As filed with the Securities and Exchange

Commission on September 24, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

MGT CAPITAL INVESTMENTS, INC.

(Exact name of registrant as specified in

charter)

Delaware

(State or jurisdiction of incorporation

or organization)

13-4148725

(I.R.S. Employer Identification No.)

500 Mamaroneck Avenue

Suite 204

Harrison, NY 10528 USA

914-630-7431

(Address, including zip code, and telephone

number, including area code,

of registrant’s principal executive

offices)

Robert B. Ladd

President and Chief Executive Officer

MGT Capital Investments, Inc.

500 Mamaroneck Avenue

Suite 204

Harrison, NY 10528 USA

914-630-7431

Copies to:

Jay Kaplowitz, Esq.

Avital Even-Shoshan, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

(212) 930-9700

Fax: (212) 930-9725

Approximate date of proposed sale to

the public: From time to time, after this registration statement becomes effective.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registrations statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, or a non-accelerated filer or a smaller reporting company. See definition of large accelerated filer”,

accelerated filer” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

|

|

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

x |

CALCULATION OF REGISTRATION FEE (1)

Title of Each Class of

Securities to be Registered (2) | |

Amount

to be

Registered (3)

Proposed

Maximum Aggregate

Offering Price (4) | | |

Amount of

Registration Fee | |

| Common Stock, par value $0.001 per share (5) | |

| | (1) | |

| | (1) |

| Preferred Stock, par value $0.001 per share (6) | |

| | (1) | |

| | (1) |

| Debt Securities | |

| | (1) | |

| | (1) |

| Warrants(7) | |

| | (1) | |

| | (1) |

| Rights(8) | |

| | (1) | |

| | (1) |

| Units(9) | |

| | (1) | |

$ | | (1) |

| Total | |

$ | 10,000,000 | | |

$ | 1,143.82 | (10) |

| (1) | Calculated pursuant to Rule 457(o) promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

Pursuant to Rule 457(o) and General Instruction II(D) of Form S-3 under the Securities Act, the table above omits certain information. |

| (2) | Any of the securities registered hereunder may be sold separately, or as units with other securities registered hereby. |

| (3) | The registrant is registering hereunder an indeterminate number or amount of common stock, preferred stock, debt securities,

warrants, rights and units, as it may from time to time issue at indeterminate prices, in U.S. Dollars. The securities registered

hereunder also include (i) such additional indeterminate number or amount of securities as may be issued upon the conversion,

exchange or exercise of other offered securities to the extent no separate consideration is received therefor and (ii) such

additional indeterminate number of shares of stock as may be issuable with respect to the shares being registered hereunder as

a result of stock splits, stock dividends or similar transactions. In no event will the aggregate initial offering price of all

securities issued pursuant to this registration statement exceed $10,000,000. |

| (4) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act. |

| (5) | An indeterminate number of shares of common stock of MGT Capital Investments, Inc. are covered by this Registration Statement |

| (6) | An indeterminate number of shares of preferred stock of MGT Capital Investments, Inc. are covered by this Registration Statement.

Shares of common stock issued upon conversion of the debt securities and the preferred stock will be issued without the payment

of additional consideration. |

| (7) | An indeterminate number of warrants of MGT Capital Investments, Inc. are covered by this registration statement. Includes

warrants to purchase common stock, warrants to purchase preferred stock, and warrants to purchase debt securities. |

| (8) | Rights evidencing rights to purchase securities of MGT Capital Investments, Inc. |

| (9) | Each Unit consists of any combination of two or more of the securities being registered hereby. |

| (10) | Pursuant to Rule 415(a)(6) promulgated under the Securities Act, (i) this registration

statement includes $156,470 of unsold securities (not including

securities unsold pursuant to the prospectus supplements dated December 30, 2013 and April 24, 2014) registered pursuant to

the registrant’s

Registration

Statement on Form S-3

(File

No. 333-182298) initially filed with the Securities and Exchange Commission on June 22, 2012, and declared effective on

September 25, 2012 (the “2012 Registration Statement”) and (ii) the registration fee of $1,146 paid by the

registrant with respect to such unsold securities in connection with the filing of the 2012 Registration Statement will

continue to be applied to such unsold securities. As a result, the amount of the registration fee paid in connection with

this registration statement is $9,843,530, calculated based on the additional $9,843,530 of securities registered pursuant

to this registration statement. Notwithstanding the foregoing,

the Proposed Maximum Aggregate Offering Price of $10,000,000

shall apply to all securities registered hereunder, including any newly-registered securities. |

The registrant hereby

amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities

and Exchange Commission acting pursuant to said Section 8(a), may determine.

Information contained herein is not complete

and may be changed. These securities may not be sold until the Registration Statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

SEPTEMBER 24, 2015

PROSPECTUS

MGT Capital Investments, Inc.

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

MGT Capital Investments,

Inc. (referred to herein as “we,” “us,” “our,” “MGT,” “Registrant,”

or the “Company”) is offering up to $10 million, in one or more offerings from time to time at prices and on terms

that it will determine at the time of each offering, sell common stock, preferred stock, debt securities, warrants, rights or a

combination of these securities or units (collectively referred as “securities”) for an aggregate initial offering

price of up to $10 million (the “Company Securities”). This prospectus describes the general manner in which the Company

Securities may be offered using this prospectus. Each time we offer and sell securities or issuable upon exercise or conversion

of any securities, we will provide you with a prospectus supplement that will contain specific information about the terms of that

offering. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully

read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated

by reference in this prospectus before you purchase any of the securities offered hereby. This prospectus may not be used to

offer and sell securities unless accompanied by a prospectus supplement. We may not issue more than 19.9% of our currently

outstanding common stock without Company stockholder approval and all such issuances are subject to NYSE MKT approval notwithstanding

shareholder approvals.

The Company Securities

may be sold by us to or through underwriters or dealers, directly to purchasers or through agents designated from time to time.

For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus. If any underwriters are involved in the sale of the Company Securities with respect to which this prospectus

is being delivered, the names of such underwriters and any applicable discounts or commissions and over-allotment options will

be set forth in a prospectus supplement. The price to the public of the Company Securities and the net proceeds we expect to receive

from such sale will also be set forth in a prospectus supplement.

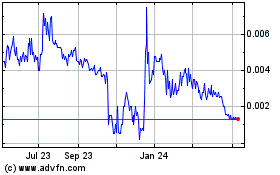

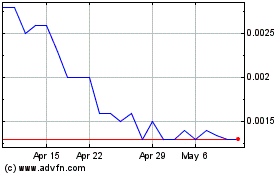

Our common stock is listed on the NYSE

MKT LLC exchange (“NYSE MKT”) under the symbol “MGT”. On September 23, 2015, the last reported sales

price of our common stock was $0.23. We will apply to list any shares

of common stock sold by us under this prospectus and any prospectus supplement on the NYSE MKT. The prospectus supplement will

contain information, where applicable, as to any other listing of the securities on the NYSE MKT or any other securities market

or exchange covered by the prospectus supplement. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our

common stock in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period

so long as our public float remains below $75 million. We have not offered any securities pursuant to General Instruction I.B.6

of Form S-3 during the 12 calendar months prior to and including the date of this prospectus except for 3,205,908 shares of common

stock sold pursuant to our At the Market Offering Agreement with Ascendiant Capital Markets, LLC dated December 30, 2013.

Investing in our

securities involves risks. You should carefully consider the risk factors beginning on page 5

of this prospectus and set forth in the documents incorporated by reference herein before making any decision to invest in our

securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________,

2015.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is

a part of a registration statement that we filed with the Securities and Exchange Commission, or the Commission, utilizing a “shelf”

registration process. Under this shelf registration process, we may offer to sell any combination of the securities described in

this prospectus, either individually or in units, in one or more offerings up to a total dollar amount of $10,000,000. This prospectus

provides you with a general description of the Company Securities we may offer. Each time we sell Company Securities under this

shelf registration, we will provide a prospectus supplement that will contain specific information about the terms of that offering.

The prospectus supplement may also add, update or change information contained in this prospectus. To the extent that any statement

that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus

will be deemed modified or superseded by those made in the prospectus supplement. You should read both this prospectus and any

prospectus supplement, including all documents incorporated herein or therein by reference, together with additional information

described under “Where You Can Find More Information” and “Information Incorporated by Reference.” We may

only use this prospectus to sell the securities if it is accompanied by a prospectus supplement.

You should rely only

on the information included or incorporated by reference in this prospectus and any accompanying prospectus supplement. We

have not authorized any dealer, salesman or other person to provide you with additional or different information. This

prospectus and any accompanying prospectus supplement are not an offer to sell or the solicitation of an offer to buy any securities

other than the securities to which they relate and are not an offer to sell or the solicitation of an offer to buy securities in

any jurisdiction to any person to whom it is unlawful to make an offer or solicitation in that jurisdiction. You should

not assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate on any date

subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct

on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying

prospectus supplement is delivered or securities are sold on a later date. We will disclose any material changes in our affairs

in a post-effective amendment to the registration statement of which this prospectus is a part, a prospectus supplement, or a future

filing with the Securities and Exchange Commission incorporated by reference in this prospectus.

Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to,

the offering of the securities and the distribution of this prospectus outside of the United States.

Unless the context

otherwise requires, references in this prospectus and the accompanying prospectus supplement to “we,” “us,”

“our,” the “Company,” and “MGT” refer to MGT Capital Investments, Inc. and its subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This Registration Statement contains

“forward-looking statements” and information relating to our business that are based on our beliefs as well as assumptions

made by us or based upon information currently available to us. When used in this Registration Statement, the words anticipate,”

“believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “should” and similar expressions are intended to identify forward-looking statements. These

forward-looking statements include, but are not limited to, statements relating to our performance in “Business” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2014, which was filed with the Commission on April 15, 2015. These statements

reflect our current views and assumptions with respect to future events and are subject to risks and uncertainties. Actual and

future results and trends could differ materially from those set forth in such statements due to various factors. Such factors

include, among others: general economic and business conditions; industry capacity; industry trends; competition; changes in business

strategy or development plans; project performance; availability, terms, and deployment of capital; and availability of qualified

personnel. These forward-looking statements speak only as of the date of this Registration Statement. Subject at all times to relevant

securities law disclosure requirements, we expressly disclaim any obligation or undertaking to disseminate any update or revisions

to any forward-looking statement contained herein to reflect any change in our expectations with regard thereto or any changes

in events, conditions or circumstances on which any such statement is based. In addition, we cannot assess the impact of each factor

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from

those contained in any forward-looking statements.

PROSPECTUS SUMMARY

The following summary

highlights material information found in more detail elsewhere in, or incorporated by reference in, the prospectus. It does not

contain all of the information you should consider. As such, before you decide to buy our common stock, in addition to the following

summary, we urge you to carefully read the entire prospectus and documents incorporated by reference herein, especially the risks

of investing in our common stock as discussed under "Risk Factors." The following summary is qualified in its entirety

by the detailed information appearing elsewhere in this prospectus.

General

MGT Capital Investments, Inc. (“MGT,” “the Company,” “we,” “us”)

is a Delaware corporation incorporated in 2000. The Company was originally incorporated in Utah in 1977. MGT is comprised of the

parent company, majority–owned subsidiary MGT Gaming, Inc. (“MGT Gaming”) and wholly–owned subsidiaries

Medicsight, Inc. (“Medicsight”), MGT Studios, Inc. (“MGT Studios”) and its minority–owned subsidiary

M2P Americas, Inc., and MGT Sports, Inc. (“MGT Sports”). The Company also owns 10.0% of DraftDay Gaming Group, Inc.

(“DDGG”). Our corporate office is located in Harrison, New York.

MGT and its

subsidiaries are principally engaged in the business of acquiring, developing and monetizing assets in the online and mobile

gaming space as well as the social casino industry. MGT’s portfolio of assets in the online, mobile gaming and social

casino gaming space includes MGTPlay.com and Slot Champ. The Company also provides a white label service to third party marketers.

In addition, MGT

Gaming owns three U.S. patents covering certain features of casino slot machines. Both patents were asserted against alleged

infringers in various actions in federal court in Mississippi. On July 29, 2015, MGT, Aruze America, Aruze Macau, and Penn

agreed, through their respective counsel, to settle all pending disputes, including terminating the Mississippi litigation

and all proceedings at the PTO. The parties have subsequently jointly terminated the Mississippi litigation and the PTO proceedings.

On September 8, 2015,

the Company and MGT Sports entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Viggle,

Inc. (“Viggle”) and Viggle’s subsidiary DDGG, pursuant to which Viggle acquired all of the assets of the DraftDay.com

business (the “DraftDay Business”) from the Company and MGT Sports. In exchange for the acquisition of the DraftDay

Business, Viggle paid MGT Sports the following: (a) 1,269,342 shares of Viggle’s common stock, par value $0.001 per share,

(b) a promissory note in the amount of $234,375 due September 29, 2015, (c) a promissory note in the amount of $1,875,000 due

March 8, 2016, and (d) 2,550,000 shares of common stock of DDGG. In addition, in exchange for providing certain transitional services,

DDGG will issue to MGT Sports a warrant to purchase 1,500,000 shares of DDGG common stock at an exercise price of $0.40 per share.

Following consummation of the transactions in the Asset Purchase Agreement, including certain agreements between Viggle and third

parties, MGT Sports owns 2,550,000 shares of DDGG common stock, Viggle owns 11,250,000 shares of DDGG common, and Sportech, Inc.

owns 9,000,000 shares of DDGG common stock.

Outside of the business

of acquiring, developing and monetizing assets in the online, mobile gaming and casino gaming space, MGT’s wholly owned subsidiary

Medicsight owns U.S. Food and Drug Administration approved medical imaging software and has designed an automated carbon dioxide

insufflation device which receives royalties on a per–unit basis from an international manufacturer on which the Company

receives royalties from an international distributor.

Strategy

MGT and its subsidiaries

are principally engaged in the business of acquiring, developing and monetizing assets in the online and mobile gaming space, as

well as the casino industry. The Company’s acquisition strategy is designed to obtain control of assets with a focus on risk

mitigation coupled with large potential upside. We plan to build our portfolio by seeking out large social and real money gaming

opportunities via extensive research and analysis. Next, we will attempt to secure controlling interests for modest cash and/or

stock outlays. MGT then budgets and funds operating costs to develop business operations and tries to motivate sellers with equity

upside. While the ultimate objective is to operate businesses for free cash flow, there may be opportunities where we sell or otherwise

monetize certain assets.

There can be no assurance

that any acquisitions will occur at all, or that any such acquisitions will be accretive to earnings, book value and other financial

metrics, or that any such acquisitions will generate positive returns for Company stockholders. Furthermore, it is contemplated

that any acquisitions may require the Company to raise capital; such capital may not be available on terms acceptable to the Company,

if at all.

Competition

MGT encounters

intense competition in all its businesses, in many cases from larger companies with greater financial resources such as

Zynga, Inc. (NASDAQ: ZNGA) and Caesars Interactive, Inc., a subsidiary of Caesars Acquisition Company (NASDAQ: CACQ) which

focus on social and real money online gaming.

SECURITIES REGISTERED HEREBY THAT WE

MAY OFFER

We may offer any of

the following securities, either individually or in combination, with a total value of up to $10,000,000 from time to time under

this prospectus at prices and on terms to be determined by market conditions at the time of the offering:

Common Stock.

We may offer shares of our common stock. Our common stock currently is listed on the NYSE MKT under the symbol “MGT”. Shares

of common stock that may be offered in this offering will, when issued and paid for, be fully paid and non-assessable.

Preferred Stock.

We may offer shares of our preferred stock, in one or more series. Our board of directors will determine the rights, preferences,

privileges and restrictions of the preferred stock, including any dividend rights, conversion rights, voting rights, terms of redemption,

liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of any series.

Convertible preferred stock will be convertible into shares of our common stock. Conversion may be mandatory or at your option

and would be at prescribed conversion rates. Shares of preferred stock that may be offered in this offering will, when issued and

paid for, be fully paid and non-assessable. The terms of the preferred stock we may offer under this prospectus and any prospectus

supplement will be set forth in a certificate of designations relating to that series and will be incorporated by reference into

the registration statement of which this prospectus is a part. We urge you to read the complete certificate of designations

containing the terms of the applicable series of preferred stock, as well as the applicable prospectus supplement, and any related

free writing prospectus that we may authorize to be provided to you, related to such series.

Debt Securities. We

may issue debt securities from time to time, in one or more series, as either senior or subordinated debt or as senior or subordinated

convertible debt. The senior debt securities will rank equally with any other unsecured and unsubordinated debt. The subordinated

debt securities will be subordinate and junior in right of payment, to the extent and in the manner described in the instrument

governing the debt, to all of our senior indebtedness. Convertible debt securities will be convertible into or exchangeable for

our Common Stock or other securities. Conversion may be mandatory or at your option and would be at prescribed conversion rates.

Any debt securities

issued under this prospectus will be issued under one or more documents called indentures, which are contracts between us and a

national banking association or other eligible party, as trustee. In this prospectus, we have summarized certain general features

of the debt securities. We urge you, however, to read the applicable prospectus supplement (and any free writing prospectus that

we may authorize to be provided to you) related to the series of debt securities being offered, as well as the complete indentures

that contain the terms of the debt securities. Forms of indentures and forms of debt securities containing the terms of the debt

securities being offered will be filed as exhibits to the registration statement of which this prospectus is a part or will be

incorporated by reference from reports that we file with the SEC.

Warrants. We

may issue warrants for the purchase of common stock, preferred stock in one or more series, and/or debt securities in one or more

series. We may issue warrants independently or in combination with common stock, preferred stock, and/or debt securities. In this

prospectus, we have summarized certain general features of the warrants under “Description of Warrants.” We urge

you, however, to read the applicable prospectus supplement, and any related free writing prospectus that we may authorize to be

provided to you, related to the particular series of warrants being offered, as well as the form of warrant and/or the warrant

agreement and warrant certificate, as applicable, that contain the terms of the warrants. We will file as exhibits to the registration

statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form

of warrant and/or the warrant agreement and warrant certificate, as applicable, that describe the terms of the particular series

of warrants we are offering, and any supplemental agreements, before the issuance of such warrants.

Warrants may be issued

under a warrant agreement that we enter into with a warrant agent. We will indicate the name and address of the warrant agent,

if any, in the applicable prospectus supplement relating to a particular series of warrants.

Rights.

We may issue rights to purchase of preferred stock or common stock or debt securities of the Company. We may issue rights independently

or together with other securities. Rights sold with other securities as a unit may be attached to or separate from the other securities

and may be (but shall not be required to be) publicly-listed securities.

Units. We

may issue units representing any combination of common stock, preferred stock, debt securities and/or warrants from time to time. The

units may be issued under one or more unit agreements. In this prospectus, we have summarized certain general features of the units.

Prospectus Supplement

We will describe the terms of any such

offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in

this prospectus. Such prospectus supplement will contain the following information about the offered securities:

| • | offering price, underwriting discounts and commissions

or agency fees, and our net proceeds; |

| • | any market listing and trading symbol; |

| • | names of lead or managing underwriters or agents and description

of underwriting or agency arrangements; and |

| • | the specific terms of the offered securities. |

This prospectus may

not be used to offer or sell securities without a prospectus supplement which includes a description of the method and terms of

this offering.

RISK FACTORS

Except for the historical

information contained in this prospectus or incorporated by reference, this prospectus (and the information incorporated by reference

in this prospectus) contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially

from those discussed here or incorporated by reference. Factors that could cause or contribute to such differences include, but

are not limited to, those discussed in the section entitled “Risk Factors” contained under Item 1A of Part I of our

most recent annual report on Form 10-K, and under “Risk Factors” under Item 1A of Part II of our subsequent quarterly

reports on Form 10-Q, as the same may be amended, supplemented or superseded from time to time by our subsequent filings and reports

under the Securities Exchange Act of 1934, as amended, or the Exchange Act, each of which are incorporated by reference in this

prospectus. For more information, see “Information Incorporated by Reference.”

Investing in our securities

involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading “Risk

Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings

in the other documents that are incorporated by reference into this prospectus, before deciding whether to purchase any of the

securities being registered pursuant to the registration statement of which this prospectus is a part. Each of the risk factors

could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment

in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment. Moreover, the

risks described are not the only ones that we face. Additional risks not presently known to us or that we currently believe are

immaterial may also significantly impair our business operations.

USE OF PROCEEDS

Unless otherwise indicated

in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities offered in the prospectus

and any prospectus supplement for general corporate purposes. We may also use a portion of the net proceeds to acquire or invest

in businesses and assets that are complementary to our own, although we have no current plans, commitments or agreements with respect

to any acquisitions as of the date of this prospectus. Pending the uses described above, we intend to invest the net proceeds in

short-term, interest bearing, investment-grade securities.

DETERMINATION OF OFFERING PRICE

Our Common Stock is traded on the NYSE MKT under the symbol

“MGT”. On September 23, 2015, the closing price of our common stock was $0.23.

This prospectus describes

some of the general terms that may apply to the Company Securities and the general manner in which they may be offered. The specific

terms of any Company Securities that we sell will be included in a prospectus supplement, which will contain specific information

about the terms of the Company Securities and the specific manner in which they will be offered.

DILUTION

As of September 22,

2015, we had 15,241,857 shares of common stock issued and outstanding on a fully diluted basis. This number

includes 10,296 shares of common stock issuable upon conversion of preferred stock, 36,500 unvested restricted shares, and 1,020,825

shares of common stock issuable upon the exercise of warrants.

If you invest in the

offering of Company Securities by us, your interest will be diluted to the extent of the difference between the public offering

price per share in an offering under this prospectus and the net tangible book value per share after the offering, except to the

extent proceeds are applied to the repayment of debt. We will set forth in the applicable prospectus supplement or free writing

prospectus the following information regarding any material dilution of the equity interests of investors purchasing the Company

Securities in an offering by us under this prospectus:

| • | the net tangible book value per share of our equity securities before and after the offering; and |

| • | the amount of the increase in such net tangible book value per share attributable to the cash payments

made by investors purchasing shares in the offering; and |

| • | the amount of the immediate dilution from the public offering price to such investors. |

DESCRIPTION OF CAPITAL STOCK

We have authorized

capital stock consisting of 75,000,000 shares of common stock, $0.001 par value per share and 10,000,000 shares of preferred stock,

$0.001 par value per share (“Preferred Stock”). As of the date of this prospectus, we have 14,210,736 shares

of common stock outstanding and 10, 296 shares of Preferred Stock outstanding,

consisting of 10, 296 shares of 6% Series A Cumulative Convertible Preferred Stock.

The following description

of our capital stock is a summary only and is subject to applicable provisions of the Delaware Revised Statutes, and our Certificate

of Incorporation and Bylaws, each as amended from time to time. You should refer to, and read this summary together with, our

Certificate of Incorporation and Bylaws, each as amended from time to time, to review all of the terms of our capital stock. Our

Certificate of Incorporation and amendments thereto are incorporated by reference as exhibits to the registration statement of

which this prospectus is a part and other reports incorporated by reference herein.

Common Stock

Each holder of record

of Common Stock shall have the right to one vote for each share of Common Stock registered in the holder’s name on the books

of the corporation on all matters submitted to a vote of stockholders except as the right to exercise such vote may be limited

by the provisions of this Certificate of Incorporation or of any class or series of Preferred Stock established hereunder. The

holders of Common Stock shall be entitled to such dividends as may be declared by the Board of Directors from time to time, provided

that required dividends, if any, on Preferred Stock have been paid or provided for. In the event of the liquidation, dissolution,

or winding up, whether voluntary or involuntary, of the corporation, the assets and funds of the corporation available for distribution

to stockholders, and remaining after the payment to holders of Preferred Stock of the amounts, if any, to which they are entitled,

shall be divided and paid to the holders of Common Stock according to their respective shares.

Our common stock is

listed and traded on the NYSE MKT exchange under the symbol “MGT”

Preferred Stock

The shares of Preferred

Stock may be divided and issued from time to time in one or more classes and/or series within any class or classes as may be determined

by the Board of Directors of the corporation, each such class or series to be distinctly designated and to consist of the number

of shares determined by the Board of Directors. The Board of Directors of the corporation is hereby expressly vested with authority

to adopt resolutions with respect to any unissued and/or treasury shares of Preferred Stock to issue the shares, to fix the number

of shares constituting any class or series, and to provide for the voting powers, designations, preferences and relative, participating,

optional or other special rights, qualifications, limitations or restrictions, if any, of Preferred Stock, and each class or series

thereof, in each case without approval of the stockholders. The authority of the Board of Directors with respect to each class

or series of Preferred Stock shall include, without limiting the generality of the foregoing, the determination of the following:

(1) The number of shares constituting

that class or series and the distinctive designation of that class or series;

(2) The dividend rate on the

shares of that class or series, whether dividends shall be cumulative, and, if so, from which date or dates;

(3) Whether that class or series

shall have voting rights, in addition to any voting rights provided by law, and, if so, the terms of such voting rights;

(4) Whether that class or series

shall have conversion privileges (including rights to convert such class or series into the capital stock of the corporation or

any other entity) and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion

rate in such events as the Board of Directors shall determine;

(5) Whether or not shares of

that class or series shall be redeemable, and if so, the terms and conditions of such redemption (including any sinking fund provisions),

the date or dates upon or after which they shall be redeemable, and the amount per share payable in case of redemption, which amount

may vary under different conditions;

(6) The rights of the shares

of that class or series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation; and

(7) Any other relative rights,

preferences and limitations of that class or series as may be permitted or required by law.

The number of shares,

voting powers, designations, preferences and relative, participating, optional or other special rights, qualifications, limitations

or restrictions, if any, of any class or series of Preferred Stock which may be designated by the Board of Directors may differ

from those of any and all other class or series at any time outstanding.

6% Series A Cumulative Convertible Preferred Stock

As of September 22,

2015, the Company has 1,500,000 shares of 6% Series A Cumulative Convertible Preferred Stock authorized and 10, 296 shares outstanding.

Each share is convertible at the option of the holder into one share of common stock, subject to a 9.99% beneficial ownership ceiling

for each holder’s ownership of common stock at any one time. The conversion rate of the 6% Series A Cumulative Convertible

Preferred Stock is subject to adjustment in the case of combination or subdivision of stock or in the event of the granting of

any stock appreciation rights, phantom stock rights or other rights with equity features. These preferred shares have such other

preferences, rights and limitations as are set forth in the Certificate of Designations of 6% Series A Cumulative Convertible Preferred

Stock filed with the Secretary of State of the State of Delaware on October 26, 2012.

Warrants

In connection

with a May 11, 2012 Contribution and Sale Agreement, we issued warrants to purchase 350,000 shares of the Company’s

Common Stock at an exercise price of $4.00 per share, exercisable at any time for four years after May 24, 2012. The Warrant

exercise price is subject to adjustment in the case of dividends payment, subdivision, reclassification or combination of the

Company’s Common Stock and when shares are granted or issued pursuant to the exercise of options to executive officers

of the Company pursuant to an equity incentive plan of the Company. On May 20, 2013, the Company modified the warrants to

eliminate the anti–dilution provision therein. The Company paid the holder $25,000 in cash as consideration for the

modification. As of September 22, 2015, the Company had 403,029 of these warrants outstanding.

In connection with

a June 1, 2012 transaction, we issued a warrant to purchase up to 875,000 shares of Common Stock at an exercise price of $3.00

per share pursuant. The warrant is exercisable at the option of the holder at a $3.00 per share exercise price at any time for

five years after June 1, 2012 or, in certain circumstances, a cashless exercise and the Company can require exercise if the Weighted

Average Price of the Company’s Common Stock equals or exceeds 250% of the exercise price for no less than twenty (20) trading

days during any thirty (30) consecutive trading day period occurring following the issuance date, as such terms are defined in

the warrant. The warrant exercise price is subject to adjustment in the case of combination or subdivision of stock or in

the event of the granting of any stock appreciation rights, phantom stock rights or other rights with equity features. The warrants

include a provision whereby the Investors are not eligible to exercise any portion of the warrants that would result in them together

with their affiliates becoming a beneficial owner of more than 9.99% of the Company's common stock. As of September 22, 2015, the Company had 517,796 of these warrants outstanding.

In connection

with an October 22, 2012 offering, we issued 1,380,362 units, at $3.26 per unit, each unit consisting of one share of 6%

Series A Cumulative Convertible Preferred Stock and a five-year warrant to purchase up to such number of shares of Common

Stock as shall be equal to 200% of the number of shares of Common Stock issuable upon conversion of the 6% Series A

Cumulative Convertible Preferred Stock purchased by the investor in the offering at a per share exercise price of $3.85. As

of September 22, 2015, none of these warrants were outstanding.

On April 24,

2014, the Company, through its subsidiary MGT Sports, entered into a six month Amended and Restated Consulting Agreement with

DFS Consultants LLC (“DFS”), giving effect as of March 5, 2014. In exchange for expert promotional and site

design services, the Company issued DFS warrants to purchase 100,000 shares of common stock at an exercise price of $3.75

per share, exercisable at any time for four years after April 24, 2014. As of September 22, 2015, all of of these warrants were outstanding.

Stock Options and Restricted Shares

Stock Incentive Plan

The Company’s

board of directors established the 2012 Stock Incentive Plan (the “Plan”) on April 15, 2012, and the Company’s

shareholders ratified the Plan at the annual meeting of the Company’s stockholders on May 30, 2012. The Plan is administered

by the board of directors or the Compensation Committee of the board of directors, which determines the individuals to whom awards

shall be granted as well as the type, terms and conditions of each award, the option price and the duration of each award. At

the annual meeting of the stockholders of MGT held on September 27, 2013, stockholders approved an amendment to the Plan (the “Amended

and Restated Plan”) to add a reload feature and to increase the amount of shares of common stock that may be issued under

the Amended and Restated Plan to 1,335,000 shares from 415,000 shares.

Options granted under

the Plan vest as determined by the Company’s Compensation and Nominations Committee and expire over varying terms, but not

more than seven years from date of grant. In the case of an Incentive Stock Option that is granted to a 10% shareholder on the

date of grant, such Option shall not be exercisable after the expiration of five years from the date of grant. No option grants

were issued during the three and six months ended June 30, 2015, and 2014. As of September 22, 2015, the Company has options to

purchase 0 shares issued and outstanding.

Restricted

Shares – Directors, Officers, Employees and Non-Employees

As of September 22,

2015, the Company has 976,691 restricted shares issued and outstanding. The restricted shares are valued using the closing market

price on the date of grant, of which the share–based compensation expense is recognized over their vesting period. The unvested

shares are subject to forfeiture if the applicable recipient is not a director, officer and/or employee of the Company at the time

the restricted shares are to vest.

PLAN OF DISTRIBUTION

We may sell the securities

offered by this prospectus in any one or more of the following ways from time to time:

| • | directly to investors, including through a specific bidding, auction or other process or in privately

negotiated transactions; |

| • | to investors through agents; |

| • | to or through brokers or dealers; |

| • | to the public through underwriting syndicates led by one or more managing underwriters; |

| • | to one or more underwriters acting alone for resale to investors or to the public; |

| • | through a block trade in which the broker or dealer engaged to handle the block trade will attempt

to sell the securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | through agents on a best-efforts basis; and |

| • | through a combination of any such methods of sale. |

We may also sell the

securities offered by this prospectus in "at the market offerings" within the meaning of Rule 415(a)(4) of the Securities

Act, to or through a market maker or into an existing trading market, on an exchange or otherwise.

Sales

may be effected in transactions:

| • | on any national securities exchange or quotation service

on which the securities may be listed or quoted at the time of sale, including the NYSE MKT in the case of shares of our common

stock; |

| • | in the over-the-counter market; |

| • | in transactions otherwise than on such exchanges or services or in the over-the-counter market; |

| • | through the writing of options; or |

| • | through the settlement of short sales. |

| • | a combination of any such methods of sale; and |

| • | any other method permitted pursuant to applicable law. |

We will provide in

the applicable prospectus supplement the terms of the offering and the method of distribution and will identify any firms acting

as underwriters, dealers or agents in connection with the offering, including:

| • | the name or names of any underwriters, dealers or agents; |

| • | the amount of securities underwritten; |

| • | the purchase price of the securities and the proceeds to us from the

sale; |

| • | any over-allotment options under which underwriters may purchase additional

securities from us; |

| • | any underwriting discounts and other items constituting compensation

to underwriters, dealers or agents; |

| • | any public offering price; |

| • | any discounts or concessions allowed or reallowed or paid to dealers; |

| • | any material relationships between the underwriters and the Company;

and |

| • | any securities exchange or market on which the securities offered

in the prospectus supplement may be listed. |

We have not entered

into any agreements, understandings or arrangements with any underwriters, broker-dealers or agents regarding the sale of any securities

covered by this prospectus.

Any underwritten offering

may be on a best efforts or a firm commitment basis. Underwriters, dealers and agents participating in the securities distribution

may be deemed to be underwriters, and any discounts and commissions they receive and any profit they realize on the resale of the

securities may be deemed to be underwriting discounts and commissions under the Securities Act. Underwriters and their controlling

persons, dealers and agents may be entitled, under agreements entered into with us, to indemnification against and contribution

toward specific civil liabilities, including liabilities under the Securities Act.

The distribution of

the securities may be effected from time to time in one or more transactions at a fixed price or prices, which may be changed,

at varying prices determined at the time of sale, at prevailing market prices at the time of sale, at negotiated prices or at prices

determined as the applicable prospectus supplement specifies.

In connection with

the sale of the securities, underwriters, dealers or agents may be deemed to have received compensation from us in the form of

underwriting discounts or commissions and also may receive commissions from securities purchasers for whom they may act as agent.

Underwriters may sell the securities to or through dealers, and the dealers may receive compensation in the form of discounts,

concessions or commissions from the underwriters or commissions from the purchasers for whom they may act as agent.

Unless otherwise specified

in the related prospectus supplement, each series of securities will be a new issue with no established trading market, other than

shares of common stock of the Company, which are listed on the NYSE MKT. Any common stock sold pursuant to a prospectus supplement

will be listed on the NYSE MKT, subject to official notice of issuance. We may elect to list any series of debt securities or preferred

stock on an exchange, but we are not obligated to do so. It is possible that one or more underwriters may make a market in the

securities, but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice.

No assurance can be given as to the liquidity of, or the trading market for, any offered securities.

In connection with

an offering, the underwriters may purchase and sell securities in the open market. These transactions may include short sales,

stabilizing transactions and purchases to cover positions created by short sales. Short sales involve the sale by the underwriters

of a greater number of securities than they are required to purchase in an offering. Stabilizing transactions consist of bids or

purchases made for the purpose of preventing or retarding a decline in the market price of the securities while an offering is

in progress. The underwriters also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters

a portion of the underwriting discount received by it because the underwriters have repurchased securities sold by or for the account

of that underwriter in stabilizing or short-covering transactions. These activities by the underwriters may stabilize, maintain

or otherwise affect the market price of the securities. As a result, the price of the securities may be higher than the price that

otherwise might exist in the open market. If these activities are commenced, they may be discontinued by the underwriters at any

time. Underwriters may engage in overallotment. If any underwriters create a short position in the securities in an offering in

which they sell more securities than are set forth on the cover page of the applicable prospectus supplement, the underwriters

may reduce that short position by purchasing the securities in the open market.

Underwriters, dealers

or agents that participate in the offer of securities, or their affiliates or associates, may have engaged or engage in transactions

with and perform services for us or our affiliates in the ordinary course of business for which they may have received or receive

customary fees and reimbursement of expenses.

We may enter into

derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated

transactions. If the applicable prospectus supplement so indicates, in connection with any derivative transaction, the third parties

may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions.

If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any

related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related

open borrowings of stock. The third party in such sale transactions may be deemed an underwriter and, if not identified in this

prospectus, may be identified in the applicable prospectus supplement or a post-effective amendment to the registration statement

of which this prospectus is a part. In addition, we may otherwise loan or pledge securities to a financial institution or other

third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may

transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

LEGAL MATTERS

Unless otherwise indicated

in the applicable prospectus supplement, the validity of the securities being offered herein has been passed upon for us by Sichenzia

Ross Friedman Ference LLP. Legal counsel to any underwriters may pass upon legal matters for such underwriters.

EXPERTS

The consolidated balance

sheets of MGT Capital Investments, Inc. and subsidiaries as of December 31, 2014 and 2013, and the related consolidated statements

of operations, redeemable preferred stock and changes in stockholders’ equity and cash flows for the years then ended were

audited by Marcum LLP, an independent registered public accounting firm, as stated in their report which is incorporated herein

by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly,

and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our

SEC filings are available to the public over the Internet at the SEC’s web site at www.sec.gov and on the “Shareholder

Information,” “SEC Filings” page of our website at www.mgtci.com. Information on our web site is not part of

this prospectus, and we do not desire to incorporate by reference such information herein. You may also read and copy any document

we file with the SEC at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549. You can also obtain

copies of the documents upon the payment of a duplicating fee to the SEC. Please call the SEC at 1-800-SEC-0330 for further information

on the operation of the Public Reference Room. The SEC maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically with the SEC like us. Our SEC filings are also available

to the public from the SEC’s website at http://www.sec.gov.

This prospectus is

part of the registration statement and does not contain all of the information included in the registration statement. Whenever

a reference is made in this prospectus to any of our contracts or other documents, the reference may not be complete and, for a

copy of the contract or document, you should refer to the exhibits that are a part of the registration statement.

This prospectus omits

some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information

and exhibits included in the registration statement for further information about us and the securities we are offering. Statements

in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with

the SEC are not intended to be comprehensive and are qualified by reference to these filings and documents. You should review the

complete document to evaluate these statements.

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

The Securities and

Exchange Commission allows us to “incorporate by reference” into this prospectus the information we file with it, which

means that we can disclose important information to you by referring you to those documents. The information incorporated by reference

is considered to be part of this prospectus from the date on which we file that document. Any reports filed by us with the SEC

(i) on or after the date of filing of the registration statement and (ii) on or after the date of this prospectus and before the

termination of the offering of the securities by means of this prospectus will automatically update and, where applicable, supersede

information contained in this prospectus or incorporated by reference into this prospectus.

We incorporate by

reference the documents listed below, all filings filed by us pursuant to the Exchange Act after the date of the registration statement

of which this prospectus forms a part prior to effectiveness of such registration statement, and any future filings we make with

the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, prior to the time that all

securities covered by this prospectus have been sold; provided, however, that we are not incorporating any information furnished

under either Item 2.02 or Item 7.01 of any current report on Form 8-K:

| • | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed with the SEC

on April 15, 2015; |

| • | Our Quarterly Reports on Form 10-Q for the quarterly periods ended (a) March 31, 2015, filed with

the SEC on May 15, 2015 and (b) June 30, 2015, filed with the SEC on August 14, 2015; |

| • | Our Current Reports on Form 8-K filed with the SEC on September 11, 2015; September 10, 2015, August

17, 2015, August 14, 2015; July 22, 2015; July 21, 2015; July 6, 2015; June 18, 2015; June 12, 2015; and May 18, 2015; |

| • | The description of our common stock contained in our registration statement on (a) Form S-3 and

Form S-3/A filed with the SEC on September 25, 2012, September 21, 2012, July 31, 2012 and June 22, 2012. (b) Forms S-1 and S-1/A

filed with the SEC on October 3, 2011, November 10, 2011, November 14, 2011, and November 16, 2011; |

| • | All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act after the date of this prospectus and prior to the termination of the offering of our common stock hereunder; and |

| • | All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act, other than any information pursuant to Item 2.02 or Item 7.01 of Form 8-K, after the date of the initial registration statement

and prior to the effectiveness of the registration statement of which this prospectus forms a part shall be deemed to be incorporated

by reference in this prospectus and to be a part of this prospectus from the date they are filed. |

These documents contain important information about us, our

business and our financial condition. You may request a copy of these filings, at no cost, by writing or telephoning us at:

MGT Capital Investments, Inc.

500 Mamaroneck Avenue

Suite 204

Harrison, NY 10528

Phone: (914) 630-7431

All documents filed

by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Act or the Exchange Act, excluding any information in those

documents that are deemed by the rules of the SEC to be furnished but not filed, after the date of this filing and before the termination

of this offering shall be deemed to be incorporated in this prospectus and to be a part hereof from the date of the filing of such

document. Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for

all purposes to the extent that a statement contained in this prospectus, or in any other subsequently filed document which is

also incorporated or deemed to be incorporated by reference, modifies or supersedes such statement. Any statement so modified or

superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. You will be deemed

to have notice of all information incorporated by reference in this prospectus as if that information was included in this prospectus.

We maintain an Internet

website at www.mgtci.com where the incorporated reports listed above can be accessed. Neither this website nor the information

on this website is included or incorporated in, or is a part of, this prospectus.

MGT Capital Investments, Inc.

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

PROSPECTUS

You should rely only on the information

contained in this prospectus. No dealer, salesperson or other person is authorized to give information that is not contained in

this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted. The information contained in this prospectus is correct only as of the date of this prospectus,

regardless of the time of the delivery of this prospectus or the sale of these securities.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION.

The

following table sets forth expenses payable by the Company in connection with the issuance and distribution of the securities being

registered. All the amounts shown are estimates, except for the SEC registration fee:

| Description | |

Amount to be Paid | |

| | |

| |

| Filing Fee - Securities and Exchange Commission | |

$ | 1,143.82 | |

| Attorney's fees and expenses | |

$ | | * |

| Accountant's fees and expenses | |

$ | | * |

| Printing and engraving expenses | |

$ | | * |

| | |

| | * |

| Total | |

$ | | * |

* Estimated

expenses are not presently known. The foregoing sets forth the general categories of expenses that we anticipate we will incur

in connection with the offering of securities under this registration statement. An estimate of the aggregate expenses in connection

with the issuance and distribution of the securities being offered will be included in the applicable prospectus supplement.

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Article NINTH of our

Restated Certificate of Incorporation states: To the fullest extent that the General Corporation Law of the State of Delaware as

it exists on the date hereof or as it may hereafter be amended permits the limitation or elimination of the liability of directors,

no director of the Corporation shall be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary

duty as a director. No amendment to this Certificate of Incorporation, directly or indirectly by merger, consolidation or otherwise,

having the effect of amending or repealing any of the provisions of this ARTICLE NINTH shall apply to, or have any effect on the

liability or alleged liability of, any director of the Corporation for or with respect to any acts or omissions of such director

occurring prior to such amendment or repeal, unless such amendment shall have the effect of further limiting or eliminating such

liability.

Article IX of our

Amended and Restated By-Laws states: The Corporation shall, to the fullest extent permitted by applicable law as then in effect,

indemnify any person (the “Indemnitee”) who was or is involved in any manner (including, without limitation, as a party

or a witness) or was or is threatened to be made so involved in any threatened, pending or completed investigation, claim,

action, suit or proceeding, whether civil, criminal, administrative or investigative (including, without limitation, any action,

suit or proceeding by or in the right of the Corporation to procure a judgment in its favor) (a “Proceeding”) by reason

of the fact that he is or was a director or officer of the Corporation, or is or was serving at the request of the Corporation

as a director or officer of another corporation or of a partnership, joint venture, trust or other enterprise (including, without

limitation, service with respect to any employee benefit plan), whether the basis of any such Proceeding is alleged action in an

official capacity as a director or officer or in any other capacity while serving as a director or officer, against all expenses,

liability and loss (including, without limitation, attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and

amounts paid or to be paid in settlement) actually and reasonably incurred by him in connection with such Proceeding. The right

to indemnification conferred in this Article IX shall include the right to receive payment in advance of any expenses incurred

by the Indemnitee in connection with such Proceeding, consistent with applicable law as then in effect. All right to indemnification

conferred in this Article IX, including such right to advance payments and the evidentiary, procedural and other provisions

of this Article IX, shall be a contract right. The Corporation may, by action of its Board of Directors, provide indemnification

for employees, agents, attorneys and representatives of the Corporation with up to the same scope and extent as provided for officers

and directors.

Section 145 of the

Delaware General Corporation Law authorizes us to indemnify any director or officer under prescribed circumstances and subject

to certain limitations against certain costs and expenses, including attorneys’ fees actually and reasonably incurred in

connection with any action, suit or proceedings, whether civil, criminal, administrative or investigative, to which such person

is a party by reason of being one of our directors or officers if it is determined that the person acted in accordance with the

applicable standard of conduct set forth in such statutory provisions.

Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of MGT

pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the Securities and Exchange Commission,

such indemnification is against public policy as expressed in such Act and is, therefore, unenforceable.

ITEM 16. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

The Exhibit Index beginning on page 20

is hereby incorporated by reference.

ITEM 17. UNDERTAKINGS.

The undersigned registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement to:

(i) Include

any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) Reflect

in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the

registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar

value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the

aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth

in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) Include

any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement;

provided,

however, that paragraphs (1)(i), (1)(ii) and (i)(iii) above do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to sections

13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are incorporated by reference

in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) of this chapter that is part

of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4) That,

for the purpose of determining liability under the Securities Act to any purchaser:

(A) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of

the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of

securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution

of the securities:

The undersigned registrant

undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless

of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser

by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered

to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to

by the undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

The undersigned registrant

hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the

registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

The undersigned registrant

hereby undertakes to deliver or cause to be delivered with the prospectus to each person to whom the prospectus is sent or given,

the latest annual report to security holders that is incorporated by reference in the prospectus and furnished pursuant to and

meeting the requirements of Rule 14a-3 or Rule 14c-3 under the Securities Exchange Act of 1934; and, where interim financial information

required to be presented by Article 3 of Regulation S-X is not set forth in the prospectus, to deliver, or cause to be delivered

to each person to whom the prospectus is sent or given, the latest quarterly report that is specifically incorporated by reference

in the prospectus to provide such interim financial information.

Insofar as indemnification

for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant

pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid

by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed

by the final adjudication of such issue.

The undersigned registrant

hereby undertakes to file an application for the purpose of determining the eligibility of the trustee to act under subsection

(a) of section 310 of the Trust Indenture Act (the "Act") in accordance with the rules and regulations prescribed by

the Commission under section 305(b)(2) of the Act.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933,

the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3

and has duly caused this Registration Statement to be signed on its behalf by the undersigned thereunto duly authorized on September