0001178253falseQ1--12-310001178253scyx:ExclusiveLicenseAndCollaborationAgreementMember2024-01-012024-03-310001178253scyx:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2024-03-310001178253scyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMember2023-06-012023-06-300001178253us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253scyx:RelaunchDateOneMemberscyx:AchivementOfThresholdUpto750MillionTo1BillionMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMember2023-12-262023-12-260001178253us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:RetainedEarningsMember2024-01-012024-03-310001178253us-gaap:MeasurementInputCreditSpreadMemberus-gaap:FairValueInputsLevel3Member2024-03-310001178253scyx:ProductRecallMember2023-03-310001178253us-gaap:CommonStockMember2023-01-012023-03-310001178253us-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:WarrantMemberscyx:April2022PublicOfferingMember2024-01-012024-03-310001178253scyx:AchivementOfTwoInterimMilestoneOfOngoingMarioStudyMembersrt:MaximumMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMember2023-12-262023-12-2600011782532022-12-310001178253scyx:April2022PublicOfferingMemberus-gaap:WarrantMember2023-12-310001178253us-gaap:RestrictedStockUnitsRSUMember2024-03-310001178253scyx:CommonStockAssociatedWithMarchTwoThousandNineteenNotesMember2023-01-012023-03-310001178253us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:WarrantMemberscyx:December2020PublicOfferingSeries2Member2023-12-310001178253us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:WarrantMemberscyx:DanforthMember2023-12-3100011782532024-05-010001178253us-gaap:CommonStockMember2022-12-310001178253us-gaap:FairValueInputsLevel1Memberus-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2023-12-310001178253scyx:TwoThousandAndFifteenInducementAwardPlanMember2023-12-310001178253us-gaap:FairValueInputsLevel1Memberscyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253scyx:ProductRecallMember2023-01-012023-03-310001178253scyx:RebatesAndIncentivesMember2022-12-310001178253scyx:WarrantsAssociatedWithApril2022PublicOfferingMemberus-gaap:WarrantMember2024-03-310001178253us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2024-03-310001178253us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-03-310001178253us-gaap:ShortTermInvestmentsMember2024-03-310001178253scyx:December2020PublicOfferingMemberus-gaap:WarrantMember2024-03-310001178253scyx:ProductReturnsMember2022-12-310001178253us-gaap:CustomerConcentrationRiskMemberscyx:WholesalerTwoMemberus-gaap:SalesRevenueNetMember2023-01-012023-03-310001178253us-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253scyx:PrefundedWarrantsMemberscyx:April2022PublicOfferingMember2024-03-310001178253us-gaap:CommonStockMember2024-01-012024-03-310001178253scyx:ProductRecallMember2022-12-310001178253us-gaap:WarrantMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2024-03-310001178253scyx:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2023-12-3100011782532023-02-012023-02-280001178253us-gaap:FairValueInputsLevel2Memberscyx:CorporateAndAgencyBondSecuritiesMember2023-12-310001178253scyx:ProductReturnsMember2023-12-310001178253us-gaap:FairValueInputsLevel3Memberus-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:FairValueInputsLevel3Memberscyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253scyx:SuccessfulCompletionOfMarioStudyMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMember2023-12-262023-12-260001178253scyx:SeniorConvertibleNotePurchaseAgreementMember2019-03-072019-03-070001178253scyx:PrefundedWarrantsMemberscyx:December2020PublicOfferingMember2023-03-310001178253us-gaap:WarrantMemberscyx:WarrantAssociatedWithDanforthMember2024-01-012024-03-310001178253scyx:ProductReturnsMember2024-01-012024-03-310001178253scyx:April2022PublicOfferingMemberus-gaap:WarrantMember2024-03-310001178253scyx:TwoThousandAndFourteenEquityIncentivePlanMember2023-12-310001178253us-gaap:AdditionalPaidInCapitalMember2022-12-310001178253scyx:LoanAndSecurityAgreementMemberscyx:TermLoanMemberscyx:HerculesCapitalIncorporatedAndSiliconValleyBankMember2021-05-132021-05-130001178253scyx:AchivementOfThresholdUpto750MillionTo1BillionMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMemberscyx:RelaunchDateThreeMember2023-12-262023-12-2600011782532023-01-012023-12-310001178253scyx:LoanAgreementAmendmentMemberscyx:HerculesCapitalIncorporatedAndSiliconValleyBankAndOtherLendersMember2023-03-300001178253us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Membersrt:WeightedAverageMember2024-03-310001178253us-gaap:EmployeeStockOptionMember2024-03-310001178253us-gaap:FairValueInputsLevel3Memberus-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:WarrantMemberscyx:December2020PublicOfferingSeries2Member2024-03-310001178253scyx:SeniorConvertibleNotePurchaseAgreementMember2024-01-012024-03-310001178253scyx:DiscountsAndChargebacksMember2024-03-3100011782532023-03-310001178253us-gaap:CorporateBondSecuritiesMemberscyx:LongTermInvestmentMember2023-12-310001178253us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001178253scyx:LongTermInvestmentMember2023-12-310001178253us-gaap:ProductMember2024-01-012024-03-310001178253scyx:ProductRecallMember2023-12-310001178253srt:MaximumMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMember2023-03-302023-03-300001178253scyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253scyx:RebatesAndIncentivesMember2023-01-012023-03-310001178253scyx:ProductRecallMember2024-03-310001178253us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001178253scyx:DiscountsAndChargebacksMember2023-12-310001178253us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001178253us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Member2024-03-310001178253us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:WarrantMember2023-12-310001178253us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253scyx:RelaunchDateOneMembersrt:MaximumMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMember2023-12-262023-12-260001178253us-gaap:FairValueInputsLevel2Memberscyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:WarrantMember2024-03-310001178253us-gaap:RetainedEarningsMember2023-01-012023-03-3100011782532023-01-012023-03-310001178253scyx:ExclusiveLicenseAndCollaborationAgreementMember2023-01-012023-03-310001178253us-gaap:AccountingStandardsUpdate202006Member2024-03-310001178253us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001178253scyx:RebatesAndIncentivesMember2024-03-310001178253scyx:TwoThousandAndFourteenEquityIncentivePlanMember2024-01-012024-01-010001178253scyx:SeniorConvertibleNotePurchaseAgreementMember2023-01-012023-03-310001178253us-gaap:FairValueInputsLevel1Memberscyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253scyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMemberscyx:AchivementOfThresholdUpto300MillionTo500MillionMemberscyx:RelaunchDateThreeMember2023-12-262023-12-260001178253scyx:TwoThousandAndFifteenInducementAwardPlanMember2024-01-012024-03-310001178253scyx:RebatesAndIncentivesMember2023-12-310001178253srt:MaximumMember2024-01-012024-03-310001178253scyx:RelaunchDateTwoMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:AchivementOfThresholdUpto300MillionTo500MillionMember2023-12-262023-12-260001178253scyx:LongTermInvestmentMember2024-03-310001178253us-gaap:CommonStockMember2024-03-310001178253us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateBondSecuritiesMember2023-12-310001178253us-gaap:WarrantMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:WarrantMemberscyx:WarrantAssociatedWithDanforthMember2023-01-012023-03-310001178253us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2023-12-310001178253us-gaap:DerivativeMember2023-12-310001178253scyx:DiscountsAndChargebacksMember2022-12-310001178253us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMember2024-03-310001178253scyx:GlaxosmithklineIntellectualPropertyMemberscyx:LoanAgreementAmendmentMember2021-05-132021-05-130001178253scyx:DiscountsAndChargebacksMember2023-03-310001178253us-gaap:LicenseAndServiceMember2024-01-012024-03-310001178253us-gaap:WarrantMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:FairValueMeasurementsRecurringMember2023-12-3100011782532024-03-310001178253us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001178253us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-3100011782532018-03-010001178253us-gaap:FairValueInputsLevel2Memberscyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-3100011782532024-01-012024-03-310001178253us-gaap:WarrantMember2024-01-012024-03-310001178253us-gaap:AdditionalPaidInCapitalMember2024-03-310001178253scyx:December2020PublicOfferingMemberus-gaap:WarrantMember2023-12-310001178253scyx:ProductReturnsMember2023-03-310001178253us-gaap:CustomerConcentrationRiskMemberscyx:WholesalerThreeMemberus-gaap:SalesRevenueNetMember2023-01-012023-03-310001178253us-gaap:WarrantMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253srt:MaximumMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMember2023-12-262023-12-260001178253us-gaap:MeasurementInputExpectedDividendRateMemberus-gaap:FairValueInputsLevel3Member2024-03-310001178253scyx:TwoThousandAndFifteenInducementAwardPlanMember2024-03-310001178253scyx:DiscountsAndChargebacksMember2023-01-012023-03-3100011782532018-03-012018-03-010001178253us-gaap:WarrantMemberscyx:December2020PublicOfferingSeries2Member2024-01-012024-03-310001178253us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:LicenseAndServiceMember2023-01-012023-03-310001178253scyx:SeniorConvertibleNotePurchaseAgreementMember2024-03-310001178253scyx:AchivementOfThresholdUpto750MillionTo1BillionMemberscyx:RelaunchDateTwoMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMember2023-12-262023-12-260001178253scyx:SeniorConvertibleNotePurchaseAgreementMember2019-03-070001178253us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2023-12-310001178253us-gaap:WarrantMemberscyx:DanforthMember2024-03-310001178253us-gaap:FairValueInputsLevel3Memberscyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:CommonStockMember2023-03-310001178253us-gaap:DerivativeMember2024-01-012024-03-310001178253scyx:WarrantsAssociatedWithLoanAgreementMemberus-gaap:WarrantMember2023-12-310001178253scyx:SixPercentConvertibleSeniorNotesDueTwoThousandAndTwentyFiveMember2023-12-310001178253us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001178253us-gaap:FairValueInputsLevel1Memberus-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:FairValueInputsLevel2Memberscyx:CorporateAndAgencyBondSecuritiesMember2024-03-310001178253scyx:CommonStockAssociatedWithMarchTwoThousandNineteenNotesMember2024-01-012024-03-310001178253scyx:WarrantsAssociatedWithApril2022PublicOfferingMemberus-gaap:WarrantMember2023-12-310001178253scyx:LoanAgreementAmendmentMember2023-03-300001178253us-gaap:EmployeeStockOptionMember2023-12-310001178253us-gaap:OtherNoncurrentLiabilitiesMember2021-12-310001178253scyx:RestrictedCashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:WarrantMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253srt:MaximumMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueInputsLevel3Member2024-03-310001178253scyx:PrefundedWarrantsMemberscyx:April2022PublicOfferingMember2023-01-012023-03-310001178253us-gaap:CustomerConcentrationRiskMemberscyx:WholesalerOneMemberus-gaap:SalesRevenueNetMember2023-01-012023-03-310001178253scyx:RelaunchDateOneMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:AchivementOfThresholdUpto300MillionTo500MillionMember2023-12-262023-12-260001178253us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-3100011782532022-07-012022-09-300001178253scyx:PrefundedWarrantsMemberscyx:April2022PublicOfferingMember2023-03-310001178253scyx:TwoThousandAndFourteenEquityIncentivePlanMember2023-01-012023-01-010001178253scyx:SixPercentConvertibleSeniorNotesDueTwoThousandAndTwentyFiveMember2024-03-310001178253us-gaap:ShortTermInvestmentsMemberscyx:AgencyBondsMember2024-03-310001178253us-gaap:RetainedEarningsMember2024-03-310001178253scyx:RebatesAndIncentivesMember2023-03-310001178253scyx:AchivementOfThresholdUpto200MillionMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:RelaunchDateThreeMember2023-12-262023-12-260001178253scyx:RelaunchDateOneMemberscyx:AchivementOfThresholdUpto200MillionMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMember2023-12-262023-12-260001178253us-gaap:RetainedEarningsMember2023-03-310001178253us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001178253scyx:RelaunchDateTwoMemberscyx:AchivementOfThresholdUpto200MillionMemberscyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMember2023-12-262023-12-260001178253us-gaap:RetainedEarningsMember2022-12-310001178253scyx:RebatesAndIncentivesMember2024-01-012024-03-310001178253us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2023-12-310001178253scyx:LoanAndSecurityAgreementMemberscyx:TermLoanMemberscyx:HerculesCapitalIncorporatedAndSiliconValleyBankMember2021-05-130001178253us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateBondSecuritiesMember2024-03-310001178253srt:MaximumMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMemberscyx:RelaunchDateThreeMember2023-12-262023-12-260001178253us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2024-03-310001178253us-gaap:WarrantMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253us-gaap:CommonStockMember2023-12-310001178253scyx:ProductReturnsMember2024-03-310001178253srt:MaximumMemberscyx:RelaunchDateTwoMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseAgreementMember2023-12-262023-12-260001178253scyx:DiscountsAndChargebacksMember2024-01-012024-03-310001178253scyx:SeniorConvertibleNotePurchaseAgreementMember2023-12-310001178253scyx:ProductRecallMember2024-01-012024-03-310001178253us-gaap:DerivativeMember2024-03-310001178253us-gaap:ShortTermInvestmentsMember2023-12-310001178253us-gaap:RestrictedStockUnitsRSUMember2023-12-310001178253scyx:LicenseAgreementMemberscyx:GlaxosmithklineIntellectualPropertyMemberscyx:LicenseTransferMember2024-01-012024-03-310001178253us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-03-310001178253us-gaap:ShortTermInvestmentsMemberscyx:AgencyBondsMember2023-12-310001178253us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253scyx:ProductReturnsMember2023-01-012023-03-310001178253us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:WarrantMemberscyx:April2022PublicOfferingMember2023-01-012023-03-310001178253us-gaap:ProductMember2023-01-012023-03-310001178253us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310001178253us-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253scyx:CompletionFuriCaresAndNatureClinicalStudiesMemberscyx:LicenseAgreementMember2023-12-262023-12-260001178253us-gaap:AdditionalPaidInCapitalMember2023-12-310001178253us-gaap:AdditionalPaidInCapitalMember2023-03-310001178253scyx:WarrantsAssociatedWithLoanAgreementMemberus-gaap:WarrantMember2024-01-012024-03-310001178253scyx:TwoThousandAndFourteenEquityIncentivePlanMember2024-03-310001178253us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:RetainedEarningsMember2023-12-310001178253scyx:GlaxosmithklineIntellectualPropertyMember2024-03-310001178253scyx:WarrantsAssociatedWithLoanAgreementMemberus-gaap:WarrantMember2024-03-310001178253scyx:WarrantsAssociatedWithLoanAgreementMemberus-gaap:WarrantMember2023-01-012023-03-310001178253us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2024-03-310001178253us-gaap:CashMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001178253scyx:TwoThousandAndFifteenInducementAwardPlanMember2023-01-012023-03-310001178253us-gaap:CorporateBondSecuritiesMemberscyx:LongTermInvestmentMember2024-03-310001178253scyx:PrefundedWarrantsMemberscyx:December2020PublicOfferingMember2024-03-310001178253us-gaap:FairValueInputsLevel2Memberus-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001178253us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001178253us-gaap:WarrantMemberscyx:December2020PublicOfferingSeries2Member2023-01-012023-03-310001178253us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-3100011782532023-12-31xbrli:pureutr:sqftxbrli:sharesiso4217:USDscyx:Tranche

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period to

Commission File Number 001-36365

SCYNEXIS, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

56-2181648 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

1 Evertrust Plaza, 13th Floor Jersey City, New Jersey |

|

07302-6548 |

(Address of principal executive offices) |

|

(Zip Code) |

(201)-884-5485

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share |

SCYX |

Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 1, 2024, there were 37,779,796 shares of the registrant’s Common Stock outstanding.

SCYNEXIS, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

SCYNEXIS, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

35,482 |

|

|

$ |

34,050 |

|

Short-term investments |

|

|

44,762 |

|

|

|

40,312 |

|

Prepaid expenses and other current assets |

|

|

1,583 |

|

|

|

5,548 |

|

License agreement receivable |

|

|

— |

|

|

|

2,463 |

|

License agreement contract asset |

|

|

19,466 |

|

|

|

19,363 |

|

Restricted cash |

|

|

380 |

|

|

|

380 |

|

Total current assets |

|

|

101,673 |

|

|

|

102,116 |

|

Investments |

|

|

13,943 |

|

|

|

23,594 |

|

Deferred offering costs |

|

|

175 |

|

|

|

175 |

|

Restricted cash |

|

|

163 |

|

|

|

163 |

|

Operating lease right-of-use asset (See Note 7) |

|

|

2,300 |

|

|

|

2,364 |

|

Total assets |

|

$ |

118,254 |

|

|

$ |

128,412 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

8,918 |

|

|

$ |

7,149 |

|

Accrued expenses |

|

|

4,601 |

|

|

|

7,495 |

|

Deferred revenue, current portion |

|

|

1,083 |

|

|

|

1,189 |

|

Operating lease liability, current portion (See Note 7) |

|

|

356 |

|

|

|

340 |

|

Warrant liabilities |

|

|

— |

|

|

|

130 |

|

Convertible debt and derivative liability (See Note 6) |

|

|

12,391 |

|

|

|

— |

|

Total current liabilities |

|

|

27,349 |

|

|

|

16,303 |

|

Deferred revenue |

|

|

2,111 |

|

|

|

2,727 |

|

Warrant liabilities |

|

|

12,202 |

|

|

|

21,680 |

|

Convertible debt and derivative liability (See Note 6) |

|

|

— |

|

|

|

12,159 |

|

Operating lease liability (See Note 7) |

|

|

2,487 |

|

|

|

2,581 |

|

Total liabilities |

|

|

44,149 |

|

|

|

55,450 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value, authorized 5,000,000 shares as of March 31, 2024 and December 31, 2023; 0 shares issued and outstanding as of March 31, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common stock, $0.001 par value, 150,000,000 shares authorized as of March 31, 2024 and December 31, 2023; 37,779,796 and 37,207,799 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively |

|

|

41 |

|

|

|

40 |

|

Additional paid-in capital |

|

|

428,900 |

|

|

|

428,169 |

|

Accumulated deficit |

|

|

(354,836 |

) |

|

|

(355,247 |

) |

Total stockholders’ equity |

|

|

74,105 |

|

|

|

72,962 |

|

Total liabilities and stockholders’ equity |

|

$ |

118,254 |

|

|

$ |

128,412 |

|

The accompanying notes are an integral part of the financial statements.

SCYNEXIS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

Product revenue, net |

|

$ |

— |

|

|

$ |

1,130 |

|

License agreement revenue |

|

|

1,373 |

|

|

|

— |

|

Total revenue |

|

|

1,373 |

|

|

|

1,130 |

|

Operating expenses: |

|

|

|

|

|

|

Cost of product revenue |

|

|

— |

|

|

|

137 |

|

Research and development |

|

|

7,212 |

|

|

|

6,835 |

|

Selling, general and administrative |

|

|

3,669 |

|

|

|

4,840 |

|

Total operating expenses |

|

|

10,881 |

|

|

|

11,812 |

|

Loss from operations |

|

|

(9,508 |

) |

|

|

(10,682 |

) |

Other (income) expense: |

|

|

|

|

|

|

Amortization of debt issuance costs and discount |

|

|

401 |

|

|

|

255 |

|

Interest income |

|

|

(1,280 |

) |

|

|

(587 |

) |

Interest expense |

|

|

205 |

|

|

|

1,447 |

|

Warrant liabilities fair value adjustment |

|

|

(9,608 |

) |

|

|

21,673 |

|

Derivative liabilities fair value adjustment |

|

|

(168 |

) |

|

|

406 |

|

Total other (income) expense |

|

|

(10,450 |

) |

|

|

23,194 |

|

Income (loss) before taxes |

|

|

942 |

|

|

|

(33,876 |

) |

Income tax expense |

|

|

(531 |

) |

|

|

— |

|

Net income (loss) |

|

$ |

411 |

|

|

$ |

(33,876 |

) |

Net income (loss) per share attributable to common stockholders – basic |

|

|

|

|

|

|

Net income (loss) per share – basic |

|

$ |

0.01 |

|

|

$ |

(0.71 |

) |

Net income (loss) per share attributable to common stockholders – diluted |

|

|

|

|

|

|

Net income (loss) per share – diluted |

|

$ |

0.01 |

|

|

$ |

(0.71 |

) |

Weighted average common shares outstanding – basic and diluted |

|

|

|

|

|

|

Basic |

|

|

48,245,559 |

|

|

|

47,757,246 |

|

Diluted |

|

|

48,565,051 |

|

|

|

47,757,246 |

|

The accompanying notes are an integral part of the financial statements.

SCYNEXIS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income (loss) |

|

$ |

411 |

|

|

$ |

(33,876 |

) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

— |

|

|

|

151 |

|

Stock-based compensation expense |

|

|

705 |

|

|

|

707 |

|

Accretion of investments discount |

|

|

(253 |

) |

|

|

(219 |

) |

Amortization of debt issuance costs and discount |

|

|

401 |

|

|

|

255 |

|

Change in fair value of warrant liabilities |

|

|

(9,608 |

) |

|

|

21,673 |

|

Change in fair value of derivative liabilities |

|

|

(168 |

) |

|

|

406 |

|

Noncash operating lease expense for right-of-use asset |

|

|

64 |

|

|

|

54 |

|

Write off of deferred asset for commitment fees |

|

|

— |

|

|

|

514 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Prepaid expenses, other assets, deferred costs, and other |

|

|

3,966 |

|

|

|

778 |

|

License agreement receivable |

|

|

2,463 |

|

|

|

— |

|

License agreement contract asset |

|

|

(103 |

) |

|

|

— |

|

Accounts receivable |

|

|

— |

|

|

|

41 |

|

Inventory |

|

|

— |

|

|

|

(2,706 |

) |

Accounts payable |

|

|

1,809 |

|

|

|

(12 |

) |

Accrued expenses |

|

|

(2,893 |

) |

|

|

(853 |

) |

Deferred revenue |

|

|

(722 |

) |

|

|

— |

|

Other liabilities and other |

|

|

(79 |

) |

|

|

(5,836 |

) |

Net cash used in operating activities |

|

|

(4,007 |

) |

|

|

(18,923 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of investments |

|

|

(2,510 |

) |

|

|

— |

|

Maturity of investments |

|

|

7,964 |

|

|

|

— |

|

Net cash provided by investing activities |

|

|

5,454 |

|

|

|

— |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Payments of deferred offering costs |

|

|

(40 |

) |

|

|

— |

|

Proceeds from employee stock purchase plan issuances |

|

|

25 |

|

|

|

4 |

|

Repurchase of shares to satisfy tax withholdings |

|

|

— |

|

|

|

18 |

|

Net cash (used in) provided by financing activities |

|

|

(15 |

) |

|

|

22 |

|

Net increase (decrease) in cash, cash equivalents, and restricted cash |

|

|

1,432 |

|

|

|

(18,901 |

) |

Cash, cash equivalents, and restricted cash at beginning of period |

|

|

34,593 |

|

|

|

46,032 |

|

Cash, cash equivalents, and restricted cash at end of period |

|

$ |

36,025 |

|

|

$ |

27,131 |

|

Supplemental cash flow information: |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

420 |

|

|

$ |

1,658 |

|

Cash received for interest |

|

$ |

1,041 |

|

|

$ |

373 |

|

The accompanying notes are an integral part of the financial statements.

SCYNEXIS, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Description of Business and Basis of Preparation

Organization

SCYNEXIS, Inc. (“SCYNEXIS” or the “Company”) is a Delaware corporation formed on November 4, 1999. SCYNEXIS is a biotechnology company, headquartered in Jersey City, New Jersey, and is pioneering innovative medicines to overcome and prevent difficult-to-treat and drug-resistant infections. The Company is developing its proprietary class of enfumafungin-derived antifungal compounds (“fungerps") as broad-spectrum, systemic antifungal agents for multiple fungal indications. Ibrexafungerp is the first representative of this novel class of antifungals with additional assets from the “fungerp” family, including SCY-247, in preclinical stages of development. In June 2021, the U.S. Food and Drug Administration (“FDA”) approved BREXAFEMME (ibrexafungerp tablets) for treatment of patients with vulvovaginal candidiasis (“VVC”), also known as vaginal yeast infection, and in December 2022, the Company announced that the FDA approved a second indication for BREXAFEMME for the reduction in the incidence of recurrent vulvovaginal candidiasis ("RVVC").

In March 2023, the Company entered into a license agreement (the "GSK License Agreement") with GlaxoSmithKline Intellectual Property (No. 3) Limited ("GSK") in which the Company granted GSK an exclusive (even as to the Company and its affiliates), royalty-bearing, sublicensable license for the development and commercialization of ibrexafungerp, including the approved product BREXAFEMME, for all indications, in all countries other than Greater China and certain other countries already licensed to third parties.

Following a review by GSK of the manufacturing process and equipment at the vendor that manufactures the ibrexafungerp drug substance, the Company became aware that a non-antibacterial beta-lactam drug substance was manufactured using equipment common to the manufacturing process for ibrexafungerp. Current FDA draft guidance recommends segregating the manufacture of non-antibacterial beta-lactam compounds from other compounds since beta-lactam compounds have the potential to act as sensitizing agents that may trigger hypersensitivity or an allergic reaction in some people. In the absence of the recommended segregation, there is a risk of cross contamination. It is not known whether any ibrexafungerp has been contaminated with a beta-lactam compound and the Company has not received reports of any adverse events due to the possible beta-lactam cross contamination. Nonetheless, out of an abundance of caution and in line with GSK’s recommendation, the Company has recalled BREXAFEMME® (ibrexafungerp tablets) from the market and placed a temporary hold on clinical studies of ibrexafungerp, including the Phase 3 MARIO study.

The patient-level and clinical product recall is ongoing and the Company is working with an experienced vendor to manage the process. In September 2023, after the Company announced its voluntary clinical hold, the FDA concurred with the Company's voluntary hold and placed a clinical hold. The Company is working with the FDA to discuss paths for resolution of this issue. The clinical hold and recall affect the Company's two ongoing clinical studies: the Phase 3 MARIO study and a Phase 1 lactation study. The hold does not impact the recently completed FURI, CARES, VANQUISH and SCYNERGIA clinical studies, for which dosing is complete. The FDA determined that the compassionate use program for ibrexafungerp, which provides ibrexafungerp to patients with limited or no other treatment options, can continue provided the patient’s treating physician concludes a favorable benefit-risk assessment and the patient is made aware of and consents to the risk. This applies to patients currently in the program, as well as for new patients, pending confirmation of available supply. The Company's preclinical stage compound, SCY-247, is not affected by these developments.

The Company had an accumulated deficit of $354.8 million at March 31, 2024. The Company's capital resources primarily comprised cash and cash equivalents and investments of $94.2 million at March 31, 2024. While the Company believes its capital resources are sufficient to fund the Company’s on-going operations for a period of at least 12 months subsequent to the issuance of the accompanying unaudited condensed consolidated financial statements, the Company's liquidity could be materially affected over this period by: (1) its ability to raise additional capital through equity offerings, debt financings, or other non-dilutive third-party funding; (2) costs associated with new or existing strategic alliances, or licensing and collaboration arrangements; (3) negative regulatory events or unanticipated costs related to its development of ibrexafungerp; (4) its ability to successfully achieve the development, regulatory, and commercial milestones under its License Agreement with GSK; and (5) any other unanticipated material negative events or costs. One or more of these events or costs could materially affect the Company’s liquidity. If the Company is unable to meet its obligations when they become due, the Company may have to delay expenditures, reduce the scope of its research and development programs, or make significant changes to its operating plan. The accompanying unaudited condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The unaudited condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary. Intercompany balances and transactions are eliminated in consolidation.

Use of Estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates and judgments include: revenue recognition including gross to net estimates and the identification of performance obligations in licensing arrangements; estimates for the relative standalone selling price and measure of progress under the input method for the GSK License Agreement; estimates for product recall reserves; determination of the fair value of stock-based compensation grants; the estimate of services and effort expended by third-party research and development service providers used to recognize research and development expense; and the estimates and assumptions utilized in measuring the fair values of the warrant and derivative liabilities each reporting period.

Unaudited Condensed Consolidated Financial Information

The accompanying unaudited condensed consolidated financial statements and notes have been prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”), as contained in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (the “Codification” or “ASC”) for interim financial information. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of the results of operations, financial position, and cash flows. The results of operations for the three months ended March 31, 2024, are not necessarily indicative of the results for the full year or the results for any future periods. These unaudited condensed consolidated financial statements should be read in conjunction with the financial statements and notes set forth in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 28, 2024.

2. Summary of Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements and notes follow the same significant accounting policies as those described in the notes to the audited consolidated financial statements of the Company for the year ended December 31, 2023, except as described below.

Basic and Diluted Net Income (Loss) per Share of Common Stock

The Company calculates net income (loss) per common share in accordance with ASC 260, Earnings Per Share. Basic net income (loss) per common share for the three months ended March 31, 2024 and 2023 was determined by dividing net income (loss) applicable to common stockholders by the weighted average number of common shares outstanding during the period. Per ASC 260, Earnings Per Share, the weighted average number of common shares outstanding utilized for determining the basic net income (loss) per common share for the three months ended March 31, 2024 includes the outstanding prefunded warrants to purchase 7,516,267 and 3,200,000 shares of common stock issued in the April 2022 public offering and December 2020 public offering, respectively. The outstanding prefunded warrants to purchase 11,303,667 and 3,200,000 shares of common stock issued in the April 2022 public offering and December 2020 public offering were included in the three months ended March 31, 2023, respectively. Diluted net income (loss) per common share for the three months ended March 31, 2024 and 2023 was determined as follows (in thousands, except share and per share amounts):

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

|

2023 |

|

Net income (loss) allocated to common shares |

$ |

411 |

|

|

$ |

(33,876 |

) |

|

|

|

|

|

|

Weighted average common shares outstanding – basic |

|

48,245,559 |

|

|

|

47,757,246 |

|

Dilutive effect of restricted stock units |

|

319,492 |

|

|

|

— |

|

Weighted average common shares outstanding – diluted |

|

48,565,051 |

|

|

|

47,757,246 |

|

|

|

|

|

|

|

Net income (loss) per share – diluted |

$ |

0.01 |

|

|

$ |

(0.71 |

) |

The following potentially dilutive shares of common stock and outstanding restricted stock units that contain certain performance contingencies have not been included in the computation of diluted net income (loss) per share for the three months ended March 31, 2024 and 2023, as the result would be anti-dilutive or the performance contingencies have not been met:

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

|

2023 |

|

Outstanding stock options |

|

2,716,602 |

|

|

|

1,931,389 |

|

Outstanding restricted stock units |

|

600,000 |

|

|

|

2,214,490 |

|

Warrants to purchase common stock associated with December 2020 public offering - Series 2 |

|

6,800,000 |

|

|

|

6,800,000 |

|

Warrants to purchase common stock associated with April 2022 public offering |

|

15,000,000 |

|

|

|

15,000,000 |

|

Warrants to purchase common stock associated with Loan Agreement |

|

198,811 |

|

|

|

198,811 |

|

Common stock associated with March 2019 Notes |

|

1,138,200 |

|

|

|

1,138,200 |

|

Warrants to purchase common stock associated with Danforth |

|

50,000 |

|

|

|

50,000 |

|

Total |

|

26,503,613 |

|

|

|

27,332,890 |

|

Reclassification of Prior Year Amounts

Certain prior year amounts within the changes in operating assets and liabilities on the unaudited condensed consolidated statement of cash flows have been reclassified for consistency with the current year presentation.

Recently Adopted Accounting Pronouncements

In August 2020, the FASB issued ASU No. 2020-06, Debt—Debt with Conversion and Other Options and Derivatives and Hedging—Contracts in Entity’s Own Equity: Accounting for Convertible Instruments and Contracts in and Entity’s Own Equity (“ASU 2020-06”). The amendments in ASU 2020-06 reduce the number of accounting models for convertible debt instruments and revises certain guidance relating to the derivative scope exception and earnings per share. The amendments in ASU 2020-06 are effective for public business entities that meet the definition of a SEC filer and a smaller reporting company for fiscal years beginning after December 15, 2023, and interim periods within those years. The Company adopted ASU 2020-06 on January 1, 2024 and the adoption did not materially impact the unaudited condensed consolidated financial statements.

Recently Issued Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280), Improvements to Reportable Segment Disclosures, which introduced new guidance on disclosures for reportable segments and significant segment expenses, including for entities with a single reportable segment. This guidance is effective for the Company for annual reporting periods beginning January 1, 2024 and interim periods beginning January 1, 2025. As a smaller reporting company, the Company is currently evaluating the impact ASU 2023-07 will have on its consolidated financial statements.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740), Improvements to Income Tax Disclosures, which introduced new guidance on disclosures for income taxes, including enhancements to the rate reconciliation and income taxes paid disclosures. This guidance is effective for the Company for annual reporting periods beginning January 1, 2025. As a smaller reporting company, the Company is currently evaluating the impact ASU 2023-09 will have on its consolidated financial statements.

3. Investments

The following table summarizes the investments at March 31, 2024 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortized

Cost |

|

|

Unrealized

Gains |

|

|

Unrealized

Losses |

|

|

Fair Value |

|

As of March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

Maturities < 1 Year |

|

|

|

|

|

|

|

|

|

|

|

|

Corporate bonds |

|

$ |

42,248 |

|

|

$ |

17 |

|

|

$ |

(34 |

) |

|

$ |

42,231 |

|

Agency bonds |

|

|

2,514 |

|

|

|

— |

|

|

|

(2 |

) |

|

|

2,512 |

|

Total short-term investments |

|

$ |

44,762 |

|

|

$ |

17 |

|

|

$ |

(36 |

) |

|

$ |

44,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maturities > 1 Year |

|

|

|

|

|

|

|

|

|

|

|

|

Corporate bonds |

|

$ |

13,943 |

|

|

$ |

33 |

|

|

$ |

(17 |

) |

|

$ |

13,959 |

|

Total investments |

|

$ |

13,943 |

|

|

$ |

33 |

|

|

$ |

(17 |

) |

|

$ |

13,959 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Maturities < 1 Year |

|

|

|

|

|

|

|

|

|

|

|

|

Corporate bonds |

|

$ |

35,286 |

|

|

$ |

25 |

|

|

$ |

(13 |

) |

|

$ |

35,298 |

|

Agency bonds |

|

|

5,026 |

|

|

|

6 |

|

|

|

— |

|

|

|

5,032 |

|

Total short-term investments |

|

$ |

40,312 |

|

|

$ |

31 |

|

|

$ |

(13 |

) |

|

$ |

40,330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maturities > 1 Year |

|

|

|

|

|

|

|

|

|

|

|

|

Corporate bonds |

|

$ |

23,594 |

|

|

$ |

143 |

|

|

$ |

(9 |

) |

|

$ |

23,728 |

|

Total investments |

|

$ |

23,594 |

|

|

$ |

143 |

|

|

$ |

(9 |

) |

|

$ |

23,728 |

|

The Company carries investments at amortized cost. As of March 31, 2024 and December 31, 2023, the fair value of the corporate and agency bonds totals $58.7 million and $64.1 million, respectively, which is determined based on “Level 2” inputs, which consist of quoted prices for similar assets in active markets. The Company has evaluated the unrealized loss position in the corporate and agency bonds as of the balance sheet dates and did not consider it to be indicative of an other-than-temporary impairment as the securities are highly-rated and the Company expects to realize the full principal amount at maturity.

4. Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Prepaid research and development services |

|

$ |

499 |

|

|

$ |

196 |

|

Prepaid insurance |

|

|

279 |

|

|

|

264 |

|

Other prepaid expenses |

|

|

249 |

|

|

|

182 |

|

Other current assets |

|

|

556 |

|

|

|

4,906 |

|

Total prepaid expenses and other current assets |

|

$ |

1,583 |

|

|

$ |

5,548 |

|

5. Accrued Expenses

Accrued expenses consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Accrued research and development expenses |

|

$ |

2,016 |

|

|

$ |

2,830 |

|

Accrued employee bonus compensation |

|

|

453 |

|

|

|

1,692 |

|

Other accrued expenses |

|

|

546 |

|

|

|

940 |

|

Accrued severance |

|

|

— |

|

|

|

11 |

|

Accrued other rebates |

|

|

32 |

|

|

|

89 |

|

Accrued product recall |

|

|

1,554 |

|

|

|

1,933 |

|

Total accrued expenses |

|

$ |

4,601 |

|

|

$ |

7,495 |

|

6. Borrowings

Loan Agreement

On May 13, 2021 (the “Closing Date”), the Company entered into the Loan and Security Agreement (the "Loan Agreement") with Hercules Capital, Inc. and Silicon Valley Bridge Bank, N.A. (as successor to Silicon Valley Bank) (the "Lenders") for an aggregate principal amount of $60.0 million (the “Term Loan”). Pursuant to the Loan Agreement, the Term Loan was available to the Company in four tranches, subject to certain terms and conditions.

In connection with the entering into of the GSK License Agreement, the Company entered into a First Amendment and Consent to Loan and Security Agreement with the Lenders pursuant to which the Lenders consented to the Company entering into the GSK License Agreement and the Company agreed to pay to the Lenders an amount equal to the sum of (i) all outstanding principal plus all accrued and unpaid interest with respect to the amounts loaned under the Loan Agreement (approximately $35.4 million), (ii) the prepayment fee payable under the Loan Agreement ($262,500), (iii) the final payment payable under the Loan Agreement ($1,382,500), and (iv) all other sums, if any, that shall have become due and payable with respect to loan advances under the Loan Agreement. Upon receipt by the Company of the $90.0 million upfront payment from GSK in May 2023, all amounts payable under the Loan Agreement were fully paid. In connection with the repayment of those amounts due, in May 2023, the Company and the Lenders executed a payoff letter confirming the amounts due under the Loan Agreement, and the Company’s confirmation that the Loan Agreement was terminated.

March 2019 Note Purchase Agreement

On March 7, 2019, the Company entered into a Senior Convertible Note Purchase Agreement (the “March 2019 Note Purchase Agreement”) with Puissance. Pursuant to the March 2019 Note Purchase Agreement, on March 7, 2019, the Company issued and sold to Puissance $16.0 million aggregate principal amount of its 6.0% Senior Convertible Notes due 2025 (“March 2019 Notes”), resulting in $14.7 million in net proceeds after deducting $1.3 million for an advisory fee and other issuance costs.

As of March 31, 2024 and December 31, 2023, the Company’s March 2019 Notes consist of the convertible debt balance of $12.4 million and $12.0 million and the bifurcated embedded conversion option derivative liability of $28,000 and $0.2 million, respectively. In connection with the Company’s issuance of its March 2019 Notes, the Company bifurcated the embedded conversion option, inclusive of the interest make-whole provision and make-whole fundamental change provision, and recorded the embedded conversion option as a long-term derivative liability in the Company’s balance sheet in accordance with ASC 815, Derivatives and Hedging, at its initial fair value of $7.0 million as the interest make-whole provision is settled in shares of common stock. The convertible debt and derivative liability associated with the March 2019 Notes are presented in total on the accompanying unaudited condensed consolidated balance sheets as the convertible debt and derivative liability. The derivative liability will be remeasured at each reporting period using the binomial lattice model with changes in fair value recorded in the statements of operations in other (income) expense. For the three months ended March 31, 2024 and 2023, the Company recognized a gain of $0.2 million and a loss of $0.4 million, respectively, on the fair value adjustment for the derivative liability. For the three months ended March 31, 2024 and 2023, the Company recognized $0.4 million and zero in amortization of debt issuance costs and discount related to the March 2019 Notes, respectively.

The Company estimated the fair value of the convertible debt and derivative liability for the March 2019 Notes using a binomial lattice valuation model and Level 3 inputs. At both March 31, 2024 and December 31, 2023, the fair value of the convertible debt and derivative liability for the March 2019 Notes is $12.7 million.

The March 2019 Notes bear interest at a rate of 6.0% per annum payable semiannually in arrears on March 15 and September 15 of each year, beginning September 15, 2019. The March 2019 Notes will mature on March 15, 2025, unless earlier converted, redeemed or repurchased. The March 2019 Notes constitute general, senior unsecured obligations of the Company.

Other Liabilities

In February 2021, the Company partnered with Amplity for the commercial launch of BREXAFEMME for the treatment of VVC. Under the terms of the agreement with Amplity, the Company was to utilize Amplity’s commercial execution and resources for sales force, remote engagement, training, market access and select operations services. In October 2022, the Company announced that it was actively pursuing a U.S. commercialization partner to out-license BREXAFEMME in order to refocus the Company's resources on the further clinical development of ibrexafungerp for severe, hospital-based indications. As a result, the Company wound down its promotional activities associated with BREXAFEMME, while keeping

BREXAFEMME on the market and available to patients. On November 30, 2022, the Company terminated the agreement with Amplity. Under the terms of the original agreement, Amplity deferred a portion of its direct service fees in the first two years (2021 and 2022) that accrued interest at an annual rate of 12.75% (“Deferred Fees”). The Deferred Fees of $5.8 million as of December 31, 2022, classified as other liabilities on the consolidated balance sheet, were fully paid as of February 2023.

7. Commitments and Contingencies

Leases

On March 1, 2018, the Company entered into a long-term lease agreement for approximately 19,275 square feet of office space in Jersey City, New Jersey, that the Company identified as an operating lease under ASC 842 (the “Lease”). The lease term is eleven years from August 1, 2018, the commencement date, with total lease payments of $7.3 million over the lease term. The Company has the option to renew for two consecutive five-year periods from the end of the first term and the Company is not reasonably certain that the option to renew the Lease will be exercised. Under the Lease, the Company furnished a security deposit in the form of a standby letter of credit in the amount of $0.3 million, which was reduced by fifty-five thousand dollars on the first anniversary of the commencement date. The security deposit will continue to be reduced by fifty-five thousand dollars every two years on the commencement date anniversary for eight years. The security deposit is classified as restricted cash in the accompanying unaudited condensed consolidated balance sheets.

The following table summarizes certain quantitative information associated with the amounts recognized in the unaudited condensed consolidated financial statements for the Lease (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating lease cost |

|

$ |

166 |

|

|

$ |

166 |

|

Variable lease cost |

|

|

(23 |

) |

|

|

58 |

|

Total operating lease expense |

|

$ |

143 |

|

|

$ |

224 |

|

|

|

|

|

|

|

|

Cash paid for amounts included in the measurement of operating lease liability |

|

$ |

181 |

|

|

$ |

177 |

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Remaining Lease term (years) |

|

|

5.34 |

|

|

|

5.59 |

|

Discount rate |

|

|

15 |

% |

|

|

15 |

% |

Future minimum lease payments for the Lease as of March 31, 2024 are as follows (in thousands):

|

|

|

|

|

|

|

March 31, 2024 |

|

2024 |

|

$ |

549 |

|

2025 |

|

|

744 |

|

2026 |

|

|

759 |

|

2027 |

|

|

774 |

|

2028 |

|

|

790 |

|

Thereafter |

|

|

466 |

|

Total |

|

$ |

4,082 |

|

The presentations of the operating lease liability as of March 31, 2024 are as follows (in thousands):

|

|

|

|

|

|

|

March 31, 2024 |

|

Present value of future minimum lease payments |

|

$ |

2,843 |

|

|

|

|

|

Operating lease liability, current portion |

|

$ |

356 |

|

Operating lease liability, long-term portion |

|

|

2,487 |

|

Total operating lease liability |

|

$ |

2,843 |

|

|

|

|

|

Difference between future minimum lease payments and discounted cash flows |

|

$ |

1,239 |

|

License Arrangement with Potential Future Expenditures

As of March 31, 2024, the Company had a license arrangement with Merck Sharp & Dohme Corp., or Merck, as amended, that involves potential future expenditures. Under the license arrangement, executed in May 2013, the Company exclusively licensed from Merck its rights to ibrexafungerp in the field of human health. In January 2014, Merck assigned the patents related to ibrexafungerp that it had exclusively licensed to the Company. Ibrexafungerp is the Company's lead product candidate. Pursuant to the terms of the license agreement, Merck was originally eligible to receive milestone payments from the Company that could total $19.0 million upon occurrence of specific events, including initiation of a Phase 2 clinical study, new drug application, and marketing approvals in each of the U.S., major European markets, and Japan. In addition, Merck is eligible to receive tiered royalties from the Company based on a percentage of worldwide net sales of ibrexafungerp. The aggregate royalties are mid- to high-single digits.

In December 2014, the Company and Merck entered into an amendment to the license agreement that deferred the remittance of a milestone payment due to Merck, such that no amount would be due upon initiation of the first Phase 2 clinical trial of a product containing the ibrexafungerp compound (the “Deferred Milestone”). The amendment also increased, in an amount equal to the Deferred Milestone, the milestone payment that would be due upon initiation of the first Phase 3 clinical trial of a product containing the ibrexafungerp compound. In December 2016 and January 2018, the Company entered into second and third amendments to the license agreement with Merck which clarified what would constitute the initiation of a Phase 3 clinical trial for the purpose of milestone payment. In January 2019, a milestone payment became due to Merck as a result of the initiation of the VANISH Phase 3 VVC program and was paid in March 2019. On December 2, 2020, the Company entered into a fourth amendment to the license agreement with Merck. The amendment eliminates two cash milestone payments that the Company would have paid to Merck upon the first filing of an NDA, triggered by the FDA acceptance for filing of the Company’s NDA for ibrexafungerp for the treatment of VVC, and first marketing approval in the U.S. Such cash milestone payments would have been creditable against future royalties owed to Merck on net sales of ibrexafungerp. With the amendment, these milestones will not be paid in cash and, accordingly, credits will not accrue. Pursuant to the amendment, the Company will also forfeit the credits against future royalties that it had accrued from a prior milestone payment already paid to Merck. All other key terms of the license agreement are unchanged.

Legal Proceedings

On November 7, 2023, a securities class action was filed by Brian Feldman against the Company and certain of the Company's executives in the United States District Court, District of New Jersey, alleging that, during the period from March 31, 2023 to September 22, 2023, the Company made materially false and/or misleading statements, as well as failed to disclose material adverse facts about the Company's business, operations, and prospects, alleging specifically that the Company failed to disclose to investors: (1) that the equipment used to manufacture ibrexafungerp was also used to manufacture a non-antibacterial beta-lactam drug substance, presenting a risk of cross-contamination; (2) that the Company did not have effective internal controls and procedures, as well as adequate internal oversight policies to ensure that its vendor complied with current Good Manufacturing Practices (cGMP); (3) that, due to the substantial risk of cross-contamination, the Company were reasonably likely to recall its ibrexafungerp tablets and halt its clinical studies; and (4) as a result of the foregoing, the Company's statements about its business, operations, and prospects were materially misleading and/or lacked a reasonable basis. The complaint seeks unspecified damages, interest, fees and costs on behalf of all persons and entities who purchased and/or acquired shares of the Company's common stock between March 31, 2023 to September 22, 2023. On May 1, 2024, a purported shareholder derivative complaint was filed in the United States District Court, District of New Jersey. The complaint names the Company’s directors and certain of its officers and asserts state and federal claims based on the same alleged misstatements as the securities class action complaint. The Company disagrees with the allegations and intends to defend these litigations vigorously and the Company has not recognized any expense for these contingencies.

8. Stockholders’ Equity

Authorized, Issued, and Outstanding Common Stock

The Company’s authorized common stock has a par value of $0.001 per share and consists of 150,000,000 shares as of March 31, 2024, and December 31, 2023; 37,779,796 and 37,207,799 shares were issued and outstanding at March 31, 2024, and December 31, 2023, respectively. For the three months ended March 31, 2023, 363,000 of the prefunded warrants from the April 2022 public offering were exercised at $0.001 per share.

The following table summarizes common stock share activity for the three months ended March 31, 2024 and 2023 (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

|

|

|

Shares of

Common Stock |

|

|

Common

Stock |

|

|

Additional

Paid-in

Capital |

|

|

Accumulated

Deficit |

|

|

Total

Stockholders’ Equity |

|

Balance, December 31, 2023 |

|

|

37,207,799 |

|

|

$ |

40 |

|

|

$ |

428,169 |

|

|

$ |

(355,247 |

) |

|

$ |

72,962 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

411 |

|

|

|

411 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

705 |

|

|

|

— |

|

|

|

705 |

|

Common stock issued through employee stock purchase plan |

|

|

18,815 |

|

|

|

— |

|

|

|

26 |

|

|

|

— |

|

|

|

26 |

|

Common stock issued for vested restricted stock units |

|

|

553,182 |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

Balance, March 31, 2024 |

|

|

37,779,796 |

|

|

$ |

41 |

|

|

$ |

428,900 |

|

|

$ |

(354,836 |

) |

|

$ |

74,105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2023 |

|

|

|

Shares of

Common Stock |

|

|

Common

Stock |

|

|

Additional

Paid-in

Capital |

|

|

Accumulated

Deficit |

|

|

Total

Stockholders’

(Deficit) Equity |

|

Balance, December 31, 2022 |

|

|

32,682,342 |

|

|

$ |

36 |

|

|

$ |

425,485 |

|

|

$ |

(422,288 |

) |

|

$ |

3,233 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(33,876 |

) |

|

|

(33,876 |

) |

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

707 |

|

|

|

— |

|

|

|

707 |

|

Common stock issued through employee stock purchase plan |

|

|

2,662 |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

Common stock issued, net of expenses |

|

|

363,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock issued for vested restricted stock units |

|

|

279,623 |

|

|

|

— |

|

|

|

18 |

|

|

|

— |

|

|

|

18 |

|

Balance, March 31, 2023 |

|

|

33,327,627 |

|

|

$ |

36 |

|

|

$ |

426,214 |

|

|

$ |

(456,164 |

) |

|

$ |

(29,914 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Reserved for Future Issuance

The Company had reserved shares of common stock for future issuance as follows:

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Outstanding stock options |

|

|

2,716,602 |

|

|

|

1,867,795 |

|

Outstanding restricted stock units |

|

|

3,202,012 |

|

|

|

1,886,374 |

|

Warrants to purchase common stock associated with December 2020 public offering - Series 2 |

|

|

6,800,000 |

|

|

|

6,800,000 |

|

Prefunded warrants to purchase common stock associated with December 2020 public offering |

|

|

3,200,000 |

|

|

|

3,200,000 |

|

Warrants to purchase common stock associated with April 2022 public offering |

|

|

15,000,000 |

|

|

|

15,000,000 |

|

Prefunded warrants to purchase common stock associated with April 2022 public offering |

|

|

7,516,267 |

|

|

|

7,516,267 |

|

Warrants to purchase common stock associated with Loan Agreement |

|

|

198,811 |

|

|

|

198,811 |

|

Warrant to purchase common stock associated with Danforth |

|

|

50,000 |

|

|

|

50,000 |

|

For possible future issuance for the conversion of the March 2019 Notes |

|

|

1,138,200 |

|

|

|

1,138,200 |

|

For possible future issuance under 2014 Plan (Note 9) |

|

|

— |

|

|

|

848,202 |

|

For possible future issuance under employee stock purchase plan |

|

|

1,458,171 |

|

|

|

1,474,045 |

|

For possible future issuance under 2015 Plan (Note 9) |

|

|

637,050 |

|

|

|

633,590 |

|

Total common shares reserved for future issuance |

|

|

41,917,113 |

|

|

|

40,613,284 |

|

Warrants Associated with the December 2020 and April 2022 Public Offerings

The outstanding warrants associated with the December 2020 public offering contains a provision where the warrant holder has the option to receive cash, equal to the Black-Scholes fair value of the remaining unexercised portion of the warrant,

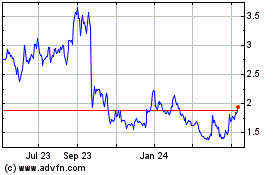

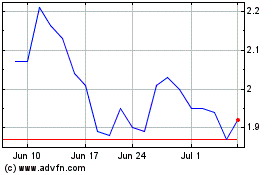

as cash settlement in the event that there is a fundamental transaction (contractually defined to include various merger, acquisition or stock transfer activities). Due to this provision, ASC 480, Distinguishing Liabilities from Equity, requires that these warrants be classified as liabilities. The fair values of these warrants have been determined using the Black-Scholes valuation model, and the changes in the fair value are recorded in the accompanying unaudited condensed consolidated statements of operations. The outstanding warrants associated with the April 2022 public offering meet the definition of a derivative pursuant to ASC 815, Derivatives and Hedging, and do not meet the derivative scope exception given the warrants do not qualify under the indexation guidance. As a result, the April 2022 public offering warrants were initially recognized as liabilities and measured at fair value using the Black-Scholes valuation model. For the three months ended March 31, 2024 and 2023, the Company recognized a gain of $9.6 million and a loss of $21.7 million, respectively, on the warrant liabilities fair value adjustment. As of March 31, 2024 and December 31, 2023, the fair value of the warrant liabilities was $12.2 million and $21.8 million, respectively.

9. Stock-based Compensation

Pursuant to the terms of the Company’s 2014 Equity Incentive Plan (“2014 Plan”), on January 1, 2024 and 2023, the Company automatically added 1,916,962 and 1,901,960 shares to the total number shares of common stock available for future issuance under the 2014 Plan, respectively. As of March 31, 2024, there were zero shares of common stock available for future issuance under the 2014 Plan.

2015 Inducement Award Plan