false

0000101594

0000101594

2024-05-09

2024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2024

U.S. ENERGY CORP.

US ENERGY CORP

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-06814

|

|

83-0205516

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

1616 S. Voss, Suite 725, Houston, Texas

|

|

77057

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (303) 993-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

USEG

|

|

The NASDAQ Stock Market LLC

(Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, U.S. Energy Corp. (“U.S. Energy” or the “Company”) issued a press release regarding its financial results for the three months ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and incorporated into this item 2.02 by reference.

The information contained in this Current Report and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The Company is making reference to non-GAAP financial information in the press release, presentation and the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release and presentation.

This Current Report on Form 8-K, including the press release attached as Exhibit 99.1 to this Current Report on Form 8-K, contains forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties and assumptions. You can identify these forward-looking statements by words such as “may,” “should,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan” and other similar expressions. These forward-looking statements relate to the Company’s current expectations and are subject to the limitations and qualifications set forth in the press release and presentation as well as in the Company’s other filings with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ materially from those projected in such forward-looking statements. These statements also involve known and unknown risks, which may cause the results of the Company, its divisions and concepts to be materially different than those expressed or implied in such statements, which include, without limitation, risks associated with increased inflation, interest rates and possible recessions; the Company’s ability to comply with the terms of its senior credit facilities; the ability of the Company to retain and hire key personnel; the business, economic and political conditions in the markets in which the Company operates; fluctuations in oil and natural gas prices, uncertainties inherent in estimating quantities of oil and natural gas reserves and projecting future rates of production and timing of development activities; competition; operating risks; drilling, completions, workovers and other activities and the anticipated costs and results of such activities; the Company’s anticipated operational results for 2024 including, but not limited to, estimated or anticipated production levels, capital expenditures and drilling plans; acquisition risks; liquidity and capital requirements; the effects of governmental regulation; anticipated future production and revenue; drilling plans including the timing of drilling, commissioning, and startup and the impact of delays thereon; adverse changes in the market for the Company’s oil and natural gas production; dependence upon third-party vendors; risks associated with COVID-19, the global efforts to stop the spread of COVID-19, potential downturns in the U.S. and global economies due to COVID-19 and the efforts to stop the spread of the virus, and COVID-19 in general; economic uncertainty relating to increased inflation and global conflicts; the lack of capital available on acceptable terms to finance the Company’s continued growth; the review and evaluation of potential strategic transactions and their impact on stockholder value; the process by which the Company engages in evaluation of strategic transactions; the outcome of potential future strategic transactions and the terms thereof; and other risk factors, and others, including those referenced in the press release and the Company’s filings with the Securities and Exchange Commission. Accordingly, readers should not place undue reliance on any forward-looking statements. Forward-looking statements may include comments as to the Company’s beliefs and expectations as to future financial performance, events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the Company’s control. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Cautionary Statement Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, filed with the SEC and available at www.sec.gov and in the “Investors” – “SEC Filings” section of the Company’s website at https://usnrg.com. Forward-looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as otherwise provided by law.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

| |

|

|

|

99.1*

|

|

|

|

104

|

|

Inline XBRL for the cover page of this Current Report on Form 8-K

|

* Furnished herewith.

The inclusion of any website address in this Form 8-K, and any exhibit thereto, is intended to be an inactive textual reference only and not an active hyperlink. The information contained in, or that can be accessed through, such website is not part of or incorporated into this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

U.S. ENERGY CORP.

|

| |

|

|

| |

By:

|

/s/ Ryan Smith

|

| |

|

Ryan Smith

|

| |

|

Chief Executive Officer

|

Exhibit 99.1

U.S. Energy Corp. Reports Financial and Operating Results for First Quarter 2024

HOUSTON, May 9, 2024 — U.S. Energy Corporation (NASDAQ: USEG, “U.S. Energy” or the “Company”), a growth-focused energy company engaged in operating a portfolio of high-quality producing oil and natural gas assets, today reported financial and operating results for the three months ended March 31, 2024.

First QUARTER 2024 HIGHLIGHTS

|

●

|

Net daily production of 1,207 barrels of oil equivalent per day (“Boe/d”);

|

|

●

|

Oil production of 68,599 barrels, or 62% of total production;

|

|

●

|

Lease Operating Expense of $3.2 million, or $29.02 per Boe, a 28% and 2% decrease, respectively, from first quarter of 2023;

|

| ● |

Adjusted EBITDA of $0.2 million; |

| ● |

Repurchased approximately 0.3 million shares of common stock, representing nearly 1.5% of outstanding shares, for approximately $0.3 million; |

| ● |

Ended the quarter with an outstanding debt balance of $5.0 million, $2.0 million of cash, and total liquidity of $17.0 million. |

MANAGEMENT COMMENTS

"I’m pleased with U.S. Energy’s first quarter, with our operations team rebounding quickly against highly adverse weather conditions while the Company continues to uphold its balance sheet strength and actively executes our stock repurchase plan,” said Ryan Smith, U.S. Energy’s Chief Executive Officer. “While the heavy rains and flooding significantly affected our East Texas and Gulf Coast operations during the quarter, much of the production was brought back online without any negative long-term effects in late March and early April. As we continue through 2024, U.S. Energy’s balance sheet and liquidity position affords the Company a high degree of optionality as we continue to pursue value enhancing initiatives with a clear focus of maximizing total returns for our shareholders."

PRODUCTION UPDATE

During the first quarter of 2024, the Company produced 109,800 Boe, or an average of 1,207 Boe/d. Weather related downtime, primarily attributed to heavy flooding throughout East Texas and the Gulf Coast, caused an estimated of 125-150 boe/d of temporarily shut-in production during the quarter. The first quarter of 2024 was the first period since the Company divested substantially all of its non-operated assets during the fourth quarter of 2023.

| |

|

Three months ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Sales volume

|

|

|

|

|

|

|

|

|

|

Oil (Bbls)

|

|

|

68,599 |

|

|

|

91,311 |

|

|

Natural gas and liquids (Mcfe)

|

|

|

247,209 |

|

|

|

384,031 |

|

|

BOE

|

|

|

109,800 |

|

|

|

155,316 |

|

|

Average daily production (BOE/Day)

|

|

|

1,207 |

|

|

|

1,726 |

|

| |

|

|

|

|

|

|

|

|

|

Average sales prices:

|

|

|

|

|

|

|

|

|

|

Oil (Bbls)

|

|

$ |

68.91 |

|

|

$ |

77.70 |

|

|

Natural gas and liquids (Mcfe)

|

|

$ |

2.69 |

|

|

$ |

3.06 |

|

|

BOE

|

|

$ |

49.10 |

|

|

$ |

53.26 |

|

First QUARTER 2024 FINANCIAL RESULTS

Total oil and gas sales during the first quarter of 2024 were approximately $5.4 million, compared to $8.3 million in the first quarter of 2023. The decrease in revenue was primarily due to a decrease in our production quantities related to the asset divestiture and the weather-related events described above, combined with an 8% decrease in realized prices. Sales from oil production represented 88% of total revenue during the quarter, an increase from 86% in the first quarter of 2023.

Lease operating expense (“LOE”) for the first quarter of 2024 was approximately $3.2 million, or $29.02 per Boe, as compared to $4.4 million, or $28.39, in the first quarter of 2023. The decrease in the total amount of LOE was due primarily to a reduction in workover activity period over period.

Cash general and administrative (“G&A”) expenses were approximately $2.0 million during the first quarter of 2024, a reduction from the $2.1 million reported during the first quarter of 2023.

Adjusted EBITDA was $0.2 million in the first quarter of 2024, compared to adjusted EBITDA of $1.2 million in the first quarter of 2023. The Company reported a net loss of $9.5 million, or a loss of $0.38 per diluted share, in the first quarter of 2024, compared to net loss of $1.3 million, or $0.05 per share, in the first quarter of 2023. The largest contributor to the net loss was a non-cash impairment taken during the first quarter of $5.4 million primarily driven by a reduction in SEC reserve pricing.

BALANCE SHEET UPDATE

As of March 31, 2024, the Company had debt outstanding of $5.0 million on its revolving credit facility with availability of $15.0 million and a cash balance of approximately $2.0 million.

HEDGING PROGRAM UPDATE

The Company previously entered into fixed priced crude oil swaps with outstanding settlement dates from the second quarter of 2024 through the fourth quarter of 2024 with a weighted average swap price of $80.01/bbl oil.

On April 2, 2024, the Company entered into fixed price crude oil swaps with outstanding settlement dates from the first quarter of 2025 to the fourth quarter of 2025 with a weighted average swap price of $73.71/bbl oil. The following table reflects the Company's hedged volumes under commodity derivative contracts and the average floor and ceiling or fixed swap prices at which production is hedged as of May 9, 2024:

| |

Swaps

|

|

|

Period

|

Commodity

|

|

Volume

(Bbls)

|

|

|

Price

($/bbl)

|

|

|

Q2 2024

|

Crude Oil

|

|

|

48,600 |

|

|

$ |

81.76 |

|

|

Q3 2024

|

Crude Oil

|

|

|

45,000 |

|

|

$ |

79.80 |

|

|

Q4 2024

|

Crude Oil

|

|

|

40,720 |

|

|

$ |

78.15 |

|

|

Q1 2025

|

Crude Oil

|

|

|

45,000 |

|

|

$ |

75.73 |

|

|

Q2 2025

|

Crude Oil

|

|

|

43,225 |

|

|

$ |

74.19 |

|

|

Q3 2025

|

Crude Oil

|

|

|

39,100 |

|

|

$ |

72.82 |

|

|

Q4 2025

|

Crude Oil

|

|

|

36,800 |

|

|

$ |

71.64 |

|

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating high-quality producing assets in the United States with the potential to optimize production and generate free cash flow through low-risk development while maintaining an attractive shareholder returns program. We are committed to being a leader in reducing our carbon footprint in the areas in which we operate. More information about U.S. Energy Corp. can be found at www.usnrg.com.

INVESTOR RELATIONS CONTACT

Mason McGuire

IR@usnrg.com

(303) 993-3200

www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this communication which are not statements of historical fact constitute forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties. Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements.

Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation, risks associated with the integration of the recently acquired assets; the Company’s ability to recognize the expected benefits of the acquisitions and the risk that the expected benefits and synergies of the acquisition may not be fully achieved in a timely manner, or at all; the amount of the costs, fees, expenses and charges related to the acquisitions; the Company’s ability to comply with the terms of its senior credit facilities; the ability of the Company to retain and hire key personnel; the business, economic and political conditions in the markets in which the Company operates; fluctuations in oil and natural gas prices, uncertainties inherent in estimating quantities of oil and natural gas reserves and projecting future rates of production and timing of development activities; competition; operating risks; acquisition risks; liquidity and capital requirements; the effects of governmental regulation; adverse changes in the market for the Company’s oil and natural gas production; dependence upon third-party vendors; risks associated with COVID-19, the global efforts to stop the spread of COVID-19, potential downturns in the U.S. and global economies due to COVID-19 and the efforts to stop the spread of the virus, and COVID-19 in general; economic uncertainty relating to increased inflation and global conflicts; the lack of capital available on acceptable terms to finance the Company’s continued growth; the review and evaluation of potential strategic transactions and their impact on stockholder value; the process by which the Company engages in evaluation of strategic transactions; the outcome of potential future strategic transactions and the terms thereof; and other risk factors included from time to time in documents U.S. Energy files with the Securities and Exchange Commission, including, but not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described in the Company’s publicly filed reports, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. These reports and filings are available at www.sec.gov.

The Company cautions that the foregoing list of important factors is not complete. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on behalf of any Sale Agreement Parties are expressly qualified in their entirety by the cautionary statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on U.S. Energy’s future results. The forward-looking statements included in this press release are made only as of the date hereof. U.S. Energy cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, U.S. Energy undertakes no obligation to update these statements after the date of this release, except as required by law, and takes no obligation to update or correct information prepared by third parties that are not paid for by U.S. Energy. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

FINANCIAL STATEMENTS

U.S. ENERGY CORP. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

| |

|

March 31, 2024

|

|

|

December 31, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and equivalents

|

|

$ |

2,006 |

|

|

$ |

3,351 |

|

|

Oil and natural gas sales receivables

|

|

|

2,088 |

|

|

|

2,336 |

|

|

Marketable equity securities

|

|

|

179 |

|

|

|

164 |

|

|

Commodity derivative asset -current

|

|

|

59 |

|

|

|

1,844 |

|

|

Other current assets

|

|

|

929 |

|

|

|

527 |

|

|

Real estate assets held for sale, net of selling costs

|

|

|

139 |

|

|

|

150 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

5,400 |

|

|

|

8,372 |

|

| |

|

|

|

|

|

|

|

|

|

Oil and natural gas properties under full cost method:

|

|

|

|

|

|

|

|

|

|

Unevaluated properties

|

|

|

- |

|

|

|

- |

|

|

Evaluated properties

|

|

|

171,339 |

|

|

|

176,679 |

|

|

Less accumulated depreciation, depletion and amortization

|

|

|

(108,250 |

) |

|

|

(106,504 |

) |

| |

|

|

|

|

|

|

|

|

|

Net oil and natural gas properties

|

|

|

63,089 |

|

|

|

70,175 |

|

| |

|

|

|

|

|

|

|

|

|

Other Assets:

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

842 |

|

|

|

899 |

|

|

Right-of-use asset

|

|

|

653 |

|

|

|

693 |

|

|

Other assets

|

|

|

286 |

|

|

|

305 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

70,270 |

|

|

$ |

80,444 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$ |

3,695 |

|

|

$ |

4,064 |

|

|

Accrued compensation and benefits

|

|

|

404 |

|

|

|

702 |

|

|

Revenue and royalties payable

|

|

|

4,937 |

|

|

|

4,857 |

|

|

Asset retirement obligations - current

|

|

|

1,273 |

|

|

|

1,273 |

|

|

Current lease obligation

|

|

|

186 |

|

|

|

182 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

10,495 |

|

|

|

11,078 |

|

| |

|

|

|

|

|

|

|

|

|

Noncurrent liabilities:

|

|

|

|

|

|

|

|

|

|

Credit facility

|

|

|

5,000 |

|

|

|

5,000 |

|

|

Asset retirement obligations - noncurrent

|

|

|

17,452 |

|

|

|

17,217 |

|

|

Long-term lease obligation, net of current portion

|

|

|

564 |

|

|

|

611 |

|

|

Deferred tax liability

|

|

|

16 |

|

|

|

16 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

33,527 |

|

|

|

33,922 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value; 245,000,000 shares authorized; 25,343,013 and 25,333,870 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively

|

|

|

253 |

|

|

|

253 |

|

|

Additional paid-in capital

|

|

|

218,161 |

|

|

|

218,403 |

|

|

Accumulated deficit

|

|

|

(181,671 |

) |

|

|

(172,134 |

) |

| |

|

|

|

|

|

|

|

|

|

Total shareholders’ equity

|

|

|

36,743 |

|

|

|

46,522 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity

|

|

$ |

70,270 |

|

|

$ |

80,444 |

|

U.S. ENERGY CORP. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE Three Months Ended AND 2023

(In thousands, except share and per share amounts)

| |

|

Three Months Ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

Oil

|

|

$ |

4,727 |

|

|

$ |

7,095 |

|

|

Natural gas and liquids

|

|

|

664 |

|

|

|

1,177 |

|

|

Total revenue

|

|

|

5,391 |

|

|

|

8,272 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Lease operating expenses

|

|

|

3,186 |

|

|

|

4,409 |

|

|

Gathering, transportation and treating

|

|

|

64 |

|

|

|

114 |

|

|

Production taxes

|

|

|

343 |

|

|

|

520 |

|

|

Depreciation, depletion, accretion and amortization

|

|

|

2,195 |

|

|

|

2,417 |

|

|

Impairment of oil and natural gas properties

|

|

|

5,419 |

|

|

|

- |

|

|

General and administrative expenses

|

|

|

2,206 |

|

|

|

2,772 |

|

|

Total operating expenses

|

|

|

13,413 |

|

|

|

10,232 |

|

| |

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

(8,022 |

) |

|

|

(1,960 |

) |

| |

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

Commodity derivative gain (loss), net

|

|

|

(1,381 |

) |

|

|

919 |

|

|

Interest (expense), net

|

|

|

(120 |

) |

|

|

(268 |

) |

|

Other income (expense), net

|

|

|

4 |

|

|

|

- |

|

|

Total other income (expense)

|

|

|

(1,497 |

) |

|

|

651 |

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) before income taxes

|

|

$ |

(9,519 |

) |

|

$ |

(1,309 |

) |

|

Income tax (expense) benefit

|

|

|

(18 |

) |

|

|

62 |

|

|

Net income (loss)

|

|

$ |

(9,537 |

) |

|

$ |

(1,247 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic and diluted weighted average shares outstanding

|

|

|

25,388,221 |

|

|

|

25,178,565 |

|

|

Basic and diluted income (loss) per share

|

|

$ |

(0.38 |

) |

|

$ |

(0.05 |

) |

U.S. ENERGY CORP. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE Three Months Ended March 31, 2024 AND 2023

(in thousands)

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

(9,537 |

) |

|

$ |

(1,247 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation, depletion, accretion, and amortization

|

|

|

2,195 |

|

|

|

2,417 |

|

|

Impairment of oil and natural gas properties

|

|

|

5,419 |

|

|

|

- |

|

|

Deferred income taxes

|

|

|

- |

|

|

|

(62 |

) |

|

Total commodity derivatives (gains) losses, net

|

|

|

1,381 |

|

|

|

(919 |

) |

|

Commodity derivative settlements received (paid)

|

|

|

404 |

|

|

|

(406 |

) |

|

(Gains) losses on marketable equity securities

|

|

|

(15 |

) |

|

|

- |

|

|

Impairment and loss on real estate held for sale

|

|

|

11 |

|

|

|

- |

|

|

Amortization of debt issuance costs

|

|

|

12 |

|

|

|

12 |

|

|

Stock-based compensation

|

|

|

200 |

|

|

|

727 |

|

|

Right of use asset amortization

|

|

|

40 |

|

|

|

55 |

|

|

Changes in operating assets and liabilities:

|

|

|

- |

|

|

|

- |

|

|

Oil and natural gas sales receivable

|

|

|

248 |

|

|

|

1,145 |

|

|

Other assets

|

|

|

(397 |

) |

|

|

52 |

|

|

Accounts payable and accrued liabilities

|

|

|

(245 |

) |

|

|

(794 |

) |

|

Accrued compensation and benefits

|

|

|

(298 |

) |

|

|

(754 |

) |

|

Revenue and royalties payable

|

|

|

80 |

|

|

|

79 |

|

|

Payments on operating lease liability

|

|

|

(43 |

) |

|

|

(58 |

) |

|

Payments of asset retirement obligations

|

|

|

(58 |

) |

|

|

(11 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

(603 |

) |

|

|

236 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Oil and natural gas capital expenditures

|

|

|

(144 |

) |

|

|

(1,106 |

) |

|

Property and equipment expenditures

|

|

|

- |

|

|

|

(261 |

) |

|

Proceeds from sale of oil and natural gas properties, net

|

|

|

(35 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) investing activities

|

|

|

(179 |

) |

|

|

(1,367 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Payments on insurance premium finance note

|

|

|

(62 |

) |

|

|

(112 |

) |

|

Shares withheld to settle tax withholding obligations for restricted stock awards

|

|

|

(105 |

) |

|

|

(151 |

) |

|

Dividends paid

|

|

|

- |

|

|

|

(596 |

) |

|

Repurchases of common stock

|

|

|

(396 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(563 |

) |

|

|

(859 |

) |

| |

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and equivalents

|

|

|

(1,345 |

) |

|

|

(1,990 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash and equivalents, beginning of period

|

|

|

3,351 |

|

|

|

4,411 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and equivalents, end of period

|

|

$ |

2,006 |

|

|

$ |

2,421 |

|

ADJUSTED EBITDA RECONCILIATION

In addition to our results calculated under generally accepted accounting principles in the United States (“GAAP”), in this earnings release we also present Adjusted EBITDA. Adjusted EBITDA is a “non-GAAP financial measure” presented as supplemental measures of the Company’s performance. It is not presented in accordance with accounting principles generally accepted in the United States, or GAAP. The Company defines Adjusted EBITDA as net income (loss), plus net interest expense, net unrealized loss (gain) on change in fair value of derivatives, income tax (benefit) expense, deferred income taxes, depreciation, depletion, accretion and amortization, one-time costs associated with completed transactions and the associated assumed derivative contracts, non-cash share-based compensation, transaction related expenses, transaction related acquired realized derivative loss (gain), and loss (gain) on marketable securities. Company management believes this presentation is relevant and useful because it helps investors understand U.S. Energy’s operating performance and makes it easier to compare its results with those of other companies that have different financing, capital and tax structures. Adjusted EBITDA is presented because we believe it provides additional useful information to investors due to the various noncash items during the period. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations are: Adjusted EBITDA does not reflect cash expenditures, or future requirements for capital expenditures, or contractual commitments; Adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs; Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on debt or cash income tax payments; although depreciation and amortization are noncash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; and other companies in this industry may calculate Adjusted EBITDA differently than the Company does, limiting its usefulness as a comparative measure.

The Company’s presentation of this measure should not be construed as an inference that future results will be unaffected by unusual or nonrecurring items. We compensate for these limitations by providing a reconciliation of this non-GAAP measure to the most comparable GAAP measure, below. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and to view this non-GAAP measure in conjunction with the most directly comparable GAAP financial measure.

| |

|

Three months ended March 31,

|

|

| In Thousands |

|

2024

|

|

|

2023

|

|

|

Adjusted EBITDA Reconciliation

|

|

|

|

|

|

|

|

|

|

Net Income (Loss)

|

|

$ |

(9,537 |

) |

|

$ |

(1,247 |

) |

| |

|

|

|

|

|

|

|

|

|

Depreciation, depletion, accretion and amortization

|

|

|

2,195 |

|

|

|

2,417 |

|

|

Non-cash loss (gain) on commodity derivatives

|

|

|

1,785 |

|

|

|

(1,325 |

) |

|

Interest Expense, net

|

|

|

120 |

|

|

|

268 |

|

|

Income tax expense (benefit)

|

|

|

18 |

|

|

|

(62 |

) |

|

Non-cash stock based compensation

|

|

|

200 |

|

|

|

727 |

|

|

Transaction related acquired realized derivative losses

|

|

|

- |

|

|

|

405 |

|

|

Loss (gain) on marketable securities

|

|

|

(14 |

) |

|

|

- |

|

|

Loss (gain) on real estate held for sale

|

|

|

11 |

|

|

|

- |

|

|

Impairment of oil and natural gas properties

|

|

|

5,419 |

|

|

|

- |

|

|

Total Adjustments

|

|

|

9,734 |

|

|

|

2,430 |

|

| |

|

|

|

|

|

|

|

|

|

Total Adjusted EBITDA

|

|

$ |

197 |

|

|

$ |

1,183 |

|

| |

|

|

|

|

|

|

|

|

v3.24.1.u1

Document And Entity Information

|

May 09, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

US ENERGY CORP

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 09, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-06814

|

| Entity, Tax Identification Number |

83-0205516

|

| Entity, Address, Address Line One |

1616 S. Voss

|

| Entity, Address, Address Line Two |

Suite 725

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77057

|

| City Area Code |

303

|

| Local Phone Number |

993-3200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

USEG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000101594

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

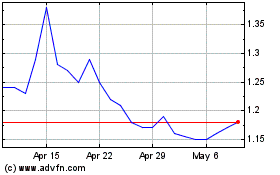

US Energy (NASDAQ:USEG)

Historical Stock Chart

From May 2024 to Jun 2024

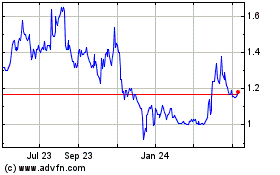

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Jun 2023 to Jun 2024