0001121702false00011217022024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 15, 2024

YIELD10 BIOSCIENCE, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 001-33133 | | 04-3158289 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

19 Presidential Way, Woburn, Massachusetts | | 01801 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 583-1700

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | YTEN | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 15, 2024, Yield10 Bioscience, Inc. issued a press release announcing the financial results for the three months ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1. This information, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| | Press Release dated May 15, 2024 announcing financial results for the three months ended March 31, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | YIELD10 BIOSCIENCE, INC. |

| | | |

May 15, 2024 | By: | /s/ Oliver P. Peoples |

| | | Oliver P. Peoples |

| | | President & Chief Executive Officer |

Yield10 Bioscience Announces First Quarter 2024 Financial Results

-Earns $1 million in milestone payments from Vision Bioenergy Oilseeds

WOBURN, Mass. - May 15, 2024 - Yield10 Bioscience, Inc. (Nasdaq:YTEN) ("Yield10" or the "Company"), an agricultural bioscience company, today reported financial results for the first quarter ended March 31, 2024.

"In the first quarter of 2024, we made the strategic decision to focus our resources on the commercialization of Camelina products targeting the aquafeed and nutritional markets for omega-3 fatty acids," said Oliver Peoples, Ph.D., President and Chief Executive Officer of Yield10. "We are building seed inventory in anticipation of commercial scale planting, planning to obtain regulatory approval to sell omega-3 oil for aquafeed in Chile, and engaging with potential commercial partners to enable future commercial sale of omega-3 oil and meal in target markets.

"We recently completed deliverables earning $1 million in milestone payments from Vision Bioenergy Oilseeds. Earlier this year, we granted a license to VISION related to our herbicide tolerance technology for Camelina. In recent months we have obtained clearances from both USDA-APHIS and the U.S. EPA allowing commercial planting of HT Camelina together with the use of glufosinate herbicide for the management of broad leaf weeds, representing a key milestone in the commercial development of Camelina.

"Yield10 is a leader in the development of Camelina as a commercial crop and in engineering novel traits into the crop. In April of 2024, Yield10 was granted a U.S. patent covering oilseed plants engineered with a complex, novel carbon fixation pathway and in May of 2024, the Company was granted a Notice of Allowance on C3004, a trait that increases photosynthesis driving increased branching and seed yield in Camelina. We expect this patent to issue in the second half of 2024.

"In the coming months, we plan to continue to execute on our commercial and regulatory plan to produce omega-3 oil and meal products in Camelina, to combine our herbicide tolerant and omega-3

traits to produce new Camelina varieties, and to continue to support grower adoption of Camelina," said Dr. Peoples.

Recent Accomplishments

Recent progress by Yield10 is underscored by corporate milestones achieved since the start of 2024.

•On May 13, 2024, Vision Bioenergy Oilseeds, LLC (“VISION”) made an additional $1 million in milestone payments to Yield10 in connection with certain deliverables to VISION in accordance with the terms of our license agreement signed in February of 2024.

•Yield10 anticipates planting its omega-3 DHA1 (EPA+DHA) Camelina variety this fall as part of its seed scale-up program to build seed inventory to produce oil for sampling potential partners and future pre-commercial scale planting.

•During the first quarter of 2024, the U.S. Environmental Protection Agency (“EPA”) approved an amendment to the label language of INTERLINE® Herbicide to include the oilseed Camelina. This allows Yield10’s glufosinate-tolerant Camelina to be sprayed with INTERLINE®, a glufosinate containing herbicide, providing farmers with a much-needed method to control broad leaf weeds during Camelina field production. INTERLINE® is marketed by UPL, Ltd., a global provider of sustainable agricultural solutions.

•On April 23, 2024 the U.S. Patent and Trademark Office (“PTO”) granted to the Company U.S. Patent No. US 11,965,182 “Plants with Enhanced Yield and Methods of Construction.” In the patent, the Yield10 inventors describe engineering a complex carbon fixation pathway into Camelina as a representative oilseed plant. The patent supports potential use of complex metabolic engineering strategies to increase crop yield.

•In May of 2024, the U.S. PTO granted to Yield10 a Notice of Allowance for a patent application entitled "Genetically engineered land plants that express an increased seed yield protein and/or an increased seed yield RNA." This U.S. patent covers Yield10's C3004 trait, which has been shown to increase photosynthesis in Camelina and to produce more branching and seed yield in field tests reported by the Company.

FIRST QUARTER 2024 FINANCIAL OVERVIEW

Reverse Stock Split

On May 2, 2024, the Company effected a 1-for-24 reverse stock split of its common stock. Unless otherwise indicated, all share amounts, per share data, share prices, and conversion rates set forth in this press release and the accompanying condensed financial statements have, where applicable, been adjusted retroactively to reflect this reverse stock split.

Cash Position

Yield10 is managed with an emphasis on cash flow and deploys its financial resources in a disciplined manner to achieve its key strategic objectives.

Yield10 ended the first quarter of 2024 with $1.6 million in unrestricted cash and cash equivalents; a net increase of $0.5 million from unrestricted cash, cash equivalents and investments of $1.1 million reported as of December 31, 2023. The Company used $0.9 million in cash for its operating activities during the three months ended March 31, 2024, in comparison to $2.7 million used for operating activities during the first three months of 2023. The net decrease in cash usage reflects the Company's continuing efforts to conserve cash resources by reducing expenses and delaying payments to vendors and the receipt of the initial $2.0 million paid by VISION upon execution of the commercial license agreement.

In February of 2024, Yield10 granted a commercial license to VISION for certain proprietary varieties of Camelina for the production of feedstock oil for biofuels and other markets excluding omega-3 oils and bioplastics. VISION will make cash payments to the Company totaling $3.0 million, of which $2.0 million was received as of March 31, 2024, and the remainder was paid by VISION during the second quarter of 2024 upon the Company's completion of certain near-term milestones. In March 2024, the Company also entered into warrant exercise agreements with certain existing institutional investors, pursuant to which these investors agreed to exercise a portion of the warrants issued to them in May of 2023 and/or August of 2023. The Company received net proceeds of approximately $1.2 million from the exercise of the warrants, net of transaction expenses of $0.2 million incurred in completing the arrangement.

Operating Results

During the three months ended March 31, 2024, the Company recognized $0.3 million in license revenue from the agreement with VISION. The license agreement with VISION contains a number of service deliverables that the Company must meet in order to fulfill its contractual obligations. The Company will recognize the $3.0 million in revenue on a straight line basis through the estimated completion date of the final service deliverables estimated to occur through September of 2025. Research grant revenue was $0.1 million for the three months ended March 31, 2023. Yield10 did not recognize grant revenue during the three months ended March 31, 2024, as the Company's five-

year sub-award with Michigan State University in support of a U.S. Department of Energy funded grant was completed in March 31, 2023 with no further grant revenue to be recognized.

Research and development expenses were $1.4 million during the first three months of 2024 compared to $2.2 million during the first three months of 2023 and general and administrative expenses were $1.4 million during the first three months of 2024 compared to $1.7 million during the three months ended March 31, 2023. The decreased expenses quarter over quarter reflect the Company's efforts to better align its expenses with its cash resources.

Yield10 reported a net loss of $2.5 million for the three months ended March 31, 2024, or $4.77 per share, as compared to a net loss of $3.8 million, or $18.16 per share, for the three months ended March 31, 2023.

About Yield10 Bioscience

Yield10 Bioscience, Inc. ("Yield10" or the "Company") is an agricultural bioscience company that is leveraging advanced genetics to develop the oilseed Camelina sativa ("Camelina") as a platform crop for large-scale production of sustainable seed products. These seed products include feedstock oils for renewable diesel and sustainable aviation biofuels; omega-3 (EPA and DHA+EPA) oils for pharmaceutical, nutraceutical and aquafeed applications; and, in the future, PHA biomaterials for use as biodegradable bioplastics. Subject to the availability of sufficient financial resources to continue operations, our commercial plan is based on establishing a grain contracting business leveraging our proprietary elite Camelina seed varieties, focusing on the production of omega-3 oils for nutritional applications and partnering or licensing our advanced Camelina gene technologies to biofuel value chain partners to support their goals of meeting the growing demand for low-carbon intensity feedstock oil. Yield10 is headquartered in Woburn, MA and has a Canadian subsidiary, Yield10 Oilseeds Inc., located in Saskatoon, Canada.

For more information about the Company, please visit www.yield10bio.com, or follow the Company on X (formerly Twitter), Facebook and LinkedIn. (YTEN-E)

Safe Harbor for Forward-Looking Statements

This press release contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The forward-looking statements in this release do not constitute guarantees of future performance. Investors are cautioned that statements in this press release which are not strictly historical statements, including, without limitation, expectations regarding Yield10’s cash position, cash forecasts and runway, expectations related to research and development and commercialization activities, intellectual property, the expected regulatory path for traits, reproducibility of data from field tests, the timing of completion of additional greenhouse and field test studies, the outcomes of its 2024 seed production activities, 2024 spring field tests, 2023-2024 winter field tests, Camelina planting under growers contracts and seed scale-up activities, the signing of research licenses and collaborations, including whether the objectives of those collaborations will be met, whether the Company will be able to generate proof points for traits in development and advance business discussions around its Camelina business plan, the geopolitical uncertainty caused by the conflict between Ukraine and Russia, and value creation as well as the overall progress of Yield10, constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the Company’s ability to secure adequate funding in the near term to continue operations, as to which no assurance can be given, as well as

the risks and uncertainties detailed in Yield10 Bioscience's filings with the Securities and Exchange Commission. Yield10 assumes no obligation to update any forward-looking information contained in this press release or with respect to the matters described herein.

Contact:

Yield10 Bioscience:

Lynne H. Brum, (617) 682-4693, LBrum@yield10bio.com

(FINANCIAL TABLES FOLLOW)

YIELD10 BIOSCIENCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue: | | | | | | | |

| | | | | | | |

| Grant revenue | $ | — | | | $ | 60 | | | | | |

| | | | | | | |

| License revenue | 300 | | | — | | | | | |

| Total revenue | 300 | | | 60 | | | | | |

| | | | | | | |

| Expenses: | | | | | | | |

| | | | | | | |

| Research and development | 1,366 | | | 2,162 | | | | | |

| General and administrative | 1,374 | | | 1,698 | | | | | |

| Total expenses | 2,740 | | | 3,860 | | | | | |

| Loss from operations | (2,440) | | | (3,800) | | | | | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| | | | | | | |

| Other income (expense), net | (32) | | | 18 | | | | | |

| Total other income (expense) | (32) | | | 18 | | | | | |

| Loss from operations before income taxes | (2,472) | | | (3,782) | | | | | |

| Income tax provision | — | | | — | | | | | |

| Net loss | $ | (2,472) | | | $ | (3,782) | | | | | |

| | | | | | | |

| Basic and diluted net loss per share | $ | (4.77) | | | $ | (18.16) | | | | | |

| Number of shares used in per share calculations: | | | | | | | |

| Basic and diluted | 518,534 | | | 208,323 | | | | | |

YIELD10 BIOSCIENCE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

UNAUDITED

(In thousands, except share and per share amounts)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 1,597 | | | $ | 1,068 | |

| | | |

| | | |

| | | |

| | | |

| Prepaid expenses and other current assets | 526 | | | 332 | |

| | | |

| Total current assets | 2,123 | | | 1,400 | |

| | | |

| Restricted cash | 47 | | | 264 | |

| Property and equipment, net | 487 | | | 548 | |

| Right-of-use assets, net | 1,529 | | | 1,653 | |

| Other assets | 57 | | | 42 | |

| Total assets | $ | 4,243 | | | $ | 3,907 | |

| | | |

| Liabilities and Stockholders’ Deficit | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 1,646 | | | $ | 1,202 | |

| Accrued expenses | 1,187 | | | 2,010 | |

| Deferred revenue | 1,700 | | | — | |

| Current portion of lease liabilities | 687 | | | 669 | |

| Convertible note payable, net of issuance costs | 990 | | | 984 | |

| Total current liabilities | 6,210 | | | 4,865 | |

| Lease liabilities, net of current portion | 1,346 | | | 1,525 | |

| | | |

| | | |

| Total liabilities | 7,556 | | | 6,390 | |

| Commitments and contingencies | | | |

| | | |

| Stockholders’ Deficit: | | | |

| | | |

Preferred stock ($0.01 par value per share); 5,000,000 shares authorized; no shares issued or outstanding | — | | | — | |

Common stock ($0.01 par value per share); 60,000,000 shares authorized at March 31, 2024 and December 31, 2023; 641,744 and 501,357 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 6 | | | 5 | |

| Additional paid-in capital | 413,567 | | | 411,929 | |

| Accumulated other comprehensive loss | (262) | | | (265) | |

| Accumulated deficit | (416,624) | | | (414,152) | |

| Total stockholders’ deficit | (3,313) | | | (2,483) | |

| Total liabilities and stockholders’ deficit | $ | 4,243 | | | $ | 3,907 | |

YIELD10 BIOSCIENCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

UNAUDITED

(In thousands)

| | | | | | | | | | | |

| Three Months Ended

March 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (2,472) | | | $ | (3,782) | |

| Adjustments to reconcile net loss to cash used in operating activities: | | | |

| Depreciation and amortization | 66 | | | 69 | |

| | | |

| | | |

| | | |

| Charge for 401(k) company common stock match | 9 | | | 29 | |

| Stock-based compensation | 403 | | | 436 | |

| Non-cash lease expense | 124 | | | 104 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | — | | | — | |

| | | |

| Unbilled receivables | — | | | 30 | |

| Prepaid expenses and other assets | (198) | | | 37 | |

| Accounts payable | 444 | | | 307 | |

| Accrued expenses | (818) | | | 241 | |

| Deferred revenue | 1,700 | | | — | |

| Lease liabilities | (161) | | | (138) | |

| | | |

| Net cash used in operating activities | (903) | | | (2,667) | |

| | | |

| Cash flows from investing activities | | | |

| Purchase of property and equipment | — | | | (9) | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from the maturity of short-term investments | — | | | 1,991 | |

| Net cash provided by investing activities | — | | | 1,982 | |

| | | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from warrant inducement exercise, net of issuance costs | 1,211 | | | — | |

| Proceeds from At-the-Market offering, net of issuance costs | — | | | 182 | |

| | | |

| Taxes paid on employees' behalf related to vesting of stock awards | — | | | (41) | |

| Net cash provided by (used in) financing activities | 1,211 | | | 141 | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 4 | | | (3) | |

| | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 312 | | | (547) | |

| Cash, cash equivalents and restricted cash at beginning of period | 1,332 | | | 2,620 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 1,644 | | | $ | 2,073 | |

| | | |

| | | |

| | | |

| | | |

| Supplemental disclosure of non-cash information: | | | |

| Offering costs remaining in accounts payable | $ | — | | | $ | 79 | |

| | | |

| | | |

| | | |

| | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

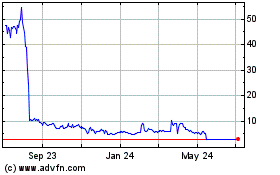

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Apr 2024 to May 2024

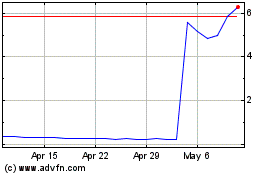

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From May 2023 to May 2024