AGF Announces Risk Rating, Fund Name and Proposed Investment Objective Changes

April 26 2023 - 8:00AM

AGF Investments Inc. (AGF) today announced risk rating changes for

certain AGF funds, as well as certain fund name changes, and a

proposed investment objective change for AGF Strategic Income Fund.

Risk Rating Changes

AGF is changing the risk ratings for the following funds

effective today. The changes are based on the risk classification

methodology mandated by the Canadian Securities Administrators to

determine the risk level of mutual funds. No material changes have

been made to the investment objectives, strategies or management of

these funds.

|

Fund Name |

Previous Risk Rating |

Revised Risk Rating |

|

AGF Canadian Dividend Income Fund |

Low to Medium |

Medium |

|

AGF North American Dividend Income Class |

Low to Medium |

Medium |

|

AGF North American Dividend Income Fund |

Low to Medium |

Medium |

|

AGF China Focus Class |

Medium to High |

High |

|

AGF Global Equity Class |

Low to Medium |

Medium |

|

AGF Global Equity Fund |

Low to Medium |

Medium |

|

AGF Elements Conservative Portfolio |

Low |

Low to Medium |

|

AGF Elements Conservative Portfolio Class |

Low |

Low to Medium |

AGF Elements Yield Portfolio/Class Renamed to AGF Global

Yield Fund/Class

Also effective today, AGF Elements Yield Portfolio has been

renamed AGF Global Yield Fund and AGF Elements Yield Class has been

renamed AGF Global Yield Class. These name changes are being made

to better reflect the funds position as yield-oriented, monthly

income paying offerings. AGF Global Yield Fund/Class can be used as

a core holding to complement existing portfolios to manage

volatility or enhance income.

Proposed Investment Objective Change – AGF Strategic

Income Fund

Subject to securityholder approval, AGF is proposing to change

the investment objective of AGF Strategic Income Fund.

At the special meeting of securityholders to be held on June 15,

2023, subject to extension or adjournment thereof, securityholders

of each of AGF Strategic Income Fund will be asked to approve the

following proposed changes in the investment objective of the

fund:

|

Fund |

Current Investment Objective |

Proposed Investment Objective |

|

AGF Strategic Income Fund |

The Fund’s objective is to provide high long-term total investment

returns with moderate risk through a combination of long-term

capital growth and current income. It invests primarily in a mix of

common and preferred shares of Canadian companies, Canadian federal

and provincial bonds, high-quality corporate bonds and money market

instruments. |

The Fund’s objective is to provide long-term capital growth and

income with moderate risk. The Fund uses an asset allocation

approach. It invests primarily in a diversified mix of funds and

ETFs that provide exposure to global equity and fixed-income

securities. |

If approved, the proposed investment objective is expected to be

implemented on or about June 30, 2023. Notwithstanding the receipt

of securityholder approval, AGF may postpone implementing the

investment objective change for the fund until a later date or may

elect not to proceed with the change at all, if it considers such

decision to be in the best interests of the securityholders of the

fund.

If approved, upon adoption of the proposed investment objective

change, additional changes are expected to be made to AGF Strategic

Income Fund, including the following:

- Name Change: AGF Strategic Income Fund

will change its name to AGF Global Strategic Income Fund.

- Strategy Changes: The investment strategies of

the AGF Strategic Income Fund will be amended.

Additional information regarding the proposed change in

investment objective, including a discussion of certain Canadian

federal income tax considerations, will be provided in the fund’s

management information circular. In advance of the special meeting,

a notice-and-access document will be mailed to securityholders of

record as at April 24, 2023. The notice-and-access document will

describe the various ways in which securityholders can obtain a

copy of the management information circular.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent

and globally diverse asset management firm delivering excellence in

investing in the public and private markets through its three

distinct business lines: AGF Investments, AGF Private Capital and

AGF Private Wealth.

AGF brings a disciplined approach focused on providing an

exceptional client experience and incorporating sound responsible

and sustainable practices. The firm’s investment solutions, driven

by its fundamental, quantitative and private investing

capabilities, extends globally to a wide range of clients, from

financial advisors and their clients to high-net worth and

institutional investors including pension plans, corporate plans,

sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations

and client servicing teams on the ground in North America and

Europe. With $42 billion in total assets under management

and fee-earning assets, AGF serves more than 800,000 investors. AGF

trades on the Toronto Stock Exchange under the symbol AGF.B.

Commissions, trailing commissions, management fees and expenses

all may be associated with mutual fund investments. Please read the

prospectus before investing. Mutual fund securities are not covered

by the Canada Deposit Insurance Corporation or by any other

government deposit insurer. There can be no assurances the fund

will be able to obtain its net asset value at a constant amount or

that the full amount of your investment in the fund will be

returned to you.

Media Contact

Amanda MarchmentDirector, Corporate

Communications416-865-4160amanda.marchment@agf.com

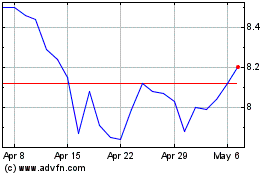

AGF Management (TSX:AGF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

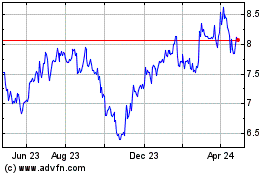

AGF Management (TSX:AGF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024