Filed

Pursuant to Rule 424(b)(5)

Registration

Statement No.: 333-275112

PROSPECTUS

SUPPLEMENT

(to Prospectus dated October 30, 2023)

8,533,000 Shares

Presto

Automation Inc.

Common

Stock

Pursuant

to this prospectus supplement and the accompanying prospectus, we are offering in a registered direct offering to certain purchasers,

8,533,000 shares of our common stock, par value $0.0001 per share (“common stock”) at an offering price of $0.25 per

share (the “public offering price”).

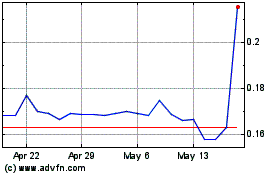

Our

common stock is listed on the Nasdaq Stock Market (“Nasdaq”) under the symbol “PRST.” On February 29, 2024, the

last reported sale price of our common stock on Nasdaq was $0.31 per share.

We

have retained Chardan Capital Markets LLC and Spartan Capital Securities, LLC to act as our exclusive placement agents (the “placement

agents”) in connection with the shares of common stock offered by this prospectus supplement. The placement agents are not

purchasing or selling any of the shares we are offering, and the placement agents are not required to arrange the purchase or sale of

any specific number of shares or dollar amount. We have agreed to pay to the placement agents the placement agent fees set forth

in the table below, which assumes that we sell all of the securities offered by this prospectus supplement. See “Plan of

Distribution” on page S-16 of this prospectus supplement for more information regarding these arrangements.

Investing

in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page S-4 of this prospectus supplement,

on page 4 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus.

| | |

Per

Share | | |

| |

| Public offering price | |

$ | 0.25 | | |

$ | 2,133,250 | |

| Placement agent fees(1) | |

$ | 0.0225 | | |

$ | 191,992.50 | |

| Proceeds to us before expenses | |

$ | 0.2275 | | |

$ | 1,941,257.50 | |

| (1) | In

addition, we have agreed to pay an additional flat deferred fee of $150,000 from a prior

offering to Chardan Capital Markets LLC and reimburse the placement agents for certain of

their offering-related expenses. See “Plan of Distribution” for a description

of the compensation to be received by the placement agents. |

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

Delivery

of the shares of common stock is expected to be made on or about March 4, 2024, subject to satisfaction of customary closing conditions.

| Chardan |

Spartan Capital

Securities, LLC |

Prospectus

Supplement dated February 29, 2024

Table

of Contents

Prospectus

Supplement

PROSPECTUS

Neither

we nor the placement agents have authorized anyone to provide any information other than that contained or incorporated by reference

in this prospectus supplement. Neither we nor the placement agents take responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you.

This

prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase,

the securities offered hereby in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation

of an offer in such jurisdiction. You should not assume that the information contained or incorporated by reference in this prospectus

supplement or the accompanying prospectus is accurate as of any date other than the date on the front cover of the applicable document.

Neither the delivery of this prospectus supplement and the accompanying prospectus, nor any distribution of securities pursuant to this

prospectus supplement or the accompanying prospectus shall, under any circumstances, create any implication that there has been no change

in our business, financial condition, results of operations and prospects since the date of this prospectus supplement or the accompanying

prospectus.

You

should read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in the accompanying prospectus

in their entirety before making an investment decision. You should also read and consider the information in the documents to which we

have referred you in the section of the prospectus supplement entitled “Incorporation of Certain Information by Reference”

and in the sections of the accompanying prospectus entitled “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference.”

For

investors outside the United States: we and the placement agents have not done anything that would permit this offering or possession

or distribution of this prospectus supplement and the accompanying prospectus in any jurisdiction where action for that purpose is required,

other than in the United States. Persons outside the United States who come into possession of this prospectus supplement and

the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common

stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States.

Important

Notice About Information in this

Prospectus Supplement and the Accompanying Prospectus

This

prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed

with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. This document contains two

parts. The first part is this prospectus supplement, which describes the specific terms of this offering of shares of our common stock.

The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering of

shares of our common stock. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. If

the information about this offering of shares of our common stock varies between this prospectus supplement and the accompanying prospectus,

you should rely on the information in this prospectus supplement.

Any

statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be

deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in

any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement.

Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Please read “Incorporation of Certain Information by Reference” in this prospectus supplement.

Special

Note Regarding Forward-Looking Statements

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933,

as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act,

and are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking

statements include information concerning our possible or assumed future results of our business and statements regarding our financial

condition, results of operations, liquidity, plans and objectives. Forward-looking statements include all statements that are not historical

facts and in some cases can be identified by terminology such as “believe,” “may,” “anticipate,”

“estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,”

“expect,” “predict,” “project,” “potential,” “will,” or the negative of these

terms or other similar expressions that convey uncertainty of future events or outcomes.

These

statements are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking

statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain

events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or

contribute to such differences are discussed in the section titled “Risk Factors” included in our Annual Report on Form 10-K for

the year ended June 30, 2023 filed with the SEC on October 11, 2023, as amended by Amendment No. 1 on Form 10-K/A filed with the SEC

on October 12, 2023 (the “2023 Form 10-K”), and other risk factors detailed from time to time in filings with the SEC. Our

ability to predict the results of our operations or the effects of various events on our operating results is inherently uncertain. Therefore,

we caution you to consider carefully the matters described under the caption “Risk Factors” and certain other matters discussed

in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, and other

publicly available sources. Such factors and many other factors beyond the control of our management could cause our actual results,

performance or achievements to differ materially from any future results, performance or achievements that may be expressed or implied

by the forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws,

we do not intend to update or revise any forward-looking statements.

Prospectus

Supplement Summary

This

summary highlights information contained elsewhere in this prospectus supplement. This summary does not contain all of the information

that you should consider before deciding whether to invest in our common stock. You should read this entire prospectus supplement carefully,

including accompanying prospectus, the “Risk Factors” section in this prospectus supplement, the risks set forth under the

heading “Risk Factors” in the 2023 Form 10-K, and the other documents incorporated by reference in this prospectus supplement

and the accompanying prospectus, prior to making an investment decision. References in this prospectus supplement to “we,”

“us,” “our,” the “Company,” and “Presto” refer to Presto Automation Inc. unless otherwise

stated or the context otherwise requires.

Our

Business

Overview

We

provide enterprise grade AI and automation solutions to the restaurant technology industry. Our solutions are designed to decrease labor

costs, improve staff productivity, increase revenue and enhance the guest experience. We offer our industry-leading AI solution, Presto

Voice, to quick service restaurants (QSR) and our pay-at-table tablet solution, Presto Touch, to casual dining chains. Some of the most

recognized restaurant names in the United States are among our customers, including Carl’s Jr. and Hardee’s, Wienerschnitzel

and Checkers for Presto Voice.

Following

our founding in 2008, we initially focused exclusively on Presto Touch. As of June 30, 2023, we had shipped over 277,000 Presto Touch

tablets to three of the largest casual dining chains in the United States. Presto Voice addresses the pressing needs of drive-thru restaurant

operators by improving order accuracy, reducing labor costs and increasing revenue through menu upselling, while also providing guests

with an improved drive-thru experience. While Presto Touch has accounted for substantially all of our historical revenues, Presto Voice

accounts for over 10% of our revenue for the three and six months ended December 31, 2023, and we believe that Presto Voice will contribute

an increasing portion of our revenues in the future.

We

are considering strategic alternatives related to our Presto Touch solution including evaluating whether to engage in a wind-down from

Presto Touch, which could include either a sale, partial sale or abandonment in the coming months, and allows us to focus our efforts

on our Presto Voice solution.

Update

Regarding Liquidity and Credit Agreement with Metropolitan

We

project that the net proceeds from this offering, together with our other cash resources and projected revenues, are sufficient for us

to sustain our operations through the middle of March 2024.

As

previously disclosed, on February 17, 2024, we received notice from the agent and the lenders under our credit agreement of the

termination of the forbearance agreement that we had entered into with them. As a result, the agent and lenders are no longer required

to forbear from exercising rights and remedies against us under the credit agreement as a result of defaults under the credit agreement.

The remedies that the agent and lenders have include instructing the banks in which we hold our deposits to transfer some or all of those

deposits to an account designated by the agent for the purpose of reducing the outstanding principal and interest under the credit agreement.

Recent

Developments

Nasdaq

Delisting Notice

On

February 23, 2024, we received a notice (“Notice”) from Nasdaq stating that the Company is not in compliance with the requirement

to maintain a minimum Market Value of Publicly Held Securities (“MVPHS”) of $15 million, as set forth in Nasdaq Listing Rule

5450(b)(2)(C) (the “MVPHS Requirement”) because the MVPHS of the Company was below $15 million for the 35 consecutive business

days prior to the date of the Notice. The Notice was in addition to the previously disclosed letters received on February 6, 2024, notifying

the Company that it was not in compliance with the requirement to maintain a minimum Market Value of Listed Securities of $50 million,

as set forth in Nasdaq Listing Rule 5450(b)(2)(A), and on December 28, 2023, notifying the Company that it was not in compliance with

the requirement to maintain a minimum bid price of $1.00 per share, as set forth in Nasdaq Listing Rule 5450(a)(1).

The

Notice does not impact the listing of the Company's common stock or warrants on The Nasdaq Global Market at this time. The Notice provided

that, in accordance with Nasdaq Listing Rule 5810(c)(3)(D), the Company has a period of 180 calendar days from the date of the Notice,

or until August 21, 2024, to regain compliance with the MVPHS Requirement. During this period, the common stock will continue to

trade on The Nasdaq Global Market. If at any time before August 21, 2024 the MVPHS closes at $15 million or more for a minimum of

ten consecutive business days, Nasdaq will provide written notification that the Company has achieved compliance with the MVPHS Requirement

and the matter will be closed.

In

the event the Company does not regain compliance by August 21, 2024, the Company will receive written notification that its securities

are subject to delisting. At that time, the Company may appeal the delisting determination to a Hearings Panel. The Notice provides that

the Company may be eligible to transfer the listing of its securities to The Nasdaq Capital Market (provided that it then satisfies the

requirements for continued listing on that market).

The

Company intends to actively monitor its MVPHS and will evaluate available options to regain compliance with the MVPHS Requirement. However,

there can be no assurance that the Company will be able to regain compliance with the MVPHS Requirement or maintain compliance with any

of the other Nasdaq continued listing requirements.

Increase

in Authorized Shares

On

February 26, 2024, our stockholders approved an amendment (the “Amendment”) to our Second Amended and Restated Certificate

of Incorporation, to increase the number of authorized shares of common stock from 180,000,000 shares to 100,000,000,000 shares. The

Company’s board of directors previously approved the Amendment on February 12, 2024, subject to stockholder approval. The Amendment

was filed and effective with the Secretary of the State of Delaware on February 27, 2024.

Corporate

Information

Our

principal executive office is located at 985 Industrial Road, San Carlos, CA 94070. Our telephone number is (650) 817-9012. Our website

address is www.presto.com. Information on or connected to our website is not a part of or incorporated by reference into this prospectus

supplement.

The

Offering

| Common stock offered by us |

|

8,533,000 shares

of our common stock. |

| |

|

|

| Common

stock outstanding after this offering |

|

87,868,628 shares of common stock |

| |

|

|

| Price

per share |

|

$0.25 per share. |

| |

|

|

| Use of proceeds |

|

We

estimate that the net proceeds to us from this offering will be approximately $1.5 million, after deducting the placement agent fees

and estimated offering expenses payable by us.

We intend

to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Listing |

|

Our common stock is listed

on Nasdaq under the trading symbol “PRST.” |

| |

|

|

| Antidilution issuance |

|

The offering will result in us issuing 4,500,000 additional

shares to CA (as defined below), 4,500,000 additional shares to investors who participated in our registered direct offering in November

2023, and 9,000,000 additional shares underlying warrants with an exercise price of $0.01 per share to our lenders, in each case,

pursuant to antidilution rights described in more detail below. |

| |

|

|

| Risk factors |

|

Investing in our common

stock involves a high degree of risk. You should read the section titled “Risk Factors,” and the other information included,

or incorporated by reference, in this prospectus supplement for a discussion of some of the risks and uncertainties you should carefully

consider before deciding to invest in our common stock. |

Unless

otherwise indicated, all information in this prospectus relating to the number of shares of our common stock outstanding is based on

81,419,280 shares of common stock outstanding as of February 28, 2024 and does not include:

| ● | shares

of common stock issuable upon the exercise of certain outstanding warrants outstanding as

of February 28, 2024 as follows: |

| Shares Underlying Warrants | | |

Exercise Price | |

| 9,329,961 | | |

$ | 0.01 | |

| 639,026 | | |

$ | 0.37 | |

| 294,725 | | |

$ | 6.53 | |

| 71,101 | | |

$ | 7.80 | |

| 584,648 | | |

$ | 8.16 | |

| 8,625,000 | | |

$ | 8.21 | |

| 170,993 | | |

$ | 9.25 | |

| 7,625,000 | | |

$ | 11.50 | |

| ● | 3,030,576

shares of common stock underlying outstanding RSUs as of February 28, 2024 and 6,076,476 shares issuable upon the exercise of stock options

outstanding as of February 28, 2024 previously granted under the Company’s equity incentive plans; and |

| ● | 9,000,000

additional shares of common stock underlying warrants with an exercise price of $0.01 per share held by Metropolitan Partners Group Administration,

LLC, Metropolitan Levered Partners Fund VII, LP, Metropolitan Partners Fund VII, LP, Metropolitan Offshore Partners Fund VII, LP and

CEOF Holdings LP (collectively, the “Lenders”), the agent under our credit facility, in connection with antidilution protections

under the warrants that are triggered by this offering, but that may only be issued following receipt of shareholder approval pursuant

to Nasdaq Rule 5635(d); |

| ● | 4,500,000

additional shares of common stock issuable to Presto CA LLC (“CA”) pursuant to anti-dilution protections previously granted

to CA LLC, an affiliate of our shareholder, Cleveland Avenue, but that may only be issued following receipt of shareholder approval pursuant

to Nasdaq Listing Rule 5635(d); and |

| ● | 4,500,000

additional shares of common stock issuable to investors who participated in the Company’s registered direct offering dated November

17, 2023, but that may only be issued following receipt of shareholder approval pursuant to Nasdaq Listing Rule 5635(d). |

Unless

otherwise indicated, all information in this prospectus (1) reflects or assumes no exercise, vesting or termination of options, RSUs

or warrants outstanding as of February 28, 2024, and (2) assumes a public offering price per share of $0.25.

Risk

Factors

An investment in our common

stock involves a high degree of risk. You should carefully consider and evaluate all of the information included and incorporated by reference

in this prospectus, including the risk factors below, in the 2023 Form 10-K (which is incorporated by reference into this prospectus

supplement), and other filings we make with the SEC, which are incorporated by reference into this prospectus supplement. It is possible

that our business, financial condition, liquidity or results of operations could be materially adversely affected by any of these risks.

Purchasers of shares

in this offering will experience immediate and substantial dilution in the book value of their investment.

The effective offering price

per share in this offering is substantially higher than the net tangible book value per share of our common stock before giving effect

to this offering. Accordingly, purchasers of our securities in this offering at the public offering price will incur immediate dilution

of approximately $1.33 per share representing the difference between the respective offering price per share and our pro forma as-adjusted

net tangible book value as of December 31, 2023. For more information, including how these amounts were calculated, see “Dilution.”

We granted anti-dilution

protection to certain of our investors, which will cause additional significant dilution to our stockholders and may have a

material adverse impact on the market price of our common stock and make it more difficult for us to raise funds through future equity

offerings.

In

addition to the immediate dilutive effects described in “The Offering”, we have granted anti-dilution protections to holders

of our shares, warrants and convertible notes that could result in the issuance of additional shares in future offerings. Moreover, the

perceived risk of dilution and the resulting downward pressure on our common stock price could encourage investors to engage in short

sales of our common stock, which could further contribute to price declines in our common stock. The fact that certain of our stockholders

and our warrant holders can sell substantial amounts of our common stock in the public market, whether or not sales have occurred

or are occurring, as well as the existence of anti-dilution provisions in the Purchase Agreement and the Third Amendment Conversion Warrants,

could make it more difficult for us to raise additional funds through the sale of equity or equity-related securities in the future at

a time and price that we deem reasonable or appropriate, or at all.

Shares of our common stock have been, and

may continue to be, thinly traded, which may contribute to volatility in our stock price and less liquidity for investors.

The trading volume of our

common stock has varied, and at times may be characterized as thinly traded. As a result of this thin trading market or “float”

for our common stock, our common stock has been, and may continue to be, less liquid than the common stock of companies with broader public

ownership. If our common stock is thinly traded, the trading of a relatively small volume of our common stock may have a greater impact

on the trading price of our common stock than would be the case if our float were larger. As a result, the trading prices of our common

stock may be more volatile than the common stock of companies with broader public ownership, and an investor be unable to liquidate an

investment in our common stock at attractive prices.

We cannot predict the prices at which our common

stock will trade in the future. Variations in financial results, announcements of material events, changes in our dividend policy, technological

innovations or new products by us or our competitors, our quarterly operating results, changes in general conditions in the economy or

government spending on law enforcement and military, other developments affecting us or our competitors or general price and volume fluctuations

in the market are among the many factors that could cause the market price of our common stock to fluctuate substantially.

We

will need additional capital to sustain our operations and to the extent additional financing is unavailable or is only available on unfavorable

terms, or if certain investors exercise their veto rights and block us from raising additional capital, it may have a material adverse

effect on our business.

If

we were to raise approximately $2.1 million in gross proceeds in this offering, we believe that we would have sufficient liquidity to

sustain the Company until approximately the middle of March 2024 absent additional funding. If we are unable to raise additional financing

in the near term, there is a significant risk that we would become insolvent and investors could lose the entirety of their investment.

Further, as described in our Current Report on Form 8-K filed with the SEC on November 16, 2023. pursuant to a contractual arrangement,

KKG Enterprises LLC, an affiliate of the REMUS Stockholders, and CA LLC, an affiliate of Cleveland Avenue, LLC, have veto rights over

our ability to issue shares of our common stock or of our subsidiaries, or securities convertible into or exercisable for common stock,

subject to certain limited exceptions, which could have a material adverse effect on our ability to raise additional financing if such

veto rights are exercised.

Certain

of our lenders are no longer required to forbear from exercising rights and remedies against us as a result of defaults under credit agreements.

On

February 17, 2024, we received notice from the agent and lenders of our credit agreement of the termination of the forbearance agreement

that we had entered into with them. As a result, the agent and lenders are no longer required to forbear from exercising rights and remedies

against us under the credit agreement as a result of defaults under the credit agreement. The remedies that the agent and lenders have

include instructing the banks in which we hold our deposits to transfer some or all of those deposits to an account designated by the

agent for the purpose of reducing the outstanding principal and interest under the credit agreement. The occurrence of these events could

limit the amount of cash available to us for use in our business.

We have broad discretion

to determine how to use the funds raised in this offering, and may use them in ways that may not enhance our operating results or the

price of our common stock.

We currently intend to use

the net proceeds from this offering for working capital and general corporate purposes. Accordingly, we will have broad discretion as

to how we use the net proceeds that we receive from this offering. We could spend the proceeds that we receive from this offering in ways

that our shareholders may not agree with or that do not yield a favorable return. You will not have the opportunity as part of your investment

decision to assess whether the net proceeds are being used appropriately. Investors in this offering will need to rely upon the judgment

of our board of directors and management with respect to the use of proceeds. If we do not use the net proceeds that we receive in this

offering effectively, our business, financial condition, results of operations and prospects could be harmed, and the market price of

our shares of common stock could decline.

Sales of substantial

amounts of our common stock in the public market, or the perception that these sales may occur, could cause the market price of our common

stock to decline.

Sales of substantial amounts

of our common stock in the public market, or the perception that these sales may occur, could cause the market price of our common stock

to decline. This could also impair our ability to raise additional capital through the sale of our equity securities. We may issue additional

shares of common stock, which may dilute existing shareholders, including purchasers of the common stock offered hereby. In connection

with the completion of this offering, we have agreed not to issue, enter into any agreement to issue or announce the issuance or proposed

issuance of any shares of Common Stock or Common Stock Equivalents (as defined in the securities purchase agreement entered into in connection

with this offering) or a period of 15 days after the date of this prospectus supplement, subject to certain exceptions. Separately,

the holders of approximately 40% of our shares have also agreed pursuant to a separate lock-up agreement with us entered into in connection

with a financing transaction not to offer, sell or transfer their shares until December 23, 2024. Following the expiration of the lock-up

periods, these shares will be available for sale in the public markets subject to restrictions under applicable securities laws. We cannot

predict the size of future issuances of our shares, or the effect, if any, that future sales and issuances of securities would have on

the market price of our shares of common stock. See “Plan of Distribution.”

We are currently listed

on the Nasdaq Stock Market. If we are unable to maintain listing of our securities on the Nasdaq Stock Market or any stock exchange, our

stock price could be adversely affected and the liquidity of our stock and our ability to obtain financing could be impaired and it may

be more difficult for our shareholders to sell their securities.

Although our common stock

is currently listed on Nasdaq, we may not be able to continue to meet the exchange’s minimum listing requirements or those of any

other national exchange. For example, On February 23, 2024, we received the Notice from Nasdaq stating that the Company is not in

compliance with the requirement to maintain a MVPHS of $15 million, as set forth in Nasdaq Listing Rule 5450(b)(2)(C) because the MVPHS

of the Company was below $15 million for the 35 consecutive business days prior to the date of the Notice. The Notice was in addition

to the previously disclosed letters received on February 6, 2024, notifying the Company that it was not in compliance with the requirement

to maintain a minimum Market Value of Listed Securities of $50 million, as set forth in Nasdaq Listing Rule 5450(b)(2)(A), and on December

28, 2023, notifying the Company that it was not in compliance with the requirement to maintain a minimum bid price of $1.00 per share,

as set forth in Nasdaq Listing Rule 5450(a)(1). The delisting of our common stock from Nasdaq may make it more difficult for us to raise

capital on favorable terms in the future. Such a delisting would likely a result in a reduction in some or all of the following may occur,

each of which could have a material adverse effect on our shareholders and may impair your ability to sell or purchase our common stock

when you wish to do so:

| ● | the

liquidity of our common stock; |

| ● | the

market price of our common stock; |

| ● | our

ability to obtain financing for the continuation of our operations; |

| ● | the

number of investors that will consider investing in our common stock; |

| ● | the

number of market makers in our common stock; |

| ● | the

availability of information concerning the trading prices and volume of our common stock; and |

| ● | the

number of broker-dealers willing to execute trades in shares of our common stock. |

Further, if we were to be

delisted from the Nasdaq Stock Market and we are unable to obtain listing on another national securities exchange, our common stock would

cease to be recognized as covered securities and we would be subject to regulation in each state in which we offer our securities.

Use

of PROCEEDS

We estimate that we will

receive net proceeds of approximately $1.5 million from the sale of the shares of common stock offered by us in this offering, after

deducting the placement agent fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering

for working capital and general corporate purposes.

We have not yet determined

the amount of net proceeds to be used specifically for any of the foregoing purposes. Accordingly, our management will have significant

discretion and flexibility in applying the net proceeds from this offering.

DILUTION

If you invest in our common

stock, your interest will be diluted immediately to the extent of the difference between the offering price per share you will pay in

this offering and the as-adjusted net tangible book value per share of our common stock immediately after giving effect

to this offering.

Our net tangible book value

as of December 31, 2023 was approximately $(53.2) million, or $(0.76) per share of common stock. Net tangible book value per share is

determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of

December 31, 2023.

Our pro forma net tangible

book value as of December 31, 2023, before giving effect to this offering, was approximately $(52.5), or $(0.75) per share of common stock.

Pro forma net tangible book value, before the issuance and sale of shares of securities in this offering, gives effect to the issuance

and sale of an aggregate of $9.0 million principal amount of subordinated convertible notes offered in January 2024, the application of

the estimated net proceeds therefrom and the issuance of shares of Common Stock pursuant to antidilution provisions triggered by the January

2024 offering, after deducting estimated offering expenses payable by us.

As-adjusted net tangible book value per share represents

our net tangible book value after giving effect to the sale of shares of common stock at the public offering price of $0.25 per share,

and, after deducting the placement agent fees and commissions and estimated offering expenses payable by us in connection with this offering,

would have been approximately $(50.47) million, or $(0.58) per share. This represents an immediate increase in net tangible book

value of $0.17 per share to our existing stockholders and an immediate dilution of approximately $1.33 per share to purchasers of our

common stock in this offering at the public offering price.

The following table illustrates

this per share dilution.

| Public offering price per share |

|

$ |

0.25 |

|

| Net tangible book value per share as of December 31, 2023 |

|

$ |

(0.75 |

) |

| Increase in net tangible book value per share attributable to the issuance and sale of an aggregate of $9.0 million principal amount of subordinated convertible notes offered in January 2024, the application of the estimated net proceeds therefrom and the issuance of shares of Common Stock pursuant to antidilution provisions triggered by the January 2024 offering, after deducting estimated offering expenses payable by us |

|

$ |

0.09 |

|

| Pro forma net tangible book value per share as of December 31, 2023 |

|

$ |

(0.66 |

) |

| Increase in net tangible book value per share attributable to this offering |

|

$ |

0.08 |

|

| Pro forma as-adjusted net tangible book value per share as of December 31, 2023, after giving effect to this offering |

|

$ |

(0.58 |

) |

| Dilution per share to new investors purchasing in this offering at the public offering price |

|

$ |

1.33 |

|

The information above and

in the foregoing table is based on 70,335,628 shares of our common stock outstanding as of December 31, 2023, and does not include:

| ● | 12,907,800

shares of common stock reserved for future issuance under the Company’s equity incentive

plans; |

| ● | 9,000,000

additional shares of common stock underlying warrants with an exercise price of $0.01 per

share held by Metropolitan Partners Group Administration, LLC, Metropolitan Levered Partners

Fund VII, LP, Metropolitan Partners Fund VII, LP, Metropolitan Offshore Partners Fund VII,

LP and CEOF Holdings LP (collectively, the “Lenders”), the agent under our credit

facility, in connection with antidilution protections under the warrants that are triggered

by this offering, but that may only be issued following receipt of shareholder approval pursuant

to Nasdaq Rule 5635(d); |

| ● | 4,500,000

additional shares of common stock issuable to Presto CA LLC (“CA”) pursuant to

anti-dilution protections previously granted to CA LLC, an affiliate of our shareholder,

Cleveland Avenue, but that may only be issued following receipt of shareholder approval pursuant

to Nasdaq Listing Rule 5635(d); and |

| ● | 4,500,000

additional shares of common stock issuable to investors who participated in the Company’s

registered direct offering dated November 17, 2023, but that may only be issued following

receipt of shareholder approval pursuant to Nasdaq Listing Rule 5635(d). |

Except

as otherwise indicated, all information in this prospectus supplement assumes no exercise, vesting or termination of options, RSUs or

warrants outstanding as of December 31, 2023. To the extent that any of these outstanding options, RSUs or warrants are exercised

at prices per share below the public offering price or lead investor price per share in this offering or we issue additional shares under

our equity incentive plans at prices below the public offering price or lead investor price per share in this offering, you may experience

further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations

even if we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital

by issuing equity or convertible debt securities, your ownership will be further diluted.

Capitalization

The following table sets

forth our cash and cash equivalents and capitalization as of December 31, 2023:

| |

● |

on an as-adjusted basis to give effect to the issuance and sale of an aggregate of $9.0 million principal amount of subordinated convertible notes offered in January 2024, the application of the estimated net proceeds therefrom and the issuance of shares of Common Stock pursuant to antidilution provisions triggered by the January 2024 offering, after deducting estimated offering expenses payable by us; and |

| |

● |

on an as-further-adjusted basis to give effect to the issuance and sale of our common stock offered hereby and the application of the estimated net proceeds therefrom as set forth under “Use of Proceeds,” based on the sale of 8,533,000 shares of common stock at public offering price of $0.25 per share, after deducting the placement agent fees and estimated offering expenses payable by us. |

You should read this table

in conjunction with the financial statements, including the notes thereto, and other financial information pertaining to us incorporated

by reference in this prospectus supplement.

| | |

As of December 31, 2023 | |

| ($ in thousands) | |

Actual | | |

As

Adjusted | | |

As Further

Adjusted | |

| Cash and cash equivalents(1)(2)(3) | |

$ | 13,375 | | |

$ | 7,795 | | |

$ | 9,586 | |

| Total debt | |

$ | 55,632 | | |

| 50,052 | | |

$ | 50,052 | |

| Stockholders’ deficit: | |

| | | |

| | | |

| | |

| Common stock, par value $0.0001 per share; 180,000,000 shares authorized, actual and 100,000,000,000 shares authorized, as adjusted and as further adjusted, 70,335,628 shares issued and outstanding, actual; 79,335,628 shares issued and outstanding, as adjusted, and 87,868,628 outstanding, as further adjusted | |

| 7 | | |

| 7 | | |

| 9 | |

| Additional paid-in capital | |

| 206,109 | | |

$ | 206,109 | | |

| 207,898 | |

| Accumulated deficit | |

| (247,945 | ) | |

| (247,945 | ) | |

| (247,945 | ) |

| Total stockholders’ deficit | |

| (41,829 | ) | |

$ | (41,829 | ) | |

| (40,038 | ) |

| Total capitalization | |

$ | 13,803 | | |

$ | 13,803 | | |

| 10,014 | |

Material

U.S. Federal Tax Considerations for Non-U.S. Holders of Our Common STOCK

The

following is a summary of the material U.S. federal income tax consequences applicable to Non-U.S. holders (as defined below)

of the acquisition, ownership and disposition of our common stock purchased in accordance with this prospectus supplement, but does not

purport to be a complete analysis of all potential tax consequences related thereto. This discussion applies only to our common stock

that is held as a capital asset within the meaning of Section 1221 of the U.S. Internal Revenue Code of 1986, as amended (the

“Code”). This discussion assumes that any distributions made (or deemed made) by us on our common stock and any consideration

received (or deemed received) by a holder in consideration for the sale or other disposition of our common stock will be in U.S. dollars.

This

discussion does not address the U.S. federal income tax consequences to our founders, sponsors, officers or directors. This discussion

is a summary only and does not describe all of the tax consequences that may be relevant to you in light of your particular circumstances,

including but not limited to the alternative minimum tax, the Medicare tax on certain net investment income and the different consequences

that may apply if you are subject to special rules that apply to certain types of investors, including but not limited to:

| ● | banks,

financial institutions or financial services entities; |

| |

● |

traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; |

| |

● |

governments or agencies or instrumentalities thereof; |

| |

● |

regulated investment companies; |

| |

● |

real estate investment trusts; |

| |

● |

expatriates or former long-term residents of the United States; |

| |

● |

except as specifically provided below, persons that actually or constructively own five percent or more (by vote or value) of our shares; |

| |

● |

persons that acquired our common stock pursuant to an exercise of employee share options, in connection with employee share incentive plans or otherwise as compensation; |

| |

● |

tax-qualified retirement plans; |

| |

● |

“qualified foreign pension funds” as defined in Section 897(l)(2) of the Code and entities all of the interests of which are held by qualified foreign pension funds; |

| |

● |

dealers or traders subject to a mark-to-market method of accounting with respect to our common stock; |

| |

● |

persons holding our common stock as part of a “straddle,” constructive sale, hedge, wash sale, conversion or other integrated or similar transaction; |

| |

● |

persons deemed to sell our common stock under the constructive sale provisions of the Code; |

| |

● |

persons subject to special tax accounting rules as a result of any item of gross income with respect to our common stock being taken into account in an applicable financial statement; |

| |

● |

Non-U.S. holders (as defined below) whose functional currency is not the U.S. dollar; |

| |

● |

partnerships (or entities or arrangements classified as partnerships or other pass-through entities for U.S. federal income tax purposes) and any beneficial owners of such partnerships; |

| |

● |

corporations that accumulate earnings to avoid U.S. federal income tax; |

| |

● |

controlled foreign corporations; and |

| |

● |

passive foreign investment companies. |

If

a partnership (including an entity or arrangement treated as a partnership or other pass-thru entity for U.S. federal income

tax purposes) holds our common stock, the tax treatment of a partner, member or other beneficial owner in such partnership will generally

depend upon the status of the partner, member or other beneficial owner, the activities of the partnership and certain determinations

made at the partner, member or other beneficial owner level. If you are a partner, member or other beneficial owner of a partnership holding

our common stock, you are urged to consult your tax advisor regarding the tax consequences of the acquisition, ownership and disposition

of our common stock.

This

discussion is based on the Code, and administrative pronouncements, judicial decisions and final, temporary and proposed Treasury regulations

as of the date hereof, which are subject to change, possibly on a retroactive basis, and changes to any of which subsequent to the date

of this prospectus may affect the tax consequences described herein. This discussion does not address any aspect of state, local or non-U.S. taxation,

or any U.S. federal taxes other than income taxes (such as gift and estate taxes).

We

have not sought, and do not expect to seek, a ruling from the U.S. Internal Revenue Service (the “IRS”) as to any U.S. federal

income tax consequence described herein. The IRS may disagree with the discussion herein, and its determination may be upheld by a court.

Moreover, there can be no assurance that future legislation, regulations, administrative rulings or court decisions will not adversely

affect the accuracy of the statements in this discussion. You are urged to consult your tax advisor with respect to the application of

U.S. federal tax laws to your particular situation, as well as any tax consequences arising under the laws of any state, local or

foreign jurisdiction.

THIS

DISCUSSION IS ONLY A SUMMARY OF CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS ASSOCIATED WITH THE ACQUISITION, OWNERSHIP AND DISPOSITION

OF OUR COMMON STOCK. EACH PROSPECTIVE INVESTOR IN OUR COMMON STOCK IS URGED TO CONSULT ITS OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR

TAX CONSEQUENCES TO SUCH INVESTOR OF THE ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK, INCLUDING THE APPLICABILITY AND EFFECT

OF ANY U.S. FEDERAL NON-INCOME, STATE, LOCAL, AND NON-U.S. TAX LAWS.

Definition of Non-U.S. Holder

As

used herein, the term “Non-U.S. holder” means a beneficial owner of our common stock (other than a partnership or entity

or arrangement classified as a partnership for U.S. federal income tax purposes) that is, for U.S. federal income tax purposes, not

a U.S. person.

A

“U.S. person” is any person that, for U.S. federal income tax purposes, is or is treated as any of the following:

| |

● |

an individual citizen or resident of the United States; |

| |

● |

a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized under the laws of the United States, any state thereof or the District of Columbia; |

| |

● |

an estate, the income of which is subject to U.S. federal income tax regardless of its source; or |

| |

● |

a trust if (a) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (b) it has in effect a valid election under applicable Treasury regulations to be treated as a U.S. person. |

Taxation of Distributions

In

general, any distributions (including constructive distributions, but not including certain distributions of our stock or rights to acquire

our stock) we make to a Non-U.S. holder of shares of our common stock, to the extent paid out of our current or accumulated earnings

and profits (as determined under U.S. federal income tax principles), will constitute dividends for U.S. federal income tax

purposes and, provided such dividends are not effectively connected with the Non-U.S. holder’s conduct of a trade or business

within the United States, we will be required to withhold tax from the gross amount of the dividend at a rate of 30%, unless such

Non-U.S. holder is eligible for a reduced rate of withholding tax under an applicable income tax treaty and provides proper certification

of its eligibility for such reduced rate (usually on an IRS Form W-8BEN or W-8BEN-E). These certifications must be provided

to the applicable withholding agent prior to the payment of dividends and must be updated periodically. A Non-U.S. holder that does

not timely furnish the required documentation, but is eligible for a reduced rate of withholding tax under an income tax treaty may obtain

a refund or credit of any excess amounts withheld by filing an appropriate claim for refund with the IRS. In the case of any constructive

dividend, it is possible that this tax would be withheld from any amount owed to a Non-U.S. holder by us or the applicable withholding

agent, including from other property subsequently paid or credited to such holder.

Dividends

that are effectively connected with a Non-U.S. holder’s conduct of a trade or business within the United States and, if

such Non-U.S. holder is entitled to claim treaty benefits (and the Non-U.S. holder complies with applicable certification and

other requirements), that are attributable to a permanent establishment (or, for an individual, a fixed base) maintained by such Non-U.S. holder

within the United States are not subject to the withholding tax described above but instead are subject to U.S. federal income

tax on a net income basis at applicable graduated U.S. federal income tax rates. In order for its effectively connected dividends

to be exempt from the withholding tax described above, a Non-U.S. holder will be required to provide a duly completed and properly

executed IRS Form W-8ECI, certifying that the dividends are effectively connected with the Non-U.S. holder’s conduct of

a trade or business within the United States. Dividends received by a Non-U.S. holder that is a corporation that are effectively

connected with its conduct of a trade or business within the United States may be subject to an additional branch profits tax at

a 30% rate or such lower rate as may be specified by an applicable income tax treaty.

Any

distribution in excess of current and accumulated earnings and profits will constitute a return of capital that will be treated first

as reducing (but not below zero) the Non-U.S. holder’s adjusted tax basis in its shares of our common stock and, to the extent

such distribution exceeds the Non-U.S. holder’s adjusted tax basis, as gain realized from the sale or other disposition of

common stock, which will be treated as described under “Gain on Sale, Taxable Exchange or Other Taxable Disposition of Common

Stock” below. In addition, if we determine that we are likely to be classified as a “United States real property

holding corporation” (see “Gain on Sale, Taxable Exchange or Other Taxable Disposition of Common Stock” below),

we generally will withhold 15% of any distribution that exceeds our current and accumulated earnings and profits.

Gain on Sale, Taxable

Exchange or Other Taxable Disposition of Common Stock

Subject

to the discussion below regarding backup withholding and FATCA, a Non-U.S. holder generally will not be subject to U.S. federal

income or withholding tax in respect of gain recognized on a sale, taxable exchange or other taxable disposition of our common stock,

unless:

| |

● |

the gain is effectively connected with the conduct by the Non-U.S. holder of a trade or business within the United States (and, under certain income tax treaties, is attributable to a United States permanent establishment or fixed base maintained by the Non-U.S. holder); |

| |

● |

the Non-U.S. holder is an individual present in the United States for 183 days or more in the taxable year of disposition and certain other requirements are met; or |

| |

● |

we are or have been a “United States real property holding corporation” (as defined below) for U.S. federal income tax purposes at any time during the shorter of the five-year period ending on the date of disposition or the Non-U.S. holder’s holding period for the applicable common stock, except, in the case where shares of our common stock are “regularly traded on an established securities market” (within the meaning of applicable Treasury Regulations, referred to herein as “regularly traded”), and the Non-U.S. holders has owned, directly or constructively, 5% or less of our common stock at all times within the shorter of the five-year period preceding such disposition of common stock or such Non-U.S. holder’s holding period for such common stock. It is unclear how the rules for determining the 5% threshold for this purpose would be applied with respect to our common stock, including how a Non-U.S. holder’s ownership of our warrants, if any, impacts the 5% threshold determination with respect to its common stock. We can provide no assurance as to our future status as a United States real property holding corporation or as to whether our common stock will be considered to be regularly traded. Non-U.S. holders should consult their own tax advisors regarding the application of the foregoing rules in light of their particular facts and circumstances. |

Unless

an applicable treaty provides otherwise, gain described in the first bullet point above will be subject to tax at generally applicable

U.S. federal income tax rates as if the Non-U.S. holder were a U.S. resident. Any gains described in the first bullet point

above of a Non-U.S. holder that is treated as a corporation for U.S. federal income tax purposes may also be subject to an additional

“branch profits tax” imposed at a 30% rate (or such lower rate as may be specified by an applicable income tax treaty) on

a portion of its effectively connected earnings and profits for the taxable year that are attributable to such gain, as adjusted for certain

items.

Gain

described in the second bullet point above will be subject to U.S. federal income tax at a 30% rate (or such lower rate as may be

specified by an applicable income tax treaty), but may be offset by U.S. source capital losses realized during the same taxable year

(even though the individual is not considered a resident of the United States), provided the Non-U.S. holder has timely filed

U.S. federal income tax returns with respect to such losses. Non-U.S. holders should consult any applicable income tax treaties

that may provide for different rules.

If

the third bullet point above applies to a Non-U.S. holder, gain recognized by such holder on the sale, exchange or other disposition

of our common stock will be subject to tax at generally applicable U.S. federal income tax rates as if the Non-U.S. holder were

a U.S. resident. In addition, a buyer of our common stock from such holder may be required to withhold U.S. federal income tax

at a rate of 15% of the amount realized upon such disposition. Any amounts withheld may be refunded or credited against a Non-U.S. holder’s

U.S. federal income tax liability, provided that the required information is timely provided to the IRS.

We

would be classified as a United States real property holding corporation if the fair market value of our “United States

real property interests” equals or exceeds 50% of the sum of the fair market value of our worldwide real property interests plus

our other assets used or held for use in a trade or business, as determined for U.S. federal income tax purposes. We believe that

we are not currently a United States real property holding corporation; however, there can be no assurance that we will not become

a United States real property holding corporation in the future.

Information Reporting

and Backup Withholding

Payments

of distributions on our common stock will not be subject to backup withholding, provided the applicable withholding agent does not have

actual knowledge or reason to know the holder is a U.S. person and the holder either certifies its non-U.S. status, such as

by furnishing a valid IRS Form W-8BEN, W-8BEN-E, W-8ECI, or W-8EXP, or otherwise establishes an exemption. However, information returns

are required to be filed with the IRS in connection with any distributions on our common stock paid to the Non-U.S. holder, regardless

of whether any tax was actually withheld. In addition, proceeds of the sale or other taxable disposition of our common stock within the

United States or conducted through certain U.S.-related brokers generally will not be subject to backup withholding or information

reporting, if the applicable withholding agent receives the certification described above and does not have actual knowledge or reason

to know that such holder is a U.S. person, or the holder otherwise establishes an exemption. Proceeds of a disposition of our common

stock conducted through a non-U.S. office of a non-U.S. broker generally will not be subject to backup withholding or information

reporting.

Copies

of information returns that are filed with the IRS may also be made available under the provisions of an applicable treaty or agreement

to the tax authorities of the country in which the Non-U.S. Holder resides or is established or organized.

Backup

withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against

a Non-U.S. holder’s U.S. federal income tax liability, provided the required information is timely furnished to the IRS.

FATCA Withholding

Taxes

Provisions

commonly referred to as “FATCA” impose withholding of 30% on payments of dividends (including constructive dividends) on our

common stock to “foreign financial institutions” (which is broadly defined for this purpose and in general includes investment

vehicles) and certain other non-U.S. entities unless various U.S. information reporting and due diligence requirements (generally

relating to ownership by United States persons of interests in or accounts with those entities) have been satisfied by, or an exemption

applies to, the payee (typically certified as to by the delivery of a properly completed IRS Form W-8BEN-E). Foreign financial institutions

located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different

rules. Under certain circumstances, a Non-U.S. holder might be eligible for refunds or credits of such withholding taxes, and a Non-U.S. holder

might be required to file a U.S. federal income tax return to claim such refunds or credits.

Thirty

percent withholding under FATCA was scheduled to apply to payments of gross proceeds from the sale or other disposition of property that

produces U.S.-source interest or dividends beginning on January 1, 2019, but on December 13, 2018, the IRS released proposed

regulations that, if finalized in their proposed form, would eliminate the obligation to withhold on gross proceeds. Such proposed regulations

also delayed withholding on certain other payments received from other foreign financial institutions that are allocable, as provided

for under final Treasury Regulations, to payments of U.S.-source dividends, and other fixed or determinable annual or periodic income.

Although these proposed Treasury Regulations are not final, taxpayers generally may rely on them until final Treasury Regulations are

issued. However, there can be no assurance that final Treasury Regulations will provide the same exceptions from FATCA withholding as

the proposed Treasury Regulations. Non-U.S. holders should consult their tax advisors regarding the effects of FATCA on their investment

in our common stock.

PLAN

OF DISTRIBUTION

We

have engaged Chardan Capital Markets LLC and Spartan Capital Markets, LLC, whom we refer to as the placement agents, to act as our placement

agents in connection with the securities offered by this prospectus supplement and the accompanying prospectus. We have entered into a

securities purchase agreement directly with the investors who have agreed to purchase our securities in this offering. We will only sell

securities in this offering to such investors.

Delivery

of the securities offered hereby is expected to occur on or about March 4, 2024, subject to the satisfaction of customary closing conditions.

We

have agreed to pay the placement agents a cash fee equal to 9.0% of the aggregate gross proceeds from the offering. The following table

shows the per share and total cash fee we will pay to the placement agents in connection with the sale of our securities offered pursuant

to this prospectus supplement and the accompanying prospectus.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 0.25 | | |

$ | 2,133,250 | |

| Placement agent fees | |

$ | 0.0225 | | |

$ | 191,992.50 | |

We estimate that our total

expenses of this offering will be approximately $425,000. This includes a flat deferred fee of $150,000 to Chardan Capital Markets LLC,

which is the amount owed from a convertible note offering that closed on February 2, 2024, and $75,000 of other fees and expenses of the

placement agents in respect of this offering. These expenses are payable by us.

We also have agreed to indemnify

the placement agents against certain liabilities, including civil liabilities under the Securities Act of 1933, as amended, or to contribute

to payments that the placement agents may be required to make in respect of those liabilities.

No Sales of Similar Securities

We have agreed not to issue,

enter into any agreement to issue or announce the issuance or proposed issuance of any shares of Common Stock or Common Stock Equivalents

(as defined in the securities purchase agreement entered into in connection with this offering) for a period of 15 days after the date

of this prospectus supplement, subject to limited exceptions.

Affiliations

The placement agents and

their affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial

and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing, and

brokerage activities. A placement agent has previously been engaged by us as a financial advisor and the placement agents may in the future

engage in investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. The placement

agents may in the future receive customary fees and commissions for these transactions.

In the ordinary course of

their various business activities, the placement agents and their affiliates may make or hold a broad array of investments and actively

trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account

and for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments of the

issuer. The placement agents and their affiliates may also make investment recommendations and/or publish or express independent research

views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short

positions in such securities and instruments.

The placement agents may

facilitate the marketing of this offering online directly or through one of their affiliates. In those cases, prospective investors may

view offering terms and the prospectus supplement and accompanying prospectus online and place orders online or through their financial

advisors.

Regulation M

The placement agents may

be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by them and

any profit realized on the resale of the securities sold by them while acting as principal might be deemed to be underwriting discounts

or commissions under the Securities Act. As an underwriter, the placement agents would be required to comply with the requirements of

the Securities Act and the Exchange Act, including, without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These rules

and regulations may limit the timing of purchases and sales of our securities by the placement agents acting as principals. Under these

rules and regulations, the placement agents (i) may not engage in any stabilization activity in connection with our securities and (ii)

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until they have completed its participation in the distribution.

Electronic Offer, Sale, and Distribution

In connection with this offering,

the placement agents or certain of the securities dealers may distribute prospectuses by electronic means, such as e-mail. In addition,

the placement agents may facilitate Internet distribution for this offering to certain of their Internet subscription customers. The placement

agents may allocate a limited number of securities for sale to their online brokerage customers. An electronic prospectus supplement and

accompanying prospectus is available on the Internet websites maintained by any such placement agent. Other than the prospectus supplement

and accompanying prospectus in electronic format, the information on the websites of the placement agents are not part of this prospectus

supplement or the accompanying prospectus.

Listing

Our common stock is listed on the Nasdaq Global

Market under the symbol “PRST.”

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock is Continental Stock Transfer and Trust Company.

Selling Restrictions

Other than in the United

States, no action has been taken by us or the placement agents that would permit a public offering of the securities offered by this prospectus

supplement in any jurisdiction where action for that purpose is required. The shares offered by this prospectus supplement may not be

offered or sold, directly or indirectly, nor may this prospectus supplement or any other offering material or advertisements in connection

with the offer and sale of any such shares be distributed or published in any jurisdiction, except under circumstances that will result

in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus supplement

comes are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus

supplement. This prospectus supplement does not constitute an offer to sell or a solicitation of an offer to buy any securities offered

by this prospectus supplement in any jurisdiction in which such an offer or a solicitation is unlawful.

European Economic Area

In relation to each Member

State of the European Economic Area, each, a Relevant State, no securities have been offered or will be offered pursuant to this offering

to the public in that Relevant State prior to the publication of a prospectus in relation to the securities which has been approved by

the competent authority in that Relevant State or, where appropriate, approved in another Relevant State and notified to the competent

authority in that Relevant State, all in accordance with the Prospectus Regulation, except that offers of securities may be made to the

public in that Relevant State at any time under the following exemptions under the Prospectus Regulation:

| (a) | to

any legal entity which is a qualified investor as defined under the Prospectus Regulation; |

| (b) | to

fewer than 150 natural or legal persons (other than qualified investors as defined under the Prospectus Regulation), subject to obtaining

the prior consent of the placement agents; or |

| (c) | in

any other circumstances falling within Article 1(4) of the Prospectus Regulation, |

provided that no such offer of the securities

shall require us or the placement agents to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus

pursuant to Article 23 of the Prospectus Regulation and each person who initially acquires any securities or to whom any offer is made

will be deemed to have represented, acknowledged and agreed to and with the placement agents and the Company that it is a “qualified

investor” within the meaning of Article 2(e) of the Prospectus Regulation. In the case of any securities being offered to a financial

intermediary as that term is used in the Prospectus Regulation, each such financial intermediary will be deemed to have represented, acknowledged

and agreed that the securities acquired by it in the offer have not been acquired on a nondiscretionary basis on behalf of, nor have they

been acquired with a view to their offer or resale to, persons in circumstances which may give rise to an offer of any securities to the

public other than their offer or resale in a Relevant State to qualified investors as so defined or in circumstances in which the prior

consent of the placement agents have been obtained to each such proposed offer or resale.

For the purposes of this

provision, the expression an “offer to the public” in relation to securities in any Relevant State means the communication

in any form and by any means of sufficient information on the terms of the offer and any securities to be offered so as to enable an investor

to decide to purchase or subscribe for any securities, and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

We have not authorized and

do not authorize the making of any offer of the securities through any financial intermediary on their behalf, other than offers made

by the placement agents with a view to the final placement of the securities in this document. Accordingly, no purchaser of the securities,

other than the placement agents, is authorized to make any further offer of the securities on behalf of us or the placement agents.

United Kingdom

In relation to the United

Kingdom, no securities have been offered or will be offered pursuant to this offering to the public in the United Kingdom prior to the

publication of a prospectus in relation to the securities that has been approved by the Financial Conduct Authority, except that offers

of securities may be made to the public in the United Kingdom at any time under the following exemptions under the UK Prospectus Regulation:

| (a) | to

any legal entity which is a qualified investor as defined in Article 2 of the UK Prospectus Regulation; |

| (b) | to

fewer than 150 natural or legal persons (other than qualified investors as defined in Article 2 of the UK Prospectus Regulation), subject

to obtaining the prior consent of the placement agents; or |

| (c) | in

any other circumstances falling within section 86 of the Financial Services and Markets Act 2000, or FSMA, |

provided that no such offer of securities shall

require us or any representatives to publish a prospectus pursuant to 85 of the FSMA or supplement a prospectus pursuant to Article 23

of the UK Prospectus Regulation.

Each person in the United

Kingdom who initially acquires any securities or to whom any offer is made will be deemed to have represented, acknowledged and agreed

to and with us and the representatives that it is a qualified investor within the meaning of Article 2 of the UK Prospectus Regulation.

In the case of any securities

being offered to a financial intermediary as that term is used in Article 1(4) of the U.K. Prospectus Regulation, each financial intermediary

will also be deemed to have represented, acknowledged and agreed that the securities acquired by it in the offer have not been acquired

on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances

which may give rise to an offer of any securities to the public, other than their offer or resale in the United Kingdom to qualified investors

as so defined or in circumstances in which the prior consent of the representatives has been obtained to each such proposed offer or resale.

For the purposes of this

provision, the expression an “offer to the public” in relation to any securities in any relevant state means the communication

in any form and by any means of sufficient information on the terms of the offer and any securities to be offered so as to enable an investor

to decide to purchase or subscribe for any securities, and the expression “UK Prospectus Regulation” means Regulation (EU)

2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018.

Australia

No placement document, prospectus,

product disclosure statement or other disclosure document has been lodged with the Australian Securities and Investments Commission in

relation to this offering. This prospectus supplement does not constitute a prospectus, product disclosure statement or other disclosure

document under the Corporations Act 2001, or the Corporations Act, and does not purport to include the information required for a prospectus,

product disclosure statement or other disclosure document under the Corporations Act.

Any offer in Australia of

the securities may only be made to persons, or the Exempt Investors, who are “sophisticated investors” (within the meaning

of section 708(8) of the Corporations Act), “professional investors” (within the meaning of section 708(11) of the Corporations

Act) or otherwise pursuant to one or more exemptions contained in section 708 of the Corporations Act so that it is lawful to offer the

securities without disclosure to investors under Chapter 6D of the Corporations Act.

The securities applied for

by Exempt Investors in Australia must not be offered for sale in Australia in the period of 12 months after the date of allotment under

this offering, except in circumstances where disclosure to investors under Chapter 6D of the Corporations Act would not be required pursuant

to an exemption under section 708 of the Corporations Act or otherwise or where the offer is pursuant to a disclosure document which complies

with Chapter 6D of the Corporations Act. Any person acquiring securities must observe such Australian on-sale restrictions.

This prospectus supplement

contains general information only and does not take account of the investment objectives, financial situation or particular needs of any

particular person. It does not contain any securities recommendations or financial product advice. Before making an investment decision,