____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November 2019

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

HIGHLIGHTS

· In 3Q19, Embraer delivered 17 commercial and 27 executive (15 light and 12 large) jets, compared to 15 commercial jets and 24 executive (17 light and 7 large) jets in 3Q18;

· The Company’s firm order backlog at the end of 3Q19 was US$ 16.2 billion;

· EBIT and EBITDA in 3Q19 were US$ (20.8) million and US$ 18.2 million, respectively, yielding EBIT margin of -1.8% and EBITDA margin of 1.5%. The quarterly results were impacted by separation costs of US$ 34.8 million related to the carve out of Embraer’s Commercial Aviation business. In the first nine months of 2019 the Company’s EBIT was US$ (9.3) million (EBIT margin of -0.3%) and EBITDA was US$ 116.2 million (EBITDA margin of 3.4%). In the same period separation costs represented US$ 66.6 million;

· 3Q19 Net loss attributable to Embraer shareholders and Loss per ADS were US$ (77.2) million and US$ (0.42), respectively. Adjusted net loss (excluding deferred income tax and social contribution) for 3Q19 was US$ (48.4) million, with Adjusted loss per ADS of US$ (0.26). Embraer reported adjusted net loss in 3Q18 of US$ (16.5) million, for an adjusted loss per ADS of US$ (0.09) in the quarter;

· Embraer reported 3Q19 Free cash flow of US$ (257.4) million, versus free cash flow of US$ (162.6) million reported in 3Q18;

· Embraer updates its 2019 and 2020 guidance. For 2019, Embraer reaffirms deliveries of 85 – 95 commercial jets, 90 – 110 executive jets, two KC-390 aircraft, and now expects five Super Tucano deliveries. The Company reaffirms guidance for 2019 revenues of US$ 5.3 – 5.7 billion and breakeven EBIT margin, while removing the estimates related to the consummation of the strategic partnership with Boeing by the end of the year. Embraer also introduces 2019 Free Cash Flow guidance for a use of US$ (300) – US$ (100) million for the year;

· For 2020, Embraer reaffirms revenues of US$ 2.5 – US$ 2.8 billion, EBIT margin of 2 – 5%, and breakeven Free Cash Flow, and now expects a special dividend of between US$ 1.3 billion and US$ 1.6 billion to be paid in 2020. Please see more on page 2 of this press release.

Main financial indicators1

1 Adjusted Net Income (loss) is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred income tax and social contribution for the period, in addition to adjusting for non-recurring items. Under IFRS for Embraer’s Income Tax benefits (expenses) the Company is required to record taxes resulting from unrealized gains or losses due to the impact of changes in the Real to US Dollar exchange rate over non-monetary assets (primarily Inventory, Intangibles, and PP&E). The taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are presented in the consolidated Cash Flow statement, under Deferred income tax and social contribution, which was US$ (4.0) million in 3Q18, US$ 28.8 million in 3Q19 and US$ (21.1) million in 2Q19. There were no special items recognized in 3Q18, 3Q19, or 2Q19. For a reconciliation of Adjusted Net Income (loss) please see page 12 of this release.

1

São Paulo, Brazil, November 12, 2019 - (B3: EMBR3, NYSE: ERJ). The Company's operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS. The financial data presented in this document as of and for the quarters ended September 30, 2019 (3Q19), June 30, 2019 (2Q19) and September 30, 2018 (3Q18), are derived from the unaudited financial statements, except annual financial data and where otherwise stated.

Beginning on page 17, the Company’s assets and liabilities related to the Commercial Aviation segment and related services are being presented in the condensed interim financial statements as assets and liabilities held for sale, and the respective results have been presented as discontinued operations, beginning February 26, 2019, the date of shareholder approval of the strategic partnership between Embraer and Boeing, when the transaction reached the “highly probable” criteria that requires the presentation of discontinued operations.

It is important to note that the Company has continued to present its financial results in this press release with 100% of the assets, liabilities, and financial results of the Commercial Aviation segment and its related services and Embraer’s 2019 financial and deliveries guidance remains based on these assumptions.

GUIDANCE REVISION

As previously communicated to the market, Embraer and The Boeing Company (“Boeing”) entered into certain agreements on January 24, 2019 with respect to a strategic partnership between the two companies (“Transaction”), and the shareholders of Embraer approved the Transaction on February 26, 2019. The parties continue to work to consummate the transaction as soon as possible. In this regard, Embraer will implement the internal separation of the Company’s commercial aviation business and related services and support businesses at the end of this fiscal year and currently expects that the Transaction will be consummated in early 2020. The parties have already obtained applicable anti-trust clearance from anti-trust authorities in certain jurisdictions and the consummation of the Transaction remains subject to approval by anti-trust authorities in certain other applicable jurisdictions and the satisfaction of other customary conditions in similar transactions. Until such approvals are received and the other conditions are satisfied, there can be no assurance as to the consummation of the Transaction or its timing.

Given the cash consumption observed in the third quarter of 2019 and the review of the short and medium-term business plan, and considering the new closing timeline of Transaction, expected to occur in early 2020, as described in the material fact published on October 3, 2019, Embraer updates its 2019 and 2020 guidance.

For 2019, the Company reaffirms deliveries of 85 – 95 commercial jets, 90 – 110 executive jets, two KC-390 aircraft, and now expects deliveries of five Super Tucano aircraft. Embraer also reaffirms expectations for 2019 revenues of US$ 5.3 – US$ 5.7 billion and breakeven (approximately zero) EBIT margin, while removing the estimates for net cash position and a special dividend in 2019 which were dependent upon closing of the Transaction by the end of this year. Embraer also introduces 2019 Free Cash Flow guidance for a usage of between US$ (300) and US$ (100) million for the year.

For 2020, including only expected results from the Executive Jet and Defense & Security businesses and their related services and support, Embraer reaffirms consolidated revenues of US$ 2.5 – US$ 2.8 billion, EBIT margin of 2% to 5%, and breakeven Free Cash Flow.

Given the Company’s expected 2019 cash consumption combined with anticipation of the consummation of the strategic partnership between Embraer and Boeing in early 2020 and the potential financial impact of these delays relative to previous expectations, Embraer now expects a special dividend of between US$ 1.3 billion and US$ 1.6 billion to be paid after the closing of the Transaction in 2020 (which remains subject to the confirmation of certain requirements, including the fiscal year results).

2

The Company summarizes its current 2019 and 2020 guidance below.

REVENUES and gross margin

In 3Q19, Embraer delivered 17 commercial and 27 executive aircraft (15 light jets and 12 large jets), for a total of 44 jets delivered during the quarter. This compares to 3Q18 deliveries of 15 commercial jets and 24 executive jets (17 light jets and 7 large jets). Large executive jet deliveries were higher on a year-over-year basis in large part due to the first full quarter of Praetor 600 deliveries, of which seven aircraft of the type were delivered in 3Q19. On a year-to-date basis, the Company delivered 54 commercial jets and 63 executive jets (42 light jets and 21 large jets), which compares to the 57 commercial jets and 55 executive jets (40 light jets and 15 large jets) Embraer delivered during the first nine months of 2018. The Company reiterates its 2019 guidance for 85 to 95 commercial jet deliveries and 90 to 110 total executive jet deliveries, with an increase in both commercial and executive jet deliveries planned for the fourth quarter.

Embraer reported 3Q19 revenues of US$ 1,175.6 million, representing year-over-year growth of 1.4% compared to 3Q18, principally as a result of higher deliveries in the Commercial Aviation and Executive Jets segments, along with 2.5% growth in Services & Support segment revenues, partially offset by a 28.7% year-over-year decline in Defense & Security revenues in 3Q19. Revenues in the Defense & Security segment were negatively impacted by cost base revisions related to the KC-390 development contract in 3Q19. Over the first nine months of 2019, the Company’s consolidated revenues totaled US$ 3,377.6 million, which was relatively stable compared to the US$ 3,373.4 million that Embraer reported in the same period of 2018. A year-over-year decline in Commercial Aviation revenues, due to lower deliveries in the first nine months of 2019 vs. 2018, was more than offset by growth in the Company’s Executive Jets, Defense & Security, and Services & Support segments. Embraer continues to guide 2019 consolidated revenues to finish the year in the range of US$ 5.3 to US$ 5.7 billion.

The Company’s 3Q19 consolidated gross margin was 13.1% as compared to 18.9% in 3Q18, with declines across all of Embraer’s main business units, led by the Commercial Aviation and Defense & Security segments. For the first nine months of 2019, Embraer’s consolidated gross margin was 15.3% versus the 15.0% reported for the first nine months of 2018, with the improvement driven by the Defense & Security business unit.

3

EBIT AND ADJUSTED EBIT

EBIT and EBIT margin as reported in 3Q19 were US$ (20.8) million and -1.8%, respectively, which compares to EBIT of US$ 54.3 million and EBIT margin of 4.7% in 3Q18. The decrease in EBIT and EBIT margin as reported was driven by profitability declines in Commercial Aviation (less favorable mix of deliveries), Defense & Security (cost base revisions on the KC-390 development contract), and Services & Support (lower spare parts and materials profitability). This was somewhat offset by improvement in Executive Jets profitability in the quarter resulting from a combination of higher revenues and SG&A efficiencies. There were no special items recorded in either the 3Q18 or 3Q19 results. On a year-to-date basis in 2019, Embraer’s reported EBIT and EBIT margin were US$ (9.3) million and -0.3%, respectively, which contained no special non-recurring items. This compares to reported EBIT of US$ 28.6 million and EBIT margin of 0.8% during the first nine months of 2018, which included a special non-recurring item relating to the KC-390 runway excursion incident during testing, which negatively impacted EBIT by US$ 127.2 million. Excluding this special item, adjusted EBIT and adjusted EBIT margin over the first nine months of 2018 were US$ 155.8 million and 4.6%, respectively. The Company reiterates its guidance for 2019 EBIT margin of approximately breakeven, including separation costs related to the carve out of Embraer’s commercial aviation business.

Administrative expenses in 3Q19 were US$ 37.3 million, down from the US$ 44.4 million reported in 3Q18. Year-to-date, administrative expenses were US$ 129.6 million in 2019 as compared to US$ 130.1 million over the same period of 2018. The Company’s selling expenses in the third quarter were US$ 70.9 million, representing a decline from the US$ 73.7 million reported in 3Q18, and were also lower over the first nine months of 2019 relative to the first nine months of 2018, at US$ 214.0 million vs. US$ 216.0 million. In 3Q19, research expenses of US$ 11.6 million were US$ 2.9 million higher than reported in 3Q18, and on a year-to-date basis research expenses in 2019 were US$ 32.6 million as compared to US$ 28.6 million over the same period of 2018.

Other operating income (expense), net in 3Q19 was expense of US$ 55.4 million compared to an expense of US$ 37.7 million in 3Q18. The increase in other operating expenses was principally due to separation costs of US$ 34.8 million in 3Q19. On a year-to-date basis, the Company’s other operating income (expense), net in the first nine months of 2019 was an expense of US$ 149.9 million compared to an expense of US$ 102.9 million, with the increase due to US$ 66.6 million in separation costs recognized in 2019 thus far.

net income (LOSS)

Net income (loss) attributable to Embraer shareholders and Earnings (Loss) per ADS for 3Q19 were US$ (77.2) million and US$ (0.42) per share, respectively, compared to US$ (12.5) million in net income (loss) attributable to Embraer shareholders and US$ (0.07) in Earnings (Loss) per ADS in 3Q18. Over the first nine months of 2019, net income (loss) attributable to Embraer shareholders was US$ (112.4) million and Earnings (Loss) per ADS was US$ (0.61).

Adjusted net income (loss), excluding deferred income tax and social contribution, was US$ (48.4) million in 3Q19, and adjusted earnings (loss) per ADS was US$ (0.26). This compares to adjusted net income (loss) of US$ (16.5) million and adjusted earnings (loss) per ADS of US$ (0.09) in 3Q18. In the first nine months of 2019, adjusted net income (loss) and adjusted earnings (loss) per ADS were US$ (124.0) million and US$ (0.67) per share, respectively, compared to adjusted net income (loss) of US$ (77.3) million and adjusted earnings (loss) per ADS of US$ (0.26) per share in the first nine months of 2018.

4

monetary balance sheet accounts and other measures

Embraer finished 3Q19 with a consolidated net debt position of US$ 1,347.2 million, compared to the net debt position of US$ 1,090.3 million at the end of 2Q19. The Company’s higher net debt position is a result of the Company’s negative free cash flow during 3Q19. Embraer’s total loans position at the end of 3Q19 was US$ 3,522.6 million.

Adjusted net cash generated (used) by operating activities net of adjustments for financial investments was US$ (127.1) million in 3Q19 and adjusted free cash flow for the quarter was US$ (257.4) million. This compares to adjusted net cash generated (used) by operating activities net of financial investments of US$ (71.0) million and adjusted free cash flow of US$ (162.6) million in 3Q18. The principal factors explaining the lower free cash flow in 3Q19 are higher capex and investments in development and lower net income in 3Q19 as compared to 3Q18. Free cash flow for the first nine months of 2019 was US$ (921.3) million versus US$ (554.5) million in the first nine months of 2018, due to a combination of higher capex and development spending in the current year and slightly higher investment in working capital. The Company expects significant positive free cash flow generation in the fourth quarter largely due to higher commercial and executive jet deliveries and has announced guidance for free cash flow usage of between US$ (300) million and US$ (100) million for 2019.

Net additions to total PP&E for 3Q19 were US$ 70.2 million, versus US$ 26.6 million in net additions reported in 3Q18. Of the total 3Q19 additions to PP&E, CAPEX amounted to US$ 44.6 million and additions of pool program spare parts was US$ 25.6 million. Year-to-date, Embraer invested a total of US$ 185.3 million in total PP&E, compared to US$ 97.6 million in the first nine months of 2018.

In 3Q19, Embraer invested a total of US$ 60.2 million in product development, which was not offset by any contributions from suppliers during the period. This investment was principally related to the development of the E-Jets E2 commercial jet program, which continues to progress according to schedule. In the first nine months of 2019, the Company invested a total of US$ 191.9 million in product development and the period’s net development was US$ 187.4 million, compared to net development investments of US$ 74.6 million over the first nine months of 2018.

5

|

The Company’s total debt decreased US$ 46.5 million to US$ 3,522.6 million at the end of 3Q19 compared to US$ 3,569.1 million at the end of 2Q19. Short-term debt at the end of 3Q19 was US$ 275.0 million and long-term debt was US$ 3,247.6 million. The average loan maturity of the Company’s debt at the end of 3Q19 was 4.9 years. The cost of Dollar denominated loans at the end of 3Q19 was stable at 5.28% p.a., while the cost of real denominated loans declined to 1.42% p.a. at the end of 3Q19 versus 1.75% at the end of 2Q19.

Embraer’s EBITDA over the last 12 months (unadjusted EBITDA LTM) to financial expenses (gross) at the end of 3Q19 fell to 0.9 vs. 1.4 at the end of 2Q19. At the end of 3Q19, 5.0% of total debt was denominated in Reais.

|

Embraer’s cash allocation management strategy continues to be one of its most important tools to mitigate exchange rate risks. By balancing cash allocation in Real and Dollar assets, the Company attempts to neutralize its balance sheet exchange rate exposure. Of total cash at the end of 3Q19, 86% was denominated in US Dollars.

|

Complementing its strategy to mitigate exchange rate risks, the Company entered into financial hedges in order to reduce its cash flow exposure.

The Company’s cash flow exposure is due to the fact that approximately 10% of its net revenues are denominated in Reais while approximately 20% of total costs are denominated in Reais. Having more Real denominated costs than revenues generates this cash flow exposure. For 2019, around 55% of the Company’s Real cash flow exposure is hedged if the US Dollar depreciates below an average rate floor of R$ 3.43. For exchange rates above this level, the Company will benefit up to an average exchange rate cap of R$ 4.10.

|

|

6

operational balance sheet accounts

During 3Q19, Embraer invested in working capital, which increased compared to that at the end of 2Q19. Trade accounts receivable and contract assets increased US$ 73.8 million to end the quarter at US$ 891.3 million, reflecting extended payment cycles from certain customers, particularly in the Defense & Security segment, which the Company expects to improve during the fourth quarter of 2019. Inventories also increased in the quarter, growing US$ 78.4 million to finish 3Q19 at US$ 3,082.7 million, driven by investment in preparation for a higher number of deliveries expected in the fourth quarter. A decrease in trade accounts payable during 3Q19 of US$ 69.0 million to finish the quarter at US$ 856.6 million also weighed on cash flow during the period, partially offset by an increase of US$ 31.6 million in contract liabilities to end 3Q19 at US$ 1,378.5 million. Property, plant and equipment increased US$ 27.5 million to US$ 2,017.1 million at the end of 3Q19, and intangibles were up US$ 43.6 million to finish the period at US$ 2,042.1 million.

Total Backlog

Considering all deliveries as well as firm orders obtained during the period, the Company’s firm order backlog ended 3Q19 at US$ 16.2 billion, as compared to US$ 16.9 billion at the end of 2Q19 and US$ 13.6 billion at the end of 3Q18.

7

Segment Results

The Commercial Aviation segment represented 34.7% of consolidated revenues in 3Q19 versus 33.0% of revenues in 3Q18, as the segment’s revenues grew 6.7% on a year-over-year basis. The portion of Executive Jets revenues also increased, from 26.9% in 3Q18 to 30.9% in 3Q19, on higher deliveries in the current year’s quarter which led to 16.3% year-over-year revenue growth. The Defense & Security segment reported a decline of 28.7% in revenues on a year-over-year basis in 3Q19 and comprised 14.0% of total revenues in the quarter compared to 19.9% in 3Q18. Revenues in the segment in 3Q19 were negatively impacted by cost base revisions on the KC-390 development contract in the quarter (leading to a negative adjustment during 3Q19 of revenues recognized in previous periods, as defense contracts are generally accounted for under percentage of completion). Revenues in the Services & Support segment increased slightly from US$ 232.5 million (20.1% of consolidated revenues) in 3Q18 to US$ 238.4 million (20.3% of revenues) in 3Q19. Over the first nine months of 2019, Commercial Aviation represented 39.0% of revenues, Executive Jets was 23.0%, Defense & Security was 16.0%, Services & Support represented 21.8%, and Others was 0.2%.

Commercial Aviation

In 3Q19, Embraer delivered 17 commercial jets, as shown in the table below:

In July, following its successful debut at the 53rd edition of the Paris International Air Show, Embraer's newest "Profit Hunter" - the E195-E2 with an impressive "TechLion" painting covering its fuselage - began its world demo tour. The first stop was in Xiamen, China, followed by several other cities in the country. The aircraft also visited Japan and the Asia Pacific region before making its Russian debut at the Moscow Air Show 2019. Following that, the E195-E2 went to Europe, where its silent cabin and incredible efficiency were highlighted.

In August, Embraer announced that it signed a contract with SkyWest, Inc. for a firm order of seven E175 jets in a 70-seat configuration. SkyWest will operate the aircraft for Delta. The order has a value of USD 340 million, based on 2019 list prices, and was already included in Embraer’s 2019 second-quarter backlog as an undisclosed customer. Deliveries are expected to begin in 4Q19.

In September, Embraer delivered its first E195-E2, the largest of the three members of the E-Jets E2 family of commercial aircraft, to AerCap, the world’s largest aircraft leasing company, and Azul Linhas Aéreas Brasileiras S.A., in a ceremony held at its main facility in São José dos Campos, Brazil. Azul is the global launch operator for the E195-E2 and has placed firm orders for 51 aircraft of the type. The airline will receive

another five aircraft before the end of the year. Azul currently owns a fleet of first generation E195 jets, and will operate the E195-E2 in a single class configuration, with 136 seats, on both domestic and international routes, leveraging the aircraft’s 25.4% lower fuel consumption per seat and 20% lower maintenance costs per seat compared to the prior generation. In addition, Azul will benefit from the most environmentally friendly aircraft in its class, with the lowest levels of external noise and emissions.

8

At the end of 3Q19, the backlog and cumulative deliveries for Commercial Aviation were as follows:

Executive JETS

The Executive Jets segment delivered 15 light and 12 large jets, totaling 27 aircraft in 3Q19.

The month of July marked Embraer’s presence at the Experimental Aircraft Association’s AirVenture, in Oshkosh, with the Phenom 100EV and Phenom 300E on static display. Both aircraft have been purchased by new and current customers, owners of each model’s predecessor. This validates the key design drivers of the Phenom jets: premium comfort, outstanding performance, state of the art technology and low operating costs.

In August, the new Praetor 500 and Praetor 600 jets made their LABACE debut at the largest business aviation show in Latin America. The Praetor jets, Embraer’s latest aircraft, are the most technologically advanced in their categories. The Phenom 100EV and the Phenom 300E were also exhibited on static display, alongside the Praetor 500, Praetor 600 and a Bandeirante (EMB-110) aircraft, which was present in celebration of Embraer’s 50-year anniversary.

In the same month, Embraer delivered the first Praetor 600 jet that had its final assembly performed at Embraer’s production facility in Melbourne, Florida. This site is where the company has produced more than 360 Phenom and Legacy aircraft since 2011. The Praetor 600 was certified in April 2019, just six months after its announcement.

Another third-quarter highlight was the certification of the Praetor 500. The midsize jet was granted its Type Certificate by Brazil’s Civil Aviation Authority (ANAC—Agência Nacional de Aviação Civil) in August, surpassing major design targets such as range, speed, and take-off and landing performance. In September, the Praetor 500 was certified by the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency).

9

Defense & security

During 3Q19, the KC-390 program achieved an important milestone: aircraft entry into service. The first aircraft was delivered to the Brazilian Air Force (FAB) in September and is now being used to train the pilots and technicians that will operate and maintain the KC-390 fleet. The delivery of the second aircraft to the Brazilian Air Force is scheduled to happen in 4Q19. The flight test campaign, now focused on military features, is proceeding at an accelerated pace, exceeding 2,300 flight hours. The highlight of 3Q19 was the Air to Air Refueling test campaign, held at Canoas and Santa Maria Brazilian Air Force bases. This campaign has successfully demonstrated the KC-390 capability to refuel A-1 and F-5 fighters.

In August, Embraer delivered the sixth modernized A1-M aircraft to the Brazilian Air Force and also accomplished the first flight of a modernized E-99 aircraft which is employed by FAB for aerial surveillance and early warning missions. In September, the 4th Legacy 500 aircraft modified to perform flight inspection operations was delivered to GEIV. In the same month, Embraer delivered to the Brazilian Navy the fifth modernized AF-1 aircraft. Also in 3Q19, the first production flight of the first A-29 Super Tucano aircraft manufactured for the Philippines government occurred.

In 3Q19, under the SISFRON contract with the Brazilian Army, SAVIS delivered five additional sites, comprising a total of 58 sites already delivered to and in operation with the Brazilian Army. SAVIS also delivered its response to the RFI (Request for Information) regarding the implementation of the second phase of the SISFRON project.

Visiona signed a contract with Transpetro S.A., a Petrobras owned company that operates with fuel transport and logistics, to monitor the areas of fuel duct locations in Brazil. Also in 3Q19, the company continued the development of the VCUB1 nanosatellite, the first satellite designed by a Brazilian company, highlighting the signature of a technological cooperation agreement with the CPRM (Geological Survey of Brazil) focusing on the development of services based on the data that will be collected by the satellite.

services & support

During 3Q19, Embraer signed a long-term Pool Program Agreement with Mongolian Hunnu Air to support a wide range of repairable components for the airline’s recently leased fleet of E190 aircraft. Hunnu Air is the first E190 operator in Mongolia and took delivery of its first E190 in May. The agreement includes full repair coverage for components and parts as well as access to a large stock of components at Embraer’s distribution center, which will support the start of the airline’s E190 operation.

At the Latin American Business Aviation Conference & Exhibition (LABACE) held at Congonhas Airport in São Paulo, Brazil in August, Embraer Services & Support showcased its TechCare space, which included a broad portfolio of interior design elements from the best manufacturers in the aircraft customization market. This collection represents the new Interior Workshop showroom at Sorocaba Service Center, in Brazil. Among the projects already developed by the Interior Workshop was the complete revitalization of a 10-year old Legacy 600, with the replacement of leather armchairs, removal and application of varnish on wood surfaces, and replacement of carpet and vinyl flooring installation in the Galley. In another project, an eight-year-old Phenom 100 received new ultra-leather panel coating, varnished cabin bulkheads and doors, formica repairs, and seat leather and base restoration.

In September, the Company announced that Horizon Air, a subsidiary of Alaska Air Group, selected Embraer Aircraft Maintenance Services (EAMS) in Nashville, Tennessee, as the exclusive heavy maintenance provider for Horizon’s fleet of 30 E175 aircraft. The multi-year agreement includes airframe maintenance, modifications, and repair services provided by Embraer’s portfolio of solutions, TechCare.

10

Reconciliation OF IFRS and “non gaap” information

We define Free cash flow as operating cash flow less Additions to property, plant and equipment, Additions to intangible assets, Financial investments and Other assets. Free cash flow is not an accounting measure under IFRS. Free cash flow is presented because it is used internally as a measure for evaluating certain aspects of our business. The Company also believes that some investors find it to be a useful tool for measuring Embraer's cash position. Free cash flow should not be considered as a measure of the Company's liquidity or as a measure of its cash flow as reported under IFRS. In addition, Free cash flow should not be interpreted as a measure of residual cash flow available to the Company for discretionary expenditures, since the Company may have mandatory debt service requirements or other nondiscretionary expenditures that are not deducted from this measure. Other companies in the industry may calculate Free cash flow differently from Embraer for purposes of their earnings releases, thus limiting its usefulness for comparing Embraer to other companies in the industry.

EBITDA LTM represents earnings before interest, taxation, depreciation and amortization accumulated over a period of the last 12 months. It is not a financial measure of the Company’s financial performance under IFRS. EBIT as mentioned in this press release refers to earnings before interest and taxes, and for purposes of reporting is the same as that reported on the Income Statement as Operating Profit before Financial Income.

EBIT and EBITDA are presented because they are used internally as measures to evaluate certain aspects of the business. The Company also believes that some investors find them to be useful tools for measuring a Company’s financial performance. EBIT and EBITDA should not be considered as alternatives to, in isolation from, or as substitutes for, analysis of the Company’s financial condition or results of operations, as reported under IFRS. Other companies in the industry may calculate EBIT and EBITDA differently from Embraer for the purposes of their earnings releases, limiting EBIT and EBITDA’s usefulness as comparative measures.

Adjusted EBIT and Adjusted EBITDA are non-GAAP measures, and both exclude the impact of several non-recurring items, as described in the tables bellow.

11

Adjusted Net Income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred Income tax and social contribution for the period, as well as removing the impact of non-recurring items. Furthermore, under IFRS for purposes of calculating Embraer’s Income Tax benefits (expenses), the Company is required to record taxes resulting from gains or losses due to the impact of the changes in the Real to the US Dollar exchange rate over non-monetary assets (primarily Inventories, Intangibles, and PP&E). It is important to note that taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are accounted for in the Company’s consolidated Cash Flow statement, under Deferred income tax and social contribution.

Some Financial Ratios based on “non GAAP” information

(i) Total debt represents short and long-term loans and financing.

(ii) Net cash represents cash and cash equivalents, plus financial investments, minus short and long-term loans and financing.

(iii) Total capitalization represents short and long-term loans and financing, plus shareholders equity.

(iv) Financial expense (gross) includes only interest and commissions on loans.

(v) The table at the end of this release sets forth the reconciliation of Net income to adjusted EBITDA, calculated on the basis of financial information prepared with IFRS data, for the indicated periods.

(vi) Interest expense (gross) includes only interest and commissions on loans, which are included in Interest income (expense), net presented in the Company’s consolidated Income Statement.

12

FINANCial statements

In the following financial statements the Company has continued to present its results with 100% of the assets, liabilities, and financial results of Embraer including the Commercial Aviation segment and its related services.

13

14

15

16

DISCONTINUED OPERATIONS

The terms and conditions approved on December 17, 2018 defined the creation of a joint venture (Boeing-Brazil Commercial) contemplating assets from Embraer’s Commercial Aviation segment and related services (Services & Support segment) with an 80% interest to be held by Boeing and 20% by Embraer. On January 10, 2019 the Brazilian Federal Government informed that it would not exercise its veto right on the strategic partnership between Boeing and Embraer, and on February 26, 2019 the shareholders of the Company approved the creation of the joint venture under the strategic partnership.

The Company’s assets and liabilities related to the Commercial Aviation segment and related services were measured and are being presented in the condensed interim financial statements as assets and liabilities held for sale, and the respective results have been presented as discontinued operations, beginning February 26, 2019, the date of shareholder approval of the transaction when the “highly probable” criteria for presentation of discontinued operations was reached.

The assets and liabilities held for sale as of September 30, 2019 related to the Commercial Aviation segment and related services are presented below. The segregation of these assets and liabilities considered their use in the manufacturing of products and services and administrative/operational support of the Commercial Aviation segment and related services, as well as the terms defined between Embraer and Boeing in the Master Transaction Agreement (MTA) of the strategic partnership.

Depreciation and amortization of non-current assets held for sale, including property, plant, and equipment and intangible assets were ceased as of February 26, 2019 due to the expectation of realization of value of these assets by sale instead of continued use as of this date.

Embraer’s cumulative results for the first nine months of 2019 ended September 30, 2019 considering the segregation of continuing and discontinued operations are presented below. The following components are excluded from results from continuing operations:

· Net revenues, cost of products and services sold, and general expenses directly associated with the Commercial Aviation segment and related services;

· G&A expenses of certain corporate areas that will be shared among Embraer’s and Boeing-Brazil Commercial’s operations;

17

· Other operating income and expenses directly associated with the discontinued operations. Corporate projects of the Company are fully maintained as a part of continuing operations;

· Financial expenses on loans and financing interest that will be contributed, including FX gains/losses on financial assets and liabilities held for sale;

· Separation costs related to the carve out of the commercial aviation and related services business. These costs are 100% allocated to discontinued operations;

· Corporate and other operating expenses previously shared among all business units and allocated to each reporting segment are fully consolidated as expenses of Embraer Continuing Operations. In the first nine months of 2019, US$ 55.7 million of corporate expenses that were previously allocated to the discontinued operations businesses are fully recognized in the Company’s consolidated results of continuing operations. This amount was US$ 70.9 million in the first nine months of 2018.

18

The Company’s balance sheet with the segregation of assets and liabilities of the Commercial Aviation segment and related services as Assets Held for Sale and Liabilities Held for Sale is presented below.

19

20

Investor Relations

Eduardo Couto, Chris Thornsberry, Caio Pinez, Nádia Santos, and Viviane Pinheiro.

(+55 12) 3927 1000

investor.relations@embraer.com.br

ri.embraer.com.br

CONFERENCE CALL INFORMATION

Embraer will host a conference call to present its 3Q19 Results on Tuesday, November 12, 2019 at 10:30 AM (SP) / 8:30 AM (NY). The conference call will also be broadcast live over the web at ri.embraer.com.br

Conference ID: EMBRAER

Telephones USA / Canada: (Toll-free) +1 (646) 291-8936 / (Dial-in) +1 (646) 828-8246

Telephones U.K.: (Toll-free) 0-808-111-0152 / (Dial-in) +44 20 7442-5660

Telephones Brazil: +55 (11) 3193-1080 / +55 (11) 2820-4080

ABOUT EMBRAER

A global aerospace company headquartered in Brazil, Embraer celebrates its 50th anniversary with businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customer after-sales.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. On average, about every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting over 145 million passengers a year.

Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe.

For more information, please visit embraer.com

This document may contain projections, statements and estimates regarding circumstances or events yet to take place. Those projections and estimates are based largely on current expectations, forecasts of future events and financial trends that affect Embraer’s businesses. Those estimates are subject to risks, uncertainties and suppositions that include, among others: general economic, political and trade conditions in Brazil and in those markets where Embraer does business; expectations of industry trends; the Company’s investment plans; its capacity to develop and deliver products on the dates previously agreed upon, and existing and future governmental regulations. The words “believe”, “may”, “is able”, “will be able”, “intend”, “continue”, “anticipate”, “expect” and other similar terms are intended to identify potentialities. Embraer does not undertake any obligation to publish updates nor to revise any estimates due to new information, future events or any other facts. In view of the inherent risks and uncertainties, such estimates, events and circumstances may not take place. The actual results may therefore differ substantially from those previously published as Embraer expectations.

21

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 12, 2019

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ Nelson Krahenbuhl Salgado

|

|

|

|

Name:

|

|

Nelson Krahenbuhl Salgado

|

|

|

|

Title:

|

|

Chief Financial and Investor Relations Officer

|

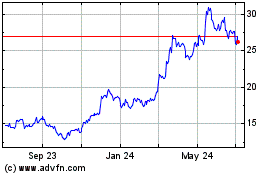

Embraer (NYSE:ERJ)

Historical Stock Chart

From Aug 2024 to Sep 2024

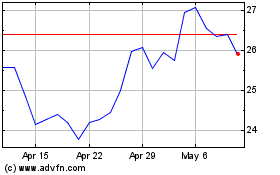

Embraer (NYSE:ERJ)

Historical Stock Chart

From Sep 2023 to Sep 2024