Potbelly Corporation (NASDAQ: PBPB),

(“Potbelly” or the

“Company”) the iconic neighborhood sandwich shop concept,

today reported financial results for its first fiscal quarter ended

March 31, 2024.

Key highlights for the quarter ended

March 31, 2024, compared to March 26, 2023:

- Total revenues decreased by 6.0% to $111.2 million compared to

$118.3 million, which included revenue from 33 shops that were

refranchised in 2023.

- Average Weekly Sales (AWS) increased 1.6% to $24,250 and,

inclusive of the impact of refranchising 33 former company

locations in 2023, total company shop sales decreased by 8.0% to

$107.6 million compared to $116.9 million.

- Same-store sales in the first quarter of (0.2)%, with expansion

of traffic share during the quarter.

- GAAP net loss attributable to Potbelly Corporation was $2.8

million compared to $1.3 million. GAAP diluted earnings per share

(EPS) was ($0.09) compared to ($0.05).

- Adjusted net income1 attributable to Potbelly Corporation was

$0.2 million compared to $0.6 million. Adjusted diluted EPS1 was

$0.01 compared to $0.02.

- Adjusted EBITDA1 increased 2.2% to $5.7 million compared to

$5.6 million.(1) Adjusted net income, adjusted diluted

EPS and adjusted EBITDA are non-GAAP measures. For reconciliations

of these measures to the most directly comparable GAAP measure, see

the accompanying financial tables. For a discussion of why we

consider them useful, see “Non-GAAP Financial Measures” below.

Bob Wright, President and Chief Executive

Officer of Potbelly Corporation, commented, “We’re proud of our

solid start to the year across multiple fronts. In terms of

profitability, we successfully managed both restaurant-level and

corporate costs, driving a 150-basis point expansion in shop-level

margins as well as strong corporate profitability with adjusted

EBITDA of $5.7 million. On the development front, our franchise

sales team added 32 additional commitments to our pipeline during

the quarter leading to a 26% increase in open and committed shops

year-over-year. We remain excited by the possibilities of this

unique brand and believe that we continue to put the building

blocks in place to achieve this potential.”

Wright added, “In addition, our board of

directors authorized a $20 million share repurchase program, driven

by their confidence in the sustainability of the momentum in our

business, our strong balance sheet and the increased predictability

of our cash flows due to our ongoing transition to a capital-light,

franchised business model. This confidence is a testament to the

disciplined execution of our team members as we seek to drive

long-term, sustainable growth.”

Financial

Outlook

In addition to the 2Q’24 and 2024 guidance

below, the company reiterates the previously provided long-term

growth ranges.

|

|

2Q’24 Guidance |

|

Same Store Sales Growth |

+0.0% to +2.0% |

|

Adjusted EBITDA (2) |

$7.0M to $8.5M |

|

|

2024 Guidance |

|

Same Store Sales % Growth |

Low-Single Digit |

|

New Unit % Growth |

~10% |

|

Adjusted EBITDA % Growth (2) |

Mid- to High-Single Digit |

|

|

|

(2) Quarterly and full-year guidance set

forth above reflect the impact of refranchising 33 former company

locations in 2023; the 53rd week in 2023, which will not recur in

2024; increased costs associated with the Company’s investment in

development efforts to support sustained franchise growth and a

$1.1 million settlement gain in the first quarter 2024 with a

third-party software provider. The effect of 2023 refranchising is

most pronounced in the first three quarters of 2024.

Stock Repurchase ProgramThe

Company also announced that its Board of Directors has authorized a

stock repurchase program authorizing the Company to repurchase up

to $20.0 million of its outstanding common stock through

May 7, 2027. The stock repurchase program replaces the stock

repurchase program approved in May 2018. The Company may repurchase

shares of its common stock from time to time through open market

purchases, in privately negotiated transactions, or by other means,

including through the use of trading plans intended to qualify

under Rule 10b5-1 under the Securities Exchange Act of 1934, as

amended, in accordance with applicable securities laws and other

restrictions. The timing and total amount of common stock

repurchases will depend upon business, economic and market

conditions, corporate and regulatory requirements, prevailing stock

prices, and other considerations.

Conference Call

A conference call and audio webcast has been

scheduled for 5:00 p.m. Eastern Time today to discuss these

results. Investors, analysts, and members of the media interested

in listening to the live presentation are encouraged to join a

webcast of the call with accompanying presentation slides,

available on the investor relations portion of the Company’s

website at www.potbelly.com. For those that cannot join the

webcast, you can participate by dialing 1-844-825-9789 in the U.S.

& Canada, or 1-412-317-5180 internationally.

For those unable to participate, an audio replay

will be available following the call through Wednesday, May 15,

2024. To access the replay, please call 844-512-2921 (U.S. &

Canada), or 412-317-6671 (International) and enter confirmation

code 10187570. A web-based archive of the conference call will also

be available at the above website.

About PotbellyPotbelly

Corporation is a neighborhood sandwich concept that has been

feeding customers’ smiles with warm, toasty sandwiches, signature

salads, hand-dipped shakes and other fresh menu items, customized

just the way customers want them, for more than 40 years. Potbelly

promises Fresh, Fast & Friendly service in an environment that

reflects the local neighborhood. Since opening its first shop in

Chicago in 1977, Potbelly has expanded to neighborhoods across the

country – with more than 425 shops in the United States

including more than 80 franchised shops in the United States.

For more information, please visit our website at

www.potbelly.com.

Definitions

The following definitions apply to these terms as used

throughout this press release:

- Revenues – represents net company-operated

sandwich shop sales and our franchise royalties and fees. Net

company-operated shop sales consist of food and beverage sales, net

of promotional allowances and employee meals. Franchise royalties

and fees consist of royalty income, franchise fee, and other fees

collected from franchisees including advertising and rent.

- Company-operated comparable store sales or same-store

traffic – an operating measure that represents the change

in year-over-year sales or entrée counts for the comparable

company-operated store base open for 15 months or longer. In fiscal

years that include a 53rd week, the last week of the fourth quarter

and fiscal year is excluded from the year-over-year comparisons so

that the time periods are consistent. In fiscal years that follow a

53-week year, the current period sales are compared to the trailing

52-week sales to compare against the most closely comparable weeks

from the prior calendar year.

- Average Weekly Sales (AWS) – an operating

measure that represents the average weekly sales of all

company-operated shops which reported sales during the associated

time period.

- Average Unit Volume (AUV) – an operating

measure that represents the average annual sales of all

company-operated shops which reported sales during the associated

time period.

- System-wide sales – an operating measure that

represents the sum of sales generated by company-operated shops and

sales generated by franchised shops, net of all promotional

allowances, discounts, and employee meals. Net sales from

franchised shops are not included in total revenues. Rather,

revenues are limited to the royalties, fees and other income

collected from franchisees.

- EBITDA – a non-GAAP measure that represents

income before depreciation and amortization expense, interest

expense and the provision for income taxes.

- Adjusted EBITDA – a non-GAAP measure that

represents income before depreciation and amortization expense,

interest expense and the provision for income taxes, adjusted to

eliminate the impact of other items, including certain non-cash and

other items that we do not consider reflective of underlying

business performance.

- Shop-level profit (loss) – a non-GAAP measure

that represents income (loss) from operations excluding franchise

royalties and fees, franchise support, marketing and rent expenses,

general and administrative expenses, depreciation expense,

pre-opening costs, restructuring costs, loss on Franchise Growth

Acceleration Initiative activities and impairment, loss on the

disposal of property and equipment and shop closures.

- Shop-level profit (loss) margin – a non-GAAP

measure that represents shop-level profit expressed as a percentage

of net company-operated sandwich shop sales.

- Adjusted net income (loss) – a non-GAAP

measure that represents net income (loss), adjusted to eliminate

the impact of restructuring costs, impairment, loss on the disposal

of property and equipment, shop closures, and other items we do not

consider representative of our ongoing operating performance,

including the income tax effects of those adjustments and the

change in our income tax valuation allowance.

- Adjusted diluted EPS – a non-GAAP measure that

represents adjusted net income (loss) divided by the weighted

average number of fully dilutive common shares outstanding.

- Shop commitments – an operating measure that

represents the number of company and franchise shops that are

committed to be developed. For franchise shops, a shop development

area agreement (SDAA) or standalone franchise agreement represents

a commitment. For company shops, a commitment is made through a

good faith combination of business decision-making and capital

allocation needed to develop and operate a new shop location.

Non-GAAP Financial Measures

We prepare our financial statements in

accordance with Generally Accepted Accounting Principles (“GAAP”).

Within this press release, we make reference to EBITDA, adjusted

EBITDA, adjusted diluted EPS, adjusted net income, shop-level

profit, and shop-level profit margin, which are non-GAAP financial

measures. The Company includes these non-GAAP financial measures

because management believes they are useful to investors in that

they provide for greater transparency with respect to supplemental

information used by management in its financial and operational

decision making.

Management uses adjusted EBITDA, adjusted net

income and adjusted diluted EPS to evaluate the Company’s

performance and in order to have comparable financial results to

analyze changes in our underlying business from quarter to quarter.

Adjusted EBITDA, adjusted net income and adjusted diluted EPS

exclude the impact of certain non-cash charges and other items that

affect the comparability of results in past quarters and which we

do not believe are reflective of underlying business performance.

Management uses shop-level profit and shop-level profit margin as

key metrics to evaluate the profitability of incremental sales at

our shops, to evaluate our shop performance across periods and to

evaluate our shop financial performance against our

competitors.

Accordingly, the Company believes the

presentation of these non-GAAP financial measures, when used in

conjunction with GAAP financial measures, is a useful financial

analysis tool that can assist investors in assessing the Company’s

operating performance and underlying prospects. This analysis

should not be considered in isolation or as a substitute for

analysis of our results as reported under GAAP. This analysis, as

well as the other information in this press release, should be read

in conjunction with the Company’s financial statements and

footnotes contained in the documents that the Company files with

the U.S. Securities and Exchange Commission. The non-GAAP financial

measures used by the Company in this press release may be different

from the methods used by other companies. For more information on

the non-GAAP financial measures, please refer to the table,

“Reconciliation of Non-GAAP Financial Measures to GAAP Financial

Measures.”

Forward-Looking Statements

In addition to historical information, this

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

Section 21E of the Securities Exchange Act of 1934, as amended and

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements, written, oral or otherwise made,

represent the Company’s expectation or belief concerning future

events. Without limiting the foregoing, the words

“believes,” “expects,” “may,” “might,” “will,” “should,”

“seeks,” “intends,” “plans,” “strives,” “goal,” “estimates,” “forecasts,” “projects”

or “anticipates” or the negative of these terms and similar

expressions are intended to identify forward-looking statements.

Forward-looking statements included in this press release may

include, among others, statements relating to our (i) future

financial position and results of operations, (ii) 2Q’24 and full

year 2024 outlook and guidance and (iii) expectations regarding our

new stock repurchase program.

By nature, forward-looking statements involve

risks and uncertainties that could cause actual results to differ

materially from those projected or implied by the forward-looking

statement, due to reasons including, but not limited to, risks

related to the COVID-19 outbreak; compliance with our Credit

Agreement covenants; competition; general economic conditions; our

ability to successfully implement our business strategy; the

success of our initiatives to increase sales and traffic; changes

in commodity, energy and other costs; our ability to attract and

retain management and employees; consumer reaction to

industry-related public health issues and perceptions of food

safety; our ability to manage our growth; reputational and brand

issues; price and availability of commodities; consumer confidence

and spending patterns; and weather conditions. In addition, there

may be other factors of which we are presently unaware or that we

currently deem immaterial that could cause our actual results to be

materially different from the results referenced in the

forward-looking statements. All forward-looking statements

contained in this press release are qualified in their entirety by

this cautionary statement. Although we believe that our plans,

intentions and expectations are reasonable, we may not achieve our

plans, intentions or expectations. Forward-looking statements are

based on current expectations and assumptions and currently

available data and are neither predictions nor guarantees of future

events or performance. You should not place undue reliance on

forward-looking statements, which speak only as of the date hereof.

See “Risk Factors” and “Cautionary Statement on Forward-Looking

Statements” included in the Company’s filings with the U.S.

Securities and Exchange Commission, including the Company’s most

recent annual report on Form 10-K and other risk factors described

from time to time in subsequent quarterly reports on Form 10-Q or

other subsequent filings, all of which are available on our website

at www.potbelly.com. The Company undertakes no obligation to

publicly update or revise any forward-looking statement as a result

of new information, future events or otherwise, except as otherwise

required by law.

Investor Contact: Jeff

PriesterICRinvestor@potbelly.com

Media Contact:ICRPotbellyPR@icrinc.com

|

Potbelly Corporation |

|

Consolidated Statements of Operations and Margin Analysis –

Unaudited |

|

(amounts in thousands, except per share data) |

| |

| |

For the Quarter Ended |

| |

Mar 31, 2024 |

|

% ofRevenue |

|

Mar 26, 2023 |

|

% ofRevenue |

| Revenues |

|

|

|

|

|

|

|

|

|

|

Sandwich shop sales, net |

$ |

107,577 |

|

|

96.8 |

|

% |

|

$ |

116,947 |

|

|

98.9 |

|

% |

|

Franchise royalties, fees and rent income |

|

3,576 |

|

|

3.2 |

|

|

|

|

1,323 |

|

|

1.1 |

|

|

|

Total revenues |

|

111,153 |

|

|

100.0 |

|

|

|

|

118,270 |

|

|

100.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

|

| (Percentages stated as a percent

of sandwich shop sales, net) |

|

|

|

|

|

|

|

|

|

|

Sandwich shop operating expenses, excluding depreciation |

|

|

|

|

|

|

|

|

|

|

Food, beverage and packaging costs |

|

29,270 |

|

|

27.2 |

|

|

|

|

32,620 |

|

|

27.9 |

|

|

|

Labor and related expenses |

|

32,253 |

|

|

30.0 |

|

|

|

|

36,502 |

|

|

31.2 |

|

|

|

Occupancy expenses |

|

11,714 |

|

|

10.9 |

|

|

|

|

13,310 |

|

|

11.4 |

|

|

|

Other operating expenses |

|

19,829 |

|

|

18.4 |

|

|

|

|

20,484 |

|

|

17.5 |

|

|

| |

|

|

|

|

|

|

|

|

|

| (Percentages stated as a percent

of total revenues) |

|

|

|

|

|

|

|

|

|

|

Franchise support, rent and marketing expenses |

|

2,537 |

|

|

2.3 |

|

|

|

|

591 |

|

|

0.5 |

|

|

|

General and administrative expenses |

|

11,547 |

|

|

10.4 |

|

|

|

|

9,969 |

|

|

8.4 |

|

|

|

Depreciation expense |

|

3,011 |

|

|

2.7 |

|

|

|

|

2,971 |

|

|

2.5 |

|

|

|

Pre-opening costs |

|

— |

|

|

NM |

|

|

|

|

22 |

|

|

NM |

|

|

|

Loss on Franchise Growth Acceleration Initiative activities |

|

133 |

|

|

0.1 |

|

|

|

|

949 |

|

|

0.8 |

|

|

|

Impairment, loss on disposal of property and equipment and shop

closures |

|

741 |

|

|

0.7 |

|

|

|

|

1,045 |

|

|

0.9 |

|

|

|

Total expenses |

|

111,035 |

|

|

99.9 |

|

|

|

|

118,463 |

|

|

100.2 |

|

|

|

Income (loss) from operations |

|

118 |

|

|

0.1 |

|

|

|

|

(193 |

) |

|

(0.2 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

364 |

|

|

0.3 |

|

|

|

|

667 |

|

|

0.6 |

|

|

| Loss on extinguishment of

debt |

|

2,376 |

|

|

2.1 |

|

|

|

|

239 |

|

|

0.2 |

|

|

| Loss before income taxes |

|

(2,622 |

) |

|

(2.4 |

) |

|

|

|

(1,099 |

) |

|

(0.9 |

) |

|

| Income tax expense |

|

51 |

|

|

NM |

|

|

|

|

105 |

|

|

NM |

|

|

| Net loss |

|

(2,673 |

) |

|

(2.4 |

) |

|

|

|

(1,204 |

) |

|

(1.0 |

) |

|

| Net income attributable to

non-controlling interest |

|

94 |

|

|

NM |

|

|

|

|

123 |

|

|

0.1 |

|

|

| Net loss attributable to

Potbelly Corporation |

$ |

(2,767 |

) |

|

(2.5 |

) |

% |

|

$ |

(1,327 |

) |

|

(1.1 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

| Net loss per common share

attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.09 |

) |

|

|

|

|

$ |

(0.05 |

) |

|

|

|

|

Diluted |

$ |

(0.09 |

) |

|

|

|

|

$ |

(0.05 |

) |

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

29,551 |

|

|

|

|

|

|

28,907 |

|

|

|

|

|

Diluted |

|

29,551 |

|

|

|

|

|

|

28,907 |

|

|

|

|

_______________________________“NM” - Amount is

not meaningful

|

Potbelly Corporation |

|

Consolidated Balance Sheets – Unaudited |

|

(amounts in thousands, except par value data) |

| |

| |

Mar 31, 2024 |

|

Dec 31, 2023 |

| Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

12,723 |

|

|

$ |

33,788 |

|

|

Accounts receivable, net of allowances of $21 and $26 as of

March 31, 2024 and December 31, 2023, respectively |

|

8,380 |

|

|

|

7,960 |

|

|

Inventories |

|

3,556 |

|

|

|

3,516 |

|

|

Prepaid expenses and other current assets |

|

7,476 |

|

|

|

7,828 |

|

|

Assets classified as held-for-sale |

|

171 |

|

|

— |

|

|

Total current assets |

|

32,306 |

|

|

|

53,092 |

|

| |

|

|

|

|

Property and equipment, net |

|

45,608 |

|

|

|

45,087 |

|

|

Right-of-use assets for operating leases |

|

138,068 |

|

|

|

144,390 |

|

|

Indefinite-lived intangible assets |

|

3,404 |

|

|

|

3,404 |

|

|

Goodwill |

|

2,053 |

|

|

|

2,056 |

|

|

Restricted cash |

|

749 |

|

|

|

749 |

|

|

Deferred expenses, net and other assets |

|

5,268 |

|

|

|

3,681 |

|

|

Total assets |

$ |

227,456 |

|

|

$ |

252,460 |

|

| |

|

|

|

| Liabilities and

equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ |

9,970 |

|

|

$ |

9,927 |

|

|

Accrued expenses |

|

32,982 |

|

|

|

35,377 |

|

|

Short-term operating lease liabilities |

|

24,464 |

|

|

|

24,525 |

|

|

Current portion of long-term debt |

— |

|

|

|

1,250 |

|

|

Total current liabilities |

|

67,416 |

|

|

|

71,078 |

|

| |

|

|

|

|

Long-term debt, net of current portion |

|

5,000 |

|

|

|

19,168 |

|

|

Long-term operating lease liabilities |

|

134,768 |

|

|

|

142,050 |

|

|

Other long-term liabilities |

|

6,616 |

|

|

|

6,070 |

|

|

Total liabilities |

|

213,800 |

|

|

|

238,367 |

|

| |

|

|

|

| Equity |

|

|

|

|

Common stock, $0.01 par value—authorized 200,000 shares;

outstanding 29,685 and 29,364 shares as of March 31, 2024 and

December 31, 2023, respectively |

|

394 |

|

|

|

389 |

|

|

Warrants |

|

1,745 |

|

|

|

2,219 |

|

|

Additional paid-in-capital |

|

466,132 |

|

|

|

462,583 |

|

|

Treasury stock, held at cost, 10,131 and 10,077 shares as of

March 31, 2024, and December 31, 2023, respectively |

|

(117,366 |

) |

|

|

(116,701 |

) |

|

Accumulated deficit |

|

(336,564 |

) |

|

|

(333,797 |

) |

|

Total stockholders’ equity |

|

14,341 |

|

|

|

14,693 |

|

|

Non-controlling interest |

|

(685 |

) |

|

|

(600 |

) |

|

Total equity |

|

13,656 |

|

|

|

14,093 |

|

| |

|

|

|

|

Total liabilities and equity |

$ |

227,456 |

|

|

$ |

252,460 |

|

|

Potbelly Corporation |

|

Consolidated Statements of Cash Flows -

Unaudited |

|

(amounts in thousands) |

| |

| |

For the Quarter to Date Ended |

| |

Mar 31, 2024 |

|

Mar 26, 2023 |

| Cash flows from

operating activities: |

|

|

|

|

Net loss |

$ |

(2,673 |

) |

|

$ |

(1,204 |

) |

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation expense |

|

3,011 |

|

|

|

2,971 |

|

|

Noncash lease expense |

|

6,191 |

|

|

|

6,127 |

|

|

Deferred income tax |

|

1 |

|

|

|

1 |

|

|

Stock-based compensation expense |

|

1,771 |

|

|

|

911 |

|

|

Asset impairment, loss on disposal of property and equipment and

shop closures |

|

474 |

|

|

|

843 |

|

|

Loss on Franchise Growth Acceleration Initiative activities |

|

133 |

|

|

|

936 |

|

|

Loss on extinguishment of debt |

|

2,376 |

|

|

|

224 |

|

|

Other operating activities |

|

77 |

|

|

|

85 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable, net |

|

(441 |

) |

|

|

(847 |

) |

|

Inventories |

|

(33 |

) |

|

|

274 |

|

|

Prepaid expenses and other assets |

|

(515 |

) |

|

|

136 |

|

|

Accounts payable |

|

(151 |

) |

|

|

(507 |

) |

|

Operating lease liabilities |

|

(7,254 |

) |

|

|

(6,923 |

) |

|

Accrued expenses and other liabilities |

|

(2,274 |

) |

|

|

(3,684 |

) |

| Net cash provided by

(used in) operating activities: |

|

693 |

|

|

|

(657 |

) |

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

Purchases of property and equipment |

|

(3,963 |

) |

|

|

(3,312 |

) |

|

Proceeds from sale of refranchised shops and other assets |

|

227 |

|

|

|

96 |

|

| Net cash used in

investing activities: |

|

(3,736 |

) |

|

|

(3,216 |

) |

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

Borrowings under Revolving Facility |

|

7,000 |

|

|

— |

|

|

Borrowings under Term Loan |

— |

|

|

|

25,000 |

|

|

Borrowings under Former Credit Facility |

— |

|

|

|

14,600 |

|

|

Repayments under Revolving Facility |

|

(2,000 |

) |

|

— |

|

|

Repayments under Term Loan |

|

(22,827 |

) |

|

— |

|

|

Repayments under Former Credit Facility |

— |

|

|

|

(23,150 |

) |

|

Payment of debt issuance costs |

|

(345 |

) |

|

|

(2,204 |

) |

|

Proceeds from exercise of warrants |

|

1,309 |

|

|

|

865 |

|

|

Employee taxes on certain stock-based payment arrangements |

|

(980 |

) |

|

|

(47 |

) |

|

Distributions to non-controlling interest |

|

(179 |

) |

|

|

(152 |

) |

|

Principal payments made for Term Loan |

— |

|

|

|

(313 |

) |

| Net cash provided by

(used in) financing activities: |

|

(18,022 |

) |

|

|

14,599 |

|

| |

|

|

|

| Net increase (decrease) in

cash and cash equivalents and restricted cash |

|

(21,065 |

) |

|

|

10,726 |

|

| Cash and cash equivalents and

restricted cash at beginning of period |

|

34,537 |

|

|

|

15,619 |

|

| Cash and cash equivalents and

restricted cash at end of period |

$ |

13,472 |

|

|

$ |

26,345 |

|

| |

|

|

|

| Supplemental cash flow

information: |

|

|

|

| Income taxes paid |

$ |

12 |

|

|

$ |

55 |

|

| Interest paid |

$ |

359 |

|

|

$ |

787 |

|

| |

|

|

|

| Supplemental non-cash

investing and financing activities: |

|

|

|

| Unpaid liability for purchases

of property and equipment |

$ |

909 |

|

|

$ |

978 |

|

| Unpaid liability for employee

taxes on certain stock-based payment arrangements |

$ |

328 |

|

|

$ |

305 |

|

|

Potbelly Corporation |

|

Reconciliation of Non-GAAP Financial Measures to GAAP

Financial Measures – Unaudited |

|

(amounts in thousands, except per share data) |

| |

| |

For the Quarter Ended |

| |

Mar 31, 2024 |

|

Mar 26, 2023 |

|

Net loss attributable to Potbelly Corporation, as reported |

$ |

(2,767 |

) |

|

$ |

(1,327 |

) |

|

Impairment, loss on disposal of property and equipment and shop

closures(1) |

|

741 |

|

|

|

1,045 |

|

|

Loss on extinguishment of debt(2) |

|

2,376 |

|

|

|

239 |

|

|

Loss on Franchise Growth Acceleration Initiative activities(3) |

|

133 |

|

|

|

949 |

|

|

Total adjustments before income tax |

|

3,250 |

|

|

|

2,233 |

|

|

Income tax adjustments(4) |

|

(254 |

) |

|

|

(322 |

) |

|

Total adjustments after income tax |

|

2,996 |

|

|

|

1,911 |

|

| Adjusted net income

attributable to Potbelly Corporation |

$ |

229 |

|

|

$ |

584 |

|

| |

|

|

|

| Adjusted net income

attributable to Potbelly Corporation per share, basic |

$ |

0.01 |

|

|

$ |

0.02 |

|

| Adjusted net income

attributable to Potbelly Corporation per share, diluted |

$ |

0.01 |

|

|

$ |

0.02 |

|

| |

|

|

|

| Shares used in computing

adjusted net income attributable to Potbelly Corporation per

share: |

|

|

|

|

Basic |

|

29,551 |

|

|

|

28,907 |

|

|

Diluted |

|

30,812 |

|

|

|

29,662 |

|

| |

For the Quarter Ended |

| |

Mar 31, 2024 |

|

Mar 26, 2023 |

|

Net loss attributable to Potbelly Corporation, as reported |

$ |

(2,767 |

) |

|

$ |

(1,327 |

) |

|

Depreciation expense |

|

3,011 |

|

|

|

2,971 |

|

|

Interest expense, net |

|

364 |

|

|

|

667 |

|

|

Income tax expense |

|

51 |

|

|

|

105 |

|

| EBITDA |

$ |

659 |

|

|

$ |

2,416 |

|

|

Impairment, loss on disposal of property and equipment and shop

closures(1) |

|

741 |

|

|

|

1,045 |

|

|

Stock-based compensation |

|

1,771 |

|

|

|

911 |

|

|

Loss on extinguishment of debt(2) |

|

2,376 |

|

|

|

239 |

|

|

Loss on Franchise Growth Acceleration Initiative activities(3) |

|

133 |

|

|

|

949 |

|

| Adjusted EBITDA |

$ |

5,680 |

|

|

$ |

5,560 |

|

|

Potbelly Corporation |

|

Reconciliation of Non-GAAP Financial Measures to GAAP

Financial Measures – Unaudited |

|

(amounts in thousands, except per share data) |

| |

| |

For the Quarter Ended |

| |

Mar 31, 2024 |

|

Mar 26, 2023 |

|

Income (loss) from operations [A] |

$ |

118 |

|

|

$ |

(193 |

) |

| Income (loss) from operations

margin [A÷B] |

|

0.1 |

% |

|

|

(0.2 |

)% |

|

Less: Franchise royalties, fees and rent income |

|

3,576 |

|

|

|

1,323 |

|

|

Franchise support, rent and marketing expenses |

|

2,537 |

|

|

|

591 |

|

|

General and administrative expenses |

|

11,547 |

|

|

|

9,969 |

|

|

Pre-opening costs |

— |

|

|

|

22 |

|

|

Loss on Franchise Growth Acceleration Initiative activities(2) |

|

133 |

|

|

|

949 |

|

|

Depreciation expense |

|

3,011 |

|

|

|

2,971 |

|

|

Impairment, loss on disposal of property and equipment and shop

closures(1) |

|

741 |

|

|

|

1,045 |

|

| Shop-level profit

[C] |

$ |

14,511 |

|

|

$ |

14,031 |

|

|

Total revenues [B] |

$ |

111,153 |

|

|

$ |

118,270 |

|

|

Less: Franchise royalties, fees and rent income |

|

3,576 |

|

|

|

1,323 |

|

| Sandwich shop sales, net

[D] |

$ |

107,577 |

|

|

$ |

116,947 |

|

| Shop-level profit

margin [C÷D] |

|

13.5 |

% |

|

|

12.0 |

% |

|

Potbelly Corporation |

|

Selected Operating Data – Unaudited |

|

(amounts in thousands, except shop counts) |

| |

| |

For the Quarter Ended |

| |

Mar 31, 2024 |

|

Mar 26, 2023 |

| Selected Operating

Data |

|

|

|

| Shop Activity: |

|

|

|

|

Company-operated shops, end of period |

345 |

|

|

373 |

|

|

Franchise shops, end of period |

82 |

|

|

53 |

|

| Revenue Data: |

|

|

|

|

Company-operated comparable store sales |

(0.2 |

%) |

|

22.2 |

% |

| |

For the Quarter Ended |

| |

Mar 31, 2024 |

|

Mar 26, 2023 |

|

Sales from company-operated shops, net |

$ |

107,577 |

|

$ |

116,947 |

| Sales from franchise shops,

net |

|

26,611 |

|

|

14,732 |

| System-wide sales |

$ |

134,188 |

|

$ |

131,679 |

| |

|

|

|

|

|

Potbelly

CorporationFootnotes to the Press Release,

Reconciliation of Non-GAAP Financial Measures to GAAP Financial

Measures & Selected Operating Data

(1) This adjustment includes costs related to

impairment of long-lived assets, loss on disposal of property and

equipment and shop closure expenses.

(2) This adjustment includes costs related to the

loss recognized upon the termination of the Company’s term loan and

former credit agreement for 2024 and 2023, respectively.

(3) This adjustment includes costs related to our

plan to grow our franchise units domestically through multi-unit

shop development area agreements, which may include refranchising

certain company-operated shops.

(4) This adjustment includes the tax impacts of the

other adjustments listed above based on the Company’s effective tax

rate and the change in the Company’s income tax valuation allowance

during the period.

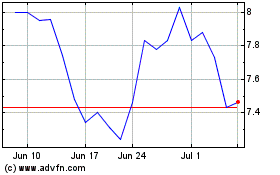

Potbelly (NASDAQ:PBPB)

Historical Stock Chart

From Apr 2024 to May 2024

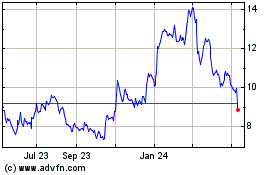

Potbelly (NASDAQ:PBPB)

Historical Stock Chart

From May 2023 to May 2024