UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): December 9, 2015

DELTA APPAREL, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Georgia | |

| (State or Other Jurisdiction of Incorporation) | |

| | |

1-15583 | | 58-2508794 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

322 South Main Street, Greenville, South Carolina | | 29601 |

(Address of principal executive offices) | | (Zip Code) |

|

| | |

| (864) 232-5200 | |

(Registrant's Telephone Number Including Area Code) |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On December 9, 2015, Delta Apparel, Inc. (the "Company") issued a press release containing a discussion of the Company's preliminary results of operations for the quarter and fiscal year ended October 3, 2015.

A copy of the press release is attached hereto as Exhibit 99.1.

Item 8.01 Other Events

On December 9, 2015, the Company issued a press release announcing that the Company's Board of Directors has authorized an increase in its share repurchase program to repurchase an additional $10 million of its common stock in open market transactions. The Company intends to continue to make open-market stock repurchases pursuant to SEC Rule 10b-18, with the timing and number of shares repurchased depending upon a variety of factors such as price, corporate and regulatory requirements, alternative investment opportunities and other market and economic conditions, and with share repurchases subject to suspension or discontinuation.

A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release dated December 9, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | DELTA APPAREL, INC. |

| | |

| | |

Date: | December 9, 2015 | /s/ Deborah H. Merrill |

| | Deborah H. Merrill |

| | Vice President, Chief Financial Officer and Treasurer |

| | |

|

| | | |

| | Company Contact: | Deborah Merrill |

| | Chief Financial Officer |

| | (864) 232-5200 x6620 |

| | |

| Investor Relations Contact: | Sally Wallick, CFA |

| | (404) 806-1398 |

| | investor.relations@deltaapparel.com |

Delta Apparel Share Repurchase Authorization Increased

Action Driven by FY15 2nd Half Growth Trend and Fiscal 2016 Expectations

GREENVILLE, SC – December 9, 2015—Delta Apparel, Inc. (NYSE MKT: DLA) today reported that its Board of Directors has increased the Company’s share repurchase authorization by an additional $10 million, bringing the total amount authorized to date under the program to $40 million. The Board based its decision upon Delta Apparel’s strong return to growth, which began in the second quarter of fiscal 2015 and continued through the end of the fiscal year. The final two quarters of fiscal 2015 produced sequentially strong revenue growth along with solid earnings performance.

“We will be reporting earnings for our fiscal 2015 fourth quarter and year-end on Monday, December 14,” commented Delta Apparel’s Chairman and Chief Executive Officer, Robert W. Humphreys, “and we believe it will be apparent that we are moving into fiscal 2016 with the Company positioned to further improve profitability despite tepid demand in some apparel market segments. Our balance sheet improved during the past year and continues to be strong. We ended fiscal 2015 with lower inventories and expect to increase our manufacturing output to meet demand for fiscal 2016. During fiscal 2015 we used our strong cash flow to fund our capital expenditures, repurchase our stock and reduce our debt by almost $28 million. It is the opinion of our Board that the Company has a great deal of intrinsic value that remains unrecognized by investors, resulting in our shares currently being undervalued. We do not expect the open-market repurchase of our shares to hamper our growth strategies, and under current conditions represents one of the best investments we believe we can make.”

The Company’s fiscal 2015 fourth quarter sales increased almost 13% compared to the prior year quarter when adjusted for the sale of The Game business, bringing sales for the full fiscal year to $449.1 million. Earnings are expected to be in the range of $0.51 to $0.53 per diluted share in the fiscal 2015 fourth quarter, which should bring full year fiscal 2015 earnings to within a range of $0.98 to $1.00 per diluted share.

Since resuming its stock repurchase program in June 2015, the Company has repurchased 200,160 shares on the open market at a cost of $3.1 million, or an average price of $15.40 per share. With this $10 million increase in share repurchase authorization, the Company currently has approximately $11.7 million remaining authorized for share repurchases. The Company intends to continue to make open-market stock repurchases pursuant to SEC Rule 10b-18, with the timing and number of shares repurchased depending upon a variety of factors such as price, corporate and regulatory requirements, alternative investment opportunities and other market and economic conditions, and with share repurchases subject to suspension or discontinuation.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries, M. J. Soffe, LLC, Junkfood Clothing Company, Salt Life, LLC and Art Gun, LLC, is an international design, marketing, manufacturing, and sourcing company that features a diverse portfolio of lifestyle basic and branded activewear apparel and headwear. The Company specializes in selling casual and athletic products across distribution tiers, including specialty stores, boutiques, department stores, mid-tier and mass chains, and the U.S. military. The Company’s products are made available direct-to-consumer on its websites at www.soffe.com, www.junkfoodclothing.com, www.saltlife.com and www.deltaapparel.com. The Company's operations are located throughout the United States, Honduras, El Salvador, and Mexico, and it employs approximately 7,400 people worldwide. Additional information about the Company is available at www.deltaapparelinc.com.

Cautionary Note Regarding Forward Looking Statements

Statements and other information in this press release that are not reported financial results or other historical information are forward-looking statements subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These are based on our expectations and are necessarily dependent upon assumptions, estimates and data that we believe are reasonable and accurate but may be incorrect, incomplete or imprecise. Forward-looking statements are also subject to a number of business risks and uncertainties, any of which could cause actual results to differ materially from those set forth in or implied by the forward-looking statements. The risks and uncertainties include, among others, the volatility and uncertainty of cotton and other raw material prices; the general U.S. and international economic conditions; deterioration in the financial condition of our customers and suppliers and changes in the operations and strategies of our customers and suppliers; the competitive conditions in the apparel and textile industries; our ability to predict or react to changing consumer preferences or trends; pricing pressures and the implementation of cost reduction strategies; changes in the economic, political and social stability of our offshore locations; our ability to retain key management; the effect of unseasonable weather conditions on purchases of our products; significant changes in our effective tax rate; restrictions on our ability to borrow capital or service our indebtedness; interest rate fluctuations increasing our obligations under our variable rate indebtedness; the ability to raise additional capital; the ability to grow, achieve synergies and realize the expected profitability of recent acquisitions; the volatility and uncertainty of energy and fuel prices; material disruptions in our information systems related to our business operations; data security or privacy breaches; significant interruptions within our distribution network; changes in or our ability to comply with safety, health and environmental regulations; significant litigation in either domestic or international jurisdictions; the ability to protect our trademarks and other intellectual property; the ability to obtain and renew our significant license agreements; the impairment of acquired intangible assets; changes in ecommerce laws and regulations; changes to international trade regulations; changes in employment laws or regulations or our relationship with our employees; cost increases and reduction in future profitability due to recent healthcare legislation; foreign currency exchange rate fluctuations; violations of manufacturing or employee safety

standards, labor laws, or unethical business practices by our suppliers and independent contractors; the illiquidity of our shares; price volatility in our shares and the general volatility of the stock market; and the costs required to comply with the regulatory landscape regarding public company governance and disclosure; and other risks described from time to time in our reports filed with the Securities and Exchange Commission. Accordingly, any forward-looking statements do not purport to be predictions of future events or circumstances and may not be realized. Further, any forward-looking statements are made only as of the date of this press release and we do not undertake publicly to update or revise the forward-looking statements even if it becomes clear that any projected results will not be realized.

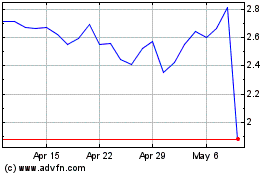

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Delta Apparel (AMEX:DLA)

Historical Stock Chart

From Apr 2023 to Apr 2024