Verizon Posts Upbeat 4Q Subscriber Gains, Lower Revenue

January 23 2024 - 8:00AM

Dow Jones News

By Will Feuer

Verizon Communications posted a small drop in revenue after

lower wireless equipment sales offset healthy wireless subscriber

gains and price increases.

The wireless carrier reported a loss of $2.71 billion, or 64

cents a share, compared with a profit of $6.58 billion, or $1.56 a

share, in the same period a year earlier.

Stripping out one-time items, including billions in charges tied

to the company's business segment, adjusted earnings were $1.08 a

share, matching analysts' expectations.

Revenue edged about 0.3% lower to $35.1 billion. Analysts

surveyed by FactSet had expected $34.6 billion.

Postpaid phone net additions accelerated to 449,000, up from

217,000 in the same period last year. Analysts surveyed by FactSet

had expected about 232,000 additions.

For 2024, Verizon is targeting adjusted earnings of $4.50 a

share to $4.70 a share. Analysts surveyed by FactSet were expecting

$4.60 a share.

Verizon is expecting 2024 wireless service revenue growth of 2%

to 3.5%.

Chief Executive Hans Vestberg said that "2023 was a year of

change. We have the right assets and the best team in place and are

well-positioned for growth in 2024."

The company added 375,000 fixed-wireless customers, bringing the

subscriber base to over 3 million. Verizon added 55,000 Fios

internet customers, down 4,000 from a year earlier.

Wireless service revenue rose 3.2%, driven by higher prices and

more customers taking up the company's premium plans.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

January 23, 2024 07:45 ET (12:45 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

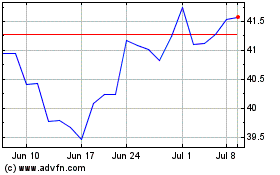

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2024 to May 2024

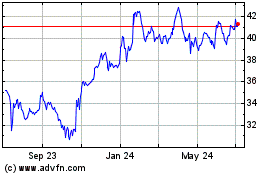

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From May 2023 to May 2024