STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-K

☒ ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended September 30, 2023

☐ TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ___________ to ___________

Commission

File No. 001-34864

GREEN

GIANT INC.

(Exact

Name of Registrant as Specified in its Charter)

| Florida | | 33-0961490 |

(State or Other Jurisdiction

of Incorporation) | | (I.R.S. Employer

Identification Number) |

6

Xinghan Road, 19th Floor, Hanzhong City

Shaanxi

Province, PRC 723000

(Address

of principal executive offices) (zip code)

Registrant’s

phone number, including area code

+(86)091-62622612

Yuhuai

Luo

Chief

Executive Officer

6

Xinghan Road, 19th Floor, Hanzhong City

Shaanxi

Province, PRC 723000

(Registrant’s

telephone number, including area code)

Securities

registered under Section 12(b) of the Exchange Act:

| Title of each class registered: | | Trading Symbol | | Name of each exchange on which registered: |

| Common Stock, par value $0.001 | | GGE | | Nasdaq Capital Market |

Securities

registered under Section 12(g) of the Exchange Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒ Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | | Emerging Growth Company | ☐ |

If

and emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate

market value of the voting and non-voting common equity held by non-affiliates of the registrant, based upon the closing price of

the registrant’s common stock on March 31, 2023, the last business day of the Company’s second fiscal quarter, as

reported by the Nasdaq Capital Market on that date, was $158 million. This calculation does not reflect a determination

that certain persons are affiliates of the registrant for any other purpose.

As of December 27, 2023, there were 113,534,447 shares of Common Stock, par value $0.001 per share, outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

GREEN GIANT INC.

FORM 10-K

For the Fiscal Year

Ended September 30, 2023

INDEX

FORWARD-LOOKING STATEMENTS

This annual report on

Form 10-K (the “Report”) and other reports (collectively the “Filings”) filed by the registrant from time

to time with the Securities and Exchange Commission (the “SEC”) contain or may contain forward looking statements and information

that are based upon beliefs of, and information currently available to, the registrant’s management as well as estimates and assumptions

made by the registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,”

“expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions

as they relate to the registrant or the registrant’s management identify forward looking statements. Such statements reflect the

current view of the registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including

the risks contained in the section of this Report entitled “Risk Factors”) relating to the registrant’s industry, the

registrant’s operations and results of operations and any businesses that may be acquired by the registrant. Should one or more

of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly

from those anticipated, believed, estimated, expected, intended or planned.

Although the registrant

believes that the expectations reflected in the forward looking statements are reasonable, the registrant cannot guarantee future results,

levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States,

the registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following

discussion should be read in conjunction with the registrant’s financial statements and the related notes thereto included in this

Report.

In this Report, “we,”

“our,” “us,” “Green Giant Inc. or the “Company” sometimes refers collectively to Green Giant

Inc. and its subsidiaries and affiliated companies.

PART I

ITEM 1. BUSINESS

Our

Organization

Green Giant Inc. (formerly

China HGS Real Estate Inc., the “Company” or “GGE,” “we”, “our”, “us”), is

a corporation organized under the laws of the State of Florida.

China HGS Investment

Inc. is a Delaware corporation and owns 100% of the equity interest in Shaanxi HGS Management and Consulting Co., Ltd. (“Shaanxi

HGS”), a wholly owned foreign entity incorporated under the laws of the People’s Republic of China (“PRC” or

“China”).

GGE does not conduct

any substantive operations of its own. Instead, through its subsidiary, Shaanxi HGS, it entered into certain exclusive contractual agreements

with Shaanxi Guangsha Investment and Development Group Co., Ltd. (“Guangsha”). Pursuant to these agreements, Shaanxi

HGS is obligated to absorb a majority of the risk of loss from Guangsha’s activities and entitles Shaanxi HGS to receive a majority

of Guangsha’s expected residual returns. In addition, Guangsha’s shareholders have pledged their equity interest in Guangsha

to Shaanxi HGS, irrevocably granted Shaanxi HGS an exclusive option to purchase, to the extent permitted under PRC Law, all or part of

the equity interests in Guangsha and agreed to entrust all the rights to exercise their voting power to the person(s) appointed

by Shaanxi HGS.

Our Company engages

in real estate development, primarily in the construction and sale of residential apartments, car parks and commercial properties.

Guangsha was organized

in August 1995 as a limited liability company under the laws of the PRC. Guangsha is headquartered in the city of Hanzhong, Shaanxi

Province. Guangsha is engaged in developing large scale and high quality commercial and residential projects, including multi-layer apartment

buildings, sub-high-rise apartment buildings, high-rise apartment buildings, and office buildings.

On November 29, 2021,

Green Giant Ltd. was incorporated in Delaware.

Green Giant Energy Texas

Inc. was incorporated in Texas on October 3, 2022 which is a wholly owned subsidiary of Green Giant Ltd.

Green Giant International

Limited (Hong Kong) was incorporated in Hong Kong on December 9, 2021 as a wholly owned subsidiary of Green Giant Ltd.

Our

corporate structure as of September 30, 2023 is set forth below:

Business Overview

The Company currently

operates in two segments, the real estate development business and green energy business. The Company engages in real estate development

through the VIE, Guangsha, in mainland China, and is transitioning itself from its real estate development business to a new energy corporation.

Currently, we are operating

in Hanzhong, a prefecture-level city in Shaanxi Province, and Yang County, a county in Hanzhong. Our management has been focused on expanding

our business in Tier 3 and Tier 4 cities and counties in China that we strategically select based on population and urbanization growth

rates, general economic conditions and growth rates, income and purchasing power of resident consumers, anticipated demand for private

residential properties, availability of future land supply and land prices, and governmental urban planning and development policies.

Initially, these Tier 3 and Tier 4 cities and counties will be located in the Shaanxi province, China. We utilize a standardized and

scalable model that emphasizes rapid asset turnover, efficient capital management and strict cost control. We plan to expand into strategically

selected Tier 3 and Tier 4 cities and counties with real estate development potential in Shaanxi Province, and expect to benefit from

rising demand for residential housing as a result of increasing income levels of consumers and growing populations in these cities and

counties due to urbanization.

In September 2020, the

Company started land leveling and construction process for the Oriental Garden Phase II and Liangzhou Mansion real estate properties

in the Liangzhou Road related projects. The Company started the construction of the Liangzhou Road related projects, which consist of

residential buildings, office buildings and a commercial plaza, after the approval by the local government of the road. Upon completion,

the Liangzhou Road related projects will become a new city center of Hanzhong city.

Since November 2022,

the Company started to explore the possibility of entering into the green energy sector in the U.S. As the usage of electric vehicles

and other battery-powered technologies surges, the demand for batteries correspondingly rises. This growth cycle presents both a challenge

and an opportunity when these batteries reach their end-of-life stage. Our solution to this challenge lies in our innovative battery recycling

process. We have been searching for a warehouse for our battery recycling production. During the recycling process, valuable metal such

as lithium, nickel, and cobalt are extracted from the used batteries. These metals are then converted into lead ingots and blocks. The

global market for these metals is dynamic, with prices fluctuating in response to the constantly changing supply and demand. We have started

the trading of metal, the end-product of battery recycling, in April 2023, to leverage the fluctuation in their prices. The Company recorded

$0.79 million revenue from the green energy segment for the fiscal year ended September 30, 2023.

Furthermore,

the Company is planning to enter the medical industry through selling medical devices like vitro short-wave radiometer, high-pressure

syringe and related consumables. In the future, it also plans to sell high-end medical equipment including gamma knife and apparatus for

kidney.

Green Energy and Battery Recycling Industry

Overview

Since November 2022, the Company has been exploring

business opportunities in the green energy sector in the U.S. and has entered into this industry with a focus on the battery recycling

business. The global green energy and battery recycling industry is experiencing significant growth because of the global shift towards

sustainable energy and the increasing demand for electric vehicles (EVs).

Green Energy Industry

Renewable Energy Sources: This sector includes

solar, wind, hydroelectric, and geothermal power. The declining cost of technology, especially in solar and wind, has accelerated adoption.

Energy Storage Solutions: With the variability

of renewable sources, energy storage systems, like lithium-ion batteries, play a crucial role in ensuring a steady energy supply.

Government Policies and

Incentives: Many governments worldwide are promoting green energy through subsidies, tax incentives, and regulations to reduce carbon

emissions.

Technological Innovations: Continuous advancements

in technology are making renewable energy more efficient and cost-effective.

Battery Recycling

Industry

Growing Demand for Battery Recycling: The

surge in EVs and portable electronics has led to a higher need for battery recycling to manage waste and recover valuable materials like

lithium, cobalt, and nickel.

Technological Advancements in Recycling: Companies

are developing more efficient and environmentally friendly recycling methods, including hydrometallurgical processes and direct recycling.

Regulatory Framework: Regulations concerning

battery disposal and recycling are becoming more stringent, encouraging the development of the recycling industry.

Supply Chain Sustainability: Recycling is

seen as key to reducing the environmental impact of battery production and ensuring a sustainable supply of raw materials.

Challenges and

Opportunities

Supply Chain Issues: The reliance on specific

countries for raw materials poses risks. Recycling can help mitigate these risks by providing a more localized supply chain.

Investment and Infrastructure: Significant

investment is needed to scale up renewable energy infrastructure and recycling facilities.

Technological Challenges: Both industries

face challenges in improving efficiency, reducing costs, and minimizing environmental impacts.

Future Outlook

Integration of Renewable Energy and Storage:

As the penetration of renewable energy grows, the integration with efficient storage solutions will be crucial.

Circular Economy in Batteries: Emphasizing

a circular economy where batteries are reused, repurposed, and recycled will become increasingly important.

Overall, the green energy

and battery recycling industries are at the forefront of the global transition to a more sustainable and environmentally friendly energy

future.

Real Estate Industry Overview

During the volatile

real estate market, the Company has been capitalizing on its inherent strengths and market opportunities in Tier 3 and Tier 4 cities

and counties to deliver value for our shareholders. We feel confident and also competent to take on every challenge and grasp every opportunity

during market consolidation. We expect to provide rapid response to the market on the basis of our projected business plans together

with a flexible approach in seizing market opportunities; strict investment standards and prudent attitude towards investment opportunities,

and appropriate replenishment of quality land resources in existing regions to realize value within the Tier 3 and Tier 4 cities and

counties in Western China.

According to China Galaxy Securities Research Report dated October

25, 2023, the sixth session of China’s 14th National People’s Congress Standing Committee voted and passed resolutions on incremental

issuance of treasury bonds by the state council and adjustment scheme of central government’s 2023 budget. The central finance

will additionally issue 1 trillion treasury bonds of 2023 in the fourth quarter 2023, and all of the treasury bonds issued will be arranged

to local governments through transfer payments. This will generate impacts to economy in following aspects: to assist reconstruction

of disaster areas and economic resurgence, and will directly drive investment growth in local infrastructure, the directions concentrated

on drainage and flood control projects and farmland construction related to water conservancy engineering.

According to CNR Cultural Media dated November 23, 2023, responsible

officer from the ministry of finance stated that according to plan of the State Council and related work arrangement, part

of increased 2024 debt limit of local governments was released in advance, to reasonably guarantee local financing need. The institutions

predicted that the limit approved in advance may exceed 2.7 trillion and may continue to tilt towards east region in good fiscal condition.

From the usage of special debit published by ministry of finance, fields of livelihood services, transportation infrastructure, infrastructure

for municipal administration and Industrial Park, agriculture, forestry, and water conservancy accounted for 64.9%、23.8%、6.0%

and 3.6% respectively.

Company Positioning

The Company is headquartered in Hanzhong

in the southwestern part of the Shaanxi province, in the center of the Hanzhong Basin, on the Han River, near the Sichuan border.

According to the China City Statistical Yearbook, Hanzhong had a population of about 3.8 million. |

|

|

Hanzhong

is a key transportation hub connecting China’s Middle Economic zone and Western Economic Zone. The travel time from Xi’an,

the provincial capital of Shaanxi province, to Hanzhong takes less than 2 hours. The airport in Hanzhong was completed and put into service

in 2014. The airport handled approximately 650,000 passengers and 2,200 tons of cargo on annual basis. Xicheng, a high-speed railway

between Chengdu, the provincial capital of Sichuan province, and Xi’an with a major stop in Hanzhong was completed in 2017. It

takes 1.5 hours from Hanzhong to Xi’an and 2.5 hours from Hanzhong to Chengdu. According to urban big data platform, GuangJunTong,

the railway passenger’s volume was around 44.65 million in 2022.

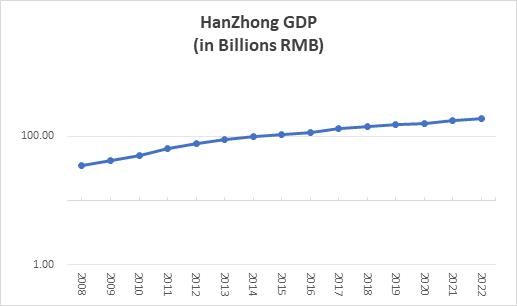

According to Statistical Bulletin of National Economic and Social

Development Hanzhong City, Hanzhong’s GDP reached RMB 190.55 billion (approximately $29.1 billion) by 2022 calendar year, representing

a 4.3% increase from 2021 calendar year. Resident’s annual disposable income for 2022 calendar year was RMB38,776 (equivalent to

$5,917 ) representing a 4.5% increase as compared to 2021 calendar year.

On

November 11, 2022 the People’s Bank of China and the China Banking and Insurance Regulatory Commission issued “Yin Fa [2022]

No. 254 “Notice on Supporting the Stable and Healthy Development of the Real Estate Market” to support the stable and healthy

development of the real estate market. The details are as follows:

A. Keeping real estate

financing stable and order

1). Stabilize the issuance of real estate development loans.

Adhere to the “two

unswerving”, and treat all types of real estate enterprises such as state-owned and private enterprises equally. Encourage financial

institutions to focus on supporting the steady development of real estate enterprises with sound governance, focus on their main business

and good qualifications.

Financial institutions

should reasonably distinguish the risks of project subsidiaries from the risks of group holding companies, and meet the reasonable financing

needs of real estate projects in accordance with the principle of marketization on the premise of ensuring the safety of creditor’s

rights and the closed operation of funds. Support the project host bank and the syndicated loan model, strengthen the management of the

whole process of loan approval, issuance and recovery, and effectively ensure the safety of funds.

2). Support the reasonable needs of individual housing loans.

Reasonably determine

the down payment ratio of local personal housing loans and the lower limit of the loan interest rate policy to support rigid and improved

housing demand.

Financial institutions

are encouraged to reasonably determine the specific down payment ratio and interest rate level for individual housing loans based on

the lower limit of urban policies in light of their own business conditions, customer risk status and credit conditions, etc.

3). Stabilize the credit supply of construction enterprises.

4). Support the reasonable extension of existing financing such as development loans and trust loans

For real estate enterprise

development loans, trust loans and other existing financing, on the premise of ensuring the safety of creditor’s rights, financial

institutions and real estate enterprises are encouraged to negotiate independently based on commercial principles, and actively support

through the extension of existing loans, adjustment of repayment arrangements, etc., to promote the completion of the project deliver.

From the date of issuance

of the notice, those due within the next six months may be allowed to extend for one more year beyond the original regulations, and the

loan classification may not be adjusted, and the loan classification submitted to the credit reporting system should be consistent with

it.

5). Keep bond stable,

and support high-quality real estate enterprises to issue bond. Promote professional credit enhancement agencies to provide credit

enhancement support for bond issuance of real estate enterprises with overall financial health and short-term difficulties.

Encourage bond issuers to communicate with holders in advance and make arrangements for borrowing bonds to redeem funds. If it is

really difficult to make payment on time, reasonable arrangements such as extension and replacement shall be made through

negotiation to proactively resolve risks.

6). Maintain stable financing of asset management products such as trusts.

B. Actively do a good

job in “delivery guarantee building” financial services

7). Support development policy banks to provide special loans for “delivery guarantee building”.

Support China Development

Bank and Agricultural Development Bank in accordance with relevant policy arrangements and requirements. In accordance with the laws

and regulations, the special insurance payment for “delivery guarantee building” is issued to the borrowers who have been

reviewed and filed in an efficient and orderly manner, which is closed and dedicated. It is specially used to support the accelerated

construction and delivery of overdue and difficult-to-deliver residential projects that have been sold.

8). Encourage financial institutions to provide supporting financing support.

Encourage financial

institutions, especially the main financing commercial banks of the project personal housing loans or the syndicates they lead to form,

in accordance with the principles of marketization and the rule of law, to provide new supporting financing support for special loan

support projects, and promote the resolution of unfinished personal housing loan risks.

For the sale of the

remaining value of goods, the project can be reviewed at the same time for special loans and new supporting financing, and the sales

of the remaining value of goods cannot cover both the special loan and the new supporting financing, but it has been clarified that the

new supporting financing and special financing The loan matching mechanism arranges and implements the project of the source of repayment,

and encourages financial institutions to actively provide new matching financing support under the premise of commercial voluntary.

The subject of the newly

added supporting financing should be consistent with the subject of the implementation of the special loan-supported project. The existing

assets and liabilities of the project should be audited and evaluated by a qualified institution organized by the local government, and

an implementation plan of “one building one policy” has been formulated. Commercial banks with the “special loan supporting

financing” sub-section can be newly established under the real estate development loan for statistics and management. In principle,

the supporting financing should not exceed the period of the corresponding special loan. For a maximum period of no more than 3 years,

the project sales receipts shall be transferred to a special project account opened with the main financing commercial bank or other

commercial banks, and the special project account shall be jointly managed by the commercial bank that provides additional financing.

It is clearly stated that in accordance with the principle of “last-in, first-out”, the sales receipts of the remaining value

of the project should be given priority to repay the newly-added supporting financing and special loans.

For commercial banks,

in accordance with the requirements of this notice, within half a year from the date of issuance of this notice, the supporting financing

issued to special fund-supported projects shall not be reduced in risk classification during the loan period; The main body management

is not good for the newly issued supporting financing, and the relevant institutions and personnel have done their due diligence. Liability

is waived.

C. Actively cooperate with trapped real estate enterprises to deal with the risk disposal

9). Provide financial support for M&A of real estate projects.

Encourage commercial

banks to carry out M&A loan business for real estate projects in a stable and orderly manner, and focus on supporting high-quality

real estate enterprises to merge and acquire projects of distressed real estate enterprises.

Encourage financial

asset management companies and local asset management companies (hereinafter collectively referred to as asset management companies)

to use their experience and capabilities in non-performing asset management and risk management, and jointly negotiate risk resolution

models with local governments, commercial banks, and real estate companies, and promote accelerate asset disposal.

10) Actively explore market-oriented support methods. For some projects that have entered judicial reorganization, financial institutions can assist in promoting project resumption and delivery by one enterprise and one policy according to the principles of independent decision-making, risk-taking, and self-responsibility for profits and losses.

Encourage asset management

companies to participate in project disposal by acting as bankruptcy administrators, reorganization investors, etc., and support qualified

financial institutions to prudently explore the establishment of funds and other methods to resolve the risks of distressed real estate

enterprises in accordance with laws and regulations, and support project completion and delivery.

D. Legally protect the

legitimate rights and interests of housing finance consumers

11). Encourage independent negotiation and extension of principal and interest repayment in accordance with the law.

For individuals who

have lost their source of income due to hospitalization or isolation due to the epidemic, or who have lost their income due to the closure

of business due to the epidemic, as well as personal housing loans due to changes or cancellations of housing purchase contracts, financial

institutions can follow the market-based approach. Based on the principle of rule of law, negotiate with the buyers independently, and

make adjustments such as postponement and extension.

For malicious evasion

of financial debts, they will be dealt with in accordance with laws and regulations to maintain a good market order.

12). Effectively protect the personal credit investigation rights of deferred loans.

If the repayment arrangement

of the personal housing loan has been adjusted, the financial institution shall submit the credit record according to the new repayment

arrangement; if the judgment or ruling of the people’s court determines that the adjustment should be made, the financial institution

shall adjust the credit record and submit it according to the effective judgment or ruling of the people’s court which has been

reported to be adjusted.

E. Phased adjustment

of some financial management policies

13). Extending the transition period of the real estate loan concentration management policy.

For banking financial

institutions that cannot meet the requirements of real estate loan concentration management as scheduled due to objective reasons such

as the epidemic, the transition period will be reasonably extended based on the actual situation and objective assessment.

14). Periodically optimize the M&A financing policy for real estate projects.

Relevant financial institutions

should make good use of the phased real estate financial management policies issued by the People’s Bank of China and the China

Banking and Insurance Regulatory Commission, which are applicable to major commercial banks and national financial asset management companies,

and accelerate the marketization of real estate risks.

F. Increase financial

support for housing leasing

15). Optimize housing leasing credit services.

16). Broaden diversified financing channels in the housing leasing market.

Support housing rental

and sales enterprises to issue credit bonds and guaranteed bonds and other direct financing products, which are specially used for the

construction and operation of rental housing, and Gupin Commercial Bank issues financial bonds to support housing rental to raise funds

to increase housing rental development and construction loans and business operations. Loans were provided, and the pilot program of

real estate investment trusts (REITs) was steadily promoted.

On

November 14, 2022 China Banking and Insurance Regulatory Commission, the Ministry of Housing and Urban-Rural Development and the Central

Bank issued the “Notice on the Relevant Work of Commercial Banks Issuing letters of Guarantee to Replace the Pre-sale Supervision

Funds” (the “Pre-sale Supervision Funds Notice”). Commercial banks’ house related credit business is expected

to expand. The “Financial Support for Real Estate Notice” issued sixteen measures to generate power at both supply and demand

ends, it further clarifies the support policies for housing credit. Many policies have been implemented at the document system level

for the first time, or will push banks to increase their support for the real estate market. It is expected to modify the conservative

attitude of commercial banks to intervene in the development loan market and support the reasonable demand for individual housing loans.

| 1) | The

existing debt financing of real estate enterprises shall be reasonably extended. Reasonable extension arrangements will be made for the

existing financing such as real estate development loans and trust loans, with an additional extension of one year for those due in the

next six months, and the credit rating will not be downgraded or credit information will not be changed. The “Financial Support

for Real Estate Notice” is the first time to mention the support policy for trust loans, which may help banks to enhance the risk

appetite of house related businesses, especially private real estate enterprises. |

| 2) | Extend

the transition period of the real estate concentration management policy arrangement. For the real estate concentration management requirements

of banking financial institutions established by the end of 2020 that cannot meet the standards as scheduled due to the epidemic and

other reasons, the transition period can be reasonably extended based on the actual situation through objective assessment. The phased

“relaxation” of management requirements will help banks to participate in the real estate credit market in a reasonable manner

based on the actual situation. |

| 3) | Emphasis

on doing a good job to provide financial services for “delivery guarantee building”. Supporting the State Development bank,

the Agricultural Development Bank and other institutions to provide special loans for real estate enterprises to “delivery guarantee

building” and providing supporting financing for special loans projects, will further resolve the risks of individual housing loans

that are not yet delivered. |

| 4) | Add

exemption clause to relieve worries. If the participation in the newly issued supporting financing of the delivery guarantee building

is bad, the relevant institutions and personnel shall perform their duties and be exempted from liability, which will boost the initiative

of the relevant institutions to participate in such projects. With the introduction of the policy of replacing pre-sale supervision funds

with letters of guarantee, real estate enterprises are facing significate liquidity benefits. According to the “Notice on Pre-sale

Supervision Funds”, high-quality real estate enterprises can apply to banks for a letter of guarantee to replace the pre-sale supervision

funds, which is a significant benefit to the short-term liquidity of real estate. According to the regulatory requirements, the replacement

funds of real estate enterprises are given priority to use for project construction and repayment of debts due. On the one hand, the

replacement funds can directly relieve the liquidity pressure of real estate enterprises and improve the cash flow of enterprises; On

the other hand, it is good for real estate enterprises to activate the pre-sale funds to complete the project delivery, promote the “delivery

guarantee building” in an orderly manner, strengthen the signal “stability maintenance” in the real estate market,

and promote the recovery of the sales side, so as to substantially improve the debt repayment ability of real estate enterprises, especially

private real estate enterprises, and the risks of banks involved in real estate can be mitigated. |

The upper limit of the

replacement quota and the term of the letter of guarantee are clearly stipulated, and the bank risk is guaranteed. According to the “Notice

on Pre-sale Supervision Funds”, the replacement amount of the real estate enterprise shall not exceed 30% of the amount of funds

required to ensure the completion and delivery of the project in the supervision account. At the same time, the term of the letter of

guarantee shall be matched with the project construction period to ensure that the replacement funds are used for the project construction.

At the regulatory level, there are clear provisions on the quota for the replacement of real estate enterprises and the term of the letter

of guarantee, which not only improves the utilization efficiency of the use of pre-sale supervision funds, but also ensures the capital

safety to the greatest extent and reduces the credit risk of banks.

The target market of

the Company is in Western China. The Company continues to focus on Tier 3 and Tier 4 cities and counties in acquiring sizable quality

land reserves at low cost in a flexible and diversified manner. There has been an increasing demand for high quality residential housing,

largely driven by the “Go West” policy and accelerated urbanization. Many buyers in Tier 3 and Tier 4 cities and counties

are first time home buyers. In order to mitigate default risk, the Company generally requires from its homebuyer customers a deposit

in the range of 30%-50% of the purchase price, which is higher than the percentage required by the government for the mortgage down payment.

The Company received

the National Grade-I real-estate development qualification granted by the Ministry of Housing and Urban-Rural Development of the People’s

Republic of China (“MOHURD”) on October 12, 2011. The Company is not required to renew the National Grade-I

real-estate development qualification after it passed the initial qualification application set out by the MOHURD. The Grade-I real-estate

development qualification is the highest qualification for real-estate developers in China and requires meeting several strict criteria,

including:

| a. | Registered capital of at least RMB 50 million (approximately

$7.3 million); |

| b. | At least five years of experience in real estate development

and operations; |

| c. | The completion of construction of a total over 300,000 square

meters. of ground floor area (GFA) within the last three years and, in the most recent year, developed real estate projects of at least

150,000 square meters; and |

| d. | The completed real estate projects have no quality issues in

each of the past five years; and an established, comprehensive quality control and guarantee system. |

Pre-Sales and Sales

In the PRC, real estate

developers are allowed to begin to market properties before construction is completed. Like other developers, we pre-sell properties

prior to completion of construction. Under PRC pre-sales regulations, property developers must satisfy specific conditions before properties

under construction can be pre-sold. These mandatory conditions include:

| ● | the

land premium must have been paid in full; |

| ● | the

land use rights certificate, the construction site planning permit, the construction work planning permit and the construction permit

must have been obtained; |

| ● | at

least 25% of the total project development cost must have been incurred; |

| ● | the

progress and the expected completion and delivery date of the construction must be fixed; |

| ● | the

pre-sale permit must have been obtained; and |

| ● | the

completion of certain milestones in the construction processes must be specified by the local government authorities. |

These mandatory conditions

are designed to require a certain level of capital expenditure and substantial progress in project construction before the commencement

of pre-sales. Generally, the local governments also require developers and property purchasers to have standard pre-sale contracts prepared

under the auspices of the government. Developers are required to file all pre-sale contracts with local land bureaus and real estate

administrations after entering into such contracts.

After-Sale Services and Delivery

We assist customers

in arranging for and providing information related to financing. We also assist our customers in various title registration procedures

related to their properties, and we have set up an ownership certificate team to assist purchasers to obtain their property ownership

certificates. We offer various communication channels to customers to facilitate customer feedback collection. We also cooperate with

property management companies that manage our properties and ancillary facilities, to handle customer feedback.

We endeavor to deliver

the units to our customers on a timely basis. We closely monitor the progress of construction of our property projects and conduct pre-delivery

property inspections to ensure timely delivery. The time frame for delivery is set out in the sale and purchase agreements entered into

with our customers, and we are subject to penalty payments to the purchasers for any delay in delivery caused by us. The Company has

never incurred any delay penalties. Once a property development has been completed, has passed the requisite government inspections and

is ready for delivery, we will notify our customers and hand over keys and possession of the properties.

Marketing and Distribution Channel

We

maintain a marketing and sales force for our development projects, which at September 30, 2023 consisted of 43 employees

specializing in marketing and sales. We also train and use outside real estate

agents to market and increase the public awareness of our projects, and spread the acceptance and influence of our brand. However, our

marketing and sales are primarily conducted by our own sales force because we believe our own dedicated sales representatives are better

motivated to serve our customers as well as to control our property pricing and selling expenses.

Our marketing and sales

team develops the appropriate advertising and selling plan for each project. We develop public awareness through marketing and advertising

as well as referrals from customers. We utilize a customer relationship management system to track customer profiles, which helps us

to forecast future customer requirements and general demand for our projects. This allows us to have real-time information on the status

of individual customer transactions as well as available inventory by project, which enables us to better anticipate the preferences

of current and future customers.

We use various advertising

media to market our developments and enhance our brand name, including newspapers, magazines, television, radio, e-marketing and outdoor

billboards. We also participate in real estate exhibitions.

We have also developed

a strong relationship with local institutional purchasers and governments. The Company has entered into various significant residential-apartment

group-purchase agreements with local government and institutional purchasers.

A typical real estate

property sales transaction usually consists of three steps. First, the customer pays a deposit to the Company. Within a week, after paying

the deposit, the customer will sign a purchase contract with us and make a down payment to us in cash. After making the down payment,

the customer arranges for a mortgage loan for the balance of the purchase price. Once the loan is approved, the mortgage loan proceeds

are paid to us directly by the bank. Finally, we deliver the property to the customer. Legal title, as evidenced by a property ownership

certificate issued by local land and construction bureaus, will be delivered to the customer.

For customers purchasing

properties with mortgage financing, under current PRC laws, their minimum down payment is 30% of the total purchase price for the purchase

of the first self-use residential unit with total GFA of 90 square meters (about 970 square feet) or more on all existing units and those

yet to be completed, and a down payment of 20% on the first residential units for self-use with total GFA of under 90 square meters.

In order to mitigate the default risk, the Company requires from its homebuyer customers deposits ranging from 30% - 50% of the purchase

price, which is higher than the percentage required by the government for the mortgage down payment.

Like most real estate

companies in China, we generally provide guarantees to mortgagee banks in respect of the mortgage loans provided to the purchasers of

our properties up until completion of the registration of the mortgage with the relevant mortgage registration authorities. As of September

30, 2023, the Company had security deposits for these guarantees of approximately $2.6 million. Guarantees for mortgages on residential

properties are typically discharged when the individual property ownership certificates are issued. In our experience, the issuance of

the individual property ownership certificates typically takes six to twelve months, so our mortgage guarantees typically remain outstanding

for up to twelve months after we deliver the underlying property.

Our Property Development Operations

We have a systematic

and standardized process of project development, which we implement through several well-defined phases. One critically significant portion

of our process is the land acquisition process, which is segmented into three stages: (i) opportunity identification, (ii) initial

planning and budgeting, and (iii) land use rights acquisition. The following diagram sets forth the key stages of our property development

process.

| LAND

ACQUISITION PROCESS |

|

Project

planning and

design |

|

Project

construction

and

Management |

|

Pre-sale, sale

and marketing |

|

After-sale

and delivery |

|

| |

|

|

|

|

|

|

|

|

|

| Opportunity

Identification |

|

Initial

Planning |

|

Land

Acquisition |

|

|

|

|

|

| -Strategic

planning |

|

-Feasibility

study |

|

-Financial

assessment |

|

-Outsource

architectural and engineering design |

|

-Outsource

construction |

|

-Pre-sale |

|

-Delivery |

|

| -Geographic

and market analysis |

|

- Preliminary design

|

|

-Internal approval

|

|

-Design

management |

|

-Construction

supervision |

|

-Marketing |

|

-Feedback

collection |

|

| |

|

-Project

evaluation |

|

-Bidding

process |

|

-Arrange

financing |

|

-Quality

control |

|

-Advertising |

|

|

|

| |

|

|

|

|

|

|

|

-Completion

inspection |

|

|

|

|

|

| |

|

|

|

|

|

|

|

-Landscaping

and fixture installation |

|

|

|

|

|

Our Projects

Overview

We develop the following

three types of real estate projects, which may be developed in one or more phases:

| ● | multi-layer

apartment buildings, which are typically six stories or less; |

| ● | sub-high-rise

apartment buildings, which are typically seven to 11 stories; and |

| ● | high-rise

apartment buildings, which are typically 12 to 33 stories. |

At any one time, our

projects (or phases of our projects) are in one of the following three stages:

| ● | completed

projects, meaning properties for which construction has been completed; |

| ● | properties

under construction, meaning properties for which construction permits have been obtained but construction has not been completed; and |

| ● | properties

under planning, meaning properties for which we have entered into land grant contracts and are in the process of obtaining the required

permits to begin construction. |

Our main projects located

in Hanzhong City are: Mingzhu Beiyuan, Oriental Pearl Garden and Liangzhou Road related projects. In Yang County, our project is

Yangzhou Pearl Garden and Yangzhou Palace. Most projects are being developed in multiple phases.

Real Estate Projects located in Hanzhong

City

Mingzhu Garden - Mingzhu Beiyuan

This project is located in the southwest

part of Hanzhong City. The Phase I project includes two high-rise residential buildings with commercial shops located on the first

floor with unsold GFA of Nil square meters as of September 30, 2020. The Phase II Mingzhu Beiyuan project includes 17 high-rise

residential buildings with GFA of 358,058 square meters. The Company started construction in the third quarter of fiscal 2012 and

completed the construction in the last quarter of fiscal 2015. As of September 30, 2023, the unsold GFA was 78,677 square meters;

un-allocated costs was $20,151,590. |

|

|

Oriental Pearl Garden

This project is located in the downtown of

Hanzhong City. The Company started construction in the third quarter of fiscal 2012. It consists of 12 high-rise residential buildings

with commercial shops on the first and second floors with GFA of approximately 275,014 square meters. The project was fully completed

in fiscal 2016. As of September 30, 2023, the unsold GFA was 53,506 square meters; un-allocated costs was $16,989,637. |

|

|

Real Estate Projects located in Yang

County

Yangzhou Pearl Garden

Yangzhou Pearl Garden

mainly consists of multi-layer residential buildings and sub-high-rise residential buildings with commercial shops on the first floors.

As of September 30, 2021, the remaining unsold GFA of Phase I of Yangzhou Pearl Garden, which includes multi-layer residential buildings,

commercial units, sub-high-rise and high-rise residential buildings was a total GFA of Nil square meters. Yangzhou Pearl Garden Phase

II consists of five high-rise residential buildings and one multi-layer residential building, with a total GFA of 67,991 square meters.

The construction was completed in fiscal 2015. As of September 30, 2023, the unsold GFA of Yangzhou Pearl Garden Phase II was 10,455

square meters; un-allocated costs was $1,981,727.

Yangzhou Palace

The Company is currently

constructing 9 high-rise residential buildings and 16 sub-high-rise residential and multi-layer residential buildings with total GFA

of 297,059 square meters in Yangzhou Palace located in Yang County. The construction started in the fourth quarter of fiscal 2013 and

was completed during the year ended September 30, 2021. The Company received the pre-sale license on September 1, 2016 and started

to promote and sell the property in November 2016. As of September 30, 2023, the remaining unsold GFA of Yangzhou Palace, which

includes multi-layer residential buildings, commercial units, sub-high-rise and high-rise residential buildings was a total GFA of 86,541

square meters; un-allocated costs was $33,009,114.

The following table

sets forth our real estate projects in the year ended September 30, 2023:

| | |

| |

| |

| | |

Unsold

GFA as of | |

| | |

| |

| |

GFA sold / disposed | | |

September 30, | |

| Project Name | |

Location | |

Type of Buildings | |

during the year | | |

2023 | |

| Mingzhu Garden | |

| |

| |

| | |

| |

| (Mingzhu Beiyuan) Phase II | |

Hanzhong City | |

High-rise residential | |

| — | | |

| 78,677 | |

| | |

| |

| |

| | | |

| | |

| Oriental Pearl Garden | |

Hanzhong City | |

High-rise residential | |

| — | | |

| 53,506 | |

| | |

| |

| |

| | | |

| | |

| Yangzhou Pearl Garden Phase II | |

Yang County | |

High-rise residential | |

| 90 | | |

| 10,455 | |

| Yangzhou Palace | |

Yang County | |

High-rise residential | |

| 1,448 | | |

| 86,541 | |

| Total | |

| |

| |

| 1,538 | | |

| 229,179 | |

| (1) | The

amounts for “total GFA” in this table are the amounts of total saleable gross floor area and are derived on the following

basis: |

| ● | for

properties that are sold, the stated GFA is based on sales contracts relating to such property; |

| ● | for

unsold properties that are completed, the stated GFA is calculated based on the detailed construction blueprint and the calculation method

approved by the PRC government for saleable GFA, after necessary adjustments; and |

| ● | for

properties that are under planning, the stated GFA is based on the land grant contract and our internal projections. |

Suppliers

Land Bank

In China, the supply

of land is controlled by the government. Since the early 2000s, the real estate industry in China has been transitioning from an

arranged system controlled by the PRC government to a more market-oriented system. At present, although the Chinese government still

owns all urban land in China, land use rights with terms of up to 70 years can be granted to, owned or leased by, private individuals

and companies.

Land - under planning

and development

In

May 2011, the Company entered into a development agreement with the local government. Pursuant to the agreement, the Company will

prepay the development cost of approximately $16.4 million (RMB 119,700,000) and the Company has the right to acquire the land use rights

through public bidding. The prepaid development cost will be deducted from the final purchase price of the land use rights. As of September

30, 2023, a deposit of approximately $2.1 million was paid by the Company (2022- $2.2 million). The

local government is still in a slow process of re-zoning the property. The Company expects to make payment of the remaining development

cost based on the government’s current work progress.

All land transactions

are required to be reported to and authorized by the local Bureau of Land and Natural Resources. With respect to real estate project

design and construction services, the Company typically selects the lowest-cost provider based on quality selected through an open bidding

process. Such service providers are numerous in China and the Company foresees no difficulties in securing alternative sources of services

as needed.

Other Suppliers

The Company uses various

suppliers in the construction of its projects. For the year ended September 30, 2023 and 2022, no suppliers accounted for more than 10%

of the total project expenditures

Competition

Real Estate Development

Business

The real estate industry

in China is highly competitive. In the Tier 3 and Tier 4 cities and counties that we focus on, the markets are relatively more fragmented

than in the Tier 1 or Tier 2 cities. We compete primarily with regional property developers and an increasing number of large national

property developers who have also started to enter these markets. Competitive factors include the geographical location of the projects,

the types of products offered, brand recognition, price, designing and quality. In the regional markets in which we operate, our major

competitors include regional real estate developers Wanbang Real Estate Development Co. Ltd. (“Wanbang”), Jingtai Real Estate

Development Co. Ltd. (“Jingtai”) and Shaanxi Fenghui Real Estate Development Co. Ltd. (“Fenghui”) as well as

other national real estate developers such as Evergrande Real Estate Group (“Evergrande”) who have also started their projects

in these local markets.

Nationally, there are

numerous national real estate developers that have real estate projects across China. There are many housing and land development companies

listed on the Shanghai and Shenzhen Stock Exchanges. However, such companies usually undertake large scale projects and are unlikely

to compete with the Company for business as the Company targets small to medium sized projects in Tier 3 and Tier 4 cities and counties.

In the regional market,

the Company’s only direct competitor with meaningful market share in the market is Wanbang. This company generally undertakes medium

and small scale projects and focuses on development of commercial real estate properties, such as hotels and shopping centers.

New Energy Business

Some prominent competitors in lithium battery

recycling sector include Contemporary Amperex Technology Co. Ltd. (CATL), Li-Cycle Corp, Redwood Materials, American Manganese Inc and

Retriev Technologies etc.

CATL is a leading global player in the development

and manufacturing of lithium-ion batteries for electric vehicles (EVs) and energy storage systems. Headquartered in Ningde, Fujian, China,

CATL has rapidly grown to become one of the world’s largest suppliers of EV batteries, boasting a significant market share. The company

is known for its strong focus on research and development, leading to advancements in battery technology, lifespan, and energy density.

Li-Cycle Corp is based in Canada but with

significant operations in the U.S., Li-Cycle is known for its patented Spoke & Hub Technologies, which allow for the recovery of high-grade

materials from used lithium batteries.

Redwood Materials was founded by a former

Tesla CTO, Redwood Materials is gaining attention for its advanced recycling processes and focus on creating a closed-loop supply chain

for battery materials.

American Manganese Inc specializes in using

its patented process for recycling lithium-ion battery cathode materials.

With over 30 years of experience, Retriev

Technologies (formerly Toxco Inc.) is a veteran in battery recycling, including lithium batteries.

Competitive Strength:

We believe the following

strengths allow us to compete effectively:

Real Estate Development Business

Well Positioned to

Capture Opportunities in Tier 3 and Tier 4 Cities and Counties.

With the increase in

consumer disposable income and urbanization rates, a growing middle-income consumer market has emerged driving demand for affordable

and high quality housing in many cities across northwest China. We focus on building large communities of modern, mid-sized residential

properties for this market segment and have accumulated substantial knowledge and experience about the residential preferences and demands

of mid-income customers. We believe we can leverage our experience to capture the growth opportunities in the markets.

Standardized and

Scalable Business Model.

Our business model focuses

on a standardized property development process designed for rapid asset turnover. We break up the overall process into well-defined stages

and closely monitor costs and development schedules through each stage. These stages include (i) identifying land, (ii) pre-planning

and budgeting, (iii) land acquisition, (iv) detailed project design, (v) construction management, (vi) pre-sales,

sales and (vii) after-sale services. We commence pre-planning and budgeting prior to the land acquisition, which enables us to acquire

land at costs that meet our pre-set investment targeted returns and to quickly begin the development process upon acquisition. Our enterprise

resource planning enables us to collect and analyze information on a real-time basis throughout the entire property development process.

We utilize our customer relationship management system to track customer profiles and sales to forecast future individual preferences

and market demand.

Experienced Management

Team Supported by Trained and Motivated Workforce.

Our management and workforce

are well-trained and motivated. Employees receive on-going training in their areas of specialization at our head office in Hanzhong.

Guangsha is also an

“AAA Enterprise in Shaanxi Construction Industry” as recognized by the Credit Association of Agricultural Bank of China,

Shaanxi Branch.

Strategies

Our goal is to become

the leading residential property developer focused on China’s Tier 3 and Tier 4 cities and counties by implementing the following

strategies:

Continue

Expanding in Selected Tier 3 and Tier 4 Cities. We believe that Tier 3 and Tier 4 cities and counties present development opportunities

that are well suited for our scalable business model of rapid asset turnover. Furthermore, Tier 3 and Tier 4 cities and counties currently

tend to be in an early stage of market maturity and have fewer large national developers. We believe that the fragmented market and relative

abundance of land supply in Tier 3 and Tier 4 cities, as compared to Tier 1 and Tier 2 cities, offer more opportunities for us to generate

attractive margins. And we also believe that our experience affords us the opportunity to emerge as a leading developer in these markets.

In the near future, we plan to enter into other Tier 3 and Tier 4 cities that have:

| ● | Increasing

urbanization rates and population growth; |

| ● | High

economic growth and increasing individual income; and |

| ● | Sustainable

land supply for future developments. |

We plan to continue

to closely monitor our capital and cash positions and carefully manage our cost for land use rights, construction costs and operating

expenses. We believe that we will be able to use our working capital more efficiently by adhering to prudent cost management, which will

help to maintain our profit margins. When selecting a property project for development, we will continue to follow our established internal

evaluation process, including utilizing the analysis and input of our experienced management team and choosing third-party contractors

through a tender process open only to bids which meet our budgeted costs.

Nevertheless, due to

the global economy slowdown and deteriorating real estate property market in mainland China, the Company is adjusting its property development

strategy from aggressive expansion to survive through this critical and challenging period as its priority.

New

Energy Business

The company has strategically

leveraged its resources by deploying experienced personnel from mainland China, renowned for its advanced and sophisticated lithium production

and recycling technology. This move not only ensures access to cutting-edge methodologies but also embeds a deep understanding of the

industry within the company’s operational framework. Furthermore, the firm has assembled a senior management team, each member

handpicked for their extensive industry experience. This leadership is instrumental in steering the company’s operations towards

efficiency and innovation, harnessing their collective expertise to navigate the complexities of the lithium production and recycling

sector. This combination of skilled manpower and seasoned leadership distinctly positions the company to excel in a competitive market.

Quality Control

We emphasize quality

control to ensure that our buildings and residential units meet our standards and provide high quality service. We select only experienced

design and construction companies. We, through our contracts with construction contractors, provide customers with warranties covering

the building structure and certain fittings and facilities of our property developments in accordance with the relevant regulations.

To ensure construction quality, our construction contracts contain quality warranties and penalty provisions for poor work quality. In

the event of delay or poor work quality, the contractor may be required to pay pre-agreed damages under our construction contracts. Our

construction contracts do not allow our contractors to subcontract or transfer their contractual arrangements with us to third parties.

We typically withhold 2% of the agreed construction fees for two to five years after completion of the construction as security to guarantee

quality, which provides us with assurance for our contractors’ work quality.

Our contractors are

also subject to our quality control procedures, including examination of materials and supplies, on-site inspection and production of

progress reports. We require our contractors to comply with relevant PRC laws and regulations, as well as our own standards and specifications.

We set up a profile for each and every unit constructed and monitor the quality of such unit throughout its construction period until

its delivery. We also employ independent surveyors to supervise the construction progress. In addition, the construction of real estate

projects is regularly inspected and supervised by the PRC governmental authorities.

Environmental Matters

As a developer of property

in the PRC, we are subject to various environmental laws and regulations set by the PRC national, provincial and municipal governments.

These include regulations on air pollution, noise emissions, as well as water and waste discharge. As of September 30, 2023,

we have never paid any penalties associated with the breach of any such laws and regulations. Compliance with existing environmental

laws and regulations has not had a material adverse effect on our financial condition and results of operations, and we do not believe

it will have such an impact in the future.

Our projects are normally

required to undergo an environmental impact assessment by government-appointed third parties, and a report of such assessment needs to

be submitted to the relevant environmental authorities in order to obtain their approval before commencing construction.

Upon completion of each

project, the relevant environmental authorities inspect the site to ensure the applicable environmental standards have been complied

with, and the resulting report is presented together with other specified documents to the relevant construction administration authorities

for their approval and records. Approval from the environmental authorities on such report is required before we can deliver our completed

work to our customers. As of September 30, 2023, we have not experienced any difficulties in obtaining those approvals for commencement

of construction and delivery of completed projects.

Employees

We

currently have 95 full-time employees.

| Department | |

| |

| Management | |

| 15 | |

| Accounting Staff | |

| 11 | |

| Sales and marketing staff | |

| 43 | |

| Administrative | |

| 26 | |

| Total | |

| 95 | |

Contractual Arrangements between Shaanxi

HGS and Guangsha

Due to PRC legal restrictions

on foreign ownership, neither we nor our subsidiaries own any direct equity interest in Guangsha. Instead, we control and receive the

economic benefits of Guangsha’s business operation through a series of contractual arrangements. Shaanxi HGS, Guangsha and the

Guangsha shareholders entered into a series of contractual arrangements, also known as VIE Agreements. The VIE agreements are designed

to provide Shaanxi HGS with the power, rights and obligations equivalent in all material respects to those it would possess as the sole

equity holder of Guangsha, including absolute control rights and the rights to the assets, property and revenue of Guangsha. If Guangsha

or the Guangsha’s shareholders fail to perform their respective obligations under the contractual arrangements, we could be limited

in our ability to enforce the contractual arrangements that give us effective control over Guangsha and its subsidiary. Furthermore,

if we are unable to maintain effective control, we would not be able to continue to consolidate the financial results of our variable

interest entity in our financial statements.

Although we took every precaution available to effectively enforce

the contractual and corporate relationship above, these contractual arrangements may still be less effective than direct ownership and

that the Company may incur substantial costs to enforce the terms of the arrangements. For example, the VIE and its shareholders could

breach their contractual arrangements with us by, among other things, failing to conduct their operations in an acceptable manner or taking

other actions that are detrimental to our interests. If we had direct ownership of the VIE, we would be able to exercise our rights as

a shareholder to effect changes in the board of directors of the VIE, which in turn could implement changes, subject to any applicable

fiduciary obligations, at the management and operational level. However, under the current contractual arrangements, we rely on the performance

by the VIE and its shareholders of their obligations under the contracts to exercise control over the VIE. The shareholders of our consolidated

VIE may not act in the best interests of our Company or may not perform their obligations under these contracts. In addition, failure

of the VIE shareholders to perform certain obligations could compel the Company to rely on legal remedies available under PRC laws, including

seeking specific performance or injunctive relief, and claiming damages, which may not be effective.

All of these contractual

arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. The legal environment

in the PRC is not as developed as in some other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal

system could limit our ability to enforce these contractual arrangements. In the event we are unable to enforce these contractual arrangements,

we may not be able to exert effective control over our operating entities and we may be precluded from operating our business, which

would have a material adverse effect on our financial condition and results of operations. In addition, there is uncertainty as to whether

the courts of the Cayman Islands or the PRC would recognize or enforce judgments of U.S. courts against us or such persons predicated

upon the civil liability provisions of the securities laws of the United States or any state.

Selected Condensed Consolidated Financial

Schedule of the Company and its Subsidiaries and the VIE

The following tables

present selected condensed consolidating financial data of the Company and its subsidiaries and the VIE for the fiscal years ended September

30, 2023 and 2022, and balance sheet data as of September 30, 2023 and 2022, which have been derived from our consolidated financial

statements for those years.

SELECTED CONDENSED

CONSOLIDATING STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (LOSS)

| | |

For the Year Ended September 30, 2023 | |

| | |

The | | |

| | |

| | |

| | |

Consolidated | |

| | |

Company | | |

Subsidiaries | | |

VIE | | |

Eliminations | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | — | | |

$ | 788,582 | | |

$ | 754,598 | | |

$ | — | | |

$ | 1,543,180 | |

| (Loss)/Income from equity method investment | |

$ | (104,086,934 | ) | |

$ | — | | |

$ | — | | |

$ | 104,086,934 | | |

$ | — | |

| Net income (loss) | |

$ | (110,121,478 | ) | |

$ | (311,764 | ) | |

$ | (103,775,170 | ) | |

$ | 104,086,934 | | |

$ | (110,121,478 | ) |

| Comprehensive income (loss) | |

$ | (109,059,183 | ) | |

$ | (311,764 | ) | |

$ | (102,712,875 | ) | |

$ | 103,024,639 | | |

$ | (109,059,183 | ) |

| | |

For the Year Ended September 30, 2022 | |

| | |

The | | |

| | |

| | |

| | |

Consolidated | |

| | |

Company | | |

Subsidiaries | | |

VIE | | |

Eliminations | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | — | | |

$ | — | | |

$ | 9,577,405 | | |

$ | — | | |

$ | 9,577,405 | |

| (Loss)/Income from equity method investment | |

$ | (87,959,503 | ) | |

$ | — | | |

$ | — | | |

$ | 87,959,503 | | |

$ | — | |

| Net income (loss) | |

$ | (108,124,682 | ) | |

$ | (65 | ) | |

$ | (87,959,438 | ) | |

$ | 87,959,503 | | |

$ | (108,124,682 | ) |

| Comprehensive income (loss) | |

$ | (119,559,356 | ) | |

$ | (65 | ) | |

$ | (99,394,112 | ) | |

$ | 99,394,177 | | |

$ | (119,559,356 | ) |

SELECTED CONDENSED

CONSOLIDATING BALANCE SHEETS

| | |

As of September 30, 2023 | |

| | |

The | | |

| | |

| | |

| | |

Consolidated | |

| | |

Company | | |

Subsidiaries | | |

VIE | | |

Eliminations | | |

Total | |

| Cash | |

$ | 2,193 | | |

$ | 45,572 | | |

$ | 45,368 | | |

$ | — | | |

$ | 93,133 | |

| Investments in subsidiaries and VIE | |

$ | (10,383,477 | ) | |

$ | — | | |

$ | — | | |

$ | 10,383,477 | | |

$ | — | |

| Total assets | |

$ | 18,443,202 | | |

$ | 442,545 | | |

$ | 178,996,918 | | |

$ | 7,209,803 | | |

$ | 205,092,468 | |

| Total liabilities | |

$ | 2,749,245 | | |

$ | 2,162,144 | | |

$ | 184,487,122 | | |

$ | — | | |

$ | 189,398,511 | |

| Total shareholders’ equity | |

$ | 15,693,957 | | |

$ | (1,719,599 | ) | |

$ | (5,490,204 | ) | |

$ | 7,209,803 | | |

$ | 15,693,957 | |

| Total liabilities and shareholders’ deficit | |

$ | 18,443,202 | | |

$ | 442,545 | | |

$ | 178,996,918 | | |

$ | 7,209,803 | | |

$ | 205,092,468 | |

| | |

As of September 30, 2022 | |

| | |

The | | |

| | |

| | |

| | |

Consolidated | |

| | |

Company | | |

Subsidiaries | | |

VIE | | |

Eliminations | | |

Total | |

| Cash | |

$ | 1,074,440 | | |

$ | 2,000 | | |

$ | 283,777 | | |

$ | — | | |

$ | 1,360,217 | |

| Investments in subsidiaries and VIE | |

$ | 94,868,534 | | |

$ | — | | |

$ | — | | |

$ | (94,868,534 | ) | |

$ | — | |

| Total assets | |

$ | 123,043,589 | | |

$ | (70 | ) | |

$ | 280,939,924 | | |

$ | (96,596,049 | ) | |

$ | 307,387,394 | |

| Total liabilities | |

$ | 3,597,919 | | |

$ | 669,765 | | |

$ | 183,674,040 | | |

$ | — | | |

$ | 187,941,724 | |

| Total shareholders’ equity | |

$ | 119,445,670 | | |

$ | (669,835 | ) | |

$ | 97,265,884 | | |

$ | (96,596,049 | ) | |

$ | 119,445,670 | |

| Total liabilities and shareholders’ deficit | |

$ | 123,043,589 | | |

$ | (70 | ) | |

$ | 280,939,924 | | |

$ | (96,596,049 | ) | |

$ | 307,387,394 | |

SELECTED CONDENSED

CONSOLIDATING STATEMENTS OF CASH FLOWS

| | |

For the Year Ended September 30, 2023 | |

| | |

The | | |

| | |

| | |

| | |

Consolidated | |

| | |

Company | | |

Subsidiaries | | |

VIE | | |

Eliminations | | |

Total | |

| Net cash (used in) operating activities | |

$ | (6,279,717 | ) | |

$ | (56,428 | ) | |

$ | 855,047 | | |

$ | — | | |

$ | (5,481,098 | ) |

| Net cash provided by investing activities | |

$ | (100,000 | ) | |

$ | 100,000 | | |

$ | — | | |

$ | — | | |

$ | — | |

| Net cash used in financing activities | |

$ | 5,307,470 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 5,307,470 | |

| | |

For the Year Ended September 30, 2022 | |

| | |

The | | |

| | |

| | |

| | |

Consolidated | |

| | |

Company | | |

Subsidiaries | | |

VIE | | |

Eliminations | | |

Total | |

| Net cash (used in) operating activities | |

$ | (925,560 | ) | |

$ | 2,000 | | |

$ | 166,053 | | |

$ | — | | |

$ | (757,507 | ) |

| Net cash provided by investing activities | |

$ | (26,936,915 | ) | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | (26,936,915 | ) |

| Net cash used in financing activities | |

$ | 28,936,915 | | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 28,936,915 | |

Transfers of Cash

to and from The VIE

Green Giant Inc. is

a holding company with no operations of its own. We conduct our operations in China primarily through our subsidiary and VIE in China.