0001021162truefalse0001021162us-gaap:CommonStockMember2024-02-162024-02-1600010211622024-02-162024-02-160001021162tgi:PurchaseRights1Member2024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2024

TRIUMPH GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

1-12235 |

|

51-0347963 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

555 E Lancaster Avenue, Suite 400 |

|

|

Radnor, Pennsylvania |

|

19087 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 610 251-1000

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $.001 per share |

|

TGI |

|

New York Stock Exchange |

Purchase Rights |

|

N/A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01. OTHER EVENTS.

On February 16, 2024, Triumph Group, Inc. (“Triumph” or the “Company”) announced the commencement of an offer to purchase for cash (the “Asset Sale Offer”) up to $580,000,000 of the Company’s 9.000% Senior Secured First Lien Notes due March 14, 2028 (the “Notes”), with a portion of the net cash proceeds that it will receive from the previously announced sale of its product support business. The Asset Sale Offer is being made pursuant to the indenture governing the notes, dated as of March 14, 2023 (the “Indenture”) and the Asset Sale Offer to Purchase, dated February 16, 2024 (the “Offer to Purchase”) which more fully sets forth the terms and conditions of the Asset Sale Offer.

The Asset Sale Offer will expire at 5:00 p.m., New York City time, on March 18, 2024 (the “Expiration Date”), unless extended or earlier terminated by the Company, with an early tender deadline of 5:00 p.m., New York City time, on March 4, 2024 (the “Early Tender Date”), unless extended or earlier terminated by the Company.

Under the terms of the Asset Sale Offer, holders of the Notes (“Holders”) who validly tender (and do not validly withdraw) their notes on or prior to March 4, 2024, (the “Early Tender Date”), and whose Notes are accepted for purchase by the Company, will receive the “Asset Sale Consideration,” which will be equivalent to $1,000 per $1,000 principal amount of Notes tendered. Holders validly tendering their Notes between the day following the Early Tender Date and on or prior to the Expiration Date will only be eligible to receive the “Tender Offer Consideration,” which will be equal to $990 per $1,000 principal amount of Notes tendered. In addition, Holders whose Notes are accepted for purchase by the Company will receive a cash payment representing the accrued and unpaid interest on those Notes from the applicable last interest payment date to, but not including, the applicable Payment Date (as defined in the Offer to Purchase) (“Accrued Interest”). If the Asset Sale Offer is oversubscribed, the Company will accept for purchase Notes on a pro rata basis as set forth in the Offer to Purchase.

A copy of the press release announcing the Asset Sale Offer, and which describes the Asset Sale Offer in greater detail, is hereby incorporated by reference and attached hereto as Exhibit 99.1.

This report does not constitute a notice of redemption under the optional redemption provisions of the Indenture, nor does it constitute an offer to sell, or a solicitation of an offer to buy, any security. No offer, solicitation or sale will be made in any jurisdiction in which such an offer, solicitation or sale would be unlawful.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Date: February 16, 2024 |

TRIUMPH GROUP, INC. By: ______________________________ Thomas A. Quigley, III Vice President, Investor Relations, Mergers & Acquisitions and Treasurer |

|

|

|

|

Exhibit 99.1

NEWS RELEASE

|

|

|

|

Contact: April Harper Director, Marketing & Communications Phone (610) 251-1000 aharper@triumphgroup.com |

|

|

Thomas A. Quigley, III VP, Investor Relations, Mergers & Acquisition and Treasurer Phone (610) 251-1000 tquigley@triumphgroup.com |

TRIUMPH ANNOUNCES OFFER TO PURCHASE A PORTION OF ITS 9.000% SENIOR SECURED FIRST LIEN NOTES DUE MARCH 14, 2028

RADNOR, PA – February 16, 2024 – Triumph Group, Inc. (NYSE: TGI) (“TRIUMPH” or the “Company”) today announced that it has commenced an offer to purchase for cash (the “Asset Sale Offer”) up to $580,000,000 of its outstanding 9.000% Senior Secured First Lien Notes due March 14, 2028 (the “Notes”) with a portion of the net cash proceeds that it will receive from its previously announced sale of its product support business (the “Sale”). The Asset Sale Offer is being made pursuant to the indenture governing the Notes, dated as of March 14, 2023 (the “Indenture”) and the Asset Sale Offer to Purchase, dated February 16, 2024, (the “Offer to Purchase”) which more fully sets forth the terms and conditions of the Asset Sale Offer.

The Asset Sale Offer will expire at 5:00 p.m., New York City time, on March 18, 2024 (the “Expiration Date”), unless extended or earlier terminated by the Company, with an early tender deadline of 5:00 p.m., New York City time, on March 4, 2024 (the “Early Tender Date”), unless extended or earlier terminated by the Company.

Under the terms of the Asset Sale Offer, holders of the Notes (“Holders”) who validly tender (and do not validly withdraw) their Notes on or prior to the Early Tender Date, and whose Notes are accepted for purchase by the Company, will receive the “Asset Sale Consideration,” which will be equivalent to $1,000 per $1,000 principal amount of Notes tendered. Holders validly tendering their Notes between the day following the Early Tender Date and on or prior to the Expiration Date will only be eligible to receive the “Tender Offer Consideration,” which will be equal to $990 per $1,000 principal amount of Notes tendered. In addition, Holders whose Notes are accepted for purchase by the Company will receive a cash payment representing the accrued and unpaid interest on those Notes from the applicable last interest payment date to, but not including, the applicable Payment Date (as defined in the Offer to Purchase) (“Accrued Interest”). The Asset Sale Consideration or the Tender Offer Consideration, as applicable, and any Accrued Interest, in each case, will be paid in cash to Holders whose Notes are accepted for purchase by the Company. If the Asset Sale Offer is oversubscribed, the Company will accept for purchase Notes on a pro rata basis as set forth in the Offer to Purchase.

On February 6, 2024, the Company issued a notice of conditional redemption in respect of $120,000,000 of the Notes to be redeemed on March 4, 2024 at a redemption price of 103.00% of the principal amount of the Notes redeemed, plus accrued and unpaid interest, to, but not including the date of redemption. Pursuant to the procedures set forth under the Indenture, by The Depository Trust Company (“DTC”) and brokers for the Holders of the Notes, any Notes selected to be redeemed pursuant to said redemption will not be eligible to be tendered pursuant to the Asset Sale Offer. The redemption of the Notes is conditioned upon the consummation of the Sale. Pursuant to the Indenture, the Company is permitted, but not obligated, to issue a second notice of redemption in respect of up to $120,000,000 of the Notes, with such redemption date to be on or after March 15, 2024 at a redemption price of 103.00% of the principal amount of the Notes redeemed, plus accrued and unpaid interest, to, but not including the date of redemption. The redemption prices described above for the Notes are higher than what Holders who tender their Notes pursuant to the Asset Sale Offer will receive as the Asset Sale Consideration and the Tender Offer Consideration, as applicable.

9.000% Senior Secured First Lien Notes due March 14, 2028

|

|

|

|

|

|

Title of Security |

CUSIP No. |

ISIN |

Outstanding Aggregate Principal Amount |

Asset Sale Consideration(1) |

Tender Offer Consideration(2) |

9.000% Senior Secured First Lien Notes due March 14, 2028 |

144A: 896818 AU5 Reg S: U8968G AH7 IAI: 869818 AV3 |

144A: US896818AU56 Reg S: USU8968GAH75 IAI: US896818AV30 |

$1,200,000,000 |

$1,000.00 plus accrued and unpaid interest, if any, to the purchase date |

$990.00 plus accrued and unpaid interest, if any, to the purchase date |

(1) Per $1,000 principal amount of Notes validly tendered (and not validly withdrawn) by Holders on or prior to the Early Tender Date and accepted for purchase by the Company.

(2) Per $1,000 principal amount of Notes validly tendered by Holders between the day following the Early Tender Date and on or before the Expiration Date and accepted for purchase by the Company.

Tendered Notes may be validly withdrawn any time on or prior to 5:00 p.m., New York City time, on March 4, 2024 (the “Withdrawal Date”), unless extended or earlier terminated by the Company. Notes validly tendered after the Withdrawal Date may not be withdrawn (except in limited circumstances where additional withdrawal rights are required by law, as determined by the Company in its sole discretion). The Asset Sale Offer is subject to the satisfaction or waiver of certain conditions as described in the Offer to Purchase.

The Company reserves the right, subject to applicable law, to (a) terminate the Asset Sale Offer, (b) waive any or all conditions to the Asset Sale Offer, (c) extend the Early Tender Date, the Withdrawal Date and/or the Expiration Date or (d) otherwise amend the Asset Sale Offer at any time (including the aggregate principal amount of Notes to be purchased in the Asset Sale Offer). Notwithstanding any of the foregoing, the Company does not intend to waive or modify the condition in the Asset Sale Offer that the Sale has been consummated.

The complete terms and conditions of the Asset Sale Offer are set forth in the Offer to Purchase. Holders are urged to read the Offer to Purchase carefully.

The Company has engaged U.S. Bank Trust Company, National Association to act as depositary and paying agent (collectively, the “Depositary”) for the Asset Sale Offer. Persons with questions or requests for documents regarding the Asset Sale Offer should contact the Depositary at (800) 934-6802, or by email at cts.specfinance@usbank.com.

This press release is for informational purposes only and is not an offer to buy or a solicitation of an offer to sell any security. The Asset Sale Offer is being made pursuant to the Asset Sale Offer documents, including the Offer to Purchase that the Company is distributing to Holders of the Notes. The Asset Sale Offer is not being made to Holders of Notes in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities or other laws of such jurisdiction. None of the Company or its affiliates, their respective boards of directors, the trustee for the Notes or the Depositary is making any recommendation as to whether or not, or when, Holders should tender their notes in the Asset Sale Offer.

About TRIUMPH

TRIUMPH, headquartered in Radnor, Pennsylvania, designs, develops, manufactures, repairs and overhauls a broad portfolio of aerospace and defense systems and components. The company serves the global aviation industry, including original equipment manufacturers and the full spectrum of military and commercial aircraft operators.

More information about TRIUMPH can be found on the Company's website at www.triumphgroup.com.

Forward Looking Statements

Statements in this release which are not historical facts are forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements about the timing and completion of the Asset Sale Offer or any redemptions of the Notes. All forward-looking statements involve risks and uncertainties which could affect the Company’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, the Company. Further information regarding the important factors that could cause actual results to differ from projected results can be found in the Company’s reports filed with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended March 31, 2023. The Company undertakes no obligation to update any such forward-looking statement.

v3.24.0.1

Document And Entity Information

|

Feb. 16, 2024 |

| Document And Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 16, 2024

|

| Securities Act File Number |

1-12235

|

| Entity Registrant Name |

TRIUMPH GROUP, INC.

|

| Entity Central Index Key |

0001021162

|

| Entity Tax Identification Number |

51-0347963

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

555 E Lancaster Avenue

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Radnor

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

610

|

| Local Phone Number |

251-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Common Stock, par value $.001 per share

|

| Trading Symbol |

TGI

|

| Security Exchange Name |

NYSE

|

| Purchase Rights [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Purchase Rights

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tgi_PurchaseRights1Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

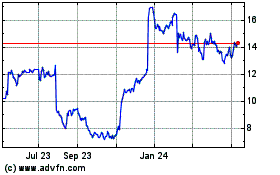

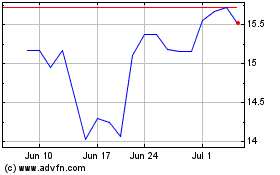

Triumph (NYSE:TGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Triumph (NYSE:TGI)

Historical Stock Chart

From Jul 2023 to Jul 2024