Emera Inc. Announces Closing of $285 Million Over-Allotment Option Completing the Common Equity Financing Needs for the TECO ...

October 02 2015 - 8:26AM

Business Wire

Not for Distribution to U.S. Newswire

Services or for Dissemination in the United States.

Emera Inc. (“Emera” or the “Company”) (TSX: EMA) announced today

that in connection with the recently completed sale (the

“Offering”) on September 28, 2015 by the Company’s direct wholly

owned subsidiary, Emera Holdings NS Company, of $1,900,000,000

aggregate principal amount of 4.00% convertible unsecured

subordinated debentures of the Company represented by instalment

receipts (the “Convertible Debentures”), the over-allotment option

(the “Over-Allotment Option”) granted to the underwriters to

purchase up to an additional $285,000,000 aggregate principal

amount of Convertible Debentures (the “Additional Convertible

Debentures”) at a purchase price per Additional Convertible

Debenture equal to the Offering Price (defined below), has been

exercised in full, generating additional gross proceeds of

$285,000,000 (assuming payment of the Final Instalment (defined

below)). The sale of the Additional Convertible Debentures today

brings the aggregate gross proceeds of the Offering, including the

Over-Allotment Option, to $2,185,000,000 (assuming payment of the

Final Instalment).

“The exercise in full of this $285,000,000 over-allotment

option, in combination with the $1.9 billion offering that closed

earlier this week, fully addresses Emera’s common equity financing

needs for the acquisition of TECO Energy”, said Scott Balfour,

Executive Vice President and CFO of Emera Inc. “Emera is pleased

with the confidence and strong support the market has shown for

this important financing.”

The Additional Convertible Debentures were sold on an instalment

basis at a price of $1,000 per Convertible Debenture (the “Offering

Price”), of which $333 was paid on closing of the sale and the

remaining $667 (the “Final Instalment”) is payable on a date

(“Final Instalment Date”) to be fixed following satisfaction of all

conditions precedent to the closing of the Company’s recently

announced acquisition of TECO Energy, Inc. (NYSE:TE) (“TECO

Energy”). Prior to the Final Instalment Date, the Convertible

Debentures sold in connection with the Offering and the Additional

Convertible Debentures will be represented by instalment receipts

and will be listed and posted for trading on the Toronto Stock

Exchange under the symbol “EMA.IR”.

The Offering, including the Over-Allotment Option, was

underwritten by a syndicate of underwriters co-led by Scotiabank,

RBC Capital Markets, and JP Morgan, and including CIBC, TD

Securities Inc., BMO Capital Markets, National Bank Financial Inc.,

Barclays Capital Canada Inc. and Credit Suisse Securities (Canada)

Inc.

Forward Looking Information

This news release contains forward-looking information within

the meaning of applicable securities laws with respect to, among

other things, the completion of the acquisition of TECO Energy; the

listing of securities on the Toronto Stock Exchange; and the timing

of the Final Instalment. Important factors that could cause actual

results, performance and results to differ materially from those

indicated by any such forward-looking statements include risks and

uncertainties relating to the following: (i) the risk that TECO

Energy may be unable to obtain shareholder approval for the

proposed acquisition or that Emera or TECO Energy may be unable to

obtain governmental and regulatory approvals required for the

proposed acquisition, or required governmental and regulatory

approvals may delay the proposed acquisition; (ii) the risk that

other conditions to the closing of the proposed acquisition may not

be satisfied; and (iii) the timing to consummate the acquisition.

There can be no assurance that the proposed acquisition will be

completed, or if it is completed, that it will close within the

anticipated time period. These factors should be considered

carefully and undue reliance should not be placed on the

forward-looking statements. By its nature, forward-looking

information requires Emera to make assumptions and is subject to

inherent risks and uncertainties. These statements reflect Emera

management’s current beliefs and are based on information currently

available to Emera management. There is risk that predictions,

forecasts, conclusions and projections that constitute

forward-looking information will not prove to be accurate, that

Emera’s assumptions may not be correct and that actual results may

differ materially from such forward-looking information. Additional

detailed information about these assumptions, risks and

uncertainties is included in Emera’s securities regulatory filings,

including under the heading “Business Risks and Risk Management” in

Emera’s annual Management Discussion and Analysis, and under the

heading “Principal Risks and Uncertainties” in the notes to Emera’s

annual and interim financial statements which can be found on SEDAR

at www.sedar.com. Except as required by law, Emera disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

About Emera

Emera Inc. is geographically diverse energy and services company

headquartered in Halifax, Nova Scotia with approximately $10

billion in assets and 2014 revenues of $2.97 billion. The company

invests in electricity generation, transmission and distribution,

as well as gas transmission and utility energy services. Emera’s

strategy is focused on the transformation of the electricity

industry to cleaner generation and the delivery of that clean

energy to market. Emera has investments throughout northeastern

North America, and in four Caribbean countries. Emera continues to

target having 75-85% of its adjusted earnings come from

rate-regulated businesses. Emera common and preferred shares are

listed on the Toronto Stock Exchange and trade respectively under

the symbol EMA, EMA.PR.A, EMA.PR.B, EMA.PR.C, EMA.PR.E, and

EMA.PR.F, and the instalment receipts are listed and trade under

the symbol EMA.IR. Additional Information can be accessed at

www.emera.com or at www.sedar.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151002005345/en/

Emera Inc.Investor Relations:Scott LaFleur,

902-428-6375Scott.lafleur@emera.comorMedia:Neera Ritcey,

902-223-2272neera.ritcey@emera.com

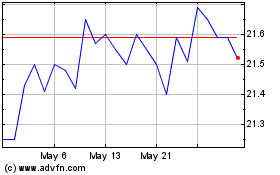

Emera (TSX:EMA.PR.C)

Historical Stock Chart

From Apr 2024 to May 2024

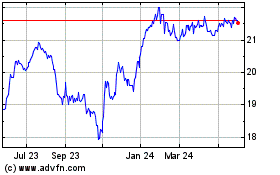

Emera (TSX:EMA.PR.C)

Historical Stock Chart

From May 2023 to May 2024