Alberta Star Completes $585,000 Private Placement with TerraX; TerraX & Alberta Star Receive Approval of Option of Central Ca...

March 03 2014 - 9:00AM

Marketwired

Alberta Star Completes $585,000 Private Placement with TerraX;

TerraX and Alberta Star Receive Approval of Option of Central

Canada Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Mar 3, 2014) -

TerraX Minerals Inc. (TSX-VENTURE:TXR)(FRANKFURT:TX0) and Alberta

Star Development Corp.

(TSX-VENTURE:ASX)(OTCBB:ASXSF)(FRANKFURT:QLD) have completed the

previously announced private placement whereby Alberta Star has

acquired 1,300,000 units of TerraX at $0.45 per Unit for gross

proceeds of $585,000 (the "Private Placement"). Each Unit consists

of one common share and one-half of one share purchase warrant,

with each full warrant entitling the holder to purchase an

additional common share at an exercise price of $0.57 per share

until February 28, 2016. No finder's fees were paid in connection

with this placement. All securities issued in connection with the

placement are subject to a hold period expiring on July 1,

2014.

In addition, TerraX and Alberta Star are pleased to announce

that they have entered into, and received approval from the TSX

Venture Exchange for, a definitive option agreement (the "Option

Agreement") pursuant to which Alberta Star may earn a 60% interest

in TerraX's wholly-owned Central Canada gold project (the "Central

Canada Property") in Ontario (the "Option"). In order to exercise

the Option, Alberta Star must make cash payments to TerraX totaling

$85,000 over a three year period, with $10,000 paid upon execution

of the Option Agreement, $25,000 due on the second anniversary of

the execution of the Option Agreement and a further $50,000 due on

the third anniversary date. Alberta Star must also incur an

aggregate of $500,000 in exploration expenditures over a three year

period, with $100,000 to be incurred by March 31, 2015, a further

$150,000 to be incurred by March 31, 2016 and the remaining

$250,000 to be incurred by March 31, 2017. Alberta Star will also

be responsible for payment of the annual pre-production royalty of

$10,000 to the original vendors of the Central Canada Property due

annually in December beginning with the next payment due on

December 11, 2014.

The net proceeds of the Private Placement will be used by TerraX

to finance additional drilling planned for Terrax's wholly-owned

Northbelt property, which encompasses 3,562 hectares on the

prolific Yellowknife belt, 15 km north of the city of Yellowknife,

and covers 13 km of strike on the northern extension of the geology

that contained the Giant (7.6 Moz) and Con (5.5 Moz) gold mines.

The Northbelt property is host to multiple shears that are the

recognized hosts for gold deposits in the Yellowknife camp and it

contains innumerable gold showings.

Mr. Stuart Rogers, a director and the Chief Financial Officer of

TerraX, is also a director and the President and Chief Executive

Officer of Alberta Star. Mr. Rogers beneficially owns or controls

855,000 common shares and 447,500 securities convertible into

common shares of TerraX, representing 2.00% of the outstanding

common shares of TerraX on a non-diluted basis and 3.06% of the

outstanding common shares of TerraX on a diluted basis. Mr. Rogers

beneficially owns or controls 339,000 common shares and 300,000

securities convertible into common shares of Alberta Star,

representing 1.57% of the outstanding common shares of Alberta Star

on a non-diluted basis and 2.95% of the outstanding common shares

of Alberta Star on a diluted basis. TerraX does not own any

securities of Alberta Star and Alberta Star does not presently own

any securities of TerraX. After completion of the Private

Placement, Alberta Star owns 3.04% of the outstanding common shares

of TerraX on a non-diluted basis and 4.56% of the outstanding

common shares of TerraX on a diluted basis. Mr. Rogers has declared

his interest in, and abstained from voting in respect of, the

Option and the Private Placement on behalf of TerraX and Alberta

Star. The directors of each of TerraX and Alberta Star have

considered the merits of the Option and the Private Placement in

the absence of Mr. Rogers. The Option and Private Placement are

exempt from the formal valuation and minority approval requirements

of Multilateral Instrument 61-101 pursuant to sections 5.5(b) and

5.7(1).

Information Regarding

the Central Canada Property

The Central Canada Property consists of seven claims totaling 24

claim units (~3.8 km2) located 20 km east of the town of Atikokan,

160 km west of Thunder Bay and 19 km from the Hammond Reef gold

deposit owned by Osisko Mining Corporation.

The Central Canada Property straddles the southern contact of

the Marmion Batholith, host to the Hammond Reef deposit and

TerraX's Blackfly property. The bulk of the property is underlain

by mafic rocks outside the batholith; these have been intruded by

abundant felsic dikes presumably related to the Marmion Batholith.

Gold mineralization is associated with quartz-iron carbonate veins

with minor pyrite and local tourmaline and/or arsenopyrite. These

veins are most common in or close to felsic dikes. Dikes and veins

trend easterly, parallel to the contact of the Marmion Batholith

and to the strike of the regional scale Quetico Fault, which also

occurs on the property. TerraX conducted due diligence on the

property in October 2009, collecting 18 grab samples of veins and

alteration. Assay values range from 9 ppb to 22.9 g/t gold, and

seven samples had >250 ppb Au. This includes results of 2.8,

4.48 and 22.9 g/t gold.

Induced Polarization ("IP") and magnetic surveys were conducted

on the Central Canada Property by TerraX in February/March 2010 and

two chargeability anomalies were detected, one of which was roughly

coincident with the 22.9 g/t Au sample with the other occurring in

an area not previously investigated by TerraX.

A comprehensive prospecting program was carried out on the

Central Canada Property in June 2010. Extensive zones of shearing

and carbonate-chlorite-sericite alteration with quartz veining were

noted across the property. This prospecting program collected 21

new grab samples. Results ranged from below detection to a high of

39.6 g/t Au on a sample collected near the circa 1900 shaft that

occurs on the property. Importantly, two samples of approximately 1

g/t Au (907 and 1070 ppb) were taken from a new showing 500 m

northeast of the shaft. This showing consists of a northeast

trending sericite carbonate shear with disseminated to semi-massive

pyrite and arsenopyrite. This was followed up with Channel sampling

in September 2010. One hundred and twenty-three channel samples

were collected over a strike length of approximately 120 m,

perpendicular to a series of easterly trending

quartz-carbonate-pyrite veins and felsic dikes. Twenty-four samples

contained anomalous gold (20 ppb or higher), with a high value of

7.5 g/t Au.

Based on these results and historical information, TerraX

commenced drilling at the Central Canada Property in March 2012.

Three holes (363 m) were drilled approximately 55 meters apart to

test a 110 m strike length of the main mineralized structure, which

trends east-northeast. Drill holes were aligned to cut normal to

the mineralized structures identified in the channel sampling.

Drill intersections from southwest to northeast include 23.30 m @

0.83 g/t Au (including 0.63 m @ 7.36 g/t Au) in hole CC12-03, 10.61

m @ 1.32 g/t Au (including 1.82 m @ 4.77 g/t Au) in hole CC12-01,

and 8.92 m @ 0.74 g/t Au in hole CC12-02. Alberta Star's

exploration activities this year will be designed to follow-up on

the initial 363 m drill program conducted by TerraX and determine

the overall size of the mineralized structure, which remains open

along strike and down-dip. A map showing the location of the

drilling conducted at Central Canada is available on TerraX's web

site at www.terraxminerals.com

On behalf of the Board of Directors of TerraX

Joseph Campbell, President

On behalf of the Board of Directors of Alberta Star

Guido Cloetens, Chairman

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

This news release contains forward-looking information, which

involves known and unknown risks, uncertainties and other factors

that may cause actual events to differ materially from current

expectation. Important factors - including the availability of

funds, the results of financing efforts, the completion of due

diligence and the results of exploration activities - that could

cause actual results to differ materially from the company's

expectations are disclosed in the company's documents filed from

time to time on SEDAR (see www.sedar.com). Readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this press release. The company

disclaims any intention or obligation, except to the extent

required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Paradox Public Relations514-341-0408 or Toll Free:

1-866-460-0408info@paradox-pr.caVanguard Shareholder

Solutions604-608-0824 or Toll Free:

1-866-801-0779ir@vanguardsolutions.ca

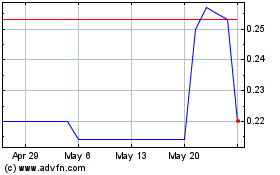

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From Apr 2024 to May 2024

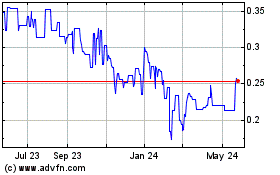

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From May 2023 to May 2024