false

0000727346

0000727346

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 9, 2024

SELECTIS

HEALTH, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Utah

|

|

0-15415 |

|

87-0340206

|

(State

or other jurisdiction

of

incorporation) |

|

Commission

File

Number |

|

(I.R.S.

Employer

Identification

number) |

8480

E. Orchard Road, Ste. 4900, Greenwood Village, CO 80111

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (720) 680-0808

(Former

name or former address, if changed since last report)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| ITEM 7.01 |

REGULATION FD DISCLOSURE |

On

May 9, 2024 Selectis Health, Inc. (OTC: GBCS) (“Selectis” or the “Company”) issued a press release announcing

that its wholly-owned subsidiary, Goodwill Hunting, LLC (the “Seller”), has executed and delivered a definitive Purchase

and Sale Agreement (the “PSA”) to sell certain real property located in Macon, Bibb County, Georgia, including the skilled

nursing facility known as Archway Transitional Care Center1 (collectively, “the Archway Property”). Pursuant to

the PSA, Bibb County Holdings II, LLC (the “Purchaser”) has agreed to purchase the Archway Property for $6.75 million, subject

to certain prorations, holdbacks, and adjustments customary in transactions of this nature. A copy of the PSA was previously filed as

an exhibit to the Company’s Current Report on Form 8-K dated May 1, 2024 and filed with the Securities and Exchange Commission

on May 8, 2024. A copy of the press release is filed herewith as Exhibit 99.1

The

information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current

Report on Form 8-K and furnishing this information pursuant to Item 7.01, The Company makes no admission as to the materiality of any

information in this Current Report on Form 8-K, including Exhibit 99.1, that is required to be disclosed solely by Regulation FD.

| |

Item |

|

Title |

| |

99.1 |

|

Press Release |

| |

104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

Selectis

Health, Inc.

(Registrant)

|

| |

|

|

| Dated:

May 9, 2024 |

|

/s/

Adam Desmond |

| |

|

Adam

Desmond, CEO |

Exhibit

99.1

Selectis

Health Enters Definitive Purchase and Sale Agreement for Archway Transitional Care Center in Georgia

-

Archway Nursing Facility and Related Property to be Sold for $6.75 Million -

Greenwood

Village, Colorado, May 9, 2024 – Selectis Health, Inc. (OTC: GBCS) (“Selectis” or the “Company”) announced

that its wholly-owned subsidiary, Goodwill Hunting, LLC (the “Seller”), has executed and delivered a definitive Purchase

and Sale Agreement (the “PSA”) to sell certain real property located in Macon, Bibb County, Georgia, including the skilled

nursing facility known as Archway Transitional Care Center1 (collectively, “the Archway Property”). Pursuant to

the PSA, Bibb County Holdings II, LLC (the “Purchaser”) has agreed to purchase the Archway Property for $6.75 million, subject

to certain prorations, holdbacks, and adjustments customary in transactions of this nature.

The

Seller and Purchaser entered into the PSA on May 1, 2024 (the “Effective Date”). Under the terms of the PSA, the Purchaser

has a 45-day period from and after the Effective Date in which to undertake any due diligence or inspections of the Archway Property

(the “Inspection Period”) where deemed necessary and appropriate, including obtaining a fair market value appraisal. Upon

full satisfaction or select waiver of the Purchaser’s closing conditions, the Purchaser and Seller shall consummate and close the

sale of the Archway Property approximately 15 days after the expiration of the Inspection Period.

Prior

to the Inspection Period’s expiration, the Purchaser shall have the right to terminate the PSA for any reason or no reason by delivering

written notice to the Seller. In the event of termination, the Purchaser shall receive a full refund of the initial $50,000 deposit delivered

to the Seller’s escrow agent.

Following

completion of the transaction, the Company and its wholly owned affiliates will continue to own and operate its Eastman Healthcare &

Rehabilitation, Glen Eagle Nursing & Rehabilitation, Providence of Sparta Healthcare & Rehabilitation, and Warrenton Healthcare

& Rehabilitation facilities in the state of Georgia. The Company’s total remaining footprint is summarized below:

Remaining

Facilities Post-Transaction

| Facility |

|

Beds |

|

Facility

Type |

|

State |

| Grand

Prairie Nursing Home 1 |

|

141 |

|

Skilled

Nursing |

|

AR |

| Eastman

Healthcare & Rehabilitation |

|

100 |

|

Skilled

Nursing |

|

GA |

| Glen

Eagle Nursing & Rehabilitation |

|

101 |

|

Skilled

Nursing |

|

GA |

| Providence

of Sparta Healthcare & Rehabilitation |

|

71 |

|

Skilled

Nursing |

|

GA |

| Warrenton

Healthcare & Rehabilitation |

|

110 |

|

Skilled

Nursing |

|

GA |

| Meadowview

Healthcare & Rehabilitation |

|

99 |

|

Skilled

Nursing |

|

OH |

| Higher

Call Healthcare & Rehabilitation |

|

86 |

|

Skilled

Nursing |

|

OK |

| Maple

Street Healthcare & Rehabilitation |

|

29 |

|

Skilled

Nursing |

|

OK |

| Park

Place Healthcare & Rehabilitation |

|

106 |

|

Skilled

Nursing |

|

OK |

| Southern

Hills Assisted Living Facility 2 |

|

24 |

|

Assisted

Living |

|

OK |

| Southern

Hills Healthcare & Rehabilitation2 |

|

106 |

|

Skilled

Nursing |

|

OK |

| Southern

Hills Retirement Facility2 |

|

90 |

|

Independent

Living |

|

OK |

1 Leased facilities operated by third parties.

2 All located on the same campus in Tulsa, OK.

Adam

Desmond, CEO of Selectis Health, commented: “With the additional capital from the sale of the Archway Property, we expect to enhance

our balance sheet and achieve greater flexibility towards optimizing our remaining facility footprint. We are working diligently to close

this transaction, and we remain opportunistic in pursuing further real estate and operational rationalization initiatives.”

For

more information on the transaction, please see the Company’s associated Form 8-K disclosure, as filed on May 8, 2024.

About

Selectis Health

Selectis

Health owns and/or operates healthcare facilities in Arkansas, Georgia, Ohio, and Oklahoma, providing a wide array of living services,

speech, occupational, physical therapies, social services, and other rehabilitation and healthcare services. Selectis focuses on building

strategic relationships with local communities in which its partnership can improve the quality of care for facility residents. With

its focused growth strategy, Selectis intends to deepen its American Southcentral and Southeastern market presence to better serve the

aging population along a full continuum of care.

For

more information, please visit www.selectis.com.

Forward

Looking Statements

This

press release contains statements that plan for or anticipate the future. In this press release, forward-looking statements are generally

identified by the words “anticipate,” “plan,” “believe,” “expect,” “estimate,”

and the like. These forward-looking statements include, but are not limited to, statements regarding the following:

| |

* |

strategic

business relationships; |

| |

* |

statements

about our future business plans and strategies; |

| |

* |

anticipated

operating results and sources of future revenue; |

| |

* |

our

organization’s growth; |

| |

* |

adequacy

of our financial resources; |

| |

* |

development

of markets; |

| |

* |

competitive

pressures; |

| |

* |

changing

economic conditions; and, |

| |

* |

expectations

regarding competition from other companies. |

| |

* |

the

duration and scope of the COVID-19 pandemic |

| |

* |

the

impact of the COVID-19 pandemic on occupancy rates and on the operations of the Company’s facilities. |

| |

* |

Actions

governments take in response to the COVID-19 pandemic, including the introduction of public health measures and other regulations

affecting our properties and our operations. |

| |

* |

The

effects of health and safety measures adopted by us in response to the COVID-19 pandemic. |

| |

* |

Increased

operational costs because of health and safety measures related to COVID-19. |

| |

* |

Disruptions

to our property acquisition and disposition activities due to economic uncertainty caused by COVID-19. |

| |

* |

General

economic uncertainty in key markets as a result of the COVID-19 pandemic and a worsening of global economic conditions or low levels

of economic growth. |

Although

we believe that any forward-looking statements, we make in this press release are reasonable, because forward-looking statements involve

future risks and uncertainties, there are factors that could cause actual results to differ materially from those expressed or implied.

For example, a few of the uncertainties that could affect the accuracy of forward-looking statements, besides the specific factors identified

above in the Risk Factors section of this press release, include:

| |

* |

changes

in general economic and business conditions affecting the healthcare industry; |

| |

* |

developments

that make our facilities less competitive; |

| |

* |

changes

in our business strategies; |

| |

* |

the

level of demand for our facilities; and |

| |

* |

regulatory

changes affecting the healthcare industry and third-party payor practices. |

Investor

Relations Contact

Scott

Liolios or Jackie Keshner

Gateway

Group, Inc.

(949)

574-3860

selectis@gateway-grp.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

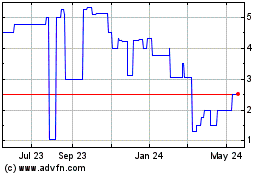

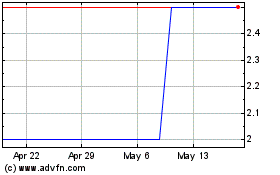

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Apr 2024 to May 2024

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From May 2023 to May 2024