UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 5)

Agrify Corporation

(Name of Issuer)

Common Stock, $0.001 par value

(Title of Class of Securities)

00853E 305

(CUSIP Number)

Raymond Chang

c/o Agrify Corporation

2468 Industrial Drive

Troy, MI 48084

(617) 896-5243

(Name, Address and Telephone

Number of Person Authorized to Receive Notices and Communications)

May 21, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ☐

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. |

The information required in the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 00853E 305

| 1. |

Names of Reporting Persons

Raymond Nobu Chang

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

☐ |

| |

(b) |

☒

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

PF (See Item 3)

|

| 5. |

Check box if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) b

☐

|

| 6. |

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole Voting Power

6,909(1)

|

| 8. |

Shared Voting Power

13,802,042(2)

|

| 9. |

Sole Dispositive Power

6,909(1)

|

| 10. |

Shared Dispositive Power

13,802,042(2)

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

13,808,951(2)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions)

☐

|

| 13. |

Percent of Class Represented by Amount in Row (11)

49.99%(3)

|

| 14. |

Type of Reporting Person (See Instructions)

IN

|

| (1) |

Consists of (i) 575 shares of common stock, par value

$0.001, of Agrify Corporation (“Common Stock”), held individually and (ii)

up to 6,334 shares of Common Stock issuable upon exercise of stock options held by Mr. Chang that are exercisable within 60 days

of the date hereof. Does not include 337,743 shares of Common Stock underlying time-based restricted

stock units that will not vest within 60 days of the day hereof granted to Mr. Chang under the Agrify Corporation 2022 Omnibus

Equity Incentive Plan, as amended (the “Plan”). |

| (2) |

Consists of (i)

1,717,051 shares of Common Stock held by RTC3 2020 Irrevocable Trust (“RTC3”), of which Mr. Chang retains the ability to remove

the independent trustee, (ii) warrants to purchase 231,223 shares of Common Stock held by RTC3 that are exercisable within 60 days of

the date hereof, subject to a 9.99% beneficial ownership limitation, (iii) 648 shares of Common Stock

held by NXT3J Capital, LLC (“NXT3J”), an entity controlled by Mr. Chang, (iv) that number of shares of Common Stock issuable

to CP Acquisitions, LLC (“CP Acquisitions”), an entity controlled by Mr. Chang, issuable to Mr. Chang upon the conversion

of that certain Senior Secured Amended, Restated and Consolidated Convertible Note, as amended (the “Convertible Note”)

due 2025 described herein with an outstanding principal amount of $3,500,000.00

and a conversion price of $1.46 per share (as may be adjusted per the Senior Secured Amended, Restated and Consolidated Convertible Note

due 2025 from time to time), which conversion is subject to a 49.99% beneficial ownership limitation; provided that CP Acquisitions

may assign its right to receive shares of common stock upon conversion to Mr. Chang and/or Ms. I-Tseng Jenny Chan, each a

member of the Board of Directors of the Issuer (“Board”), in which case the 49.99%

beneficial ownership limitation will apply to each of them individually, (v) pre-funded warrants to purchase 7,876,712 shares of

Common Stock held by CP Acquisitions that are exercisable within 60 days of the date hereof, subject to a 49.99% beneficial ownership

limitation, (vi) pre-funded warrants to purchase 7,383,053 shares of Common Stock held by GIC Acquisition LLC (“GIC Acquisition”)

that are exercisable within 60 days of the date hereof, subject to a 49.99% beneficial ownership limitation, (vii) options to purchase

200 shares of common stock that are held by Raymond Chang Jr., Mr. Chang’s son, that are exercisable

within 60 days of the date hereof, and (viii) 1,578,947 shares

of Common Stock held individually by Chinwei Wang, Mr. Chang’s spouse. Does not include (i) up to 3 shares

of Common Stock issuable upon exercise of stock options held by Raymond Chang, Jr., that are not exercisable within 60 days of the date

hereof and (ii) 105,139 shares of Common Stock underlying time-based restricted stock units that

will not vest within 60 days of the day hereof granted to Raymond Chang, Jr., under the Plan.

Mr. Chang disclaims beneficial ownership with

respect to the shares and warrants held by RTC3, the shares held by NXT3J, the shares entitled to CP Acquisitions upon conversion of its

convertible note, the options and shares held by Raymond Chang Jr., and the shares held by Chinwei Wang, in each case except to the extent

of his pecuniary interest therein. |

| (3) |

Based on 14,229,386 shares of Common Stock outstanding as of May 13, 2024, as set forth in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed with the Securities and Exchange Commission (the “SEC”) on May 21, 2024, plus the shares of Common Stock issuable upon exercise of the warrants and options and conversion of the convertible note in footnotes (1) and (2) above, subject to applicable beneficial ownership limitations. |

CUSIP No. 00853E 305

| 1. |

Names of Reporting Persons

RTC3 2020 Irrevocable Trust

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

☐ |

| |

(b) |

☒

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO (See Item 3)

|

| 5. |

Check box if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) b

☐

|

| 6. |

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole Voting Power

0

|

| 8. |

Shared Voting Power

1,948,274(1)

|

| 9. |

Sole Dispositive Power

0

|

| 10. |

Shared Dispositive Power

1,948,274(1)

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,948,274(1)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions)

☐

|

| 13. |

Percent of Class Represented by Amount in Row (11)

13.47%(2)

|

| 14. |

Type of Reporting Person (See Instructions)

OO

|

| (1) |

Consists of (i) 1,717,051 shares of Common Stock held by RTC3, and (ii) warrants to purchase 231,223 shares of Common Stock held by RTC3 that are exercisable within 60 days of the date hereof, subject to a 9.99% beneficial ownership limitation. Does not include the 1,578,947 shares of Common Stock held individually by Chinwei Wang which may in the future be transferred to RTC3 for estate planning purposes. |

| (2) |

Based on 14,229,386 shares of Common Stock outstanding as of May 13, 2024, as set forth in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed with the SEC on May 21, 2024, plus the shares of Common Stock issuable upon exercise of the warrants described in footnote (1) above, subject to the beneficial ownership limitation described therein. |

CUSIP No. 00853E 305

| 1. |

Names of Reporting Persons

NXT3J Capital, LLC

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

☐ |

| |

(b) |

☒

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

WC (See Item 3)

|

| 5. |

Check box if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) b

☐

|

| 6. |

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole Voting Power

0

|

| 8. |

Shared Voting Power

648(1)

|

| 9. |

Sole Dispositive Power

0

|

| 10. |

Shared Dispositive Power

648(1)

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

648(1)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions)

☐

|

| 13. |

Percent of Class Represented by Amount in Row (11)

0.0%(2)

|

| 14. |

Type of Reporting Person (See Instructions)

PN

|

| (1) | Consists of 648 shares of Common Stock held by NXT3J. |

| (2) |

Based on 14,229,386 shares of Common Stock outstanding as of May 13, 2024, as set forth in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed with the SEC on May 21, 2024. |

CUSIP No. 00853E 305

| 1. |

Names of Reporting Persons

CP Acquisitions, LLC

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

☐ |

| |

(b) |

☒

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

WC (See Item 3)

|

| 5. |

Check box if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) b

☐

|

| 6. |

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole Voting Power

0

|

| 8. |

Shared Voting Power

10,273,973(1)

|

| 9. |

Sole Dispositive Power

0

|

| 10. |

Shared Dispositive Power

10,273,973(1)

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

10,273,973(1)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions)

☐

|

| 13. |

Percent of Class Represented by Amount in Row (11)

49.99%(2)

|

| 14. |

Type of Reporting Person (See Instructions)

PN

|

| (1) |

Includes (i) that number of shares of Common Stock issuable to CP Acquisitions, an entity controlled by Mr. Chang, issuable to Mr. Chang upon the conversion of the Convertible Note due 2025 described herein with an outstanding principal amount of $3,500,000.00 and a conversion price of $1.46 per share (as may be adjusted per the Senior Secured Amended, Restated and Consolidated Convertible Note due 2025 from time to time), which conversion is subject to a 49.99% beneficial ownership limitation; provided that CP Acquisitions may assign its right to receive shares of common stock upon conversion to Mr. Chang and/or Ms. I-Tseng Jenny Chan, each a member of the Board, in which case the 49.99% beneficial ownership limitation will apply to each of them individually, and (ii) pre-funded warrants to purchase 7,876,712 shares of Common Stock held by CP Acquisitions that are exercisable within 60 days of the date hereof, subject to a 49.99% beneficial ownership limitation. |

| (2) |

Based on 14,229,386 shares of Common Stock outstanding as of May 13, 2024, as set forth in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed with the SEC on May 21, 2024, plus the shares of Common Stock issuable upon conversion of the convertible note and the shares of Common Stock purchasable upon exercise of the pre-funded warrants described in footnote (1) above, subject to applicable beneficial ownership limitations. |

CUSIP No. 00853E 305

| 1. |

Names of Reporting Persons

GIC Acquisition LLC

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

☐ |

| |

(b) |

☒

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

WC (See Item 3)

|

| 5. |

Check box if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) b

☐

|

| 6. |

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole Voting Power

0

|

| 8. |

Shared Voting Power

7,383,053 (1)

|

| 9. |

Sole Dispositive Power

0

|

| 10. |

Shared Dispositive Power

7,383,053 (1)

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

7,383,053 (1)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions)

☐

|

| 13. |

Percent of Class Represented by Amount in Row (11)

34.16%(2)

|

| 14. |

Type of Reporting Person (See Instructions)

PN

|

| (1) | Includes pre-funded warrants to purchase 7,383,053 shares

of Common Stock held by GIC Acquisition that are exercisable within 60 days of the date hereof, subject to a 49.99% beneficial ownership

limitation. |

| (2) | Based on 14,229,386 shares of Common Stock outstanding as

of May 13, 2024, as set forth in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed

with the SEC on May 21, 2024, plus the shares of Common Stock purchasable upon exercise of the pre-funded warrants described in footnote

(1) above, subject to applicable beneficial ownership limitations. |

CUSIP No. 00853E 305

| 1. |

Names of Reporting Persons

Raymond Chang Jr.

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

☐ |

| |

(b) |

☒

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO (See Item 3)

|

| 5. |

Check box if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) b

☐

|

| 6. |

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole Voting Power

0

|

| 8. |

Shared Voting Power

200(1)

|

| 9. |

Sole Dispositive Power

0

|

| 10. |

Shared Dispositive Power

200(1)

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

200(1)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions)

☐

|

| 13. |

Percent of Class Represented by Amount in Row (11)

0.0%(2)

|

| 14. |

Type of Reporting Person (See Instructions)

IN

|

| (1) |

Consists of up to 200 shares of Common Stock issuable upon exercise of stock options held by Mr. Chang, Jr., that are exercisable within 60 days of the date hereof. Does not consist of (i) up to 3 shares of Common Stock issuable upon exercise of stock options held by Mr. Chang, Jr. that are not exercisable within 60 days of the date hereof and (ii) 105,139 shares of Common Stock underlying time-based restricted stock units that will not vest within 60 days of the day hereof granted to Mr. Chang, Jr. under the Plan. |

| (2) |

Based on 14,229,386 shares of Common Stock outstanding as of May 13, 2024, as set forth in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed with the SEC on May 21, 2024, plus 200 shares of Common Stock issuable upon exercise of the options described in footnote (1) above. |

CUSIP No. 00853E 305

| 1. |

Names of Reporting Persons

Chinwei Wang

|

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

(a) |

☐ |

| |

(b) |

☒

|

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO (See Item 3)

|

| 5. |

Check box if disclosure of legal proceedings is required pursuant

to Items 2(d) or 2(e) b

☐

|

| 6. |

Citizenship or Place of Organization

United States of America

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With: |

7. |

Sole Voting Power

1,578,947(1)

|

| 8. |

Shared Voting Power

0

|

| 9. |

Sole Dispositive Power

1,578,947(1)

|

| 10. |

Shared Dispositive Power

0

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,578,947(1)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions)

☐

|

| 13. |

Percent of Class Represented by Amount in Row (11)

11.10%(2)

|

| 14. |

Type of Reporting Person (See Instructions)

IN

|

| (1) |

Consists of 1,578,947 shares of Common Stock held individually, which may be transferred to RTC3 for estate planning purposes. |

| |

|

| (2) |

Based on 14,229,386 shares of Common Stock outstanding as of May 13, 2024, as set forth in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed with the SEC on May 21, 2024. |

SCHEDULE 13D – EXPLANATORY NOTE

This

Amendment No. 5 to the statement on Schedule 13D (“Amendment No. 5”)

amends the Schedule 13D originally filed by the Reporting Persons (as defined herein) on December

30, 2022, as amended by that certain Amendment No. 1 filed on October 31, 2023, Amendment No. 2 filed on January 29, 2024, Amendment

No. 3 filed on March 1, 2024, and Amendment No. 4 filed on March 29, 2024 (collectively, the “Schedule

13D”), and relates to the shares of Common Stock of the Agrify Corporation (“Issuer”)

beneficially owned by the Reporting Persons.

In

accordance with Rule 13d-2 of the Securities Exchange Act of 1934, as amended, except as specifically provided herein, this Amendment

No. 5 does not modify any of the information previously reported on the Schedule 13D. Capitalized

terms used but not otherwise defined in this Amendment No. 5 shall have the meanings ascribed to

them in the Schedule 13D.

Item 2. Identity and Background.

Item 2 of the Schedule 13D

is hereby amended and restated in its entirety as follows:

This statement is filed by

Raymond Nobu Chang (“Mr. Chang”), RTC3 2020 Irrevocable Trust (“RTC3”), NXT3J Capital, LLC (“NXT3J”),

CP Acquisitions, LLC (“CP Acquisitions”), GIC Acquisition LLC (“GIC Acquisition”), Raymond Chang

Jr. and Chinwei Wang (each, a “Reporting Person” and together, the “Reporting Persons”) with respect

to shares of Common Stock that they may be deemed to have beneficial ownership.

Mr. Chang’s principal

occupation is serving as a business executive and as Chairman of the Issuer’s Board of Directors. Raymond Chang Jr.’s principal

occupation is Director of Business Development of the Issuer. The principal occupation of RTC3, NXT3J, CP Acquisitions and GIC Acquisition

is asset management. Chinwei Wang is Mr. Chang’s spouse.

Mr. Chang, Raymond Chang Jr.

and Chinwei Wang are each a citizen of the United States of America, and their principal business address is c/o Agrify Corporation, 2468

Industrial Drive, Troy, MI 48084. RTC3 is organized under the laws of the Massachusetts, and has a principal business address of c/o of

Nutter McClennen & Fish, 155 Seaport Blvd, Boston, MA 02210. NXT3J is organized under the laws of the Delaware, and has a principal

business address of 21 Sears Road, Brookline, MA 02445. CP Acquisitions is organized under the laws of Delaware, and has a principal business

address of 675 VFW Parkway, Suite 152, Chestnut Hill, MA 02467. GIC Acquisition is organized under the laws of Delaware, and has a principal

business address of 675 VFW Parkway, Suite 152, Chestnut Hill, MA 02467.

During the last five years,

the Reporting Persons have not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). During

the last five years, the Reporting Persons have not been a party to any other civil proceeding of a judicial or administrative body of

competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws.

Item 4. Purpose of the Transaction

Item 4 of the Schedule 13D

is hereby amended and supplemented as follows:

As such terms are defined

and as further described in Item 5, the purpose of the actions taken by the Reporting Persons with respect to the CP Note Amendment, the

Restated Junior Note and the conversion of both the Convertible Note and the Restated Junior Note into Pre-Funded Warrants was to improve

the shareholders’ equity of the Issuer and mitigate the Issuer’s negative shareholder equity.

Except as described herein,

the Reporting Persons have no present plans or proposals that relate to or would result in any of the transactions described in subparagraphs

(a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

Item 5(a) of the Schedule

13D is hereby amended and restated in its entirety as follows:

Each

Reporting Person is the record owner of the securities set forth on their respective cover sheet. The percentage of outstanding Common

Stock which may be deemed to be beneficially owned by each Reporting Person is set forth on Line 13 of each Reporting Person’s cover

sheet. Such percentage was calculated based on the 14,229,386 shares of Common Stock outstanding

as of the date hereof. Notwithstanding the foregoing, Mr. Chang hereby disclaims beneficial ownership with respect to the securities held

by NXT3J, RTC3, CP Acquisitions, GIC Acquisition and Raymond Chang Jr. except to the extent of his

pecuniary interest therein.

Item 5(c) of the Schedule 13D is hereby amended

and supplemented as follows:

Amendment of Convertible

Note

As previously reported on

this Schedule 13D, on January 25, 2024, Issuer and CP Acquisitions, an entity affiliated with and controlled by Raymond Chang, the Chief

Executive Officer of the Issuer and a member of its Board, and I-Tseng Jenny Chan, a member of the Board, agreed to amend, restate and

consolidate certain outstanding notes held by CP Acquisitions into the Convertible Note.

On May 21, 2024, the Issuer

and CP Acquisitions entered into an amendment to the Convertible Note (the “CP Note Amendment”), pursuant to which CP Acquisitions

may elect, in lieu of shares of common stock issuable upon conversion of the Convertible Note, to instead receive pre-funded warrants

(“Pre-Funded Warrants”). The conversion price applicable to the Pre-Funded Warrants will remain unchanged at $1.46.

The Pre-Funded Warrants have

an exercise price of $0.001 per share, were exercisable upon issuance, will expire when the applicable warrant is exercised in full, and

are exercisable on a cash basis or, if there is no effective registration statement registering the resale of the underlying shares of

common stock, on a cashless exercise basis at CP Acquisitions’ discretion.

The Pre-Funded Warrants provide

that each time the Issuer consummates any bona fide equity financing with the primary purpose of raising capital, then the number of shares

of common stock underlying the Pre-Funded Warrants will be increased (the “Adjustment Provision”) to an amount equal

to (i) the amount of the Convertible Note that was originally converted into the applicable Pre-Funded Warrants divided by (ii) the purchase

or conversion price in the equity financing transaction, subject to proportional adjustment in the event the Pre-Funded Warrant has been

partially exercised. The Adjustment Provision will not be effective unless and until it is approved by stockholders of the Issuer pursuant

to Nasdaq Listing Rule 5635.

Immediately following the

execution of the CP Note Amendment, CP Acquisitions elected to convert $11.5 million of outstanding principal into a Pre-Funded Warrant

exercisable at issuance for up to 7,876,712 shares of common stock.

Amendment and Restatement

of Junior Secured Promissory Note

As previously reported, on

July 12, 2023, the Issuer issued an unsecured promissory note with an original principal amount of $500,000 in favor of GIC Acquisition,

an entity that is indirectly owned and managed by Mr. Chang, and on October 27, 2023, GIC and the Issuer amended and restated the note

to extend the maturity date to December 31, 2023, and to grant a security interest in the Issuer’s assets that ranks junior to the

Convertible Note (the “Junior Note”). As previously reported, on January 25, 2024, GIC and the Issuer amended and restated

the Junior Note to increase the principal amount thereunder to $1.0 million and to extend the maturity date until June 30, 2024.

On May 21, 2024, GIC and the

Issuer amended and restated the Junior Note (the “Restated Junior Note”) to increase the aggregate principal amount

to approximately $2.29 million, extend the maturity date to December 31, 2025, and provide that the Junior Note may be converted into

common stock of the Issuer or, at GIC’s election, Pre-Funded Warrants, in each case at a conversion price of $0.31.

Immediately following the

execution of the Restated Junior Note, GIC elected to convert all of the outstanding principal and accrued but unpaid interest under the

Restated Junior Note into a Pre-Funded Warrant exercisable at issuance for up to 7,383,053 shares of common stock. The Pre-Funded Warrant

includes an Adjustment Provision, subject to stockholder approval pursuant to Nasdaq Listing Rule 5635.

The foregoing descriptions

and summaries of the CP Note Amendment, the form of Pre-Funded Warrant and the Restated Junior Note do not purport to be complete, and

are qualified in their entirety by reference to copies of the CP Note Amendment, the form of Pre-Funded Warrant, and the Restated Junior

Note, which are filed as Exhibits 4.1, 4.2, and 4.3, respectively, to the Issuer’s Current Report on Form 8-K, filed with the SEC

on May 22, 2024, which are attached as an exhibit to this Schedule 13D and are incorporated herein by reference.

There can be no assurance

that the Adjustment Provision will be adopted and approved, or that any other transactions contemplated by the CP Note Amendment, the

form of Pre-Funded Warrant and the Restated Junior Note that require stockholder approval will occur.

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer

The information provided

or incorporated by reference in Items 4 and 5 of this Schedule 13D, is hereby incorporated herein by

this reference thereto.

Item 6 is hereby amended

and modified to include the following (which shall be in addition to the information previously included in the Schedule 13D):

Except as set forth in the

Convertible Note, Pre-Funded Warrant and Restated Junior Note, or herein, the Reporting Persons do not have any contracts, arrangements,

understandings or relationships (legal or otherwise) with any person with respect to any securities of the Issuer, including, but not

limited to, any contracts, arrangements, understandings or relationships concerning the call options, put options, security-based swaps

or any other derivative securities, transfer or voting of such securities, finder’s fees, joint ventures, loan or option arrangements,

guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

Item 7. Material to be Filed as Exhibits.

| Exhibit No. |

|

Description |

| 1 |

|

Joint Filing Agreement, dated as of May 23, 2024, by and between Raymond Nobu Chang, RTC3 2020 Irrevocable Trust, NXT3J Capital, LLC, CP Acquisitions, LLC, GIC Acquisition LLC, Raymond Chang, Jr and Chinwei Wang. |

| 2 |

|

Amendment No. 1 to Senior Secured Amended, Restated and Consolidated Convertible Note between Agrify Corporation and CP Acquisitions, LLC (incorporated by reference to Exhibit 4.1 to the Issuer’s Current Report on Form 8-K, filed with the SEC on May 22, 2024). |

| 3 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.2 to the Issuer’s Current Report on Form 8-K, filed with the SEC on May 22, 2024). |

| 4 |

|

Third Amended and Restated Junior Secured Convertible Promissory Note dated as of May 21, 2024 (incorporated by reference to Exhibit 4.3 to the Issuer’s Current Report on Form 8-K, filed with the SEC on May 22, 2024). |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: May 23, 2024

| Raymond Nobu Chang |

|

| |

|

| /s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| RTC3 2020 Irrevocable Trust |

|

| |

|

|

| By: |

/s/ Johanna Wise Sullivan |

|

| Name: |

Johanna Wise Sullivan |

|

| Title: |

Trustee |

|

| NXT3J Capital, LLC |

|

| |

|

|

| By: |

/s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| Title: |

Manager |

|

| CP Acquisitions, LLC |

|

| |

|

|

| By: |

/s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| Title: |

Manager |

|

| GIC Acquisition LLC |

|

| |

|

|

| By: |

/s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| Title: |

Manager |

|

Raymond Chang, Jr.

| /s/ Raymond Chang, Jr. |

|

| Name: |

Raymond Chang, Jr. |

|

| Chinwei Wang |

|

| |

|

| /s/ Chinwei Wang |

|

| Name: |

Chinwei Wang |

|

12

Exhibit 1

Joint Filing Agreement

May 21, 2024

The undersigned hereby agree, pursuant to Rule

13d-1(k)(1) under the Securities Exchange Act of 1934, as amended (the “Act”), that a statement of beneficial ownership as

required under Sections 13(g) or 13(d) of the Act and the Rules promulgated thereunder may be filed on each of their behalf on Schedule

13G or Schedule 13D, as appropriate, and that said joint filing may thereafter be amended by further joint filings.

| Raymond Nobu Chang |

|

| |

|

| /s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| RTC3 2020 Irrevocable Trust |

|

| |

|

|

| By: |

/s/ Johanna Wise Sullivan |

|

| Name: |

Johanna Wise Sullivan |

|

| Title: |

Trustee |

|

| NXT3J Capital, LLC |

|

| |

|

|

| By: |

/s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| Title: |

Manager |

|

| CP Acquisitions, LLC |

|

| |

|

|

| By: |

/s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| Title: |

Manager |

|

| GIC Acquisition LLC |

|

| |

|

|

| By: |

/s/ Raymond Nobu Chang |

|

| Name: |

Raymond Nobu Chang |

|

| Title: |

Manager |

|

| /s/ Raymond Chang, Jr. |

|

| Name: |

Raymond Chang, Jr. |

|

| Chinwei Wang |

|

| |

|

| /s/ Chinwei Wang |

|

| Name: |

Chinwei Wang |

|

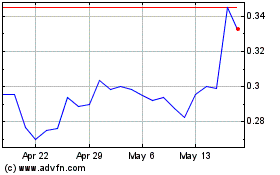

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From May 2024 to Jun 2024

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Jun 2023 to Jun 2024