Lincoln Financial Group Expands Partnership to Support Customers as They Recover and Return to Work

May 21 2024 - 9:00AM

Business Wire

Claims specialists use new technology to

provide claimants with better support and resources for

recovery

Lincoln Financial Group (NYSE:LNC) today announced the expansion

of its efforts to enhance disability insurance claims processes

with human-in-the-loop artificial intelligence (AI) technology,

leading to better disability claims management analytics, improved

claim guidance to assist claimants in their return-to-work journeys

and streamlined processes to deliver more value to customers.

The enhanced process implemented by Lincoln uses AI to analyze

claims data and extract critical insights. This analysis helps

support more accurate claim outcomes by providing claims

professionals with timely insights that help them better assist

claimants in their return-to-work journeys.

“We are focused on investing in innovations and the latest

capabilities to drive the best claim outcomes for our customers,”

said Christen White, SVP, Lincoln Financial Group Protection Claims

and Operations. “Partnering with a technology leader in this space

is a part of that investment and has quickly advanced our ability

to provide claimants with even better support and resources for

their recovery and to return to work. Implementing this new

technology helps our claims specialists efficiently focus on the

right claims at the right time — all so that we can make the best

determinations for our claimants.”

Lincoln’s Group Protection business began its partnership with

EvolutionIQ in early 2023 with its long-term disability business.

After seeing success, Lincoln expanded the partnership this year to

help improve the claimant experience in short-term disability.

In 2023, Lincoln Financials’ GP claimants reported an average

91% satisfaction rate1, and EvolutionIQ’s enhancements are expected

to continue to improve this strong customer experience.

“We’re thrilled to be part of Lincoln Financial’s efforts to

incorporate advanced technologies that help enhance claims teams

efficiencies while facilitating even better care and support for

their customers,” said Michael Saltzman, Co-Founder & Co-CEO of

EvolutionIQ. “This collaboration enables Lincoln to extend its

capabilities and deliver the cutting edge in claimant service to

its many stakeholders.”

About Lincoln Financial Group

Lincoln Financial Group helps people to plan, protect and retire

with confidence. As of December 31, 2023, approximately 17 million

customers trust our guidance and solutions across four core

businesses – annuities, life insurance, group protection, and

retirement plan services. As of March 31, 2024, the company had

$310 billion in end-of-period account balances, net of reinsurance.

Headquartered in Radnor, Pa., Lincoln Financial Group is the

marketing name for Lincoln National Corporation (NYSE: LNC) and its

affiliates. Learn more at LincolnFinancial.com.

About EvolutionIQ

EvolutionIQ pioneered Claims Guidance in 2019. Its explainable

AI guides insurance claims professionals to their highest potential

impact claims, improving the claimant experience and delivering

better claim outcomes to claimants, carriers and their customers.

EvolutionIQ serves the group disability, individual disability and

workers’ compensation markets worldwide. EvolutionIQ’s AI native

products have been adopted by 70% of the top 15 U.S. disability

carriers and a growing list of workers’ compensation carriers. The

New York-based company employs 150 staff across the United States,

Europe and Australia. For more information, visit evolutioniq.com

and follow the company on LinkedIn.

1 Lincoln Group Protection reporting data, February 2024

LCN-6623268-051424

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240521697881/en/

Lincoln Financial Group Julianne Mattera

Julianne.Mattera@lfg.com 267-418-0346 Jason Kapler Vice President

of Marketing EvolutionIQ 917-740-5608 Press@evolutioniq.com

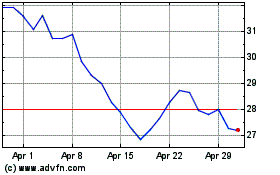

Lincoln National (NYSE:LNC)

Historical Stock Chart

From May 2024 to Jun 2024

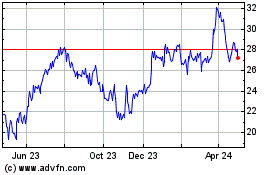

Lincoln National (NYSE:LNC)

Historical Stock Chart

From Jun 2023 to Jun 2024