false

--06-30

0001822145

0001822145

2024-02-23

2024-02-23

0001822145

us-gaap:CommonStockMember

2024-02-23

2024-02-23

0001822145

us-gaap:WarrantMember

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 23, 2024

Presto Automation Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39830 |

|

84-2968594 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

985 Industrial Road

San Carlos, CA 94070

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (650) 817-9012

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which

registered |

| Common stock, par value $0.0001 per share |

|

PRST |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of common stock |

|

PRSTW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

On February 23, 2024, Presto Automation Inc. (the “Company”) received

a notice (the “Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company is not in compliance

with the requirement to maintain a minimum Market Value of Publicly Held Securities (“MVPHS”) of $15 million, as set forth

in Nasdaq Listing Rule 5450(b)(2)(C) (the “MVPHS Requirement”), because the MVPHS of the Company was below $15 million

for the 35 consecutive business days prior to the date of the Notice. The Notice is in addition to the previously disclosed letters received

on February 6, 2024, notifying the Company that it was not in compliance with the requirement to maintain a minimum Market Value

of Listed Securities of $50 million, as set forth in Nasdaq Listing Rule 5450(b)(2)(A), and on December 28, 2023, notifying

the Company that it was not in compliance with the requirement to maintain a minimum bid price of $1.00 per share, as set forth in Nasdaq

Listing Rule 5450(a)(1).

The Notice does not impact the listing of the Company's common stock, par value $0.0001 per share (the “Common Stock”), or warrants on The Nasdaq

Global Market at this time. The Notice provided that, in accordance with Nasdaq Listing Rule 5810(c)(3)(D), the Company has a period

of 180 calendar days from the date of the Notice, or until August 21, 2024, to regain compliance with the MVPHS Requirement. During

this period, the Common Stock will continue to trade on The Nasdaq Global Market. If at any time before August 21, 2024 the MVPHS

closes at $15 million or more for a minimum of ten consecutive business days, Nasdaq will provide written notification that the Company

has achieved compliance with the MVPHS Requirement and the matter will be closed.

In the event the Company

does not regain compliance by August 21, 2024, the Company will receive written notification that its securities are subject to delisting.

At that time, the Company may appeal the delisting determination to a Hearings Panel. The Notice provides that the Company may be eligible

to transfer the listing of its securities to The Nasdaq Capital Market (provided that it then satisfies the requirements for continued

listing on that market).

The Company intends to

actively monitor its MVPHS and will evaluate available options to regain compliance with the MVPHS Requirement. However, there can be

no assurance that the Company will be able to regain compliance with the MVPHS Requirement or maintain compliance with any of the other

Nasdaq continued listing requirements.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

As

indicated below, on February 26, 2024, the stockholders of the Company approved an amendment (the “Amendment”) to the

Second Amended and Restated Certificate of Incorporation of the Company (the “Certificate of Incorporation”). The Company’s

board of directors previously approved the Amendment on February 12, 2024, subject to stockholder approval. The Amendment increased

the number of authorized shares of Common Stock, of the Company from 180,000,000

shares to 100,000,000,000 shares.

The

foregoing summary is qualified in its entirety by reference to the Amendment, a copy of which is filed as Exhibit 3.1 to this current

report on Form 8-K and is incorporated herein by reference. A more complete description of the terms of the Amendment can be found

in “Proposal 1 – Approval of the Amendment to the Second Amended and Restated Certificate of Incorporation of the Company

to Increase the Total Number of Authorized Shares of Common Stock” on pages 7 to 8 of the Company’s definitive proxy

statement filed with the U.S. Securities and Exchange Commission on February 12, 2024 (the “Proxy Statement”), which

description is incorporated by reference herein.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On

February 26, 2024, the Company held its Special Meeting of Stockholders (the “Special Meeting”). Set forth below are

the voting results of the four proposals considered and voted upon at the Special Meeting, all of which were described in the Proxy Statement.

Proposal

1 – To approve the Amendment to increase the total number of authorized shares of Common Stock of the Company from 180,000,000

to 100,000,000,000 shares.

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 38,392,937 | | |

| 387,273 | | |

| 10,768 | | |

| - | |

Proposal 2 – To approve the issuance

of shares of Common Stock in an amount in excess of 19.99% of the Company’s outstanding Common Stock, pursuant to the terms of certain

Securities Purchase Agreement, dated October 10, 2023, and warrants to purchase Common Stock, dated October 16, 2023, issued

to certain Metropolitan funds.

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 20,932,519 | | |

| 17,845,536 | | |

| 12,923 | | |

| - | |

Proposal 3 – To approve the issuance

of shares of Common Stock in an amount in excess of 19.99% of the Company’s outstanding Common Stock, pursuant to the terms of certain

Common Stock Purchase Agreements, dated November 17, 2023.

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 38,435,745 | | |

| 345,612 | | |

| 9,621 | | |

| - | |

Proposal 4 – To approve the proposed

issuance of shares of Common Stock underlying subordinated convertible notes and warrants in an amount in excess of 19.99% of the Company’s

outstanding Common Stock, pursuant to the terms of certain Securities Purchase Agreements, dated January 29, 2024, and warrants to

purchase Common Stock.

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 38,426,181 | | |

| 355,123 | | |

| 9,674 | | |

| - | |

Item 8.01. Other Events.

On February 29, 2024, the Company issued

a press release announcing that it has entered into a securities purchase agreement with certain institutional investors, providing for

the purchase and sale of 8,533,000 shares of Common Stock in a registered direct offering at a price per share of $0.25 (the “Offering”).

The Offering is expected to close on or about March 4, 2024, subject to the satisfaction of customary closing conditions.

A copy of the press release is filed herewith as Exhibit 99.1

to this Current Report.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

PRESTO AUTOMATION INC. |

| |

|

| |

By: |

/s/ Guillaume Lefevre |

| |

|

Name: |

Guillaume Lefevre |

| |

|

Title: |

Interim Chief Executive Officer |

Dated: February 29, 2024

Exhibit 3.1

PRESTO AUTOMATION

INC.

Amendment to

the Second Amended and Restated Certificate of Incorporation

Presto Automation

Inc. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware,

hereby certifies as follows:

1. This

Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s Second Amended

and Restated Certificate of Incorporation filed with the Secretary of State on September 21, 2022 (the “Certificate of Incorporation”).

2. Section 4.1.1

of the Certificate of Incorporation is hereby amended and restated in its entirety as follows:

“4.1.1

The total number of shares of all classes of stock that the Corporation has authority to issue is 100,001,500,000 shares, consisting

of two classes: 100,000,000,000 shares of Common Stock, $0.0001 par value per share (“Common Stock”), and 1,500,000 shares

of Preferred Stock, $0.0001 par value per share (“Preferred Stock”).”

3. This

amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

4. All

other provisions of the Certificate of Incorporation shall remain in full force and effect.

IN WITNESS WHEREOF,

the Corporation has caused this Certificate of Amendment to be signed by Susan Shinoff, its General Counsel, this 27th day

of February, 2024.

| |

PRESTO AUTOMATION INC. |

| |

|

| |

By: |

/s/

Susan Shinoff |

| |

|

Susan Shinoff |

| |

|

General Counsel & Corporate Secretary |

Exhibit 99.1

Presto Automation Announces Pricing of $2.1M Registered Direct Offering

Feb 29, 2024

San Carlos, California, Feb. 29, 2024 (GLOBE NEWSWIRE) –

Presto Automation Inc. (“Presto” or the “Company”) (NASDAQ: PRST), one of the largest AI and automation

technology providers to the restaurant industry,, announced today that it has entered into a securities purchase agreement with institutional

investors, providing for the purchase and sale of 8,533,000 shares of common stock in a registered direct offering, at a price per share

of $0.25. The offering is expected to close on or about March 4, 2024, subject to the satisfaction of customary closing conditions.

Chardan Capital Markets LLC and Spartan Capital Securities, LLC are

acting as the placement agents (the “Placement Agents”) for the offering.

The gross proceeds to Presto from this offering are expected to be

approximately $2.1 million, before deducting the Placement Agents’ fees and other offering expenses payable by Presto. Presto intends

to use the net proceeds from this offering for working capital and general corporate purposes.

The offering

is being made pursuant to a shelf registration statement on Form S-3 (File No. 333-275112) (including a base prospectus) previously

filed with the Securities and Exchange Commission (the “SEC”) on October 20, 2023 and declared effective by the SEC

on October 30, 2023. A prospectus supplement and the accompanying base prospectus relating to and describing the terms of the offering

will be filed with the SEC and will be available on the SEC’s website at www.sec.gov. When available, copies of the prospectus

supplement and the accompanying base prospectus relating to the offering may also be obtained by contacting Chardan Capital Markets,

LLC, Attn: Capital Markets, 17 State Street, Suite 2100, New York, New York 10004, by email at prospectus@chardan.com and

Spartan Capital Securities, LLC, 45 Broadway, New York, NY 10006, at (212) 293-0123.

This press

release does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under

the securities laws of any such state or jurisdiction.

About Presto

Automation

Presto (Nasdaq:

PRST) provides enterprise-grade AI and automation solutions to the restaurant industry. Presto’s solutions are designed to decrease

labor costs, improve staff productivity, increase revenue, and enhance the guest experience. Presto offers its AI solution, Presto Voice™,

to quick service restaurants (QSR) and its pay-at-table tablet solution, Presto Touch, to casual dining chains. Some of the most recognized

restaurant names in the United States are among Presto’s customers, including Carl’s Jr., Hardee’s, and Checkers for

Presto Voice™.

Cautionary

Note Regarding Forward-Looking Statements

This press

release contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements

of present or historical fact included in this press release, regarding including statements about the closing of the offering, are forward-looking

statements. When used in this press release, the words “could,” “should,” “will,” “may,”

“believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,”

“initiatives,” “continue,” the negative of such terms and other similar expressions are intended to identify

forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements

are based on management’s current expectations and assumptions about future events and are based on currently available information

as to the outcome and timing of future events. The forward-looking statements speak only as of the date of this press release or as of

the date they are made. The Company cautions you that these forward-looking statements are subject to numerous risks and uncertainties,

most of which are difficult to predict and many of which are beyond the control of the Company. In addition, the Company cautions you

that the forward-looking statements contained in this press release are subject to risks and uncertainties, including but not limited

to, the Company’s ability to secure additional capital resources, the Company’s ability to compete successfully to maintain

the relationship with Checkers, the Company’s ability to continue to roll out its AI technology with current franchisees, the Company’s

ability to engage with new customers for its AI technology, including: the uncertainties related to market conditions and the completion

of the offering on the anticipated terms or at all and such other factors and those additional risks and uncertainties discussed under

the heading “Risk Factors” in the Form 10-K filed by the Company with the Securities and Exchange Commission (the “SEC”)

on October 11, 2023 and the other documents filed, or to be filed, by the Company with the SEC. Additional information concerning

these and other factors that may impact the operations and projections discussed herein can be found in the reports that the Company

has filed and will file from time to time with the SEC. These SEC filings are available publicly on the SEC’s website at www.sec.gov.

Should one or more of the risks or uncertainties described in this press release materialize or should underlying assumptions prove incorrect,

actual results and plans could differ materially from those expressed in any forward-looking statements. Except as otherwise required

by applicable law, the Company disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the

statements in this section, to reflect events or circumstances after the date of this press release.

Source: Presto Automation Inc.

Investor and

Media Contacts: investors@presto.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

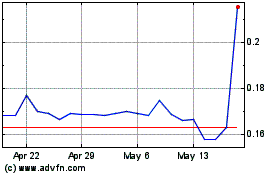

Presto Technologies (NASDAQ:PRST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Presto Technologies (NASDAQ:PRST)

Historical Stock Chart

From Jul 2023 to Jul 2024