qualified personnel in

the areas of our activities. If we fail to identify, attract, retain and motivate these highly skilled personnel, we

may be unable to continue our marketing and development activities, and this could have a material adverse effect on our business,

financial condition, results of operations and future prospects.

If we do not effectively

manage growth or changes in our business, these changes could place a significant strain on our management and operations.

To manage our growth successfully,

we must continue to improve and expand our systems and infrastructure in a timely and efficient manner. Our controls,

systems, procedures and resources may not be adequate to support a changing and growing company. If our management fails

to respond effectively to changes and growth in our business, including acquisitions, this could have a material adverse effect

on our business, financial condition, results of operations and future prospects.

We need to manage

growth in operations to maximize our potential growth and achieve our expected revenues. Our failure to manage growth can cause

a disruption of our operations that may result in the failure to generate revenues at levels we expect.

In order to maximize potential

growth in our current markets, we may have to expand our operations. Such expansion will place a significant strain on our management

and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls,

operating procedures and management information systems. We will also need to effectively train, motivate, and manage our employees.

Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

General market risks

We may not be able

to access credit.

We face the risk that

we may not be able to access credit, either from lenders or suppliers. Failure to access credit from any of these sources

could have a material adverse effect on our business, financial condition, results of operations and future prospects.

We may not be able

to maintain effective internal controls.

If we fail to maintain

the adequacy of our internal accounting controls, as such standards are modified, supplemented or amended from time to time, we

may not be able to ensure that we can conclude on an on–going basis that we have effective internal controls over financial

reporting in accordance with Section 404 of the Sarbanes–Oxley Act of 2002. Failure to achieve and maintain an

effective internal control environment could cause us to face regulatory action and also cause investors to lose confidence in

our reported financial information, either of which could have a material adverse effect on our business, financial condition,

results of operations and future prospects.

Risks related to this offering and securities

market risks

Our management will

have broad discretion as to the use of the net proceeds from this offering and may not use the proceeds effectively.

Our management will have

broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that you do not

agree with or that do not improve our results of operations or enhance the value of our common stock, see "Use of Proceeds"

in this prospectus supplement for more information. Our failure to apply these funds effectively could have a material adverse

effect on our business and cause the price of our common stock to decline.

Our stock price and

trading volume may be volatile, which could result in losses for our stockholders.

The equity markets may

experience periods of volatility, which could result in highly variable and unpredictable pricing of equity securities. The market

price of our Common stock could change in ways that may or may not be related to our business, our industry or our operating performance

and financial condition and could negatively affect our share price or result in fluctuations in the price or trading volume of

our Common stock. We cannot predict the potential impact of these periods of volatility on the price of our Common stock.

The Company cannot assure you that the market price of our Common stock will not fluctuate or decline significantly in the future.

If our Common stock

is delisted from the NYSE MKT LLC, the Company would be subject to the risks relating to penny stocks.

If our Common stock were

to be delisted from trading on the NYSE MKT LLC and the trading price of the Common stock were below $5.00 per share on the date

the Common stock were delisted, trading in our Common stock would also be subject to the requirements of certain rules promulgated

under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These rules require additional disclosure

by broker–dealers in connection with any trades involving a stock defined as a "penny stock" and impose various

sales practice requirements on broker–dealers who sell penny stocks to persons other than established customers and accredited

investors, generally institutions. These additional requirements may discourage broker–dealers from effecting transactions

in securities that are classified as penny stocks, which could severely limit the market price and liquidity of such securities

and the ability of purchasers to sell such securities in the secondary market. A penny stock is defined generally as any non–exchange

listed equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

If we need additional

capital to fund the growth of our operations, and cannot obtain sufficient capital, we may be forced to limit the scope of our

operations.

As we implement our growth

strategies, we may experience increased capital needs. We may not, however, have sufficient capital to fund our future operations

without additional capital investments. If adequate additional financing is not available on reasonable terms or at all, we may

not be able to carry out our corporate strategy and we would be forced to modify our business plans (e.g., limit our expansion,

limit our marketing efforts and/or decrease or eliminate capital expenditures), any of which may adversely affect our financial

condition, results of operations and cash flow. Such reduction could materially adversely affect our business and our ability to

compete.

Our capital needs will

depend on numerous factors, including, without limitation, (i) our profitability or lack thereof, (ii) our ability to respond to

a release of competitive products by our competitors, and (iii) the amount of our capital expenditures, including acquisitions.

Moreover, the costs involved may exceed those originally contemplated. Cost savings and other economic benefits expected may not

materialize as a result of any cost overruns or changes in market circumstances. Failure to obtain intended economic benefits could

adversely affect our business, financial condition and operating performances.

We do not anticipate

paying any cash dividends on our common stock in the foreseeable future and our stock may not appreciate in value.

We have not declared or

paid cash dividends on our common stock to date. We currently intend to retain our future earnings, if any, to fund the development

and growth of our business. In addition, the terms of any existing or future debt agreements may preclude us from paying dividends.

There is no guarantee that shares of our Common stock will appreciate in value or that the price at which our stockholders have

purchased their shares will be able to be maintained.

If securities or industry

analysts do not publish research or reports about our business, or publish inaccurate or unfavorable research reports about our

business, our share price and trading volume could decline.

The trading market for

our Common stock will, to some extent, depend on the research and reports that securities or industry analysts publish about us

or our business. We do not have any control over these analysts. If one or more of the analysts who cover us should downgrade our

shares or change their opinion of our business prospects, our share price would likely decline. If one or more of these analysts

ceases coverage of our company or fails to regularly publish reports on us, we could lose visibility in the financial markets,

which could cause our share price and volume to decline.

You may experience dilution

of your ownership interests because of the future issuance of additional shares of our common or preferred stock or other securities

that are convertible into or exercisable for our common or preferred stock.

In the future, we may issue

our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders.

We are authorized to issue an aggregate of 75,000,000 shares of common stock and 10,000,000 shares of “blank check”

preferred stock. We may issue additional shares of our common stock or other securities that are convertible into or exercisable

for our common stock in connection with hiring or retaining employees, future acquisitions, future sales of our securities for

capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common

stock may create downward pressure on the trading price of the common stock. We will need to raise additional capital in the near

future to meet our working capital needs, and there can be no assurance that we will not be required to issue additional shares,

warrants or other convertible securities in the future in conjunction with these capital raising efforts, including at a price

(or exercise or conversion prices) below the price an investor paid for stock.

You could lose all of

your investment.

An investment in our securities

is speculative and involves a high degree of risk. Potential investors should be aware that the value of an investment in the Company

may go down as well as up. In addition, there can be no certainty that the market value of an investment in the Company will fully

reflect its underlying value. You could lose your entire investment.

The ability of our Board

of Directors to issue additional stock may prevent or make more difficult certain transactions, including a sale or merger of the

Company.

Our Board of Directors

is authorized to issue up to 10,000,000 shares of preferred stock with powers, rights and preferences designated by it. See

“Preferred Stock” in the section of this prospectus titled “Description of Securities.” Shares of voting

or convertible preferred stock could be issued, or rights to purchase such shares could be issued, to create voting impediments

or to frustrate persons seeking to effect a takeover or otherwise gain control of the Company. The ability of the Board of

Directors to issue such additional shares of preferred stock, with rights and preferences it deems advisable, could discourage

an attempt by a party to acquire control of the Company by tender offer or other means. Such issuances could therefore deprive

stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price for

their shares in a tender offer or the temporary increase in market price that such an attempt could cause. Moreover, the

issuance of such additional shares of preferred stock to persons friendly to the Board of Directors could make it more difficult

to remove incumbent officers and directors from office even if such change were to be favorable to stockholders generally.

Offers or availability

for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell

substantial amounts of our common stock in the public market, including upon the expiration of any statutory holding period under

Rule 144, or issued upon the conversion of preferred stock or exercise of warrants, it could create a circumstance commonly referred

to as an "overhang" and in anticipation of which the market price of our common stock could fall. The existence

of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional

financing through the sale of equity or equity––related securities in the future at a time and price that we deem reasonable

or appropriate.

Investor relations

activities, nominal “float” and supply and demand factors may affect the price of our stock.

The Company may utilize

various techniques such as non––deal road shows and investor relations campaigns in order to create investor awareness

for the Company. These campaigns may include personal, video and telephone conferences with investors and prospective