UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

Commission file number:

333-103780

Paradigm Oil and Gas, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

33-1037546

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

2701 Gulf Blvd.

|

|

|

|

Indian Rocks Beach, FL

|

|

33785

|

|

(Address of principal executive offices)

|

|

(Postal Code)

|

Registrant’s telephone number, including area code:

(727) 595-8101

Securities to be registered pursuant to Section 12(b) of the Act: None

Name of each exchange on which each class is to be registered: None

Securities to be registered pursuant to Section 12(g) of the Act:

$0.0001 par value common stock

Title of Class

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filed,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ]

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

(Do not check if a smaller reporting company)

Table of Contents

|

Item 1.

|

|

Description of Business

|

4

|

|

|

|

|

|

|

Item 1A.

|

|

Risk Factors

|

8

|

|

|

|

|

|

|

Item 2.

|

|

Management's Discussion And Analysis of Financial Conditions And Plan of Operation

|

15

|

|

|

|

|

|

|

Item 3.

|

|

Description of Properties

|

20

|

|

|

|

|

|

|

Item 4.

|

|

Security Ownership of Certain Beneficial Owners and Management

|

24

|

|

|

|

|

|

|

Item 5.

|

|

Directors, Executive Officers, Promoters and Control Persons

|

25

|

|

|

|

|

|

|

Item 6.

|

|

Executive Compensation

|

27

|

|

|

|

|

|

|

Item 7.

|

|

Certain Relationships and Related Transactions, and Director Independence

|

29

|

|

|

|

|

|

|

Item 8.

|

|

Legal Proceedings

|

29

|

|

|

|

|

|

|

Item 9.

|

|

Market Price of Registrant’s Common Equity and Related Stockholder Matters

|

29

|

|

|

|

|

|

|

Item 10.

|

|

Recent Sales of Unregistered Securities

|

30

|

|

|

|

|

|

|

Item 11.

|

|

Description of Registrant’s Securities to be Registered

|

30

|

|

|

|

|

|

|

Item 12.

|

|

Indemnification of Directors and Officers

|

31

|

|

|

|

|

|

|

Item 13.

|

|

Financial Statements and Supplementary Data

|

33

|

|

|

|

|

|

|

Item 14.

|

|

Changes and Disagreements with Accountants on Accounting and Financial Disclosure

|

34

|

|

|

|

|

|

|

Item 15.

|

|

Financial Statements and Exhibits

|

35

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). These forward-looking statements are generally located in the material set forth under the headings “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” and “Properties” but may be found in other locations as well. These forward-looking statements are subject to risks and uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results, performance or achievements expressed or implied by the forward-looking statements. You should not unduly rely on these statements. Factors, risks, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements include, among others,

|

·

|

our growth strategies;

|

|

|

|

|

·

|

anticipated trends in our business;

|

|

|

|

|

·

|

our ability to make or integrate acquisitions; our liquidity and ability to finance our exploration, acquisition and development strategies;

|

|

|

|

|

·

|

market conditions in the oil and gas industry; the timing, cost and procedure for proposed acquisitions;

|

|

|

|

|

·

|

the impact of government regulation;

|

|

|

|

|

·

|

estimates regarding future net revenues from oil and natural gas reserves and the present value thereof; planned capital expenditures (including the amount and nature thereof);

|

|

|

|

|

·

|

increases in oil and gas production; the number of wells we anticipate drilling in the future;

|

|

|

|

|

·

|

estimates, plans and projections relating to acquired properties; the number of potential drilling locations; and

|

|

|

|

|

·

|

our financial position, business strategy and other plans and objectives for future operations.

|

We identify forward-looking statements by use of terms such as “may,” “will,” “expect,” “anticipate,” “estimate,” “hope,” “plan,” “believe,” “predict,” “envision,” “intend,” “will,” “continue,” “potential,” “should,” “confident,” “could” and similar words and expressions, although some forward-looking statements may be expressed differently. You should be aware that our actual results could differ materially from those contained in the forward-looking statements. You should consider carefully the statements under the “Risk Factors” section of this report and other sections of this report which describe factors that could cause our actual results to differ from those set forth in the forward-looking statements, and the following factors:

|

·

|

the possibility that our acquisitions may involve unexpected costs;

|

|

|

|

|

·

|

the volatility in commodity prices for oil and gas;

|

|

|

|

|

·

|

the accuracy of internally estimated proved reserves;

|

|

|

|

|

·

|

the presence or recoverability of estimated oil and gas reserves; the ability to replace oil and gas reserves;

|

|

|

|

|

·

|

the availability and costs of drilling rigs and other oilfield services;

|

|

|

|

|

·

|

environmental risks; exploration and development risks;

|

|

|

|

|

·

|

competition;

|

|

|

|

|

·

|

the inability to realize expected value from acquisitions;

|

|

|

|

|

·

|

the ability of our management team to execute its plans to meet its goals; and

|

|

|

|

|

·

|

other economic, competitive, governmental, legislative, regulatory, geopolitical and technological factors that may negatively impact our businesses, operations and pricing.

|

Forward-looking statements speak only as of the date of this report or the date of any document incorporated by reference in this report. Except to the extent required by applicable law or regulation, we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

ITEM 1. BUSINESS

History and Organization

We were incorporated as Paradigm Enterprises, Inc. in the state of Nevada on July 15, 2002. On February 7, 2005 we changed our name to Paradigm Oil And Gas, Inc. On January 28, 2010, Paradigm Oil & Gas Inc. entered into a Share exchange agreement with the shareholders of Integrated Oil and Gas Solutions Inc. (the "Acquired Company") a Texas corporation. The Transaction was considered to be a reverse acquisition. The acquisition date now becomes the inception date of the Company.

From July, 2002 to December, 2004, we were in the business of the exploration and development of a mineral property of approximately 1,236 acres in size in south-western, British Columbia. The property was without known reserves and our program was exploratory in nature. The Board of Directors decided to abandon its interest in this mineral property on August 26, 2005.

We are now engaged in the exploration, development, acquisition and operation of oil and gas properties. Because oil and gas exploration and development requires significant capital and our assets and resources are limited, we participate in the oil and gas industry through the purchase of small interests in either producing wells or oil and gas exploration and development projects.

From January 28, 2010, the date of the reverse acquisition, the Company now holds 100% working interests in certain oil and gas leases along with certain Oil and Gas production equipment in the States of Texas, Louisiana, and Oklahoma USA., and is now engaged in the rework and development of those properties.

Overview of Our Business

We are an exploration company focused on developing North American oil and natural gas reserves. Our current focus is on the exploration of our land portfolio comprised of working interests in highly prospective acreage in the States of Texas, Louisiana, and Oklahoma USA and in the Southern Alberta Foothills area in Canada; and North Central Alberta, Canada.

We have not been involved in any bankruptcy, receivership or similar proceeding. Other than the reverse acquisition on January 28, 2010, when the acquisition date became the inception date of the Company, there has not been any material reclassification or merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of business.

OUR CURRENT BUSINESS

PETROLEUM EXPLORATION, DEVELOPMENT AND RECOVERY

Effective January 28, 2010, Paradigm Oil & Gas Inc. entered into a Share exchange agreement with the shareholders of Integrated Oil and Gas Solutions Inc. (the "Acquired Company") a Texas corporation, whereby the Company has issued 42,000,000 US$.001 Par value common shares to unrelated shareholders in exchange for their one hundred percent (100%) interest in all of the capital stock of the Acquired company. The Acquired Company was a 100% owned subsidiary of the Company until it was sold to Terry Rutter, who at the time was a senior Executive of the Company. The Company recognized a loss of $42,613 on the sale of the Acquired Company to Ms. Rutter.

The oil and gas properties were comprised of 4 leases totaling approximately nine hundred and thirty four (934) net mineral Acres, all located in the State of Texas, USA. 692 acres in Kaufman County, carry a 80% Net Revenue Interest, 40 acres located in the County of Wood, carry a 80% Net Revenue Interest, 122.37 acres located in the County of Henderson carry a 81.25% Net Revenue Interest and 80 acres in the County of Wichita carry a 75% Net Revenue Interest. Combined there are a total of 9 existing previously producing wells and available spacing to support the drilling of approximately 30 new wells in the 3800' to 9000' range and approximately 50 new wells in the 800' to 1,800' range.

On June 22, 2010 the Company's then subsidiary, Integrated Oil and Gas Solutions Inc. acquired the Corsicana lease. The cost to acquire this lease amounted to $ 20,700 for a 50% working interest in the 80% Net Revenue Interest. The lease has 9 previously producing wells and have spacing over a total of 60 acres to support the potential of 17 new wells to depths of up to 2000 feet. The Corsicana lease is located in Navarro County, Texas.

On June 25, 2010 the Company's then subsidiary, Integrated Oil and Gas Solutions Inc. acquired 2 additional Chilson leases, known as Chilson B. The cost to acquire these leases amounted to $ 17,977 for a 100% working interest in the 81% Net Revenue Interest. Combined the 2 leases have 5 previously producing wells and have spacing over a total of 154 acres to support the potential of 37 new wells to depths of up to 2000 feet. The new Chilson leases are adjacent to the existing Chilson lease the Company has which are all located in Wichita County, Texas.

Integrated Oil and Gas Solutions Inc. was a 100% owned subsidiary of the Company until it was sold to Terry Rutter, who at the time was a senior Executive of the Company. The Company recognized a loss of $42,613 on the sale of the Acquired Company.

The Company currently owns and or operates numerous properties as outlined in this Form 10 under Item 3, Properties.

Competition

The oil producing properties and exploratory drilling prospects, and gas industry is a highly competitive market in all its phases. Properties in which we have an interest will encounter strong competition from many other oil and gas producers, including many that possess substantial financial resources, in acquiring economically desirable producing properties and exploratory drilling prospects, and in obtaining equipment and labor to operate and maintain their properties.

Patents, Licenses, Trademarks, Franchises, Concessions, Royalty Agreements, or Labor Contracts

We do not own, either legally or beneficially, any patents or trademarks.

Regulation

We monitor and comply with current government regulations that affect our activities, although our operations may be adversely affected by changes in government policy, regulations or taxation. There can be no assurance that we will be able to obtain all of the necessary licenses and permits that may be required to carry out our exploration and development programs. It is not expected that any of these controls or regulations will affect our operations in a manner materially different than they would affect other natural gas and oil companies operating in the areas in which we operate.

Our operations are subject to various types of regulation at the federal, state and local levels. These regulations include requiring permits for the drilling of wells; maintaining hazard prevention, health and safety plans; submitting notification and receiving permits related to the presence, use and release of certain materials incidental to oil and gas operations; and regulating the location of wells, the method of drilling and casing wells, the use, transportation, storage and disposal of fluids and materials used in connection with drilling and production activities, surface plugging and abandonment of wells and the transporting of production. Our operations are also subject to various conservation matters, including the number of wells which may be drilled in a unit, and the unitization or pooling of oil and gas properties. In this regard, some states allow the forced pooling or integration of tracts to facilitate exploration, while other states rely on voluntary pooling of lands and leases, which may make it more difficult to develop oil and gas properties. In addition, state conservation laws establish maximum rates of production from oil and gas wells, generally limit the venting or flaring of gas, and impose certain requirements regarding the ratable purchase of production. The effect of these regulations is to possibly limit the amounts of oil and gas we can produce from our wells and to limit the number of wells or the locations at which we can drill.

In the United States, legislation affecting the oil and gas industry has been pervasive and is under constant review for amendment or expansion. Pursuant to such legislation, numerous federal, state and local departments and agencies have issued extensive rules and regulations binding on the oil and gas industry and its individual members, some of which carry substantial penalties for failure to comply. These laws and regulations have a significant impact on oil and gas drilling, gas processing plants and production activities, increasing the cost of doing business and, consequently, affect profitability. Insomuch as new legislation affecting the oil and gas industry is common-place and existing laws and regulations are frequently amended or reinterpreted, we may be unable to predict the future cost or impact of complying with these laws and regulations. We consider the cost of environmental protection a necessary and manageable part of our business. We have been able to plan for and comply with new environmental initiatives without materially altering our operating strategies.

Other Matters

Environmental

.

Our exploration, development, and production of oil and gas, including our operation of saltwater injection and disposal wells, are subject to various federal, state and local environmental laws and regulations. Such laws and regulations can increase the costs of planning, designing, installing and operating oil and gas wells. Our domestic activities are subject to a variety of environmental laws and regulations, including but not limited to, the Oil Pollution Act of 1990 (OPA), the Clean Water Act (CWA), the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), the Resource Conservation and Recovery Act (RCRA), the Clean Air Act, and the Safe Drinking Water Act, as well as state regulations promulgated under comparable state statutes. We are also subject to regulations governing the handling, transportation, storage, and disposal of naturally occurring radioactive materials that are found in our oil and gas operations. Civil and criminal fines and penalties may be imposed for non-compliance with these environmental laws and regulations. Additionally, these laws and regulations require the acquisition of permits or other governmental authorizations before undertaking certain activities, limit or prohibit other activities because of protected areas or species, and impose substantial liabilities for cleanup of pollution.

Under the OPA, a release of oil into water or other areas designated by the statute could result in the company being held responsible for the costs of remediating such a release, certain OPA specified damages, and natural resource damages. The extent of that liability could be extensive, as set forth in the statute, depending on the nature of the release. A release of oil in harmful quantities or other materials into water or other specified areas could also result in the company being held responsible under the CWA for the costs of remediation, and civil and criminal fines and penalties.

CERCLA and comparable state statutes, also known as “Superfund” laws, can impose joint and several and retroactive liability, without regard to fault or the legality of the original conduct, on certain classes of persons for the release of a “hazardous substance” into the environment. In practice, cleanup costs are usually allocated among various responsible parties. Potentially liable parties include site owners or operators, past owners or operators under certain conditions, and entities that arrange for the disposal or treatment of, or transport hazardous substances found at the site. Although CERCLA, as amended, currently exempts petroleum, including but not limited to, crude oil, gas and natural gas liquids, from the definition of hazardous substance, our operations may involve the use or handling of other materials that may be classified as hazardous substances under CERCLA. Furthermore, there can be no assurance that the exemption will be preserved in future amendments of the act, if any.

RCRA and comparable state and local requirements impose standards for the management, including treatment, storage, and disposal, of both hazardous and non-hazardous solid wastes. We generate hazardous and non-hazardous solid waste in connection with our routine operations. From time to time, proposals have been made that would reclassify certain oil and gas wastes, including wastes generated during drilling, production and pipeline operations, as “hazardous wastes” under RCRA, which would make such solid wastes subject to much more stringent handling, transportation, storage, disposal, and clean-up requirements.

This development could have a significant impact on our operating costs. While state laws vary on this issue, state initiatives to further regulate oil and gas wastes could have a similar impact. Because oil and gas exploration and production, and possibly other activities, have been conducted at some of our properties by previous owners and operators, materials from these operations remain on some of the properties and in some instances, require remediation. In addition, in certain instances, we have agreed to indemnify sellers of producing properties from which we have acquired reserves against certain liabilities for environmental claims associated with such properties. While we do not believe that costs to be incurred by us for compliance and remediating previously or currently owned or operated properties will be material, there can be no guarantee that such costs will not result in material expenditures.

Additionally, in the course of our routine oil and gas operations, surface spills and leaks, including casing leaks, of oil or other materials may occur, and we may incur costs for waste handling and environmental compliance. Moreover, we are able to control directly the operations of only those wells for which we act as the operator. Management believes that the Company is in substantial compliance with applicable environmental laws and regulations.

In response to liabilities associated with these activities, accruals have been established when reasonable estimates are possible. Such accruals primarily include estimated costs associated with remediation. We have used discounting to present value in determining our accrued liabilities for environmental remediation or well closure, but no material claims for possible recovery from third party insurers or other parties related to environmental costs have been recognized in our financial statements. We adjust the accruals when new remediation responsibilities are discovered and probable costs become estimable, or when current remediation estimates must be adjusted to reflect new information.

We do not anticipate being required in the near future to expend amounts that are material in relation to our total capital expenditures program by reason of environmental laws and regulations, but inasmuch as such laws and regulations are frequently changed, we are unable to predict the ultimate cost of compliance. There can be no assurance that more stringent laws and regulations protecting the environment will not be adopted or that we will not otherwise incur material expenses in connection with environmental laws and regulations in the future.

Occupational Health and Safety

.

We are subject to laws and regulations concerning occupational safety and health. Due to the continued changes in these laws and regulations, and the judicial construction of many of them, we are unable to predict with any reasonable degree of certainty our future costs of complying with these laws and regulations. We consider the cost of safety and health compliance a necessary and manageable part of our business. We have been able to plan for and comply with new initiatives without materially altering our operating strategies.

Taxation

. Our operations, as is the case in the petroleum industry generally, are significantly affected by federal tax laws. Federal, as well as state, tax laws have many provisions applicable to corporations which could affect our future tax liabilities.

Commitments and Contingencies

.

We are liable for future restoration and abandonment costs associated with our oil and gas properties. These costs include future site restoration, post closure and other environmental exit costs. The costs of future restoration and well abandonment have not been determined in detail. State regulations require operators to post bonds that assure that well sites will be properly plugged and abandoned. The State of Texas requires us to post a security bond depending on the number of wells we operate in Texas. Management views this as a necessary requirement for operations and does not believe that these costs will have a material adverse effect on its financial position as a result of this requirement.

Number of Total Employees and Number of Full Time Employees

As of the date of this Registration Statement, we have one full-time employee and two part-time employees, including our executive officers.

Additional Information

You may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may also find this Registration Statement and all reports that we file electronically with the SEC at their Internet site www.sec.gov. Please call the SEC at 1-202-551-8090 for further information on this or other Public Reference Rooms. This Registration Statement, and our SEC reports or other registration statements, once filed, will also be available from commercial document retrieval services, such as Corporation Service Company, whose telephone number is 1-800-222-2122.

ITEM 1A. RISK FACTORS

Before making an investment decision, you should carefully consider the risks described below as well as the other information in this report and related financial statements. The market or trading price of our securities could decline due to any of these risks. In addition, please read “Cautionary Note Regarding Forward-Looking Statements” at the beginning of this report, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this filing. Please note that additional risks not currently known to us or that we currently deem immaterial may also impair our business and operations.

Risks Relating to Our Business and Financial Condition

Our operations have resulted in negative cash flows and our ability to sustain operations is dependent on our ability to raise money. As a result, our auditor has expressed substantial doubt about our ability to continue as a going concern.

In the course of our development activities, we have incurred cumulative losses of $8,867,817 through September 30, 2013 and expect such losses to continue through at least the end of our fiscal year ending December 31, 2014. Our current cash resources are not sufficient to fund our operations and our future is dependent upon our ability to obtain financing. These factors raise substantial doubt that we will be able to continue as a going concern for at least the next twelve months. Our independent auditor has issued an audit opinion on our financial statements for the fiscal year ended December 31, 2012, which includes a statement expressing substantial doubt as to our ability to continue as a going concern. These factors could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our business plan. As a result, we may have to liquidate our business and you may lose your investment. You should consider our auditor's opinion when determining if an investment in us is appropriate for you.

Crude oil and natural gas prices are highly volatile in general and low prices will negatively affect our financial results.

Our revenues, operating results, profitability, cash flow, future rate of growth and ability to borrow funds or obtain additional capital, as well as the carrying value of our oil and gas properties, are substantially dependent upon prevailing prices of crude oil and natural gas. Lower crude oil and natural gas prices also may reduce the amount of crude oil and natural gas that we can produce economically. Historically, the markets for crude oil and natural gas have been very volatile, and such markets are likely to continue to be volatile in the future. Prices for crude oil and natural gas are subject to wide fluctuation in response to relatively minor changes in the supply of and demand for crude oil and natural gas, market uncertainty and a variety of additional factors that are beyond our control, including: worldwide and domestic supplies of crude oil and natural gas; the level of consumer product demand; weather conditions and natural disasters; domestic and foreign governmental regulations; the price and availability of alternative fuels; political instability or armed conflict in oil producing regions; the price and level of foreign imports; and overall domestic and global economic conditions.

It is extremely difficult to predict future crude oil and natural gas price movements with any certainty. Declines in crude oil and natural gas prices may materially adversely affect our financial condition, liquidity, ability to finance planned capital expenditures and results of operations. Further, oil and gas prices do not move in tandem.

We have a limited operating history, and we may not be able to operate profitably in the near future, if at all.

We have a limited operating history and businesses such as ours, which are starting up or in their initial stages of development, present substantial business and financial risks and may suffer significant losses from which we cannot recover. We will face all of the challenges of a smaller microcap oil and natural gas company that operates in a highly competitive industry, including but not limited to: locating, acquiring and successfully developing oil and gas properties; raising financing to fund our capital expenditure program; attracting, engaging and retaining the services of qualified management, technical and support personnel; establishing budgets and maintaining internal operating policies and procedures; and the design and implementation of effective financial and disclosure controls to meet public company statutory compliance requirements. We can provide no assurance that we will achieve a level of profitability that will provide a return on invested capital or that will result in an increase in the market value of our securities. Accordingly, we are subject to the risk that, because of these factors and other general business risks noted throughout these “Risk Factors,” we may, in particular, not be able to profitably execute our business plan.

Without additional funding, which we may not be able to obtain, we will be unable to implement our business plan.

Our current cash reserves, together with anticipated cash flow from operations, will not be sufficient to meet our working capital and operating needs for approximately the next twelve months. Furthermore, to continue growth and to fund our business and expansion plans, we will require additional financing. The amount of capital available to us is limited, and may not be sufficient to enable us to fully implement our business plan. There can be no assurance that we will be able to obtain such financing on attractive terms, if at all. We have no firm commitments for additional cash funding as of the date of this report.

Our officers and directors have limited liability, and we are required in certain instances to indemnify our officers and directors for their actions.

We have adopted provisions in our Articles of Incorporation and Bylaws which limit the liability of our officers and directors and provide for indemnification by us of our officers and directors to the full extent permitted by Nevada law. Our Articles of Incorporation and Bylaws generally provide that our officers and directors shall have no personal liability to us or our stockholders for monetary damages as a result of actions or inactions undertaken in their capacities as officers or directors, except for breaches of their duties of loyalty, acts or omissions not in good faith or which involve intentional misconduct or knowing violation of law, or any transaction from which an officer or director derives an improper personal benefit. Such provisions substantially limit our stockholders' ability to hold officers and directors liable for their actions and may require us to indemnify our officers and directors.

Our industry is highly competitive, attractive resource properties are scarce, and we may not be able to obtain quality properties.

We are in direct competition for properties with numerous oil and natural gas companies, drilling and income programs and partnerships exploring various areas of Texas and elsewhere. Many competitors are large, well-known oil and gas and/or energy companies, although no single entity dominates the industry. Many of our competitors possess greater financial and personnel resources enabling them to identify and acquire more economically desirable energy producing properties and drilling prospects than us. Additionally, there is competition from other fuel choices to supply the energy needs of consumers and industry.

We depend significantly upon the continued involvement of our present management.

Our success depends to a significant degree upon the involvement of our current management, who are in charge of our strategic planning and operations. We may need to attract and retain additional talented individuals in order to carry out our business objectives. The competition for such persons could be intense and there are no assurances that these individuals will be available to us.

Government regulation and liability for environmental matters may adversely affect our business and results of operations.

Crude oil and natural gas operations are subject to extensive federal, state and local government regulations, which may be changed from time to time. Matters subject to regulation include discharge permits for drilling operations, drilling bonds, reports concerning operations, the spacing of wells, unitization and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of crude oil and natural gas wells below actual production capacity in order to conserve supplies of crude oil and natural gas. There are federal, state and local laws and regulations primarily relating to protection of human health and the environment applicable to the development, production, handling, storage, transportation and disposal of crude oil and natural gas, byproducts thereof and other substances and materials produced or used in connection with crude oil and natural gas operations. In addition, we may inherit liability for environmental damages caused by previous owners of property we purchase or lease. As a result, we may incur substantial liabilities to third parties or governmental entities. The implementation of new, or the modification of existing, laws or regulations could have a material adverse effect on us.

Future increases on taxes on energy products, energy service companies and exploration activities may adversely affect our results of operations and increase our operating expenses.

Federal, state and local governments have jurisdiction in areas where we operate and impose taxes on the oil and natural gas products sold by us. Recently there have been discussions by federal, state and local officials concerning a variety of energy tax proposals, some of which, if passed, would add or increase taxes on energy products, service companies and exploration activities. Such matters are beyond our ability to accurately predict or control; however, any such increase in taxes or additional taxes levied on us by federal, state or local jurisdictions could adversely affect our results of operations and/or increase our operating expenses.

Certain U.S. federal income tax deductions currently available with respect to oil and gas exploration and development may be eliminated as a result of future legislation.

Future legislative actions could modify or eliminate certain key U.S. federal income tax incentives currently available to oil and natural gas exploration and production companies. Legislative proposals that might modify or eliminate certain investment incentives include, but are not limited to: (1) the repeal of the percentage depletion allowance for oil and natural gas properties, (2) the elimination of current deductions for intangible drilling and development costs, (3) the elimination of the deduction for certain domestic production activities, and (4) an extension of the amortization period for certain geological and geophysical expenditures. It is unclear whether any such changes will be enacted into law or how soon any such changes could become effective in the event they were enacted into law. The passage of any legislation as a result of these proposals or any other changes in U.S. federal income tax laws could eliminate certain tax deductions that are currently available with respect to oil and gas exploration and development activities undertaken by us, and any such changes could negatively affect our financial condition and results of operations.

The crude oil and natural gas reserves we report in our SEC filings are estimates and may prove to be inaccurate.

There are numerous uncertainties inherent in estimating crude oil and natural gas reserves and their estimated values. The reserves we will report in our filings with the SEC will only be estimates and such estimates may prove to be inaccurate because of these uncertainties. Reservoir engineering is a subjective and inexact process of estimating underground accumulations of crude oil and natural gas that cannot be measured in an exact manner. Estimates of economically recoverable crude oil and natural gas reserves depend upon a number of variable factors, such as historical production from the area compared with production from other producing areas and assumptions concerning effects of regulations by governmental agencies, future crude oil and natural gas prices, future operating costs, severance and excise taxes, development costs and work-over and remedial costs. Some or all of these assumptions may in fact vary considerably from actual results. For these reasons, estimates of the economically recoverable quantities of crude oil and natural gas attributable to any particular group of properties, classifications of such reserves based on risk of recovery, and estimates of the future net cash flows expected therefrom prepared by different engineers or by the same engineers but at different times may vary substantially. Accordingly, reserve estimates may be subject to downward or upward adjustment. Actual production, revenue and expenditures with respect to our reserves will likely vary from estimates, and such variances may be material.

The SEC has historically prohibited us from including “probable reserves” and “possible reserves” in statutory public filings; however, in addition to permitting us to disclose proved reserve estimates, effective January 1, 2010, the SEC allows us to report “probable” and “possible” reserves realizing that both reserve categories are considered unproved reserves and as such, the SEC views the estimates to be inherently unreliable. Probable and possible reserve estimates may be misunderstood or seen as misleading to investors that are not “experts” in the oil or natural gas industry. Unless you have such expertise, you should not place undue reliance on these estimates. Except as required by applicable law, we undertake no duty to update this information and do not intend to update this information.

Crude oil and natural gas development, re-completion of wells from one reservoir to another reservoir, restoring wells to production and drilling and completing new wells are speculative activities and involve numerous risks and substantial and uncertain costs.

Our growth will be materially dependent upon the success of our future development program. Drilling for crude oil and natural gas and reworking existing wells involves numerous risks, including the risk that no commercially productive crude oil or natural gas reservoirs will be encountered. The cost of drilling, completing and operating wells is substantial and uncertain, and drilling operations may be curtailed, delayed or cancelled as a result of a variety of factors beyond our control, including: unexpected drilling conditions; pressure or irregularities in formations; equipment failures or accidents; inability to obtain leases on economic terms, where applicable; adverse weather conditions and natural disasters; compliance with governmental requirements; and shortages or delays in the availability of drilling rigs or crews and the delivery of equipment.

Drilling or reworking is a highly speculative activity. Even when fully and correctly utilized, modern well completion techniques such as hydraulic fracturing and horizontal drilling do not guarantee that we will find crude oil and/or natural gas in our wells. Hydraulic fracturing involves pumping a fluid with or without particulates into a formation at high pressure, thereby creating fractures in the rock and leaving the particulates in the fractures to ensure that the fractures remain open, thereby potentially increasing the ability of the reservoir to produce oil or gas. Horizontal drilling involves drilling horizontally out from an existing vertical well bore, thereby potentially increasing the area and reach of the well bore that is in contact with the reservoir. Our future drilling activities may not be successful and, if unsuccessful, such failure would have an adverse effect on our future results of operations and financial condition. We cannot assure you that our overall drilling success rate or our drilling success rate for activities within a particular geographic area will not decline. We may identify and develop prospects through a number of methods, some of which do not include lateral drilling or hydraulic fracturing, and some of which may be unproven. The drilling and results for these prospects may be particularly uncertain. Our drilling schedule may vary from our capital budget. The final determination with respect to the drilling of any scheduled or budgeted prospects will be dependent on a number of factors, including, but not limited to: the results of previous development efforts and the acquisition, review and analysis of data; the availability of sufficient capital resources to us and the other participants, if any, for the drilling of the prospects; the approval of the prospects by other participants, if any, after additional data has been compiled; economic and industry conditions at the time of drilling, including prevailing and anticipated prices for crude oil and natural gas and the availability of drilling rigs and crews; our financial resources and results; the availability of leases and permits on reasonable terms for the prospects; and the success of our drilling technology.

We cannot assure you that these projects can be successfully developed or that the wells discussed will, if drilled, encounter reservoirs of commercially productive crude oil or natural gas. There are numerous uncertainties in estimating quantities of proved reserves, including many factors beyond our control.

Because of the speculative nature of oil and gas exploration and development, there is substantial risk that we will not find any commercially exploitable oil or gas and that our business will fail.

The search for commercial quantities of oil as a business is extremely risky. We cannot provide investors with any assurance that we will be able to obtain rights to additional producing properties in the future and/or that any properties we obtain rights to will contain commercially exploitable quantities of oil and/or gas. Future exploration and development expenditures made by us, if any, may not result in the discovery of commercial quantities of oil and/or gas in any future properties we may acquire the rights to, and problems such as unusual or unexpected formations and other conditions involved in oil and gas exploration often result in unsuccessful exploration efforts. If we are unable to find commercially exploitable quantities of oil and gas in any properties we may acquire in the future, and/or we are unable to commercially extract such quantities we may find in any properties we may acquire in the future, the value of our securities may decline in value.

Because of the inherent dangers involved in oil and gas exploration, there is a risk that we may incur liability or damages as we conduct our business operations, which could force us to expend a substantial amount of money in connection with litigation and/or a settlement.

The oil and natural gas business involves a variety of operating hazards and risks such as well blowouts, pipe failures, casing collapse, explosions, uncontrollable flows of oil, natural gas or well fluids, fires, spills, pollution, releases of toxic gas and other environmental hazards and risks. These hazards and risks could result in substantial losses to us from, among other things, injury or loss of life, severe damage to or destruction of property, natural resources and equipment, pollution or other environmental damage, cleanup responsibilities, regulatory investigation and penalties and suspension of operations. In addition, we may be liable for environmental damages caused by previous owners of property purchased and leased by us in the future. As a result, substantial liabilities to third parties or governmental entities may be incurred, the payment of which could reduce or eliminate the funds available for the purchase of properties and/or property interests, exploration, development or acquisitions or result in the loss of our properties and/or force us to expend substantial monies in connection with litigation or settlements. As such, there can be no assurance that any insurance we currently maintain or that we obtain in the future will be adequate to cover any losses or liabilities. We cannot predict the availability of insurance or the availability of insurance at premium levels that justify our purchase. The occurrence of a significant event not fully insured or indemnified against could materially and adversely affect our financial condition and operations. We may elect to self-insure if management believes that the cost of insurance, although available, is excessive relative to the risks presented. In addition, pollution and environmental risks generally are not fully insurable. The occurrence of an event not fully covered by insurance could have a material adverse effect on our financial condition and results of operations, which could lead to any investment in us declining in value or becoming worthless.

Risks Related to Ownership of Our Common Stock

Because the public market for shares of our common stock is limited, investors may be unable to resell their shares.

Currently, there is only a limited public trading market for our common stock on the “pink sheets” and investors may be unable to resell their shares of our common stock. The development of an active public trading market depends upon the existence of willing buyers and sellers who are able to sell their shares as well as market makers willing to create a market in such shares. Under these circumstances, the market bid and ask prices for the shares may be significantly influenced by the decisions of the market makers to buy or sell the shares for their own account. Such decisions of the market makers may be critical for the establishment and maintenance of a liquid public market in our common stock. Market makers are not required to maintain a continuous two-sided market and are free to withdraw firm quotations at any time. We cannot give you any assurance that an active public trading market for the shares will develop or be sustained.

The price of our common stock is volatile, which may cause investment losses for our stockholders.

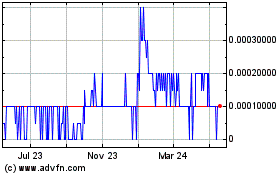

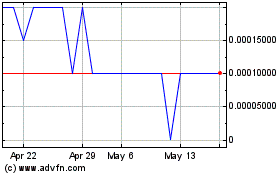

The market for our common stock is highly volatile, having ranged in the last twelve months from a low of $0.02 to a high of $0.09 on the “pink sheets.” The trading price of our common stock on the “pink sheets” is subject to wide fluctuations in response to, among other things, the limited number of shares traded, and general economic and market conditions. In addition, statements or changes in opinions, ratings, or earnings estimates made by brokerage firms or industry analysts relating to our market or relating to us could result in an immediate and adverse effect on the market price of our common stock. The highly volatile nature of our stock price may cause investment losses for our stockholders. In the past, securities class action litigation has often been brought against companies following periods of volatility in the market price of their securities. If securities class action litigation is brought against us, such litigation could result in substantial costs while diverting management’s attention and resources.

Securities analysts may elect not to report on our common stock or may issue negative reports that adversely affect the price of our common stock.

At this time, no securities analyst provides research coverage of our common stock. Further, securities analysts may never provide this coverage in the future. Rules mandated by the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and other restrictions led to a number of fundamental changes in how analysts are reviewed and compensated. In particular, many investment banking firms are required to contract with independent financial analysts for their stock research. It may remain difficult for a company with a smaller market capitalization such as ours to attract independent financial analysts that will cover our common stock. If securities analysts do not cover our common stock, the lack of research coverage may adversely affect our actual and potential market price and trading volume.

If one or more analysts elect to cover us and then downgrade our common stock, the stock price would likely decline rapidly. If one or more of these analysts cease coverage of us, we could lose visibility in the market, which in turn could cause our stock price to decline. This could have a negative effect on the market price of our shares.

Our common stock is considered to be

a “penny

stock” and is subject to rules which may limit a stockholder's ability to buy and sell our stock.

The SEC generally defines

what is referred to as “penny

stock” to be any equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our common stock is a

penny

stock and as such is covered by the

penny

stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The

penny

stock rules require a broker-dealer, prior to a transaction in a

penny

stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the

penny

stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the

penny

stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each

penny

stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the

penny

stock rules require that prior to a transaction in a

penny

stock not otherwise exempt from the rules a broker-dealer must make a special written determination that the

penny

stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these

penny

stock rules. Consequently, these

penny

stock rules may affect the ability of broker-dealers to trade our securities. We believe that the

penny

stock rules may discourage investor interest in, and limit the marketability of, our common stock.

Financial Industry Regulatory Authority, Inc. (“FINRA”) sales practice requirements may limit a stockholder’s ability to buy and sell our common shares.

In addition to the

“penny

stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Directors, executive officers and principal stockholders own a significant percentage of our capital stock, and they may make decisions that you do not consider to be in the best interests of our stockholders.

As of March 3, 2014, our directors, executive officers and principal stockholders beneficially owned, in the aggregate, approximately 9.6% of our outstanding voting securities. As a result, if some or all of them acted together, they would have the ability to exert substantial influence over the election of our Board of Directors and the outcome of issues requiring approval by our stockholders. This concentration of ownership also may have the effect of delaying or preventing a change in control of the Company that may be favored by other stockholders. This could prevent transactions in which stockholders might otherwise recover a premium for their shares over current market prices.

As a public company, we are subject to complex legal and accounting requirements that will require us to incur significant expenses and will expose us to risk of non-compliance.

As a public company, we are subject to numerous legal and accounting requirements that do not apply to private companies. The cost of compliance with many of these requirements is material, not only in absolute terms but, more importantly, in relation to the overall scope of the operations of a small company. Our relative inexperience with these requirements may increase the cost of compliance and may also increase the risk that we will fail to comply. Failure to comply with these requirements can have numerous adverse consequences including, but not limited to, our inability to file required periodic reports on a timely basis, loss of market confidence and/or governmental or private actions against us. We cannot assure you that we will be able to comply with all of these requirements or that the cost of such compliance will not prove to be a substantial competitive disadvantage vis-à-vis our privately held and larger public competitors.

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results.

If we fail to comply with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a negative effect on the trading price of our common shares.

Pursuant to Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we are required to prepare assessments regarding internal controls over financial reporting. In connection with our on-going assessment of the effectiveness of our internal control over financial reporting, we may discover “material weaknesses” in our internal controls as defined in standards established by the Public Company Accounting Oversight Board, or the PCAOB. A material weakness is a significant deficiency, or combination of significant deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. The PCAOB defines “significant deficiency” as a deficiency that results in more than a remote likelihood that a misstatement of the financial statements that is more than inconsequential will not be prevented or detected. We determined that our disclosure controls and procedures over financial reporting are not effective and were not effective as of December 31, 2012.

The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We cannot assure you that we will implement and maintain adequate controls over our financial process and reporting in the future or that the measures we will take will remediate any material weaknesses that we may identify in the future. Any failure to complete our assessment of our internal control over financial reporting, to remediate any material weaknesses that we may identify or to implement new or improved controls, or difficulties encountered in their implementation, could harm our operating results, cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our shares.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses and pose challenges for our management.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, and the rules and regulations promulgated thereunder, the Sarbanes-Oxley Act and SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the U.S. public markets. Our management team will need to devote significant time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

We do not intend to pay cash dividends. Any return on investment may be limited to the value of our common stock, if any.

We have never declared or paid cash dividends on our capital stock. We do not anticipate paying cash dividends on our common stock in the foreseeable future. We currently expect to use available funds and any future earnings in developing, operating and expanding our business and do not anticipate paying any cash dividends in the foreseeable future. In addition, the terms of any future debt or credit facility we may obtain may preclude us from paying any dividends. As a result, capital appreciation, if any, of our common stock will be a stockholder's only source of potential gain from our common stock for the foreseeable future.

Stockholders may be diluted significantly through our efforts to obtain financing and/or satisfy obligations through the issuance of additional shares of our common stock.

We currently have no committed source of financing. Wherever possible, our Board of Directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock. Our Board of Directors has authority, without action or vote of the stockholders, to issue all or part of the authorized but unissued shares of common stock. These actions will result in dilution of the ownership interests of existing stockholders, and that dilution may be material.

Provisions in the Nevada Revised Statutes (“NRS”) and our Articles of Incorporation may prevent takeover attempts that could be beneficial to our stockholders.

Provisions in the NRS may make it difficult and expensive for a third-party to pursue a takeover attempt we oppose even if a change in control of the Company would be beneficial to the interests of our stockholders. Any provision of Nevada law that has the effect of delaying or deterring a change in control could limit the opportunity for our stockholders to receive a premium for their securities, and could also affect the price that some investors are willing to pay for our securities. As a Nevada corporation, we are subject to NRS 78.438 which generally prohibits us from engaging in mergers and other business combinations with stockholders that have beneficially owned 10% or more of our voting stock for less than three years, or with their affiliates, unless our directors or stockholders approve the business combination in the prescribed manner.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-looking Statements

Statements made in this Registration Statement which are not purely historical are forward-looking statements with respect to the goals, plan objectives, intentions, expectations, financial condition, results of operations, future performance and business of our Company and our wholly-owned subsidiary, ESI, including, without limitation, (i) our ability to raise capital, and (ii) statements preceded by, followed by or that include the words “may,” “would,” “could,” “should,” “expects,” “projects,” “anticipates,” “believes,” “estimates,” “plans,” “intends,” “targets” or similar expressions.

Forward-looking statements involve inherent risks and uncertainties, and important factors (many of which are beyond our control) that could cause actual results to differ materially from those set forth in the forward-looking statements, including the following, general economic or industry conditions, nationally and/or in the communities in which we may conduct business, changes in the interest rate environment, legislation or regulatory requirements, conditions of the securities markets, our ability to raise capital, changes in accounting principles, policies or guidelines, financial or political instability, acts of war or terrorism, other economic, competitive, governmental, regulatory and technical factors affecting our current or potential business and related matters. Accordingly, results actually achieved may differ materially from expected results in these statements. Forward-looking statements speak only as of the date they are made. We do not undertake, and specifically disclaim, any obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

Plan of Operation

For the current fiscal year we will concentrate our efforts on our projects in the petroleum sector.

The Company will continue to rework the current wells that have been acquired on the leases the Company controls. Furthermore effort will be spent on marketing and signing agreements that utilize the Transportable Enhanced Oil Recovery Portable Platform to generate revenue.

We do not expect any changes or more hiring of employees since contracts will be given to consultants and sub-contractor specialists in specific fields of expertise for the exploration work.

Following industry trends and demands, we are also considering the acquisition of other petroleum properties or an interest in such projects. In either situation, a new public offering would be needed. We are delinquent in our payments to Compton and will not receive any further information until full payment is made.

Liquidity

As of the period ended from January 28, 2010 (inception) to December 31, 2013, we have yet to generate any revenues from our business operations.

As shown in the accompanying consolidated financial statements, the Company has incurred net losses of $1,348,036, $836,891, and $8,867,817 for the nine months ended September 30, 2013 and 2012, and for the period from January 28, 2010 (inception) through September 30, 2013 respectively.

Since our inception we have used our common stock, and entered into convertible loan agreements to raise capital for our operational and corporate expenses, retire debt, lease acquisitions and for the purchase of equipment and other capital. Net cash provided by financing activities at September 30, 2013 amounted $ 43,794 as a result of proceeds received loans converted to shares our common stock.

As of September 30, 2013, our total assets which consist of cash, advances, a note and related party receivable, inventory, furniture, production equipment and oil and gas properties, were stated at $ 122,767. Our total liabilities amounted to $776,841.

Management continues to source additional financing and analyze Oil production acquisitions to support the Company's cash requirements during the Company's development phase. There are no assurances that the Company will be successful with these initiatives.

Results of Operations

During the nine month period ended September 20, 2013 the company spent $ 21,599 on lease development activities.

General and administrative

expenses are those related to day-to-day activity and management. These expenses include legal, lobbying, accounting, payroll, consulting and other costs. General and administrative expenses increased from $10,760 for nine months ending September 30, 2012 to $89,960 for the nine months ended September 30, 2013. The significant increase in these costs during 2013 compared to 2012 is primarily related to significant legal and accounting expense incurred in preparing our Form 10 registration statement, as well as a change in management which prompted an expansion in business activity. Total professional and consulting fees for the period ended September 20, 2013 were $188,181 compared to $388,317 for the period ended September 30, 2012. Payroll expanded from $141,438 for the period ended September 30, 2012 to $808,088 for the period ended September 30, 2013. Depreciation was $21,012 for both periods ended September 30, 2012 and September 30, 2013. Other general administrative costs were $30,628 for the period ended September 30, 2013 as compared to $38,639 for the period ended September 30, 2012.

We expect that general and administrative expenses will continue to increase during 2014 as we build out our infrastructure to comply with Exchange Act and SEC reporting rules and regulations.

Income Tax Provision:

a) The provision for income taxes differs from the result which would be obtained by applying the statutory rate of 34% to income before income taxes.

|

|

|

September 30,

2013

|

|

|

December 31,

2012

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

$

|

(1,348,036

|

)

|

|

$

|

(2,019,450

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit 34% (estimated)

|

|

|

(458,332

|

)

|

|

|

(686,613

|

)

|

|

Unrecognized benefit of operating loss carry forwards

|

|

|

458,332

|

|

|

|

686,613

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit

|

|

$

|

-

|

|

|

$

|

-

|

|

b) Significant components of the Company's deferred income tax assets are as follows:

|

|

|

September 30,

2013

|

|

|

December 31,

2012

|

|

|

|

|

|

|

|

|

|

|

Operating loss carry forwards

|

|

$

|

8,848,000

|

|

|

$

|

7,500,000

|

|

|

Statutory tax rate

|

|

|

34.0

|

%

|

|

|

34.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Deferred tax asset

|

|

|

3,008,320

|

|

|

|

2,550,000

|

|

|

Valuation allowance

|

|

|

(3,008,320

|

)

|

|

|

(2,550,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net deferred tax assets

|

|

$

|

-

|

|

|

$

|

-

|

|

As of September 30, 2013, the Company has incurred operating losses of approximately $8,848,000 which, if unutilized, will expire through the year 2031. However, due to the change in control of the Company during June 2013, the Company does not have any significant NOL carry forwards as of the date of the change in control. Future tax benefits existing at September 30, 2013, which may arise as a result of these losses, have been offset by a valuation allowance. The change in valuation allowance for the nine months ended September 30, 2013 and the year ended December 31, 2012 and for the period from January 28, 2010 through December 31, 2012 was $458,332, $680,000, and $3,008,000, respectively.

The Company accounts for corporate income taxes in accordance with ASC Topic 740 Income Taxes. Under ASC Topic 740, deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. In addition, future tax benefits, such as those from net operating loss carry forwards, are not recognized to the extent that realization of such benefits is more likely than not. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized as set forth below in the period that includes the enactment date.

The Company does not have any significant deferred tax assets or liabilities. As of June 2013, the Company no longer had any net operating loss carry forwards available to offset future taxable income of the Company. The Company is not current in filing its tax returns.

The Company has not filed tax returns since its inception. The Company is currently working with an external tax firm to prepare past tax returns and does not believe that it will be exposed to any risk of penalty or forfeiture of NOLs.

Property and equipment

The following table details the composition of property and equipment:

|

|

|

September 30,

|

|

|

December 31,

|

|

|

|

|

2013

|

|

|

2012

|

|

|

Production equipment

|

|

$

|

75,020

|

|

|

$

|

75,020

|

|

|

Furniture and equipment

|

|

|

-

|

|

|

|

-

|

|

|

Less accumulated depreciation

|

|

|

(56,032

|

)

|

|

|

(35,020

|

)

|

|

Property and equipment, net

|

|

$

|

18,988

|

|

|

$

|

40,000

|

|

Property and equipment are stated at the Company's cost and are depreciated on a straight line basis over five or seven years. Maintenance and repair costs are expensed when incurred while major improvements are capitalized. Depreciation expense totaled $21,012 for the nine months ended September 30, 2013 and 2012, and $64,721 for the period from January 28, 2010 (inception) through September 30, 2013.

Subsequent to December 31, 2012, the Company sold certain production equipment for $40,000. In accordance with the guidance for the impairment of long-lived assets, the Company evaluated the equipment for recovery and in 2012 recorded an impairment charge of $121,105.

Recent accounting pronouncements

During the nine months ended September 30, 2013, there were several new accounting pronouncements issued by the Financial Accounting Standards Board (FASB). Each of these pronouncements, as applicable, has been or will be adopted by the Company. Management does not believe the adoption of any of these accounting pronouncements has had or will have a material impact on the Company’s financial position or operating results. The Company will monitor these emerging issues to assess any potential future impact on its consolidated financial statements.

Use of Estimates

The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The oil and gas industry is subject, by its nature, to environmental hazards and clean-up costs. At this time, management knows of no substantial costs from environmental accidents or events for which the Company may be currently liable. In addition, the Company's oil and gas business makes it vulnerable to changes in prices of crude oil and natural gas. Such prices have been volatile in the past and can be expected to be volatile in the future.

Fair value of financial instruments

In accordance with the reporting requirements of Accounting Standards Codification ("ASC") Topic No. 825, Financial Instruments, (ASC 825) the Company calculates the fair value of its assets and liabilities which qualify as financial instruments under this standard and includes this additional information in the notes to the consolidated financial statements when the fair value is different than the carrying value of those financial instruments.

The Company does not have any assets or liabilities measured at fair value on a recurring or a non-recurring basis, consequently, the Company did not have any fair value adjustments for assets and liabilities measured at fair value at September 30, 2013 and 2012.

Principles of Consolidation

The consolidated financial statements for the nine months ended September 30, 2013 and 2012 include the accounts of Paradigm Oil and Gas, Inc. and its subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Reclassifications

Certain amounts in the comparative consolidated financial statements have been reclassified from financial statements previously presented to conform to the current period presentation.

Cash

Cash consists of cash on deposit with high quality major financial institutions, and to date the Company has not experienced losses on any of its balances. The carrying amounts of cash approximate fair market value due to the liquidity of these deposits. For purposes of the consolidated balance sheets and consolidated statements of cash flows, the Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents. At September 30, 2013 and December 31, 2012, the Company had $43,794 and $3,642 in cash, respectively.

Income Taxes