false

0000771266

0000771266

2024-05-14

2024-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported) May 14, 2024

KOPIN

CORPORATION

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

000-19882 |

|

04-2833935 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

125

North Drive, Westborough, MA 01581

(Address

of Principal Executive Offices) (Zip Code)

(508)

870-5959

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2 below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 |

|

KOPN |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

Kopin

Corporation (the “Company”) issued a press release on May 14, 2024, a copy of which is attached as Exhibit 99.1 to this Current

Report on Form 8-K and incorporated herein by reference, in which the Company announced financial results for the first quarter ended

March 30, 2024. The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities

of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

KOPIN

CORPORATION |

| |

|

|

| Dated: |

May

14, 2024 |

/s/

Richard A. Sneider |

| |

|

Richard

A. Sneider |

| |

|

Treasurer

and Chief Financial Officer |

| |

|

(Principal

Financial and Accounting Officer) |

Exhibit 99.1

Kopin

Corporation Reports Financial Results for the First Quarter 2024

| |

● |

Q1

2024 product revenues increased 18% compared to the same period in 2023 |

| |

|

|

| |

● |

Defense

product revenues increased 28% partially offset by a 17% decrease in Industrial product revenues |

| |

|

|

| |

● |

2.7:1

Positive book-to-bill for Q1, 2024 |

| |

|

|

| |

● |

Expect

Double Digit Revenue Growth in 2024 over 2023 |

| |

|

|

| |

● |

Received

several new customer orders including a Naval Warfare Research Contract |

| |

|

|

| |

● |

Verdict

received in Blue Radios Litigation |

WESTBOROUGH,

MA, May 14, 2024 (BUSINESSWIRE) – Kopin Corporation (“Kopin” or “the Company”) (Nasdaq: KOPN), a leading

developer and provider of high-performance application-specific optical solutions consisting of high-resolution microdisplays, microdisplays

subassemblies and related components for defense, enterprise, industrial, and consumer products, today reported financial results for

the first quarter ended March 30, 2024.

Commenting

on the quarterly results, Michael Murray, Chief Executive Officer, stated, “We continued to make strong progress on our strategy

to reset the course and focus within Kopin. Sales of our products for defense applications continued to be strong, which has been our

primary focus since we initiated our new strategies in 2023. We continue to believe that 2024 revenues will have double digit-growth

as the first quarter marked the entrance of new customers and projects including a new development project with the Navy Air Warfare

Center for research in advanced high frame rate lens-less display architectures. Also in the first quarter, Kopin received a $20.5M order

for a new weapon sight configuration deliverable in 2024 and 2025. Furthermore, the company also received a $1.4M order for a specialized

weapon sight.

“Kopin

continues to demonstrate very strong momentum in our book-to-bill rate which ended positively in the first quarter of 2024. We are fortunate

to have many great long-standing customers who remain supportive of Kopin during this transformative time. Further, we are excited to

see the benefits of these efforts as we see new designs and opportunities with our current and new customers increasing.

“Our

focus remains on quality and efficiency. Over the last year, we have instituted several organizational changes to clarify accountability,

established measurable goals and metrics, and brought in new program management, business development, and quality skill sets. These

changes are the foundation of our growth plan. To improve cashflow and focus, we also began exploring the process of monetizing the investments

we have in several companies, our Intellectual Property portfolio, and several cost reduction activities.

“The

global landscape suggests aggressive tensions are increasing around the world and defense affairs are becoming more dynamic. We believe

Kopin is well positioned to deliver to our soldiers and allies the defense systems they need and the innovations that enable the market

and return value to our customers, society, and internal and external stakeholders.”

Mr.

Murray concluded: “Regarding our recent announcement of our Blue Radios litigation, we are disappointed in the outcome and do not

believe the findings were justified by the facts. We are reviewing our options, including a possible appeal of any judgment that Court

ultimately enters.”

First

Quarter Financial Results

Total

revenues for the first quarter ended March 30, 2024, were $10.0 million, compared to $10.8 million for the first quarter ended April

1, 2023, a 7% decrease. Year-over-year product revenues increased 18%, with defense product revenues increasing by $1.8 million

or 28% year over year, while industrial product revenues decreased by $0.2 million or 17%, year over year. First quarter 2024 funded

research and development revenues declined by $2.0 million or 69% as certain defense development programs were completed.

Cost

of Product Revenues for the first quarter of 2024 were $8.5 million, or 95% of net product revenues, compared with $6.6 million, or 87%

of net product revenues for the first quarter of 2023. The increase in cost of product revenues resulted from a higher provision for

excess and obsolete materials in the first quarter of 2024 compared to the first quarter of 2023.

Research

and Development (R&D) expenses for the first quarter of 2024 were $2.1 million compared to $2.3 million for the first quarter of

2023, essentially flat year over year. Customer-funded R&D expense declined $0.8 million in the first quarter of 2024 as compared

to the first quarter of 2023, while internal R&D increased $0.6 million year over year. The decline in customer-funded R&D programs

was due to the completion of certain defense development programs.

Selling,

General and Administration (SG&A) expenses were $7.2 million for the first quarter of 2024, compared to $4.6 million for the first

quarter of 2023. The increase for the three months ended March 30, 2024, as compared to the three months ended April 1, 2023, was primarily

due to an increase in legal fees of $2.6 million, professional fees of approximately $0.2 million, marketing expenses of $0.2 million

and stock-based compensation of $0.2 million, partially offset by a decrease in bad debt expense of $0.5 million.

On

April 22, 2024, a jury verdict was entered in the U.S. District Court for the District of Colorado, finding for the plaintiff, BlueRadios,

Inc., and awarding approximately $5.1 million in damages as well as recommending $19.7 million in disgorgement and exemplary damages.

While the court has not yet entered a final judgement, the Company has accrued the full $24.8 million judgment under the relevant accounting

guidance. The Company is reviewing its options, including a possible appeal of any judgment that the Court ultimately enters.

Net

Loss Attributed to Kopin Corporation for the first quarter of 2024 was ($32.5) million, or ($0.27) per share, compared with ($2.6) million,

or ($0.03) per share, for the first quarter of 2023.

All

amounts above are estimates and readers should refer to our Form 10-Q for the quarter ended March 30, 2024, for final disposition as

well as important risk factors.

Earnings

Call and Webcast

Kopin

Corporation management will host the conference call, followed by a question and answer session.

Date:

Tuesday May 14, 2024

Time:

8:30 AM Eastern Time (5:30 AM Pacific Time)

U.S.

dial-in number: 800-274-8461

International

number: 203-518-9843

Webcast:

Q1 2024 Webcast Link

Conference

ID: KOPIN

The

Company will also provide a link at https://www.kopin.com/investors/ for those who wish to stream the call via webcast. Please call the

conference telephone number 5-10 minutes prior to the start time.

A

telephonic replay of the conference call will also be available through May 21, 2024.

Toll-free

replay number: 844-512-2921

International

replay number: 412-317-6671

Replay

passcode: 11155912

About

Kopin

Kopin

Corporation is a leading developer and provider of high-performance application-specific optical solutions consisting of high-resolution

microdisplays, microdisplays subassemblies and related components for defense, enterprise, industrial, and consumer products. Our products

are used for soldier, avionic, armored vehicle, and training & simulation defense applications; industrial, public safety and medical

headsets; 3D optical inspection systems; and consumer augmented reality (“AR”) and virtual reality (“VR”) wearable

headsets systems. For more information, please visit Kopin’s website at www.kopin.com.

Kopin

is a trademark of Kopin Corporation.

Forward-Looking

Statements

Statements

in this press release may be considered “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), which are subject to the safe harbor created by such sections. Words such as “expects,” “believes,”

“can,” “will,” “estimates,” and variations of such words and similar expressions, and the negatives

thereof, are intended to identify such forward-looking statements. We caution readers not to place undue reliance on any such “forward-looking

statements,” which speak only as of the date made, and advise readers that these forward-looking statements are not guarantees

of future performance and involve certain risks, uncertainties, estimates, and assumptions by us that are difficult to predict. These

forward-looking statements include statements with respect to our belief that 2024 revenues will have double digit-growth; that new designs

and opportunities with our current and new customers is increasing; our goals of cash flow breakeven by year-end and sustainable revenue

and profitable growth in 2024; and our belief that Kopin is well positioned to deliver to our soldiers and allies the defense systems

they need and the innovations that enable the market and return value to our customers, society, and internal and external stakeholders.

Statements in this press release are qualified by the disclosure in our Form 10-Q relating to our ability to continue as a going concern

if the recommended disgorgement and exemplary damages in our lawsuit with BlueRadios is not reduced in the final order or if we do not

appeal any final decision by the court. Various factors, some of which are beyond our control, could cause actual results to differ materially

from those expressed in, or implied by, such forward-looking statements. All such forward-looking statements, whether written or oral,

and whether made by us or on our behalf, are expressly qualified by these cautionary statements and any other cautionary statements that

may accompany the forward-looking statements. In addition, we disclaim any obligation to update any forward-looking statements to reflect

events or circumstances after the date of this press release, except as may otherwise be required by the federal securities laws. These

forward-looking statements are only predictions, subject to risks and uncertainties, and actual results could differ materially from

those discussed. Important factors that could affect performance and cause results to differ materially from management’s expectations

are described in our Annual Report on Form 10-K, or as updated from time to time our Securities and Exchange Commission filings.

Contact

Information

For

Investor Relations

Kopin

Corporation

Richard

Sneider

Treasurer

and Chief Financial Officer

rsneider@kopin.com

MZ

Contact

Brian

M. Prenoveau, CFA

MZ

Group – MZ North America

KOPN@mzgroup.us

+561

489 5315

Kopin

Corporation

Supplemental

Information

(Unaudited)

| | |

Three Months Ended | |

| | |

March 30, 2024 | | |

April 1, 2023 | |

| Display Revenues by Category (in millions) | |

| | | |

| | |

| Defense | |

$ | 8.2 | | |

$ | 6.4 | |

| Industrial/Enterprise | |

| 0.8 | | |

| 1.0 | |

| Consumer | |

| - | | |

| 0.3 | |

| R&D | |

| 0.9 | | |

| 2.9 | |

| License and Royalties | |

| 0.1 | | |

| 0.2 | |

| Total | |

$ | 10.0 | | |

$ | 10.8 | |

| | |

| | | |

| | |

| Stock-Based Compensation Expense | |

| | | |

| | |

| Cost of product revenues | |

$ | 221,000 | | |

$ | 26,000 | |

| Research and development | |

| 144,000 | | |

| 17,000 | |

| Selling, general and administrative | |

| 370,000 | | |

| 151,000 | |

| | |

$ | 735,000 | | |

$ | 194,000 | |

| | |

| | | |

| | |

| Other Financial Information | |

| | | |

| | |

| Depreciation and amortization | |

$ | 195,000 | | |

$ | 225,000 | |

Kopin

Corporation

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

Three Months Ended | |

| | |

March 30, 2024 | | |

April 1, 2023 | |

| Revenues: | |

| | | |

| | |

| Net product revenues | |

$ | 9,025,366 | | |

$ | 7,654,716 | |

| Research and development revenues | |

| 899,965 | | |

| 2,896,451 | |

| Other revenues | |

| 107,310 | | |

| 207,024 | |

| | |

| 10,032,641 | | |

| 10,758,191 | |

| Expenses: | |

| | | |

| | |

| Cost of product revenues | |

| 8,541,574 | | |

| 6,624,101 | |

| Research and development | |

| 2,100,753 | | |

| 2,312,217 | |

| Selling, general and administration | |

| 7,231,865 | | |

| 4,648,130 | |

| Litigation damages | |

| 24,800,000 | | |

| - | |

| | |

| 42,674,192 | | |

| 13,584,448 | |

| | |

| | | |

| | |

| Loss from operations | |

| (32,641,551 | ) | |

| (2,826,257 | ) |

| | |

| | | |

| | |

| Other income, net | |

| 93,336 | | |

| 236,702 | |

| | |

| | | |

| | |

| Loss before provision for income taxes | |

| (32,548,215 | ) | |

| (2,589,555 | ) |

| | |

| | | |

| | |

| Tax provision | |

| - | | |

| (39,000 | ) |

| | |

| | | |

| | |

| Net loss | |

$ | (32,548,215 | ) | |

$ | (2,628,555 | ) |

| | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | |

| Basic | |

$ | (0.27 | ) | |

$ | (0.03 | ) |

| Diluted | |

$ | (0.27 | ) | |

$ | (0.03 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | |

| Basic | |

| 120,114,985 | | |

| 105,036,382 | |

| Diluted | |

| 120,114,985 | | |

| 105,036,382 | |

Kopin

Corporation

Condensed

Consolidated Balance Sheets

(Unaudited)

| | |

March 30, 2024 | | |

December 30, 2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash, restricted cash and marketable securities | |

$ | 21,809,842 | | |

$ | 17,902,685 | |

| Accounts receivable, net | |

| 6,801,658 | | |

| 9,706,036 | |

| Inventory | |

| 6,120,355 | | |

| 7,601,806 | |

| Contract assets and unbilled receivables | |

| 5,687,165 | | |

| 3,409,809 | |

| Prepaid and other current assets | |

| 1,569,627 | | |

| 1,210,207 | |

| | |

| | | |

| | |

| Total current assets | |

| 41,988,647 | | |

| 39,830,543 | |

| | |

| | | |

| | |

| Plant and equipment, net | |

| 2,212,691 | | |

| 2,163,417 | |

| Operating lease right-of-use assets | |

| 2,328,152 | | |

| 2,504,909 | |

| Equity investments | |

| 4,611,510 | | |

| 4,688,522 | |

| Other assets | |

| 124,925 | | |

| 124,925 | |

| | |

| | | |

| | |

| Total assets | |

$ | 51,265,925 | | |

$ | 49,312,316 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 8,993,894 | | |

$ | 7,076,759 | |

| Accrued expenses | |

| 5,426,540 | | |

| 5,564,187 | |

| Accrued Compensation | |

| 602,500 | | |

| 790,000 | |

| Customer deposits | |

| 701,777 | | |

| 408,156 | |

| Deferred tax liabilities | |

| 470,884 | | |

| 470,884 | |

| Contract liabilities and billings in excess of revenue earned | |

| 886,432 | | |

| 916,826 | |

| Operating lease liabilities | |

| 628,019 | | |

| 651,503 | |

| Accrued litigation damages | |

| 24,800,000 | | |

| - | |

| | |

| | | |

| | |

| Total current liabilities | |

| 42,510,046 | | |

| 15,878,315 | |

| | |

| | | |

| | |

| Other long term liabilities | |

| 2,135,791 | | |

| 2,092,124 | |

| Operating lease liabilities, net of current portion | |

| 1,680,063 | | |

| 1,832,982 | |

| | |

| | | |

| | |

| Total stockholders' equity | |

| 4,940,025 | | |

| 29,508,895 | |

| Total liabilities and stockholders' equity | |

$ | 51,265,925 | | |

$ | 49,312,316 | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

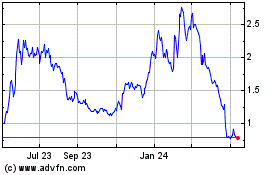

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From Apr 2024 to May 2024

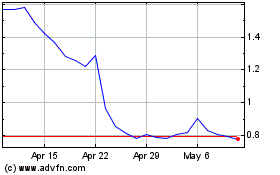

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From May 2023 to May 2024