false

0001499961

0001499961

2024-05-14

2024-05-14

0001499961

muln:CommonStockCustomMember

2024-05-14

2024-05-14

0001499961

muln:RightsToPurchaseCustomMember

2024-05-14

2024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported):

|

May 14, 2024

|

MULLEN AUTOMOTIVE INC.

__________________________________________________

(Exact name of registrant as specified in its charter)

| |

|

|

|

Delaware

|

001-34887

|

86-3289406

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1405 Pioneer Street, Brea, California 92821

(Address, including zip code, of principal executive offices)

| |

|

|

|

Registrant’s telephone number, including area code

|

(714) 613-1900

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001

|

MULN

|

The Nasdaq Stock Market, LLC (Nasdaq Capital Market)

|

| Rights to Purchase Series A-1 Junior Participating Preferred Stock |

None |

The Nasdaq Stock Market, LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 14, 2024, Mullen Automotive Inc. issued a press release announcing financial results for the three and six months ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

The information in this Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Exhibits.

(d) Exhibits

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MULLEN AUTOMOTIVE INC.

|

| |

|

| |

|

|

|

Date: May 14, 2024

|

By:

|

/s/ David Michery

|

| |

|

David Michery

|

| |

|

Chief Executive Officer

|

Exhibit 99.1

Mullen Reports Q2 2024 Fiscal Quarter Results

Positive stockholders’ equity of $117,414,643 as of March 31, 2024

Company has additional $150 million in capital commitments to support the scaling of commercial EV operations

BREA, Calif., May 14, 2024 -- via IBN -- Mullen Automotive Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an electric vehicle (“EV”) manufacturer, today announces financial results for the three and six months ended March 31, 2024, and a business update.

Commenting on the results for the three and six months ended March 31, 2024, and recent Company developments, CEO and chairman David Michery stated,

“Our Company continues to grow despite difficult market conditions, and I am thankful to our team and the effort put forth in getting our EVs into the market and onto U.S. roads. We continue to drive forward and remain laser-focused on scaling our commercial EV business. Today, we announced an additional $150 million in capital commitments to support our commercial EV operations.”

Recent Highlights Include

| |

●

|

In May 2024, the Company received approval from the Department of Commerce for Foreign Trade Zone status at its Tunica, Mississippi, commercial vehicle manufacturing facility.

|

| |

●

|

In May 2024, the Company expanded its retail commercial dealer network with addition of Pritchard EVs and National Auto Fleet Group, adding both national and regional fleet focus in the Midwest and West Coast.

|

| |

●

|

In April 2024, Mullen received California Air Resource Board’s (“CARB”) HVIP approval for the Mullen THREE, Class 3 EV truck, providing up to $45,000 in a cash voucher at time of vehicle purchase.

|

| |

●

|

In April 2024, the Company received CARB approval on the 2025 Mullen Class 3 EV truck.

|

Mullen Class 1 and 3 Commercial Vehicles

| |

●

|

Mullen opened the Dominican Republic and Caribbean markets with Grupo Cavel for commercial EVs and began initial shipment of vehicles in April 2024.

|

| |

●

|

Tunica recently built 500th commercial vehicle and continues to build Class 1 and Class 3 vehicles.

|

| |

●

|

Mullen announced the completion of a new light-weight service truck body, targeted for utility and municipality customers, for the All-Electric Mullen THREE. The vehicles are available now and were developed in collaboration with Phenix Truck Bodies & Van Equipment and Knapheide Manufacturing.

|

| |

●

|

In February 2024, the Company began Class 1 EV cargo van road testing with the integrated solid-state polymer battery pack in Troy, Michigan, with actual road tests resulting in 86% increase in vehicle range, from 110 miles to 205 miles.

|

| |

●

|

After successful road testing, Company is moving to production pack design with multiple packs being produced for vehicle-level testing, including environmental and durability.

|

Bollinger Motors - Oak Park, Michigan

Class 4 – 6 Commercial Vehicles

| |

●

|

Bollinger recently announced new retail dealers, including LaFontaine Automotive Group, Nacarato Truck Centers, and Nuss Truck and Equipment, covering initial states of Michigan, Florida, Georgia, Kentucky, Maryland and Minnesota.

|

| |

●

|

In February, Bollinger received IRS Approval for $40,000 Commercial EV Tax Credit.

|

| |

●

|

In January, Bollinger Motors received first vehicle orders for 40 B4, Class 4 EV trucks for a combined total order valued at approximately $6.0 million.

|

| |

●

|

The Company expects to begin B4, Class 4 vehicle deliveries in the second half of 2024.

|

Mullen Consumer Vehicle Program - Irvine, California

Mullen FIVE EV Crossover Program

| |

●

|

Development and production of the high-performance Mullen FIVE RS (“FIVE RS” or “RS”) limited-edition has been fast-tracked for completion and launch in Q4 2025 in the European market. This vehicle will be a limited production run delivering over 200-plus mph and 1.95 sec 0-60 mph.

|

| |

●

|

The Company debuted the high-performance Mullen FIVE RS on Jan. 9, 2024, at CES 2024 in Las Vegas.

|

Mullen High Energy Facility - Fullerton, California

| |

●

|

In January 2024, Mullen Advanced Energy, LLC submitted a pre-application to the U.S. Department of Energy (“DOE”) Advanced Technology Vehicles Manufacturing (“ATVM”) Loan Program to support its expansion into domestic battery material processing and manufacturing.

|

| |

●

|

In January 2024, The Company submitted a grant funding opportunity to DOE for domestic battery materials processing.

|

| |

●

|

The Company opened the Fullerton facility in 2023 and is focused on reducing reliance on foreign battery components.

|

Solid-State Polymer Battery Pack Update

| |

●

|

In February 2024, the Company began Class 1 EV cargo van road testing with the integrated solid-state polymer battery pack in Troy, Michigan. Actual road tests resulted in 86% increase in vehicle range, from 110 miles to 205 miles.

|

| |

●

|

After successful road testing, Company is moving to production pack design with multiple packs being produced for vehicle-level testing, including environmental and durability.

|

Financial Results – Three and Six Months Ended March 31, 2024

For the six months ended March 31, 2024, we delivered 362 vehicles valued at $16.3 million. The Company has deferred the revenue and accounts receivable recognition until invoices are paid and the return provision on the vehicles are nullified by the dealer’s sale of vehicle to the end user.

|

Invoiced during the 6 months ended March 31, 2024 (in thousand dollars)

|

|

|

Type

|

|

Units invoiced

|

|

|

Amount invoiced

|

|

|

Cash received

|

|

|

Revenue recognized

|

|

|

Mullen 3 (UU)

|

|

|

131 |

|

|

$ |

8,543.8 |

|

|

$ |

652.2 |

|

|

$ |

— |

|

|

Urban Delivery (UD1)

|

|

|

231 |

|

|

|

7,769.4 |

|

|

|

33.3 |

|

|

|

33.3 |

|

|

Total

|

|

|

362 |

|

|

$ |

16,313.2 |

|

|

$ |

685.5 |

|

|

$ |

33.3 |

|

The total cash spent (Operating and Investing cash flows) for the six months ended March 31, 2024 and 2023, was $120.9 million and $165.0 million, respectively.

| |

|

Six months ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Net loss

|

|

$ |

(235,355,627 |

) |

|

$ |

(495,369,280 |

) |

|

Non-cash adjustments

|

|

|

135,101,417 |

|

|

|

424,626,754 |

|

|

Working capital investment

|

|

|

(8,218,766 |

) |

|

|

3,175,141 |

|

|

Net cash used in operating activities

|

|

|

(108,472,976 |

) |

|

|

(67,567,385 |

) |

|

Net cash used in investing activities

|

|

|

(12,470,001 |

) |

|

|

(97,420,097 |

) |

|

Cash spent

|

|

$ |

(120,942,977 |

) |

|

$ |

(164,987,482 |

) |

The detail of non-cash adjustments to the Consolidated Statements of Cash Flows are as follows:

| |

|

Six months ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Non-cash expenses and gains during the period:

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

$ |

15,609,276 |

|

|

$ |

60,303,367 |

|

|

Revaluation of derivative liabilities

|

|

|

3,106,223 |

|

|

|

89,221,391 |

|

|

Depreciation and amortization

|

|

|

14,310,450 |

|

|

|

8,523,682 |

|

|

Issuance of warrants to suppliers

|

|

|

— |

|

|

|

6,814,000 |

|

|

Deferred income taxes

|

|

|

(3,891,300 |

) |

|

|

(901,999 |

) |

|

Other financing costs - initial recognition of derivative liabilities

|

|

|

— |

|

|

|

255,960,025 |

|

|

Impairment of goodwill

|

|

|

28,846,832 |

|

|

|

— |

|

|

Impairment of right-of-use assets

|

|

|

3,167,608 |

|

|

|

— |

|

|

Impairment of intangible assets

|

|

|

73,447,067 |

|

|

|

— |

|

|

Non-cash interest and other operating activities

|

|

|

216,021 |

|

|

|

(1,745,882 |

) |

|

Loss/(gain) on assets disposal

|

|

|

323,865 |

|

|

|

— |

|

|

Loss/(gain) on extinguishment of debt

|

|

|

(34,625 |

) |

|

|

6,452,170 |

|

|

Total

|

|

$ |

135,101,417 |

|

|

$ |

424,626,754 |

|

We invested an additional $8.2 million and recovered $3.2 million in working capital during the six months ended March 31, 2024 and 2023, respectively. Details of changes in working capital are as follows:

| |

|

Six months ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

$ |

671,750 |

|

|

$ |

— |

|

|

Inventories

|

|

|

(16,154,711 |

) |

|

|

— |

|

|

Prepaids and other assets

|

|

|

(726,490 |

) |

|

|

(8,271,388 |

) |

|

Accounts payable

|

|

|

9,523,141 |

|

|

|

8,429,257 |

|

|

Accrued expenses and other liabilities

|

|

|

(77,010 |

) |

|

|

2,672,040 |

|

|

Right-of-use assets and lease liabilities

|

|

|

(1,455,446 |

) |

|

|

345,232 |

|

|

Total

|

|

$ |

(8,218,766 |

) |

|

$ |

3,175,141 |

|

The net loss attributable to common shareholders after preferred dividends was $193.9 million, or $35.83 net loss per share, for the six months ended March 31, 2024, as compared to a net loss attributable to common shareholders after preferred dividends of $483.8 million, or $6,378.47 loss per share, for the six months ended March 31, 2023. Share counts were adjusted retroactively for reverse stock splits. The net loss for the six months ended March 31, 2024, of $193.9 million included impairment charges totaling $105.5 million mainly due to the uncertainty of future fundings required to support the business and decrease of Company's market capitalization. These write-downs include Bollinger goodwill of $28.8 million, intangible assets for Bollinger ($58.3) and ELMS ($15.1) and the write-down of right-of-use assets of $3.2 million.

Turning to our balance sheets and liquidity, we had $5.3 million and $58.5 million of working capital at March 31, 2024, and Sept. 30, 2023, respectively. Adding back derivative liabilities and liability to issue shares (items settled in stock), the numbers increase to $18.3 million and $133.3 million at March 31, 2024, and Sept. 30, 2023, respectively. We had total cash (including cash equivalents and restricted cash) of $29.8 million at March 31, 2024, versus $155.7 million at Sept. 30, 2023.

Current notes payable were $2.7 million and $7.5 million as of March 31, 2024, and Sept. 30, 2023, respectively. During the quarter ended March 31, 2024, we paid off $4.9 million in current notes payable that was secured by a mortgage on our Tunica, Mississippi, facility. We now own Tunica and Mishawaka facilities debt free.

Shareholders’ equity was $117.4 million as of March 31, 2024, versus $272.8 million for Sept. 30, 2023. The decrease in stockholders’ equity for the six months ended March 31, 2024, reflects the impairment charges of $105.5 and other operating losses of $129.9 million offset by warrant exercises, stock-based compensation and other equity adjustments.

Following are our unaudited Consolidated Balance Sheets, Consolidated Statements of Operations and Consolidated Statements of Cash Flows for the three and six months ended March 31, 2024, and 2023.

MULLEN AUTOMOTIVE, INC.

CONSOLIDATED BALANCE SHEETS

(unaudited)

| |

|

March 31, 2024

|

|

|

Sept. 30, 2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

22,378,089 |

|

|

$ |

155,267,098 |

|

|

Restricted cash

|

|

|

7,429,572 |

|

|

|

429,372 |

|

|

Accounts receivable

|

|

|

— |

|

|

|

671,750 |

|

|

Inventory

|

|

|

32,961,724 |

|

|

|

16,807,013 |

|

|

Prepaid expenses and prepaid inventories

|

|

|

26,114,664 |

|

|

|

24,955,223 |

|

|

TOTAL CURRENT ASSETS

|

|

|

88,884,049 |

|

|

|

198,130,456 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant, and equipment, net

|

|

|

82,803,852 |

|

|

|

82,032,785 |

|

|

Intangible assets, net

|

|

|

28,812,583 |

|

|

|

104,235,249 |

|

|

Related party receivable

|

|

|

— |

|

|

|

2,250,489 |

|

|

Right-of-use assets

|

|

|

11,616,450 |

|

|

|

5,249,417 |

|

|

Goodwill, net

|

|

|

— |

|

|

|

28,846,832 |

|

|

Other noncurrent assets

|

|

|

2,002,815 |

|

|

|

960,502 |

|

|

TOTAL ASSETS

|

|

$ |

214,119,749 |

|

|

$ |

421,705,730 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

22,698,645 |

|

|

$ |

13,175,504 |

|

|

Accrued expenses and other current liabilities

|

|

|

43,192,512 |

|

|

|

41,208,929 |

|

|

Dividends payable

|

|

|

445,205 |

|

|

|

401,859 |

|

|

Derivative liabilities

|

|

|

5,124,487 |

|

|

|

64,863,309 |

|

|

Liability to issue shares

|

|

|

7,789,786 |

|

|

|

9,935,950 |

|

|

Lease liabilities, current portion

|

|

|

1,142,350 |

|

|

|

2,134,494 |

|

|

Notes payable, current portion

|

|

|

2,717,804 |

|

|

|

7,461,492 |

|

|

Refundable deposits

|

|

|

429,572 |

|

|

|

429,372 |

|

|

TOTAL CURRENT LIABILITIES

|

|

|

83,540,361 |

|

|

|

139,610,909 |

|

| |

|

|

|

|

|

|

|

|

|

Liability to issue shares, net of current portion

|

|

|

526,684 |

|

|

|

1,827,889 |

|

|

Lease liabilities, net of current portion

|

|

|

12,638,061 |

|

|

|

3,566,922 |

|

|

Deferred tax liability

|

|

|

— |

|

|

|

3,891,900 |

|

|

TOTAL LIABILITIES

|

|

$ |

96,705,106 |

|

|

$ |

148,897,620 |

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Preferred stock; $0.001 par value; 127,474,455 preferred shares authorized;

|

|

|

|

|

|

|

|

|

|

Preferred Series D; 84,572,538 shares authorized; 363,097 and 363,097 shares issued and outstanding at March 31, 2024, and Sept. 30, 2023, respectively (preference in liquidation of $159,000 and $159,000 at March 31, 2024, and Sept. 30, 2023, respectively).

|

|

|

363 |

|

|

|

363 |

|

|

Preferred Series C; 26,085,378 shares authorized; 1,211,757 and 1,211,757 shares issued and outstanding at March 31, 2024, and Sept. 30, 2023, respectively (preference in liquidation of $10,696,895 and $10,696,895 at March 31, 2024, and Sept. 30, 2023, respectively).

|

|

|

1,212 |

|

|

|

1,212 |

|

|

Preferred Series A; 83,859 shares authorized; 648 and 648 shares issued and outstanding at March 31, 2024, and Sept. 30, 2023, respectively (preference in liquidation of $836 and $836 at March 31, 2024, and Sept. 30, 2023, respectively).

|

|

|

1 |

|

|

|

1 |

|

|

Common stock; $0.001 par value; 5,000,000,000 and 5,000,000,000 shares authorized at March 31, 2024, and Sept. 30, 2023, respectively; and 2,871,707 shares issued and outstanding at March 31, 2024, and Sept. 30, 2023, respectively.

|

|

|

7,974 |

|

|

|

2,872 |

|

|

Additional paid-in capital

|

|

|

2,151,067,184 |

|

|

|

2,071,110,126 |

|

|

Accumulated deficit

|

|

|

(2,055,988,895 |

) |

|

|

(1,862,162,037 |

) |

|

TOTAL STOCKHOLDERS' EQUITY ATTRIBUTABLE TO THE COMPANY'S STOCKHOLDERS

|

|

|

95,087,839 |

|

|

|

208,952,537 |

|

|

Noncontrolling interest

|

|

|

22,326,804 |

|

|

|

63,855,573 |

|

|

TOTAL STOCKHOLDERS' EQUITY

|

|

|

117,414,643 |

|

|

|

272,808,110 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

214,119,749 |

|

|

$ |

421,705,730 |

|

MULLEN AUTOMOTIVE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| |

|

Three months ended March 31,

|

|

|

Six months ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vehicle sales

|

|

$ |

33,335 |

|

|

$ |

— |

|

|

$ |

33,335 |

|

|

$ |

— |

|

|

Cost of revenues

|

|

|

(13,440 |

) |

|

|

— |

|

|

|

(13,440 |

) |

|

|

— |

|

|

Gross profit / (loss)

|

|

|

19,895 |

|

|

|

— |

|

|

|

19,895 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

$ |

47,903,692 |

|

|

$ |

47,412,338 |

|

|

$ |

91,137,744 |

|

|

$ |

112,408,349 |

|

|

Research and development

|

|

|

24,023,526 |

|

|

|

20,478,971 |

|

|

|

40,193,493 |

|

|

|

29,100,980 |

|

|

Impairment of goodwill

|

|

|

28,846,832 |

|

|

|

— |

|

|

|

28,846,832 |

|

|

|

— |

|

|

Impairment of right-of-use assets

|

|

|

3,167,608 |

|

|

|

— |

|

|

|

3,167,608 |

|

|

|

— |

|

|

Impairment of intangible assets

|

|

|

73,447,067 |

|

|

|

— |

|

|

|

73,447,067 |

|

|

|

— |

|

|

Loss from operations

|

|

|

(177,368,830 |

) |

|

|

(67,891,309 |

) |

|

|

(236,772,849 |

) |

|

|

(141,509,329 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financing costs - initial recognition of derivative liabilities

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(255,960,025 |

) |

|

Gain/(loss) on derivative liability revaluation

|

|

|

3,622,758 |

|

|

|

(48,439,415 |

) |

|

|

(3,106,223 |

) |

|

|

(89,221,391 |

) |

|

Gain/(loss) on extinguishment of debt

|

|

|

34,625 |

|

|

|

(40,000 |

) |

|

|

34,625 |

|

|

|

(6,452,170 |

) |

|

Gain/(loss) on disposal of fixed assets

|

|

|

(449,855 |

) |

|

|

385,031 |

|

|

|

(373,865 |

) |

|

|

385,031 |

|

|

Gain on lease termination

|

|

|

— |

|

|

|

— |

|

|

|

50,000 |

|

|

|

— |

|

|

Interest expense

|

|

|

(259,700 |

) |

|

|

(1,888,169 |

) |

|

|

(517,723 |

) |

|

|

(4,716,258 |

) |

|

Other income, net

|

|

|

893,692 |

|

|

|

482,405 |

|

|

|

1,439,108 |

|

|

|

1,128,286 |

|

|

Net loss before income tax benefit

|

|

$ |

(173,527,310 |

) |

|

$ |

(117,391,457 |

) |

|

$ |

(239,246,927 |

) |

|

$ |

(496,345,856 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit

|

|

|

2,165,062 |

|

|

|

482,922 |

|

|

|

3,891,300 |

|

|

|

976,576 |

|

|

Net loss

|

|

$ |

(171,362,248 |

) |

|

$ |

(116,908,535 |

) |

|

$ |

(235,355,627 |

) |

|

$ |

(495,369,280 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to noncontrolling interest

|

|

|

(38,930,288 |

) |

|

|

(1,995,217 |

) |

|

|

(41,528,769 |

) |

|

|

(4,180,176 |

) |

|

Net loss attributable to stockholders

|

|

$ |

(132,431,960 |

) |

|

$ |

(114,913,318 |

) |

|

$ |

(193,826,858 |

) |

|

$ |

(491,189,104 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Waived/(accrued) accumulated preferred dividends

|

|

|

(22,043 |

) |

|

|

8,039,612 |

|

|

|

(43,346 |

) |

|

|

7,400,935 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders after preferred dividends

|

|

$ |

(132,454,003 |

) |

|

$ |

(106,873,706 |

) |

|

$ |

(193,870,204 |

) |

|

$ |

(483,788,169 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Share

|

|

$ |

(19.39 |

) |

|

$ |

(1,167.18 |

) |

|

$ |

(35.83 |

) |

|

$ |

(6,378.47 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted

|

|

|

6,829,415 |

|

|

|

91,566 |

|

|

|

5,410,894 |

|

|

|

75,847 |

|

MULLEN AUTOMOTIVE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| |

|

Six Months Ended March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Cash Flows from Operating Activities

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(235,355,627 |

) |

|

$ |

(495,369,280 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

15,609,276 |

|

|

|

60,303,367 |

|

|

Revaluation of derivative liabilities

|

|

|

3,106,223 |

|

|

|

89,221,391 |

|

|

Depreciation and amortization

|

|

|

14,310,450 |

|

|

|

8,523,682 |

|

|

Issuance of warrants to suppliers

|

|

|

— |

|

|

|

6,814,000 |

|

|

Deferred income taxes

|

|

|

(3,891,300 |

) |

|

|

(901,999 |

) |

|

Other financing costs - initial recognition of derivative liabilities

|

|

|

— |

|

|

|

255,960,025 |

|

|

Impairment of intangible assets

|

|

|

73,447,067 |

|

|

|

— |

|

|

Impairment of goodwill

|

|

|

28,846,832 |

|

|

|

— |

|

|

Impairment of right-of-use assets

|

|

|

3,167,608 |

|

|

|

— |

|

|

Non-cash interest and other operating activities

|

|

|

216,021 |

|

|

|

(1,745,882 |

) |

|

Loss/(gain) on assets disposal

|

|

|

323,865 |

|

|

|

— |

|

|

Loss/(gain) on extinguishment of debt

|

|

|

(34,625 |

) |

|

|

6,452,170 |

|

| |

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

671,750 |

|

|

|

— |

|

|

Inventories

|

|

|

(16,154,711 |

) |

|

|

— |

|

|

Prepaids and other assets

|

|

|

(726,490 |

) |

|

|

(8,271,388 |

) |

|

Accounts payable

|

|

|

9,523,141 |

|

|

|

8,429,257 |

|

|

Accrued expenses and other liabilities

|

|

|

(77,010 |

) |

|

|

2,672,040 |

|

|

Right-of-use assets and lease liabilities

|

|

|

(1,455,446 |

) |

|

|

345,232 |

|

|

Net cash used in operating activities

|

|

|

(108,472,976 |

) |

|

|

(67,567,385 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities

|

|

|

|

|

|

|

|

|

|

Purchase of equipment

|

|

|

(12,470,001 |

) |

|

|

(4,298,563 |

) |

|

Purchase of intangible assets

|

|

|

— |

|

|

|

(204,660 |

) |

|

ELMS assets purchase

|

|

|

— |

|

|

|

(92,916,874 |

) |

|

Net cash used in investing activities

|

|

|

(12,470,001 |

) |

|

|

(97,420,097 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible notes payable

|

|

|

— |

|

|

|

150,000,000 |

|

|

Payment of notes payable

|

|

|

(4,945,832 |

) |

|

|

(460,000 |

) |

|

Reimbursement for over issuance of shares

|

|

|

— |

|

|

|

17,819,660 |

|

|

Net cash provided by financing activities

|

|

|

(4,945,832 |

) |

|

|

167,359,660 |

|

| |

|

|

|

|

|

|

|

|

|

Change in cash

|

|

|

(125,888,809 |

) |

|

|

2,372,178 |

|

|

Cash and restricted cash (in amount of $429,372), beginning of period

|

|

|

155,696,470 |

|

|

|

84,375,085 |

|

|

Cash and restricted cash (in amount of $7,429,572), ending of period

|

|

$ |

29,807,661 |

|

|

$ |

86,747,263 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosure of Cash Flow information:

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$ |

37,458 |

|

|

$ |

5,028 |

|

|

Cash paid for income taxes

|

|

|

— |

|

|

|

800 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental Disclosure for Non-Cash Activities:

|

|

|

|

|

|

|

|

|

|

Exercise of warrants recognized earlier as liabilities

|

|

$ |

59,163,019 |

|

|

$ |

268,713,397 |

|

|

Right-of-use assets obtained in exchange of operating lease liabilities

|

|

|

11,185,901 |

|

|

|

370,668 |

|

|

Convertible notes and interest - conversion to common stock

|

|

|

— |

|

|

|

153,222,236 |

|

|

Reclassification of derivatives to equity upon authorization of sufficient number of shares

|

|

|

— |

|

|

|

47,818,882 |

|

|

Common stock issued to extinguish other liabilities

|

|

|

— |

|

|

|

10,500,712 |

|

|

Waiver of dividends by stockholders

|

|

|

— |

|

|

|

6,872,075 |

|

|

Warrants issued to suppliers

|

|

|

— |

|

|

|

6,814,000 |

|

|

Debt conversion to common stock

|

|

|

— |

|

|

|

1,096,787 |

|

|

Extinguishment of operational liabilities by sale of property

|

|

|

— |

|

|

|

767,626 |

|

|

Extinguishment of financial liabilities by sale of property

|

|

|

— |

|

|

|

231,958 |

|

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern California-based automotive company building the next generation of commercial electric vehicles (“EVs”) with two United States-based vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen began commercial vehicle production in Tunica. In September 2023, Mullen received IRS approval for federal EV tax credits on its commercial vehicles with a Qualified Manufacturer designation that offers eligible customers up to $7,500 per vehicle. As of January 2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a Class 3 EV cab chassis truck are California Air Resource Board (“CARB”) and EPA certified and available for sale in the U.S. Recently CARB issued HVIP approval on the Mullen THREE, Class 3 EV truck, providing up to $45,000 cash voucher at time of vehicle purchase. The Company has also recently expanded its commercial dealer network with the addition of Pritchard EV and National Auto Fleet Group, providing sales and service coverage in key Midwest and West Coast markets. The Company also recently announced Foreign Trade Zone (“FTZ”) status approval for its Tunica, Mississippi, commercial vehicle manufacturing center. FTZ approval provides a number of benefits, including deferment of duties owed and elimination of duties on exported vehicles.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking Statements

Certain statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact may be deemed forward-looking statements. Words such as "continue," "will," "may," "could," "should," "expect," "expected," "plans," "intend," "anticipate," "believe," "estimate," "predict," "potential" and similar expressions are intended to identify such forward-looking statements. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Mullen and are difficult to predict. Examples of such risks and uncertainties include, but are not limited to the timing and receipt of the $150 Million capital commitment, whether such funding will be sufficient to meet the needs of the Company and its affiliated entities, the impact to the Company and its shareholders as a result of the anticipated financing , whether the B4, Class 4 vehicle deliveries will occur in the timeline expected, whether development and production of the Mullen FIVE RS will be completed and launched within the anticipated timeframes, whether governmental grant applications submitted by the Company will be successful and the outcome of the integrated solid-state polymer battery packs in vehicle level testing. Additional examples of such risks and uncertainties include but are not limited to: (i) Mullen’s ability (or inability) to obtain additional financing in sufficient amounts or on acceptable terms when needed; (ii) Mullen's ability to maintain existing, and secure additional, contracts with manufacturers, parts and other service providers relating to its business; (iii) Mullen’s ability to successfully expand in existing markets and enter new markets; (iv) Mullen’s ability to successfully manage and integrate any acquisitions of businesses, solutions or technologies; (v) unanticipated operating costs, transaction costs and actual or contingent liabilities; (vi) the ability to attract and retain qualified employees and key personnel; (vii) adverse effects of increased competition on Mullen’s business; (viii) changes in government licensing and regulation that may adversely affect Mullen’s business; (ix) the risk that changes in consumer behavior could adversely affect Mullen’s business; (x) Mullen’s ability to protect its intellectual property; and (xi) local, industry and general business and economic conditions. Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements can be found in the most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen with the Securities and Exchange Commission. Mullen anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Mullen assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen Automotive, Inc.

+1 (714) 613-1900

www.MullenUSA.com

Corporate Communications:

InvestorBrandNetwork (IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com

v3.24.1.1.u2

Document And Entity Information

|

May 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MULLEN AUTOMOTIVE INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 14, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-34887

|

| Entity, Tax Identification Number |

86-3289406

|

| Entity, Address, Address Line One |

1405 Pioneer Street

|

| Entity, Address, City or Town |

Brea

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

92821

|

| City Area Code |

714

|

| Local Phone Number |

613-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001499961

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MULN

|

| Security Exchange Name |

NASDAQ

|

| RightsToPurchase Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Rights to Purchase

|

| Security Exchange Name |

NASDAQ

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_RightsToPurchaseCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

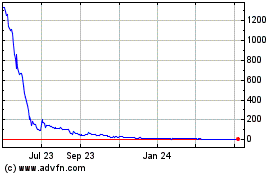

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From Apr 2024 to May 2024

Mullen Automotive (NASDAQ:MULN)

Historical Stock Chart

From May 2023 to May 2024